Question: Lydia Trottier has prepared baked goods for

Lydia Trottier has prepared baked goods for sale since 1998. She started a baking business in her home and has been operating in a rented building with a storefront since 2003. Trottier incorporated the business as MLT Inc. on January I, 2014, with an initial share issue of 1,000 common shares for $2,500. Lydia Trottier is the principal shareholder of MLT Inc.

Sales have increased by 30% annually since operations began at the present location, and additional equipment is needed for the continued growth that is expected. Trottier wants to purchase some additional baking equipment and to finance the equipment through a long-term note from a commercial bank. Woodslee Bank & Trust has asked Trottier to submit an income statement for MLT Inc. for the first five months of 2014 and a statement of financial position as at May 31, 2014.

Trottier assembled the following information from the corporation's cash basis records to use in preparing the financial statements that the bank wants to see:

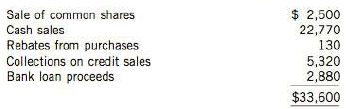

1. The bank statement showed the following 2014 deposits through May 31:

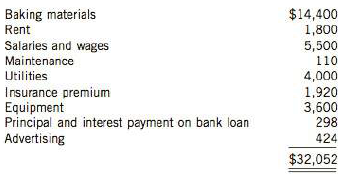

2. The following amounts were disbursed through May 31, 2014:

3. Unpaid invoices at May 31, 2014, were as follows:

4. Accounts receivable records showed uncollected sales of $4,336 at May 31, 2014.

5. Baking materials costing $2,075 were on hand at May 31, 2014. There were no materials in process or finished goods on hand at that date. No materials were on hand or in process and no finished goods were on hand at January 1, 2014.

6. The note for the three-year bank Joan is dated January 1, 2014, and states a simple interest rate of 8%. The Joan requires quarterly payments on April 1, July 1, October 1, and January l. Each payment is to consist of equal principal payments plus accrued interest since the last payment.

7. Lydia Trottier receives a salary of $750 on the last day of each month. The other employees have been paid through May 25, 2014, and are due an additional $270 on May 31, 2014.

8. New display cases and equipment costing $3,600 were purchased on January 2, 2014, and have an estimated useful life of five years. These are the only fixed assets that are currently used in the business. Straight-line depreciation is used for book purposes.

9. Rent was paid for six months in advance on January 2, 2014.

10. A one-year insurance policy was purchased on January 2, 2014.

11. MLT Inc. is subject to an income tax rate of 20%.

12. Payments and collections from the unincorporated business through December 31, 2013, were not included in the corporation's records, and no cash was transferred from the unincorporated business to the corporation.

Instructions

(a) Using the accrual basis of accounting, prepare an income statement for the five months ended May 31, 2014.

(b) Using the accrual basis, prepare a statement of financial position as at May 31, 2014.

*(c) Assume the role of a bank manager at Woodslee Bank & Trust. Based only on MLT's current ratio as a measure of liquidity, and tin1es interest earned ratio as a measure of coverage, would you recommend extending a long-term note for financing of MLT's purchase of additional baking equipment?

Transcribed Image Text:

Sale of common shares $ 2,500 Cash sales 22,770 130 Rebates from purchases Collections on credit sales 5,320 2,880 Bank loan proceeds $33,600 Baking materials Utilities $256 270 $526

> Bluebell Enterprises Ltd.'s records reported an inventory cost of $55,600 and a net realizable value of $54,000 at December 31, 2012. At December 31, 2013, the records indicated a cost of $68,700 and a net realizable value of $61,625. All opening invento

> Antimatter Corporation has the following four items in its ending inventory: (a) Assume that Antimatter is a public company using IFRS. Determine the total value of ending inventory using the lower of cost and net realizable value model applied on an in

> Canali Corporation uses a perpetual inventory system. On November 19, the company sold 600 units. The following additional information is available: Calculate the November 30 inventory and the November cost of goods sold using (a) The moving average cost

> Instructions From SEDAR (www.sedar.com), or the company websites, access the financial statements of Loblaw Companies Limited for its year ended December 31, 2011, and of Empire Company Limited for its year ended May 5, 2012. Review the financial stateme

