Question: Massachusetts Stove Company manufactures

Massachusetts Stove Company manufactures wood-burning stoves for the heating of homes and businesses. The company has approached you, as chief lending officer for the Massachusetts Regional Bank, seeking to increase its loan from the current level of $93,091 as of January 15, Year 12, to $143,091. Jane O’Neil, chief executive officer and majority stockholder of the company, indicates that the company needs the loan to finance the working capital required for an expected 25% annual increase in sales during the next two years, including to pay suppliers and provide funds for expected nonrecurring legal and retooling costs.

The company’s woodstoves have two distinguishing characteristics:

(1) the metal frame of the stoves includes inlaid soapstone, which increases the intensity and duration of the heat provided by the stoves and enhances their appearance as an attractive piece of furniture, and

(2) a catalytic combustor, which adds heating potential to the stoves and reduces air pollution. The company manufactures wood-burning stoves in a single plant in Greenfield, Massachusetts. It purchases metal castings for the stoves from foundries in Germany and Belgium. The soapstone comes from a supplier in Canada. These purchases are denominated in U.S. dollars. The catalytic combustor is purchased from a supplier in the United States. The manufacturing process is essentially an assembly operation. The plant employs an average of eight workers. The two keys to quality control are structural airtightness and effective operation of the catalytic combustor. The company rents approximately 60% of the 25,000-square-foot building it uses for manufacturing and administrative activities. This building also houses the company’s factory showroom. The remaining 40% of the building is not currently rented.

The company’s marketing of woodstoves follows three channels:

1. Wholesaling of stoves to retail hardware stores. This channel represents approximately 20% of the company’s sales in units.

2. Retail direct marketing to individuals in all 50 states.

This channel utilizes

(a) national advertising in construction and design magazines and

(b) the sending of brochures to potential customers identified from personal inquiries. This channel represents approximately 70% of the company’s sales in units.

The company is the only firm in the industry with a strategic emphasis on retail direct marketing.

3. Retailing from the company’s showroom. This channel represents approximately 10% of the company’s sales in units.

The company offers three payment options to retail purchasers of its stoves:

1. Full payment: Check, money order, or charge to a third-party credit card is used to pay in full. 2. Layaway plan: Monthly payments are made over a period not exceeding one year. The company ships the stove after receiving the final payment.

