Question:

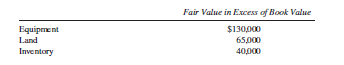

(Note that this is the same problem as Problem 5-4 and Problem 5-11, but assuming the use of the complete equity method.) On January 1, 2013, Porter Company purchased an 80% interest in the capital stock of Salem Company for $850,000. At that time, Salem Company had capital stock of $550,000 and retained earnings of $80,000. Porter Company uses the complete equity method to record its investment in Salem Company. Differences between the fair value and the book value of the identifiable assets of Salem Company were as follows:

The book values of all other assets and liabilities of Salem Company were equal to their fair values on January 1, 2013. The equipment had a remaining life of five years on January 1, 2013. The inventory was sold in 2013.

Salem Company’s net income and dividends declared in 2013 and 2014 were as follows:

Year 2013 net income of $100,000; Dividends Declared of $25,000

Year 2014 net income of $110,000; Dividends Declared of $35,000

Required:

A. Present the eliminating/adjusting entries needed on the consolidated worksheet for the year ended December 31, 2013. (It is not necessary to prepare the worksheet.)

B. Present the eliminating/adjusting entries needed on the consolidated worksheet for the year ended December 31, 2014. (It is not necessary to prepare the worksheet.)

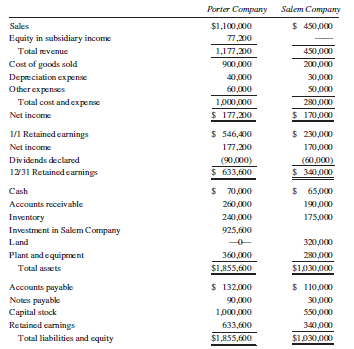

Use the following financial data for 2015 for requirements C through G.

Required:

C. Although no goodwill impairment was reflected at the end of 2013 or 2014, the goodwill impairment test conducted at December 31, 2015 revealed implied goodwill from Salem to be only $150,000. The impairment was reflected in the books of the parent. Prepare a t-account calculation of the controlling and noncontrolling interests in consolidated income for the year ended December 31, 2015.

D. Prepare a consolidated financial statements workpaper for the year ended December 31, 2015.

E. Prepare a consolidated statement of financial position and a consolidated income statement for the year ended December 31, 2015.

F. Describe the effect on the consolidated balances if Salem Company uses the LIFO cost flow assumption in pricing its inventory and there has been no decrease in ending inventory quantities since 2013.

G. Prepare an analytical calculation of consolidated retained earnings for the year ended December 31, 2015.

Note: If you completed Problem 5-4 and Problem 5-11, a comparison of the consolidated balances in this problem with those you obtained in Problem 5-4 and Problem 5-11 will demonstrate that the method (cost or partial equity) used by the parent company to record its investment in a consolidated subsidiary has no effect on the consolidated balances.

Transcribed Image Text:

Fair Value in Excess of Book Value Equipment $130,000 Land 65,000 Inventory 40,000 Porter Company Salem Company Sales $1,100,000 $ 450,000 Equity in subsidiary income 77,00 Total evenue 1,177,200 450,000 Cost of goods sold 900,000 200,000 Depreciation ex pense Other expenses 40,000 30,000 60,000 S0,000 Total cost and expense 1,000,000 $ 177,X00 280,000 $ 170,000 Net income 1/1 Retained earnings $ 546,400 $ 230,000 Net income 177,200 170,000 Dividends declared (90,000) $ 633,600 (60,000) $ 340,000 12/31 Retained earnings Cash $ 70,000 $ 65,000 Accounts receivable 260,(00 190,000 Inventory Investment in Salem Company 240,000 175,000 925,600 Land 320,000 Plant and equipment 360,000 280,000 Total assets $1.855,600 $1.030,000 Accounts payabke $ 132,(00 $ 110,000 Notes payabke Capital stock Retained camings 90,000 30,000 1,000,000 550,000 633,600 340,000 Total liabilities and equity $1,855,600 $1.030,000

> At the date of an 80% acquisition, a subsidiary had common stock of $100,000 and retained earnings of $16,250. Seven years later, at December 31, 2015, the subsidiary’s retained earnings had increased to $461,430. What adjustment will be made on the cons

> Define: Consolidated net income; consolidated retained earnings.

> How is the income reported by the subsidiary reflected on the books of the investor under each of the methods of accounting for investments?

> How are dividends declared and paid by a subsidiary during the year eliminated in the consolidated workpapers under each method of accounting for investments?

> How are liquidating dividends treated on the books of an investor, assuming the investor uses the cost method? Assuming the investor uses the equity method?

