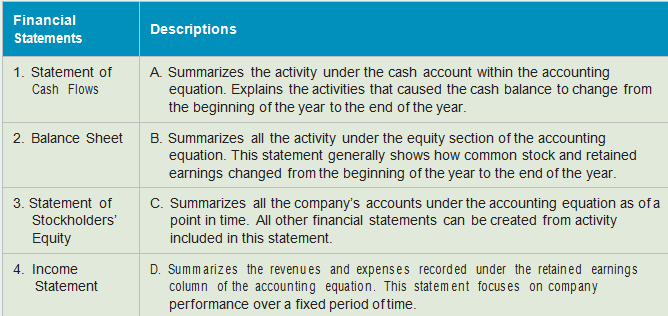

Question: Match the financial statements with the appropriate

> Sage Inc. experienced the following transactions for Year 1, its first year of operations: 1. Issued common stock for $50,000 cash. 2. Purchased $140,000 of merchandise on account. 3. Sold merchandise that cost $110,000 for $250,000 on account. 4. Collec

> The Kroger Co. was founded in 1883 and is one of the largest retailers in the world, based on annual sales. Publix Super Markets, Inc. operates 1,167 grocery stores throughout the southeastern and mid- Atlantic United States. It is employee owned, and it

> On January 1, Year 2, Shapiro Company paid $70,000 cash to purchase a truck. The truck has a $10,000 salvage value and a five-year useful life. Assume that Shapiro earns $18,000 of cash revenue per year for Year 1 through Year 5 of the assets useful life

> Alcorn Service Company was formed on January 1, Year 1. Events Affecting the Year 1 Accounting Period 1. Acquired $20,000 cash from the issue of common stock. 2. Purchased $800 of supplies on account. 3. Purchased land that cost $14,000 cash. 4. Paid $80

> After reconciling its bank account, Watson Company made the following adjustments to its cash account: Required Identify the event depicted in each adjustment as asset source (AS), asset use (AU), asset exchange (AE), or claims exchange (CE). Also explai

> Identify the financial statements on which each of the following items (titles, date descriptions, and accounts) appears by placing a check mark in the appropriate column. If an item appears on more than one statement, place a check mark in every applica

> For each of the following events, determine the amount of transportation paid by The Box Company. Also indicate whether the transportation cost would be classified as a product or period (selling and administrative) cost. a. Purchased merchandise with tr

> Simpson Company had the following balances in its accounting records as of December 31, Year 1: The following accounting events apply to Simpson Company’s Year 2 fiscal year: Jan. 1 Acquired $20,000 cash from the issue of common stock.

> Each of the following independent events requires an end-of-period adjustment. Show how each event and its related adjustment affect the accounting equation. Assume the fiscal year ends December 31. The first event is shown as an example. a. Paid $4,800

> At the beginning of Year 2, the Redd Company had the following balances in its accounts: During Year 2, the company experienced the following events: 1. Purchased inventory that cost $15,200 on account from Ross Company under terms 1/10, n/30. The mercha

> The following information was drawn from the records of Bennett Company: Required a. Use the appropriate accounts and balances from Bennett Company to construct an end of period income statement, a statement of changes in stockholders’

> Sentry, Inc. was started on January 1, Year 1. Year 1 Transactions 1. Acquired $20,000 cash by issuing common stock. 2. Earned $62,000 of revenue on account. 3. On October 1, Year 1, borrowed $12,000 cash from the local bank. 4. Incurred $3,700 of operat

> Presented here is selected information from the 2017 fiscal-year 10-K reports of four companies. The four companies, in alphabetical order, are Advance Micro Devices, a global semiconductor company; AT&T, Inc., a company that provides communications

> Waddell Company had the following balances in its accounting records as of December 31, Year 1: The following accounting events apply to Waddell Company’s Year 2 fiscal year: Jan. 1 Acquired $20,000 cash from the issue of common stock.

> The following horizontal financial statements model shows the transactions experienced by Surf’s Up Industries during Year 1. The table contains missing data that are labeled with alphabetic characters (a) through (n). Assume all transa

> The Bruce Spruce Co. experienced the following events during its first year of operations, Year 1: 1. Acquired $75,000 cash by issuing common stock. 2. Earned $48,000 cash revenue. 3. Paid $34,000 cash for operating expenses. 4. Borrowed $20,000 cash fro

> Resource owners provide three types of resources to businesses that transform the resources into products or services that satisfy consumer demands. Required Identify the three types of resources. Write a brief memo explaining how resource owners select

> For each of the following T-accounts, indicate the side of the account that should be used to record an increase or decrease in the financial statement element:

> Define the IASB and describe its function.

