Question: Mackenzie Corp. is preparing the December 31,

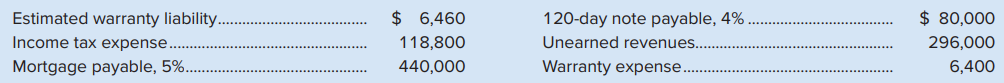

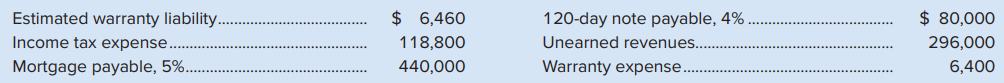

Mackenzie Corp. is preparing the December 31, 2020, year-end financial statements. Following are selected unadjusted account balances:

Additional information:

a. $10,800 of income tax was accrued monthly from January through to November inclusive and paid on the 15th day of the following month. The actual amount of tax expense for the year is determined to be $126,040.

b. A customer is suing the company. Legal advisers believe it is probable that the company will have to pay damages, the amount of which will approximate $140,000 given similar cases in the industry.

c. During December, Mackenzie had sales of $710,000. 5% of sales typically require warranty work equal to 20% of the sales amount.

d. Mortgage payments are made on the first day of each month.

e. $111,500 of the Unearned Revenues remain unearned at December 31, 2020.

f. The 120-day note payable was dated November 15, 2020.

Required:

1. Prepare any required adjusting entries at December 31, 2020, for each of the above.

2. Determine the adjusted amounts for total liabilities and profit assuming these were $940,000 and $620,000, respectively, prior to preparing the adjustments in (a) to (f) above.

Analysis Component: What is the effect on the income statement and balance sheet if the above entries are not recorded? Identify which GAAP, if any, would be violated if these entries are not recorded.

> The December 31, 2020, equity section of ZoomZoom Inc.’s balance sheet appears below. Required: All the shares were issued on January 1, 2018 (when the corporation began operations). No dividends had been declared during the first two y

> Westby Corp., a high school uniform manufacturer, was authorized to issue an unlimited number of common shares. During January 2020, its first month of operations, the following selected transactions occurred: Required a. Journalize the above transaction

> Mainland Resources Inc. began operations on June 5, 2020. Journalize the following equity transactions that occurred during the first month of operations:

> On March 1, the board of directors declared a cash dividend of $0.70 per common share to shareholders of record on March 10, payable March 31. There were 127,000 shares issued and outstanding on March 1 and no additional shares had been issued during the

> Fast Cars Inc. was authorized to issue 50,000 $1.50 preferred shares and 300,000 common shares. During 2020, its first year of operations, the following selected transactions occurred: Required a. Journalize the above transactions. b. Prepare the equity

> Using the information from the alphabetized post-closing trial balance below, prepare a classified balance sheet for Malta Industries Inc. as at October 31, 2020. Be sure to use proper form, including all appropriate subtotals.

> SW Company provides the Equity & Liability information below for analysis. SW Company had net income of $389,050 in 2020 and $342,650 in 2019. Note 1: Cash dividends were paid at the rate of $1 per share in 2019 and $2 per share in 2020. Required 1.

> Prepare journal entries for each of the following selected transactions that occurred during Trio Networks Corporation’s first year of operations:

> Sunray Solar Ltd. is a growing company with a hot new marketing plan. On January 1, 2020, it had 127,650 shares outstanding, and it issued an additional 44,500 shares during the year. The company reported $3,222,850 in common shareholders’ equity in its

> Earth Star Diamonds Inc. began a potentially lucrative mining operation on October 1, 2020. It is authorized to issue 100,000 shares of $0.60 cumulative preferred shares and 500,000 common shares. Part A Required: Prepare journal entries for each of the

> The equity section of the December 31, 2019, balance sheet for Delicious Alternative Desserts Inc. showed the following: During the year 2020, the company had the following transactions affecting equity accounts: The board of directors had not declared d