> Identify two types of temporary differences that may arise in the consolidated financial statements when the affiliates file separate income tax returns. (See online appendix 4B available at www.wiley.com/college/jeter)

> The FASB elected to require that deferred tax effects relating to unrealized intercompany profits be calculated based on the income tax paid by the selling affiliate rather than on the future tax benefit to the purchasing affiliate. Describe circumstance

> What assumptions must be made about the realization of undistributed subsidiary income when the affiliates file separate income tax returns? Why? (See online appendix 4B available at www.wiley.com/college/jeter)

> What do potential voting rights refer to, and how do they affect the application of the equity method for investments under IFRS? Under U.S. GAAP? What is the term generally used for equity method investments under IFRS?

> On April 1, Year 1, Company P purchased 85% of S Company for total consideration of $357,000, which included $30,000 of contingent consideration as measured according to GAAP at fair value. Each company has a December 31 year-end. The cost method is used

> In the preparation of a consolidated statement of cash flows, what adjustments are necessary because of the existence of a noncontrolling interest? (AICPA adapted)

> A principal limitation of consolidated financial statements is their lack of separate financial information about the assets, liabilities, revenues, and expenses of the individual companies included in the consolidation. Identify some problems that the r

> What effect does a noncontrolling interest have on the amount of intercompany receivables and payables eliminated on a consolidated balance sheet?

> What effect do subsidiary treasury stock holdings have at the time the subsidiary is acquired? How should the treasury stock be treated on consolidated work papers?

> Define noncontrolling (minority) interest. List three methods that might be used for reporting the noncontrolling interest in a consolidated balance sheet, and state which is preferred under current GAAP.

> What aspects of control must exist before a subsidiary is consolidated?

> Why is it often necessary to prepare separate financial statements for each legal entity in a consolidated group even though consolidated statements provide a better economic picture of the combined activities?

> What is the justification for preparing consolidated financial statements when, in fact, it is apparent that the consolidated group is not a legal entity?

> Current rules require that a deferred tax asset or liability be recognized for likely differences between the reported values and tax bases of assets and liabilities recognized in business combinations (for example, in exchanges that are nontaxable to

> What are the advantages of acquiring the majority of the voting stock of another company rather than acquiring all its voting stock?

> The consolidated income statement for the year December 31, 2014, and comparative balance sheets for 2013 and 2014 for Parks Company and its 90% owned subsidiary SCR, Inc. are as follows: SCR, Inc. declared and paid an $8,000 dividend during 2014. Requ

> What is the difference between net income, or earnings, and comprehensive income?

> How does the FASB’s conceptual framework influence the development of new standards?

> Is the economic entity or the parent concept more consistent with the principles addressed in the FASB’s conceptual framework? Explain your answer.

> Under the economic entity concept, the net assets of the subsidiary are included in the consolidated financial statements at the total fair value that is implied by the price paid by the parent company for its controlling interest. What practical or conc

> Contrast the consolidated effects of the parent company concept and the economic entity concept in terms of: (a) The treatment of noncontrolling interests. (b) The elimination of intercompany profits. (c) The valuation of subsidiary net assets in the con

> Describe the difference between the economic entity concept and the parent company concept approaches to the reporting of subsidiary assets and liabilities in the consolidated financial statements on the date of the acquisition.

> Explain the difference between an accretive and a dilutive acquisition.

> Explain the potential advantages of a stock acquisition over an asset acquisition.

> Define some defensive measures used by target firms to avoid a takeover. Are these measures beneficial for shareholders?

> Give several reasons why a parent company would be willing to pay more than book value for subsidiary stock acquired.

> A consolidated income statement for 2013 and comparative consolidated balance sheets for 2012 and 2013 for P Company and its 80% owned subsidiary follow: Other information: 1. Equipment depreciation was $95,000. 2. Equipment was purchased during the

> When contingent consideration in an acquisition is based on the acquirer issuing its shares to the seller, how should this contingency be reflected on the acquisition date?

> Distinguish among a statutory merger, a statutory consolidation, and a stock acquisition.

> AOL announced that because of an accounting change (FASB Statements Nos. 141R [ASC 805] and 142 [ASC 350]), earnings would be increasing over the next 25 years by $5.9 billion a year. What change(s) required by FASB (in SFAS Nos. 141R and 142) resulted i

> How would a company determine whether goodwill has been impaired?

> List four advantages of a business combination as compared to internal expansion.

> Distinguish between internal and external expansion of a firm.

