Question: Mohawk Enterprises is considering the following

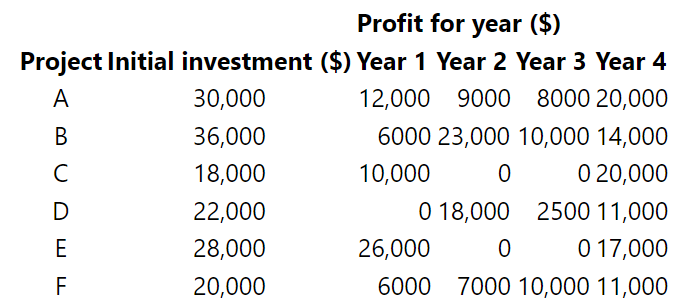

Mohawk Enterprises is considering the following investment opportunities.

If Mohawk’s cost of capital is 8% and its capital budget is limited to $90,000, which projects should it choose?

> Victoria Developments has obtained $3.6 million of total capital from three sources. Preferred shareholders contributed $550,000 (preferred equity), common shareholders contributed $1.2 million (common equity), and the remainder was borrowed (debt). What

> Don, Bob, and Ron Maloney’s partnership interests in Maloney Bros. Contracting are in the ratio of their capital contributions of $78,000, $52,000, and $65,000, respectively. What is the ratio of Bob’s to Ron’s to Don’s partnership interest?

> Shaheed has budgeted 12% of his monthly spending to cell phone and internet, 22% to food, and 40% to rent and utilities. What is the ratio of his spending for cell phone and internet to food to rent and utilities?

> An online catalogue business sent out 12,000 emails to previous customers in its database, of which 10,500 were successfully delivered and 750 were opened. What is the ratio of emails sent to emails delivered to emails opened?

> An online business purchased 15,000 Google display ads that 1250 people clicked on, and 250 purchases were finalized as a result of the ads. What is the ratio of ads displayed to clicks to purchases?

> Determine the IRR on the school bus contract in Problem 1 of Exercise 17.2. At which of the three costs of capital would the contract be financially acceptable? Data from Exercise 17.2 Problem 1: St. Lawrence Bus Lines is offered a contract for busing s

> Express ratios as an equivalent ratio whose smallest term is 1. Maintain three-figure accuracy. 5 1 2 : 3 3 4 : 8 1 3

> Express ratios as an equivalent ratio whose smallest term is 1. Maintain three-figure accuracy. 5 8 : 17 11 : 6 7

> Express ratios as an equivalent ratio whose smallest term is 1. Maintain three-figure accuracy. 0.47 : 0.15 : 0.26

> Express ratios in its lowest terms. 45 : 15 : 30

> Express ratios as an equivalent ratio whose smallest term is 1. Maintain three-figure accuracy. 3.5 : 5.4 : 8

> Express ratios as an equivalent ratio whose smallest term is 1. Maintain three-figure accuracy. 11 : 38 : 27

> Express ratios as an equivalent ratio whose smallest term is 1. Maintain three-figure accuracy. 77 : 23 : 41

> Express ratios as an equivalent ratio whose smallest term is 1. Maintain three-figure accuracy. 4 3 13 : 27 17

> Express ratios as an equivalent ratio whose smallest term is 1. Maintain three-figure accuracy. 3 7 : 19 17

> Express ratios as an equivalent ratio whose smallest term is 1. Maintain three-figure accuracy. 0.0131 : 0.0086

> An investment of $100,000 will yield annual profits of $12,000 for 10 years. The proceeds on disposition at the end of the 10 years are estimated at $15,000. On the basis of its IRR and a 6% cost of capital, should the investment be made?

