Question: Monsecours Corp., a public company incorporated on

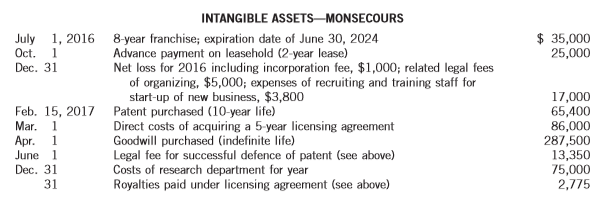

Monsecours Corp., a public company incorporated on June 28, 2016, set up a single account for all of its intangible assets. The following summary discloses the debit entries that were recorded during 2016 and 2017 in that account:

The new business started up on July 2, 2016. No amortization was recorded for 2016 or 2017. The goodwill purchased on April 1, 2017, includes in-process development costs that meet the six development stage criteria, valued at $175,000. The company estimates that this amount will help it generate revenues over a 10-year period.

Instructions:

(a) Prepare the necessary entries to clear the intangible assets account and to set up separate accounts for distinct types of intangibles. Make the entries as at December 31, 2017, and record any necessary amortization so that all balances are appropriate as at that date. State any assumptions that you need to make to support your entries.

(b) In what circumstances should goodwill be recognized? From the perspective of an investor, does the required recognition and measurement of goodwill provide useful financial statement information?

Transcribed Image Text:

Intangible Assets–MONSECOURS July 1, 2016 1 Oct. $ 35,000 25,000 8-year franchise; expiration date of June 30, 2024 Advance payment on leasehold (2-year lease) Net loss for 2016 including incorporation fee, $1,000; related legal fees of organizing, $5,000; expenses of recruiting and training staff for start-up of new business, $3,800 Dec. 31 17,000 65,400 86,000 287,500 13,350 75,000 2,775 Feb. 15, 2017 Patent purchased (10-year life) Mar. 1 Аpr. June 1 Dec. 31 31 Direct costs of acquiring a 5-year licensing agreement Goodwill purchased (indefinite life) Legal fee for successful defence of patent (see above) Costs of research department for year Royalties paid under licensing agreement (see above)

> In an examination of Garganta Limited as at December 31, 2017, you have learned about the following situations. No entries have been made in the accounting records for these items. 1. The corporation erected its present factory building in 2001. Deprecia

> The statement of financial position of Delacosta Corporation as at December 31, 2017, is as follows: Note 1: Goodwill in the amount of $70,000 was recognized because the company believed that the carrying amount of assets was not an accurate representa

> The trial balance of Eastwood Inc. and other related information for the year 2017 follows: Additional information: 1. The inventory has a net realizable value of $212,000. The FIFO method of inventory valuation is used. 2. The fair valueâ€&

> Statement of financial position items for Montoya Inc. follow for the current year, 2017: Instructions: (a) Prepare a classified statement of financial position in good form. The numbers of authorized shares are as follows: unlimited common and 20,000

> A list of accounts follows: Instructions: Prepare a classified statement of financial position in good form, without specific amounts. Accounts Receivable Pension Obligation, non-current Bonds Payable due in four years Prepaid Rent Buildings Purcha

> A combined single-step income and statement of retained earnings for California Tanning Salon Corp. follows for 2017 (amounts in thousands): Additional facts are as follows: 1. Selling, general, and administrative expenses for 2017 included a usual but

> Canadian Tire Corporation, Limited is one of Canada’s best-known retailers. Obtain a copy of Canadian Tire’s financial statements for the year ended January 3, 2015, through SEDAR (www.sedar.com) or on the company’s website. To answer the following quest

> The following account balances were included in the trial balance of Reid Corporation at June 30, 2017: During 2017, Reid incurred production salary and wage costs of $710,000, consumed raw materials and other production supplies of $474,670, and had a

> The following financial statement was prepared by employees of Intellisys Corporation: Note 1: New styles and rapidly changing consumer preferences resulted in a $37,000 loss on the disposal of discontinued styles and related accessories. Note 2: The c