> Canadian Tire Corporation, Limited is one of Canada's best-known retailers. The company operates 488 "hard-goods" retail stores through associate dealers, and a total of 385 corporate and franchise stores under its subsidiary Mark's Work Wearhouse, and h

> The trial balance of Imotex Ltd. contains the following accounts: 1. Accounts receivable, trade 2. Accounts receivable, related company 3. Accounts receivable, to be exchanged for shares in another company 4. Note receivable, receivable in grams of a pre

> The trial balance before adjustment of Chloe Inc. shows the following balances: Instructions (a) Give the entry for bad debt expense for the current year assuming: 1. The allowance should be 4% of gross accounts receivable. 2. Historical records indicat

> Write a brief essay highlighting the differences between IFRS and ASPE noted in this chapter, discussing the conceptual justification for each.

> Who would have thought that musicians David Bowie and James Brown had anything to do with accounting? Asset- or artist-backed financing vehicles have been used by these performers and others as a means of securitizing royalties and rights to other intell

> Information on Janut Corp. follows: Instructions Prepare all necessary journal entries on Janut Corp.'s books. July 1 Janut Corp. sold to Harding Ltd. merchandise having a sales price of $9,000, terms 3/10, net/60. Janut records its sales and recei

> Rudolph Corp. is a subsidiary of Hundey Corp. The ethical accountant, working as Rudolph's controller, believes that the yearly charge for doubtful accounts for Rudolph should be 2% of net credit sales. The president, nervous that the parent company migh

> Soon after beginning the year-end audit work on March 10 for the 2014 year end at Arkin Corp., the auditor has the following conversation with the controller: Controller: The year ending March 31, 2014, should be our most profitable in history and, becau

> Creative Choice Corporation (CC) is a publicly traded company that has been providing traditional mortgage loans for the past 10 years. In an effort to grow its business, it has decided to build another 5 banking service locations across the country. The

> Bowearth Limited (BL) is in the lumber business. The company sells pulp and paper products as well as timber and lumber. It has over 500,000 hectares of timberland that it either owns or leases. The company's shares trade on the public stock exchange. Ne

> Fritz's Furniture (FF) is a mid-sized owner-operated business that was started 25 years ago by Fred Fritz. The retail furniture business is cyclical, with business dropping off in times of economic downturn, as is the case currently. In order to encourag

> TEL US Corporation is one of Canada’s; largest telecommunications companies and provides both products and services. Its shares are traded on the Toronto and New York stock exchanges. The credit facilities contain certain covenants relating to the amount

> Hanley Limited manufactures camera equipment. The company plans to list its shares on the Venture Exchange. To do so, it must meet all of the following initial listing requirements (among others): 1. Net tangible assets must be at least $500,000. 2. Pre-

> The following information relates to Shea Inc.'s Accounts Receivable for the 2014 fiscal year: 1. An aging schedule of the accounts receivable as at December 31, 2014, is as follows: 2. The Accounts Receivable control account has a debit balance of $372,

> Fortini Corporation had record sales in 2014. It began 2014 with an Accounts Receivable balance of $475,000 and an Allowance for Doubtful Accounts of $33,000. Fortini recognized credit sales during the year of $6,675,000 and made monthly adjusting entrie

> Civic Company made sales of $40,000 with terms 1/10, n/30. Within the discount period, it received a cash payment on $35,000 of the sales from customers; after the discount period, it received $5,000 in payments from customers. Assuming Civic uses the gr

> A series of unrelated situations follow: 1. Atlantic Inc.'s unadjusted trial balance at December 31, 2014, included the following accounts: 2. An analysis and aging of Central Corp.’s accounts receivable at December 31, 2014, disclosed

> Dev Equipment Corp. usually closes its books on December 31, but at the end of 2014 it held its cash book open so that a more favorable statement of financial position could be prepared for credit purposes. Cash receipts and disbursements for the first I

> Information follows for Quartz Industries Ltd.: aBank service charges bBank debit memo for $1,050.00 for a customer's cheque returned and marked NSF was included with the June bank statement. Cash received on June 30 and put in the bank's night deposit b

