Question: Millington Materials is a leading supplier of

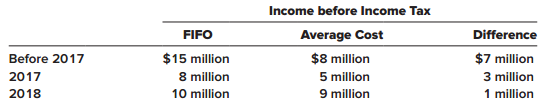

Millington Materials is a leading supplier of building equipment, building products, materials and timber for sale, with over 200 branches across the Mid-South. On January 1, 2018, management decided to change from the average inventory costing method to the FIFO inventory costing method at each of its outlets. The following table presents information concerning the change. The income tax rate for all years is 40%.

Required:

1. Prepare the journal entry to record the change in accounting principle.

2. Determine the net income to be reported in the 2018–2017 comparative income statements.

3. Which other 2017 amounts would be reported differently in the 2018–2017 comparative income statements and 2018–2017 comparative balance sheets than they were reported the previous year?

4. How would the change be reflected in the 2018–2017 comparative statements of shareholders’ equity? Cash dividends were $1 million each year. Assume no dividends were paid prior to 2017.

Transcribed Image Text:

Income before Income Tax FIFO Average Cost Difference Before 2017 $15 million $8 million $7 million 2017 8 million 5 million 3 million 2018 10 million 9 million 1 million

> Shown below are net income amounts as they would be determined by Weihrich Steel Company by each of three different inventory costing methods ($ in thousands). Required: 1. Assume that Weihrich used FIFO before 2018, and then in 2018 decided to switch

> In 2017, Quapau Products introduced a new line of hot water heaters that carry a one-year warranty against manufacturer’s defects. Based on industry experience, warranty costs were expected to approximate 5% of sales revenue. First-year sales of the heat

> The Pyramid Company has used the LIFO method of accounting for inventory during its first two years of operation, 2016 and 2017. At the beginning of 2018, Pyramid decided to change to the average cost method for both tax and financial reporting purposes.

> On January 1, 2018, VKI Corporation awarded restricted stock units (RSUs) representing 12 million of its $1 par common shares to key personnel, subject to forfeiture if employment is terminated within three years. After the recipients of the RSUs satisfy

> Sheen Awnings reported net income of $90 million. Included in that number were depreciation expense of $3 million and a loss on the sale of equipment of $2 million. Records reveal increases in accounts receivable, accounts payable, and inventory of $1 mi

> The Cecil-Booker Vending Company changed its method of valuing inventory from the average cost method to the FIFO cost method at the beginning of 2018. At December 31, 2017, inventories were $120,000 (average cost basis) and were $124,000 a year earlier.

> Shown below in T-account format are the changes affecting the retained earnings of Brenner-Jude Corporation during 2018. At January 1, 2018, the corporation had outstanding 105 million common shares, $1 par per share. Required: 1. From the information

> George Young Industries (GYI) acquired industrial robots at the beginning of 2015 and added them to the company’s assembly process. During 2018, management became aware that the $1 million cost of the machinery was inadvertently recorded as repair expens

> You are internal auditor for Shannon Supplies, Inc., and are reviewing the company’s preliminary financial statements. The statements, prepared after making the adjusting entries, but before closing entries for the year ended December 3

> Conrad Playground Supply underwent a restructuring in 2018. The company conducted a thorough internal audit, during which the following facts were discovered. The audit occurred during 2018 before any adjusting entries or closing entries are prepared. a.

> Wilkins Food Products Inc. acquired a packaging machine from Lawrence Specialists Corporation. Lawrence completed construction of the machine on January 1, 2016. In payment for the machine Wilkins issued a three-year installment note to be paid in three

> Whaley Distributors is a wholesale distributor of electronic components. Financial statements for the years ended December 31, 2016 and 2017, reported the following amounts and subtotals ($ in millions): In 2018, the following situations occurred or ca

> Williams-Santana Inc. is a manufacturer of high-tech industrial parts that was started in 2006 by two talented engineers with little business training. In 2018, the company was acquired by one of its major customers. As part of an internal audit, the fol

> Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Determine the specific citation for accounting for each of the following items: 1. Initial measurement of stock options. 2. The measurement date for share-based payment

> Williams-Santana Inc. is a manufacturer of high-tech industrial parts that was started in 2006 by two talented engineers with little business training. In 2018, the company was acquired by one of its major customers. As part of an internal audit, the fol

