Question: On April 1, 20Y7, Maria Adams established

On April 1, 20Y7, Maria Adams established Custom Realty. Maria completed the following transactions during the month of April:

a. Opened a business bank account with a deposit of $24,000 from personal funds.

b. Paid rent on office and equipment for the month, $3,600.

c. Paid automobile expenses (including rental charge) for the month, $1,350, and miscellaneous expenses, $600.

d. Purchased office supplies on account, $1,200.

e. Earned sales commissions (revenue) from selling real estate, receiving cash, $19,800.

f. Paid creditor on account, $750.

g. Paid office salaries, $2,500.

h. Withdrew cash for personal use, $3,500.

i. Determined that the cost of supplies on hand was $300; therefore, the cost of supplies used was $900.

Instructions:

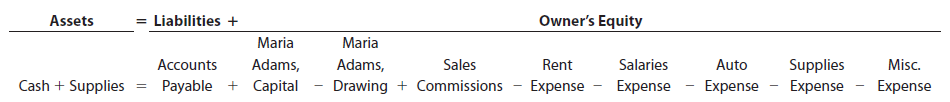

1. Indicate the effect of each transaction and the balances after each transaction, using the following tabular headings:

2. Prepare an income statement for April, a statement of owner’s equity for April, and a balance sheet as of April 30.

> The following accounts appear in an adjusted trial balance of Carbinaro Consulting. Indicate whether each account would be reported as (a) A current asset; (b) Property, plant, and equipment; (c) A current liability; (d) A long-term liability; or (e) Own

> Ava Marie Rowland owns and operates Road Runner Delivery Services. On January 1, 20Y3, Ava Marie Rowland, Capital had a balance of $781,000. During the year, Ava Marie made no additional investments and withdrew $19,000. For the year ended December 31, 2

> Identify the permanent accounts from the following accounts: Cash; Chris Hawkins, Drawing; Fees Earned; Office Equipment; Wages Expense.

> Cyrus Bautista owns and operates Aquarius Advertising Services. On January 1, 20Y3, Cyrus Bautista, Capital had a balance of $471,900. During the year, Cyrus invested an additional $72,000 and withdrew $17,000. For the year ended December 31, 20Y3, Aquar

> Current assets and current liabilities for Sandstone Company follow: a. Determine the working capital and current ratio for 20Y9 and 20Y8. b. Is the change in the current ratio from 20Y8 to 20Y9 favorable or unfavorable?

> Current assets and current liabilities for Konex Properties Company follow: a. Determine the working capital and current ratio for 20Y9 and 20Y8. b. Is the change in the current ratio from 20Y8 to 20Y9 favorable or unfavorable?

> On August 1, 20Y1, Newhouse Co. received $13,200 for the rent of land for 12 months. Journalize the adjusting entry (include an explanation) required for unearned rent on December 31, 20Y1.

> Silver Star Realty Co. pays weekly salaries of $16,200 on Friday for a five-day workweek ending on that day. Journalize the necessary adjusting entry (include an explanation) assuming that the accounting period ends on Tuesday.

> Blue Ocean Realty Co. pays weekly salaries of $33,300 for a six-day workweek (Monday through Saturday). Journalize the necessary adjusting entry (include an explanation) assuming that the accounting period ends on Thursday.

> At the end of the current year, $27,480 of fees have been earned but have not been billed to clients. Journalize the adjusting entry (include an explanation) to record the accrued fees.

> At the end of the current year, $18,540 of fees have been earned but have not been billed to clients. Journalize the adjusting entry (include an explanation) to record the accrued fees.

> Two income statements for Versatile Company follow: a. Prepare a vertical analysis of Versatile Company’s income statements. b. Does the vertical analysis indicate a favorable or an unfavorable change?

> Two income statements for Upward Company follow: a. Prepare a vertical analysis of Upward Company’s income statements. b. Does the vertical analysis indicate a favorable or an unfavorable change?