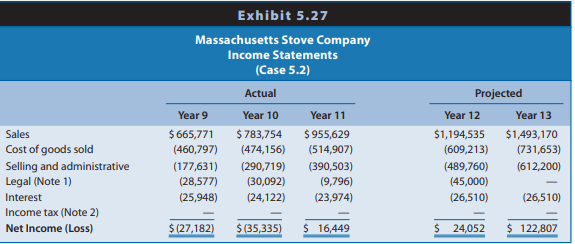

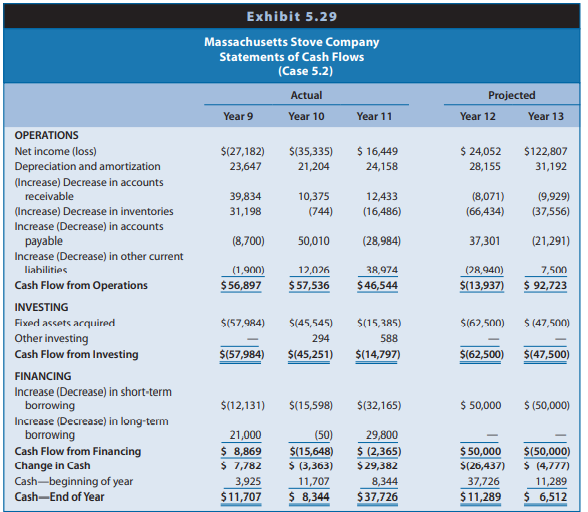

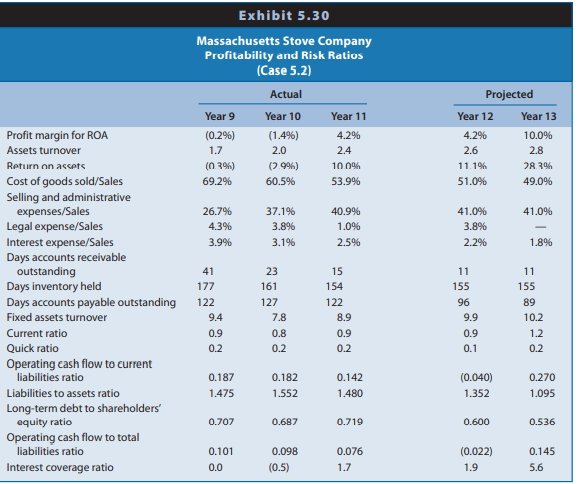

3. Installment financing plan: The company has a financing arrangement with a local bank to finance the purchase of stoves by credit-approved customers. The company is liable if customers fail to repay their installment bank loans. The imposition of strict air emission standards by the Environmental Protection Agency (EPA) has resulted in a major change in the woodstove industry. By December 31, Year 9, firms were required by EPA regulations to demonstrate that their woodstoves met or surpassed specified air emission standards. These standards were stricter than industry practices accommodated at the time, and firms had to engage in numerous company-sponsored and independent testing of their stoves to satisfy EPA regulators. As a consequence, the number of firms in the woodstove industry decreased from more than 200 in the years prior to Year 10 to approximately 35 by December 31, Year 11. The company received approval for its Soapstone Stove I in Year 11, after incurring retooling and testing costs of $63,001. It capitalized these costs in the Property, Plant, and Equipment account. It depreciates these costs over the five-year EPA approval period. A second stove, Soapstone Stove II, is currently undergoing retooling and testing. For this stove, the company incurred costs of $19,311 in Year 10 and $8,548 in Year 11 and has received preliminary EPA approval. It anticipates additional design, tooling, and testing costs of approximately $55,000 in Year 12 and $33,000 in Year 13 to obtain final EPA approval. The company holds an option to purchase the building in which it is located for $608,400. The option also permits the company to assume the unpaid balance on a low-interest-rate loan on the building from the New England Regional Industrial Development Authority. The interest rate on this loan is adjusted annually and equals 80% of the bank prime interest rate. The unpaid balance on the loan exceeds the option price and will result in a cash transfer to the company from the owner of the building at the time of transfer. The company exercised its option in Year 9, but the owner of the building refused to comply with the option provisions. The company sued the owner. The case has gone through the lower court system in Massachusetts and is currently under review by the Massachusetts Supreme Court. The company incurred legal costs totaling $68,465 through Year 11 and anticipates additional costs of approximately $45,000 in Year 12. The lower courts have ruled in favor of the company’s position on all of the major issues in the case. The company expects the Massachusetts Supreme Court to concur with the decisions of the lower courts when it renders its final decision in the spring of Year 12. The company has held discussions with two prospective tenants for the building’s 10,000 square feet that Massachusetts Stove Company does not use in its operations. Jane O’Neil owns 51% of the company’s common stock. The remaining stockholders include John O’Neil (chief financial officer and father of Jane O’Neil), Mark Forest (vice president of manufacturing), and four independent local investors. To assist in the loan decision, the company provides you with financial statements (see the first three columns of Exhibits 5.27–5.29) and notes for the three years ending December 31, Year 9, Year 10, and Year 11. These financial statements were prepared by John O’Neil, chief financial officer, and are not audited. The company also provides you with projected financial statements for Year 12 and Year 13 (see the last two columns of Exhibits 5.27–5.29) to demonstrate its need for the loan and its ability to repay. The loan requested involves an increase in the current loan amount from $93,091 to $143,091. The company will pay monthly interest and repay the $50,000 additional amount borrowed by December 31, Year 13. Exhibit 5.30 presents financial statement ratios for the company.

The assumptions underlying the projected financial statements are as follows:

Sales: Sales are projected to increase 25% annually during the next two years, after increasing 17.7% in Year 10 and 21.9% in Year 11. The increase reflects continuing market opportunities related to the company’s strategic emphasis on retail direct marketing and to the expected continuing contraction in the number of competitors in the industry.