> The Collins Corporation purchased office equipment at the beginning of 2016 and capitalized a cost of $2,000,000. This cost included the following expenditures: Purchase price ………………………………………….. $1,850,000 Freight charges ……………………………………………….. 30,000 Inst

> You have been hired as the new controller for the Ralston Company. Shortly after joining the company in 2018, you discover the following errors related to the 2016 and 2017 financial statements: a. Inventory at 12/31/2016 was understated by $6,000. b. In

> Refer to the situation described in BE 21–9. What amount should Carter report as net cash from financing activities? In BE 21–9 Carter Containers sold marketable securities, land, and common stock for $30 million, $15 million, and $40 million, respectiv

> Allied Paper Products, Inc. offers a restricted stock award plan to its vice presidents. On January 1, 2018, the company granted 16 million of its $1 par common shares, subject to forfeiture if employment is terminated within two years. The common shares

> At the beginning of 2018, Wagner Implements undertook a variety of changes in accounting methods, corrected several errors, and instituted new accounting policies. Required: Indicate for each item 1 to 10 below the type of change and the reporting appro

> Described below are six independent and unrelated situations involving accounting changes. Each change occurs during 2018 before any adjusting entries or closing entries were prepared. Assume the tax rate for each company is 40% in all years. Any tax eff

> On December 12, 2018, an investment costing $80,000 was sold for $100,000. The total of the sale proceeds was credited to the investment account. Required: 1. Prepare the journal entry to correct the error, assuming it is discovered before the books are

> The following excerpt is from an article reported in an online issue of Bloomberg. (Bloomberg) Ford Motor Co. (F) said it will repurchase $1.8 billion of its shares to reduce dilution from recent stock grants to executives. The par amount per share for F

> Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Determine the specific citation for accounting for each of the following items: 1. Reporting most changes in accounting principle. 2. Disclosure requirements for a chan

> Companies often invest in the common stock of other corporations. The way we report these investments depends on the nature of the investment and the investor’s motivation for the investment. The FASB Accounting Standards Codification represents the sing

> Three programmers at Feenix Computer Storage, Inc., write an operating systems control manual for Hill-McGraw Publishing, Inc., for which Feenix receives royalties equal to 12% of net sales. Royalties are payable annually on February 1 for sales the prev

> The Crump Companies, Inc., has ownership interests in several public companies. At the beginning of 2018, the company’s ownership interest in the common stock of Silken Properties increased to the point that it became appropriate to begin using the equit

> In keeping with a modernization of corporate statutes in its home state, UMC Corporation decided in 2018 to discontinue accounting for reacquired shares as treasury stock. Instead, shares repurchased will be viewed as having been retired, reassuming the

> Aquatic Equipment Corporation decided to switch from the LIFO method of costing inventories to the FIFO method at the beginning of 2018. The inventory as reported at the end of 2017 using LIFO would have been $60,000 higher using FIFO. Retained earnings

> During 2016 (its first year of operations) and 2017, Batali Foods used the FIFO inventory costing method for both financial reporting and tax purposes. At the beginning of 2018, Batali decided to change to the average method for both financial reporting

> Douglas McDonald Company’s balance sheet included the following shareholders’ equity accounts at December 31, 2017: ????????__________________________________($ in millions) Paid-in capital: Common stock, 900 million shares at $1 par …………………….. $ 900 Pai

> Indicate with the appropriate letter the nature of each adjustment described below: Type of Adjustment A. Change in accounting principle (reported retrospectively) B. Change in accounting principle (exception reported prospectively) C. Change in estimate

> During 2018, WMC Corporation discovered that its ending inventories reported on its financial statements were misstated by the following amounts: WMC uses the periodic inventory system and the FIFO cost method. Required: 1. Determine the effect of the

> Indicate with the appropriate letter the nature of each situation described below: Type of Change PR ……………………. Change in principle reported retrospectively PP …………..………… Change in principle reported prospectively E ………………………. Change in estimate EP ………………

> Carter Containers sold marketable securities, land, and common stock for $30 million, $15 million, and $40 million, respectively. Carter also purchased treasury stock, equipment, and a patent for $21 million, $25 million, and $12 million, respectively. W

> Wardell Company purchased a mini computer on January 1, 2016, at a cost of $40,000. The computer has been depreciated using the straight-line method over an estimated five-year useful life with an estimated residual value of $4,000. On January 1, 2018, t