> Hamza Khan, vice-president of finance for Dani Ipo Corp., has recently been asked to conduct a seminar for the company’s division controllers. He would discuss the proper accounting for items that are large but do not typify normal business transactions

> The trial balance follows for Thompson Corporation at December 31, 2017: A physical count of inventory on December 31 showed that there was $64,000 of inventory on hand. Instructions: Prepare a single-step income statement and a statement of retained

> Wavecrest Inc. reported income from continuing operations before tax of $1,790,000 during 2017. Additional transactions occurring in 2017 but not included in the $1,790,000 are as follows: 1. The corporation experienced an insured flood loss of $80,000 d

> Information for 2017 follows for Rolling Thunder Corp.: Retained earnings, January 1, 2017…………………………………………………………….$ 1,980,000 Sales revenue…………………………………………………………………………………………….36,500,000 Cost of goods sold……………………………………………………………………………………….28,500,000 Inte

> On November 1, 2016, Campbell Corporation management decided to discontinue operation of its Rocketeer Division and approved a formal plan to dispose of the division. Campbell is a successful corporation with earnings of $150 million or more before tax f

> Zephyr Corporation began operations on January 1, 2014. Recently the corporation has had several unusual accounting problems related to the presentation of its income statement for financial reporting purposes. The company follows ASPE. You are the CPA f

> A combined statement of income and retained earnings for DC 5 Ltd. for the year ended December 31, 2017, follows. (As a private company, DC 5 has elected to follow ASPE.) Also presented are three unrelated situations involving accounting changes and the

> P4-1 In recent years, Grace Inc. has reported steadily increasing income. The company reported income of $20,000 in 2014, $25,000 in 2015, and $30,000 in 2016. Several market analysts have recommended that investors buy Grace Inc. shares because they exp

> Brookfield Asset Management Inc. is a global publicly traded Canadian company. Brookfield’s financial statements for its year ended December 31, 2014, are included at the end of this book. Instructions: Access Brookfield’s financial statements for the y

> The unadjusted trial balance of Clancy Inc. at December 31, 2017, is as follows: Additional information: 1. Actual advertising costs amounted to $1,500 per month. The company has already paid for advertisements in Montezuma Magazine for the first quart

> Fusters, Inc., provides audited financial statements to its creditors and is required to maintain certain covenants based on its debt to equity ratio and return on assets. In addition, management of Fusters receives a bonus partially based on revenues fo

> The following information relates to Joachim Anderson, Realtor, at the close of the fiscal year ending December 31: 1. Joachim paid the local newspaper $335 for an advertisement to be run in January of the next year, and charged it to Advertising Expense

> The trial balance and other information for consulting engineers Mustang Rovers Consulting Limited follow: Additional information: 1. Service revenue includes fees received in advance from clients of $6,900. 2. Services performed for clients that wer

> You are hired to review the accounting records of Sheridan Inc. (a public corporation) before it closes its revenue and expense accounts as at December 31, 2017, the end of its current fiscal year. The following information comes to your attention. 1. Du

> Second-Hand Almost New Department Store Inc. is located near a shopping mall. At the end of the company’s fiscal year on December 31, 2017, the following accounts appeared in two of its trial balances: Analysis reveals the following a

> Transactions from Gravenhurst Inc.’s current year follow. Gravenhurst follows IFRS. 1. Gravenhurst Inc. thinks it should dispose of its excess land. While the carrying value is $50,000, current market prices are depressed and only $25,000 is expected upo

> Mason Advertising Agency Inc. was founded in January 2013. Presented below are adjusted and unadjusted trial balances as at December 31, 2017. Instructions: (a) Journalize the annual adjusting entries that were made. (Omit explanations.) (b) Prepare an

> The trial balance of Slum Dog Fashion Centre Inc. contained the following accounts at November 30, the company’s fiscal year end: Adjustment data: 1. Store supplies on hand totalled $3,100. 2. Depreciation is $40,000 on the store equi