> Pauline Emm is the owner and operator of Power Thoughts, a motivational consulting business. At the end of its accounting period, December 31, 20Y8, Power Thoughts has assets of $382,000 and liabilities of $94,000. Using the accounting equation, determin

> For each of the following errors, considered individually, indicate whether the error would cause the adjusted trial balance totals to be unequal. If the error would cause the adjusted trial balance totals to be unequal, indicate whether the debit or cre

> For each of the following errors, considered individually, indicate whether the error would cause the adjusted trial balance totals to be unequal. If the error would cause the adjusted trial balance totals to be unequal, indicate whether the debit or cre

> For the year ending August 31, Solstice Medical Co. mistakenly omitted adjusting entries for (1) Depreciation of $8,400, (2) Fees earned that were not billed of $64,400, and (3) Accrued wages of $10,600. Indicate the effect of the errors on (a) Revenues,

> For the year ending April 30, Safeguard Medical Services Co. mistakenly omitted adjusting entries for (1) $1,700 of supplies that were used, (2) Unearned revenue of $8,000 that was earned, and (3) Insurance of $10,900 that expired. Indicate the effect of

> The estimated amount of depreciation on a building for the current year is $8,120. Journalize the adjusting entry (include an explanation) to record the depreciation.

> The estimated amount of depreciation on equipment for the current year is $14,400. Journalize the adjusting entry (include an explanation) to record the depreciation.

> The supplies account had a beginning balance of $4,085 and was debited for $7,810 for supplies purchased during the year. Journalize the adjusting entry (include an explanation) required at the end of the year, assuming the amount of supplies on hand is

> The prepaid insurance account had a beginning balance of $6,800 and was debited for $25,100 of premiums paid during the year. Journalize the adjusting entry (include an explanation) required at the end of the year, assuming the amount of unexpired insura

> The balance in the unearned fees account, before adjustment at the end of the year, is $316,290. Journalize the adjusting entry (include an explanation) required if the amount of unearned fees at the end of the year is $220,240.

> On July 1, the cash account balance was $42,830. During July, cash payments totaled $132,500 and the July 31 balance was $33,850. Determine the cash receipts during July.

> Why are most large companies like Microsoft, PepsiCo, Caterpillar, and AutoZone organized as corporations?

> Prepare a journal entry on June 30 for the withdrawal of $9,500 by Claire Hope for personal use.

> Prepare a journal entry on December 23 for the withdrawal of $27,000 by Graeme Schneider for personal use.

> Prepare a journal entry on August 13 for cash received for services rendered, $7,480.

> Prepare a journal entry on April 30 for fees earned on account, $12,980.

> Assume that you recently accepted a position with Five Star National Bank & Trust as an assistant loan officer. As one of your first duties, you have been assigned the responsibility of evaluating a loan request for $300,000 from West Gate Auto Co.,

> Your friend, Daniel Nat, recently began work as the lead accountant for Asheville Company. Daniel prepared the following balance sheet for December 31, 20Y4: Write a brief memo to Daniel explaining the errors in the Asheville Company balance sheet and t

> In teams, select two public companies of different industries that interest you. Obtain each company’s most recent annual report on Form 10-K. The Form 10-K is a company’s annually required filing with the Securities and Exchange Commission (SEC). It inc

> Suzi Nomro operates Watercraft Supply Company, an online boat parts distributorship that is in its third year of operation. The following income statement was prepared for the year ended October 31, 20Y2. 2/15, n/30 and by shipping all merchandise FOB s

> In teams, select a public company that interests you. Obtain the company’s most recent annual report on Form 10-K. The Form 10-K is a company’s annually required filing with the Securities and Exchange Commission (SEC). It includes the company’s financia

> Daryl Kirby opened Squid Realty Co. on January 1, 20Y7. At the end of the first year, the business needed additional capital. On behalf of Squid Realty Co., Daryl applied to Ocean National Bank for a loan of $375,000. Based on Squid Realty Co.’s financia

> The general merchandise retail industry has a number of segments represented by the following companies: For a recent year, the following cost of merchandise sold and beginning and ending inventories have been provided from corporate annual reports (in

> Prepare a journal entry for the purchase of office supplies on September 30 for $1,900, paying $600 cash and the remainder on account.

