Question: Molton Company had 300 units of product

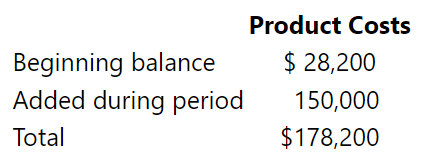

Molton Company had 300 units of product in work in process inventory at the beginning of the period. It started 1,500 units during the period and transferred 1,200 units to finished goods inventory. The ending work in process inventory was estimated to be 70 percent complete. Cost data for the period follow.

Required

Prepare a cost of production report showing the following:

1. The number of equivalent units of production.

2. The product cost per equivalent unit.

3. The total cost allocated between ending work in process inventory and finished goods inventory.

> Mantooth Manufacturing Company experienced the following accounting events during its first year of operation. With the exception of the adjusting entries for depreciation, assume that all transactions are cash transactions. 1. Acquired $50,000 by issuin

> Stan Fox, the production manager of Hollis Construction Components, is trying to figure out the cost behavior of his factory supplies cost. The company uses machine hours as the cost driver. Joe Parrish, the assistant manager, collected the following cos

> Jenkins Frames Company, which manufactures ornate frames for original art work, began operations in January, Year 1. Bruce Preston, the owner, asks for your assistance. He believes that he needs to better understand the cost of the frames for pricing pur

> Kane Legal Services provides legal advice to clients. The following data apply to the first six months of operation. Required 1. What is the average service revenue per hour for the six-month time period? 2. Use the high-low method to estimate the total

> West Tours, Inc., organizes adventure tours for people interested in visiting a desert environment. A desert tour generally lasts three days. West provides food, equipment, and guides. Dan Silva, the president of West Tours, needs to set prices for the c

> The Magic Amusement Park is considering signing a contract to hire a circus at a cost of $3,000 per day. The contract requires a minimum performance period of one week. Estimated circus attendance is as follows. /Required 1. For each day, determine the a

> June Wade has invested in two startup companies. At the end of the first year, she asks you to evaluate their operating performance. The following operating data apply to the first year. Required 1. Use the contribution margin approach to compute the ope

> Canton Club and Tobin Club are competing health and recreation clubs in Orlando. They both offer tennis training clinics to adults. Canton pays its coaches $4,800 per season. Tobin pays its coaches $120 per student enrolled in the clinic per season. Both

> CFEs R Us conducts CFE review courses. Public universities that permit free use of a classroom support the classes. The only major expense incurred by CFEs R Us is the salary of instructors, which is $5,000 per course taught. The company recently planned

> Sean Franklin sells a newly developed camera, Panorama Vision. He purchases the cameras from the manufacturer for $150 each and rents a store in a shopping mall for $6,000 per month. Required 1. Determine the average cost of sales per unit if Mr. Frankli

> Kelly and Valdez Tax Services’ Development Department is responsible for establishing new community branches. Each branch opens with four tax accountants. Total cost of payroll per branch is $240,000 per year. Together the four accountants can process up

> Kilby Company is considering the purchase of new automated manufacturing equipment that would cost $150,000. The equipment would save $42,500 in labor costs per year over its six-year life. At the end of the fourth year, the equipment would require an ov

> Nancy Watson visited her personal physician for treatment of flu symptoms. She was greeted by the receptionist, who gave her personal history and insurance forms to complete. She needed no instructions; she completed these same forms every time she visit

> The CEO and the CFO of Automation Company were both aware that the company’s controller was reporting fraudulent revenues. Upper-level executives are paid very large bonuses when the company meets the earnings goals established in the company’s budgets.

> Briggs Company was started when it acquired $150,000 by issuing common stock. During the first year of operations, the company incurred specifically identifiable product costs (materials, labor, and overhead) amounting to $120,000. Briggs also incurred $

> Mark’s Hamburger is a small fast-food shop in a busy shopping center that operates only during lunch hours. Mark Thorpe, the owner and manager of the shop, is confused. On some days, he does not have enough hamburgers to satisfy customer demand. On other

> Garza Automobile Dealership, Inc. (GAD), buys and sells a variety of cars made by Perez Motor Corporation. GAD maintains about 30 new cars in its parking lot for customers’ selection; the cost of this inventory is approximately $750,000. Additionally, GA