> Using the information in Exercise 12-15, prepare a classified balance sheet at December 31, 2020, and then answer each of the following questions (assume that the preferred shares are non-cumulative; round percentages to the nearest whole percent): 1. Wh

> Spicer Inc. showed the following alphabetized list of adjusted account balances at December 31, 2020: Required Assuming normal balances, prepare the closing entries at December 31, 2020, the company’s yearend. Also, calculate the post-c

> Cableserve Inc. has the following outstanding shares: 15,000 shares, $5.40 cumulative preferred 35,000 shares, common During 2020, the company declared and paid $180,000 in dividends. Dividends were in arrears for the previous year (2019) only. No new sh

> Match each of the numbered descriptions with the characteristic of preferred shares that it best describes. Indicate your answer by writing the letter for the correct characteristic in the blank space next to each description. A. Callable or redeemable

> Determine the total dividends paid in each year to each class of shareholders of Exercise 12-11 under the assumption that the preferred shares are non-cumulative. Also determine the total dividends paid to each class over the four years.

> Leslie Bjorn, Jason Douglas, and Tom Pierce have an architect firm and share profit(losses) in a 3:1:1 ratio. They decide to liquidate their partnership on March 31, 2020. The balance sheet appeared as follows on the date of liquidation: Required Prepare

> The outstanding share capital of Sheng Inc. includes 43,000 shares of $9.60 cumulative preferred and 78,000 common shares, all issued during the first year of operations. During its first four years of operations, the corporation declared and paid the fo

> Convertible preferred shares Swift Current Company Equity Section of the Balance Sheet October 31, 2020 Required: Refer to the equity section above. Assume that the preferred are convertible into common at a rate of eight common shares for each share of

> Surj Uppal and Parvinder Atwal began a new business on February 14, when each invested $154,500 in the company. On December 20, it was decided that $60,800 of the company’s cash would be distributed equally between the owners. Two cheques for $30,400 wer

> Talent, a local HR consulting firm, has total partners’ equity of $774,000, which is made up of Hall, Capital, $607,000, and Reynolds, Capital, $167,000. The partners share profit/(losses) in a ratio of 75% to Hall and 25% to Reynolds. On July 1, Morris

> Keith Williams and Brian Adams were students when they formed a partnership several years ago for a part time business called Music Works. Adjusted trial balance information for the year ended December 31, 2020, appears below. // Required 1. Prepare calc

> Debra and Glen are partners who agree that Debra will receive a $100,000 salary allowance after which remaining profits or losses will be shared equally in their flower shop. If Glen’s capital account is credited $8,000 as his share of the profit (loss)

> Liam and Katano formed a partnership to open a sushi restaurant by investing $95,000 and $105,000, respectively. They agreed to share profit based on an allocation to Liam of an annual salary allowance of $150,000, interest allowance to both Liam and Kat

> Jensen and Stafford began a partnership to start a hardwood flooring installation business, by investing $160,000 and $200,000, respectively. They agreed to share profits/(losses) by providing yearly salary allowances of $150,000 to Jensen and $75,000 to

> Dallas and Weiss formed a partnership to manage rental properties, by investing $144,000 and $216,000, respectively. During its first year, the partnership recorded profit of $469,000. Required: Prepare calculations showing how the profit should be alloc

> On February 1, 2020, Tessa Williams and Audrey Xie formed a partnership in Ontario. Williams contributed $80,000 cash and Xie contributed land valued at $120,000 and a small building valued at $180,000. Also, the partnership assumed responsibility for Xi

> Poppy, Sweetbean, and Olive have always shared profit and losses in a 3:1:1 ratio. They recently decided to liquidate their partnership. Just prior to the liquidation, their balance sheet appeared as follows: Required Part 1 Under the assumption that the

> The December 31, 2020, adjusted trial balance of Biomedics Inc. showed the following information: During 2021, a major increase in market demand for building space caused the company to assess the useful life and residual value of the building. It was de

