Question: Mustafa Limited began operations on January 2,

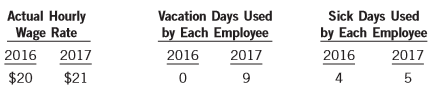

Mustafa Limited began operations on January 2, 2016. Mustafa employs nine individuals who work eight-hour days and are paid hourly. Each employee earns 10 paid vacation days and 6 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows:

Mustafa Limited has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when they are earned and to accrue sick pay when it is earned. For the purpose of this question, ignore any tax, CPP, and EI deductions when making payments to the employees.

Instructions:

(a) Prepare the journal entries to record the transactions related to vacation entitlement during 2016 and 2017.

(b) Prepare the journal entries to record the transactions related to sick days during 2016 and 2017.

(c) Calculate the amounts of any liability for vacation pay and sick days that should be reported on the statement of financial position at December 31, 2016 and 2017.

(d) How would your answers to parts (b) and (c) change if the entitlement to sick days did not accumulate?

Transcribed Image Text:

Actual Hourly Wage Rate Vacation Days Used by Each Employee Sick Days Used by Each Employee 2016 2017 2016 2017 2016 2017 $20 $21 9 4 5

> On January 2, 2012, Kowalchuk Corporation, a small company that follows ASPE, issued $1.5 million of 10% bonds at 97 due on December 31, 2021. Legal and other costs of $110,000 were incurred in connection with the issue. Kowalchuk Corporation has a polic

> Anaconda Inc. has issued three types of debt on January 1, 2017, the start of the company’s fiscal year: 1. $10 million, 10-year, 13% unsecured bonds, with interest payable quarterly, priced to yield 12% 2. $2.5 million par of 10-year, zero-coupon bonds

> Refer to E14-18 and Auburn Limited. Instructions: Repeat the instructions of E14-18 assuming that Auburn Limited follows IFRS and uses the effective interest method. Provide an effective-interest table for the bonds from the inception of the bond to the

> On June 30, 2010, Auburn Limited issued 12% bonds with a par value of $800,000 due in 20 years. They were issued at 98 and were callable at 104 at any date after June 30, 2017. Because of lower interest rates and a significant change in the company’s cre

> Friedman Corporation had bonds outstanding with a maturity value of $500,000. On April 30, 2017, when these bonds had an unamortized discount of $10,000, they were called in at 104. To pay for these bonds, Friedman had issued other bonds a month earlier

> On June 30, 2017, Mosca Limited issued $4 million of 20-year, 13% bonds for $4,300,920, which provides a yield of 12%. The company uses the effective interest method to amortize any bond premium or discount. The bonds pay semi-annual interest on June 30

> Four independent situations follow. 1. Wen Corporation incurred the following costs when it issued bonds: printing and engraving costs, $25,000; legal fees, $69,000; and commissions paid to underwriter, $70,000. 2. Griffith Inc. sold $3 million of 10-yea

> Minor Inc. sells 10% bonds having a maturity value of $3 million for $2,783,713. The bonds are dated January 1, 2017 and mature on January 1, 2022. Interest is payable annually on January 1. Instructions: (a) Set up a schedule of interest expense and di

> Cinderella Shoes Inc. is having difficulty meeting its working capital requirements. As a result, on January 1, 2017, the company sold bonds with a face value of $1 million, receiving $800,000 in cash. The bonds have an interest rate of 8% and mature on

> Refer to the data and other information provided for Wong Corporation in E20-15. Assume that the equipment has an estimated economic life of seven years and that its fair value on September 1, 2017 is $79,000. Instructions: (a) Explain why this lease is

> On January 1, 2017, Osborn Inc. sold 12% bonds having a maturity value of $800,000 for $860,652, which provides the bondholders with a 10% yield. The bonds are dated January 1, 2017 and mature on January 1, 2022, with interest payable on January 1 of eac

> Kanish Corporation’s general ledger includes the following account balances: The Contributed Surplus account arose from net excess of proceeds over cost on a previous cancellation of common shares. The average cost of the common share

> Collins Corporation bought a computer on December 31, 2017, paying $30,000 down with a further $75,000 payment due on December 31, 2020. An interest rate of 10% is implicit in the purchase price. Collins uses the effective interest method and has a Decem

> The following examples describe possible features or characteristics of long term debt: 1. The debt agreement includes a covenant that requires the debtor to maintain a minimum amount of working capital. 2. The stated rate of a bond issue is less than th

> On December 31, 2017, Zimmer Corporation has $7.9 million of short term debt in the form of notes payable that will be due periodically in 2018 to Provincial Bank. On January 28, 2018, Zimmer enters into a refinancing agreement with the bank that will pe