> Below are the completed financial statement columns of the work sheet for Canned Heat Limited: Instructions: (a) Prepare a statement of comprehensive income, statement of changes in equity, and statement of financial position. During 2017, Canned Heat&

> Gomi Medical Labs Inc. began operations five years ago producing a new type of instrument it hoped to sell to doctors, dentists, and hospitals. The demand for the new instrument was much higher than had been planned for, and the company was unable to pro

> Instructions: From the SEDAR website (www.sedar.com) choose one company from each of four different industry classifications. Choose from a variety of industries, such as real estate (e.g., Crombie Real Estate Investment Trust), food stores— merchandisin

> The following transactions fall somewhere in continuum of choices in accounting decision-making. 1. The company president approaches one of the company’s creditors to ask for a modification of the repayment terms so that they extend beyond the current ye

> Samuels Corp. began operations on January 1, 2017. Its fiscal year end is December 31. Samuels has decided that prepaid costs are debited to an asset account when paid, and all revenues are credited to revenue when the cash is received. During 2017, the

> Mona Kamaka, CPA, was retained by Downtown TV Repair Ltd. to prepare financial statements for the month of March 2017. Mona accumulated all the ledger balances from the business records and found the following: Mona reviewed the records and found the f

> Kitchigami Limited was attracted to the Town of Mornington by the town’s municipal industry commission. Mornington donated a plant site to Kitchigami, and the provincial government provided $180,000 toward the cost of the new manufacturing facility. The

> Munro Limited reports the following information in its tax fi les covering the five-year period from 2015 to 2019. All assets are Class 10 with a 30% maximum CCA, and no capital assets had been acquired before 2015. Instructions: (a) Prepare a capital

> Consider the following independent situations. Situation 1: Ducharme Corporation purchased electrical equipment at a cost of $12,400 on June 2, 2014. From 2014 through 2017, the equipment was depreciated on a straight-line basis, under the assumption tha

> Sung Corporation, a manufacturer of steel products, began operations on October 1, 2016. Sung’s accounting department has begun to prepare the capital asset and depreciation schedule that follows. You have been asked to assist in comple

> The following is a schedule of property dispositions for Shangari Corp.: The following additional information is available: Land On February 15, land that was being held mainly as an investment was expropriated by the city. On March 31, another parcel

> The president of Plain Corp., Joyce Lima, is thinking of purchasing Balloon Bunch Corporation. She thinks that the offer sounds fair but she wants to consult a professional accountant to be sure. Balloon Bunch Corporation is asking for $85,000 in excess

> Macho Inc. has recently become interested in acquiring a South American plant to handle many of its production functions in that market. One possible candidate is De Fuentes SA, a closely held corporation, whose owners have decided to sell their business

> Hotel Resort Limited is a company that builds world-class resorts in tourist areas around the globe. When the company decided to build a resort in Yellowknife, the federal government agreed to provide a forgivable loan in the amount of $50 million to hel

> On September 1, 2017, Madonna Lisa Corporation, a public company, acquired Jaromil Enterprises for a cash payment of $763,000. At the time of purchase, Jaromil’s statement of financial position showed assets of $850,000, liabilities of $430,000, and owne

> In late July 2017, Mona Ltd., a private company, paid $2 million to acquire all of the net assets of Lubello Corp., which then became a division of Mona. Lubello reported the following statement of financial position at the time of acquisition: It was

> Six examples of purchased intangible assets follow. They are reported on the consolidated statement of financial position of Powers Enterprises Limited and include information about their useful and legal lives. Powers prepares financial statements in ac

> Use the data provided in P12-8. Assume instead that Meridan Golf and Sports is a public company. The relevant information for the impairment test on December 31, 2019, is as follows: Instructions: Provide the calculations for the impairment test and an

> Meridan Golf and Sports was formed on July 1, 2017, when Steve Power driver purchased Old Master Golf Corporation. Old Master provides video golf instruction at kiosks in shopping malls. Power driver’s plan is to make the instruction bu