> Packer Company began operations on January 1, Year 1, by issuing common stock for $120,000 cash. During Year 1, Packer received $98,000 cash from revenue and incurred costs that required $90,000 of cash payments. Required Prepare a GAAP-based income stat

> Distant Ride, Inc., develops and makes a battery for electrical cars. The manufacturing costs per unit include $450 direct materials, $180 direct labor, and $300 manufacturing overhead. These costs are based on a production and sales volume of 5,000 unit

> The following transactions pertain to Year 1, the first year of operations of Fuzhou Company. All inventory was started and completed during the accounting period. All transactions were cash transactions. 1. Acquired $50,000 of contributed capital from i

> Ito Company experienced the following accounting events during its first year of operation. With the exception of the adjusting entries for depreciation, all transactions were cash transactions. Also, assume that all financial statement data are prepared

> Zell Manufacturing Company was started on January 1, Year 1, when it acquired $98,000 cash by issuing common stock. Zell immediately purchased office furniture and manufacturing equipment costing $28,000 and $58,000, respectively. The office furniture ha

> Gaines Company recently initiated a postaudit program. To motivate employees to take the program seriously, Gaines established a bonus program. Managers receive a bonus equal to 10 percent of the amount by which actual net present value exceeds the proje

> Use the following table to indicate whether the information is more representative of managerial versus financial accounting. The first item is shown as an example. Information Item Cost per unit of individual products Profit margin of individual product

> Chris Quill asks you to analyze the operating cost of his lawn services business. He has purchased the needed equipment with a cash payment of $90,000. Upon your recommendation, he agrees to adopt straight-line depreciation. The equipment has an expected

> Identify the following costs as fixed or variable. Costs related to operating a retail gasoline company follow. 1. Depreciation of equipment relative to the number of customers served at a station. 2. Property and real estate taxes relative to the amount

> Bombay Rug Company makes two types of rugs, seasonal and all-purpose. Both types of rugs are handmade, but the seasonal rugs require significantly more labor because of their decorative designs. The annual number of rugs made and the labor hours required

> Fenway Electronics produces video games in three market categories: commercial, home, and miniature. Fenway has traditionally allocated overhead costs to the three products using the companywide allocation base of direct labor hours. The company recently

> Duncan Paint Company makes paint in many different colors; it charges the same price for all of its paint regardless of the color. Recently, Duncan’s chief competitor cut the price of its white paint, which normally outsells any other color by a margin o

> York Company engaged in the following transactions for Year 1. The beginning cash balance was $86,000 and the ending cash balance was $59,100. 1. Sales on account were $548,000. The beginning receivables balance was $128,000 and the ending balance was $9

> The comparative balance sheets and an income statement for Raceway Corporation follow. Table Summary: The Balance Sheets as of December 31 show 3 columns. Column 1 has entries. Column 2 has year 2. Column 3 has year 1. The Income Statement for the year e

> The comparative balance sheets and income statements for Gypsy Company follow. Table Summary: The Balance Sheets as of December 31 show 3 columns. Column 1 has entries. Column 2 has year 2. Column 3 has year 1. The Income Statement for the year ended Dec

> Webb Publishing Company is evaluating two investment opportunities. One is to purchase an Internet company with the capacity to open new marketing channels through which Webb can sell its books. This opportunity offers a high potential for growth but inv

> The following information can be obtained by examining a company’s balance sheet and income statement information: 1. Increases in current asset account balances, other than cash. 2. Decreases in current asset account balances, other th

> The following information was drawn from the year-end balance sheets of Fox River Inc. Additional information regarding transactions occurring during Year 2: 1. Fox River Inc. issued $100,000 of bonds during Year 2. The bonds were issued at face value. A

> The following information was drawn from the year-end balance sheets of Mass Trading Company. Additional information regarding transactions occurring during Year 2: 1. Investment securities that had cost $6,100 were sold. The Year 2 income statement cont

> Green Brands Inc. (GBI) presents its statement of cash flows using the indirect method. The following accounts and corresponding balances were drawn from GBI’s Year 2 and Year 1 year-end balance sheets. Assume that Accounts Payable is

> Use the financial statements for Allendale Company from Problem 13-17A to calculate the following ratios for Year 4 and Year 3: 1. Working capital. 2. Current ratio. 3. Quick ratio. 4. Receivables turnover (beginning receivables at January 1, Year 3, wer

