Question: Lott Company uses a job order cost

Lott Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2020, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $20,000, direct labor $12,000, and manufacturing overhead $16,000. As of January 1, Job 49 had been completed at a cost of $90,000 and was part of finished goods inventory. There was a $15,000 balance in the Raw Materials Inventory account.

During the month of January, Lott Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were also sold on account during the month for $122,000 and $158,000, respectively. The following additional events occurred during the month.

1. Purchased additional raw materials of $90,000 on account.

2. Incurred factory labor costs of $70,000. Of this amount $16,000 related to employer payroll taxes.

3. Incurred manufacturing overhead costs as follows: indirect materials $17,000, indirect labor

$20,000, depreciation expense on equipment $12,000, and various other manufacturing overhead costs on account $16,000.

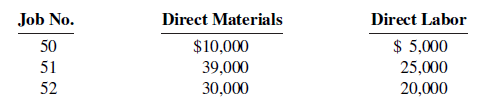

4. Assigned direct materials and direct labor to jobs as follows.

Instructions:

a. Calculate the predetermined overhead rate for 2020, assuming Lott Company estimates total manufacturing overhead costs of $840,000, direct labor costs of $700,000, and direct labor hours of 20,000 for the year.

b. Open job cost sheets for Jobs 50, 51, and 52. Enter the January 1 balances on the job cost sheet for Job 50.

c. Prepare the journal entries to record the purchase of raw materials, the factory labor costs incurred, and the manufacturing overhead costs incurred during the month of January.

d. Prepare the journal entries to record the assignment of direct materials, direct labor, and manufacturing overhead costs to production. In assigning manufacturing overhead costs, use the overhead rate calculated in (a). Post all costs to the job cost sheets as necessary.

e. Total the job cost sheets for any job(s) completed during the month. Prepare the journal entry (or entries) to record the completion of any job(s) during the month.

f. Prepare the journal entry (or entries) to record the sale of any job(s) during the month.

g. What is the balance in the Finished Goods Inventory account at the end of the month? What does this balance consist of?

h. What is the amount of over- or under-applied overhead?

Transcribed Image Text:

Job No. Direct Materials Direct Labor $ 5,000 25,000 20,000 50 $10,000 51 39,000 30,000 52

> Identify four disadvantages of a partnership form of business organization.

> Describe leveraging and give an example of how a corporation can gain leverage by issuing bonds.

> Briefly describe five advantages of the corporate form of business organization. Describe two disadvantages.

> If a corporation issues only one class of stock, what four rights does each stockholder have?

> What are the three dates involved in the declaration and payment of dividends? What is the meaning of each date?

> How do the procedures for closing Income Summary of a corporation differ from those of a sole proprietorship or partnership?

> Describe four tips for finding errors on the work sheet.

> What five types of transactions involving notes payable do businesses generally encounter?

> What information usually is included in the charter?

> What seven types of transactions involving notes receivable do businesses generally encounter?

> What are three disadvantages of using the direct write-off method?

> What accounts and related adjustments are new in the work sheet of ToyJoy Manufacturing Co.?

> Rogen Corporation manufactures a single product. The standard cost per unit of product is shown below. Direct materials—1 pound plastic at $7.00 per pound ………………………… $ 7.00 Direct labor—1.6 hours at $12.00 per hour …………………………………………. 19.20 Variable manuf

> Condensed financial data of Cheng Inc. follow. Additional information: 1. New equipment costing $85,000 was purchased for cash during the year. 2. Old equipment having an original cost of $57,500 was sold for $1,500 cash. 3. Bonds matured and were pai

> Data for Nosker Company are presented in P17.7A. Further analysis reveals the following. 1. Accounts payable pertain to merchandise suppliers. 2. All operating expenses except for depreciation were paid in cash. Instructions a. Prepare a statement of ca

> Sentinel Industries has manufactured prefabricated houses for over 20 years. The houses are constructed in sections to be assembled on customers’ lots. Sentinel expanded into the precut housing market when it acquired Jensen Company, on

> Durham Company uses a responsibility reporting system. It has divisions in Denver, Seattle, and San Diego. Each division has three production departments: Cutting, Shaping, and Finishing. The responsibility for each department rests with a manager who re

