Question: Logan B. Taylor is a widower whose

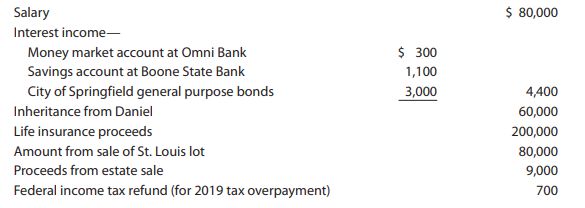

Logan B. Taylor is a widower whose wife, Sara, died on June 6, 2018. He lives at 4680 Dogwood Lane, Springfield, MO 65801. He is employed as a paralegal by a local law firm. During 2020, he had the following receipts:

Logan inherited securities worth $60,000 from his uncle, Daniel, who died in 2020. Logan also was the designated beneficiary of an insurance policy on Daniel’s life with a maturity value of $200,000. The lot in St. Louis was purchased on May 2, 2015, for $85,000 and held as an investment. Because the neighborhood has deteriorated, Logan decided to cut his losses and sold the lot on January 5, 2020, for $80,000. The estate sale consisted largely of items belonging to Sara and Daniel (e.g., camper, boat, furniture, and fishing and hunting equipment). Logan estimates that the property sold originally cost at least twice the $9,000 he received and has declined or stayed the same in value since Sara and Daniel died.

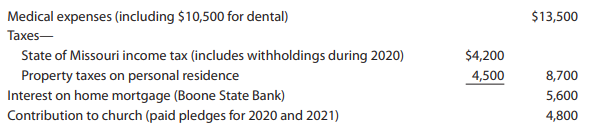

Logan’s expenditures for 2020 include the following:

While Logan and his dependents are covered by his employer’s health insurance policy, he is subject to a deductible, and dental care is not included. The $10,500dental charge was for Helen’s implants. Helen is Logan’s widowed mother, who lives with him (see below). Logan normally pledges $2,400 ($200 per month) each year to his church. On December 5, 2020, upon the advice of his pastor, he prepaid his pledge for 2021.

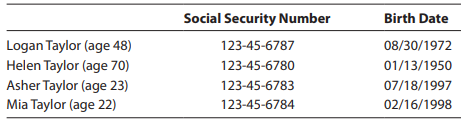

Logan’s household, all of whom he supports, includes the following:

Helen receives a modest Social Security benefit. Asher, a son, is a full-time student in dental school and earns $4,500 as a part-time dental assistant. Mia, a daughter, does not work and is engaged to be married.

Part 1—Tax Computation

Using the appropriate forms and schedules, compute Logan’s income tax for 2020. Federal income tax of $4,200 was withheld from his wages. If Logan has any overpayment on his income tax, he wants the refund sent to him. Assume that the proper amounts of Social Security and Medicare taxes were withheld. Logan received the appropriate coronavirus recovery rebates (economic impact payments); related questions in ProConnect Tax should be ignored. Logan does not own and did not use any virtual currency during the year, and he does not want to contribute to the Presidential Election Campaign Fund. Suggested software: ProConnect Tax.

Part 2—Follow-Up Advice

In early 2021, the following take place:

• Helen decides that she wants to live with one of her daughters and moves to Arizona.

• Asher graduates from dental school and joins an existing practice in St. Louis.

• Mia marries, and she and her spouse move in with his parents.

• Using the insurance proceeds he received on Daniel’s death, Logan pays off the mortgage on his personal residence.

Logan believes that these events may have an effect on his tax position for 2021. Therefore, he requests your advice. Write a letter to Logan explaining in general terms the changes that will occur for tax purposes. Assume that Logan’s salary and other factors not mentioned (e.g., property and state income taxes) will remain the same.

> Paul wholly owns and operates an office supplies business and a printing/ shipping business through separate entities. The office supplies business and printing/shipping business share centralized purchasing to obtain volume discounts and share a central

> Identify the requirements that must be met in order to aggregate businesses for purposes of the QBI deduction.