> Information related to Banzai Books Ltd. is as follows: balance per books at October 31, $41,847.85; November receipts, $173,528.91; November disbursements, $166,193.54; balance per bank statement at November 30, $56,270.20. The following cheques were ou

> The cash account of Villa Corp. shows a ledger balance of $3,969.85 on June 30, 2014. The bank statement as at that date indicates a balance of $4,150. When the statement was compared with the cash records, the following facts were determined: 1. There

> Joseph Kiuvik is reviewing the cash accounting for Connolly Corporation, a local mailing service. Kiuvik's review will focus on the petty cash account and the bank reconciliation for the month ended May 31, 2014. He has collected the following informatio

> Furlana Company Limited uses the gross profit method to estimate inventory for monthly reports. Information follows for the month of May: Instructions (a) Calculate the estimated inventory at May 31, assuming that the gross profit is 25% of sales. (b) C

> Battle Tank Limited had net sales in 2014 of $1.1 million. At December 31, 2014, before adjusting entries, the balances in selected accounts were as follows: Accounts Receivable 5250,000 debit; Allowance for Doubtful Accounts 52,800 credit. Assuming B

> Creative Corporation is a manufacturer of children's toys. Creative has significant debt outstanding that has been used to purchase equipment and inventory used in its manufacturing process. Creative has positive cash from operating activities during the

> Brave Maven Inc. (BMI) operates in challenging economic times. It currently manufactures trucks and equipment used for construction as well as off-road automobiles and automotive parts. During the year, net losses from off-road automobiles and parts tota

> Before filing for bankruptcy protection, the company was able to buy a large shipment of snow tubes wholesale for a bargain price of $7 million from a supplier that was in financial trouble. The value of the inventory is approximately $10 million. The in

> As a reviewer for the Ontario Securities Commission, you are in the process of reviewing the financial statements of public companies. The following items have come to your attention: 1. A merchandising company overstated its ending inventory two years a

> The statement of financial position of Delacosta Corporation as of December 31, 2014, is as follows: Note 1: Buildings are stated at cost, except for one building that was recorded at its appraised value as management determined the building to be worth

> The following account balances were included in the trial balance of Reid Corporation at June 30, 2014: During 2014, Reid incurred production salary and wage costs of S71 0,000, consumed raw materials and other production supplies of $ 474,670, and had

> The following financial statement was prepared by employees of Klein Corporation: * 1: New styles and rapidly changing consumer preferences resulted in a $37,000 loss on the disposal of discontinued styles and related accessories. * 2: The corporation so

> Veselin Kamel, vice-president of finance for Hand Corp., has recently been asked to conduct a seminar for the company's division controllers. He would discuss the proper accounting for items that are large but do not typify normal business transactions (

> Hawthorn Corporation's adjusted trial balance contained the following accounts at December 31, 2014: Retained Earnings………………………………………………. $120,000 Common Shares…………………………………………………..$700,000 Bonds Payable…………………………………………………..$100,000 Contributed Surplus……

> Use the information presented in BE5-8 for Cellin Limited to prepare the non-current liabilities section of the statement of financial position in accordance with (a) IFRS and (b) ASPE. Information from BE5-8 Accounts Payable…...…………………………251,000 Oblig

> Included in Cellin Limited’s December 31, 2014 trial balance are the following accounts: Accounts Payable…………………………251,000 Obligations Under Capital Leases……$175,000 Discount on Bonds Payable………………$142,000 Unearned Revenue…………………………$141, 000 Bonds Payabl

> Pine Corporation's adjusted trial balance contained the following asset accounts at December 31, 2014: Prepaid Rent………………………$12,000 Goodwill……………………………$50,000 Franchise Fees Receivable……$2,000 Intangible Assets- Franchises…………$47,000 Intangible Assets- P

> Billy's Burgers (BB) is a franchisor that operates several corporate-owned restaurants as well as several franchised restaurants. The franchisees pay 3% of their sales revenues to BB in return for advertising and support. During the year, BB sold its cor

> Use the annual reports of Brookfield Asset Management Inc. for the year ended December 31, 2011, and Mainstreet Equity Corp. for the year ended September 30, 2011, to answer the following questions. These reports are available on SEDAR ('www.sedar.com) o