> Express ratios as an equivalent ratio whose smallest term is 1. Maintain three-figure accuracy. 0.177 : 0.81

> Express ratios as an equivalent ratio whose smallest term is 1. Maintain three-figure accuracy. 1.41 : 8.22

> Express ratios as an equivalent ratio whose smallest term is 1. Maintain three-figure accuracy. 7.6 : 3

> Express ratios in its lowest terms. 10 1 2 : 7 : 4 1 5

> Express ratios in its lowest terms. 56 : 21

> Express ratios in its lowest terms. 1 15 : 1 5 : 1 10

> Express ratios in its lowest terms. 2 3 : 3 4 : 5 6

> Express ratios in its lowest terms. 4 1 8 : 2 1 5

> Express ratios in its lowest terms. 2 1 2 : 5 8

> Express ratios in its lowest terms. 1 1 4 : 1 2 3

> Carl Williams does custom wheat combining in southern Alberta. He will purchase either a new Massey or a new Deere combine to replace his old machine. The Massey combine costs $190,000, and the Deere combine costs $156,000. Their trade-in values after si

> Express ratios in its lowest terms. 11 3 : 11 7

> Express ratios in its lowest terms. 3 5 : 6 7

> Express ratios in its lowest terms. 4 3 : 3 2

> Express ratios in its lowest terms. 1 8 : 3 4

> Express ratios in its lowest terms. 0.091 : 0.021 : 0.042

> Express ratios in its lowest terms. 12 : 64

> The top selling brand of cordless vacuums sold 14,000 units at $395 per unit in 2019. What is their market share if the cordless vacuum market had sales of $19.7M?

> Acme Ltd. had sales of $365M in 2019, which represents a 40% market share in the industry. In 2020 their market share decreased to 35% with sales of $309.82M. What is the market growth for the industry?

> BooBoo Banana Athletic Wear had sales of $146.27M in 2019, which represents a 3.6% market share. In 2020 their market share increased to 5.5% with sales of $239.11M. What is the market growth for the athletic wear industry?

> Fassbender Industries tracks the annual sales from each of its six divisions to help evaluate performance and plan budgeting for the following year. Calculate the market growth (divisional growth) for each division.

> A small regional airline has narrowed down the possible choices for its next passenger plane purchase to two alternatives. The Eagle model costs $600,000, and would have an estimated resale value of $100,000 after seven years. The Albatross model has a $

> The home gym equipment industry in Canada had annual sales of $862.4M in 2019. Sales in the industry saw a slight decline of 2.5% in 2020. Sales for the top selling brands for the past two years are shown in the table below. 1. Calculate the market share

> Frito-Lay’s two most popular brands of potato chips are Lays, with a 30.1% market share, and Ruffles, with a 10.4% market share. If sales in the potato chip market were $7.35B for the year, what were sales for Lays and Ruffles?

> Pepsi and Coke have been fighting for dominance in the soft drink industry for decades. In one year, Pepsi held 6.12% of the soft drink market and Coke held 11.95% of the market. If the market as a whole consumed 124.56B litres of soft drinks in the year

> Fassbender Industries tracks the annual sales from each of its six divisions to help evaluate performance and plan budgeting for the following year. Calculate the market share (divisional share) for each division for both 2018 and 2019.

> Industrial Supplies Warehouse tracks the performance of its sales team by looking at the sales share for the team and their annual sales growth. Calculate the missing values in the following table.

> The smart speaker market in North America had sales of $2.9M in 2017 and ballooned to sales of $9.0M in 2018. Google-brand smart speakers had a 19.3% share of this market in 2017. This increased to a 36.2% market share in 2018. Compare the growth of the

> The two top selling brands in a specific market hold 24.5% and 18.6% market shares, respectively. If the top selling brand sold 242,650, how many units of the second top selling brand were sold during the year? Round your answer to the nearest whole numb

> Six different brands compete in the same Canadian market and their sales for 2018 and 2019 are shown in the following table. Calculate the market share for each brand for both 2018 and 2019.

> Rose purchased units of the Trimark Fund one year ago at $24.10 per unit. Today they are valued at $25.50. On the intervening December 31, there was a distribution of $0.83 per unit. (“Distribution” is the term used by most mutual funds for income paid t

> One year ago, Art Vandelay bought Norwood Industries shares for $37 per share. Today they are worth $40 per share. During the year, Art received dividends of $0.60 per share. What was his income yield, capital gain yield, and rate of total return for the

> Calculate the income yield, capital gain yield, and rate of total return in each of 2017 and 2018 for BlackBerry shares and Scotia Canadian Bond Fund units.