> In 2017, Aquaculture Incorporated applied for several commercial fishing licences for its commercial fishing vessels. The application was successful and on January 2, 2017, Aquaculture was granted 22 commercial fishing licences for a registration fee of

> During 2015, Medicine Hat Tools Ltd., a Canadian public company, purchased a building site for its product development laboratory at a cost of $61,000. Construction of the building started in 2015. The building was completed in late December 2016 at a co

> Fields Laboratories holds a valuable patent (No. 758-6002-1A) on a precipitator that prevents certain types of air pollution. Fields does not manufacture or sell the products and processes it develops. Instead, it conducts research and develops products

> Gelato Corporation, a private entity reporting under ASPE, was incorporated on January 3, 2016. The corporation’s financial statements for its first year of operations were not examined by a public accountant. You have been engaged to a

> A machine’s invoice price is $40,000. Various other costs relating to the acquisition and installation of the machine—including transportation, electrical wiring, a special base, and so on—amount to $7,500. The machine has an estimated life of 10 years,

> Information for Naples Corporation’s intangible assets follows: 1. On January 1, 2017, Naples signed an agreement to operate as a franchisee of Copy Service, Inc., for an initial franchise fee of $75,000. Of this amount, $35,000 was paid when the agreeme

> Guiglano Inc. is a large, publicly held corporation. The following are six selected expenditures that were made by the company during the fiscal year ended April 30, 2017. The proper accounting treatment of these transactions must be determined in order

> The records of Sudbury Menswear report the following data for the month of September: Instructions: (a) Estimate the ending inventory using the conventional retail inventory method. (b) Assuming that a physical count of the inventory determined that th

> In early January 2017, Chi Inc., a private enterprise that applies ASPE, purchased 40% of the common shares of Washi Corp. for $410,000. Chi was now able to exercise considerable influence in decisions made by Washi’s management. Washi Corp.’s statement

> On January 3, 2017, Mego Limited purchased 3,000 (30%) of the common shares of Sonja Corp. for $438,000. The following information is provided about the identifiable assets and liabilities of Sonja at the date of acquisition: During 2017, Sonja reporte

> The following are two independent situations. Situation 1: Lauren Inc. received dividends from its common share investments during the year ended December 31, 2017, as follows: • A cash dividend of $12,250 is received from Peel Corporation. Lauren owns a

> On January 1, 2017, Rae Corporation purchased 30% of the common shares of Martz Limited for $196,000. Martz Limited shares are not traded in an active market. The carrying amount of Martz’s net assets was $520,000 on that date. Any excess of the purchase

> Harnish Inc. acquired 25% of the outstanding common shares of Gregson Inc. on December 31, 2016. The purchase price was $1,250,000 for 62,500 shares, and is equal to 25% of Gregson’s carrying amount. Gregson declared and paid a $0.75 per share cash divid

> Fox Ltd. invested $1 million in Gloven Corp. early in the current year, receiving 25% of its outstanding shares. At the time of the purchase, Gloven Corp. had a carrying amount of $3.2 million. Gloven Corp. pays out 35% of its net income in dividends eac

> Holmes, Inc. purchased 30% of Nadal Corporation’s 30,000 outstanding common shares at a cost of $15 per share on January 3, 2017. The purchase price of $15 per share was based solely on the book value of Nadal’s net assets. On September 21, Nadal declare

> Access the financial statements of BHP Billiton plc for the company’s year ended June 30, 2014. Also access the financial statements of Newfield Exploration Company for the company’s year ended December 31, 2014. These are available at the companies’ web

> On January 1, 2017, Kenn Corp. purchased at par 10% bonds having a maturity value of $300,000. They are dated January 1, 2017, and mature on January 1, 2022, with interest receivable on December 31 of each year. The bonds are accounted for using the amor

> Weekly Corp., a December 31 yearend company that applies IFRS, acquired an investment of 1,000 shares of Credence Corp. in mid-2013 for $29,850. Between significant volatility in the markets and in the business prospects of Credence Corp., the accounting