> The Peridot Company purchased machinery on January 2, 2016, for $800,000. A five-year life was estimated and no residual value was anticipated. Peridot decided to use the straight-line depreciation method and recorded $160,000 in depreciation in 2016 and

> As part of its stock-based compensation package, International Electronics granted 24 million stock appreciation rights (SARs) to top officers on January 1, 2018. At exercise, holders of the SARs are entitled to receive cash or stock equal in value to th

> Bronson Industries reported a deferred tax liability of $8 million for the year ended December 31, 2017, related to a temporary difference of $20 million. The tax rate was 40%. The temporary difference is expected to reverse in 2019, at which time the de

> Listed below are several terms and phrases associated with earnings per share. Pair each item from List A with the item from List B (by letter) that is most appropriately associated with it. List A List B 1. Subtract preferred dividends 2. Time-weig

> Woodmier Lawn Products introduced a new line of commercial sprinklers in 2017 that carry a one-year warranty against manufacturer’s defects. Because this was the first product for which the company offered a warranty, trade publications

> The Commonwealth of Virginia filed suit in October 2016, against Northern Timber Corporation seeking civil penalties and injunctive relief for violations of environmental laws regulating forest conservation. When the financial statements were issued in 2

> Dreighton Engineering Group receives royalties on a technical manual written by two of its engineers and sold to William B. Irving Publishing, Inc. Royalties are 10% of net sales, receivable on October 1 for sales in January through June and on April 1 f

> On two previous occasions, the management of Dennison and Company, Inc., repurchased some of its common shares. Between buyback transactions, the corporation issued common shares under its management incentive plan. Shown below is shareholdersâ

> The Canliss Milling Company purchased machinery on January 2, 2016, for $800,000. A five-year life was estimated and no residual value was anticipated. Canliss decided to use the straight-line depreciation method and recorded $160,000 in depreciation in

> For financial reporting, Clinton Poultry Farms has used the declining-balance method of depreciation for conveyor equipment acquired at the beginning of 2015 for $2,560,000. Its useful life was estimated to be six years with a $160,000 residual value. At

> On July 15, 2018, M.W. Morgan Distribution sold land for $35 million that it had purchased in 2013 for $22 million. What would be the amount(s) related to the sale that Morgan would report in its statement of cash flows for the year ended December 31, 20

> Wolfgang Kitchens has always used the FIFO inventory costing method for both financial reporting and tax purposes. At the beginning of 2018, Wolfgang decided to change to the LIFO method. Net income in 2018 was correctly stated as $90 million. If the com

> Flay Foods has always used the FIFO inventory costing method for both financial reporting and tax purposes. At the beginning of 2018, Flay decided to change to the LIFO method. As a result of the change, net income in 2018 was $80 million. If the company

> Anderson Steel Company began 2018 with 600,000 shares of common stock outstanding. On March 31, 2018, 100,000 new shares were sold at a price of $45 per share. The market price has risen steadily since that time to a high of $50 per share at December 31.

> As part of its stock-based compensation package, International Electronics granted 24 million stock appreciation rights (SARs) to top officers on January 1, 2018. At exercise, holders of the SARs are entitled to receive stock equal in value to the excess

> Refer to the situation described in BE 20–4. Suppose Irwin has been using the straight-line method and switches to the sum-of-the-years’-digits method. Ignoring income taxes, what journal entry(s) should Irwin record relating to the machine for 2018? In

> British Telecommunications Plc (BT), a U.K. company, is the world’s oldest communications company. The company prepares its financial statements in accordance with International Financial Reporting Standards. Locate BT’s statement of cash flows from it’s

> Irwin, Inc., constructed a machine at a total cost of $35 million. Construction was completed at the end of 2014 and the machine was placed in service at the beginning of 2015. The machine was being depreciated over a 10-year life using the sum-of-the-ye

> “This one’s got me stumped,” you say to no one in particular. “First day on the job; I’d better get it right.” It’s the classification of notes payable in the statement of cash flows that has you in doubt. Having received an “A” in Intermediate Accountin

> Refer to the financial statements and related disclosure notes of The Kroger Company for the fiscal year ending January 30, 2016. You can locate the report online from “investor relations” at www.kroger.com. Notice that Kroger’s net income has increased

> What action is required when it is discovered that a five-year insurance premium payment of $50,000 two years ago was debited to insurance expense? (Ignore taxes.)

