Question: Megan Company (not a corporation) was careless

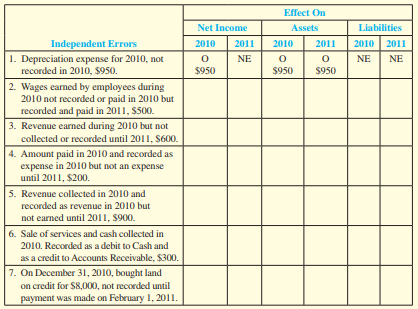

Megan Company (not a corporation) was careless about its financial records during its first year of operations, 2010. It is December 31, 2010, the end of the annual accounting period. An outside CPA has examined the records and discovered numerous errors, all of which are described here. Assume that each error is independent of the others.

Required:

Analyze each error and indicate its effect on 2010 and 2011 net income, assets, and liabilities if not corrected. Do not assume any other errors. Use these codes to indicate the effect of each dollar amount: O = overstated, U = understated, and NE = no effect. Write an explanation of your analysis of each transaction to support your response. The first transaction is used as an example.

Following is a sample explanation of the first error:

Failure to record depreciation in 2010 caused depreciation expense to be too low; therefore, income was overstated by $950. Accumulated depreciation also is too low by $950, which causes assets to be overstated by $950 until the error is corrected.

Transcribed Image Text:

Effect On Net Income Assets Liabilities Independent Errors 1. Depreciation expense for 2010, not recorded in 2010, $950. 2010 2011 2010 2011 2010 2011 NE NE NE $950 $950 $950 2. Wages eamed by employees during 2010 not recorded or paid in 2010 but recorded and paid in 2011, $500. 3. Revenue earned during 2010 but not collected or recorded until 2011, S600. 4. Amount paid in 2010 and recorded as expense in 2010 but not an expense until 2011, $200. 5. Revenue collected in 2010 and recorded as revenue in 2010 but not earned until 2011, $900. 6. Sale of services and cash collected in 2010. Recorded as a debit to Cash and as a credit to Accounts Receivable, $300. 7. On December 31, 2010, bought land on credit for $8,000, not recorded until payment was made on February 1, 2011.

> Granger Service Company, Inc., was organized by Ted Granger and five other investors. The following activities occurred during the year: a. Received $63,000 cash from the investors; each was issued 1,400 shares of capital stock. b. Purchased equipment

> Following are the concepts of accounting covered in Chapters 2 through 5. Match each transaction or definition with its related concept by entering the appropriate letter in the space provided. Use one letter for each blank. Concepts Transactions/De

> The following transactions are July 2011 activities of Craig’s Bowling, Inc., which operates several bowling centers (for games and equipment sales). For each of the following transactions, complete the tabulation, indicating the amount

> The Securities and Exchange Commission (SEC) regulates companies that issue stock on the stock market. It receives financial reports from public companies electronically under a system called EDGAR (Electronic Data Gathering and Retrieval Service). Using

> Net income was $900,000. Beginning and ending assets were $8,000,000 and $9,600,000, respectively. What was the return on assets (ROA)? a. 9.4% b. 10.23% c. 11.25% d. 10.41%

> When companies issue par value stock for cash, which accounts are normally affected? a. Common Stock; Additional Paid-In Capital; and Property, Plant, and Equipment, Net. b. Cash; and Property, Plant, and Equipment, Net. c. Common Stock; Additional Pa

> The classified balance sheet format allows one to ascertain quickly which of the following? a. The most valuable asset of the company. b. The specific due date for all liabilities of the company. c. What liabilities must be paid within the upcoming ye

> Which of the following is not a normal function of a financial analyst? a. Issue earnings forecasts. b. Examine the records underlying the financial statements to certify their conformance with GAAP. c. Make buy, hold, and sell recommendations on comp

> Which of the following would normally not be found in the notes to the financial statements? a. Accounting rules applied in the company’s financial statements. b. Additional detail supporting numbers reported in the company’s financial statements. c.