> On January 1, 2014, Pump Company acquired all the outstanding common stock of Sound Company for $556,000 in cash. Financial data relating to Sound Company on January 1, 2014, are presented here: Sound Company would expect to pay 10% interest to borrow

> Patten Corporation acquired an 85% interest in Savage Company for $3,100,000 on January 1, 2014. On this date, the balances in Savage Company’s capital stock and retained earnings accounts were $2,000,000 and $700,000, The remaining use

> On January 1, 2014, Pueblo Corporation purchased a 75% interest in Sanchez Company for $900,000. A summary of Sanchez Company’s balance sheet at date of purchase follows: The equipment had an original life of 15 years and remaining us

> On January 1, 2014, Perini Company purchased an 85% interest in Silvas Company for $400,000. On this date, Silvas Company had common stock of $90,000 and retained earnings of $210,000. An examination of Silvas Company’s assets and liabi

> Pillow Company purchased 90% of the common stock of Satin Company on May 1, 2011, for a cash payment of $474,000. December 31, 2011, trial balances for Pillow and Satin were: Satin Company declared a $60,000 cash dividend on December 20, 2011, payable

> On January 1, 2014, Palmer Company acquired a 90% interest in Stevens Company at a cost of $1,000,000. At the purchase date, Stevens Company’s stockholders’ equity consisted of the following: Common stock â€

> On January 1, 2013, Porter Company purchased an 80% interest in the capital stock of Salem Company for $850,000. At that time, Salem Company had capital stock of $550,000 and retained earnings of $80,000. Differences between the fair value and the book v

> Perke Corporation purchased 80% of the stock of Superstition Company for $1,970,000 on January 1, 2015. On this date, the fair value of the assets and liabilities of Superstition Company was equal to their book value except for the inventory and equipmen

> On January 1, 2014, Paxton Company purchased a 70% interest in Sagon Company for $1,300,000, at which time Sagon Company had retained earnings of $500,000 and capital stock of $1,000,000. On January 1, 2014, the fair value of the assets and liabilities o

> The Mcquire Company is considering acquiring 100% of the Sosa Company. The management of Mcquire fears that the acquisition price may be too high. Condensed financial statements for Sosa Company for the current year are as follows: You believe that Sos

> On January 1, 2014, Palmer Company acquired a 90% interest in Stevens Company at a cost of $1,000,000. At the purchase date, Stevens Company’s stockholders’ equity consisted of the following: Common stock â€

> On January 1, 2012, Push Company purchased an 80% interest in the capital stock of Way-Down Company for $820,000. At that time, WayDown Company had capital stock of $500,000 and retained earnings of $100,000. Differences between the fair value and the bo

> On January 2, 2014, Press Company purchased on the open market 90% of the outstanding common stock of Sensor Company for $800,000 cash. Balance sheets for Press Company and Sensor Company on January 1, 2014, just before the stock acquisition by Press Com

> (Note that this is the same problem as Problem 5-5, but assuming the use of the partial equity method.) On January 1, 2014, Palmer Company acquired a 90% interest in Stevens Company at a cost of $1,000,000. At the purchase date, Stevens Companyâ

> Punca Company purchased 85% of the common stock of Surrano Company on July 1, 2012, for a cash payment of $590,000. December 31, 2012, trial balances for Punca and Surrano were: Surrano Company declared a $50,000 cash dividend on December 20, 2012, pay

> (Note that this is the same problem as Problem 5-4, but assuming the use of the partial equity method.) On January 1, 2013, Porter Company purchased an 80% interest in the capital stock of Salem Company for $850,000. At that time, Salem Company had capit

> Pearson Company purchased a 100% interest in Sanders Company and a 90% interest in Taylor Company on January 2, 2014, for $800,000 and $1,300,000, respectively. The account balances and fair values of the acquired companies on the acquisition date were a

> On January 1, 2014, Palmero Company purchased an 80% interest in Santos Company for $2,800,000, at which time Santos Company had retained earnings of $1,000,000 and capital stock of $500,000. On the date of acquisition, the fair value of the assets and l

> (This is a continuation of Problem 4-21) Pequity Company purchased 85% of the common stock of Sequity Company on April 1, Year 1 for total consideration of $545,000 cash plus $50,000 of contingent consideration as measured according to GAAP at fair value

> (This is a continuation of Problem 4-20.) Pcost Company purchased 85% of the common stock of Scost Company on April 1, Year 1 for total consideration of $545,000 cash plus $50,000 of contingent consideration as measured according to GAAP at fair value.