Cost of Goods Sold: Most manufacturing costs vary with sales. The company projects cost of goods sold to equal 51% of sales in Year 12 and 49% of sales in Year 13, having declined from 69.2% of sales in Year 9 to 53.9% of sales in Year 11. The reductions resulted from a higher proportion of retail sales in the sales mix (which have a higher gross margin than wholesale sales), a more favorable pricing environment in the industry (fewer competitors), a switch to lower-cost suppliers, and more efficient production.

Selling and Administrative Expenses: The company projects these costs to equal 41% of sales, having increased from 26.7% of sales in Year 9 to 40.9% of sales in Year 11. The increases resulted from a heavier emphasis on retail sales, which require more aggressive marketing than wholesale sales.

Legal Expenses: The additional $45,000 of legal costs represents the best estimate by the company’s attorneys.

Interest Expense: Interest expense has averaged approximately 6% of short- and long-term borrowing during the last three years. The projected income statement assumes a continuation of the 6% average rate.

Income Tax Expense: The company has elected to be taxed as a Subchapter S corporation, which means that the net income of the firm is taxed at the level of the individual shareholders, not at the corporate level. Thus, the pro forma financial statements include no income tax expense. The firm operated at a net loss for several years prior to Year 11, primarily because of losses of a lawn products business that it acquired 10 years ago. The company discontinued the lawn products business in Year 10

Cash: The projected amounts for cash represent a plug to equate projected assets with projected liabilities and shareholders’ equity. Projected liabilities include the requested loan during Year 12 and its repayment at the end of Year 13.

Accounts Receivable: Days accounts receivable outstanding, calculated on the average accounts receivable balances, will be 11 days in Year 12 and Year 13.

Inventories: Days inventory held, calculated on the average inventory balances, will be 155 days in Year 12 and Year 13.

Property, Plant, and Equipment: Capital expenditures for Year 12 include a $55,000 cost for retooling the Soapstone Stove II and $7,500 for other equipment; for Year 13, they include $33,000 for retooling the Soapstone Stove II and $14,500 for other equipment. The projected balance excludes the cost of acquiring the building, its related debt, the cash received at the time of transfer, and rental revenues from leasing the unused 40% of the building to other businesses. Accumulated Depreciation: This is a continuation of the historical

relation between depreciation expense and the cost of property, plant, and equipment.

Other Assets: A new financial reporting standard no longer requires amortization of intangibles after Year 11.

Accounts Payable: Days accounts payable outstanding, based on the average accounts payable balances, will be 97 days in Year 12 and 89 days in Year 13. The decrease in days payable reflects the ability to pay suppliers more quickly with the proceeds of the increased bank loan.

Notes Payable: Notes payable is projected to increase by the amount of the bank loan in Year 12 and to decrease by the loan repayment at the end of Year 13.

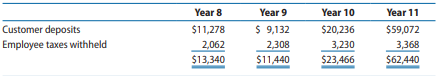

Other Current Liabilities: The large increase at the end of Year 11 resulted from a major promotional offer in the fall of Year 11, which increased the amount of deposits by customers. The projected amounts for Year 12 and Year 13 represent more normal expected levels of deposits.

Long-Term Debt: Long-term borrowing represents loans from shareholders to the company. The company does not plan to repay any of these loans in the near future.

Retained Earnings: The change each year represents net income or net loss from operations. The company does not pay dividends.

Statement of Cash Flows: Amounts are taken from the changes in various accounts on the actual and projected balance sheets. Note 1: The company has incurred legal costs to enforce its option to purchase the building used in its manufacturing and administrative activities. The case is under review by the Massachusetts Supreme Court, with a decision expected in the spring of Year 12. Note 2: The company is not subject to income tax because it has elected Subchapter S tax status. Note 3: The notes payable to banks are secured by machinery and equipment, shares of common stock of companies traded on the New York Stock Exchange owned by two shareholders, and personal guarantees of three shareholders. The long-term debt consists of unsecured loans from three shareholders. Note 4: Other current liabilities include the following

REQUIRED:

Would you make the loan to the company in accordance with the stated terms? Explain. In responding, consider the reasonableness of the company’s projections, positive and negative factors affecting the industry and the company, and the likely ability of the company to repay the loan. (Excel spreadsheet for this case is available at www.cengagebrain.com.