> Which of the following reports is filed annually with the SEC? a. Form 10-Q b. Form 10-K c. Form 8-K d. Press release

> Which of the following is not one of the possible nonrecurring items that must be shown in a separate line item below the Income from Continuing Operations subtotal in the income statement? a. Gains and losses from the sale of fixed assets. b. Discont

> If a company reported the following items on its income statement (cost of goods sold $5,000, income tax expense $2,000, interest expense $500, operating expenses $3,500, sales revenue $14,000), what amount would be reported for the subtotal “income from

> If a company plans to differentiate its products by offering low prices and discounts for items packaged in bulk (like a discount retailer that requires memberships for its customers), which component in the ROA profit driver analysis is the company atte

> Refer to E2-5 . Nike, Inc., with headquarters in Beaverton, Oregon, is one of the world’s leading manufacturers of athletic shoes and sports apparel. The following activities occurred during a recent year. The amounts are rounded to millions of dollars.

> For each of the transactions in M3-4 , write the journal entry in good form. The following transactions are July 2011 activities of Craig’s Bowling, Inc., which operates several bowling centers (for games and equipment sales). If expen

> If average total assets increase, but net income, net sales, and average stockholders’ equity remain the same, what is the impact on the return on assets ratio? a. Increases. b. Decreases. c. Remains the same. d. Cannot be determined without additi

> Saunders, Inc., recently reported the following December 31 amounts in its financial statements (dollars in thousands): Compute return on assets for the current year. What does this ratio measure? Current Year Prior Year Gross profit $ 170 $120 Net

> Prepare journal entries for each transaction listed in M5-5. Using the following categories, indicate the effects of the following transactions. Use + for increase and − for decrease and indicate the accounts affected and the amounts.

> Using the following categories, indicate the effects of the following transactions. Use + for increase and − for decrease and indicate the accounts affected and the amounts. a. Sales on account were $800 and related cost of goods sold

> Complete the following tabulation, indicating the sign of the effect ( + for increase, − for decrease, and NE for no effect) of each transaction. Consider each item independently. a. Recorded sales on account of $120 and related cost o

> Match each financial statement with the items presented on it by entering the appropriate letter in the space provided. Elements of Financial Statements Financial Statements (1) Expenses (2) Cash from operating activities (3) Losses A. Income statem

> Indicate the order in which the following disclosures or reports are normally issued by public companies. No....................................................Title _____..................................................Form 10-K _____.................

> Match each player with the related definition by entering the appropriate letter in the space provided. Players Definitions (1) Independent auditor A. Adviser who analyzes financial and other economic (2) CEO and CFO information to form forecasts an

> Tiffany & Co. is one of the world’s premier jewelers and a designer of other fine gifts and house wares. Presented here are selected income statement and balance sheet amounts (dollars in thousands). Required: 1. Compute ROA for

> Avalos Corporation is preparing its annual financial statements at December 31, 2011. Listed here are the items on its statement of cash flows presented in alphabetical order. Parentheses indicate that a listed amount should be subtracted on the cash flo

> For each of the transactions in M3-3 , write the journal entry in good form. The following transactions are July 2011 activities of Craig’s Bowling, Inc., which operates several bowling centers (for games and equipment sales). If reven

> Refer to E2-4. The following events occurred for Christensen Company: a. Received investment of $34,000 cash by organizers and distributed stock to them. b. Purchased $8,000 of equipment, paying $1,000 in cash and signing a note for the rest. c . Bor

> Listed here are selected aggregate transactions for ModernStyle Furniture Company from the first quarter of a recent year (dollars in millions). Complete the following tabulation, indicating the sign ( + for increase, − for decrease, an

> Hasbro is one of the world’s leading toy manufacturers and maker of such popular board games as Monopoly, Scrabble, and Clue, among others. Listed here are selected aggregate transactions from the first quarter of a recent year (dollars

> The following data were taken from the records of Cofelt Appliances, Incorporated, at December 31, 2011: Sales revenue..........................................................$130,000 Administrative expense..............................................