> On December 31, 2017, Hornsby Corporation had $1.2 million of short term debt in the form of notes payable due on February 2, 2018. On January 21, 2018, in order to ensure that it had sufficient funds to pay for the short-term debt when it matured, Horns

> The following is a list of possible transactions. 1. Purchased inventory for $80,000 on account. (Assume a perpetual system is used.) 2. Issued an $80,000 note payable in payment of an account (see item 1 above). 3. Recorded accrued interest on the note

> Shaddick Corp., a public company following IFRS, began its 2017 fiscal year with a debit balance of $11,250 in its Income Tax Receivable account. During the year, Shaddick made quarterly income tax instalment payments of $8,100 each. In early June, a che

> Sararas Ltd. is a merchant and operates in the province of Ontario, where the HST rate is 13%. Sararas uses a perpetual inventory system. Transactions for the business for the months of March and April are as follows: Mar. 1 Paid March rent to the landlo

> Diagnostics Corp. follows IFRS and sells its products in expensive, reusable containers that can be tracked. The customer is charged a deposit for each container that is delivered and receives a refund for each container that is returned within two years

> On September 1, 2017, Wong Corporation, which uses ASPE, signed a five-year, non-cancellable lease for a piece of equipment. The terms of the lease called for Wong to make annual payments of $13,668 at the beginning of each lease year, starting September

> Harold Limited’s condensed financial statements provide the following information: Instructions: (a) Determine the following: 1. Current ratio at December 31, 2017 2. Acid-test ratio at December 31, 2017 3. Accounts receivable turnov

> Kawani Corporation has been operating for several years. On December 31, 2017, it presented the following statement of financial position. Cost of goods sold in 2017 was $420,000, operating expenses were $51,000, and net income was $27,000. Accounts pa

> Henrietta Aguirre, the ethical accountant, is the newly hired Director of Corporate Taxation for Mesa Incorporated, which is a publicly traded corporation. Aguirre’s first job with Mesa was to review the company’s accounting practices for deferred taxes.

> Locate the 2015 audited annual financial statements of a company that may be experiencing financial difficulties, such as a pharmaceutical company still primarily in the research and development stage. One such company is Antibe Therapeutics Inc., a Cana

> Refer to the information for Darby Corporation in E13-2. Instructions: (a) Prepare the journal entries for the payment of the notes at maturity. (b) Repeat part (a) assuming Darby uses reversing entries. (Show the reversing entries at January 1, 2018.)

> Four independent situations follow. Situation 1: During 2017, Sugarpost Inc. became involved in a tax dispute with the CRA. Sugarpost’s tax lawyers have informed management that Sugarpost will likely lose this dispute. They also believe that Sugarpost wi

> Islim Limited manufactures faux fur coats of all types and sizes that are sold to specialty stores throughout Canada. Sales to retailers provide for payment within 60 days of delivery and the retailer may return a maximum of 25% of an order at the retail

> St. Thomas Auto Repairs is preparing the financial statements for the year ended November 30, 2017. As the accountant, you are looking over the information regarding short-term liabilities, and determining the amounts that should be reported on the balan

> Timo van Leeuwen operates a very busy roadside fruit and vegetable stand from May to October every year as part of his farming operation, which has a December 31 year end and uses ASPE. Each time a customer purchases over $10 of produce, Timo gives the c

> Three independent situations follow. Situation 1: Marquart Stamp Corporation records stamp service revenue and provides for the cost of redemptions in the year stamps are sold to licensees. The stamps can be collected and then redeemed for discounts on f

> Pucci Corporation is a machinery dealer whose shares trades on the TSX, and so uses IFRS 16. Pucci leased a machine to Ernst Ltd. on January 1, 2017. The lease is for a six-year period and requires equal annual payments of $24,736 at the beginning of eac

> Moleski Limited, a private company following ASPE, includes one coupon in each box of soap powder that it produces, and 10 coupons are redeemable for a premium (a kitchen utensil). In 2017, Moleski purchased 8,800 premiums at $0.90 each and sold 120,000

> To increase sales, Bélanger Inc., a public company following IFRS, implemented a customer loyalty program that rewards a customer with 1 loyalty point for every $10 of purchases on a select group of products. Each point is redeemable for a $1 discount on

> Novack Machinery Co. manufactures equipment to a very high standard of quality; however, it must still provide a warranty for each unit sold, and there are instances where the machines do require repair after they have been put into use. Novack started i