> Optimus Company manufactures a variety of tools and industrial equipment. The company operates through three divisions. Each division is an investment center. Operating data for the Home Division for the year ended December 31, 2020, and relevant budget

> Clarke Inc. operates the Patio Furniture Division as a profit center. Operating data for this division for the year ended December 31, 2020, are as shown below. In addition, Clarke incurs $180,000 of indirect fi xed costs that were budgeted at $175,000

> Ratchet Company uses budgets in controlling costs. The August 2020 budget report for the company’s Assembling Department is as follows. The monthly budget amounts in the report were based on an expected production of 60,000 units per

> Zelmer Company manufactures tablecloths. Sales have grown rapidly over the past 2 years. As a result, the president has installed a budgetary control system for 2020. The following data were used in developing the master manufacturing overhead budget for

> Data for Cheng Inc. are presented in P17.9A. Further analysis reveals that accounts payable pertain to merchandise creditors. Instructions Prepare a statement of cash flows for Cheng Inc. using the direct method. Data from P17.9A: Condensed financial d

> Brooks Clinic is considering investing in new heart-monitoring equipment. It has two options. Option A would have an initial lower cost but would require a significant expenditure for rebuilding after 4 years. Option B would require no rebuilding expendi

> Bumblebee Company estimates that 300,000 direct labor hours will be worked during the coming year, 2020, in the Packaging Department. On this basis, the following budgeted manufacturing overhead cost data are computed for the year. It is estimated that d

> Owen Company manufactures bicycles and tricycles. For both products, materials are added at the beginning of the production process, and conversion costs are incurred uniformly. Owen Company uses the FIFO method to compute equivalent units. Production an

> Krause Industries’ balance sheet at December 31, 2019, is presented below. Budgeted data for the year 2020 include the following. To meet sales requirements and to have 2,500 units of finished goods on hand at December 31, 2020, the

> The budget committee of Suppar Company collects the following data for its San Miguel Store in preparing budgeted income statements for May and June 2020. 1. Sales for May are expected to be $800,000. Sales in June and July are expected to be 5% higher t

> Colter Company prepares monthly cash budgets. Relevant data from operating budgets for 2020 are as follows. All sales are on account. Collections are expected to be 50% in the month of sale, 30% in the first month following the sale, and 20% in the sec

> Hill Industries had sales in 2019 of $6,800,000 and gross profit of $1,100,000. Management is considering two alternative budget plans to increase its gross profit in 2020. Plan A would increase the selling price per unit from $8.00 to $8.40. Sales volum

> Deleon Inc. is preparing its annual budgets for the year ending December 31, 2020. Accounting assistants furnish the data shown below. / / An accounting assistant has prepared the detailed manufacturing overhead budget and the selling and administrativ

> Cook Farm Supply Company manufactures and sells a pesticide called Snare. The following data are available for preparing budgets for Snare for the first 2 quarters of 2020. 1. Sales: quarter 1, 40,000 bags; quarter 2, 56,000 bags. Selling price is $60 pe

> Data for Zumbrunn Company are presented in P17.5A. Instructions Prepare the operating activities section of the statement of cash flows using the direct method. Data from P17.5A: Zumbrunn Company’s income statement contained the follo

> Brislin Company has four operating divisions. During the first quarter of 2020, the company reported aggregate income from operations of $213,000 and the following divisional results. Analysis reveals the following percentages of variable costs in each

> Wilma Company must decide whether to make or buy some of its components. The costs of producing 60,000 switches for its generators are as follows. Instead of making the switches at an average cost of $2.95 ($177,000 ÷ 60,000), the compan

> At the beginning of last year (2019), Richter Condos installed a mechanized elevator for its tenants. The owner of the company, Ron Richter, recently returned from an industry equipment exhibition where he watched a computerized elevator demonstrated. He

> Thompson Industrial Products Inc. (TIPI) is a diversified industrial-cleaner processing company. The company’s Dargan plant produces two products: a table cleaner and a floor cleaner from a common set of chemical inputs (CDG). Each week