> On January 1, 2015, Pruitt Company issued 25,500 shares of its common stock ($2 par) in exchange for 85% of the outstanding common stock of Shah Company. Pruitt’s common stock had a fair value of $28 per share at that time. Pruitt Compa

> Balance sheets for Prego Company and Sprague Company as of December 31, 2013, follow: The fair values of Sprague Company’s assets and liabilities are equal to their book values. Required: Prepare a consolidated balance sheet as of

> On July 31, 2014, Ping Company purchased 90% of Santos Company’s common stock for $2,010,000 cash. Immediately after the acquisition, the two companies’ balance sheets were as follows: Santos Company has not yet rec

> On January 1, 2014, Pat Company purchased 90% of the outstanding common stock of Solo Company for $236,000 cash. The balance sheet for Pat Company just before the acquisition of Solo Company stock, along with the consolidated balance sheet prepared at th

> On January 2, 2014, Phillips Company purchased 80% of Sanchez Company and 90% of Thomas Company for $225,000 and $168,000, respectively. Immediately before the acquisitions, the balance sheets of the three companies were as follows: The note receivab

> (Note that this problem is the same as Problem 4-9, but assuming the use of the partial equity method.) December 31, 2014, trial balances for Pledge Company and its subsidiary Stom Company follow: Pledge Company purchased 72,000 shares of Stom Company&

> Balance sheets for P Company and S Company on August 1, 2014, are as follows: Required: Prepare a workpaper for a consolidated balance sheet for P Company and its subsidiary on August 1, 2014, taking into consideration the following: 1. P Company acqui

> On January 1, 2014, Perry Company purchased 8,000 shares of Soho Company’s common stock for $120,000. Immediately after the stock acquisition, the statements of financial position of Perry and Soho appeared as follows: Required: A. Ca

> The two following separate cases show the financial position of a parent company and its subsidiary company on November 30, 2014, just after the parent had purchased 90% of the subsidiary’s stock: Required: A. Prepare a November 30, 2

> On January 1, 2015, Pruitt Company issued 25,500 shares of its common stock in exchange for 85% of the outstanding common stock of Shah Company. Pruitt’s common stock had a fair value of $28 per share at that time (par value of $2 per s

> On January 1, 2015, Pope Company purchased 90% of Sun Company’s common stock for $5,800,000 cash. Immediately after the acquisition, the two companies’ balance sheets were as follows: Sun Company’s

> On February 1, 2014, Punto Company purchased 95% of the outstanding common stock of Sara Company and 85% of the outstanding common stock of Rob Company. Immediately before the two acquisitions, balance sheets of the three companies were as follows: The

> On January 1, 2015, Pruitt Company issued 30,000 shares of its $2 par value common stock for the net assets of Shah Company in a statutory merger accounted for as a purchase. Pruitt’s common stock had a fair value of $28 per share at th

> Spalding Company has offered to sell to Ping Company its assets at their book values plus $1,800,000 representing payment for goodwill. Operating data for 2013 for the two companies are as follows: Ping Company’s management estimates the f

> Balance sheets for Salt Company and Pepper Company on December 31, 2013, follow: Pepper Company tentatively plans to issue 30,000 shares of its $20 par value stock, which has a current market value of $37 per share net of commissions and other issue co

> Pham Company acquired the assets (except for cash) and assumed the liabilities of Senn Company on January 1, 2014, paying $720,000 cash. Senn Company’s December 31, 2013, balance sheet, reflecting both book values and fair values, showe

> On January 1, 2012, Parker Company purchased 90% of the outstanding common stock of Sid Company for $180,000. At that time, Sid’s stockholders’ equity consisted of common stock, $120,000; other contributed capital, $20

> On January 1, 2014, Perez Company acquired all the assets and assumed all the liabilities of Stalton Company and merged Stalton into Perez. In exchange for the net assets of Stalton, Perez gave its bonds payable with a maturity value of $600,000, a state

> Stockholders of Acme Company, Baltic Company, and Colt Company are considering alternative arrangements for a business combination. Balance sheets and the fair values of each company’s assets on October 1, 2014, were as follows: Acme

> Condensed balance sheets for Phillips Company and Solina Company on January 1, 2013, are as follows: On January 1, 2013, the stockholders of Phillips and Solina agreed to a consolidation. Because FASB requires that one party be recognized as the acquir

> A 90% interest in Saxton Corporation was purchased by Palm Incorporated on January 2, 2014. The capital stock balance of Saxton Corporation was $3,000,000 on this date, and the balance in retained earnings was $1,000,000. The cost of the investment to Pa

> Pascal Corporation purchased 90% of the stock of Salzer Company for $2,070,000 on January 1, 2015. On this date, the fair value of the assets and liabilities of Salzer Company was equal to their book value except for the inventory and equipment accounts.