> Comparative statements of retained earnings for Renn-Dever Corporation were reported in its 2018 annual report as follows. At December 31, 2015, common shares consisted of the following: Common stock, 1,855,000 shares at $1 par …&ac

> Staples, Inc., is the world’s leading office products company. Locate the statement of cash flows of Staples for the fiscal year ended January 30, 2016, on the Internet. Required: 1. In the three years reported, what was Staples’ primary investing activ

> “Be careful with that coffee!” Your roommate is staring in disbelief at the papers in front of her. “This was my contribution to our team project,” she moaned. “Whe

> The following schedule relates the income statement with cash flows from operating activities, derived by both the direct and indirect methods, in the format illustrated by Illustration 21–11 in the chapter. Some elements necessary to c

> Portions of the financial statements for Hawkeye Company are provided below. Required: 1. Prepare the cash flows from operating activities section of the statement of cash flows for Hawkeye Company using the direct method. 2. Prepare the cash flows fro

> Portions of the financial statements for Parnell Company are provided below. Required: 1. Prepare the cash flows from operating activities section of the statement of cash flows for Parnell Company using the direct method. 2. Prepare the cash flows fro

> Effects of all cash flows affect the balances of various accounts reported in the balance sheet. Also, the activities that cause some of these cash flows are reported in the income statement. What, then, is the need for an additional financial statement

> In 2018, J J Dishes changed its method of valuing inventory from the FIFO method to the LIFO method. At December 31, 2017, J J’s inventories were $96 million (FIFO). J J’s records were insufficient to determine what inventories would have totaled if dete

> The income statement and a schedule reconciling cash flows from operating activities to net income are provided below for Macrosoft Corporation. Required: Prepare the cash flows from operating activities section of the statement of cash flows (direct m

> The income statement and a schedule reconciling cash flows from operating activities to net income are provided below for Mike Roe Computers. Required: 1. Calculate each of the following amounts for Mike Roe Computers: a. Cash received from customers d

> Comparative balance sheets for 2018 and 2017 and a statement of income for 2018 are given below for Metagrobolize Industries. Additional information from the accounting records of Metagrobolize also is provided. Additional information from the accounti

> The comparative balance sheets for 2018 and 2017 and the statement of income for 2018 are given below for Dux Company. Additional information from Dux’s accounting records is provided also. Additional information from the accounting

> If it is discovered that an extraordinary repair in the previous year was incorrectly debited to repair expense, how will retained earnings be reported in the current year’s statement of shareholders’ equity?

> The comparative balance sheets for 2018 and 2017 and the statement of income for 2018 are given below for National Intercable Company. Additional information from NIC’s accounting records is provided also. Additional information from

> National Supply’s shareholders’ equity included the following accounts at December 31, 2017: Shareholders’ Equity ____________________($ in millions) Common stock, 6 million shares at $1 par ………………………… $ 6,000,000 Paid-in capital—excess of par …………………………

> The comparative balance sheets for 2018 and 2017 and the statement of income for 2018 are given below for Wright Company. Additional information from Wright’s accounting records is provided also. Additional information from the accoun

> Listed below are transactions that might be reported as investing and/or financing activities on a statement of cash flows. Possible reporting classifications of those transactions are provided also. Required: Indicate the reporting classification of ea

> Refer to the data provided in the P 21–11 for Arduous Company. In P 21–11 The comparative balance sheets for 2018 and 2017 and the income statement for 2018 are given below for Arduous Company. Additional information

> In 2018, the Barton and Barton Company changed its method of valuing inventory from the FIFO method to the average cost method. At December 31, 2017, B & B’s inventories were $32 million (FIFO). B & B’s records indicated that the inventories would have t

> On January 1, 2018, David Mest Communications granted restricted stock units (RSUs) representing 30 million of its $1 par common shares to executives, subject to forfeiture if employment is terminated within three years. After the recipients of the RSUs

> Refer to the data provided in the P 21–5 for Metagrobolize Industries. In P 21–5 Comparative balance sheets for 2018 and 2017 and a statement of income for 2018 are given below for Metagrobolize Industries. Additional