> On January 1, 2015, Mamood Ltd. paid $322,744.44 for 12% bonds of Variation Ltd. with a maturity value of $300,000. The bonds provide the bondholders with a 10% yield. They are dated January 1, 2015, mature on January 1, 2021, and pay interest each Decem

> Tsui Corporation owns corporate bonds at December 31, 2017, accounted for using the amortized cost model. These bonds have a par value of $800,000 and an amortized cost of $788,000. After an impairment review was triggered, Tsui determined that the disco

> In early 2017, for the first time, HTSM Corp. invested in the common shares of another Canadian company. It acquired 5,000 shares of Toronto Stock Exchange–traded Bayscape Ltd. at a cost of $68,750. Bayscape is projected to reach a value of $15.50 per sh

> Niger Corp. provided you with the following information about its investment in Fahad Corp. shares purchased in May 2017 and accounted for using the FV-OCI method: Cost…………………………………………………………….$ 39,900 Fair value, December 31, 2017………………………..$41,750 Fair

> At December 31, 2017, the equity investments of Wang Inc. that were accounted for using the FV-OCI model without recycling (application of IFRS 9) were as follows: Because of a change in relationship with Ahn Inc., Wang Inc. sold its investment in Ahn

> Assume the same information as in E9-12, except that the bonds are carried at FV-OCI. The fair value of the bonds at December 31 of each year-end is as follows: Instructions: (a) Prepare the journal entries to record the interest received and recogniti

> On January 1, 2016, Hi and Lois Company purchased 12% bonds having a maturity value of $300,000 for $322,744.72. The bonds provide the bondholders with a 10% yield. They are dated January 1, 2016, and mature January 1, 2021, with interest receivable Dece

> Arantxa Corporation made the following purchases of investments during 2017, the first year in which Arantxa invested in equity securities: 1. On January 15, purchased 9,000 shares of Nirmala Corp.’s common shares at $33.50 per share plus commission of $

> Access the financial statements of Brookfield Asset Management Inc. for the company’s year ended December 31, 2014. These are included at the end of the book. Review the information that is provided and answer the following questions about the company.

> The following information is available about Kao Corp.’s investments at December 31, 2017. This is the first year Kao has purchased securities for investment purposes. Assume that Kao Corp. follows IFRS and applies IFRS 9. Instructio

> Transactions follow for Cassio Limited: March 10………………Purchased goods billed at $40,000, terms 3/10, n/60. 11…………………………..Purchased goods billed at $25,000, terms 1/15, n/30. 19……………………………………………………………………Paid invoice of March 10. 24………………………….Purchased go

> Eureka Limited has a calendar-year accounting period. The following errors were discovered in 2017. 1. The December 31, 2015 merchandise inventory had been understated by $51,000. 2. Merchandise purchased on account in 2016 was recorded on the books for

> Salamander Limited makes the following errors during the current year. Each error is an independent case. 1. Ending inventory is overstated by $1,020, but purchases are recorded correctly. 2. Both ending inventory and a purchase on account are understate

> At December 31, 2017, Igor Ltd. has outstanding non-cancellable purchase commitments for 32,500 litres of raw material at $2.00 per litre. The material will be used in Igor’s manufacturing process, and the company prices its raw materials inventory at co

> During 2017, Build it Furniture Limited purchased a railway car load of wicker chairs. The manufacturer of the chairs sold them to Build it for a lump sum of $59,850, because it was discontinuing manufacturing operations and wanted to dispose of its enti

> In an annual audit of Solaro Company Limited, you find that a physical inventory count on December 31, 2017, showed merchandise of $441,000. You also discover that the following items were excluded from the $441,000: 1. Merchandise of $61,000 is held by

> The following is a list of items that may or may not be reported as inventory in J Soukas Corp.’s December 31 balance sheet: 1. Goods out on consignment at another company’s store 2. Goods sold on an installment basis 3. Goods purchased f.o.b. shipping p

