Question: Match each of the following performance measures

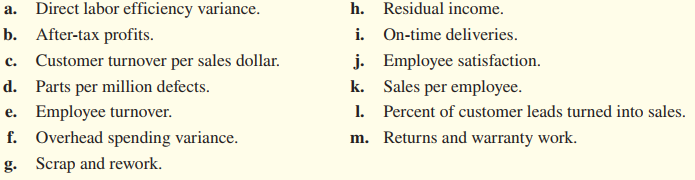

Match each of the following performance measures with one of the four perspectives of the balanced scorecard (Financial—F, Customer—C, Business Process—B, or Learning and Growth L).

> Kent Corporation manufactures filtration systems. The manufacturing costs incurred during its first year of operations are as follows. During the year, 220 completed units were manufactured, of which 180 were sold. (Assume that ending Finished Goods Inv

> Company P, a U.S. company, has a foreign subsidiary in Country Q, where various forms of bribery are accepted and expected. Company P sent one of its top U.S. managers to oversee operations in its subsidiary in Country Q. That manager engaged in the foll

> Fox Games is a U.S. company that manufacturers computer game consoles. Many of the components for the consoles are purchased abroad, and the finished product is sold in foreign countries as well as in the United States. Among the recent transactions of F

> The following financial assets appeared in a recent balance sheet of Apple Inc. (dollar amounts are stated in millions). a. Define financial assets. b. A different approach is used in determining the balance sheet value for each category of Apple Inc.&a

> Sky Tracker Corporation manufactures a telecommunications device. During its first year of operations, the company started and completed 45 devices at a cost of $66,000 per unit. Of these, 43 were sold for $126,000 each and two remain in finished goods i

> Form a group of students and research the Dominican Republic–Central America–United States (CAFTA-DR) trade agreement for Central America. A government website, www.ustr.gov, provides information on various trade agreements. Prepare a short presentation

> Why do companies that use perpetual inventory systems also take an annual physical inventory? When is this physical inventory usually taken? Why?

> The accounting records of Hobart Industries show the following information for the most recent year ended December 31. a. Find the amount debited to the Work In Process Inventory account during the year. b. What is the cost of goods manufactured for the

> Rainbow Paints operates a chain of retail paint stores. Although the paint is sold under the Rainbow label, it is purchased from an independent paint manufacturer. Guy Walker, president of Rainbow Paints, is studying the advisability of opening another s

> Big Oak Lumber is a lumber yard on Angel Island. Some of Big Oak’s transactions during the current year are as follows. Instructions: a. Prepare journal entries to record these transactions and events in the accounting records of Big

> You are the controller for 21st Century Technologies. Your staff has prepared an income statement for the current year and has developed the following additional information by analyzing changes in the company’s balance sheet accounts.

> On August 3, Cinch Construction purchased special-purpose equipment at a cost of $1,000,000. The useful life of the equipment was estimated to be eight years, with an estimated residual value of $50,000. a. Compute the depreciation expense to be recogniz

> Identify the following expenditures as capital expenditures or revenue expenditures. a. Immediately after acquiring a new delivery truck, paid $260 to have the name of the store and other advertising material painted on the vehicle. b. Painted delivery t

> Assume that you recently applied for a student loan to go to graduate school. As part of the application process, your bank requested a list of your assets. Aside from an extensive CD collection, your only other asset is a pickup truck. You purchased the

> The Home Depot financial statements and related material appear in Appendix A at the end of this textbook. Use these to answer the following questions and indicate where in the financial statements you found the information. a. What depreciation method d

> LGIN was founded in 2020 to apply a new technology for the Internet. The company earned a profit of $190,000 in 2020, its first year of operations. Management expects both sales and net income to more than double in each of the next four years. Comparati

> Sexton Company acquired a truck for use in its business for $26,500 in a cash transaction. The truck is expected to be used over a five-year period, will be driven approximately 18,000 miles per year, and is expected to have a value at the end of the fiv