> The following financial statements apply to Karl Company: Required Calculate the following ratios for Year 1 and Year 2. When data limitations prohibit computing averages, use year-end balances in your calculations. Round computations to two decimal poin

> Otis Company’s income statement information follows. The average number of shares outstanding was 9,600 for Year 3 and 8,000 for Year 2. Required Compute the following ratios for Otis for Year 3 and Year 2 and round the computation to t

> Selected data for Dalton Company for Year 3 and additional information on industry averages follow. Industry averages Earnings per share $ 2.60 Price-earnings ratio 9.50 Return on equity 11.20% Required 1. Calculate Dalton Companyâ€

> The bookkeeper for Packard’s Country Music Bar left this incomplete balance sheet. Packard’s working capital is $90,000 and its debt-to-assets ratio is 40 percent. Required Complete the balance sheet by supplying the m

> Riley Manufacturing has a current ratio of 3:1 on December 31, Year 3. Indicate whether each of the following transactions would increase (+), decrease (−), or have no effect (NA) on Riley’s current ratio and its working capital. Required 1. Paid cash fo

> Obtain Shake Shack Inc.’s Form 10-K for the fiscal year ending on December 25, 2019. To obtain the Form 10-K, you can use the EDGAR system, or it can be found under the “Investor Relations” link on the company’s website at www.shakeshack.com. Read the fo

> Use the financial statements for Allendale Company from Problem 13-17A to perform a vertical analysis of both the balance sheets and income statements for Year 4 and Year 3. Round computations to two decimal points. Data from Problem 13-17A: Financial s

> Financial statements for Allendale Company follow. Table Summary: The Balance Sheet of Allendale Company as of December 31 shows 3 columns. Column 1 has entries. Column 2 has year 4. Column 3 has year 3. Table Summary: The Statements of Income and retain

> The following percentages apply to Thornton Company for Year 3 and Year 4. Required Assuming that sales were $800,000 in Year 3 and $960,000 in Year 4, prepare income statements for the two years.

> Tonbridge Corporation makes a health beverage named Tonbridge that is manufactured in a two-stage production process. The drink is first created in the Conversion Department where material ingredients (natural juices, supplements, preservatives, etc.) ar

> Plymouth Company had 400 units of product in its work in process inventory at the beginning of the period and started 2,100 additional units during the period. At the end of the period, 750 units were in work in process inventory. The ending work in proc

> Wright Cola Corporation produces a new soft drink brand, Sweet Spring, using two production departments: mixing and bottling. Wright’s beginning balances and data pertinent to the mixing department’s activities for Yea

> Lisburn Plastic Products Company makes a plastic toy using two departments: parts and assembly. The following data pertain to the parts department’s transactions in Year 2. 1. The beginning balance in the Work in Process Inventory account was $10,000. Th

> Use the ending balances from Problem 12-15A as the beginning balances for this problem. The transactions for the second year of operation (Year 2) are described here. (Assume that all transactions are cash transactions unless otherwise indicated.) 1. The

> Eminence Corporation makes rocking chairs. The chairs move through two departments during production. Lumber is cut into chair parts in the cutting department, which transfers the parts to the assembly department for completion. The company sells the unf

> Espada Real Estate Investment Company (EREIC) purchases new apartment complexes, establishes a stable group of residents, and then sells the complexes to apartment management companies. The average holding time is three years. EREIC is currently investig

> Ladora Construction Company began operations on January 1, Year 1, when it acquired $30,000 cash from the issuance of common stock. During the year, Ladora purchased $6,000 of direct raw materials and used $5,640 of the direct materials. There were 108 h

> Lehigh Manufacturing Corporation was started with the issuance of common stock for $60,000. It purchased $14,000 of raw materials and worked on three job orders during Year 1 for which data follow. (Assume that all transactions are for cash unless otherw

> Levine Manufacturing pays its production managers a bonus based on the company’s profitability. During the two most recent years, the company maintained the same cost structure to manufacture its products. Levine sells its products for

> Cloverton Glass Company makes stained glass lamps. Each lamp that it sells for $128 requires $20 of direct materials and $32 of direct labor. Fixed overhead costs are expected to be $72,000 per year. Cloverton Glass expects to sell 1,000 lamps during the

> Fulton Manufacturing Company makes a product that sells for $64 per unit. Manufacturing costs for the product amount to $24 per unit variable, and $96,000 fixed. During the current accounting period, Fulton made 4,000 units of the product and sold 3,500

