Question: Mountainside Manors, Inc., builds environmentally

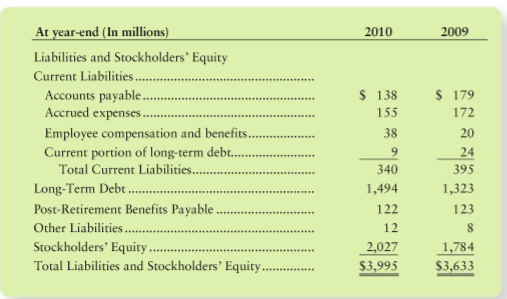

Mountainside Manors, Inc., builds environmentally sensitive structures. The companys 2010 revenues totaled $2,760 million, and at December 31, 2010, the company had $650 million in current assets. The December 31, 2010 and 2009, balance sheets reported the liabilities and stockholders’ equity as follows:

Requirements

1. Describe each of Mountainside Manors, Inc.s liabilities and state how the liability arose.

2. What were the companys total assets at December 31, 2010? Was the companys debt ratio at the end of 2010 high, low, or in a middle range?

Transcribed Image Text:

At year-end (In millions) 2010 2009 Liabilities and Stockholders' Equity Current Liabilities.. $ 138 $ 179 Accounts payable. Accrued expenses . 155 172 Employee compensation and benefits. Current portion of long-term debt.. 38 20 9 24 Total Current Liabilities. 340 395 Long-Term Debt . 1,494 1,323 Post-Retirement Benefits Payable . 122 123 Other Liabilities. 12 Stockholders' Equity 2,027 $3,995 1,784 $3,633 Total Liabilities and Stockholders' Equity..

> The stockholders equity for Icy Pop Drive-Ins (IP) on December 31, 2010, follows: On August 15, 2011, the market price of IP common stock was $15 per share. Assume IP distributed a 20% stock dividend on this date. Requirements 1. Journalize the distri

> At December 31, 2010, Eastern Corporation reported the stockholders equity accounts shown here (with dollar amounts in millions, except per share amounts). Easterns 2011 transactions included the following: a. Net income, $447 million. b. Issuance of

> Journalize the following assumed transactions of Applebug Productions: What was the overall effect of these transactions on Applebugs stockholders equity? Issued 2,400 shares of $1.50 par common stock at $7 per share. Purchased 800 shares of treasur

> Bukala Software had the following selected account balances at December 31, 2010 (in thousands, except par value per share): Requirements 1. Prepare the stockholders equity section of Bukala Softwares balance sheet (in thousands). 2. How can Bukala ha

> Journey Publishing was recently organized. The company issued common stock to an attorney who provided legal services worth $24,000 to help organize the corporation. Journey also issued common stock to an inventor in exchange for his patent with a market

> Honcho Sporting Goods is authorized to issue 7,000 shares of preferred stock and 16,000 shares of common stock. During a two-month period, Honcho completed these stock issuance transactions: Requirement 1. Prepare the stockholders equity section of the

> Sweet & Sour, Inc., is authorized to issue 110,000 shares of common stock and 5,000 shares of preferred stock. During its first year, the business completed the following stock issuance transactions: Requirements 1. Journalize the transactions. Exp

> Amazon.com s consolidated financial statements appear in Appendix A at the end of this book. 1. Refer to the Consolidated Balance Sheets and Note 8 (Stockholders Equity). Describe the classes of stock that Amazon.com, Inc., has authorized. How many share

> Littleton Company included the following items in its financial statements for 2010, the current year (amounts in millions): Requirement 1. Compute Littletons return on assets and return on common equity during 2010 (the current year). Littleton has no

> Luna Inns reported these figures for 2011 and 2010 (in millions): Requirement 1. Compute Lunas return on assets and return on common stockholder’s equity for 2011. Do these rates of return suggest strength or weakness? Give your reaso