> Target Corp. sells merchandise primarily through its retail stores. On the other hand, Amazon .com uses its e-commerce services, features, and technologies to sell its products through the Internet. Recent balance sheet inventory disclosures for Target a

> On April 18, 20Y1, Bontanica Company, a garden retailer, purchased $9,800 of seed, terms 2/10, n/30, from Whitetail Seed Co. Even though the discount period had expired, Shelby Davey subtracted the discount of $196 when he processed the documents for pay

> Cory Neece is planning to manage and operate Eagle Caddy Service at Canyon Lake Golf and Country Club during June through August 20Y9. Cory will rent a small maintenance building from the country club for $500 per month and will offer caddy services, inc

> Several years ago, your brother opened Magna Appliance Repairs. He made a small initial investment and added money from his personal bank account as needed. He withdrew money for living expenses at irregular intervals. As the business grew, he hired an a

> On January 1, 20Y8, Dr. Marcie Cousins established Health-Wise Medical, a medical practice organized as a proprietorship. The following conversation occurred the following August between Dr. Cousins and a former medical school classmate, Dr. Avi Abu, at

> Peyton Smith enjoys listening to all types of music and owns countless CDs. Over the years, Peyton has gained a local reputation for knowledge of music from classical to rap and the ability to put together sets of recordings that appeal to all ages. Duri

> The unadjusted trial balance of PS Music as of July 31, 20Y9, along with the adjustment data for the two months ended July 31, 20Y9, are shown in Chapter 3. Based upon the adjustment data, the following adjusted trial balance was prepared: Instructions:

> The unadjusted trial balance that you prepared for PS Music at the end of Chapter 2 should appear as follows: The data needed to determine adjustments are as follows: • During July, PS Music provided guest disc jockeys for KXMD for a t

> The transactions completed by PS Music during June 20Y9 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business’s operations: July 1. Peyton Smith made an additiona

> Palisade Creek Co. is a merchandising business that uses the perpetual inventory system. The account balances for Palisade Creek Co. as of May 1, 20Y7 (unless otherwise indicated), are as follows: During May, the last month of the fiscal year, the follo

> Prepare a journal entry for the purchase of office equipment on February 19 for $14,800 paying $3,600 cash and the remainder on account.

> Tech Support Services has the following unadjusted trial balance as of January 31, 20Y8: The debit and credit totals are not equal as a result of the following errors: a. The cash entered on the trial balance was overstated by $8,000. b. A cash receipt

> Jose Loder established Bronco Consulting on August 1, 20Y2. The effect of each transaction and the balances after each transaction for August follow: Instructions: 1. Prepare an income statement for the month ended August 31, 20Y2. 2. Prepare a statemen

> The amounts of the assets and liabilities of Wilderness Travel Service at April 30, 20Y5, the end of the year, and its revenue and expenses for the year follow. The capital of Harper Borg, owner, was $180,000 at May 1, 20Y4, the beginning of the year, an

> Last Chance Company offers legal consulting advice to prison inmates. Last Chance Company prepared the end-of-period spreadsheet shown at the top of the following page at June 30, 20Y1, the end of the fiscal year. Instructions: 1. Prepare an income stat

> The beginning inventory for Rhodes Co. and data on purchases and sales for a three-month period are shown in Problem 7-1B. Instructions: 1. Determine the inventory on June 30 and the cost of merchandise sold for the three-month period, using the first-i

> The beginning inventory for Rhodes Co. and data on purchases and sales for a three month period are shown in Problem 7-1B. Instructions: 1. Record the inventory, purchases, and cost of merchandise sold data in a perpetual inventory record similar to the

> The beginning inventory for Rhodes Co. and data on purchases and sales for a three month period are shown in Problem 7-1B. Instructions: 1. Record the inventory, purchases, and cost of merchandise sold data in a perpetual inventory record similar to the

> The beginning inventory of merchandise at Rhodes Co. and data on purchases and sales for a three-month period ending June 30 are as follows: Instructions: 1. Record the inventory, purchases, and cost of merchandise sold data in a perpetual inventory rec

> Selected accounts and related amounts for Kanpur Co. for the fiscal year ended June 30, 20Y5, are presented in Problem 6-5B. Data from Problem 5: Instructions: 1. Prepare a single-step income statement in the format shown in Exhibit 12. 2. Prepare clos

> Two income statements for Satterfield Company follow: Prepare a horizontal analysis of Satterfield Company’s income statements.