> At the beginning of the current year, Henry purchased a ski resort for $10,000,000. Henry does not own the land on which the resort is located. The Federal government owns the land, and Henry has the right to operate the resort on the land pursuant to Sp

> Aubry, a cash basis and calendar year taxpayer, decides to reduce his taxable income for 2021 by buying $65,000 worth of supplies for his business on December 27, 2021. The supplies will be used up in 2022. a. Can Aubry deduct the expenditure for 2021? E

> In May 2021, Gwen began searching for a trade or business to acquire. In anticipation of finding a suitable acquisition, Gwen hired an investment banker to evaluate three potential businesses. She also hired a law firm to begin drafting regulatory approv

> Amos began a business, Silver LLC (a single-member LLC), on July 1, 2018. The business extracts and processes silver ore. During 2021, as a result of a decline in demand for silver ore, Amos expects to generate a large loss. Identify the relevant tax iss

> In 2018, John opened an investment account with Randy Hansen, who held himself out to the public as an investment adviser and securities broker. John contributed $200,000 to the account in 2018. John provided Randy with a power of attorney to use the $20

> In 2021, Kelsey sustained a loss on the theft of a painting. She had paid $20,000 for the painting, but it was worth $40,000 at the time of the theft. Evaluate the tax consequences of treating the painting as investment property or as personal use proper

> Dolly is a cash basis taxpayer. In 2021, she filed her 2020 South Carolina income tax return and received a $2,200 refund. Dolly took the standard deduction on her 2020 Federal income tax return but will itemize her deductions in 2021. Molly, a cash basi

> In January 2021, Sonja deposited $20,000 in a bank in the Bahamas. She earned $500 interest income. She closed the account in December 2021. a. Is Sonja subject to the FBAR reporting requirement? Explain. b. Is the interest income taxable in the United S

> Nanette, a single taxpayer, is a first-grade teacher. Potential deductions are charitable contributions of $800, personal property taxes on her car of $240, and various supplies purchased for use in her classroom of $225 (none reimbursed by her school).

> Connor purchased an annuity that was to pay him a fixed amount each month for the remainder of his life. He began receiving payments in 2004, when he was 65 years old. In 2021, Connor was killed in an automobile accident. What are the effects of the annu

> In 2020, Henry Jones (Social Security number 123-45-6789) works as a freelance driver, finding customers using various platforms like Uber and Grubhub. He is single and has no other sources of income. In 2020, Henry’s qualified business income from drivi

> In 2021, the CEO of Crimson, Inc., entertains seven clients at a skybox in Memorial Stadium for a single athletic event during the year. Substantive business discussions occurred at various times during the event. The box costs $2,000 per event and seats

> In 2021, Larry and Susan each invest $10,000 in separate investment activities. They each incur deductible expenses of $800 associated with their respective investments. Explain why Larry’s expenses might not be deductible and Susan’s expenses might be a

> On March 25, Parscale Company purchases the rights to a mineral interest for $8,000,000. At that time, the remaining recoverable units in the mineral interest are estimated to be 500,000 tons. If 80,000 tons are mined and 75,000 tons are sold this year,

> On October 1, 2021, Verónica purchased a business. Of the purchase price, $60,000 is allocated to a patent and $375,000 is allocated to goodwill. Calculate Verónica’s 2021 § 197 amortization deduction.

> On April 5, 2021, Kinsey places in service a new automobile that cost $60,000. He does not elect $179 expensing, and he elects not to take any available additional first-year depreciation. The car is used 70% for business and 30% for personal use in each

> McKenzie purchased qualifying equipment for his business that cost $212,000 in 2021. The taxable income of the business for the year is $5,600 before consideration of any § 179 deduction. a. Calculate McKenzie’s § 179 expense deduction for 2021 and any c

> Diana acquires, for $65,000, and places in service a 5-year class asset on December 19, 2021. It is the only asset that Diana acquires during 2021. Diana does not elect immediate expensing under § 179. She elects additional firstyear deprecation. Calcula

> Andre acquired a computer on March 3, 2021, for $2,800. He elects the straight-line method for cost recovery. Andre does not elect immediate expensing under § 179. He does not claim any available additional first-year depreciation. Calculate Andre’s cost

> Lopez acquired a building on June 1, 2016, for $1,000,000. Calculate Lopez’s cost recovery deduction for 2021 if the building is: a. Classified as residential rental real estate. b. Classified as nonresidential real estate.