> The balance sheet of Luxury Rug Company reported the following: Requirements 1. Compute the book value per share for the common stock, assuming all preferred dividends are fully paid up (none in arrears). 2. Compute the book value per share of the com

> The stockholders equity for Heavenly Desserts Drive-Ins (HD) on December 31, 2010, follows: On May 11, 2011, the market price of HD common stock was $19 per share. Assume HD distributed a 15% stock dividend on this date. Requirements 1. Journalize the

> Clubhouse, Inc., ended 2010 with 7 million shares of $1 par common stock issued and outstanding. Beginning additional paid-in capital was $10 million, and retained earnings totaled $35 million. In April 2011, Clubhouse issued 5 million shares of common

> Space Walk Corporation reported the following stockholders equity data (all dollars in millions except par value per share): Space Walk earned net income of $2,980 during 2010. For each account except Retained Earnings, one transaction explains the chan

> Use the D-4 Networking Solutions data in Exercise 9-52 to show how the company reported cash flows from financing activities during 2010. From exercise 52: D-4 Networking Solutions began operations on January 1, 2010, and immediately issued its stock, r

> D-4 Networking Solutions began operations on January 1, 2010, and immediately issued its stock, receiving cash. D-4s balance sheet at December 31, 2010, reported the following stockholders equity During 2010, D-4 a. Issued stock for $3 per share. b. P

> Army Navy Sporting Goods is authorized to issue 10,000 shares of preferred stock and 19,000 shares of common stock. During a two-month period, Army Navy completed these stock-issuance transactions: Requirement 1. Prepare the stockholders equity section

> This (adapted) advertisement appeared in the Wall Street Chronicle. (Note: A subordinated debenture is an unsecured bond payable whose rights are less than the rights of other bondholders.) Requirements 1. Journalize Holidays issuance of these bonds

> This case is based on the consolidated financial statements of Foot Locker, Inc., given in Appendix B at the end of this book. In particular, this case uses Foot Locker, Inc.s consolidated statement of shareholder’s equity for the year 2007. (Note: The S

> Great Brands completed one of the most famous debt refinancing in history. A debt refinancing occurs when a company issues new bonds payable to retire old bonds. The company debits the old bonds payable and credits the new bonds payable. Great Brands had

> The top management of Pratt Marketing Services examines the following company accounting records at August 29, immediately before the end of the year, August 31: Suppose Pratts management wants to achieve a current ratio of 2.25. How much in current lia

> First Federal Financial Services is considering two plans for raising $600,000 to expand operations. Plan A is to borrow at 5%, and plan B is to issue 100,000 shares of common stock at $6.00 per share. Before any new financing, First Federal Financial Se

> Companies that operate in different industries may have very different financial ratio values. These differences may grow even wider when we compare companies located in different countries. Compare three leading companies on their current ratio, debt ra

> Worldview Imaging Ltd. issued $3,600,000 of 9% notes payable on December 31, 2010, at a price of 94. The notes term maturity is 10 years. After four years, the notes may be converted into Worldview common stock. Each $1,000 face amount of notes is conver

> Eerie Manufacturing, Inc., reported the following: Eerie Manufacturing has paid all preferred dividends through 2007. Requirement 1. Compute the total amounts of dividends to both preferred and common for 2010 and 2011 if total dividends are $100,000

> Supreme Products Company reported the following stockholders equity on its balance sheet: Requirements 1. What caused Supremes preferred stock to decrease during 2011? Cite all possible causes. 2. What caused Supremes common stock to increase during 2

> Bread & Butter, Inc., is authorized to issue 120,000 shares of common stock and 7,000 shares of preferred stock. During its first year, the business completed the following stock issuance transactions: Requirements 1. Journalize the transactions. E

> Commonwealth Bank has $400,000 of 9% debenture bonds outstanding. The bonds were issued at 104 in 2010 and mature in 2030. Requirements 1. How much cash did Commonwealth Bank receive when it issued these bonds? 2. How much cash in total will Commonwea