> On April 1, 2020, Harry Regal and Meghan Merle formed a partnership in Alberta, renting reusable moving boxes. Net Income during the year was $177,000 and was in the Income Summary account. Required: 1. Present general journal entries to record the initi

> Toast, a Belleville, Ontario, restaurant, began with investments by the partners as follows: Lea, $233,700; Eva, $177,700; and Sophia, $192,100. The first year of operations did not go well, and the partners finally decided to liquidate the partnership,

> Assume the same information as in Exercise 11-15 except that capital deficiencies at liquidation are absorbed by the remaining partners in Wake according to their profit (loss) ratio. Required: Prepare the entry to distribute the remaining cash to the pa

> Martha Wheaton, Bess Chen, and Sam Smith were partners in an urban Calgary tea shop called Wake and showed the following account balances as of December 31, 2020: Due to difficulties, the partners decided to liquidate the partnership. The land and buildi

> David Wallace, Olena Dunn, and Danny Lin were partners in a commercial architect firm and showed the following account balances as of December 31, 2020: Due to several unprofitable periods, the partners decided to liquidate the partnership. The equipment

> Brenda Roberts, Lacy Peters, and Aarin MacDonald are partners in RPM Dance Studios. They share profit and losses in a 40:40:20 ratio. Aarin retires from the partnership on October 14, 2020, and receives $80,000 cash plus a car with a book value of $40,00

> Barth, Holt, and Tran have been partners of a ski, snowboard, and mountain bike shop in Whistler, BC, called Storm. Based on the partnership agreement, they share profit and losses in a 6:2:2 ratio. On November 30, the date Tran retires from the partners

> The partners in the Majesty partnership have agreed that partner Prince may sell his $140,000 equity in the partnership to Queen, for which Queen will pay Prince $110,000. Present the partnership’s journal entry to record the sale on April 30.

> Keri & Nick Consulting’s partners’ equity accounts reflected the following balances on August 31, 2020: Keri Lee, Capital $50,000 Nick Kalpakian, Capital 195,000 Lee and Kalpakian share profit/losses in a 2:3 ratio, respectively. On September 1, 2020, Li

> For each scenario below, recommend a form of business organization: sole proprietorship, partnership, or corporation. Along with each recommendation, explain how business profits would be taxed if the form of organization recommended were adopted by the

> Burke, Comeau, and LeJeune are partners of Happy Feet, a music theatre production company with capital balances as follows: Burke, $244,800; Comeau, $81,600; and LeJeune, $163,200. The partners share profit/(losses) in a 1:2:1 ratio. LeJeune decides to w

> Sunnyside Solar Consultants provided $180,000 of consulting services to Delton Developments on April 14, 2020, on account. Required: Journalize Sunnyside’s April 14 transaction including applicable PST and GST/HST assuming it is located in: a. Nova Scoti

> Real People Sporting (RPS) Co-op introduced a loyalty program in 2020. Every customer who signed up would receive 1% of their total purchases as a cheque, each February for the previous year, that could be used in-store on any merchandise within the next

> Sarah’s Pottery and Gift store had the following transactions: a. On November 15, 2020, Katie from the small office business Custom Graphics contacted Sarah to purchase gift cards for the holiday season. Katie’s boss gave her $2,000 to purchase 40 gift c

> Designer Architects had the following additional information at its November 30, 2020, year-end: a. The Unearned Revenue account showed a balance of $62,000, which represented four months of services paid in advance by a client for services beginning on

> Stone Works is a paving stone installation business that operates from about April to October each year. The company has an outstanding reputation for the quality of its work and as a result pre books customers a full year in advance. Customers must pay

> The following alphabetized list of selected adjusted account balances is from the records of Jasper Company on December 31, 2020: Required: Prepare the current liability section of Jasper Company’s 2020 balance sheet (for simplicity, li

> On January 2, 2020, the Casual Elite Co. acquired land to build a distribution centre by issuing a 6%, three-year note for $200,000. The note will be paid in three annual payments of $74,822 each December 31. The payment schedule follows: Required: 1. Pr

> Brar Maintenance Company showed the following adjusted trial balance information for its December 31, 2020, year-end. Required: Prepare a classified balance sheet for Brar Maintenance Company at December 31, 2020.