> Create a matrix diagram in which each row is a category of the Baldrige Award criteria and four columns correspond to a level of organizational maturity with respect to quality: Traditional management practices Growing awareness of the importance of qua

> Discuss how the Baldrige Core Values and Concepts define a high-performance culture. How might they be used as a starting point for self-assessment, without actually answering the formal questions in the Baldrige Criteria?

> Refer to the example of how K&N Management addressed some of the questions in the Senior Leadership category of the Baldrige Criteria in this chapter. Explain what practices address each of the specific questions: a. How do senior leaders set your organ

> We introduced the Baldrige Core Values and Concepts in this chapter. Look back at Deming’s 14 Points and System of Profound Knowledge in Chapter 2, and discuss how Deming’s philosophy is reflected in the Core Values and Concepts.

> Obtain a copy of the current Baldrige Criteria. Examine the questions asked in the Criteria. Select what you believe are the “top 10” most difficult questions for an organization to answer and justify your reasoning.

> In 2012, the House Appropriations Committee of the U.S. Congress targeted dozens of federal programs for elimination to reduce the federal budget by at least $1.5 billion. Unfortunately, even though the portion of its budget that came from federal fundin

> Discuss how the Baldrige Core Values and Concepts (see Chapter 10) are reflected in each question of the Baldrige Criteria for Strategic Planning using the Baldrige Excellence Builder available in the Baldrige Materials folder on the Student Companion Si

> Carla works at a typical quick service restaurant (QSR). She is never involved in any problem-solving activities because the system dictates they must defer to managers when problems arise. In addition, she has never been asked to provide any input at th

> What are the core competencies of your school, college, or university? How are they leveraged from a strategic perspective?

> Propose three applications for each of the seven management and planning tools discussed in the chapter. You might consider some applications around school, such as in the classroom, studying for exams, and so on

> A Conference Board study found that CEOs identified the top global challenges they face as (1) improving human capital within their organizations, (2) improving operational excellence, and (3) enhancing innovation. Suggest some strategies that a typical

> Contrast the following vision statements in terms of their usefulness to an organization. a. To become the industry leader and achieve superior growth and market share. b. To become the best-managed electric utility in the United States and an excellen

> Try to match the following companies with their actual mission statement in question 2. Could you think of more appropriate mission statements for any of these organizations? a. Volvo b. AT&T c. The International Red Cross d. Caterpillar e. DHL World

> Examine the following mission statements. Do you think they have a true purpose or are they merely cosmetic devices because someone felt that no major organization can be seen without one?22 a. Our single focus will continue to be helping customers all

> The Johnson & Johnson credo was written in 1943 by its chairman Robert Wood Johnson: “We believe our first responsibility is to the doctors, nurses, and patients, to mothers and fathers, and all others who use our products and services. In meeting their

> The Six Sigma philosophy seeks to develop technical leadership through “Belt” training, then use it in team-based projects designed to improve processes. To what extent are these two concepts (technical experts versus team experts) at odds? What must be

> How can lean concepts be applied in a classroom?

> Discuss what would be the most appropriate tool to use to attack each of these problems: a. A copy machine suffers frequent paper jams and users are often confused as to how to fix the problem. b. The publication team for an engineering department want

> Jerome, his wife Sandy, and their two daughters were vacationing and visited a popular restaurant, Captain Mark’s Seafood Shack, that has several locations in the eastern United States. The hostess was friendly, and their table location was removed from

> Discuss how DMAIC might be used in your personal life. For example, how could you use it if you wanted to lose weight or improve a skill such as playing a musical instrument?

> List some of the common processes that a student performs. How can these processes be improved using a process improvement approach?

> “Resistance to change” is a common theme in the behavioral sciences. What part do you believe that resistance to change plays in management’s fostering of successful versus unsuccessful adoptions of Six Sigma approaches? What impact does workers’ resista

> Suggest a set of CTQs that might influence overall service satisfaction for service at an automobile dealership.

