Question: Oak Ridge Garden Supplies uses a perpetual

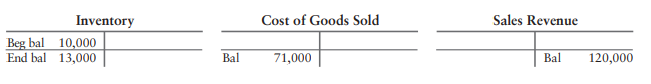

Oak Ridge Garden Supplies uses a perpetual inventory system. The company has these account balances at May 31, 2018, prior to making the year-end adjustments:

A year ago, the net realizable value of ending inventory was $11,500, which exceeded the cost of $10,000. Oak Ridge has determined that the net realizable value of the May 31, 2018, ending inventory is $12,000.

Requirement:

1. Prepare the company’s 2018 income statement through gross profit to show how the company would apply the lower-of-cost-or-market rule to its inventories.

> Use the Thompson Turf Trimmers data in Short Exercise 11-8 to calculate the following; enter all amounts in thousands. a. Payments to employees b. Payments of other expenses Data from 11-8:

> Use the Thompson Turf Trimmers data in Short Exercise 11-8 to calculate the following; enter all amounts in thousands. a. Collections from customers b. Payments for inventory Data from 11-8:

> On February 5, 2018, Festival Rental Corporation’s board of directors declared a dividend of $0.30, to be paid on March 18, 2018, to the shareholders of record as of the close of business on March 9, 2018. Festival has 5,000,000 shares of $0.01 par-value

> January 10, 2019, Mahlon Design Services purchased treasury stock at a cost of $26 million. On July 3, 2019, Mahlon resold some of the treasury stock for $11 million; this resold treasury stock had cost the company $4 million. Record the purchase and res

> The top management of Flashline Services examines the following company accounting records at July 29, immediately before the end of the year, July 31: Requirement: 1. Suppose Flashline’s management wants to achieve a current ratio of

> This short exercise demonstrates the similarity and the difference between two ways to acquire plant assets. Case A – Issue stock and buy the assets in separate transactions: Wolford Company issued 12,000 shares of its $35 par common stock for cash of $

> Attorney Kristen Maloney invoiced Dunn for $20,400 and has agreed to accept 1,500 shares of its $0.01 par-value common stock in full payment for this invoice. Dunn issued the common stock to Attorney Maloney on January 29. Record the stock-issuance trans

> At the end of fiscal year 2018, Hammond Legal Services and Delectable Doughnuts reported these adapted amounts on their balance sheets (all amounts in millions except for par value per share) Assume each company issued its stock in a single transaction.

> Saltwell Industries received $11,500,000 for the issuance of its stock on May 14. The par value of the Saltwell stock was only $11,500. Was the excess amount of $11,488,500 a profit to Saltwell? If not, what was it?Suppose the par value of the Saltwell s

> The statement of stockholders’ equity for Bailey Corporation follows. Use Bailey Corporation’s statement to answer these questions: 1. How much cash did the issuance of common stock bring in during 2018? 2. What was th

> Use the following statement of stockholders’ equity to answer the following questions about Flannery Corporation: 1. How much cash did the issuance of common stock bring in during 2018? 2. How much in dividends did Flannery declare duri

> During 2018, Smokey Corporation earned net income of $5.4 billion and paid off $2.5 billion of long-term notes payable. Smokey raised $1.1 billion by issuing common stock, paid $3.7 billion to purchase treasury stock, and paid cash dividends of $1.3 bill

> Zanzibar Corporation is conducting a special meeting of its board of directors to address some concerns raised by the stockholders. Stockholders have submitted the following questions. Answer each question. 1. What are the differences between common stoc

> Waketown Marina needs to raise $2.0 million to expand the company. The company is considering issuing either: ■ $2,000,000 of 6% bonds payable to borrow the money; or ■ 100,000 shares of common stock at $20 per share. Before any new financing, Waketown e

> Toyama Corporation’s 2018 financial statements reported the following information, with 2017 figures shown for comparison (adapted, and in millions): Use the DuPont model to calculate Toyama’s return on assets and re

> The Blue Heron Shop had the following inventory data: Company managers need to know the company’s gross profit percentage and rate of inventory turnover for 2018 under 1. FIFO. 2. LIFO. Which method produces a higher gross profit perc

> Petrov Gold, Inc., has the following stockholders’ equity: The company has not paid any preferred dividends for three years, including the current year. Calculate the book value per share of the company’s common stock

> The financial statements of Ridgeline Employment Services, Inc., reported the following accounts: Prepare the stockholders’ equity section of Ridgeline’s balance sheet. Net income has already been closed to Retained