> The following balances were drawn from the accounts of Carter Company. The accounts and balances shown here are presented in random order: Equipment-$26,000; Cash-$18,000; Depreciation Expense-$3,000; Notes Payable-$26,000; Common St

> The following information was drawn from the accounting records of Schafer Company: 1. On January 1, Year 1, Schafer paid $72,000 cash to purchase a truck. The truck had a seven-year useful life and a $9,000 salvage value. 2. As of December 31, Year 1, S

> Bronson Inc. has 300,000 shares authorized, 175,000 shares issued, and 25,000 shares of treasury stock. At this point, Bronson has $820,000 of assets. $250,000 liabilities, $400,000 of common stock, and $170,000 of retained earnings. Further, assume that

> Tyler Co. issued $250,000 of 6 percent, 10-year, callable bonds on January 1, Year 1, at their face value. The call premium was 2 percent (bonds are callable at 102). Interest was payable annually on December 31. The bonds were called on December 31, Yea

> Obtain Target Corporation’s annual report for its 2018 fiscal year (year ended February 2, 2019) at http:// investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. What was Target’s gross margin percent

> On January 1, Year 1, Chen Company issued $300,000 of five-year, 6 percent bonds at 101. Interest is payable annually on December 31. The premium is amortized using the straight-line method. Required a. Determine the amount of cash proceeds received by C

> On January 1, Year 1, Files Co. issued $400,000 of five-year, 6 percent bonds at 97. Interest is payable annually on December 31. The discount is amortized using the straight-line method. Required a. Determine the amount of cash proceeds received by File

> Dixon Construction, Inc. issued $300,000 of 10-year, 6 percent bonds on July 1, Year 1, at 96. Interest is payable in cash semiannually on June 30 and December 31. Dixon uses the straight-line method of amortization. Required a. Use a financial statement

> Frey Company issued bonds of $300,000 face value on January 1, Year 1. The bonds had a 6 percent stated rate of interest and a 10-year term. Interest is paid in cash annually, beginning December 31, Year 1. The bonds were issued at 98. Frey uses the stra

> To support himself while attending school, Steve Owens sold computers to other students. During the year, Steve purchased computers for $150,000 and sold them for $280,000 cash. He provided his customers with a one-year warranty against defects in parts

> Hinds Company started operations by acquiring $120,000 cash from the issue of common stock. On January 1, Year 1, the company purchased equipment that cost $110,000 cash. The equipment had an expected useful life of five years and an estimated salvage va

> Edd’s Shoe Repair had the following balances at December 31, Year 1: Cash of $22,000, Accounts Receivable of $76,000, Allowance for Doubtful Accounts of $3,200, and Retained Earnings of $94,800. During Year 2, $2,900 of accounts receivable were written o

> The following trial balance was drawn from the accounts of Southern Timber Co. as of December 31, Year 1: Transactions for Year 2 1. Acquired additional $20,000 cash from the issue of common stock. 2. Purchased $80,000 of inventory on account. 3. Sold in

> Required Identify which of the following items are added to or subtracted from the unadjusted bank balance to arrive at the true cash balance. Distinguish the additions from the subtractions by placing a + beside the items that are added to the unadjuste

> The following information pertains to the inventory of Steelman Company for Year 2: During Year 3, Steelman sold 2,500 units of inventory at $85 per unit and incurred $38,600 of operating expenses. Steelman currently uses the FIFO method but is consideri

> A great number of companies must file financial reports with the SEC, and many of these reports are available electronically through the EDGAR database. EDGAR is an acronym for Electronic Data Gathering, Analysis, and Retrieval system, and its database i

> The Shirt Shop had the following transactions for T-shirts for Year 1, its first year of operations: During the year, The Shirt Shop sold 800 T-shirts for $25 each. Required a. Compute the amount of ending inventory The Shirt Shop would report on the bal

> For each of the following situations, fill in the blank with FIFO, LIFO, or weighted average: a. would produce the highest amount of net income in an inflationary environment. b. would produce the highest amount of assets in an inflationary environment.