> Hamlet acquires a 7-year class asset on November 23, 2021, for $100,000 (the only asset acquired during the year). Hamlet does not elect immediate expensing under § 179. He does not claim any available additional first-year depreciation. Calculate Hamlet

> Emily, who is single, sustains an NOL of $7,800 in 2021. The loss is carried forward to 2022. For 2022, Emily’s income tax information before taking into account the 2021 NOL is as follows: How much of the NOL carryforward can Emily use

> Valeria and Trey are married and file a joint tax return. For 2021, they have $4,800 of nonbusiness capital gains, $2,300 of nonbusiness capital losses, $500 of interest income, and no itemized deductions. The standard deduction for married filing jointl

> Sally Andrews calls you on the phone. She says that she has found a 2015 letter ruling that agrees with a position she wants to take on her tax return. She asks you about the precedential value of a letter ruling. Draft a memo for the tax files, outlinin

> Sandstorm Corporation decides to develop a new line of paints. The project begins in 2021. Sandstorm incurs the following expenses in 2021 in connection with the project: Salaries ………………………………………………………………$85,000 Materials ……………………………………………………………...30,000

> Belinda was involved in a boating accident in 2021. Her speedboat, which was used only for personal use and had a fair market value of $28,000 and an adjusted basis of $14,000, was completely destroyed. She received $10,000 from her insurance company. He

> Noelle’s diamond ring was stolen in November 2017. She originally paid $8,000 for the ring, but it was worth considerably more at the time of the theft. Noelle filed an insurance claim for the stolen ring, but the claim was denied. Because the insurance

> On May 9, 2019, Calvin acquired 250 shares of stock in Hobbes Corporation, a new startup company, for $68,750. Calvin acquired the stock directly from Hobbes, and it is classified as § 1244 stock (at the time Calvin acquired his stock, the corporation ha

> In 2021, David is age 78, is a widower, and is being claimed as a dependent by his son. How does this situation affect the following? a. David’s own individual filing requirement. b. The standard deduction allowed to David. c. The availability of any add

> Lime Finance Company requires its customers to purchase a credit life insurance policy associated with the loans it makes. Lime is the beneficiary of the policy to the extent of the remaining balance on the loan at the time of the customer’s death. In 20

> In late 2021, the Polks come to you for tax advice. They are considering selling some stock investments for a loss and making a contribution to a traditional IRA. In reviewing their situation, you note that they have large medical expenses and a casualty

> In 2019, Emma purchased an automobile, which she uses for both business and personal purposes. Although Emma does not keep records as to operating expenses (e.g., gas, oil, and repairs), she can prove the percentage of business use and the miles driven e

> Fred specified in his will that his nephew John should serve as executor of Fred’s estate. John received $10,000 for serving as executor. John inherited $100,000 of cash from his uncle as well. He also borrowed $5,000 when he bought a new car this year.

> This textbook includes many features beyond the text materials in each chapter. For example, a glossary is included in the appendices and the end of each chapter contains a list of key terms. Skim through the chapters, appendices, and any other supplemen

> Stanford owns and operates two dry cleaning businesses. He travels to Boston to discuss acquiring a restaurant. Later in the month, he travels to New York to discuss acquiring a bakery. Stanford does not acquire the restaurant but does purchase the baker

> Saanvi Patel (Social Security number 123-45-6785), single and age 32, lives at 3218 Columbia Drive, Spokane, WA 99210. She is employed as a regional sales manager by VITA Corporation, a manufacturer and distributor of vitamins and food supplements. Durin

> Mason Phillips, age 45, and his wife, Alyssa, live at 230 Wood Lane, Salt Lake City, UT 84101. Mason’s Social Security number is 111-11-1111. Alyssa’s Social Security number is 123-45-6789. Mason and Alyssa are cash basis taxpayers and report the followi

> Denise Lopez, age 40, is single and has no dependents. She is employed as a legal secretary by Legal Services, Inc. She owns and operates Typing Services located near the campus of Florida Atlantic University at 1986 Campus Drive, Boca Raton, FL 33434. D

> John and Mary Jane Diaz are married, filing jointly. Their address is 204 Shoe Lane, Blacksburg, VA 24061. John is age 35, and Mary Jane is age 30. They are expecting their first child in early 2022. John’s salary in 2021 was $125,000, from which $22,800