> Hometown Bancshares has 40,000 shares of $3 par value common stock outstanding. Suppose Hometown declares and distributes a 5% stock dividend when the market value of its stock is $15 per share. 1. Journalize Hometown’s declaration and distribution of th

> Alloy Corporation has 25,000 shares of $1.40 preferred stock outstanding in addition to its common stock. The $1.40 designation means that the preferred stockholders receive an annual cash dividend of $1.40 per share. In 2018, Alloy declares an annual di

> Glenmore Corporation earned net income of $90,000 during the year ended December 31, 2018. On December 15, Glenwood declared the annual cash dividend on its 1% preferred stock (13,000 shares with total par value of $130,000) and a $0.45 per share cash di

> Use the amortization table that you prepared for Leon Corporation’s bonds in S9-8 to answer the following questions: 1. How much cash did Leon Corporation borrow on January 1, 2019? How much cash will Leon Corporation pay back at maturity? 2. How much ca

> Leon Corporation issued $400,000 of 10%, 10-year bonds payable on January 1, 2019. The market interest rate at the date of issuance was 8%, and the bonds pay interest semiannually (on June 30 and December 31). Leon Corporation’s year-end is June 30. 1. U

> Use the amortization table that you prepared for Pearce Corporation’s bonds in S9-6 to answer the following questions: 1. How much cash did Pearce Corporation borrow on March 31, 2019? How much cash will the company pay back at maturity on March 31, 2029

> Pearce Corporation issued $580,000 of 6%, 10-year bonds payable on March 31, 2019. The market interest rate at the date of issuance was 10%, and the bonds pay interest semiannually. Pearce Corporation’s year-end is March 31. 1. Using the PV function in E

> Windsor Company borrowed money by issuing $3,000,000 of 6% bonds payable at 102.9 on July 1, 2018. The bonds are five-year bonds and pay interest each January 1 and July 1. 1. How much cash did Windsor receive when it issued the bonds payable? Journalize

> Refer to the Data in E6-23A. Compute all ratio values to answer the following questions: â– Which company has the highest and which company has the lowest gross profit percentage? â– Which company has the highest and whi

> The present value of $3,000 at the end of seven years at 8% interest is a. $2,228. b. $1,749. c. $3,000. d. $15,618.

> Starlight Drive-Ins Ltd. borrowed money by issuing $5,000,000 of 7% bonds payable at 95.5 on July 1, 2018. The bonds are 10-year bonds and pay interest each January 1 and July 1. 1. How much cash did Starlight receive when it issued the bonds payable? Jo

> Yancy Corp. issued 6% seven-year bonds payable with a face amount of $110,000 when the market interest rate was 6%. Yancy’s fiscal year-end is December 31. The bonds pay interest on January 1 and July 1. Journalize the following transactions for Yancy. I

> Determine whether the following bonds payable will be issued at par value, at a premium, or at a discount. a. Evergreen Company issued bonds payable that pay stated interest of 61/4%. On the date of issuance, the market interest rate was 63/4%. b. Seven

> Regal, Inc., includes the following selected accounts in its general ledger at December 31, 2018: Prepare the liabilities section of Regal’s balance sheet at December 31, 2018, to show how the company would report these items. Report

> Examine the following selected financial information for The Deal Corporation and Simple Stores, Inc., as of the end of their fiscal years ending in 2018: 1. Complete the table, calculating all the requested information for the two companies. Use year

> Tolbert Plumbing Products Ltd. reported the following data in 2018 (in millions): Compute Tolbert’s leverage ratio, debt ratio, and times-interest-earned ratio, and write a sentence to explain what those ratio values mean. Use year-en

> Complete the following statements with one of the terms listed here. Commitment Finance lease Leverage ratio Debt ratio Income tax payable Operating lease Deferred income taxes payable Lessee Times-interest-earned ratio 1. The measures the proportion of

> Jamison Corporation has $300 million of debenture bonds outstanding that have an unamortized discount of $30 million. Lower interest rates convinced the company to pay off the bonds now by purchasing them on the market where the price of the bonds is 98.