> Calculate the income yield, capital gain yield, and rate of total return in each of 2017 and 2018 for TD Bank shares and Desjardins Dividend Growth Fund units.

> Calculate the income yield, capital gain yield, and rate of total return in 2018 for BCE Inc. shares and Mawer New Canada Fund units.

> One year ago, $13,000 was invested in units of a mutual fund. The units paid a distribution of $260 during the year, but the mutual fund units are now worth only $11,400. What has been the: 1. Income yield? 2. Capital gain yield? 3. Rate of total return?

> The Globe and Mail Report on Business noted that shares of Compact Computers produced a 55% rate of total return in the past year. The shares paid a dividend of $0.72 per share during the year, and they currently trade at $37.50. What was the price of th

> Victor cannot find the original record of his purchase four years ago of units of the Imperial Global Fund. The current statement from the fund shows that the total current value of the units is $47,567. From a mutual fund database, Victor found that the

> The S&P/TSX Composite Index rose 3.4%, dropped 1.4%, and then rose 2.1% in three successive months. The index ended the three-month period at 9539. 1. What was the index at the beginning of the three-month period? 2. How many points did the index drop in

> Shares purchased one year ago for $8790 are now worth $15,390. During the year, the shares paid dividends totalling $280. Calculate the shares’: 1. Income yield. 2. Capital gain yield. 3. Rate of total return.

> One year ago, Morgan invested $5000 to purchase 400 units of a mutual fund. He has just noted in the Financial Post that the fund’s rate of return on investment for the year was 22% and that the current price of a unit is $13.75. What amount did the fund

> Assume that the TD Bank shares will pay a $1.48 per share dividend in 2019. What must the share price be at the end of 2019 for a total rate of return in 2019 of 7%?

> The investment committee of a company has identified the following seven projects with positive NPVs. If the board of directors has approved a $3 million capital budget for the current period, which projects should be selected?

> Answering this question occupies dozens of financial commentaries as the March 1 RRSP contribution deadline approaches each year. Many financial institutions and mutual fund companies promote the idea of arranging an “RRSP loan” to obtain money for an RR

> Assume that the Suncor Energy shares will pay a $0.40 per share dividend in 2019. What must the share price be at the end of 2019 for a total rate of return in 2019 of 10%?

> The following table shows the rates of total return in successive years from 2010 to 2014 for the PH&N Bond Fund and for the benchmark Toronto Stock Exchange S&P/TSX Composite Index. By how much did the bond fund’s overall perce

> The following table shows the rates of total return in successive years from 2013 to 2017 for the Fidelity Canadian Asset Allocation Fund and for the benchmark Toronto Stock Exchange S&P/TSX Composite Index. By how much did the allocation fundâ

> The following table shows the rates of total return in successive years from 2013 to 2017 for the BMO Dividend Fund and for the benchmark Toronto Stock Exchange S&P/TSX Composite Index. By how much did the dividend fund’s overall pe

> The following table shows the rates of total return in successive years from 2013 to 2017 for Canopy Growth Corp. and for the benchmark Toronto Stock Exchange S&P/TSX Composite Index. By how much did this stock’s overall percentage

> After two consecutive years of 10% losses, what rate of return in the third year will produce a cumulative loss of 30%??

> After two consecutive years of 10% rates of return, what rate of return in the third year will produce a cumulative gain of 30%?

> What rate of return in the second year of an investment is required to break even after a rate of return of −20% in the first year?

> A $100 investment purchased one year ago is now worth $90. It also generated $10 of income during the year. Determine the investment’s: 1. Income yield. 2. Capital gain yield. 3. Rate of total return.

> What rate of return in the second year of an investment is required to break even after a 50% loss in the first year?

> A firm has identified the following four investment opportunities and calculated their net present values. If the firm’s capital budget for this period is limited to $300,000, which projects should be selected?

> What rate of return in the second year of an investment will nullify a 25% return on investment in the first year?

> What rate of return in the second year of an investment will wipe out a 50% gain in the first year?

> The price of Biomed Corp. shares also began the same two-year period at $12, but fell 25% in each year. What was their overall percent decline in price?

> The price of Bionex Inc. shares rose by 25% in each of two successive years. If they began the two-year period at $12 per share, what was the percent increase in price over the entire two years?