> Roberta Santos, age 41, is single and lives at 120 Sanborne Avenue, Springfield, IL 62701. Her Social Security number is 123-45-6780. Roberta has been divorced from her former husband, Wayne, for three years. She has a son, Jason, who is 17, and a daught

> Alfred E. Old and Beulah A. Crane, each age 42, married on September 7, 2018. Alfred and Beulah will file a joint return for 2020. Alfred’s Social Security number is 111-11- 1109. Beulah’s Social Security number is 123-45-6780, and she has chosen to use

> Martin S. Albert (Social Security number 111-11-1111) is 39 years old and is married to Michele R. Albert (Social Security number 123-45-6789). The Alberts live at 512 Ferry Road, Newport News, VA 23601. They file a joint return and have two dependent ch

> Cecil C. Seymour is a 64-year-old widower. He had income for 2021 as follows: Pension from former employer …………………………………………………………………………..$39,850 Interest income from Alto National Bank……………………………………………………………….. 5,500 Interest income on City of Alto bonds

> Daniel B. Butler and his spouse Freida C. Butler file a joint return. The Butlers live at 625 Oak Street in Corbin, KY 40701. Dan’s Social Security number is 111-11-1112, and Freida’s is 123-45-6780. Dan was born on Ja

> John Rivera, age 31, is single and has no dependents. At the beginning of 2021, John started his own excavation business and named it Earth Movers. John lives at 1045 Center Street, Lindon, UT, and his business is located at 381 State Street, Lindon, UT.

> Meghan, a calendar year taxpayer, is the owner of a sole proprietorship that uses the cash method. On February 1, 2021, she leases an office building to use in her business for $120,000 for an 18-month period. To obtain this favorable lease rate, she pay

> Janice Morgan, age 24, is single and has no dependents. She is a freelance writer. In January 2020, Janice opened her own office located at 2751 Waldham Road, Pleasant Hill, NM 88135. She called her business Writers Anonymous. Janice is a cash basis taxp

> Lance H. and Wanda B. Dean are married and live at 431 Yucca Drive, Santa Fe, NM 87501. Lance works for the convention bureau of the local Chamber of Commerce, and Wanda is employed part-time as a paralegal for a law firm. During 2020, the Deans had the

> David R. and Ella M. Cole (ages 39 and 38, respectively) are husband and wife who live at 1820 Elk Avenue, Denver, CO 80202. David is a self-employed consultant specializing in retail management, and Ella is a dental hygienist for a chain of dental clini

> Research the following questions regarding virtual currency, and write your answers in the form of a set of “frequently asked questions” (FAQs) suitable for the website of your CPA firm. As part of your research, consider the IRS’s FAQs on virtual curren

> On December 29, 2021, an employee received a $5,000 check from her employer’s client. The check was payable to the employer. The employee did not remit the funds to the employer until December 30, 2021. The employer deposited the check on December 31, 20

> Jamie has an undergraduate degree in finance and has an established financial planning practice (a single member LLC). To expand her knowledge base and serve her clients better, she decides to pursue a master’s degree in quantitative finance at a local u

> Isabelle was contemplating making a contribution to her traditional IRA in 2020. She determined that she would contribute $6,000 in December 2020, but forgot about making the contribution until she was preparing her 2020 tax return in February 2021. Use

> Classify each of the following expenditures paid in 2021 as a deduction for AGI, a deduction from AGI, or not deductible: a. Roberto gives cash to his father as a birthday gift. b. Sandra gives cash to her church. c. Albert pays Dr. Dafashy for medical s

> Oleander Corporation, a calendar year entity, begins business on March 1, 2021. The corporation incurs startup expenditures of $64,000. If Oleander elects § 195 treatment, determine the total amount of startup expenditures that it may deduct for 2021.