> Some of the key processes associated with business activities for a typical company include sales and marketing, supply chain management, managing information technology, and managing human resources. What types of Six Sigma projects might be considered

> A consultant told the story of two Six Sigma teams that made separate presentations on how they would improve processes in their own areas. At the end of the second presentation, the consultant asked a basic question that stopped both Black Belt team lea

> In 1995, Jack Welch, who was then CEO of General Electric, sent a memo to his senior managers telling them that they would have to require every employee to have started Six Sigma training to be promoted. Furthermore, 40 percent of the managers’ bonuses

> How can a manager effectively balance the key components of a Six Sigma implementation design related to who, what, where, when, why, and how it could be done?

> How might a Six Sigma project be done to improve a registration process in a university? An admission process?

> The January 22, 2001, issue of Fortune contained an article “Why You Can Safely Ignore Six Sigma,” that was highly critical of Six Sigma. Here are some of the criticisms levied against Six Sigma: a. the results often don’t have any noticeable impact on

> Jessica shopped at two different retail clothing stores in a shopping mall. At store A, she was greeted by a girl on a ladder working on changing the promotions for the next day who did not ask if she needed help with anything. She walked to the back to

> Skilled Care Pharmacy, located in Mason, Ohio, is a $25 million privately held regional provider of pharmaceutical products delivered within the long-term care, assisted living, hospice, and group home environments. The following products are included wi

> Provide examples of costs to create computer software for internal use. Should firms capitalize or expense these costs?

> Go to the website of the International Accounting Standards Board (www.ifrs.org). Search for the International Financial Reporting Standards (IFRS) summaries. Identify the most recently issued international financial reporting standard and summarize brie

> Go to the website of the Financial Accounting Standards Board (www.fasb.org). Identify the most recently issued financial reporting standard and summarize briefly (in one paragraph) its principal provisions. Also search under Project Activities to identi

> Bookman Co. develops digital accounting systems and provides accounting-related consulting services. a. On January 1, Year 1, Bookman signs a contract with Brock Florists to install a system and provide consulting services over a two-year period ending

> Use the following hypothetical data for Walgreens in 2021 and 2022 to project revenues, cost of goods sold, and inventory for Year 11. Assume that Year 11 revenue growth rate, gross profit margin growth rate, and inventory turnover will be identical to 2

> The notes to a firm’s financial statements reveal that the obligations for postretirement health care benefits at the balance sheet date total $2.1 billion. The fair value of plan assets for these benefits at the same date is reported at zero, with an un

> Using the following key, identify the effects of the following transactions or conditions on the various financial statement elements: I 5 increases; D 5 decreases; NE 5 no effect.

> Exhibits 1.19–1.23 of Integrative Case 1.1 (Chapter 1) present the financial statements for Walmart for 2017 to 2020. In addition, the website for this text (www.cengagebrain.com) contains Walmart’s January 31, 2021, F

> Given the following information, compute December 31, Year 1, projected benefit obligation (PBO) and fair market value (FMV) of plan assets for Lee Company. What amount of asset or liability will be reported on the balance sheet at December 31, Year 1?

> Choosing the functional currency is a key decision for translating the financial statements of foreign entities of U.S. firms into U.S. dollars. Qing Corporation, a U.S. firm that sells car batteries, formed a wholly owned subsidiary in Mexico to manufac

> U.S. GAAP requires firms to account for equity investments in which ownership is between 20% and 50% using the equity method. Ace Corporation owns 35% of Spear Corporation. Spear Corporation reported net income of $100.4 million and declared and paid div

> Firms invest in marketable securities for a variety of reasons, one of the most common being the need to temporarily invest excess cash. Describe how to account for these investments on the balance sheet and in comprehensive income assuming that they are

> Assume Swift Company acquires a machine with a fair value of $100,000 on January 1 of Year 1 by signing a five-year lease. Swift must make payments of $16,275 each December 31. The appropriate interest rate on the lease is 10%. Compute the following assu

> Rock of Ages, Inc., a large North American integrated granite quarrier, manufacturer, and retailer of finished granite memorials, reported a Year 4 net loss of $3.2 million. In that year, the firm reported a pretax litigation settlement loss of $6.5 mill

> Checkpoint Systems, a leading provider of source tagging, handheld labeling systems, retail merchandising systems, and bar-code labeling systems, stated the following in a press release: GAAP reported net loss for the fourth quarter of Year 4 was $29.3 m