> Bill Gladstone has owned and operated Gladstone’s Service Station for over 30 years. The business, which is currently the town’s only service station, has always been extremely profitable. Gladstone recently decided that he wanted to sell the business an

> For several years, a number of Prestland Company’s grocery stores were unprofitable, leading to a decision to close several of these locations where it was apparent that the company would not beagle to recover the cost of the assets associated with those

> XL Industries uses department budgets and performance reports in planning and controlling its manufacturing operations. The following annual performance report for the widget production department was presented to the president of the company. Although a

> Why are investments in marketable securities shown separately from cash equivalents in the balance sheet?

> Honda Motor Company reports that it has manufacturing facilities in over 25 locations around the world. Only five of those locations are in Japan. Several are in the United States, Europe, and South America. Identify the advantages and disadvantages for

> During the past several years the annual net income of Avery Company has averaged $540,000. At the present time the company is being offered for sale. Its accounting records show the book value of net assets (total assets minus all liabilities) to be $2,

> Willis Bus Service traded in a used bus for a new one. The original cost of the old bus was $52,000. Accumulated depreciation at the time of the trade-in amounted to $34,000. The new bus cost $67,000, but Willis was given a trade-in allowance of $10,000.

> Green Lawns, Inc., performs adjusting entries every month, but closes its accounts only at yearend. The following is the company’s year-end adjusted trial balance dated December 31, current year. a. Prepare an income statement and stat

> Listed as follows are nine technical terms used in this chapter. Each of the following statements may (or may not) describe one of these technical terms. For each statement, indicate the accounting term described, or answer “Noneâ

> The division managers of Chester Construction Corporation submit capital investment proposals each year for evaluation at the corporate level. Typically, the total dollar amount requested by the divisional managers far exceeds the company’s capital inves

> Ran’s Supply uses a perpetual inventory system. On January 1, its inventory account had a beginning balance of $7,740,000. Ranns engaged in the following transactions during the year. 1. Purchased merchandise inventory for $11,400,000. 2. Generated net

> Ferrent is debating whether to invest in new equipment to manufacture industrial distilling vats. The new equipment would cost $1,600,000 and would have an estimated eight-year life and no salvage value. The estimated annual operating results with the ne

> Northwest Records is considering the purchase of Seattle Sound, Inc., a small company that promotes and manages blues rock bands. The terms of the agreement require that Northwest pay the current owners of Seattle Sound $600,000 to purchase the company.

> Winett Corporation is considering an investment in special-purpose equipment to enable the company to obtain a six-year municipal contract. The equipment costs $1,320,000 and would have no value when the contract expires at the end of six years. Estimate

> The following information relates to three independent investment decisions, each with a 10-year life and no salvage value. Using the present value tables in Exhibits 26–3 and 26–4, solve for the missing information p

> Refer to Exhibit 15–6 in this chapter. Assume a United Kingdom company, Brits International, lists on both the London Exchange using U.K. GAAP and the New York Stock Exchange. Brits International must prepare a reconciliation from U.K.

> Mineral World recognizes $20 depletion for each ton of ore mined. During the current year the company mined600,000 tons but sold only 500,000 tons, as it was attempting to build up inventories in anticipation of a possible strike by employees. How much d

> Global Motors is a U.S. corporation that purchases automobiles from European manufacturers for distribution in the United States. A recent purchase involved the following events: Instructions: a. Prepare in general journal form the entries necessary to

> Using the tables in Exhibits 26–3 and 26–4, determine the present value of the following cash flows, discounted at an annual rate of 15 percent. a. $60,000 to be received 20 years from today. b. $32,000 to be received

> Wabash, Inc., had revenue and expenses (including income tax) from ongoing business operations for the current year of $480,000 and $430,000, respectively. During the year, the company sold a division of the company that had revenue and expenses (not inc

> Foz Co. is considering four investment proposals (A, B, C, and D). The following table provides data concerning each of these investments. Solve for the missing information pertaining to each investment proposal.