> Inc., a motorcycle manufacturer, included the following note in its annual report: 1. Why are these contingent (versus real) liabilities? 2. In the United States, how can the contingent liability become a real liability for Martinson? What are the limi

> Employees every other Friday. December 31, 2017, was a Sunday. On Friday, January 5, 2018, Fitzgerald paid wages of $112,000, which covered the 14-day period from December 20, 2017, through January 2, 2018. Wages were earned evenly across all days, inclu

> Supply the missing income statement amounts for each of the following companies: Requirement: 1. Prepare the income statement for Sutherland Company for the year ended December 31, 2018. Use the cost-of-goods-sold model to compute cost of goods sold. S

> data given in S8-6. What amount of warranty expense will North Boulder USA report during 2018? Which accounting principle addresses this situation? Does the warranty expense for the year equal the year’s cash payments for warranties? Explain the relevant

> North Boulder USA, a tire manufacturer, guarantees its tires against defects for five years or 60,000 miles, whichever comes first. Suppose North Boulder USA can expect warranty costs during the five-year period to add up to 3% of sales. Assume that a No

> Authority purchased inventory costing $25,000 by signing a 12%, six-month, short-term note payable. The purchase occurred on January 1, 2018. Jamison will pay the entire note (principal and interest) on the note’s maturity date of July 1, 2018. Journaliz

> Franklin Company purchased inventory costing $90,000 by signing an 8%, nine-month, short-term note payable. Franklin will pay the entire note (principal and interest) on the note’s maturity date. Journalize the company’s (a) purchase of inventory (b)

> Corporation’s accounts payable at the beginning of the most recent year was $50,000. At the end of the year, the accounts payable balance was $54,000. Landy’s sales revenue for the year was $3,105,000, while its cost of goods sold for the year was $1,508

> On Willow Grove Department Stores’ most recent balance sheet, the balance of its inventory at the beginning of the year was $12,000. At the end of the year, the inventory balance was $14,500. During that year, its cost of goods sold was $55,000. All purc

> Identify the current liability associated with each of the following operating activities: 1. Perform work on a warranty claim 2. Pay income taxes 3. Purchase supplies 4. Pay payroll taxes 5. Borrow money for operations using a short-term note 6. Process

> Grafton Company purchased a new car for use in its business on January 1, 2017. It paid $29,000 for the car. Grafton expects the car to have a useful life of four years with an estimated residual value of zero. Grafton expects to drive the car 40,000 m

> Grafton Company purchased a new car for use in its business on January 1, 2017. It paid $29,000 for the car. Grafton expects the car to have a useful life of four years with an estimated residual value of zero. Grafton expects to drive the car 40,000 m

> Grafton Company purchased a new car for use in its business on January 1, 2017. It paid $29,000 for the car. Grafton expects the car to have a useful life of four years with an estimated residual value of zero. Grafton expects to drive the car 40,000 mil

> This exercise uses the Northeast data from S7-5. Assume Northeast is trying to decide which depreciation method to use for income tax purposes. The company can choose from among the following methods: (a) straight-line, (b) units-of-production, or (c) do

> On January 1, 2017, Northeast Transportation Company purchased a used aircraft at a cost of $58,900,000. Northeast expects the plane to remain useful for five years (7,200,000 miles) and to have a residual value of $4,900,000. Northeast expects to fly

> LimeBike, located in San Mateo, California, is a startup founded in 2017. Its mission is to make shared bicycles accessible and affordable. The company has taken the basic idea of shared bicycles and eliminated the need to return the bike to a docking

> Identify each of the following items as a capital expenditure, an immediate expense, or neither. 1. Constructed a new parking lot on leased property for $300,000. 2. Paid property taxes of $75,000 for the first year a new administrative services building

> During 2018, Silverspring Systems, Inc., purchased two other companies for $10 million in cash. Also during 2018, Silverspring made capital expenditures of $8.6 million in cash to expand its market share. During the year, Silverspring sold its North Amer

> Oscar Optical Corporation provides a full line of designer eyewear to consumers. Oscar reported the following information for 2018 and 2017: Compute return on assets (ROA) for 2018 and 2017. Using the DuPont model, identify the components and state whe

> Lexington Garden Supply pays $280,000 for a group purchase of land, building, and equipment. At the time of acquisition, the land has a current market value of $124,000, the building’s current market value is $31,000, and the equipment’s current market v

> In 2018, Ambrosia Corporation LO 7reported $100 million in sales, $18 million in net income, and average total assets of $200 million. What is Ambrosia’s return on assets in 2018?

> For each of the following scenarios, indicate whether a long-term asset has been impaired (Y for yes and N for no) and, if so, the amount of the loss that should be recorded.