> The following selected accounts and their current balances appear in the ledger of Kanpur Co. for the fiscal year ended June 30, 20Y5: Instructions: 1. Prepare a multiple-step income statement. 2. Prepare a statement of owner’s equity.

> Transactions related to revenue and cash receipts completed by Affiliate Engineering Services during the period June 2–30 are as follows: June 2. Issued Invoice No. 717 to Yee Co., $2,210. 3. Received cash from Auto-Flex Co. for the bal

> For the past several years, Jeff Horton has operated a part-time consulting business from his home. As of April 1, 20Y9, Jeff decided to move to rented quarters and to operate the business, which was to be known as Rosebud Consulting, on a full-time basi

> The Gorman Group is a financial planning services firm owned and operated by Nicole Gorman. As of October 31, 20Y3, the end of the fiscal year, the accountant for The Gorman Group prepared an end-of-period spreadsheet, part of which follows: Instruction

> Reece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services’ accounting clerk prepared the following unadjusted trial balance at July 31, 20Y6: The data ne

> The Signage Company specializes in the maintenance and repair of signs, such as billboards. On March 31, 20Y5, the accountant for The Signage Company prepared the trial balances shown at the top of the following page. Instructions: Journalize the seven

> Crazy Mountain Outfitters Co., an outfitter store for fishing treks, prepared the following unadjusted trial balance at the end of its first year of operations: For preparing the adjusting entries, the following data were assembled: •

> Valley Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on July 31, 20Y7, follows: The following business transactions were completed by Valley Realty during August 20Y7: Aug. 1. Purchased offic

> On October 1, 20Y6, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Oct. 1. Jay transferred cash from a personal bank account to an account to be

> On August 1, 20Y5, Rafael Masey established Planet Realty, which completed the following transactions during the month: a. Rafael Masey transferred cash from a personal bank account to an account to be used for the business, $17,500. b. Purchased supplie

> Two income statements for Vaughn Company follow: Prepare a horizontal analysis of Vaughn Company’s income statements.

> The financial statements at the end of Atlas Realty’s first month of operations follow: Instructions: By analyzing the interrelationships among the four financial statements, determine the proper amounts for (a) through (q).

> On June 1, 20Y6, Hannah Ellis established an interior decorating business, Whitworth Designs. During the month, Hannah completed the following transactions related to the business: June 1. Hannah transferred cash from a personal bank account to an accoun

> The amounts of the assets and liabilities of Excalibur Travel Agency at December 31, 20Y5, the end of the year, and its revenue and expenses for the year follow. The capital of James Brewster, owner, was $710,000 on January 1, 20Y5, the beginning of the

> On June 1 of the current year, Pamela Schatz established a business to manage rental property. She completed the following transactions during June: a. Opened a business bank account with a deposit of $55,000 from personal funds. b. Purchased office supp

> On December 31, 20Y6, the balances of the accounts appearing in the ledger of Wyman Company are as follows: Instructions: 1. Does Wyman Company use a periodic or perpetual inventory system? Explain. 2. Prepare a multiple-step income statement for Wyman

> Selected accounts and related amounts for Druid Hills Co. for the fiscal year ended May 31, 20Y8, are presented in Problem 6-5A. Data from Problem 5: Instructions: 1. Prepare a single-step income statement in the format shown in Exhibit 12. 2. Prepare

> The following selected accounts and their current balances appear in the ledger of Druid Hills Co. for the fiscal year ended May 31, 20Y8: Instructions: 1. Prepare a multiple-step income statement. 2. Prepare a statement of owner’s equ

> The following were selected from among the transactions completed by Harrison Company during November of the current year: Nov. 3. Purchased merchandise on account from Moonlight Co., list price $120,000, trade discount 25%, terms FOB destination, 2/10,

> For the past several years, Samantha Hogan has operated a part-time consulting business from her home. As of July 1, 20Y9, Samantha decided to move to rented quarters and to operate the business, which was to be known as Arborvite Consulting, on a full-t

> The unadjusted trial balance of Lakota Freight Co. at March 31, 20Y7, the end of the year, follows: The data needed to determine year-end adjustments are as follows: a. Supplies on hand at March 31 are $7,500. b. Insurance premiums expired during the ye