> Farm Tractor Supply experienced the following events during Year 1, its first year of operation: 1. Acquired $85,000 cash from the issue of common stock. 2. Purchased inventory for $42,000 cash. 3. Sold inventory costing $25,000 for $56,000 cash. 4. Paid

> McDowell Company began the Year 3 accounting period with $50,000 cash, $72,000 inventory, $55,000 common stock, and $67,000 retained earnings. During Year 3, McDowell experienced the following events: 1. Sold merchandise costing $52,000 for $85,700 on ac

> The beginning account balances for Franchoni’s Body Shop as of January 1, Year 2, follow: The following events affected the company during the Year 2 accounting period: 1. Purchased merchandise on account that cost $17,000. 2. The goods

> Alpine Ski Co. experienced the following events during Year 1, its first year of operation: 1. Started the business when it acquired $145,000 cash from the issue of common stock. 2. Paid $85,000 cash to purchase inventory. 3. Sold inventory costing $55,3

> The following information was drawn from the Year 3 balance sheets of two companies: During Year 3, Williamson’s net income was $35,800, while Hendrix’s net income was $22,900. Required a. Compute the return-on-equity

> On January 1, Year 2, KimCom Boat Rentals purchased a boat that is to be used to produce rental income. The boat cost $120,000. It has an expected useful life of 10 years and a $20,000 salvage value. The boat produced rental income of $15,000 per year th

> Indicate whether each of the following statements is true or false. a. Prepaid rent appears on the balance sheet. b. The book value of a long-term asset appears on the statement of changes in stockholders’ equity. c. Supplies expense appears on the state

> The following is a partial list of transactions FRC Company experienced during its Year 4 accounting period: 1. Collected cash for services to be performed in the future. 2. Paid cash to purchase supplies. 3. Paid cash to purchase a long-term depreciable

> Saul Sellers is the Chief Accountant for Bright Day Cafe (BDC) and is close to retirement. Traditionally, BDC provides a retirement plan that pays a bonus equal to 10 percent of the net income the restaurant reports in the year of retirement. BDC has jus

> Identify whether each of the following items would appear on the income statement (IS), statement of changes in stockholders’ equity (SE), balance sheet (BS), or statement of cash flows (CF). Some items may appear on more than one statement; if so, ident

> Explain how each of the following events or series of events and the related adjustments will affect the amount of net income and the amount of cash flow from operating activities reported on the year-end financial statements. Identify the direction of c

> Identify each of the following events as an accrual, deferral, or neither: a. Incurred other operating expenses on account. b. Recorded expense for salaries owed to employees at the end of the accounting period. c. Paid a cash dividend to the stockholder

> Amelia Company experienced the following events during its first- and second-year operations: Year 1 Transactions: 1. Acquired $75,000 cash from the issue of common stock. 2. Borrowed $28,000 cash from the National Credit Union. 3. Earned $72,000 of cash

> As of January 1, Year 2, Shundra Inc. had a balance of $4,500 in Cash, $2,500 in Common Stock, and $2,000 in Retained Earnings. These were the only accounts with balances on January 1, Year 2. During Year 2, the company had (1) revenue of $9,900, (2) exp

> On January 1, Year 2, the following information was drawn from the accounting records of Zeke Company: cash of $200; land of $1,800; notes payable of $600; and common stock of $1,000. Required a. Determine the amount of retained earnings as of January 1,

> Tennessee Company experienced the following events during Year 2: 1. Acquired $50,000 cash from the issue of common stock. 2. Paid $15,000 cash to purchase land. 3. Borrowed $25,000 cash. 4. Provided services for $60,000 cash. 5. Paid $12,000 cash for re

> During Year 6, Shelby Enterprises earned $115,000 of cash revenue. The company incurs all operating expenses on account. The Year 6 beginning balance in Shelby’s accounts payable account was $25,000 and the ending balance was $18,000. The company made ca

> London Falls Inc. had a beginning balance of $15,000 in its Accounts Receivable account. The ending balance of Accounts Receivable was $8,500. During the period, London Falls collects $65,000 of its accounts receivable. London Falls incurred $53,000 of c

> The following scenarios are independent of each other. 1. During Year 1, a company pays $3,000 cash to purchase supplies. There are $1,000 of supplies on hand at the end of Year 1. 2. On April 1, Year 1, a company pays $4,000 for a one-year insurance pol

> Determine the missing amounts in each of the following four independent scenarios: a. W Co. had a $5,500 beginning balance in accounts payable on January 1, Year 8. During Year 8, the company incurred $45,200 of operating expenses on account and paid $43

> Companies make sacrifices known as expenses to obtain benefits called revenues. The accurate measurement of net income requires that expenses be matched with revenues. In some circumstances, matching a particular expense directly with revenue is difficul

> Forrest Inc. experienced the following events during its first-year operations: 1. Acquired $65,000 cash from the issue of common stock. 2. Borrowed $20,000 from the First City Bank. 3. Earned $65,000 of cash revenue. 4. Incurred $52,000 of cash expenses