> A 90% interest in Saxton Corporation was purchased by Palm Incorporated on January 2, 2014. The capital stock balance of Saxton Corporation was $3,000,000 on this date, and the balance in retained earnings was $1,000,000. The cost of the investment to Pa

> On January 1, 2013, Piper Company acquired an 80% interest in Sand Company for $2,276,000. At that time the capital stock and retained earnings of Sand Company were $1,800,000 and $700,000, respectively. Differences between the fair value and the book va

> On January 2, 2013, Page Corporation acquired a 90% interest in Salcedo Company for $3,500,000. At that time Salcedo Company had capital stock of $2,250,000 and retained earnings of $1,250,000. The book values of Salcedo Company’s assets and liabilities

> On January 1, 2013, Pam Company purchased an 85% interest in Shaw Company for $540,000. On this date, Shaw Company had common stock of $400,000 and retained earnings of $140,000. An examination of Shaw Company’s assets and liabilities r

> On October 1, 2015, Para Company purchased 90% of the outstanding common stock of Star Company for $210,000. Additional data concerning Star Company for 2015 follows: Common stock …………………………………………….$70,000 Other contributed capital……………………………….. 30,000

> (Note that this is the same problem as Problem 4-7, but assuming the use of the partial equity method.) Price Company purchased 90% of the outstanding common stock of Score Company on January 1, 2011, for $450,000. At that time, Score Company had stockho

> On May 1, 2015, Peters Company purchased 80% of the common stock of Smith Company for $50,000. Additional data concerning these two companies for the years 2015 and 2016 are: Any difference between book value and the value implied by the purchase price

> Continue the situation in Exercise 4-6 and assume that during 2015 Sales Company earned $190,000 and declared and paid a $50,000 dividend. Required: A. Prepare the investment-related entries on Pert Company’s books for 2015. B. Prepare the workpaper elim

> On January 1, 2014, Pert Company purchased 85% of the outstanding common stock of Sales Company for $350,000. On that date, Sales Company’s stockholders’ equity consisted of common stock, $100,000; other contributed capital, $40,000; and retained earning

> On January 1, 2014, Plate Company purchased a 90% interest in the common stock of Set Company for $650,000, an amount $20,000 in excess of the book value of equity acquired. The excess relates to the understatement of Set Company’s land

> Poco Company purchased 85% of the outstanding common stock of Serena Company on December 31, 2014, for $310,000 cash. On that date, Serena Company’s stockholders’ equity consisted of the following: Common stock……………………………………………. $240,000 Other contribu

> At the beginning of 2009, Presidio Company purchased 95% of the common stock of Succo Company for $494,000. On that date, Succo Company’s stockholders’ equity consisted of the following: Common stock…………………………………………. $300,000 Other contributed capital

> Park Company purchased 90% of the stock of Salt Company on January 1, 2014, for $465,000, an amount equal to $15,000 in excess of the book value of equity acquired. This excess payment relates to an undervaluation of Salt Company’s land. On the date of p

> On January 1, 2014, Plenty Company purchased a 70% interest in the common stock of Set Company for $650,000, an amount $20,000 in excess of the book value of equity acquired. The excess relates to the understatement of Set Company’s lan

> Badco Inc. purchased a 90% interest in Lazytoo Company for $600,000 cash on January 1, 2016. Any excess of implied over book value was attributed to depreciable assets with a 15-year remaining life (straight-line depreciation). To help pay for the acquis

> The following accounts appeared in the separate financial statements at the end of 2014 for Pressing Inc. and its wholly-owned subsidiary, Stressing Inc. Stressing was acquired in 2009. Required: 1. How can you determine whether Pressing is using the c

> Poco Company purchased 80% of Solo Company’s common stock on January 1, 2012, for $250,000. On December 31, 2012, the companies prepared the following trial balances: Required: Prepare a consolidated statements workpaper on December

> Plantation Homes Company is considering the acquisition of Condominiums, Inc. early in 2015. To assess the amount, it might be willing to pay, Plantation Homes makes the following computations and assumptions. A. Condominiums, Inc. has identifiable asse

> This information relates to Rice Co. 1. On April 5, purchased merchandise from Jax Company for $28,000 on account. 2. On April 7, purchased equipment on account for $30,000. 3. On April 8, returned $3,600 of April 5 merchandise to Jax Company. 4. On Apri

> Barto Company provides this information for the month ended October 31, 2017: sales on credit $300,000, cash sales $150,000, sales discounts $5,000, and sales returns and allowances $19,000. Prepare the sales section of the income statement based on this