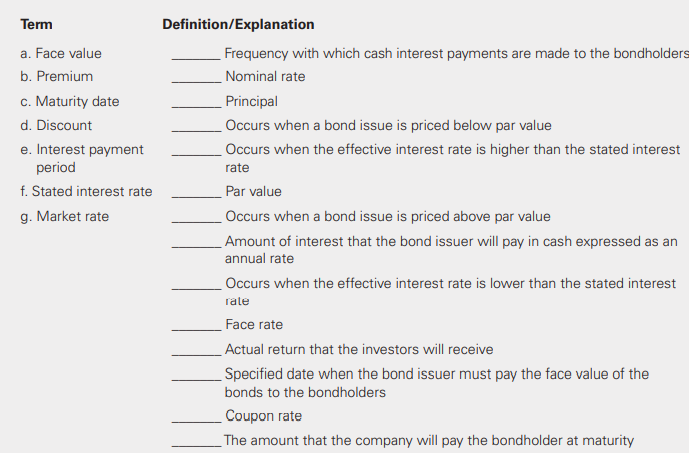

Question: Match each term with its definition or

> Loggins Lumber Company experienced net losses during the first 2 years of its operations. Year 3 was the company’s first profitable year. Loggins uses the same accounting methods for financial reporting and its tax returns. The company

> If all potentially dilutive securities are dilutive (as opposed to antidilutive), will diluted earnings per share be the same whether there are actual or hypothetical conversions of potentially dilutive securities?

> Does the if-converted assumption apply only to diluted earnings per share?

> Do firms adjust the numerator of the EPS ratio for preferred dividends if the dividends are declared?

> Do earnings per share disclosures include a reconciliation of the numbers used in the computation of EPS to the information provided in the financial statements?

> Is an entity required to present earnings per share on income from continuing operations and earning per share on discontinued operations on the face of its financial statements?

> How do financial statement analysts use earnings per share information?

> Do corporations report the projected benefit obligation and the plan assets as individual accounts on the sponsor corporation’s balance sheet?

> Does a company report the funded status of the defined-benefit plan as calculated by an actuary on the financial statement?

> The corridor method requires computing the amortization of net actuarial gains and losses under the straightline method. Will the amortization be the same each year?

> Does the going-concern concept justify the use of the projected benefit obligation in all pension calculations?

> Phlash Photo Labs, Ltd. provided you the following information for the 3 years ended December 31. Required: a. Assuming no book-tax differences and no uncertainty regarding the realization of the tax benefits of the net operating loss carryforward, prep

> ABC Toy Company earned $357 million of net income in 2019 and paid $45 million in dividends. It issued no new stock. Complete the stockholders’ equity section for ABC Toy Company:

> Does the employee always absorb the total risk of loss on pension plan assets?

> When accounting for employee stock options, will a reduction of compensation expense or compensation “income” occur in future periods?

> Do companies with equity-based compensation plans make adjustments for changes in the market price of the stock?

> How do companies account for stock-based compensation?

> Does aggregating the five components of pension cost always results in a reduction in income?

> What is the allocation period used to expense stock-based compensation?

> How does a lessee separate lease and nonlease components?

> What components are included in a lease contract?

> How is the right-of-use asset measured?

> Evergreen Waste Company provides weekly trash collection services to small companies. Evergreen collected a $1,000 deposit from each of 12 new customers for large trash dumpsters. The cost of each dumpster is $700. The company uses a perpetual inventory

> Over what time period does the lessee amortize the leased asset transferred by the lessor?

> Jorge Corporation issued $100,000 par value, 6%, 4-year bonds (i.e., there were 100 of $1,000 par value bonds in the issue). Interest is payable semiannually each January 1 and July 1 with the first interest payment due at the end of the period on July 1

> How does a lease offer business and financial flexibility for the lessee?

> What are typical terms and provisions in a lease contract?

> What types of payments are included in variable lease payments? How are variable lease payments treated in accounting for leases?

> In a direct financing lease, does a lessor always report selling profit or loss on the sale of the leased asset at the lease commencement date? Explain

> In a sales-type lease, does a lessor always report a selling profit or loss on the sale of the leased asset at the lease commencement date? Explain.

> How does the lessor measure the net investment in the lease for a lease classified as a sales-type lease?

> Who bears the risk of obsolescence in a lease transaction?

> What are the lessee’s accounting and reporting requirements for the subsequent measurement of the lease transaction if a lease is classified as a finance lease?

> Tank Top Menswear, Ltd. reported net plant and equipment of $1,600,000. These assets cost $2,500,000 with accumulated depreciation taken to date of $900,000. Based on recently assessed negative evidence, Tank Top’s management concluded that its plant ass

> What are the lessee’s accounting and reporting requirements for the initial measurement of the lease transaction if a lease is classified as a finance lease?

> What is the accounting treatment for initial direct costs the lessor pays?

> Fill in the missing items for each of the cases below:

> What are the lessee’s accounting and reporting requirements for the subsequent measurement of the lease transaction if a lease is classified as an operating lease?

> What are the lessee’s accounting and reporting requirements for the initial measurement of the lease transaction if a lease is classified as an operating lease?

> What is the lessee’s short-term lease policy election?

> How does a lessee measure the lease liability?

> What types of expenditures are included in initial direct costs paid by the lessee?

> What is reported by a lessee under a lease when the lessee makes the short-term lease policy election?

> What does the lessor report on the income statement under an operating lease?