> Munchies, Inc., dominates the snack-food industry with its Salty Chip brand. Assume that Munchies purchased Sweet Snacks Company for $5.4 million cash. The market value of Sweet Snacks’ assets is $10 million, and Sweet Snacks has liabilities with a marke

> Suppose a Walmart store in Fillmore, Missouri, ended January 2018 with 900,000 units of merchandise that cost $5 each. Suppose the store then sold 50,000 units for $510,000 during February. Further, assume the store made two large purchases during Februa

> Jackson Petroleum, a giant oil company, holds reserves of oil and gas assets. At the end of 2018, assume the cost of Jackson’s oil reserves totaled $180 billion, representing 10 billion barrels of oil in the ground. 1. Which depreciation method is simila

> On January 1, 2017, Worldwide Manufacturing purchased a machine for $810,000 that it expected to have a useful life of four years. The company estimated that the residual value of the machine was $50,000. Worldwide Manufacturing used the machine for tw

> Fun Town Amusement Park paid $500,000 for a concession stand. Fun Town started out depreciating the building using the straight-line method over 25 years with a residual value of zero. After using the concession stand for four years, Fun Town determines

> Assume that on September 30, 2017, EuroAir, an international airline based in Germany, purchased a Jumbo aircraft at a cost of €45,000,000 (€ is the symbol for the euro). EuroAir expects the plane to remain useful for four years (4,000,000 miles) and to

> FlavorRite purchased a used van for use in its business on January 1, 2017. It paid $17,000 for the van. FlavorRite expects the van to have a useful life of four years, with an estimated residual value of $1,400. FlavorRite expects to drive the van 16,

> FlavorRite purchased a used van for use in its business on January 1, 2017. It paid $17,000 for the van. FlavorRite expects the van to have a useful life of four years, with an estimated residual value of $1,400. FlavorRite expects to drive the van 16,

> FlavorRite purchased a used van for use in its business on January 1, 2017. It paid $17,000 for the van. FlavorRite expects the van to have a useful life of four years, with an estimated residual value of $1,400. FlavorRite expects to drive the van 16,

> Examine the excerpt of a footnote from Albrecht Corporation’s September 30, 2018, annual report to follow. 1. What are Albrecht’s largest two categories of property and equipment as of September 30, 2018? Describe in

> Using the LIFO method, calculate the cost of ending inventory and cost of goods sold for Sandy Corporation.

> Using the FIFO method, calculate the cost of ending inventory and cost of goods sold for Sandy Corporation.

> Woody’s specializes in sound equipment. Company records indicate the following data for a line of speakers: Requirements: 1. Determine the amounts that Woody’s should report for cost of goods sold and ending inventory

> Using the average-cost method, calculate the cost of ending inventory and cost of goods sold for Sandy Corporation.

> This exercise should be used in conjunction with S6-4. Carson Print Supplies, Inc., is a corporation subject to a 25% income tax. Compute the company’s income tax expense under the average-cost, FIFO, and LIFO inventory costing methods.

> Carson Print Supplies, Inc., sells laser printers and supplies. Assume Carson started the year with 100 containers of ink (average cost of $8.90 each, FIFO cost of $9.00 each, LIFO cost of $7.80 each). During the year, the company purchased 800 container

> Beavercreek Company sold 14,000 jars of its organic honey in the most current year for $15 per jar. The company had paid $10.50 per jar of honey. (Assume that sales returns are nonexistent.) Calculate the following: 1. Sales revenue 2. Cost of goods so

> Beavercreek Company sold 14,000 jars of its organic honey in the most current year for $15 per jar. The company had paid $10.50 per jar of honey. (Assume that sales returns are nonexistent.) Calculate the following: 1. Sales revenue 2. Cost of goods so

> Here is the original schedule of cost of goods sold for Talladega Company for the years of 2016 through 2019: During the preparation of its 2019 financial statements, Talladega Company discovered that its 2017 ending inventory was understated by $400. M

> Warner Supply’s $3.5 million cost of inventory at the end of last year was understated by $1.9 million. 1. Was last year’s reported gross profit of $3.1 million overstated, understated, or correct? What was the correct amount of gross profit last year?