> The following data were taken from the records of Township Corporation at December 31, 2012: Sales revenue.................................................$79,000 Gross profit.......................................................28,000 Selling (distrib

> Supply the missing dollar amounts for the 2012 income statement of BGT Company for each of the following independent cases. Case A Case B Case C Case D Case E $ ? $ ? 150 Sales revenue $770 $600 $1,050 Pretax income 130 370 Income tax expense Cost o

> Supply the missing dollar amounts for the 2012 income statement of NexTech Company for each of the following independent cases. Case A Case B Case C Case D Case E Sales revenue $900 $750 $420 $ ? $ ? Selling expense Cost of goods sold Income tax exp

> Following are terms related to the income statement. Match each definition with its related term by entering the appropriate letter in the space provided. Terms Definitions (1) Net income (2) Income tax expense on A. Revenues + Gains - Expenses - Lo

> The Kroger Co. is one of the largest retailers in the United States and also manufactures and processes some of the food for sale in its supermarkets. Kroger reported the following January 31 balances in its stockholders’ equity account

> Lance, Inc., manufactures, markets, and distributes a variety of snack foods. Product categories include sandwich crackers, cookies, restaurant crackers and bread basket items, candy, chips, meat snacks, nuts, and cake items. These items are sold under t

> The following transactions are July 2011 activities of Craig’s Bowling, Inc., which operates several bowling centers (for games and equipment sales). If expense is to be recognized in July, indicate the expense account title and amount.

> Campbell Soup Company is the world’s leading maker and marketer of soup and sells other well-known brands of food in 120 countries. Presented here are the items listed on its recent balance sheet (dollars in millions) presented in alpha

> Nike, Inc., with headquarters in Beaverton, Oregon, is one of the world’s leading manufacturers of athletic shoes and sports apparel. The following activities occurred during a recent year. The amounts are rounded to millions of dollars. a. Purchased ad

> Following are information items included in various financial reports. Match each information item with the report(s) where it would most likely be found by entering the appropriate letter(s) in the space provided. Information Item Report (1) Summar

> Following are the titles of various information releases. Match each definition with the related release by entering the appropriate letter in the space provided. Information Release Definitions (1) Form 10-Q (2) Quarterly report (3) Press release A

> Match each player with the related definition by entering the appropriate letter in the space provided. Players Definitions A. Financial institution or supplier that lends money to the company. (1) Financial analyst (2) Creditor B. Chief executive o

> Papa John’s is one of the fastest-growing pizza delivery and carry-out restaurant chains in the country. Presented here are selected income statement and balance sheet amounts (dollars in thousands). Required: 1. Compute ROA for the

> In a recent year, Coach, Inc., a designer and marketer of handbags and other accessories, issued 10,200 shares of its $0.01 par value stock for $43,000 (these numbers are rounded). These additional shares were issued under an employee stock option plan.

> Following is a list of classifications on the balance sheet. Number them in the order in which they normally appear on a balance sheet. No....................................................Title ___......................................Long-term liabil

> As a team, select an industry to analyze. Reuters provides lists of industries under Sectors and Industries at www.reuters.com . (Click on an industry and then select Company Rankings for a list of members of that industry.) Each team member should acqui

> The following amounts were selected from the annual financial statements for Genesis Corporation at December 31, 2012 (end of the third year of operations): From the 2012 income statement: Sales revenue...................................................

> The following transactions are July 2011 activities of Craig’s Bowling, Inc., which operates several bowling centers (for games and equipment sales). If revenue is to be recognized in July, indicate the revenue account title and amount.