> At the end of Year 1, Jameson Co. had $800 of cash, $500 of liabilities, $300 of common stock, and zero in retained earnings. During Year 2, the company generated $650 of cash revenue and incurred $950 of cash expenses. Required Based on this information

> Leaf Company experienced the following events during its first-year operations: 1. Acquired $65,000 cash from the issue of common stock. 2. Borrowed $18,000 from the First City Bank. 3. Earned $48,000 of cash revenue. 4. Incurred $34,000 of cash expenses

> Determine the missing amounts in each of the following four independent scenarios: a. W Co. had a $5,000 beginning balance in accounts receivable on January 1, Year 4. During Year 4, the company earned $72,500 of revenue on account and collected $70,000

> Both balance sheets shown in the following table were dated as of December 31, Year 3: Required a. Based only on the information shown in the balance sheets, can Smith Co. pay a $2,000 cash dividend? b. Based only on the information shown in the balance

> Lewis Enterprises was started on January 1, Year 1 when it acquired $4,000 cash from creditors and $6,000 from owners. The company immediately purchased land that cost $9,000. The land purchase was the only transaction occurring during Year 1. Required a

> This exercise continues the scenario described in Exercise 1-11B shown earlier. Specifically, Green Gardens’s Year 1 ending balances become the Year 2 beginning balances. At the beginning of Year 2, Green Gardens’s acc

> Green Gardens, Inc. began operations on January 1, Year 1. During Year 1, Green Gardens experienced the following accounting events. 1. Acquired $20,000 cash from the issue of common stock. 2. Borrowed $8,000 cash from the State Bank. 3. Collected $38,00

> The following data were taken from the 2017 annual reports of Biogen Idec, Inc. and Amgen, Inc. Both companies are leaders in biotechnology. All dollar amounts are in millions. Required a. For each company, compute the debt-to-assets ratio, return-on-ass

> Sara Bayer started a small merchandising business in Year 1. The business experienced the following events during its first year of operation. Assume that Bayer uses the perpetual inventory system. 1. Acquired $50,000 cash from the issue of common stock.

> Middleton Co. paid $80,000 cash to purchase land from Saws Lumber Company. Saws originally paid $80,000 for the land. Required a. Did this event cause the balance in Middleton’s cash account to increase, decrease, or remain unchanged? b. Did this event c

> The following information is available for two different types of businesses for the Year 1 accounting year. Diamond Consulting is a service business that provides consulting services to small businesses. University Bookstore is a merchandising business

> The Woodstock Shop experienced the following events during its first year of operations, Year 1: 1. Acquired $38,000 cash by issuing common stock. 2. Earned $30,000 revenue on account. 3. Paid $25,000 cash for operating expenses. 4. Borrowed $15,000 cash

> Kendall Company earned $20,000 of cash revenue. Kendall Co. incurred $10,000 of utility expense on account during Year 1. The company made cash payments of $5,000 to reduce its accounts payable during Year 1. Required Based on this information alone, det

> Calculate the missing amounts in the following table:

> On March 1, Year 1, Windy Mill Co. paid $48,000 for 12 months’ rent on its factory. In addition, on September 1, Year 1, the company paid $18,000 for a one-year insurance policy on the factory. Required Show how both purchases and the associated end-of-p

> Holloway Company started operations on January 1, Year 1. During Year 1, Holloway earned $18,000 of service revenue and collected $14,000 cash from accounts receivable. Required Based on this information alone, determine the following for Holloway Compan

> The following horizontal financial statements model shows the transactions experienced by The Frame Shop (TFS) during Year 1. The table contains missing data that are labeled with alphabetic characters (a) Through (n). Assume all transactions shown in th

> Dan Watson started a small merchandising business in Year 1. The business experienced the following events during its first year of operation. Assume that Watson uses the perpetual inventory system. 1. Acquired $30,000 cash from the issue of common stock

> The following data were taken from Netflix, Inc.’s 2017 annual report. All dollar amounts are in millions. Required a. For each year, compute Netflix’s debt-to-assets ratio, return-on-assets ratio, and return-on-equity

> The Ramires, Incorporated experienced the following events during its first year of operations, Year 1: 1. Acquired $56,000 cash by issuing common stock. 2. Earned $52,000 cash revenue. 3. Paid $27,000 cash for operating expenses. 4. Borrowed $15,000 cas