> The management of Shatner Manufacturing Company is trying to decide whether to continue manufacturing a part or to buy it from an outside supplier. The part, called CISCO, is a component of the company’s finished product. The following

> ThreePoint Sports Inc. manufactures basketballs for the Women’s National Basketball Association (WNBA). For the fi rst 6 months of 2020, the company reported the following operating results while operating at 80% of plant capacity and producing 120,000 u

> Polk Company manufactures basketballs. Materials are added at the beginning of the production process and conversion costs are incurred uniformly. Production and cost data for the month of July 2020 are as follows. Instructions a. Calculate the followi

> Rivera Company has several processing departments. Costs charged to the Assembly Department for November 2020 totaled $2,280,000 as follows. Production records show that 35,000 units were in beginning work in process 30% complete as to conversion costs

> Thakin Industries Inc. manufactures dorm furniture in separate processes. In each process, materials are entered at the beginning, and conversion costs are incurred uniformly. Production and cost data for the first process in making a product are as foll

> Rosenthal Company manufactures bowling balls through two processes: Molding and Packaging. In the Molding Department, the urethane, rubber, plastics, and other materials are molded into bowling balls. In the Packaging Department, the balls are placed in

> Fire Out Company manufactures its product, Vitadrink, through two manufacturing processes: Mixing and Packaging. All materials are entered at the beginning of each process. On October 1, 2020, inventories consisted of Raw Materials $26,000, Work in Proce

> The following are the financial statements of Nosker Company. Additional data: 1. Dividends declared and paid were $20,000. 2. During the year, equipment was sold for $8,500 cash. This equipment cost $18,000 originally and had a book value of $8,500 a

> Obermeyer Corporation issued the following statement of cash flows for 2020. (a) Compute free cash flow for Obermeyer Corporation. (b) Explain why free cash flow often provides better information than “Net cash provided by operating a

> Phillips Corporation’s fiscal year ends on November 30. The following accounts are found in its job order cost accounting system for the first month of the new fiscal year. Other data: 1. On December 1, two jobs were in process: Job N

> The following data were taken from the records of Clarkson Company for the fiscal year ended June 30, 2020. Instructions a. Prepare a cost of goods manufactured schedule. (Assume all raw materials used were direct materials.) b. Prepare an income state

> Case Inc. is a construction company specializing in custom patios. The patios are constructed of concrete, brick, fiberglass, and lumber, depending upon customer preference. On June 1, 2020, the general ledger for Case Inc. contains the following data.

> For the year ended December 31, 2020, the job cost sheets of Cinta Company contained the following data. Other data: 1. Raw materials inventory totaled $15,000 on January 1. During the year, $140,000 of raw materials were purchased on account. 2. Finis

> Empire Company is a manufacturer of smart phones. Its controller resigned in October 2020. An inexperienced assistant accountant has prepared the following income statement for the month of October 2020 Prior to October 2020, the company had been profi

> Condensed balance sheet and income statement data for Jergan Corporation are presented here. Additional information: 1. The market price of Jergan’s common stock was $7.00, $7.50, and $8.50 for 2018, 2019, and 2020, respectively. 2.

> Bell Company, a manufacturer of audio systems, started its production in October 2020. For the preceding 3 years, Bell had been a retailer of audio systems. After a thorough survey of audio system markets, Bell decided to turn its retail store into an au

> Ohno Company specializes in manufacturing a unique model of bicycle helmet. The model is well accepted by consumers, and the company has enough orders to keep the factory production at 10,000 helmets per month (80% of its full capacity). Ohnoâ€

> Suppose selected financial data of Target and Wal-Mart for 2020 are presented here (in millions). Instructions a. For each company, compute the following ratios. 1. Current ratio. 2. Accounts receivable turnover. 3. Average collection period. 4. Inv

> Alex Company reported the following information for 2020. Additional information: 1. Operating expenses include depreciation expense of $40,000. 2. Land was sold at its book value for cash. 3. Cash dividends of $85,000 were declared and paid in 2020.