> A firm’s income tax return shows income taxes for 2020 of $35,000. The firm reports deferred tax assets before any valuation allowance of $24,600 at the beginning of 2020 and $27,200 at the end of 2020. It reports deferred tax liabilities of $18,900 at t

> A firm’s income tax return shows $50,000 of income taxes owed for 2020. For financial reporting, the firm reports deferred tax assets of $42,900 at the beginning of 2020 and $38,700 at the end of 2020. It reports deferred tax liabilities of $28,600 at th

> Fair Value Measurement and Other Comprehensive Income For its fiscal year ended February 1, 2020, Zumiez, Inc. shows a line item for $1.059 million labeled “Net change in unrealized gain on available-for-sale debt securities” as part of other comprehensi

> Using the following key, identify the effects of the following transactions or conditions on the various financial statement elements: I 5 increases; D 5 decreases; NE 5 no effect.

> Sony Corporation manufactures and markets consumer electronics products. Assume the following are selected income statement data for 2021 and 2022 (amounts in billions of yen): Required: a. Estimate the variable cost as a percentage of sales for the cos

> The data in Exhibit 11.3 on industry median betas suggest that firms in the following three sets of related industries have different degrees of systematic risk. REQUIRED: a. For each matched pair of industries, describe factors that characterize a typ

> Intel is a global leader in manufacturing microprocessors, which is very capital-intensive. The production processes in microprocessor manufacturing require sophisticated technology, and the technology changes rapidly, particularly with each new generati

> The Home Depot is a leading specialty retailer of hardware and home improvement products and is the second-largest retail store chain in the United States. It operates large warehouse-style stores. Assume in 2021 and 2022, The Home Depot invested in five

> Gap Inc. Operates chains of retail clothing stores under the names of Gap, Banana Republic, and Old Navy. Exhibit 3.19 presents the statement of cash flows for Gap for Year 0 to Year 4 REQUIRED: Discuss the relations between net income and cash flow fro

> Tesla Motors Manufactures high-performance electric vehicles that are extremely slick looking. Exhibit 3.18 presents the statement of cash flows for Tesla Motors for Year 1 through Year 3. REQUIRED Discuss the relations among net income, cash flows fro

> Refer to the financial statement data for Abercrombie & Fitch in Problem 4.25 in Chapter 4. Exhibit 5.15 presents risk ratios for Abercrombie & Fitch for fiscal Year 3 and Year 4. Data from Problem 4.25 in Chapter 4: Abercrombie & Fitch sell

> The financial statements of ABC Corporation, a retail chain, reveal the information for income taxes shown in Exhibit 2.11. REQUIRED a. Assuming that ABC had no significant permanent differences between book income and taxable income, did income befor

> Refer to the financial statement data for Hasbro in Problem 4.24 in Chapter 4. Exhibit 5.14 presents risk ratios for Hasbro for Year 2 and Year 3. LO 5-3, LO 5-4 LO 5-6 LO 5-7 LO 5-6 LO 5-3, LO 5-4 Data from Problem 4.24 in Chapter 4: Hasbro is a leadin

> Exhibit 5.26 presents risk ratios for Walmart for 2019 and 2018. Exhibits 1.19, 1.20, and 1.21 in Chapter 1 present the financial statements for Walmart. REQUIRED a. Compute the values of each of the ratios in Exhibit 5.26 for Walmart for 2020. Walmar

> ALFA Romeo incurs direct cash costs of $30,000 in manufacturing a red convertible automobile during 2018. Assume that it incurs all of these costs in cash. Alfa Romeo sells this automobile to you on January 1, 2019, for $45,000. You pay $5,000 immediatel

> Assume Southern Copper Corporation (SCCO) acquired mining equipment for $100,000 cash on January 1, 2018. The equipment had an expected useful life of four years and zero salvage value. SCCO calculates depreciation using the straight-line method over the

> Refer to Problem 2.13. Assume that Walmart has accounted for the value of the land at acquisition cost and sells the land on December 31, 2020, for a two-year note receivable with a present value of $180,000 instead of for cash. The note bears interest a

> Assume Walmart acquires a tract of land on January 1, 2018, for $100,000 cash. On December 31, 2018, the current market value of the land is $150,000. On December 31, 2019, the current market value of the land is $120,000. The firm sells the land on Dece

