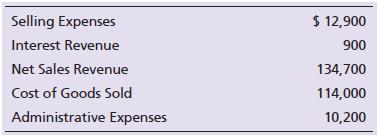

Question: Macarthy Landscape Supply’s selected accounts as

Macarthy Landscape Supply’s selected accounts as of December 31, 2018, follow. Compute the gross profit percentage for 2018.

Transcribed Image Text:

Selling Expenses $ 12,900 Interest Revenue 900 Net Sales Revenue 134,700 Cost of Goods Sold 114,000 Administrative Expenses 10,200

> Centerpiece Arrangements has just completed operations for the year ended December 31, 2018. This is the third year of operations for the company. The following data have been assembled for the business: Prepare the income statement of Centerpiece Arra

> Consider the following accounts: a. Accounts Payable b. Cash c. Common Stock d. Accounts Receivable e. Rent Expense f. Service Revenue g. Office Supplies h. Dividends i. Land j. Salaries Expense Identify the financial statement (or statements) that each

> Consider the following accounts: a. Accounts Payable b. Cash c. Common Stock d. Accounts Receivable e. Rent Expense f. Service Revenue g. Office Supplies h. Dividends i. Land j. Salaries Expense Identify each account as Asset, Liability, or Equity.

> Thompson Handyman Services has total assets for the year of $18,400 and total Liabilities of $9,050. Requirements: 1. Use the accounting equation to solve for equity. 2. If next year assets increased by $4,300 and equity decreased by $3,850, what would

> Michael McNamee is the proprietor of a property management company, Apartment Exchange, near the campus of Pensacola State College. The Business has cash of $8,000 and furniture that cost $9,000 and has a market value of $13,000. The business debts inclu

> Suppose you are starting a business, Wholly Shirts, to imprint logos on T-shirts. In organizing the business and setting up its accounting records, you take your information to a CPA to prepare financial statements for the bank. Name the organization tha

> For each user of accounting information, identify if the user would use financial accounting or managerial accounting. a. investor b. banker c. IRS d. manager of the business e. controller f. stockholder g. human resources director h. creditor

> Describe the similarities and differences among the four different types of business entities discussed in the chapter.

> What is accounting?

> Explain the purpose of Generally Accepted Accounting Principles (GAAP),including the organization currently responsible for the creation and governance of these standards.

> What are two certifications available for accountants? Briefly explain each certification.

> Describe the various types of individuals who use accounting information and how they use that information to make important decisions.

> List the four financial statements. Briefly describe each statement.

> Canyon Canoe Company is a service-based company that rents canoes for use on local lakes and rivers. Amber and Zack Wilson graduated from college about 10 years ago. They both worked for one of the “Big Four” accountin

> What is the calculation for ROA? Explain what ROA measures.

> Abby Perry recently opened her own law office on December 1, which she operates as a corporation. The name of the new entity is Abby Perry, Attorney. Perry experienced the following events during the organizing phase of the new business and its first mon

> Amos Sharp recently opened his own accounting firm on October 1, which heoperatesas a corporation. The name of the new entity is Amos Sharp, CPA. Sharp experienced the following events during the organizing phase of the new business and its first month o

> The bookkeeper of Juniper Landscaping prepared the company’s balance sheet while the accountant was ill. The balance sheet, shown on the next page, contains numerous errors. In particular, the bookkeeper knew that the balance sheet shou

> Pretty Pictures works weddings and prom-type parties. The balance of Retained Earnings was $20,000 at December 31, 2017. At December 31, 2018, the business’s accounting records show these balances: Prepare the following financial stat

> What is the role of the Financial Accounting Standards Board (FASB)?