> Refer to the data provided in the P 21–4 for Dux Company. In P 21–4 The comparative balance sheets for 2018 and 2017 and the statement of income for 2018 are given below for Dux Company. Additional information from Du

> Refer to the data provided in the P 21–11 for Arduous Company. In P 21–11 The comparative balance sheets for 2018 and 2017 and the income statement for 2018 are given below for Arduous Company. Additional information

> Refer to the data provided in the P 21–5 for Metagrobolize Industries. In P 21–5 Comparative balance sheets for 2018 and 2017 and a statement of income for 2018 are given below for Metagrobolize Industries. Additional

> Refer to the data provided in the P 21–4 for Dux Company. In P 21–4 The comparative balance sheets for 2018 and 2017 and the statement of income for 2018 are given below for Dux Company. Additional information from Du

> If merchandise inventory is understated at the end of 2017, and the error is not discovered, how will net income be affected in 2018?

> Digital Telephony issued 10% bonds, dated January 1, with a face amount of $32 million on January 1, 2018. The bonds mature in 2028 (10 years). For bonds of similar risk and maturity the market yield is 12%. Interest is paid semiannually on June 30 and D

> The comparative balance sheets for 2018 and 2017 are given below for Surmise Company. Net income for 2018 was $50 million. Required: Prepare the statement of cash flows of Surmise Company for the year ended December 31, 2018. Use the indirect method to

> Indicate by letter whether each of the terms or phrases listed below is more associated with financial statements prepared in accordance with U.S. GAAP (U) or International Financial Reporting Standards (I). _______________________Terms and phrases______

> In 2018, the internal auditors of Development Technologies, Inc., discovered that (a) 2017 accrued wages of $2 million were not recognized until they were paid in 2018, and (b) A $3 million purchase of merchandise in 2018 was recorded in 2017 instead. Th

> Following are selected balance sheet accounts of Del Conte Corp. at December 31, 2018 and 2017, and the increases or decreases in each account from 2017 to 2018. Also presented is selected income statement information for the year ended December 31, 2018

> U.S. GAAP designates cash outflows for interest payments and cash inflows from interest and dividends received as operating cash flows. Dividends paid to shareholders are classified as financing cash flows. How are these cash flows reported under IFRS?

> Shown below in T-account format are the changes affecting the retained earnings of Brenner-Jude Corporation during 2018. At January 1, 2018, the corporation had outstanding 105 million common shares, $1 par per share. Required: 1. From the information

> The comparative balance sheets for 2018 and 2017 and the income statement for 2018 are given below for Arduous Company. Additional information from Arduous’s accounting records is provided also. Additional information from the accoun

> In preparation for developing its statement of cash flows for the year ended December 31, 2018, Rapid Pac, Inc., collected the following information: _________________________________________________ ($ in millions) Fair value of shares issued in a stock

> National Food Services, Inc., borrowed $4 million from its local bank on January 1, 2018, and issued a 4-year installment note to be paid in four equal payments at the end of each year. The payments include interest at the rate of 10%. Installment paymen

> Most Solutions, Inc., issued 10% bonds, dated January 1, with a face amount of $640 million on January 1, 2018. The bonds mature in 2028 (10 years). For bonds of similar risk and maturity the market yield is 12%. Interest expense is recorded at the effec

> For each of the five independent situations below, prepare a single journal entry that summarizes the recording and payment of income taxes in order to determine the amount of cash paid for income taxes and explain the change (if any) in each of the acco

> Describe the process of correcting an error when it’s discovered in a subsequent reporting period.

> Determine the amount of cash paid for income taxes in each of the nine independent situations below. All dollars are in millions. Income Tax Deferred Tax Cash Paid for Taxes Income Tax Payable Increase (Decrease) Liability Increase (Decrease) Situat

> At December 31, 2017, the balance sheet of Meca International included the following shareholders’ equity accounts: Shareholders’ Equity ___________________ ($ in millions) Common stock, 60 million shares at $1 par …………………………… $ 60 Paid-in capital—excess

> For each of the four independent situations below, prepare a single journal entry that summarizes the recording and payment of interest in order to determine the amount of cash paid for bond interest and explain the change (if any) in each of the account

> Determine the amount of cash paid to bondholders for bond interest for each of the six independent situations below. All dollars are in millions. Bond Interest Unamortized Bond Interest Discount Payable Increase (Decrease) Cash Paid Situation Expens