> Shanna, a calendar year and cash basis taxpayer, rents property to be used in her business from Janice. As part of the rental agreement, Shanna pays $8,400 rent on April 1, 2021, for the 12 months ending March 31, 2022. a. How much is Shanna’s deduction

> Using the legend provided, classify each of the following statements: a. Sue writes a $707 check for a charitable contribution on December 26, 2021, but does not mail the check to the charitable organization until January 10, 2022. She takes a deduction

> In 2021, Muhammad purchased a new computer for $16,000. The computer is used 100% for business. Muhammad did not make a § 179 election with respect to the computer. He does not claim any available additional first-year depreciation. If Muhammad uses the

> On June 5, 2020, Leo purchased and placed in service a new car that cost $75,000. The business use percentage for the car is always 100%. Leo does not claim any available additional first-year depreciation. Compute Leo’s cost recovery deductions for 2020

> Naya purchased a new computer (5-year property) on June 1, 2021, for $4,000. Naya could use the computer 100% of the time in her business, or she could allow her family to use the computer as well. Naya estimates that if her family uses the computer, the

> Stella Watters is a CPA who operates her own accounting firm (Watters CPA LLC). As a single-member LLC, Stella reports her accounting firm operations as a sole proprietor. Stella has QBI from her accounting firm of $540,000, she reports W–2 wages of $156

> For tax year 2019, the IRS assesses a deficiency against David for $500,000. Disregarding the interest component, what is David’s penalty if the deficiency is attributable to: a. Negligence? b. Fraud?

> Rita files her income tax return 35 days after the due date of the return without obtaining an extension from the IRS. Along with the return, she remits a check for $40,000, which is the balance of the tax she owes. Disregarding the interest element, wha

> Using the legend provided, classify each of the following tax sources: a. Sixteenth Amendment to the U.S. Constitution. b. Tax treaty between the United States and India. c. Revenue Procedure. d. An IRS publication. e. U.S. District Court decision. f. Y

> Brianna, a calendar year taxpayer, files her income tax return for 2020 on February 3, 2021. Although she makes repeated inquiries, she does not receive her refund from the IRS until May 28, 2021. Is Brianna entitled to interest on the refund? Explain

> During 2021, Stork Associates paid $60,000 for a 20-seat skybox at Veterans Stadium for eight professional football games. Regular seats to these games range from $80 to $250 each. At one game, an employee of Stork entertained 18 clients. Stork furnished

> Mio was transferred from New York to Germany. He lived and worked in Germany for 340 days in 2021. Mio’s salary for 2021 is $190,000. In your computation, round any division to four decimal places before converting to a percentage. For example, 0.473938

> Janice acquired an apartment building on June 4, 2021, for $1,600,000. The value of the land is $300,000. Janice sold the apartment building on November 29, 2027. a. Determine Janice’s cost recovery deduction for 2021. b. Determine Janice’s cost recovery

> Rex, age 55, is an officer of Blue Company, which provides him with the following nondiscriminatory fringe benefits in 2021: • Hospitalization insurance premiums for Rex and his dependents. The cost of the coverage for Rex is $2,900 per year, and the add

> On May 5, 2021, Christy purchased and placed in service a hotel. The hotel cost $10,800,000, and the land cost $1,200,000 ($12,000,000 in total). Calculate Christy’s cost recovery deductions for 2021 and for 2031.

> On April 3, 2021, Terry purchased and placed in service a building that cost $2,000,000. An appraisal determined that 25% of the total cost was attributed to the value of the land. The bottom floor of the building is leased to a retail business for $32,0

> On August 2, 2021, Wendy purchased a new office building for $3,800,000. On October 1, 2021, she began to rent out office space in the building. On July 15, 2025, Wendy sold the office building. a. Determine Wendy’s cost recovery deduction for 2021. b. D

> Juan acquires a new 5-year class asset on March 14, 2021, for $200,000. This is the only asset Juan acquired during the year. He does not elect immediate expensing under § 179. He does not claim any available additional first-year depreciation. On July 1

> Selma operates a contractor’s supply store. She maintains her books using the cash method. At the end of 2021, her accountant computes her accrual basis income that is used on her tax return. For 2021, Selma had cash receipts of $1,400,000, which include

> Orange Corporation acquired new office furniture on August 15, 2021, for $130,000. Orange does not elect immediate expensing under § 179. Orange claims any available additional first-year depreciation. a. Determine Orange’s cost recovery for 2021. b. How

> In 2018, José purchased a house for $325,000 ($300,000 relates to the house; $25,000 relates to the land). He used the house as his personal residence. In March 2021, when the fair market value of the house was $400,000, he converted the house to rental

> In 2021, Ava, an employee, has AGI of $58,000 and the following itemized deductions: Home office expenses …………………………………………………………….$1,200 Union dues and work uniforms ……………………………………………………350 Unreimbursed employee expenses ………………………………………………..415 Gambling