> Presented here are the accounts of Pembroke Bookkeeping Company for the year ended December 31, 2018: Requirements: 1. Prepare Pembroke Bookkeeping Company’s income statement. 2. Prepare the statement of retained earnings. 3. Prepare

> Cosmo Thomas started a new business, Thomas Gymnastics, and completed the following transactions during December: Analyze the effects of the transactions on the accounting equation of Thomas Gymnastics using a format similar to Exhibit 1-6. Dec. 1

> Meg McIntyre opened a public relations firm called Pop Chart on August 1, 2018. The following amounts summarize her business on August 31, 2018: During September 2018, the business completed the following transactions: a. Received contribution of $14,0

> Annette Pachelo recently opened her own law office on March 1, which she operates as a corporation. The name of the new entity is Annette Pachelo, Attorney. Pachelo experienced the following events during the organizing phase of the new business and its

> Allen Shonton recently opened his own accounting firm on April 1, which he operates as a corporation. The name of the new entity is Allen Shonton, CPA. Shonton experienced the following events during the organizing phase of the new business and its first

> The bookkeeper of Outdoor Life Landscaping prepared the company’s balance sheet while the accountant was ill. The balance sheet, shown on the next page, contains numerous errors. In particular, the bookkeeper knew that the balance sheet

> Picture Perfect Photography works weddings and prom-type parties. The balance of retained earnings was $16,000 at December 31, 2017. At December 31, 2018, the business’s accounting records show these balances: Prepare the following fi

> Presented here are the accounts of Hometown Décor Company for the year ended December 31, 2018. Requirements: 1. Prepare Hometown Décor Company’s income statement. 2. Prepare the statement of retained earning

> Conner Thomas started a new business, Thomas Gymnastics, and completed the following transactions during December: Analyze the effects of the transactions on the accounting equation of Thomas Gymnastics using a format similar to Exhibit 1-6. Dec.

> Meg McKinney opened a public relations firm called Solid Gold on August 1, 2018. The following amounts summarize her business on August 31, 2018: During September 2018, the business completed the following transactions: a. Received contribution of $17,

> Exeter is a building contractor on the Gulf Coast. After losing a number of big lawsuits, it was facing its first annual net loss as the end of the year approached. The owner, Hank Snow, was under intense pressure from the company’s creditors to report p

> Alice Appliance Service had net income for the year of $58,500. In addition, the balance sheet reports the following balances: Calculate the return on assets for Alice Appliance Service for the year ending December 31, 2018. Jan 1, 2018 Dec 31, 201

> Morning Bean Food Equipment Company had the following transactions for the month ending January 31, 2018. Morning Bean’s cash balance on January 1, 2018, was $11,800. Prepare the statement of cash flows of Morning Bean Food Equipment

> Macy’s, Inc. is a premier retailer in the United States, operating nearly 900 stores in 45 states. Macy’s, Bloomingdale’s, and Bloomingdale’s Outlet are all brands that operate under Macy’s, Inc. The company sells a wide range of merchandise including ap

> Consider the following transactions for Garman Packing Supplies: Requirements: 1. Journalize the purchase transactions assuming Garman Packing Supplies uses the periodic inventory system. Explanations are not required. 2. What is the amount of net purc

> Journalize the following sales transactions for King Company. Explanations are not required. Apr. 1 King Company sold merchandise inventory for $150. The cost of the inventory was $90. The customer paid cash. King Company was running a promotion and

> For each transaction, identify the appropriate section on the statement of cash flows to report the transaction. Choose from: Cash flows from operating activities (O), Cash flows from investing activities (I), Cash flows from financing activities (F), or

> Camilia Communications reported the following figures from its adjusted trial balance for its first year of business, which ended on July 31, 2018: Requirements: 1. Prepare Camilia Communications’s statement of retained earnings for t

> Camilia Communications reported the following figures from its adjusted trial balance for its first year of business, which ended on July 31, 2018: Prepare Camilia Communications’s multi-step income statement for the year ended July 3

> Rocky RV Center’s accounting records include the following accounts at December 31, 2018. Requirements: 1. Journalize the required closing entries for Rocky. 2. Determine the ending balance in the Retained Earnings account. Cost o

> On November 4, 2018, Cain Company sold merchandise inventory on account to Tarin Wholesalers, $12,000, that cost $4,800. Terms 3/10, n/30. On November 5, 2018, Tarin Wholesalers paid shipping of $30. Tarin Wholesalers paid the balance to Cain Company on