> On January 31, Daughtry Logistics, Inc., issued five-year, 5% bonds payable with a face value of $11,000,000. The bonds were issued at 95 and pay interest on January 31 and July 31. Daughtry Logistics, Inc., amortizes bond discounts by the straight-line

> St. Genevieve Petroleum Company is an independent oil producer in Baton Parish, Louisiana. In February, company geologists discovered a pool of oil that tripled the company’s proven reserves. Prior to disclosing the new oil to the public, St. Genevieve q

> Assume Five Mile Electronics completed these selected transactions during September 2010. a. Sales of $2,150,000 are subject to estimated warranty cost of 5%. The estimated warranty payable at the beginning of the year was $33,000, and warranty payments

> Peterson Security Systems revenues for 2010 totaled $26.2 million. As with most companies, Peterson is a defendant in lawsuits related to its products. Note 14 of the Peterson Annual Report for 2010 reported the following: Requirements 1. Suppose Peter

> New Planet Structures, Inc., builds environmentally sensitive structures. The company’s 2010 revenues totaled $2,815 million, and at December 31, 2010, the company had $654 million in current assets. The December 31, 2010 and 2009, bala

> At December 31, 2010, Saglio Real Estate reported a current liability for income tax payable of $190,000. During 2011, Saglio earned income of $1,500,000 before income tax. The companys income tax rate during 2011 was 25%. Also during 2011, Saglio paid i

> Assume that Concilio Company completed the following note-payable transactions: Requirements 1. How much interest expense must be accrued at December 31, 2010? (Round your answer to the nearest whole dollar.) 2. Determine the amount of Concilios final

> Potvin Talent Search has an annual payroll of $160,000. In addition, the company incurs payroll tax expense of 9%. At December 31, Potvin owes salaries of $7,900 and FICA and other payroll tax of $850. The company will pay these amounts early next year.

> Trevor Publishing completed the following transactions for one subscriber during 2010: Requirement 1. Journalize these transactions (explanations not required). Then report any liability on the company’s balance sheet at December 31.

> The accounting records of Made from Clay Ceramics included the following balances at the end of the period: In the past, Made from Clays warranty expense has been 4% of sales. During 2010 the business paid $5,000 to satisfy the warranty claims. Require

> First Bank Financial Services is considering two plans for raising $800,000 to expand operations. Plan A is to borrow at 10%, and plan B is to issue 200,000 shares of common stock at $4.00 per share. Before any new financing, First Bank Financial Service

> Companies that operate in different industries may have very different financial ratio values. These differences may grow even wider when we compare companies located in different countries. Compare three leading companies on their current ratio, debt r

> United Parcel Service (UPS), Inc., had the following stockholders equity amounts on December 31, 2010 (adapted, in millions): During 2010, UPS paid a cash dividend of $0.715 per share. Assume that, after paying the cash dividends, UPS distributed a 10%

> Coastalview Imaging Ltd. issued $3,300,000 of 6% notes payable on December 31, 2010, at a price of 95. The notes term to maturity is 20 years. After four years, the notes may be converted into Coastalview common stock. Each $1,000 face amount of notes is

> Huron Manufacturing, Inc., reported the following: Huron Manufacturing has paid all preferred dividends through 2007. Requirement 1. Compute the total amounts of dividends to both preferred and common for 2010 and 2011 if total dividends are $60,000 i

> Theta Products Company reported the following stockholders equity on its balance sheet: Requirements 1. What caused Thetas preferred stock to decrease during 2011? Cite all possible causes. 2. What caused Thetas common stock to increase during 2011? I

> Use the Northeast Corporation data in Exercise 9-25A to prepare the stockholders equity section of the company’s balance sheet at December 31, 2011. From exercise 25: At December 31, 2010, Northeast Corporation reported the stockholder