> Baylor Lumber Products is considering the purchase of a high-efficiency conveyor system. Two manufacturers have approached Baylor with proposals: (1) Duke Industries and (2) Wake Manufacturing. Regardless of which vendor Baylor chooses, the following inc

> PC Connection is a leading mail-order retailer of personal computers. A recent financial report issued by the company revealed the following information. a. Compute the company’s cost of goods sold for the year. b. Approximately how mu

> The section entitled “Impairment of Long-Lived Assets” can be found in the Home Depot financial information in Appendix A. In this section, Home Depot explains procedures used to estimate the carrying value of impaired stores that it closes. How does the

> Over the next four years, the City of Mythica, New York, is expecting the following cash flows from a federal grant: year 1—$150,000; year 2—$220,000; year 3—$250,000; year 4—$175,00

> The radiology department at St. Joseph’s Hospital, a not-for-profit, is considering purchasing a magnetic resonance imaging (MRI) machine. The cost to purchase and install an MRI is approximately $2,000,000. Assume St. Josephâ

> Swirl Incorporated designs and manufactures fashionable women’s clothing. For the coming year, the company has scheduled production of 50,000 silk skirts. Budgeted costs for this product are as follows. The management of Swirl is cons

> Refer to Exercise 26.11. Assume Concrete Suppliers Inc. has assembled the following expected annual income statement data for each of its trucks Analyze this income statement data for expected cash flow effects each year. Data from exercise 26.11: Supp

> Suppose Concrete Suppliers Inc. sells one of its $155,000 concrete trucks, with an original fiveyear economic life, at the end of year 3 after taking three years of straight-line depreciation. Concrete Suppliers has a 40 percent tax rate. If the truck is

> EnterTech has noticed a significant decrease in the profitability of its line of its wireless headphones. The production manager believes that the source of the trouble is old, inefficient equipment used to manufacture the product. The issue raised, ther

> Eight Flags is a retail department store. The following cost-volume relationships were used in developing a flexible budget for the company for the current year. Management expected to attain a sales level of $20 million during the current year. At the

> The following are 10 technical accounting terms introduced or emphasized in this chapter. Each of the following statements may (or may not) describe one of these technical terms. For each statement, indicate the accounting term described, or answer &aci

> Explain how to compute the average collection period and why it is a critical factor in creating the collections of receivables budget

> Shown as follows are selected transactions of Konshock’s, a retail store that uses a perpetual inventory system. a. Purchased merchandise on account. b. Recognized the revenue from a sale of merchandise on account. (Ignore the related

> Consider the different responsibilities involved in the following three positions at Vortnoy Corporation: (1) supervisor of the second shift at the Fairfield, Rhode Island, plant, (2) manager for the Northeastern Division, and (3) corporatewide chief fin

> You are the manager of the Midwest Region, a 27-restaurant division that is part of the chain “Bites and Bits.” The restaurants offer casual dining and compete with such chains in your region as Olive Garden and Outback Steakhouse. You receive an annual

> Reconsider Exhibit panel B, in the chapter. Use current exchange rates to estimate the global costs of making a Barbie® doll. Has the total cost increased or decreased as a result of changes in exchange rates?

> The Home Depot, Inc., financial statements appear in Appendix A at the end of this textbook. a. Does the company use straight-line depreciation? How can you tell? b. At what point does the company recognize and record revenue from its customers? c. Us

> Jennifer Baskiter is president and CEO of Plants&More.com, an Internet company that sells plants and flowers. The success of her startup Internet company has motivated her to expand and create two divisions. One division focuses on sales to the general p

> An investment center in Shellforth Corporation was asked to identify three proposals for its capital budget. Details of those proposals are as follows. Shellforth uses residual income to evaluate all capital budgeting projects. Its minimum required retu

> Bailey uses ROI to measure the performance of its operating divisions and to reward its division managers. A summary of the annual reports from two of Bailey’s divisions is shown provided below. The company’s weighted-

> Assume that a recent survey revealed that 60 percent of Taylor Company employees spend time on social media and other online activities while at work. What performance evaluation incentives might encourage or discourage these behaviors?