> In this chapter, we evaluated shares of common equity in Clorox using the value-to-book approach, market multiples, and reverse engineering. The Coca-Cola Company is also a company that sells well-known brand name consumer goods (although the two compan

> The Coca-Cola Company is a global soft-drink beverage company. The data in Chapter 12, Exhibits 12.14 through 12.16, include the actual amounts for 2020 and projected amounts for Year 11 to Year 16 for the income statements, balance sheets, and statement

> The Coca-Cola Company is a global soft drink beverage company (ticker: KO). The data in Chapter 12’s Exhibits 12.14, 12.15, and 12.16 (pages 712–715) include the actual amounts for 2020 and projected amounts for Year 11 to Year 16 for the income statemen

> Suppose the following hypothetical data represent total assets, book value, and market value of common shareholders’ equity (dollar amounts in millions) for Microsoft, Intel, and Dell, three firms involved in different aspects of the co

> The Coca-Cola Company is a global soft drink beverage company (ticker symbol = KO). The data in Exhibits 12.14 to 12.16 include the actual amounts for fiscal 2020 and projected amounts for Year +1 to Year +6 for the income statements, balance sheets, and

> The 3M Company is a global diversified technology company active in the following product markets: consumer and office; display and graphics; electronics and communications; health care; industrial; safety, security, and protection services; and transpor

> Walmart Stores (Walmart) is the world’s largest retailer. It employs an “everyday low price” strategy and operates stores as three business segments: Walmart U.S., International, and Samâ€&

> The Coca-Cola Company is a global soft drink beverage company (ticker: KO). The following data for Coca-Cola include the actual amounts for Year 0 and the projected amounts for Years 11 through 15 for comprehensive income and common shareholdersâ&#

> Barnes & Noble sells books, magazines, music, and videos through retail stores and online. For a retailer like Barnes & Noble, inventory is a critical element of the business, and it is necessary to carry a wide array of titles. Inventories constitute th

> Hasbro designs, manufactures, and markets toys and games for children and adults in the United States and in international markets. Hasbro’s portfolio of brands and products contains some of the most well-known toys and games under famous brands such as

> The following is an excerpt from Note 13 (Pensions and Other Post-Employment Benefits) to the 2020 Consolidated Financial Statements of Coca-Cola Company (Coca-Cola): REQUIRED: a. Write a memorandum explaining the change in the net pension liability in

> The following are excerpts from Note 14 (Income Taxes) to the 2020 Consolidated Financial Statements of Coca-Cola Company (Coca-Cola): A reconciliation of the statutory U.S. federal tax rate and our effective tax rate is as follows: REQUIRED: a. Does Co

> Kentucky Gold (KG) holds 10,000 gallons of whis key in inventory on October 31, Year 1, that costs $225 per gallon. KG contemplates selling the whiskey on March 31, Year 2, when it completes the aging process. Uncertainty about the selling price of whisk

> Lynn Construction enters into a firm purchase commitment for equipment to be delivered on June 30, Year 1, for a price of £10,000. It simultaneously signs a forward foreign exchange contract for £10,000. The forward rate on June 30, Year 1, for settlemen

> Following information relates to a firm’s pension plan. REQUIRED: a. Compute the December 31, Year 1, PBO and FMV of pension assets. b. Compute Year 1 pension expense. c. Use the financial statements effects template to show the eff

> A large manufacturer of truck and car tires recently changed its cost-flow assumption method for inventories at the beginning of Year 2. The manufacturer has been in operation for almost 40 years, and for the last decade it has reported moderate growth i

> Deere & Company manufactures agricultural and industrial equipment and provides financing services for its independent dealers and their retail customers. In Note 2 to its October 31, Year 12, Form 10-K, Deere discloses the following revenue recognition

> Prime Contractors (Prime) is a privately owned company that contracts with the U.S. government to provide various services under multiyear (usually five-year) contracts. Its principal services are as follows: Refuse: Picks up and disposes of refuse from

> On January 1, Year 1, assume that Turner Construction Company agreed to construct an observatory for Dartmouth College for $120 million. Dartmouth College must pay $60 million upon signing and $30 million in Year 2 and Year 3. Expected construction costs