> Volcano Technology began the year with inventory of $275,000 and purchased $1,850,000 of goods during the year. Sales for the year are $2,600,000, and Volcano Technology’s gross profit percentage is 40% of sales. Compute Volcano Technology’s estimated co

> Fairbanks Company made sales of $24,600 million during 2018. Cost of goods sold for the year totaled $9,840 million. At the end of 2017, Fairbanks’ inventory stood at $1,000 million, and Fairbanks ended 2018 with inventory of $1,400 million. Compute Fair

> It is December 31, the end of the year, and the controller of Reed Corporation is applying the lowerof-cost-or-market (LCM) rule to inventories. Before any year-end adjustments, the company reports the following data: Reed determines that the net realiz

> Selma Company’s inventory records for the most recent year contain the following data:

> Jasmine Corporation purchased inventory costing $125,000 and sold 75% of the goods for $163,750. All purchases and sales were on account. Jasmine later collected 25% of the accounts receivable. Assume that sales returns are nonexistent. 1. Journalize th

> Using the data from E-S-15, make the adjusting entries that Glimmer Pools would need to make on December 31, 2018, related to the investment in AKL bonds. How would the bonds be reported on Glimmer Pools’ balance sheet as of December 31, 2018? What amoun

> Glimmer Pools purchased $50,000 of 7% AKL bonds on January 1, 2018, at a price of 104.2 when the market rate of interest was 6%. Glimmer intends to hold the bonds until their maturity date of January 1, 2023. The bonds pay interest semiannually on each J

> Using the data from E-S-12, make the adjusting entries that Brackett Insurance would need to make on December 31, 2018, related to the investment in AMS bonds. How would the bonds be reported on Brackett Insurance’s balance sheet as of December 31, 2018?

> Using the data from E-S-12, calculate the amount of discount amortization (using the straight-line amortization method) on July 1, 2018, and record the related journal entry. What is the total interest revenue for the first six months of 2018? (Hint: in

> Brackett Insurance purchased $60,000 of 10% AMS bonds on January 1, 2018, at a price of 85 when the market rate of interest was 12%. Brackett intends to hold the bonds until their maturity date of January 1, 2038. The bonds pay interest semiannually on e

> On January 1, 2018, Downtown Industries purchased $8,000 of 4% JMK bonds at a price of 100 (par). Downtown intends to hold the bonds until their maturity date of January 1, 2021. The bonds pay interest semiannually on each January 1 and July 1. Record th

> McGee Leasing leased a car to a customer. McGee will receive $300 a month, at the end of each month, for 36 months. Use the PV function in Excel® to calculate the answers to the following questions 1. What is the present value of the lease if the annual

> Use the data given in E-S-8. On January 1, 2019, Western Motors sold half of its investment in Yaza Motors. The sale price was $135 million. Calculate Western Motors’ gain or loss on the sale. Data from E-S-8: On January 1, 2018, Western Motors paid $4

> On January 1, 2018, Western Motors paid $450 million for a 40% investment in Yaza Motors. Yaza earned net income of $65 million and declared and paid cash dividends of $45 million during 2018. 1. What method should Western Motors use to account for the

> Use the data for Griffin Company in E6-16A to illustrate Griffin’s income tax advantage from using LIFO over FIFO. Sales revenue is $8,000, operating expenses are $2,000, and the income tax rate is 30%. How much in taxes would Griffin Company save by usi

> Use the data given in E-S-6. On May 21, 2019, Athens Company sold its investment in Technomite stock for $28 per share. 1. Journalize the sale. No explanation is required. 2. How does the gain or loss you recorded differ from the gain or loss recorded on

> For an investment to be classified as a current asset, a. the investment must be easily convertible to cash. b. the investor must intend to convert the investment to cash within one year or current operating cycle, whichever is longer, or use it to pay a

> Notes payable due in six months are reported as a. current liabilities on the balance sheet. b. current liabilities on the income statement. c. contra-assets on the income statement. d. long-term liabilities on the balance sheet.

> A company with high earnings quality is more likely to experience than a company with low earnings quality. a. low revenue levels in the future b. increasing operating expenses, compared to sales, in the future c. high earnings in the future d. low earn

> The quality of earnings concept indicates that a. stockholders want the corporation to earn enough income to be able to pay its debts. b. net income is the best measure of the results of operations. c. continuing operations and one-time transactions are

> Book value per share1 of Orlando Medical’s common stock outstanding at December 31, 2018, was a. 137.9. b. $35,147. c. $2.99. d. 20.1

> How many shares of common stock did Orlando Medical have outstanding, on average, during 2018? (Hint: Calculate earnings per share.) a. 137.9 million b. 1,880 million c. 20.1 million d. 35,147 million