> The following errors took place in journalizing and posting transactions: a. The receipt of $10,700 for services rendered was recorded as a debit to Accounts Receivable and a credit to Fees Earned. b. The purchase of supplies of $4,300 on account was rec

> The unadjusted trial balance of Epicenter Laundry at June 30, 20Y3, the end of the fiscal year, follows: The data needed to determine year-end adjustments are as follows: a. Laundry supplies on hand at June 30 are $3,600. b. Insurance premiums expired d

> Finders Investigative Services is an investigative services firm that is owned and operated by Stacy Tanner. On June 30, 20Y3, the end of the fiscal year, the accountant for Finders Investigative Services prepared an end-of-period spreadsheet, a part of

> Outreach Signals Company maintains and repairs warning lights, such as those found on radio towers and lighthouses. Outreach Signals Company prepared the following end-of-period spreadsheet at December 31, 20Y1, the end of the fiscal year: Instructions:

> Emerson Company is a small editorial services company owned and operated by Suzanne Emerson. On October 31, 20Y6, Emerson Company’s accounting clerk prepared the unadjusted trial balance shown on the next page. The data needed to determ

> Good Note Company specializes in the repair of music equipment and is owned and operated by Robin Stahl. On November 30, 20Y5, the end of the current year, the accountant for Good Note prepared the following trial balances: Instructions: Journalize the

> Milbank Repairs & Service, an electronics repair store, prepared the following unadjusted trial balance at the end of its first year of operations: For preparing the adjusting entries, the following data were assembled: • Fees earn

> On December 31, the following data were accumulated for preparing the adjusting entries for Flagship Realty: • The supplies account balance on December 31 is $1,585. The supplies on hand on December 31 are $320. • The unearned rent account balance on Dec

> Elite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on March 31, 20Y7, follows: The following business transactions were completed by Elite Realty during April 20Y7: Apr. 1. Paid rent on offi

> On January 1, 20Y5, Fahad Ali established Mountain Top Realty, which completed the following transactions during the month: a. Fahad Ali transferred cash from a personal bank account to an account to be used for the business, $53,000. b. Paid rent on off

> Connie Young, an architect, opened an office on October 1, 20Y4. During the month, she completed the following transactions connected with her professional practice: a. Transferred cash from a personal bank account to an account to be used for the busine

> The following errors took place in journalizing and posting transactions: a. Rent expense of $3,220 paid for the current month was recorded as a debit to Miscellaneous Expense and a credit to Rent Expense. b. The payment of $5,080 from a customer on acco

> The following revenue transactions occurred during April: Apr. 6. Issued Invoice No. 78 to BlueBird Co. for services provided on account, $1,710. 11. Issued Invoice No. 79 to Hitchcock Inc. for services provided on account, $3,320. 19. Issued Invoice No.

> The financial statements at the end of Wolverine Realty’s first month of operations are as follows: Instructions: By analyzing the interrelationships among the four financial statements, determine the proper amounts for (a) through (q

> The Colby Group has the following unadjusted trial balance as of August 31, 20Y8: The debit and credit totals are not equal as a result of the following errors: a. The cash entered on the trial balance was understated by $6,000. b. A cash receipt of $5,

> On July 1, 20Y7, Pat Glenn established Half Moon Realty. Pat completed the following transactions during the month of July: a. Opened a business bank account with a deposit of $25,000 from personal funds. b. Purchased office supplies on account, $1,850.

> The total assets and total liabilities (in millions) of Dunkin Brands Group and Starbucks Corporation follow: Determine the stockholders’ equity of each company.

> Bamboo Consulting is a consulting firm owned and operated by Lisa Gooch. The following end-of-period spreadsheet was prepared for the year ended July 31, 20Y5: Based on the preceding spreadsheet, prepare an income statement, statement of ownerâ

> Based on the data presented in Exercise 5-1, assume that the beginning balances for the customer accounts were zero, except for Jordan Inc., which had a $1,080 beginning balance. In addition, there were no collections during the period. a. Set up a T acc

> The following accounts appeared in recent financial statements of Delta Air Lines: Identify each account as either a balance sheet account or an income statement account. For each balance sheet account, identify it as an asset, a liability, or owner&aci

> Assume that the business in Exercise 7-3 maintains a perpetual inventory system, costing by the last-in, first-out method. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, presenting the data in the form ill