> Federal Bank has $500,000 of 7% debenture bonds outstanding. The bonds were issued at 103 in 2010 and mature in 2030. Requirements 1. How much cash did Federal Bank receive when it issued these bonds? 2. How much cash in total will Federal Bank pay th

> On January 31, Driftwood Logistics, Inc., issued 10-year, 6% bonds payable with a face value of $13,000,000. The bonds were issued at 94 and pay interest on January 31 and July 31. Driftwood Logistics, Inc., amortizes bonds by the straight-line method. R

> Assume that McKinley Electronics completed these selected transactions during June 2010: a. Sales of $2,200,000 are subject to estimated warranty cost of 7%. The estimated warranty payable at the beginning of the year was $34,000, and warranty payments

> Roden Security Systems revenues for 2010 totaled $6.3 million. As with most companies, Roden is a defendant in lawsuits related to its products. Note 14 of the Roden Annual Report for 2010 reported: Requirements 1. Suppose Rodens lawyers believe that a

> At December 31, 2010, Souza Real Estate reported a current liability for income tax payable of $180,000. During 2011, Souza earned income of $1,200,000 before income tax. The companys income tax rate during 2011 was 36%. Also during 2011, Souza paid inco

> Business is going well for Park N Fly, the company that operates remote parking lots near major airports. The board of directors of this family-owned company believes that Park N Fly could earn an additional $1.5 million income before interest and taxes

> Assume that Crandell Company completed the following note-payable transactions. Requirements 1. How much interest expense must be accrued at December 31, 2010? (Round your answer to the nearest whole dollar.) 2. Determine the amount of Crandells final

> Perform Talent Search has an annual payroll of $200,000. In addition, the company incurs payroll tax expense of 8%. At December 31, Perform owes salaries of $8,100 and FICA and other payroll tax of $800. The company will pay these amounts early next year

> TransWorld Publishing completed the following transactions for one subscriber during 2010: Requirement 1. Journalize these transactions (explanations not required). Then report any liability on the companys balance sheet at December 31, 2010. Oct 1

> The accounting records of From the Earth Ceramics included the following balances at the end of the period: In the past, From the Earths warranty expense has been 7% of sales. During 2010 the business paid $8,000 to satisfy the warranty claims. Require

> Like Home, Inc., includes the following selected accounts in its general ledger at December 31, 2010: Prepare the liabilities section of Like Home, Inc.s balance sheet at December 31, 2010, to show how the company would report these items. Report total

> Houle Plumbing Products Ltd. reported the following data in 2010 (in billions): Compute Houles times-interest-earned ratio, and write a sentence to explain what the ratio value means. Would you be willing to lend Houle $1 billion? State your reason.

> Identify the effects both the direction and the dollar amount of these assumed transactions on the total stockholders’ equity of Athol Corporation. Each transaction is independent. a. Declaration of cash dividends of $78 million. b. Payment of the cash

> Determine whether the following bonds payable will be issued at maturity value, at a premium, or at a discount: a. The market interest rate is 5%. Carlisle Corp. issues bonds payable with a stated rate of 4 1/2%. b. Oiler, Inc., issued 7% bonds payable

> Compute the price of the following bonds: a. $300,000 issued at 75.75 b. $300,000 issued at 102.75 c. $300,000 issued at 94.50 d. $300,000 issued at 104.50

> Speedtown Marina needs to raise $3 million to expand the company. Speedtown Marina is considering the issuance of either: $3,000,000 of 8% bonds payable to borrow the money , or 100,000 shares of common stock at $30 per share. Before any new financing, S

> Identify the effects both the direction and the dollar amount of these assumed transactions on the total stockholders’ equity of Dracut Corporation. Each transaction is independent. a. Declaration of cash dividends of $85 million. b. Payment of the cas

> Karen Scanlon and Jennifer Shaw are opening a Submarines deli. Scanlon and Shaw need outside capital, so they plan to organize the business as a corporation. They come to you for advice. Write a memorandum informing them of the steps in forming a corpora