> The Creative Electronics Company shows the following selected adjusted account balances as at December 31, 2020: Required: Prepare the current liability section of Creative’s balance sheet. $52,000 in principle is due during 2021 regard

> On November 1, 2020, Harris, Davis, and Tallis formed Restore, a home renovation business, by contributing $56,000 in cash, $91,000 of equipment, and a truck worth $42,000, respectively. The partners agreed to share profits and losses as follows: Davis a

> Superior Skateboard Company, located in Ontario, is preparing adjusting entries at December 31, 2020. An analysis reveals the following: a. During December, Superior sold 6,500 skateboards that carry a 60-day warranty. The skateboard sales totalled $390,

> Music Media Ltd. prepares statements quarterly. Part A: Required: 1. Based on 2019 results, Music’s estimated tax liability for 2020 is $285,960. Music will accrue 1/12 of this amount at the end of each month (assume the installments ar

> On October 6, 2020, Norwood Co., an office equipment supplier, sold a copier for cash of $21,000 (cost $13,900) with a two-year parts and labour warranty. Based on prior experience, Norwood expects eventually to incur warranty costs equal to 6% of the se

> Shefford Cutlery extends a lifetime replacement warranty on all units sold. Using past experience, the company estimates that 0.5% of units sold will be returned and require replacement at an average cost of $108 per unit. On January 1, 2020, the balance

> Trista and Co. borrowed $180,000 on December 1, 2020, for 90 days at 5% interest by signing a note to buy jewellery inventory. 1. On what date will this note mature? 2. How much interest expense is created by this note in 2020? 3. How much interest expen

> On April 15, 2020 Dallas Consulting borrowed $17,000 to pay the tax bill owing, for 45 days at 9% interest by signing a note. 1. On what date will this note mature? 2. How much interest expense is created by this note? 3. Prepare the journal entries for

> Mercedes Boats borrowed $220,000 on September 15, 2020, for 45 days at 7% interest by signing a note. 1. On what date will this note mature? 2. How much interest expense is created by this note? 3. Prepare the journal entries for September 15, 2020, and

> Snowbot Snow Removal Company of Halifax purchased some snowplow equipment on March 10, 2020, that had a cost of $150,000 (ignore GST/PST). Show the journal entries that would record this purchase and payment under these three separate situations: a. The

> Assume Pebble Inc. on October 15 purchased $2,500 of merchandise on credit. The next day, it recorded sales of $1,700; cost of sales was $1,200. Record the October 15 and October 16 entries assuming each of the geographical areas noted in Exhibit 10.6. A

> The following items appear on the balance sheet of Crunched Auto Body Repair Shop, which has a 12-month operating cycle. Identify the proper classification of each item. In the space beside each item write a C if it is a current liability, an L if it is

> On July 1, 2019, Alleya Amrick and Breanne Balas formed a partnership to make crafts and sell them online. Net Income during the year was $410,000 and was in the Income Summary account. On July 1, 2020 Calla Cameron invested $123,000 and was admitted to

> Nova Scotia Telecom Company had a truck that was purchased on July 7, 2018, for $36,000. The PPE subledger shows the following information regarding the truck: A customized tool carrier was constructed and permanently fitted to the truck on July 3, 2020,

> Jessica Grewal decided to open a food truck business, the Samosa Shack. She encountered the following transactions in managing her equipment over the first 2 years of her business. Record all the entries for the 2 years that Jessica owned the truck, incl

> Montalvo Bionics showed the following alphabetized unadjusted trial balance at April 30, 2020: Other information: a. All accounts have normal balances. b. The furniture was depreciated using the straight-line method and had a useful life of five years an