> Turnabout Enterprises provided the following information regarding book-tax differences for its first year of operations: Installment sales are a normal part of Turnabout’s operations. The depreciation expense is related to a building

> Dentquity Corporation has the following capital structure at the beginning of the current year: Required: a. Prepare the journal entries (including closing entries) to record each of the following transactions affecting shareholders’ e

> Is it advantageous to the lessee that the lessor bears the risk of the asset becoming obsolete? Explain.

> Does the choice of discount rate (i.e., the lessee’s incremental borrowing rate versus the lessor’s implicit rate) materially affect lease valuation for the lessee?

> What discount rate does the lessee use to determine the present value of the lease payments? What is the rationale behind this requirement?

> Local Craft Designs, Inc. reported goodwill at $600,000 related to its Central Avenue Division. The fair value of Central Avenue is $2,500,000. The carrying value of Central Avenue’s net assets, excluding goodwill, is reported at $2,100,000 and appraised

> How does the probability of the collection of the lease payments and guaranteed residual value affect the net investment in lease by the lessor?

> How does a guaranteed residual value affect the lease accounting for the lessor and the lessee?

> What is the difference in the lessee’s lease capitalization criteria under IFRS and U.S. GAAP?

> Can the lessor account for a lease either as an operating, direct financing, or a sales-type lease at its discrtion? Explain

> What elements are included in the total lease payments?

> Flex Mirrors, Ltd. offers a 3-year warranty on all its products. In Year 1, the company reported income before warranty expense of $600,000 and estimated that warranty repairs would cost the company $115,000 over the 3-year period. Actual repairs for the

> What are the criteria for a lessee to report a finance lease?

> Does a lessee have an option not to separate lease and nonlease components?

> How does a lessor separate lease and nonlease components?

> Does the lessee become the owner of the equipment when entering into an agreement to lease a piece of equipment? Explain.

> Does the requirement that a firm must assess its deferred tax assets every period for realizability and adjust the valuation allowance as necessary create volatility in the entity’s effective tax rate? Explain.

> Ironbound, Inc. borrows $150,000 by issuing a 12%, 4-year note on January 1, 2016. Ironbound must make payments of principal and interest every 3 months, beginning March 31, 2016. The note will be fully paid at maturity on December 31, 2019. The company’

> When can firms recognize net deferred tax assets on the balance sheet?

> When do deferred tax liabilities occur?

> How does the balance sheet approach measure deferred taxes?

> How are deferred tax assets and deferred tax liabilities created?

> Farris Casinos recently acquired a newly built hotel and casino in Atlantic City. The cost of the complex was $6,000,000 with a 6-year useful life and no residual value expected. Farris depreciates its buildings using the straight-line method for financi

> When do permanent differences arise?

> Will permanent differences cause the effective tax rate to be lower than the statutory rate?

> When will income tax expense and income taxes payable be equal?

> Are extensive disclosures required for deferred taxes?

> Do U.S. GAAP and IFRS classify deferred tax accounts in the same manner?

> How do firms classify deferred tax accounts?

> For each case, provide the missing information. Assume that payments occur at the end of each period.

> Do U.S. GAAP and IFRS have similar approaches to accounting for tax contingencies?

> How does an entity account for uncertain tax positions?

> Does accounting for a net operating loss (NOL) carryback require less judgment than accounting for the NOL carryforward?

> Repeat E16-8 assuming that Greenburg Company is an IFRS reporter and the company would like to elect to report the investment at fair value through other comprehensive income if it qualifies for this treatment. Greenburg is holding the investment in comm

> When do firms adjust for the cumulative effect of changes in future tax rates affecting income?

> Do firms measure deferred tax accounts at the statutory tax rate expected to be in effect at the future reversal date to properly value the deferred tax asset and deferred tax liability?

> How does a firm determine the need for a valuation allowance against a deferred tax asset in the more-likelythan-not test?

> Do the objectives of GAAP accounting and tax accounting methods differ?

> Does the fair value option enable firms to offset earnings volatility in financial reporting? Explain.

> When is the equity method of accounting for investments required

> What categories can managers use to classify equity investments?

> Sallie Corporation borrowed $700,000 on November 1, 2016. The note agreement specifies that it will pay interest quarterly at 6% and the principal will be due on October 31, 2017. The company’s fiscal year ends December 31. What journal entry will Sallie

> Do entities report unrealized gains and losses on fair value adjustments to both debt and equity security investments in earnings? Explain.

> How does a company account for equity investments in which it has significant influence?

> Greenburg Company reported the following investment activity occurring at January 1 of the current year. Greenburg does not have significant influence over the investees Required: a. Prepare the journal entry required to record the acquisition of the

> What categories can managers use to classify debt investments?

> Is the fair value of an investment subjective? Explain

> Is reporting an investment at its cost considered relevant? Explain.

> Are companies required to assess whether their equity investments are impaired? Explain

> Is there a difference in how companies report impairment losses on equity investments under U.S. GAAP and IFRS?

> Is there a difference in how companies report impairment losses on debt investments under IFRS compared to U.S. GAAP?

> How do companies report impairment losses on equity investments?

> How do companies report impairment losses on debt investments measured at amortized cost?

> Use the following excerpt from the financial statements of Fixet Company’s debt footnote (from Fixet Company’s 2018 annual report) to answer these questions: a. At December 31, 2018, what is the amount of the current

> Do companies generally disclose the amounts of debt investment by classification: held to maturity, trading, or available for sale? Explain.

> Using the information provided in E16-6, satisfy the following requirements assuming that the equity securities held by Armonico Capital do not have a readily determinable fair value because neither company is publicly traded. Armonico elects to carry bo