> The federal government cut transfer payments to the provinces by a total of 20% over a five-year period. In the next budget speech, the Minister of Finance announced “the level of transfer payments will be restored to their former level by a 20% increase

> Adjusted for stock splits, the price of Microsoft shares rose 40.06%, 24.16%, 19.44%, and 12.00% in the years 2013 to 2016, respectively. In 2017, the share prices rose 37.66%. 1. What was the overall five-year percent change in the price of Microsoft sh

> Jeff purchased some Target preferred shares on the Toronto Stock Exchange for $56.49. The shares pay a quarterly dividend of $0.30. Twelve months later the shares were trading at $65.75. What was Jeff’s rate of total return for the year?

> Vitaly’s shares of Offshore Petroleum have dropped in value from $36.75 to $32.25 during the past year. The shares paid a $0.50 per share dividend six months ago. Calculate Vitaly’s income yield, capital gain yield, and rate of total return for the year.

> The market value of Stephanie’s bonds has declined from $1053.25 to $1021.75 per bond during the past year. In the meantime she has received two semiannual interest payments of $35 per bond. Calculate Stephanie’s income yield, capital gain yield, and rat

> A $100 investment purchased one year ago is now worth $110. It also earned $10 of income during the year. Determine the investment’s: 1. Income yield. 2. Capital gain yield. 3. Rate of total return.

> A construction company has identified two machines that will accomplish the same job. The Caterpillar model costs $160,000, and has a service life of eight years if it receives a $30,000 overhaul every two years. The International model costs $210,000, a

> Calculate the missing value: Initial Value = 26.3 cm Final Value = ? Percent Change = 300

> Calculate the missing value: Initial Value = 112 g Final Value = ? Percent Change = 112

> Calculate the missing value: Initial Value = $134.39 Final Value = ? Percent Change = -12

> A hospital can increase the dollar amount budgeted for nurses’ overtime wages during the next year by only 3%. The nurses’ union has just won a 5% hourly rate increase for the next year. By what percentage must the hospital cut the number of overtime hou

> If the euro is worth 39% more than the Canadian dollar, how much less (in percentage terms) is the Canadian dollar worth than the euro?

> The Lightning laser printer prints 30% more pages per minute than the Reliable laser printer. What percentage less time than the Reliable will the Lightning require for long print jobs?

> The Hampton District school board decided to reduce the number of students per teacher next year by 15%. If the number of students does not change, by what percentage must the number of teachers be increased?

> If the denominator of a fraction decreases by 20% and the numerator remains unchanged, by what percentage does the value of the fraction change?

> A car dealer normally lists new cars at 22% above cost. A demonstrator model was sold for $17,568 after a 10% reduction from the list price. What amount did the dealer pay for this car?

> An owner listed a property for 140% more than she paid for it 12 years ago. After receiving no offers during the first three months of market exposure she dropped the list price by 10%, to $172,800. What was the original price that the owner paid for the

> Neil always trades in his car when it reaches five years of age because of the large amount of driving he does in his job. He is investigating whether there would be a financial advantage in buying a two-year-old car every three years instead of buying a

> If the Canadian dollar is worth 6.5% less than the U.S. dollar, by what percentage does the U.S. dollar exceed the value of the Canadian dollar?

> The share price of Goldfield Resources fell by $4 in Year 1 and then rose by $4 in Year 2. If the share price was $6 at the end of Year 1, what was the percent change in share price each year?

> The manufacturer of Caramalt chocolate bars wants to implement a 7.5% increase in the unit retail price along with a reduction in the bar size from 100 g to 80 g. If the current retail price of a 100-g bar is $1.15, what should be the price of an 80-g ba

> Calculate the missing value: Initial Value = 0.095 Final Value = 0.085 Percent Change = ?

> Elegance shampoo has a suggested retail price of $4.49 for its 500-mL bottle. The manufacturer of the shampoo wants to increase the unit retail price by 10% at the same time that it reduces the container size to 425 mL. What should be the suggested retai

> A company has 50% less equity financing than debt financing. What percentage of the equity is the debt? What percentage more debt financing than equity financing does the company have?