> Centerville Bancshares has 13,000 shares of $3 par common stock outstanding. Suppose Centerville distributes a 15% stock dividend when the market value of its stock is $25 per share. 1. Journalize Centervilles distribution of the stock dividend on May 11

> Greentea Corporation earned net income of $95,000 during the year ended December 31, 2010. On December 15, Greentea declared the annual cash dividend on its 6% preferred stock (11,000 shares with total par value of $110,000) and a $1.00 per share cash di

> McGahan Corporation is conducting a special meeting of its board of directors to address some concerns raised by the stockholders. Stockholders have submitted the following questions. Answer each question. 1. Why are common stock and retained earnings s

> Give the formula for computing (a) rate of return on total assets (ROA) and (b) rate of return on common stockholders’ equity (ROE). Then answer these questions about the rate-of-return computations. 1. Why is interest expense added to net income in t

> Consider the authority structure in a corporation, as diagrammed in Exhibit 9-2. 1. What group holds the ultimate power in a corporation? 2. Who is the most powerful person in the corporation? Whats the abbreviation of this persons title? 3. Whos in c

> MarleyDavid, Inc., the motorcycle manufacturer, included the following note in its annual report: 1. Why are these contingent (versus real) liabilities? 2. In the United States, how can the contingent liability become a real liability for MarleyDavid? W

> Refer to the data given in Short Exercise 8-3. What amount of warranty expense will Trekster USA report during 2010? Which accounting principle addresses this situation? Does the warranty expense for the year equal the years cash payments for warranties?

> Sunset Drive-Ins Ltd. issued a $500,000, 8%, 10-year bond payable on July 1, 2010, at a price of 94. Also assume that Sunsets accounting year ends on December 31. Journalize the following transactions for Sunset Drive-Ins Ltd., including an explanation f

> Trekster USA guarantees automobiles against defects for five years or 55,000 miles, whichever comes first. Suppose Trekster USA can expect warranty costs during the five-year period to add up to 6% of sales. Assume that Trekster USA dealer in Atlanta, Ge

> This short exercise works with Short Exercise 8-1. 1. Refer to the data in Short Exercise 8-1. Show what the company would report on its balance sheet at June 30, 2011, and on its income statement for the year ended on that date. 2. What single item wi

> Franklin Sports Authority purchased inventory costing $5,000 by signing an 8% short-term note payable. The purchase occurred on September 30, 2010. Franklin pays annual interest each year on September 30. Journalize the company’s (a) purchase of invento

> SHOE received $73,000,000 for the issuance of its stock on April 24. The par value of the SHOE stock was only $73,000. Was the excess amount of $72,927,000 a profit to SHOE? If not, what was it? Suppose the par value of the SHOE stock had been $2 per sh

> Antonio Companys net income and interest expense are $27,000 and $3,000, respectively , and average total assets are $600,000. How much is Antonios return on assets? a. 5.0% b. 4.5% c. 6.2% d. 4.0%

> Assume the same facts as in question 70. What is the amount of dividends per share on common stock? a. $1.00 b. $5.50 c. $2.50 d. $12.50 e. None of these

> A corporation has 40,000 shares of 10% preferred stock outstanding. Also, there are 40,000 shares of common stock outstanding. Par value for each is $100. If a $500,000 dividend is paid, how much goes to the preferred stockholders? a. None b. $400,000

> Lucas Foods has outstanding 600 shares of 7% preferred stock, $100 par value, and 1,600 shares of common stock, $30 par value. Lucas declares dividends of $15,800. The correct entry is: a. Dividends Payable, Preferred Dividends Payable, Common 4,200

> Stockholders are eligible for a dividend if they own the stock on the date of: a. record. b. issuance. c. declaration. d. payment.