> Huang Resources showed the following alphabetized adjusted trial balance at October 31, 2020: Other information: a. All accounts have normal balances. b. $38,000 of the note payable is due after October 31, 2021. Required: Prepare a classified balance sh

> On September 5, 2020, Nelson Lumber purchased timber rights in Northern Quebec for $432,000, paying $96,000 cash and the balance by issuing a non-current note. Logging the area is expected to take three years, and the timber rights will have no value aft

> Jazzy Antiques purchased the copyright on a watercolour painting for $177,480 on January 1, 2020. The copyright legally protects its owner for 19 more years. However, Jazzy plans to market and sell prints of the original for the next 12 years only. Prepa

> On January 2, 2020, Direct Shoes Inc. disposed of a machine that cost $96,000 and had been depreciated $50,450. Present the journal entries to record the disposal under each of the following unrelated assumptions: a. The machine was sold for $44,500 cash

> On November 3, 2020, Gamez 2 Go Media exchanged an old computer for a new computer that had a list price of $190,000. The original cost of the old computer was $150,000 and related accumulated depreciation was $65,000 up to the date of the exchange. Game

> On October 6, 2020, Western Farms Co. traded in an old tractor for a new one, receiving a $68,000 trade-in allowance and paying the remaining $170,000 in cash. The old tractor cost $202,000, and straight-line depreciation of $111,000 had been recorded as

> Candy Craze purchased and installed a machine on January 1, 2020, at a total cost of $296,800. Straight-line depreciation was taken each year for four years, based on the assumption of a seven year life and no residual value. The machine was disposed of

> Conway, Kip, and Zack are partners of Force, a local cross-fit training facility with capital balances as follows: Conway, $367,200; Kip, $122,400; and Zack, $244,800. The partners share profit and losses in a 1:2:1 ratio. Young is admitted to the partne

> Macho Taco sold a food truck on March 1, 2020. The accounts showed adjusted balances on February 28, 2020, as follows: Food Truck $42,000 Accumulated Depreciation, Food Truck 21,850 Required Record the sale of the food truck assuming the cash proceeds we

> Kane Biotech was preparing the annual financial statements and, as part of the year-end procedures, assessed the assets and prepared the following alphabetized schedule based on adjusted values at December 31, 2020: Required 1. Record any impairment los

> At its December 31, 2019, year-end, Athletic Apparel had a warehouse with an adjusted book value of $292,500 and an estimated remaining useful life of 15 years and residual value of $90,000. Because of pick-up and delivery issues at the warehouse, a cont

> On April 3, 2020, David’s Chocolates purchased a machine for $71,200. It was assumed that the machine would have a five-year life and a $15,200 trade-in value. Early in January 2023, it was determined that the machine would have a seven-year useful life

> The Hilton Skating Club used straight-line depreciation for a used Zamboni ice-resurfacing machine that cost $43,500, under the assumption it would have a four-year life and a $5,000 trade-in value. After two years, the club determined that the Zamboni s

> On April 1, 2020, Ice Drilling Co. purchased a trencher for $125,000. The machine was expected to last five years and have a residual value of $12,500. Required: Calculate depreciation expense for 2020 and 2021 to the nearest month, using (a) the straigh

> Design Pro purchased on October 1, 2019, $110,000 of furniture that was put into service on November 10, 2019. The furniture will be used for five years and then donated to a charity. Complete the schedule below by calculating annual depreciation for 201

> VanHoutte Foods bought machinery on September 10, 2018, for $168,000. It was determined that the machinery would be used for six years or until it produced 260,000 units and then would be sold for about $27,600. Complete the schedule below by calculating

> Kenartha Oil recently paid $483,900 for equipment that will last five years and have a residual value of $114,000. By using the machine in its operations for five years, the company expects to earn $180,000 annually, after deducting all expenses except d