> Obtain the 2011 annual report for the Royal Bank of Canada from the company's website or from SEDAR (www.sedar.com). Financial reporting for Canadian banks is also constrained by the Bank Act and monitored by the Office of the Superintendent of Financial

> An excerpt from the annual report of BCE Inc. is shown below. The excerpt shows summarized financial information, including calculations of earnings before interest, tax, depreciation, and amortization (EBITDA); adjusted net earnings; and free cash flows

> The trial balance follows for McLean Corporation at December 3!, 2014: A physical count of inventory on December 31 showed that there was $124,000 of inventory on hand. Instructions Prepare a single-step income statement and a statement of retained ear

> Quality of earnings analysis is a very important tool in assessing the value of a company and its shares. The chapter presents a framework for evaluating quality of earnings. Instructions Do an Internet search on the topic and write a critical essay di

> The IASB and FASB are currently studying the issue of reporting financial performance. Instructions Go to the IASB website (www.ifrs.org) and download the Discussion Paper: Preliminary Views on Financial Statement Presentation from October 2008. (a) Exp

> The Canadian Securities Administrators (CSA), an umbrella group of Canadian provincial securities commissions, accumulates and publishes all documents that public companies are required to file under securities law. This database may be accessed from the

> Under IFRS, items of income and expenses are not allowed to be presented as "extraordinary" in the income statement or notes. Under U.S. GAAP, this is allowed. Instructions Explain what reasons the IASB might have had to eliminate the separate reporting

> Other comprehensive income is a category of comprehensive income that is made up of specific gains and losses that are reported separately after net earnings under IFRS. Under ASPE, there is no such concept as comprehensive income or other comprehensive

> Anikan Limited has approved a formal plan to sell its head office tower to an outside party. A detailed plan has been approved by the board of directors. The building is on the books at $50 million (net book value). The estimated selling price is S49 mil

> The ethical accountant is the manager and accountant for a small company that is privately owned by three individuals. He has always given the owners cash-based financial statements. The owners are not accountants and do not understand how financial stat

> On January 1, 2014, Rocket Corp. had cash and common shares of$60,000. At that date, the company had no other asset, liability, or shareholders' equity balances. On January 2, 2014, Rocket paid 540,000 cash for equity securities that it designated as fai

> Information about a corporation's operations is presented in a statement of earnings or a statement of comprehensive income. Income statements are prepared on either a current operating performance basis or an all-inclusive basis. Users of these income s

> Lanestar Inc. reported income from continuing operations before tax of$1,790,000 during 2014. Additional transactions occurring in 2014 but not included in the $1,790,000 are as follows: 1. The corporation experienced an insured flood loss of $80,000 dur

> Information for 2014 follows for Rolling Thunder Corp. Rolling Thunder decided to discontinue its entire wholesale division (a major line of business) and to keep its manufacturing division. On September 15, it sold the wholesale division to Dylane Corp

> Delray Inc. follows IFRS and has the following amounts for the year ended December 31, 2014: gain on sale of FV-NI investments (before tax) $1,000; loss from operation of discontinued division (net of tax) $3,000; income from operations (before tax) 515,

> On November I, 2013, Campbell Corporation management decided to discontinue operation of its Rocketeer Division and approved a formal plan to dispose of the division. Campbell is a successful corporation with earnings of $150 million or more before tax f

> In recent years, Grace Inc. has reported steadily increasing income. The company reported income of $20,000 in 2011, $25,000 in 2012, and 530,000 in 2013. Several market analysts have recommended that investors buy Grace Inc. shares because they expect t

> Dr. John Gleason, M.D., maintains the accounting records of Bones Clinic on a cash basis. During 2014, Dr. Gleason collected 5146,000 in revenues and paid 555,470 in expenses. At January 1, 2014, and December 31, 2014, he had accounts receivable, unearne

> The trial balance of Eastwood Inc. and other related information for the year 2014 follows: Additional information: 1. The inventory has a net realizable value of $212,000. The FIFO method of inventory valuation is used. 2. The fair value- OCI investmen