> Newly formed S&J Iron Corporation has 50,000 shares of $10 par common stock authorized. On March 1, Year 1, S&J Iron issued 6,000 shares of the stock for $16 per share. On May 2, the company issued an additional 10,000 shares for $18 per share. S

> Nivan Co. issued $500,000 of 5 percent, 10-year, callable bonds on January 1, Year 1, at their face value. The call premium was 3 percent (bonds are callable at 103). Interest was payable annually on December 31. The bonds were called on December 31, Yea

> Doyle Company issued $500,000 of 10-year, 7 percent bonds on January 1, Year 2. The bonds were issued at face value. Interest is payable in cash on December 31 of each year. Doyle immediately invested the proceeds from the bond issue in land. The land wa

> On January 1, Year 1, Sayers Company issued $280,000 of five-year, 6 percent bonds at 102. Interest is payable semiannually on June 30 and December 31. The premium is amortized using the straight-line method. Required a. Determine the amount of cash pro

> On January 1, Year 1, Price Co. issued $190,000 of five-year, 6 percent bonds at 96½. Interest is payable annually on December 31. The discount is amortized using the straight-line method. Required a. Determine the amount of cash proceeds received by Pri

> Vail Book Mart sells books and other supplies to students in a state where the sales tax rate is 8 percent. Vail Book Mart engaged in the following transactions for Year 1. Sales tax of 8 percent is collected on all sales. 1. Book sales, not including sa

> At the beginning of Year 1, Copeland Drugstore purchased a new computer system for $52,000. It is expected to have a five-year life and a $7,000 salvage value. Required a. Compute the depreciation for each of the five years, assuming that the company use

> Golden Manufacturing Company started operations by acquiring $150,000 cash from the issue of common stock. On January 1, Year 1, the company purchased equipment that cost $120,000 cash, had an expected useful life of six years, and had an estimated salva

> The following events apply to Gulf Seafood for the Year 1 fiscal year: 1. The company started when it acquired $60,000 cash by issuing common stock. 2. Purchased a new cooktop that cost $40,000 cash. 3. Earned $72,000 in cash revenue. 4. Paid $25,000 cas

> On January 1, Year 1, three companies purchased the same make and model copy machine. However, each company made different assumptions regarding the useful life and salvage value of its particular asset. Required a. Divide the class into groups of four o

> Obtain Target Corporation’s annual report for its 2018 fiscal year (year ended February 2, 2019) at http://investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. What was Target’s net income for 2018 (

> You have been hired as a consultant by CARE (Conservatives Are Responsible), a political action committee focusing on fiscal responsibility. The Florida chapter has become increasingly worried about the state’s indebtedness. In an effort to assess the ex

> Brown Company contracts with Sebastian Company to exchange refrigerated trucks. Brown Company will trade three SMC trucks for four DROF trucks owned by Sebastian Company. The DROF refrigerated trucks have a cost of $100,000 and accumulated depreciation u

> Brown Company contracts with Sebastian Company to exchange refrigerated trucks. Brown Company will trade three SMC trucks for four DROF trucks owned by Sebastian Company. The trucks are approximately the same age and have the same remaining useful lives.

> Using the data in Table 10.2, a. What was the average annual return of Microsoft stock from 2005–2017? b. What was the annual volatility for Microsoft stock from 2005–2017? Data from Table 10.2:

> What if the last two and a half decades had been “normal”? Download the spreadsheet from MyLab Finance containing the data for Figure 10.1. a. Calculate the arithmetic average return on the S&P 500 from 1926 to 198

> Procter and Gamble (PG) paid an annual dividend of $2.87 in 2018. You expect PG to increase its dividends by 8% per year for the next five years (through 2023), and thereafter by 3% per year. If the appropriate equity cost of capital for Procter and Gamb

> In September 2008, the IRS changed tax laws to allow banks to utilize the tax loss carry forwards of banks they acquire to shield up to 100% of their future income from taxes (prior law restricted the ability of acquirers to use these credits). Suppose F

> See Table 2.5 showing financial statement data and stock price data for Mydeco Corp. a. Compare Mydeco’s accounts payable days in 2015 and 2019. b. Did this change in accounts payable days improve or worsen Mydeco’s ca

> See Table 2.5 showing financial statement data and stock price data for Mydeco Corp. a. How did Mydeco’s accounts receivable days change over this period? b. How did Mydeco’s inventory days change over this period? c.

> At the end of 2017, Apple had cash and short-term investments of $74.18 billion, accounts receivable of $17.87 billion, current assets of $128.65 billion, and current liabilities of $100.81 billion. a. What was Apple’s current ratio? b. What was Apple’s