> During their senior year at Clarkson College, two business students, Gerry Keating and Louise Lamont, began a part-time business making personal computers. They bought the various components from a local supplier and assembled the machines in the basemen

> The following events apply to Milligan Manufacturing Company. Assume that all transactions are cash transactions unless otherwise indicated. Transactions for the Year 1 Accounting Period 1. The company was started on January 1, Year 1, when it acquired $

> The following Balance Sheet was taken from the records of Fairport Manufacturing Company at the beginning of Year 3. Transactions for the Accounting Period 1. Fairport purchased $11,400 of direct raw materials and $600 of indirect raw materials on accoun

> Blanding Manufacturing started in Year 2 with the following account balances. Transactions during Year 2 Purchased $6,000 of raw materials with cash. Transferred $7,500 of raw materials to the production department. Incurred and paid cash for 180 hours o

> Evelyn Carter started Carter Manufacturing Company to make a universal television remote control device that she had invented. The company’s labor force consisted of part-time employees. The following accounting events affected Carter Manufacturing Compa

> In recent years, there has been a lot of media coverage about the funding status of pension plans for state employees. In many states, the amount of money invested in employee pension plans is far less than the amount estimated to pay employees the retir

> The following accounting events affected Stratford Manufacturing Company during its first three years of operation. Assume that all transactions are cash transactions. Transactions for Year 1 Started manufacturing company by issuing common stock for $2,0

> Barlae Auto Repair Inc. is evaluating a project to purchase equipment that will not only expand the company’s capacity but also improve the quality of its repair services. The board of directors requires all capital investments to meet or exceed the mini

> Harper Electronics is considering investing in manufacturing equipment expected to cost $250,000. The equipment has an estimated useful life of four years and a salvage value of $25,000. It is expected to produce incremental cash revenues of $125,000 per

> Daryl Kearns saved $240,000 during the 30 years that he worked for a major corporation. Now he has retired at the age of 60 and has begun to draw a comfortable pension check every month. He wants to ensure the financial security of his retirement by inve

> Seth Fitch owns a small retail ice cream parlor. He is considering expanding the business and has identified two attractive alternatives. One involves purchasing a machine that would enable Mr. Fitch to offer frozen yogurt to customers. The machine would

> Dwight Donovan, the president of Donovan Enterprises, is considering two investment opportunities. Because of limited resources, he will be able to invest in only one of them. Project A is to purchase a machine that will enable factory automation; the ma

> Brett Collins is reviewing his company’s investment in a cement plant. The company paid $12,000,000 five years ago to acquire the plant. Now top management is considering an opportunity to sell it. The president wants to know whether th

> Antonio Melton, the chief executive officer of Melton Corporation, has assembled his top advisers to evaluate an investment opportunity. The advisers expect the company to pay $500,000 cash at the beginning of the investment and the cash inflow for each

> Swift Delivery is a small company that transports business packages between New York and Chicago. It operates a fleet of small vans that moves packages to and from a central depot within each city and uses a common carrier to deliver the packages between

> Gary Radio Corporation is a subsidiary of Salem Companies. Gary makes car radios that it sells to retail outlets. It purchases speakers for the radios from outside suppliers for $56 each. Recently, Salem acquired the Hyden Speaker Corporation, which make

> The Pillar Manufacturing Company has three identified levels of authority and responsibility. The organization chart as of December 31, Year 1, appears as follows. Pertinent expenses for Level 3 follow. Pertinent expenses for Level 2 follow. Pertinent ex

> Altoona Technologies Inc. (ATI) has three divisions. ATI has a desired rate of return of 12.5 percent. The operating assets and income for each division are as follows. ATI headquarters has $120,000 of additional cash to invest in one of its divisions. T

> Kerston Company has operating assets of $20,000,000. The company’s operating income for the most recent accounting period was $1,600,000. The Dannica Division of Kerston controls $8,000,000 of the company’s assets and earned $720,000 of its operating inc

> Helena Corporation operates three investment centers. The following financial statements apply to the investment center named Bowman Division. Table Summary: Income Statement of Bowman Division for the year ended December 31, year 2 shows 2 columns. Colu