> The following financial information is for Priscoll Company. Additional information: 1. Inventory at the beginning of 2019 was $115,000. 2. Accounts receivable (net) at the beginning of 2019 were $86,000. 3. Total assets at the beginning of 2019 were $

> The comparative statements of Wahlberg Company are presented here. All sales were on account. Net cash provided by operating activities for 2020 was $220,000. Capital expenditures were $136,000, and cash dividends were $70,000. Instructions Compute t

> Here are comparative statement data for Duke Company and Lord Company, two competitors. All balance sheet data are as of December 31, 2020, and December 31, 2019. Instructions a. Prepare a vertical analysis of the 2020 income statement data for Duke Co

> Zumbrunn Company’s income statement contained the following condensed information. Zumbrunn’s balance sheets contained the comparative data at December 31, shown below. Accounts payable pertain to operating expenses

> Data for Whitlock Company are presented in P17.3A. Instructions Prepare the operating activities section of the statement of cash flows using the direct method. Data from P17.3A: The income statement of Whitlock Company is presented here. Whitloc

> Diane Buswell is preparing the 2020 budget for one of Current Designs’ rotomolded kayaks. Extensive meetings with members of the sales department and executive team have resulted in the following unit sales projections for 2020. Quarter 1 …………………….… 1,0

> The financial statements of Louis Vuitton are presented in Appendix F. The complete annual report, including the notes to its financial statements, is available at the company’s website. Instructions Use the company’s

> Green Pastures is a 400-acre farm on the outskirts of the Kentucky Bluegrass, specializing in the boarding of broodmares and their foals. A recent economic downturn in the thoroughbred industry has made the boarding business extremely competitive. To mee

> Harding Financial Services Company holds a large portfolio of debt and equity securities as an investment. The total fair value of the portfolio at December 31, 2020, is greater than total cost. Some securities have increased in value and others have dec

> Ken Iwig is the president, founder, and majority owner of Olathe Medical Corporation, an emerging medical technology products company. Olathe is in dire need of additional capital to keep operating and to bring several promising products to fi nal develo

> Refer to P19.5A and add the following requirement. Prepare a letter to the president of the company, Shelly Phillips, describing the changes you made. Explain clearly why net income is different after the changes. Keep the following points in mind as you

> (IMA) is an organization dedicated to excellence in the practice of management accounting and financial management. Instructions Go to the IMA’s website to locate the answers to the following questions. a. How many members does the IMA have, and what ar

> The income statement of Whitlock Company is presented here. Additional information: 1. Accounts receivable increased $200,000 during the year, and inventory decreased $500,000. 2. Prepaid expenses increased $150,000 during the year. 3. Accounts payable

> If your school has a subscription to the FASB Codification, log in and prepare responses to the following. Use the Master Glossary for determining the proper definitions. a. Discontinued operations. b. Comprehensive income.

> Your parents are considering investing in Apple Inc. common stock. They ask you, as an accounting expert, to make an analysis of the company for them. Apple’s financial statements are presented in Appendix A. The complete annual report,

> You are a loan officer for White Sands Bank of Taos. Paul Jason, president of P. Jason Corporation, has just left your office. He is interested in an 8-year loan to expand the company’s operations. The borrowed funds would be used to pu

> Amazon.com, Inc.’s financial statements are presented in Appendix D. Financial statements of Wal-Mart Stores, Inc. are presented in Appendix E. The complete annual reports of Amazon and Wal-Mart, including the notes to the financial sta

> PepsiCo’s financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. The complete annual reports of PepsiCo and Coca- Cola, including the notes to the financial statement

> Wendall Company specializes in producing fashion outfits. On July 31, 2020, a tornado touched down at its factory and general office. The inventories in the warehouse and the factory were completely destroyed as was the general office nearby. Next mornin

> Wesley Corp. is a medium-sized wholesaler of automotive parts. It has 10 stockholders who have been paid a total of $1 million in cash dividends for 8 consecutive years. The board’s policy requires that, for this dividend to be declared, net cash provide

> Quigley Corporation’s trial balance at December 31, 2020, is presented below. All 2020 transactions have been recorded except for the items described below. Unrecorded transactions and adjustments: 1. On January 1, 2020, Quigley issue

> Seacrest Company’s overhead rate was based on estimates of $200,000 for overhead costs and 20,000 direct labor hours. Seacrest’s standards allow 2 hours of direct labor per unit produced. Production in May was 900 units, and actual overhead incurred in M

> Indicate two behavioral principles that pertain to (a) the manager being evaluated and (b) top management.