> Suppose Piranha.com sells 3,500 books on account for $17 each (cost of these books is $35,700) on October 10, 2018 to The Textbook Store. One hundred of these books (cost $1,020) were damaged in shipment, so Piranha.com later received the damaged goods f

> Journalize the following sales transactions for Salem Sportswear. Explanations are not required. The company estimates sales returns at the end of each month. Jul. 1 Salem sold $20,000 of men's sportswear for cash. Cost of goods sold is $10,000. 3 S

> Consider the following transactions for Burlington Drug Store: Requirements: 1. Journalize the purchase transactions. Explanations are not required. 2. In the final analysis, how much did the inventory cost Burlington Drug Store? Feb. 2 Burlington

> Consider the following transactions for Toys and More: Requirements: 1. Journalize the purchase transactions. Explanations are not required. 2. In the final analysis, how much did the inventory cost Toys and More? May 8 Toys and More buys $113,300

> D & T Printing Supplies’s accounting records include the following accounts at December 31, 2018. Requirements: 1. Journalize the required closing entries for D & T Printing Supplies assuming that D & T usesthe periodic in

> M Wholesale Company began the year with merchandise inventory of $5,000. During the year, M purchased $93,000 of goods and returned $6,600 due to damage. M also paid freight charges of $1,200 on inventory purchases. At year-end, M’s ending merchandise in

> The assets, liabilities, and equities of Damon Design Studio have the following balances at December 31, 2018. The retained earnings was $39,000 at the beginning of the year. At year end, common stock was $13,000 and dividends were $57,000. Prepare the

> Journalize the following sales transactions for Sanborn Camera Store using the periodicinventory system. Explanations are not required. Dec. 3 Sanborn sold $41,900 of camera equipment on account, credit terms are 3/15, n/EOM. Sanborn receives paymen

> Jeana’s Furniture’s unadjusted Merchandise Inventory account at year-end is $69,000. The physical count of inventory came up with a total of $67,600. Journalize the adjusting entry needed to account for inventory shrinkage.

> On December 31, Jack Photography Supplies estimated that approximately 2% of merchandise sold will be returned. Sales Revenue for the year was $80,000 with a cost of $48,000. Journalize the adjusting entries needed to account for the estimated returns.

> For each statement below, identify whether the statement applies to the periodic inventory system, the perpetual inventory system, or both. a. Normally used for relatively inexpensive goods. b. Keeps a running computerized record of merchandise inventor

> What are the four steps involved in the closing process for a merchandising company?

> Describe FOB shipping point and FOB destination. When does the buyer take ownership of the goods, and who typically pays the freight?

> What are the two types of inventory accounting systems? Briefly describe each.

> Highlight the differences in the closing process when using the periodic inventory system rather than the perpetual inventory system.

> Describe the calculation of cost of goods sold when using the periodic inventory system.

> The assets, liabilities, and equities of Damon Design Studio have the following balances at December 31, 2018. The retained earnings was $39,000 at the beginning of the year. At year end, common stock was $13,000 and dividends were $57,000. Prepare the

> Is an adjusting entry needed for inventory shrinkage when using the periodic inventory system? Explain.

> Describe the journal entry(ies) when recording a sale of inventory using the periodic inventory system.

> What account is debited when recording the payment of freight in when using the periodic inventory system?

> When recording purchase returns and purchase allowances under the periodic inventory system, what account is used?

> What account is debited when recording a purchase of inventory when using a periodic inventory system?

> When a company has a contract involving multiple performance obligations, how must the company recognize revenue?

> What does the gross profit percentage measure, and how is it calculated?

> What financial statement is merchandise inventory reported on, and in what section?

> Describe the multi-step income statement.

> Describe the single-step income statement.

> The assets, liabilities, and equities of Damon Design Studio have the following balances at December 31, 2018. The retained earnings was $39,000 at the beginning of the year. At year end, common stock was $13,000 and dividends were $57,000. Prepare the

> What is inventory shrinkage? Describe the adjusting entry that would be recorded to account for inventory shrinkage.

> What is freight out and how is it recorded by the seller?

> When granting a sales allowance is there a return of merchandise inventory from the customer? Describe the journal entry(ies) that would be recorded.