> Sorrento Corporation’s balance sheet indicates that the company has $500,000 invested in operating assets. During Year 2, Sorrento earned operating income of $50,000 on $1,000,000 of sales. Required 1. Compute Sorrento’s profit margin for Year 2. 2. Comp

> Yalaha National Bank is a large municipal bank with several branch offices. The bank’s computer department handles all data processing for bank operations. In addition, the bank sells the computer department’s expertise in systems development and excess

> Amarillo Corporation has four divisions: the assembly division, the processing division, the machining division, and the packing division. All four divisions are under the control of the vice president of manufacturing. Each division has a manager and se

> Carol Morgan manages the production division of Casper Corporation. Ms. Morgan’s responsibility report for the month of August follows. The budget had called for 4,600 pounds of raw materials at $20 per pound, and 4,600 pounds were used

> Juan Rubio is the manager of the production department of Radison Corporation. Radison incurred the following costs during Year 2. Production department supplies $22,000 Administrative salaries 700,000 Production wages 1,160,000 Materials used 1,058,400

> Gepp Manufacturing Company produces a single product. The following data apply to the standard cost of materials and labor associated with making the product. Materials quantity per unit: 1 pound Materials price: $12.50 per pound Labor quantity per unit:

> Spiro Company manufactures molded candles that are finished by hand. The company developed the following standards for a new line of drip candles. Amount of direct materials per candle: 1.6 pounds Price of direct materials per pound: $1.50 Quantity of la

> Waldon Corporation’s balance sheet shows that the company has $600,000 invested in operating assets. During Year 2, Waldon earned $120,000 on $960,000 of sales. The company’s desired return on investment (ROI) is 12 pe

> Shawnee Manufacturing Company produces a component part of a top secret military communication device. Standard production and cost data for the part, Product X, follow. Planned production: 30,000 units Per unit direct materials: 2 pounds @ $1.80 per pou

> Bonnie’s Doll Company produces handmade dolls. The standard amount of time spent on each doll is 2.0 hours. The standard cost of labor is $20 per hour. The company planned to make 8,000 dolls during the year but actually used 17,500 hours of labor to mak

> Caribou Fruit Drink Company planned to make 200,000 containers of apple juice. It expected to use two cups of frozen apple concentrate to make each container of juice, thus using 400,000 cups of frozen concentrate. The standard price of one cup of apple

> The following data were drawn from the records of Quentin Corporation. Planned volume for year (static budget): 6,000 units Standard direct materials cost per unit: 3.1 pounds @ $3.00 per pound Standard direct labor cost per unit: 2 hours @ $8.00 per hou

> In addition to other costs, Grosha Telephone Company planned to incur $600,000 of fixed manufacturing overhead in making 500,000 telephones. Grosha actually produced 508,000 telephones, incurring actual overhead costs of $599,400. Grosha establishes its

> Use the standard price and cost data supplied in Problem 8-20A. Assume that Narcisco actually produced and sold 32,000 books. The actual sales price and costs incurred follow. Required 1. Determine the flexible budget variances. 2. Indicate whether each

> Narcisco Publications established the following standard price and costs for a hardcover picture book that the company produces. Standard price and variable costs Sales price $ 90.00 Materials cost 18.00 Labor cost 9.00 Overhead cost 12.60 Selling, gen

> The Redmond Management Association held its annual public relations luncheon in April Year 2. Based on the previous year’s results, the organization allocated $25,290 of its operating budget to cover the cost of the luncheon. To ensure

> Howard Cooper, the president of Glacier Computer Services, needs your help. He wonders about the potential effects on the firm’s net income if he changes the service rate that the firm charges its customers. The following basic data pertain to fiscal Yea

> Camden Company is a retail company that specializes in selling outdoor camping equipment. The company is considering opening a new store on October 1, Year 1. The company president formed a planning committee to prepare a master budget for the first thre

> A widely recognized financial trick known as the “big bath” occurs when a company makes huge unwarranted asset write-offs that drastically overstate expenses. Outside auditors (CPAs) permit companies to engage in the practice because the assets being wri

> Jasper Fruits Corporation wholesales peaches and oranges. Barbara Jasper is working with the company’s accountant to prepare next year’s budget. Ms. Jasper estimates that sales will increase 5 percent for peaches and 1

> Top executive officers of Tildon Company, a merchandising firm, are preparing the next year’s budget. The controller has provided everyone with the current year’s projected income statement. Cost of goods sold is usual