> Assume you have just been hired as the management accountant in charge of providing your firm’s managers with product information. What activities might you undertake if you were participating in the design of a balanced scorecard?

> Ann Hoffman, owner of Hoffman Industries, is negotiating with the bank for a $250,000, 90-day, 15 percent loan effective July 1 of the current year. If the bank grants the loan, the net proceeds will be $240,000, which Hoffman intends to use on July 1 as

> Use Home Depot’s financial information in Appendix A to compute the ROI and EVA for the two most recent years reported. Use Net Earnings as a measure of earnings or returns, and Net Property and Equipment as the invested capital base. Assume the weighted

> Hendersonville Meats has two divisions. The company’s Outlets division sells smoked hams, sausages, steaks, and other delicacies through its traditional suburban stores. Its Online division was formed several years ago and sells the pro

> The Home Depot, Inc., financial statements appear in Appendix A at the end of this textbook. Use the statements to complete the following requirements. a. Calculate the gross profit percentage of Home Depot, Inc., for each of the years shown in the comp

> In Appendix A, you will find a table titled “Five-Year Summary of Financial and Operating Results” for Home Depot. Review the various performance measures listed in the table. Choose at least one measure for each category of the balanced scorecard. Expla

> Find the Consolidated Statement of Comprehensive Income section of the Home Depot 2018 financial statements in Appendix A. Locate the translation adjustment for 2018. Was the effect of the adjustment positive or negative on Comprehensive Income? What is

> In the current year, Hudson Company had revenue and expense numbers of $750,000 and $600,000, respectively, before income taxes and before the following item. The company had a gain of $115,000 that resulted from the passage of new legislation, which was

> Millennium Frozen Foods owes the bank $50,000 on a line of credit. Terms of the agreement specify that Millennium must maintain a minimum current ratio of 1.2 to 1, or the entire outstanding balance becomes immediately due in full. To date, the company h

> The following information for companies X, Y, and Z is incomplete. Supply the missing data for items (a) through (l).

> Easton’s Fabric Division has assets of $980,000, current liabilities of $130,000, and net operating income of $196,000. a. What is the Fabric Division’s ROI? b. If the weighted-average cost of capital is 15 percent, what is the division’s EVA? c. How mig

> Emily Adams is the manager of City Wide Door, a company specializing in installing and maintaining garage doors of many types. Her associate, Alyssa, has provided Emily with three proposals for different investments in machinery to help expand the busine

> Listed are eight terms introduced or emphasized in this chapter. Each of the following statements may (or may not) describe one of these terms. For each statement, indicate the term described, or answer “none” if the

> From the following information for Alfred Industries, compute the overhead spending variance and the volume variance.

> Sunder’s has been in business since January of the current year. The company buys fresh pasta and resells it to large supermarket chains in five states. The following information pertains to Sunder’s first four months

> The manager of a manufacturing firm received the following information related to the last period’s direct materials and direct labor variances. a. Ignoring all other variances, what are possible reasons for a favorable direct material

> State College Technology Store (SCTS) is a retail computer store in the university center of a large Midwestern university. SCTS engaged in the following transactions during November of the current year Assume that the other expenses incurred by SCTS du

> Match the following transactions, which are denominated in a foreign currency, with the appropriate foreign currency and exchange gain or loss effects. //

> Satka Fishing Expeditions, Inc., recorded the following transactions in July. 1. Provided an ocean fishing expedition for a credit customer; payment is due August 10. 2. Paid Marine Service Center for repairs to boats performed in June. (In June, Satka

> The following computation of the materials variances of Weitzen Foods is incomplete. The missing data are labeled (a) through (d). Supply the missing data for items (a) through (d). Prepare a caption describing the item, as well as indicating the dollar