> Valentino is a patient in a nursing home for 45 days of 2021. While in the nursing home, he incurs total costs of $13,500. Medicare pays $8,000 of the costs. Valentino receives $15,000 from his long-term care insurance policy, which pays while he is in t

> In May 2021, Hernando, a resident of California, has his 2019 Federal income tax return audited by the IRS. An assessment of additional tax is made because he inadvertently omitted some rental income. In October 2021, California audits his state return f

> In 2021, Meghann, a single taxpayer, has QBI of $110,000 and modified taxable income of $78,000 (this is also her taxable income before the QBI deduction). Given this information, what is Meghann’s QBI deduction?

> Jayda maintains an office in her home that comprises 8% (200 square feet) of total floor space. Gross income for her business is $42,000, and her residence expenses are as follows: Real property taxes …………………………………………………………….$2,400 Interest on mortgage …

> Charlie purchased an apartment building on November 16, year 1, for $1,000,000. Determine the cost recovery for year 20. a. $36,360 b. $32,100 c. $45,500 d. $331,850

> In 2021, Robert takes four key clients and their spouses out to dinner at a local restaurant. Business discussions occurred over dinner. Expenses were $700 (drinks and dinner) and $140 (tips to servers). If Robert is self-employed, how much can he deduct

> Many states have their income tax calculations “piggyback” the Federal income tax calculation. In other words, these states’ income tax calculations incorporate many of the Federal calculations and deductions to make both compliance and verification of t

> Carlos is retired and receives Social Security benefits. During the year, Carlos appeared on a television game show and won $5,000. By how much will the prize increase his gross income?

> A qualified expense is not deductible unless there is appropriate substantiation to document it. Find two websites and/or articles that provide (1) guidance on the types of substantiation required for business expenses and (2) suggestions for taxpayers o

> Lara uses the standard mileage method for determining auto expenses. During 2021, she used her car as follows: 9,000 miles for business, 2,000 miles for personal use, 2,500 miles for a move to a new job, 1,000 miles for charitable purposes, and 500 miles

> Use information about individual income tax returns available at the IRS Tax Stats website (irs.gov/statistics/soi-tax-stats-individual-income-tax-returns) to find data on the number of individuals who report tax-exempt interest income on their tax retur

> Apply the tax benefit rule to determine the amount of the state income tax refund included in gross income in 2021. a. Myrna and Geoffrey filed a joint tax return in 2020. Their AGI was $85,000, and itemized deductions were $25,500, which included $7,000

> A taxpayer is considering two alternative investments. A Series EE U.S. government savings bond accrues 3.5% interest each year. The bond matures in three years, at which time the principal and interest will be paid. Alternatively, a bank will pay the ta

> Find a newspaper article that discusses tax planning for casualty losses when a Federal disaster area designation is made. Does the article convey the pertinent tax rules correctly? Then list all of the locations identified by the President as Federal di

> Kelly decided to invest in Lime, Inc. common stock after reviewing Lime’s public disclosures, including recent financial statements and a number of press releases issued by Lime. On August 7, 2019, Kelly purchased 60,000 shares of Lime for $210,000. In M

> There are significant tax planning opportunities related to fixed asset acquisition (and depreciation). Search out how large public accounting firms are assisting clients in this area. Summarize your findings in an e-mail to your instructor

> Mark and Lisa were divorced in 2020. In 2021, Mark has custody of their children, but Lisa provides nearly all of their support. Who is entitled to claim the children as dependents?

> Locate a financial calculator app or program that assesses the wisdom of buying versus leasing a new car. Use it to work through Problem 46 in this chapter.

> Caden and Lily are divorced on March 3, 2020. For financial reasons, however, Lily continues to live in Caden’s apartment and receives her support from him. Caden does not claim Lily as a dependent on his 2020 Federal income tax return but does so on his

> How many U.S. individuals claim a deduction for casualties? Does it vary by size of income (AGI)? How do casualty loss deductions compare to the amounts of other itemized deductions claimed by taxpayers? Go to the IRS tax statistics website (irs.gov/stat

> Which of the following is not a deduction for AGI? a. Alimony paid for a divorce finalized in 2018. b. Business rent on a self-employed business. c. Property taxes paid on your primary residence. d. One half of self-employment tax.