> On January I, 2014, Caroline Lampron and Jenni Meno formed a computer sales and service enterprise in Montreal by investing $90,000 cash. The new company, Razorback Sales and Service, has the following transactions in January: l. Paid $6,000 in advance f

> The following is from a recent income statement for Baring Corp (a public company): It includes only five separate numbers, two subtotals, and the net earnings figure. Instructions (a) Indicate the deficiencies in the income statement. (b) What recommen

> The equity accounts of Feeling Alright Vitamin Limited as at January 1, 2014, were as follows: During 2014, the following transactions took place: Instructions Prepare a statement of changes in equity for the year ended December 31, 2014. The company fo

> Amos Corporation was incorporated and began business on January 1, 2014. It has been successful and now requires a bank loan for additional working capital to finance an expansion. The bank has requested an audited income statement for the year 2014 usin

> Faldo Corp. is a public company and has 100,000 common shares outstanding. In 2014, the company reported income from continuing operations before income tax of $2,710,000. Additional transactions not considered in the $2,710,000 are as follows: 1. In 201

> Joe Schreiner, controller for On Time Clock Company Inc., recently prepared the company's income statement and statement of changes in equity for 2014. Schreiner believes that the statements are a fair presentation of the company's financial progress dur

> Hamad Corporation began operations on January 1, 2011. Recently the corporation has had several unusual accounting problems related to the presentation of its income statement for financial reporting purposes. The company follows ASPE. You are the CA for

> Faz Corporation is a manufacturer of paints and specialty coatings. In March 2014, Beck Inc. filed a lawsuit against Faz Corporation for alleged patent infringement, claiming $1.l million in damages. Faz's lawyer disputed the claim, but in December 2014,

> A combined statement of income and retained earnings for DC 5 Ltd. for the year ended December 31, 2014, follows. (As a private company, DC 5 has elected to follow ASPE.) Also presented are three unrelated situations involving accounting changes and the

> Bruno Corp. has decided to expand its operations. The bookkeeper recently completed the following statement of financial position in order to obtain additional funds for expansion: Instructions (a) Prepare a revised statement of financial position using

> Videohound Video Company, a sole proprietorship, had the following information for 2014: Instructions Calculate the net income for 2014. Cash balance, January 1 Accounts receivable, January 1 Collections from customers during year Capital account ba

> The following are all changes in the account balances of Bravar Company Ltd. during the current year, except for Retained Earnings: Instructions Calculate the net income for the current year, assuming that there were no entries in the Retained Earnings

> On October 5, 2014, Diamond in the Rough Recruiting Group Inc.'s board of directors decided to dispose of the Blue Division. A formal plan was approved. Diamond derives approximately 7 5% of its income from its human resources management practice. The Bl

> Assume that PAC Inc. decided to sell SBT, a subsidiary, on September 30, 2014. There is a formal plan to dispose of the business component, and the sale qualifies for discontinued operations treatment. Pertinent data on the operations of the TV subsidiar

> Pike Corporation, a clothing retailer, had income from operations (before tax) of $375,000, and recorded the following before tax gains/ (losses) for the year ended December 31, 2014: Pike also had the following account balances as of January I, 2014: A

> Reach Out Card Company Limited reported the following for 2014: net sales revenue $1.2 million; cost of goods sold $750,000; selling and administrative expenses $320,000; gain on disposal of building $250,000; and unrealized gain-OCI (related to fair val

> Portmann Corp. maintains its financial records using the cash basis of accounting. As it would like to secure a long-term loan from its bank, the company asks you, as an independent CA, to convert its cash basis income statement information to accrual ba

> The shareholders' equity section of Emerson Corporation as at December 31, 2014, follows: Net income of$24 million for 2014 reflects a total effective tax rate of25%. Included in the net income figure is a loss of $15 million (before tax) relating to th

> Environmental Corporation specializes in the production and sale of eco-friendly packaging. In 2014, Environmental reported net income (earnings) in excess of analyst expectations. This included a significant gain on sale of investments in the year and l

> Rainy Day Umbrella Corporation had the following balances at December 31, 2013 (all amounts in thousands): preferred shares $2,006; common shares $5,291; contributed surplus 52,225; retained earnings $ 13,692; and accumulated other comprehensive income 5