> A company purchased 100 shares of its common stock at $50 per share. It then sells 35 of the treasury shares at $56 per share. The entry to sell the treasury stock includes a a. credit to Paid-in Capital, Treasury Stock for $210. b. debit to Retained E

> Susan Smith Exports, Inc., is located in Birmingham, Alabama. Smith is the only company with reliable sources for its imported gifts. The company does a brisk business with specialty stores such as Bloomingdales. Smith’s recent success has made the compa

> When treasury stock is sold for less than its cost, the entry could include a debit to: a. Paid-in Capital in Excess of Par. b. Retained Earnings. c. Gain on Sale of Treasury Stock. d. Loss on Sale of Treasury Stock.

> A company paid $24 per share to purchase 600 shares of its common stock as treasury stock. The stock was originally issued at $16 per share. The journal entry to record the purchase of the treasury stock is: a. Treasury Stock 14,400 Cash 14,400 b. Tr

> These account balances at December 31 relate to Sportworld, Inc.: Sportworlds net income for the period is $119,100 and beginning common stockholders equity is $681,500. Calculate Sportworlds return on common stockholders equity . a. 17.2% b. 16.4% c.

> These account balances at December 31 relate to Sportworld, Inc.: What is total stockholders equity for Sportworld, Inc.? a. $688,100 b. $641,345 c. $693,300 d. $698,500 e. None of the above $ 51,500 Paid-in Capital in Excess of Par-Common.. Pref

> These account balances at December 31 relate to Sportworld, Inc.: What is total paid-in capital for Sportworld, Inc.? a. $634,445 b. $622,000 c. $641,345 d. $693,300 e. None of the above $ 51,500 Paid-in Capital in Excess of Par-Common.. Preferre

> The paid-in capital portion of stockholders equity does not include a. Common Stock. b. Preferred Stock. c. Retained Earnings. d. Paid-in Capital in Excess of Par Value.

> Par value a. represents the original selling price for a share of stock. b. is established for a share of stock after it is issued. c. may exist for common stock but not for preferred stock. d. represents what a share of stock is worth. e. is an arb

> Spirit World, Inc., issues 280,000 shares of no-par common stock for $9 per share. The journal entry is: a. Cash 2,520,000 Common Stock 560,000 Paid-In Capital in Excess of Par 1,960,000 b. Сash 2,520,000 Common Stock 2,520,000 C. Cash 2,520,000 Comm

> On February 28, 2010, Marlin Corp. issues 8%, 10-year bonds payable with a face value of $900,000. The bonds pay interest on February 28 and August 31. Marlin Corp. amortizes bonds by the straight-line method. Requirements 1. If the market interest rat

> The board of directors of Monitors Plus authorizes the issue of $9,000,000 of 10%, five-year bonds payable. The semiannual interest dates are May 31 and November 30. The bonds are issued on May 31, 2010, at par. Requirements 1. Journalize the following

> Use the amortization table that you prepared for GITs bonds in Short Exercise 8-9 to answer the following questions: 1. How much cash did GIT borrow on March 31, 2010? How much cash will GIT pay back at maturity on March 31, 2022? 2. How much cash inter

> In 2002, Enron Corporation filed for Chapter 11 bankruptcy protection, shocking the business community: How could a company this large and this successful go bankrupt? This case explores the causes and the effects of Enrons bankruptcy. At December 31, 20

> Is it enough to just write down the business strategy of a firm? Why or why not? Conversely, what are the limitations of not writing down the strategy but rather depending on the firm’s actions to define the strategy?

> Do you think the process of mass customization is common practice in recent times? Can you think of an example from daily life?

> Can a company complete its material requirements plans before it does master scheduling? Explain.

> Yield management is a powerful tool in operations and supply chain management. It is commonly employed to handle highly perishable products and/or services. Do you agree? Give an example.

> One of your friends argues that EOQ has limitations, such as providing no consideration for the other supply chain members. Do you agree? Can you give an example?

> Competitive bidding is better applied when purchasing products and services with straightforward specifications, while negotiation is good for new and/or technically complex products and services with only vague specifications. Do you think they could be