> Margo Corporation produces air filtration systems. Information pertaining to the company’s monthly direct labor usage is provided as follows. a. Compute the company’s labor rate variance. b. Compute the companyâ

> Klinkhammer Corporation estimated overhead for the year as follows: fixed = $720,000; variable = $4 per unit. Klinkhammer expected to produce 72,000 units for the year. a. Compute the rate that will be used to apply overhead costs to products. b. During

> Gumchara Corporation reported the following information with respect to the materials required to manufacture amalgam florostats during the current month. a. Determine Gumchara’s materials price variance. b. Determine Gumcharaâ&#

> Explain why companies that undergo periods of rapid growth often experience cash flow problems.

> The cost accountant for Blue Pharmaceuticals has informed you that the company’s materials quantity variance for the drug Allegro was exactly equal to its materials price variance for the year. The company’s normal lev

> Blue Dingo uses a standard costing system. The company’s standard costs and variances for direct materials, direct labor, and factory overhead for the month of May are as follows. Determine the actual costs incurred during the month of

> It may be easier to think about setting standards to help manage manufacturing businesses, like the lumber business of Brice Mills, Inc., discussed in this chapter, than to help manage retail establishments. For a company like Home Depot, main inputs (di

> For each of the following variances, briefly explain at least one probable cause and indicate the department manager (if any) responsible for the variance. a. A favorable materials price variance. b. An unfavorable labor rate variance. c. A favorable vol

> The following are nine global business terms used in this chapter. Each of the following statements may describe one of these terms. For each statement, indicate the global business term described, or answer “None” if

> Peter Corporation sells its products to a single customer. At the beginning of the current quarter, the company reports the following selected account balances. Peter’s management has made the following budget estimates regarding opera

> Mountain Mabel’s is a small general store located just outside of Yellowstone National Park. The store uses a periodic inventory system. Every January 1, Mabel and her husband close the store and take a complete physical inventory while watching the Rose

> Nolan Mills uses a standard cost system. During May, Nolan manufactured 15,000 pillowcases, using 27,000 yards of fabric costing $3.05 per yard and incurring direct labor costs of $19,140 for 3,300 hours of direct labor. The standard cost per pillowcase

> Mastrolia’s overhead spending variance is unfavorable by $900. The company’s cost accountant credited the Cost of Goods Sold account for $6,300 to close out any over- or underapplied overhead at the end of the current period. Compute Mastrolia’s overhead

> Zeta, Inc., produces handwoven rugs. Budgeted production is 5,000 rugs per month, and the standard direct labor required to make each rug is 2 hours. All overhead is allocated based on direct labor hours. Zeta’s manager is interested in

> Use the information in Exercise 24.9 to prepare the journal entry to record the overhead at Alfred Industries. Data from Exercise 24.9: From the following information for Alfred Industries, compute the overhead spending variance and the volume variance.

> The following are seven technical terms introduced in this chapter. Each of the following statements may (or may not) describe one of these technical terms. For each statement, indicate the accounting term discussed, or answer “None&ac

> Delmar Foods has two divisions: (1) a processed meat division and (2) a frozen pizza division. Delmar’s frozen pizzas use processed meat as a topping. The company’s processed meat division supplies the frozen pizza division with all of its meat toppings.

> For the year just ended, Fillips, Inc., had income before income taxes of $275,000 from its normal, recurring operations. In addition, during the year, a tornado damaged one of the company’s warehouses and its contents. Tornado damage is quite rare in Fi

> Shown as follows is a segmented income statement for Drexel-Hall during the current month. All stores are similar in size, carry similar products, and operate in similar neighborhoods. Store 1 was established first and was built at a lower cost than wer

> The financial statements of large public companies are often accompanied by a multiple-year summary of key financial and other information that is helpful in understanding the company. Appendix A of this text includes the financial statements of Home Dep

> Shown as follows is a segmented income statement for Drexel-Hall during the current month. All stores are similar in size, carry similar products, and operate in similar neighborhoods. Store 1 was established first and was built at a lower cost than wer