> Selzer Equipment Limited sold 500 Rollomatics on account during 2017 for $6,000 each. During 2017, Selzer spent $30,000 servicing the two-year warranties that are included in each sale of the Rollomatic. All servicing transactions were paid in cash. Ins

> The amount of income tax that is due to the government for a period of time is rarely the same as the amount of income tax expense that is reported on the income statement for that same period under IFRS and one of the alternatives under ASPE. Instructi

> Cool Sound Ltd. manufactures a line of amplifiers that carry a three-year warranty against defects. Based on experience, the estimated warranty costs related to dollar sales are as follows: first year after sale—2% of sales; second year

> The following are selected 2017 transactions of Darby Corporation. Sept. 1 Purchased inventory from Orion Ltd. on account for $50,000. Darby uses a periodic inventory system and records purchases using the gross method of accounting for purchase discount

> Cléroux Corporation sold 150 colour laser copiers in 2017 for $4,000 each, including a one-year warranty. Maintenance on each machine during the warranty period averages $300. Instructions: (a) Prepare entries to record the machine sales and the related

> Listed below are selected transactions of Schultz Department Store for the current year ending December 31. 1. On December 5, the store received $500 from the Selig Players as a deposit to be returned after certain furniture to be used in a stage product

> On May 1, 2017, Green Machine Inc. entered into a contract to deliver one of its specialty mowers to Schroeter Landscaping Co. The contract requires Schroeter to pay the contract price of $3,200 in advance on May 15, 2017. Schroeter pays Green Machine on

> On May 1, 2017, a machine was purchased for $1,750,000 by Pomeroy Corp., a private company following ASPE. The machine is expected to have an eight-year life with no salvage value and is to be depreciated on a straight-line basis. The machine was leased

> Crude Oil Limited purchased an oil tanker depot on July 2, 2017 at a cost of $600,000 and expects to operate the depot for 10 years. After the 10 years, Crude Oil is legally required to dismantle the depot and remove the underground storage tanks. It is

> On January 1, 2017, Offshore Corporation erected a drilling platform at a cost of $5,460,000. Offshore is legally required to dismantle and remove the platform at the end of its six-year useful life, at an estimated cost of $950,000. Offshore estimates t

> The incomplete income statement of Justin Corp. follows. The employee profit-sharing plan requires that 20% of all profits remaining after the deduction of the bonus and income tax be distributed to the employees by the first day of the fourth month fo

> Goldwing Corporation offers enriched parental benefits to its staff. While the government provides compensation based on Employment Insurance legislation for a period of 12 months, Goldwing increases the amounts received and extends the period of compens

> Refer to the data in E13-11 and assume instead that Mustafa Limited has chosen not to recognize paid sick leave until it is used, and has chosen to accrue vacation time at expected future rates of pay without discounting. Mustafa uses the following proje

> Sporon Corp. is a fast-growing Canadian private company involved in the manufacturing, distribution, and retail of specially designed yoga and leisure wear. Sporon has recently signed 10 leases for new retail locations and is looking to sign about 30 mor

> As the new accountant for Carly’s Pet Express Inc., a line of pet boutiques, you are developing the financial statement disclosures for the 2017 financial statement note on income taxes. The company uses ASPE, and has selected the taxes payable method. T

> Refer to the information in E18-15 for Zdon Inc. Assume that the company follows the taxes payable method of accounting for income taxes under ASPE. During the year, Zdon Inc. made tax instalment payments of $42,000. Instructions: (a) Calculate the taxa

> Refer to the information in E18-11 for Henry Limited. Assume that the company reports under ASPE and that the taxes payable method of accounting is used for income tax. Instructions: (a) Prepare the journal entries to record income tax at December 31,

> On January 1, 2017, Vick Leasing Inc., a lessor that uses IFRS 16, signed an agreement with Rock River Inc., a lessee, for the use of a compression system. The system cost $415,000 and was purchased from Manufacturing Solutions Ltd. specifically for Rock

> Geoff Corp.’s operations in 2017 had mixed results. One division, Vincenti Group, again failed to earn income at a rate that was high enough to justify its continued operation, and management therefore decided to close the division. Vincenti Group earned

> Darrell Corporation reports under IFRS. At December 31, 2017, the company had a net deferred tax liability of $402,000. An explanation of the items that make up this balance follows: Instructions: (a) Indicate how deferred tax should be presented on Da

> Refer to the information provided about Roux Corp. in E18-28. Instructions: (a) Assuming that it is more likely than not that $25,000 of the deferred tax asset will not be realized, prepare the journal entries to record income taxes for 2017. Roux uses