> Netherlands-based Royal Ahold ranks among the world’s three largest food retailers. In the United States it operates the Stop & Shop and Giant supermarket chains. Dutch and U.S regulators and prosecutors have brought criminal and civil charges against th

> The following events occurred for Christensen Company: a. Received investment of $34,000 cash by organizers and distributed stock to them. b. Purchased $8,000 of equipment, paying $1,000 in cash and signing a note for the rest. c . Borrowed $9,000 cas

> Sony is a world leader in the manufacture of consumer and commercial electronics as well as in the entertainment and insurance industries. Its ROA has decreased over the last three years. Required: Indicate the most likely effect of each of the changes

> Refer to the financial statements of American Eagle Outfitters (Appendix B) and Urban Outfitters (Appendix C) and the Industry Ratio Report (Appendix D) at the end of this book. Required: 1. Compute return on assets for the most recent year. Which compa

> Refer to the financial statements of Urban Outfitters given in Appendix C at the end of this book. At the bottom of each statement, the company warns readers that “The accompanying notes are an integral part of these financial statements.” The following

> Refer to the financial statements of American Eagle Outfitters given in Appendix B at the end of this book. At the bottom of each statement, the company warns readers to “Refer to Notes to Consolidated Financial Statements.” The following questions illus

> Avon Products, Inc., is a leading manufacturer and marketer of beauty products and related merchandise. The company sells its products in 110 countries through a combination of direct selling and use of individual sales representatives. Presented here is

> Dynamite Sales (organized as a corporation on September 1, 2010) has completed the accounting cycle for the second year, ended August 31, 2012. Dynamite also has completed a correct trial balance as follows: Required: Complete the financial statements,

> At the end of the 2011 annual reporting period, Mesa Industries’s balance sheet showed the following: MESA INDUSTRIES Balance Sheet At December 31, 2011 Stockholders’ Equity Common stock (par $15; 7,000 shares)........................$105,000 Additional

> Skidmore Music Company had the following transactions in March: a. Sold instruments to customers for $15,000; received $10,000 in cash and the rest on account. The cost of the instruments was $9,000. b. Purchased $3,000 of new instruments inventory; paid

> TangoCo is developing its annual financial statements for 2012. The following amounts were correct at December 31, 2012: cash, $48,800; investment in stock of PIL Corporation (long-term), $36,400; store equipment, $67,200; accounts receivable, $71,820; i

> Why are the income statement accounts closed but the balance sheet accounts are not?

> Differentiate among (a) permanent, (b) temporary, (c) real, and (d) nominal accounts.

> As described in a recent annual report, Verizon Wireless provides wireless voice and data services across one of the most extensive wireless networks in the United States. Verizon now serves more than 80 million customers, making it the largest wireless

> What are the purposes for closing the books?

> Contrast an unadjusted trial balance with an adjusted trial balance. What is the purpose of each?

> Explain the effect of adjusting entries on cash.

> What is the equation for each of the following statements: (a) income statement, (b) balance sheet, (c) statement of cash flows, and (d) statement of stockholders’ equity?

> Explain how the financial statements relate to each other.

> List the four types of adjusting entries, and give an example of each type.

> Match each definition with its related term by entering the appropriate letter in the space provided. There should be only one definition per term (that is, there are more definitions than terms). Term Definition (1) Losses (2) Matching principle (3

> What is a post-closing trial balance? Is it a useful part of the accounting information processing cycle? Explain.

> How is net profit margin computed and interpreted?

> How is earnings per share computed and interpreted?

> What is a contra-asset? Give an example of one.

> The following are independent situations. a. A new company is formed and sells 100 shares of stock for $12 per share to investors. b. A company purchases for $18,000 cash a new delivery truck that has a list, or sticker, price of $21,000. c. A women’s

> What is the purpose of recording adjusting entries?

> What is a trial balance? What is its purpose?

> Ellis, Inc., a small service company, keeps its records without the help of an accountant. After much effort, an outside accountant prepared the following unadjusted trial balance as of the end of the annual accounting period, December 31, 2011: Data n

> Ramirez Company is completing the information processing cycle at its fiscal year-end, December 31, 2012. Following are the correct balances at December 31, 2012, for the accounts both before and after the adjusting entries for 2012. Required: 1. Compa

> Refer to P4-3. Brayden Towing Company is at the end of its accounting year, December 31, 2011. The following data that must be considered were developed from the company’s records and related documents: a. On January 1, 2011, the compa