> Under the new revenue recognition standard, what must companies do at the end of the period related to sales returns? Describe the journal entries that would be recorded.

> Under the new revenue recognition standard, how is the sale of inventory recorded?

> What are the two journal entries involved when recording the sale of inventory when using the perpetual inventory system?

> How is the net cost of inventory calculated?

> What is a purchase return? How does a purchase allowance differ from a purchase return?

> What would the credit terms of “2/10, n/EOM” mean?

> What account is debited when recording a purchase of inventory when using the perpetual inventory system?

> The account balances of Wilson Towing Service at June 30, 2018, follow: Requirements: 1. Prepare the balance sheet for Wilson Towing Service as of June 30, 2018. 2. What does the balance sheet report? Equipment $ 25,850 Service Revenue $ 15,000 Off

> What is an invoice?

> How is gross profit calculated, and what does it represent?

> What is Cost of Goods Sold (COGS), and where is it reported?

> Describe the operating cycle of a merchandiser.

> What are the two types of merchandisers? How do they differ?

> What is a merchandiser, and what is the name of the merchandise that it sells?

> Taylor Department Store uses a periodic inventory system. The adjusted trial balance of Taylor Department Store at December 31, 2018, follows: Requirements: 1. Prepare Taylor Department Store’s multi-step income statement for the year

> Journalize the following transactions that occurred in June 2018 for Daley Company. Assume Daley uses the periodic inventory system. No explanations are needed. Identify each accounts payable and accounts receivable with the vendor or customer name. Dale

> The records of Grade A Beef Company list the following selected accounts for the quarter ended September 30, 2018: Requirements: 1. Prepare a single-step income statement. 2. Prepare a multi-step income statement. 3. J. Douglas, manager of the company,

> The unadjusted trial balance for Tuttle Electronics Company follows: Requirements: 1. Journalize the adjusting entries using the following data: a. Interest revenue accrued, $550. b. Salaries (Selling) accrued, $2,800. c. Depreciation Expenseâ

> The account balances of Wilson Towing Service at June 30, 2018, follow: Requirements: 1. Prepare the statement of retained earnings for Wilson Towing Service for the month ending June 30, 2018. 2. What does the statement of retained earnings report?

> The adjusted trial balance of Rockin Robbin Dance Company at April 30, 2018, follows: Requirements: 1. Prepare Rockin Robbin’s multi-step income statement for the year ended April 30, 2018. 2. Journalize Rockin Robbinâ€

> Journalize the following transactions that occurred in January 2018 for Sylvia’s Amusements. No explanations are needed. Identify each accounts payable and accounts receivable with the vendor or customer name. Sylvia estimates sales ret

> Journalize the following transactions that occurred in February 2018 for Oceanic. No explanations are needed. Identify each accounts payable and accounts receivable with the vendor or customer name. Oceanic estimates sales returns at the end of each mont

> Triton Department Store uses a periodic inventory system. The adjusted trial balance of Triton Department Store at December 31, 2018, follows: Requirements: 1. Prepare Triton Department Store’s multi-step income statement for the year

> Journalize the following transactions that occurred in March 2018 for Double Company. Assume Double uses the periodic inventory system. No explanations are needed. Identify each accounts payable and accounts receivable with the vendor or customer name. D

> The records of Farm Quality Steak Company list the following selected accounts for the quarter ended April 30, 2018: Requirements: 1. Prepare a single-step income statement. 2. Prepare a multi-step income statement. 3. M. Doherty, manager of the compan

> The unadjusted trial balance for Trudel Electronics Company at March 31, 2018, follows: Requirements: 1. Journalize the adjusting entries using the following data: a. Interest revenue accrued, $200. b. Salaries (Selling) accrued, $2,300. c. Depreciatio

> The adjusted trial balance of Rachael Rey Music Company at June 30, 2018, follows: Requirements: 1. Prepare Rachael Rey’s multi-step income statement for the year ended June 30, 2018. 2. Journalize Rachael Rey’s clos

> Journalize the following transactions that occurred in November 2018 for Julie’s Fun World. No explanations are needed. Identify each accounts payable and accounts receivable with the vendor or customer name. Julie’s F