> Roux Corp. had a Deferred Tax Asset account with a balance of $81,000 at the end of 2016 due to a single temporary difference of $270,000 related to warranty liability accruals. At the end of 2017, this same temporary difference has increased to $300,000

> Refer to the information for Riley Inc. in E18-26. Instructions: (a) Assume that Riley Inc. uses a valuation allowance to account for deferred tax assets, and also that it is more likely than not that 25% of the carryforward benefits will not be realize

> Riley Inc. reports the following pre-tax incomes (losses) for both financial reporting purposes and tax purposes: The tax rates listed were all enacted by the beginning of 2015. Riley reports under the ASPE future/deferred income taxes method. Instruc

> Corby Spirit and Wine Limited is a leading Canadian marketer and distributor of premium spirits and wine brands. Obtain a copy of the company’s comparative financial statements for the year ended June 30, 2015 from the company’s website (www.corby.ca).

> The accounting income (loss) figures for Farah Corporation are as follows: 2012…………………………………………………$ 160,000 2013 …………………………………………………..250,000 2014……………………………………………………..80,000 2015………………………………………………….(160,000) 2016………………………………………………….(380,000) 2017………………

> Cuomo Mining Corporation, a public company whose stock trades on the Toronto Stock Exchange, uses IFRS. The vice-president of finance has asked you, the assistant controller, to prepare a comparison of the company’s current accounting of a lease (IAS 17)

> The comparative statement of financial position for Cosky Corporation follows: Additional information: 1. Dividends of $15,000 were declared and paid in 2017. 2. There were no unrealized gains or losses on the FV-NI investments. Instructions: Based on

> The Bank of Montreal and Royal Bank of Canada financial statements for their years ended October 31, 2015 can be found on SEDAR (www. sedar.com). Instructions: (a) What is the average carrying amount of each company’s common shares? Compare these values

> The following transactions took place during the year 2017 for Mia Inc. 1. Convertible bonds payable with a carrying amount of $300,000 along with conversion rights of $9,000 were exchanged for common shares. 2. The net income for the year was $410,000.

> Shen Limited reported net income of $32,000 for its latest year ended March 31, 2017. Instructions: For each of the five different situations involving the statement of financial position accounts that follow, calculate the cash flow from operating acti

> The following are transactions of Albert Sing, an interior design consultant, for the month of September 2017. Sept. 1 Albert Sing began business as an interior design consultant, investing $31,000 for 5,000 common shares of the company, A. S. Design Lim

> Huang Corp. uses the direct method to prepare its statement of cash flows and follows IFRS. Huang’s trial balances at December 31, 2017 and 2016 were as follows: Additional information: 1. Huang purchased $5,000 of equipment during 20

> Data for Malouin Corp. are presented in E22-12. Instructions: Prepare the operating activities section of the statement of cash flows using the indirect method. Data from E22-12: Malouin Corp.’s income statement for the year ended De

> Sunlight Equipment Manufacturers (SEM) makes barbecue equipment. The company has historically been very profitable; however, in the last year and a half, things have taken a turn for the worse due to higher consumer interest rates and a slowdown in the e

> Earthcom Inc. is in the telecommunications industry. The company builds and maintains telecommunication lines that are buried in the ground. The company is a public company and has been having some bad luck. One of its main underground telecommunications

> AltaGas Ltd. capitalizes on the supply and demand dynamic for natural gas and power by owning and operating assets in gas, power, and utilities in places that provide a strategic competitive advantage. Instructions: Access the financial statements for A

> Temple Limited is in the real estate business. After several years of economic growth, most of the company’s assets are now worth significantly more than the amount that is recognized on the financial statements. Wanting to capitalize on this positive tr

> Saltworks Inc. (SI) produces salt. Its main assets are two properties that have two salt mines in them (mine 1 and mine 2). Both mines are currently in production. The salt exists in a crystalline layer of rock that rests about 50 meters below ground lev

> Castle Leasing Corporation, which uses IFRS 16, signs a lease agreement on January 1, 2017 to lease electronic equipment to Wai Corporation, which also uses IFRS 16. The term of the non-cancellable lease is two years and payments are required at the end

> Martel Industries Limited is in the mining business. The company has significant exploration activities in many countries and has started to explore and develop oil and gas properties in the past few years. The company’s shares trade on the national stoc

> Cauchy Inc. (CI) has just had a planning meeting with its auditors. There were several concerns that had been raised during the meeting regarding the draft financial statements for the December 31, 2017 year end. CI is a public company whose shares list

> Tiziana’s Foods Limited (TFL) is in the supermarket business. It is a public company and is thinking of going private (that is, buying up all of its shares that are available). The funds will come from a private consortium. The consortium has offered to