> Frances Sabatier asked a local bank for a $50,000 loan to expand her small company. The bank asked Frances to submit a financial statement of the business to supplement the loan application. Frances prepared the following balance sheet. Required: The

> Refer to P4-2 . Zimmerman Company’s annual accounting year ends on December 31. It is December 31, 2011, and all of the 2011 entries except the following adjusting entries have been made: a. On September 1, 2011, Zimmerman collected si

> Brayden Towing Company is at the end of its accounting year, December 31, 2011. The following data that must be considered were developed from the company’s records and related documents: a. On January 1, 2011, the company purchased a new hauling van at

> Zimmerman Company’s annual accounting year ends on December 31. It is December 31, 2011, and all of the 2011 entries except the following adjusting entries have been made: a. On September 1, 2011, Zimmerman collected six months’ rent of $8,400 on storage

> Dell Inc. is the world’s largest computer systems company selling directly to customers. Products include desktop computer systems, notebook computers, workstations, network server and storage products, and peripheral hardware and softw

> If a company is successful in reducing selling and administrative costs while maintaining sales volume and the sales price of its product, what is the effect on the net profit margin ratio? a. The ratio will increase. b. The ratio will not change. c

> For the transactions in M2-5, identify each as an investing (I) activity or financing (F) activity on the statement of cash flows. M2-5 For each of the following transactions of Pitt Inc. for the month of January 2012, indicate the accounts, amounts,

> What ratio is required by GAAP to be reported on the financial statements or in the notes to the statements? a. Return on equity ratio. b. Net profit margin ratio. c. Earnings per share ratio. d. Current ratio.

> At the beginning of 2011, Donna Company had $1,000 of supplies on hand. During 2011, the company purchased supplies amounting to $6,400 (paid for in cash and debited to Supplies). At December 31, 2011, a count of supplies reflected $2,600. The adjusting

> JJ Company owns a building. Which of the following statements regarding depreciation as used by accountants is false? a. As depreciation is recorded, stockholders’ equity is reduced. b. As depreciation is recorded, the net book value of the asset is re

> An adjusted trial balance a. Shows the ending account balances in a “debit” and “credit” format before posting the adjusting journal entries. b. Is prepared after closing entries have been posted. c. Shows the ending account balances resulting from th

> You are evaluating your current portfolio of investments to determine those that are not performing to your expectations. You have all of the companies’ most recent annual reports. Required: For each of the following, indicate where you would locate t

> Failure to make an adjusting entry to recognize accrued salaries payable would cause which of the following? a. An understatement of expenses, liabilities, and stockholders’ equity. b. An understatement of expenses and liabilities and an overstatement

> On June 1, 2010, Oakcrest Company signed a three-year $100,000 note payable with 9 percent interest. Interest is due on June 1 of each year beginning in 2011. What amount of interest expense should be reported on the income statement for the year ended D

> On October 1, 2011, the $12,000 premium on a one-year insurance policy for the building was paid and recorded as Prepaid Insurance. On December 31, 2011 (end of the accounting period), what adjusting entry is needed? a. Insurance Expense (+E) Prepai

> Which account is least likely to appear in an adjusting journal entry? a. Interest Receivable b. Cash c. Property Tax Expense d. Salaries Payable

> Which of the following accounts would not appear in a closing entry? a. Salary Expense b. Interest Income c. Accumulated Depreciation d. Retained Earnings

> Compute net income based on the adjusted trial balance in M4-8. Then compute Romney’s Marketing Company’s net profit margin for 2012. In M4-8. Romney’s Marketing Company has the following adjusted t

> You are considering investing the cash you inherited from your grandfather in various stocks. You have received the annual reports of several major companies. Required: For each of the following, indicate where you would locate the information in an ann

> Adamson Incorporated is a small manufacturing company that makes model trains to sell to toy stores. It has a small service department that repairs customers’ trains for a fee. The company has been in business for five years. At Decembe

> 1. Prepare a classified balance sheet in good form at December 31, 2012 from the information in M4-8. Romney’s Marketing Company has the following adjusted trial balance at December 31, 2012. No dividends were declared. However, 500 sh