> Jaeco Corporation asks you to review its December 31, 2017 inventory values and prepare the necessary adjustments to the books. The following information is given to you: 1. Jaeco uses the periodic method of recording inventory. A physical count reveals

> Khalfan Industries would like to determine the fair value of its manufacturing facility in London, Ontario. The facility consists of land, building, and manufacturing equipment. Instructions: (a) Identify some of the considerations that are involved in

> Companies in the same line of business usually have similar investments and capital structures, and an opportunity for similar rates of return. One of the key performance indicators that is used to assess the profitability of companies is the return on a

> The financial statements of Trifolium Corporation for fiscal 2015 to fiscal 2017 are as follows (in thousands): Instructions: (a) Calculate Trifolium’s (1) inventory turnover and (2) average days to sell inventory for each of the two

> Milan Company Limited uses the gross profit method to estimate inventory for monthly reports. Information follows for the month of May: Instructions: (a) Calculate the estimated inventory at May 31, assuming that the gross profit is 25% of sales. (b) C

> Nicholas’s Christmas Tree Farm Ltd. grows pine, fi r, and spruce trees. The farm cuts and sells trees during the Christmas season and exports most of the trees to the United States. The remaining trees are sold to local tree-lot operators. It normally ta

> The Becker Milk Company Limited, a real estate and investment management company, reports the following information in its financial statements for the years ended April 30, 2014, 2013, and 2102: Instructions: (a) Calculate the accounts receivable turn

> The inventory of 3T Company on December 31, 2017, consists of the following items. Instructions: (a) Determine the inventory as at December 31, 2017, by the lower of cost and net realizable value method, applying this method directly to each item. (b)

> As a result of its annual inventory count, Tarweed Corp. determined its ending inventory at cost and at lower of cost and net realizable value at December 31, 2016, and December 31, 2017. This information is as follows: Instructions: (a) Prepare the jo

> The Ogale Equipment Corporation maintains a general ledger account for each class of inventory, debiting the individual accounts for increases during the period and crediting them for decreases. The transactions that follow are for the Raw Materials inve

> Information is presented in E8-18 on the inventory of mini-kettles at Funnell Company Limited for the month of May. Instructions: (a) Assuming that the perpetual inventory method is used, calculate the inventory cost at May 31 under each of the followin

> The following information is for the inventory of mini-kettles at Funnell Company Limited for the month of May: Instructions: (a) Assuming that the periodic inventory method is used, calculate the inventory cost at May 31 under each of the following co

> Schonfeld Corporation began operations on December 1, 2016. The only inventory transaction in 2016 was the purchase of inventory on December 10, 2016, at a cost of $20 per unit. None of this inventory was sold in 2016. Relevant information for fi scal 20

> Access the annual financial statements of Stora Enso Oyj for the company’s year ended December 31, 2014. These are available at the company’s website, www.storaenso.com. Review the information that is provided and answer the following questions about the

> Aquino Corporation is a multi-product fi rm. The following information concerns one of its products, the Trinton: Instructions: Calculate cost of goods sold, assuming Aquino uses: (a) A periodic inventory system and FIFO cost formula (b) A periodic inv

> On July 1, 2017, Agincourt Inc. made two sales: 1. It sold excess land in exchange for a four-year, non–interest-bearing promissory note in the face amount of $1,101,460. The land’s carrying value is $590,000. 2. It rendered services in exchange for an e

> Two or more items are omitted in each of the following tabulations of income statement data. Fill in the amounts that are missing. 2015 2016 2017 Sales $290,000 6,000 $410,000 Sales returns 13,000 347,000 32,000 Net sales Beginning inventory Ending

> In fiscal 2017, Ivanjoh Realty Corporation purchased unimproved land for $55,000. The land was improved and subdivided into building lots at an additional cost of $34,460. These building lots were all the same size but, because of differences in location

> Linsang Corporation’s retail store and warehouse closed for an entire weekend while the year-end inventory was counted. When the count was finished, the controller gathered all the count books and information from the clerical staff, co