> Refer to Exercise 9-10. Assume that the only other assets at December 31, 2019, were total current assets of $338,000. Prepare the asset section of Dynamic Exploration’s classified balance sheet at December 31, 2019. Data from Exercise

> Jobs, Alford, and Norris formed the JAN Partnership to provide landscape design services in Edmonton, by making capital contributions of $150,000, $100,000, and $250,000, respectively, on January 7, 2020. They anticipate annual profit of $240,000 and are

> At December 31, 2019, Dynamic Exploration’s balance sheet showed total PPE assets of $802,000 and total accumulated depreciation of $339,980 as detailed in the PPE subledger below. Dynamic calculates depreciation to the nearest whole mo

> On January 1, 2020, Creative Calligraphy Inc. purchased land, building, equipment, and tools for a total of $2,520,000. An appraisal identified the fair values to be $700,000 (land), $1,120,000 (building), $210,000 (equipment), and $70,000 (tools). The e

> On January 3, 2020, Xenex Innovations purchased computer equipment for $125,250. The equipment will be used in research and development activities for five years or a total of 8,500 hours and then sold for about $19,000. Prepare a schedule with headings

> Jackal Energy purchased a transport truck on January 1, 2020, for $305,200 cash. Its estimated useful life is five years or 320,000 kilometres with an estimated residual value of $52,400. Required Calculate depreciation expense for the year ended Decembe

> On January 2, 2018, Archer Company, a skateboard manufacturer, installed a computerized machine in its factory at a cost of $150,200. The machine’s useful life was estimated at four years or a total of 186,000 units with a $20,000 trade

> On January 1, 2020, Land’s End Construction purchased a used truck for $52,500. A new motor had to be installed to get the truck in good working order; the costs were $21,000 for the motor and $7,500 for the labour. The truck was also painted for $6,000.

> Paul, Frank, and Basil formed Fresh, a greenhouse and garden centre business, 10 years ago, and Paul is about to retire. Paul is not experienced in financial accounting, but knows, based on the partnership agreement, that he is entitled to one-third of p

> Mike Li is a sales manager for an electric car dealership in Alberta. Mike earns a bonus each year based on revenue generated by the number of vehicles sold in the year less related warranty expenses. The quality of electric cars sold each year seems to

> Marcia Diamond is a small business owner who handles all the books for her business. Her company just finished a year in which a large amount of borrowed funds were invested into a new building addition as well as numerous equipment and fixture additions

> In your position as controller of Flashy Inc., a video production company, you are responsible for keeping the board of directors informed about the financial activities and status of the company. At the board meeting, you present the following report: A

> Bosch and Gilbert are in the process of forming a golf course equipment maintenance company. Bosch will contribute one-third time and Gilbert will work full time. They have discussed the following alternative plans for sharing profit and losses. a. In th

> Wendy Cramer is working late on a Friday night in preparation for a meeting with her banker early Monday morning. Her business is just finishing its fourth year. In Year 1, the business experienced negative cash flows from operations. In Years 2 and 3, c

> Jack Phelps is the controller for Jayhawk Corporation. Jayhawk has a corporate policy of investing idle cash in non-strategic investments. About 18 months ago, the company had significant amounts of idle cash and invested in 16%, 10-year Delta Inc. bonds

> A few years ago, politicians needed a new headquarters building for their municipal government. The price tag for the building approached $24 million. The politicians felt that the voters were unlikely to approve a bond issue to raise money for the headq

> JenStar’s management team has decided that its income statement would be more useful if depreciation were calculated using the straight-line method instead of the double-declining balance method. This change in accounting policy adds $156,000 to income

> Jack and Bill are partners in a computer software company. They developed a word processing program that is remarkably similar to a Corel product. Jack telephones Bill at home one evening and says, “We should convert our partnership into a corporation be

> Jones Inc. needs $100,000 to finance the purchase of new equipment. The finance manager is considering two options: 1. Borrowing the funds over a five-year term and paying interest at the rate of 6% per year, or 2. Issuing 6,000 shares of $1 cumulative p