> Foreign Sub is a wholly owned subsidiary of U.S. Domestic Corporation. U.S. Domestic Corporation acquired the subsidiary several years ago. The financial statements for Foreign Sub for Year 2 in its own currency appear in Exhibit 8.31. LO 8-6 December 31

> Exhibit 8.28 presents the separate financial statements at December 31, Year 2, of Prestige Resorts and its 80%-owned subsidiary Booking, Inc. Two years earlier on January 1, Year 1, Prestige acquired 80% of the common shares of B

> On December 31, Year 1, Pace Co. paid $3,000,000 to Sanders Corp. shareholders to acquire 100% of the net assets of Sanders Corp. Pace Co. also agreed to pay former Sanders shareholders $200,000 in cash if certain earnings projections were achieved over

> Ormond Co. acquired all of the outstanding common stock of Daytona Co. on January 1, Year 1. Ormond Co. gave shares of its common stock with a fair value of $312 million in exchange for 100% of the Daytona Co. common stock. Daytona Co. will remain a lega

> Lexington Corporation acquired all of the outstanding common stock of Chalfont, Inc., on January 1, Year 1. Lexington gave shares of its no par common stock with a market value of $504 million in exchange for the Chalfont common stock. Chalfont will rema

> Bed and Breakfast (B&B), an Italian company operating in the Tuscany region, follows IFRS and has made the choice to premeasure long-lived assets at fair value. B&B purchased land in Year 1 for €150,000. At December 31 of the next four years, the land is

> Floral Delivery, Inc. (FD) acquired a fleet of vans on January 1, 2021, by issuing a $500,000, four-year, 4% fixed rate note, with interest payable annually on December 3. FD has the option to repay the note prior to maturity at the note’s fair value. FD

> Exhibits 7.14 and 7.15 provide footnote excerpts to the financial reports of The Coca-Cola Company and Eli Lilly and Company that discuss the stock option grants given to the employees of the two firms. Each firm uses options extensively to reward employ

> Eli Lilly and Company Produces pharmaceutical products for humans and animals. Exhibit 7.15 includes a footnote excerpt from the annual report of Lilly for the period ending December 31, Year 4. REQUIRED: Review Exhibits 7.15 and answer the following qu

> Refer to financial statements for Walmart in Exhibit 1.19 (Balance Sheets), Exhibit 1.20 (Statements of Income), and Exhibit 1.22 (Statement of Cash Flows). Exhibit 1.19: Exhibit 1.20: Exhibit 1.22: REQUIRED a. Explain why depreciation and amortiza

> Exhibit 7.14 includes a footnote excerpt from the annual report of The Coca-Cola Company for Year 4. The beverage company offers stock options to key employees under plans approved by stockholders. REQUIRED: Review Exhibit 7.14 and answer the followin

> On January 1 of Year 1, Baylor Company needs to acquire an industrial drilling machine that has a five-year life. Baylor could borrow funds and buy the machine outright for $50,000 or it could lease it from Gonzaga Financial by making annual end-of-the-y

> Exhibits 6.17–6.19 present the December 31, 2019, Consolidated Statements of Income, Statements of Comprehensive Income, Consolidated Statements of Cash Flows for Chipotle Mexican Grill, Inc. Notes 5 and 6 to the financial statements pr

> Socket Mobile develops and deploys bar-code-enabled mobile apps, cordless bar-code scanners, and contactless reading and writing devices to enable data capture. Its primary revenue source is the servicing of firms in the specialty retailer, field service

> Exhibit 6.16 presents the Consolidated Statements for Income of Harley-Davidson, Inc., and Note 3 describes restructuring expenses. NOTE: 3 Accompanying HARLEY-DAVIDSON, INC. December 31, 2019, Consolidated Financial Statements 3. Restructuring Expense

> Diviney Company wants to raise $50 million cash but for various reasons does not want to do so in a way that results in a newly recorded liability. The firm is sufficiently solvent and profitable, so its bank is willing to lend up to $50 million at the p

> Delta Air Lines, Inc., is one of the largest airlines in the United States. It has operated on the verge of bankruptcy for several years. Exhibit 5.17 presents selected financial data for Delta Air Lines for each of the five years ending December 31, 200