> The following account balances relate to the stockholders’ equity accounts of Kerbs Corp. at year-end. A small stock dividend was declared and issued in 2020. The result of the stock dividend was to decrease retained earnings by $10,5

> The information shown below was taken from the annual manufacturing overhead cost budget of Connick Company. Variable manufacturing overhead costs ………………………………. $34,650 Fixed manufacturing overhead costs ………………………………….. $19,800 Normal production level i

> Data for Levine Inc. are given in E26.7. Instructions Journalize the entries to record the materials and labor variances. Data from E26.7: Levine Inc., which produces a single product, has prepared the following standard cost sheet for one unit of the

> How do direct fixed costs differ from indirect fixed costs? Are both types of fixed costs controllable?

> How does the output of manufacturing operations differ from that of service operations?

> How do responsibility reports differ from budget reports?

> Using the data in Question 14, what are (a) the total cost of work in process and (b) the cost of goods manufactured? Data from Question 14: Tate Inc. has beginning work in process $26,000, direct materials used $240,000, direct labor $220,000, total ma

> The flexible budget formula is fixed costs $50,000 plus variable costs of $4 per direct labor hour. What is the total budgeted cost at (a) 9,000 hours and (b) 12,345 hours?

> Kaiser Industries carries no inventories. Its product is manufactured only when a customer’s order is received. It is then shipped immediately after it is made. For its fiscal year ended October 31, 2020, Kaiser’s break-even point was $1.3 million. On sa

> Bryant Company has a factory machine with a book value of $90,000 and a remaining useful life of 5 years. It can be sold for $30,000. A new machine is available at a cost of $400,000. This machine will have a 5-year useful life with no salvage value. The

> Jerry Lang is unclear as to the difference between the balance sheets of a merchandising company and a manufacturing company. Explain the difference to Jerry.

> You are provided with the following information regarding events that occurred at Moore Corporation during 2020 or changes in account balances as of December 31, 2020. a. Depreciation expense was $80,000. b. Interest Payable account increased $5,000. c

> Viejol Corporation has collected the following information after its first year of sales. Sales were $1,600,000 on 100,000 units, selling expenses $250,000 (40% variable and 60% fixed), direct materials $490,000, direct labor $290,000, administrative exp

> NuComp Company operates in a state where corporate taxes and workers’ compensation insurance rates have recently doubled. NuComp’s president has just assigned you the task of preparing an economic analysis and making a recommendation relative to moving t

> What factors should be considered in setting (a) the direct materials price standard and (b) the direct materials quantity standard?

> Explain the primary difference between line positions and staff positions, and give examples of each.

> Zeller Company estimates that 2020 sales will be $40,000 in quarter 1, $48,000 in quarter 2, and $58,000 in quarter 3. Cost of goods sold is 50% of sales. Management desires to have ending finished goods inventory equal to 10% of the next quarter’s expec

> Refer back to E27.9 to address the following. Instructions Prepare a memo to Maria Fierro, your supervisor. Show your calculations from E27.9 (a) and (b). In one or two paragraphs, discuss important nonfinancial considerations. Make any assumptions you

> Pine Street Inc. makes unfinished bookcases that it sells for $62. Production costs are $36 variable and $10 fixed. Because it has unused capacity, Pine Street is considering finishing the bookcases and selling them for $70. Variable finishing costs are

> Tanek Corp.’s sales slumped badly in 2020. For the first time in its history, it operated at a loss. The company’s income statement showed the following results from selling 500,000 units of product: sales $2,500,000,

> During the current month, Standard Corporation completed Job 310 and Job 312. Job 310 cost $70,000 and Job 312 cost $50,000. Job 312 was sold on account for $90,000. Journalize the entries for the completion of the two jobs and the sale of Job 312.

> Manson Industries incurs unit costs of $8 ($5 variable and $3 fixed) in making an assembly part for its finished product. A supplier offers to make 10,000 of the assembly part at $6 per unit. If the offer is accepted, Manson will save all variable costs