> On-line Deals Inc. (ODI) is in the business of selling things on-line. The company is currently owned by two founding partners, Jay and Wen. Due to the rise in Internet commerce, Jay and Wen are thinking about taking the company public. Revenues have inc

> Wind and Solar Inc. (WSI) is in the business of providing electricity. The company started up in 2016. Currently, it is owned by Winifred Wind and Winston Chang. Both Winston and Winifred own 50% of the WSI common shares. Under the terms of the sharehold

> Sandolin Incorporated (SI) is a global, diversified firm whose shares trade on the major Canadian and U.S. stock markets. It owns numerous toll highways, several companies in the energy business, and an engineering consulting fi rm. Currently, its shares

> RTL is a family-owned and operated business that prints flyers and banners. It has been in operation for over 20 years and is being passed on to the next generation. Profits from the past two years have been significantly declining. This is a direct resu

> Big Bath Emporium (BBE), a private company based in Toronto, is the city’s largest manufacturer and vendor of bathtubs, showers, and sinks. The company sells products direct to consumers, and also sells wholesale to other retailers. BBE is owned by Bob B

> Access the financial statements of Bombardier Inc. for the years ended December 31, 2015 and December 31, 2014 from the company’s website or SEDAR (www.sedar.com). Instructions: Changes in non-cash working capital items can have a significant impact on

> Landfill Limited (LL) is a private company that collects and disposes of household garbage. Waste is collected and trucked to local disposal sites, where it is dumped and then covered with topsoil. The disposal sites are owned by LL and were financed by

> Yogendran Corp., which uses ASPE, leases a car to Jaimme DeLory on June 1, 2017. The term of the non-cancellable lease is 48 months. The following information is provided about the lease. 1. The lessee is given an option to purchase the automobile at the

> Enviro company Limited (EL) is a pulp and paper company that has been in operation for 50 years. Its shares trade on a major stock exchange. It is located in a small town in Northern Ontario and employs thousands of people. In fact, the town exists mainl

> Candelabra Limited (CL) is a manufacturing company that is privately owned. The company’s production facilities produce a significant amount of carbon dioxide, and currently the town is suing CL for polluting the surrounding area. The company is enjoying

> Frangipani Ltd. (FL) is a new company that has just started up in January 2017. The company is the brainchild of Frank Frangi, who is working on developing a new process for a solar-powered car. To date, most of the year has been taken up with setting up

> Penron Limited is in the energy business, buying and selling gas and oil and related derivatives. It is a public company whose shares are widely held. It underwent a tremendous expansion over the past decade, and revenues quadrupled and continue to climb

> Tobita Limited, which follows IFRS, has adopted the policy of classifying interest paid as operating activities and dividends paid as financing activities. Condensed financial data for 2017 and 2016 follow (in thousands): Additional information: Durin

> Information from the statement of financial position and statement of income are given below for North Road Inc., a company following IFRS, for the year ended December 31. North Road has adopted the policy of classifying interest paid as operating activi

> Robbins Ltd. is a wholesale distributor of professional equipment and supplies. The company’s sales have averaged about $900,000 annually for the three-year period 2015–2017. The firm’s total assets a

> The following information (in $000) has been obtained from Patinka Limited’s financial statements for the fiscal years ended December 31. There are no preferred shares issued by Patinka. Instructions: (a) Calculate the following item

> Tarzwell Limited is preparing some analysis of past financial performance and positions to include in the management discussion and analysis (MD&A) portion of the annual report to shareholders. You have suggested that it would be useful for users o

> Brookfield Asset Management Inc.’s 2014 financial statements can be found at the end of this volume or on the company website. Brookfield owns and operates assets with a focus on property, renewable energy, infrastructure, and private equity. Instructio

> On January 1, 2017, Maleki Corp., which uses IFRS 16, signs a 10-year, non-cancellable lease agreement to lease a specialty lathe from Liu Inc. The following information concerns the lease agreement. 1. The agreement requires equal rental payments of $73

> The condensed statements of changes in financial position and detailed income statement information for Tran Consulting Ltd. follow. Tran contracts professionals in the electronic data management field and provides services to clients around the globe.

> The financial statements of Mackay Corporation show the following information: Instructions: (a) Using horizontal analysis, analyze Mackay Corporation’s change in liquidity, solvency, and profitability in 2017. (b) Using vertical anal

> Canadian law firms typically use a partnership structure. The Income Tax Act allows law firms the reporting of revenue when invoices are remitted to clients, as opposed to when the work is performed and the revenue is earned. This provision in the Act al