> Plato Inc. prepares financial statements in accordance with IFRS and uses the following headings on its statement of financial position: l. Current assets 2. Long-term investments 3. Property, plant, and equipment 4. Intangible assets 5. Other assets

> The Holiday Corporation, a private company, began operations on January I, 2011. During its first three years of operations, Holiday reported net income and declared dividends as follows: The following information is for 2014: Instructions Prepare a 20

> The following are selected ledger accounts of Holland Rose Corporation at December 31, 2014: Holland's effective tax rate on all items is 25%. A physical inventory indicates that the ending inventory is $686,000. The number of common shares outstanding

> The following balances were taken from the books of the Big Track Trucking Company Limited on December 31, 2014: Assume the total effective tax rate on all items is 25%. Instructions Prepare a multiple-step income statement showing expenses by function.

> Two accountants, Yuan Tsui and Sergio Aragon, are arguing about the merits of presenting an income statement in the multiple-step versus the single-step format, and presenting expenses in the nature or function of expense format. The discussion involves

> The financial records of Geneva Inc. were destroyed by fire at the end of 2014. Fortunately, the controller had kept the following statistical data related to the income statement: l. The beginning merchandise inventory was 584,000 and it decreased by 20

> The following is information for Gottlieb Corp. for the year ended December 31, 2014: The effective tax rate is 25% on all items. Gottlieb prepares financial statements in accordance with IFRS, and accounts for its investments in accordance with IAS 39.

> The following information was taken from the records of Presley Inc. for the year 2014: The following additional information was also available: income tax applicable to income from continuing operations, $187,000; income tax applicable to loss from oper

> Income statement information for Flett Tire Repair Corporation for the year 2014 follows: The effective tax rate on all income is 25%, and Flea applies ASPE. Instructions (a) Prepare a multiple-step income statement for 2014, showing expenses by function

> Certain account balances follow for Vincenti Products Corp. Instructions Based on the balances, calculate the following: (a) Total net revenue, (b) Net income or loss, and (c) Dividends declared during the current year. Rental revenue Interest exp

> Several of Jae Corporation's major customers experienced cash flow problems in 2014, mainly due to their increasing labor and production costs in 2013 and 2014. As a result, Jae's accounts receivable turnover ratio (net sales revenue/average trade receiv

> The classifications on Chesapeake Limited's statement of financial position are as follows: l. Current assets 2. Long-term investments 3. Property, plant, and equipment 4. Intangible assets 5. Other assets 6. Current liabilities 7. Non-current liabi

> At December 31, 2014, Tres Hombres Corporation had the following shares outstanding: 10% cumulative preferred shares, 107,500 shares outstanding $10,750,000 Common shares, 4,000,000 shares outstanding 20,000,000 During 2014, the corporation's only s

> In 2014, Renato Corp. had cash receipts from customers of $ 152,000 and cash payments for operating expenses of $97,000. At January I, 2014, accounts receivable was $ 13,000 and total prepaid expenses was $17,500. At December 31, 2014, accounts receivabl

> In 2014, I & T Corporation reported net income of $1.6 million, and declared and paid preferred share dividends of $400,000. During 2014, I & T had a weighted average of 120,000 common shares outstanding. Calculate I & T's 2014 earnings per share.

> Turner Limited had 40,000 common shares on January I, 2014. On April I, 8,000 shares were repurchased. On August 31, 12,000 shares were issued. Calculate the number of shares outstanding at December 31, 2014, and the weighted average number of shares for

> Use the information in BE4-14 to prepare a statement of retained earnings for Global Corporation, assuming that in 2014, Global discovered that it had overstated 2011 depreciation by $25,000 (net of tax). In BE4-14 Global Corporation prepares financial s

> Global Corporation prepares financial statements in accordance with ASPE. At January I, 2014, the company had retained earnings of $529,000. In 2014, net income was $1,646,000, and cash dividends of $660,000 were declared and paid. Prepare a 2014 stateme

> Your Pal Postcard Company Limited report the following for 2014: sales revenue $900,000; cost of sales $750,000; operating expenses $100,000; and unrealized gain on fair value-OCI investments $60,000. The company had January I, 2014 balances as follows: