Question: On August 4, 2018, Cappio Corporation purchased

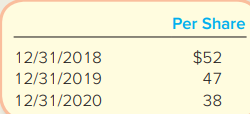

On August 4, 2018, Cappio Corporation purchased 1,000 shares of Maxwell Company for $45,000. The following information applies to the fair value of Maxwell Company:

Maxwell Company declares and pays cash dividends of $2 per share on June 1 of each year.

Required:

1. Prepare journal entries to record the facts in the case, assuming Cappio owns less than 10 percent of Maxwell’s stock. TIP: Ownership of less than 10 percent implies Cappio’s investment is passive.

2. Prepare journal entries to record the facts in the case, assuming Cappio owns 30 percent of Maxwell’s stock. Maxwell reported $50,000 of net income each year.

> Precision Construction entered into the following transactions during a recent year Required: 1. Analyze the accounting equation effects and record journal entries for each of the transactions. 2. For the tangible and intangible assets acquired in the

> Ly Company disposed of two different assets. On January 1, prior to their disposal, the accounts reflected the following: The machines were disposed of in the following ways: a. Machine A: Sold on January 1 for $9,000 cash. b. Machine B: On January 1,

> At the beginning of the year, Grillo Industries bought three used machines from Freeman Incorporated. The machines immediately were overhauled, were installed, and started operating. Because the machines were different, each was recorded separately in th

> Coca-Cola and PepsiCo are two of the largest and most successful beverage companies in the world in terms of the products that they sell and their receivables management practices. To evaluate their ability to collect on credit sales, consider the follow

> Web Wizard, Inc., has provided information technology services for several years. For the first two months of the current year, the company has used the percentage of credit sales method to estimate bad debts. At the end of the first quarter, the company

> C&S Marketing (CSM) recently hired a new marketing director, Jeff Otos, for its downtown Minneapolis office. As part of the arrangement, CSM agreed on February 28, 2018, to advance Jeff $50,000 on a one-year, 8 percent note, with interest to be paid at m

> Expedia, Inc., disclosed the following rounded amounts (in thousands) concerning the Allowance for Doubtful Accounts on its Form 10-K annual report. Required: 1. Create a T-account for the Allowance for Doubtful Accounts and enter into it the 2014 amou

> Buzz Coffee Shops is famous for its large servings of hot coffee. After a famous case involving McDonald’s, the lawyer for Buzz warned management (during 2014) that it could be sued if someone were to spill hot coffee and be burned. “With the temperature

> The Kraft Heinz Company was formed in 2015 with the merger of Kraft Foods and H. J. Heinz Corporation. The company reported the following rounded amounts for the year ended January 3, 2016 (all amounts in millions): Required: 1. Assume Kraft Heinz uses

> Partial income statements for Sherwood Company summarized for a four-year period show the following: An audit revealed that in determining these amounts, the ending inventory for 2016 was overstated by $20,000. The inventory balance on December 31, 2017

> Using the information in PA7-1, calculate the cost of goods sold and ending inventory for Gladstone Company assuming it applies the LIFO cost method perpetually at the time of each sale. Compare these amounts to the periodic LIFO calculations in requirem

> What internal control functions are performed by a cash register and point-of-sale system? How are these functions performed when cash is received by mail?

> Harman International Industries is a world-leading producer of loudspeakers and other electronics products, which are sold under brand names like JBL, Infinity, and Harman/Kardon. The company reported the following amounts in its financial statements (in

> Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost

> Gladstone Company tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period, as if it uses a periodic inventory system. Assume its accounting records provided the fo

> Home Hardware reported beginning inventory of 20 shovels, for a total cost of $100. The company had the following transactions during the month: Required: 1. Prepare the journal entries that would be recorded using a periodic inventory system. 2. Prep

> Big Tommy Corporation is a local grocery store organized seven years ago as a corporation. The bookkeeper prepared the following statement at year-end (assume that all amounts are correct, but note the incorrect format): Required: 1. Prepare a properly

> Hospital Equipment Company (HEC) acquired several fMRI machines for its inventory at a cost of $2,300 per machine. HEC usually sells these machines to hospitals at a price of $5,800. HEC also separately sells 12 months of training and repair services for

> What is the difference between Accounts Payable for advertising and Advertising Expense?

> Hair World Inc. is a wholesaler of hair supplies. Hair World uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $28,797). $51,200 b. Received mer

> Use the information in PA6-1 to complete the following requirements. Required: 1. For each of the events (a) through (c), indicate the amount and direction of the effect (+ for increase, − for decrease, and NE for no effect) on New B

> The transactions listed below are typical of those involving New Books Inc. and Readers’ Corner. New Books is a wholesale merchandiser and Readers’ Corner is a retail merchandiser. Assume all sales of merchandise from New Books to Readers’ Corner are mad

> Harristown Hockey Club (HHC) maintains a petty cash fund for minor club expenditures. The petty cash custodian, Wayne Crosby, describes the events that occurred during the last two months: a. I established the fund by cashing a check from HHC for $250 m

> What is the primary internal control goal for cash receipts?

> The December bank statement and cash T-account for Stewart Company follow: There were no deposits in transit or outstanding checks at November 30. Required: 1. Identify and list the deposits in transit at the end of December. 2. Identify and list t

> The bookkeeper at Martin Company has asked you to prepare a bank reconciliation as of May 31. The May 31 bank statement and the May T-account for cash (summarized) are below. Martin Company’s bank reconciliation at the end of April show

> The following procedures are used by The Taco Shop. a. Customers pay cash for all food orders. Cash is placed in a cash register and a receipt is issued upon request by the customer. b. At the end of each day, the cashier counts the cash, prepares a ca

> Val’s Hair Emporium operates a hair salon. Its unadjusted trial balance as of December 31, 2018, follows, along with information about selected accounts. Required: 1. Calculate the (preliminary) unadjusted net income for the year ende

> Indicate the accounting equation effects (amount and direction) of each adjusting journal entry. Use + for increase, − for decrease, and NE for no effect. Provide an appropriate account name for any revenue and expense effects. Data fr

> Schlitterbahn Waterslide Company issued 25,000, 10-year, 5 percent, $100 bonds on January 1 at face value. Interest is payable each December 31. Show the accounting equation effects and prepare journal entries for (a) the issuance of these bonds on Janua

> Brokeback Towing Company is at the end of its accounting year, December 31, 2018. The following data that must be considered were developed from the company’s records and related documents: a. On July 1, 2018, a two-year insurance premium on equipment i

> Star books Corporation provides an online bookstore for electronic books. The following is a simplified list of accounts and amounts reported in its accounting records. The accounts have normal debit or credit balances. Assume the year ended on September

> On September 1, Pat Hopkins established Ona Cloud Corporation (OCC) as a provider of cloud computing services. Pat contributed $10,000 for 1,000 shares of OCC. On September 8, OCC borrowed $30,000 from a bank, promising to repay the bank in two years. On

> Spicewood Stables, Inc., was established in Dripping Springs, Texas, on April 1. The company provides stables, care for animals, and grounds for riding and showing horses. You have been hired as the new assistant controller. The following transactions fo

> Diana Mark is the president of ServicePro, Inc., a company that provides temporary employees for not-for-profit companies. ServicePro has been operating for five years; its revenues are increasing with each passing year. You have been hired to help Diana

> What are two limitations of internal control?

> The following is a series of accounts for Dewan & Allard, Incorporated, which has been operating for two years. The accounts are listed alphabetically and numbered for identification. Following the accounts is a series of transactions. For each trans

> Ethan Allen Interiors Inc. is a leading manufacturer and retailer of home furnishings in the United States and abroad. The following is adapted from Ethan Allen’s September 30, 2016, trial balance. (The amounts shown represent millions

> Deliberate Speed Corporation (DSC) was incorporated as a private company. The company’s accounts included the following at June 30: During the month of July, the company had the following activities: a. Issued 4,000 shares of common s

> Mallard Incorporated (MI) is a small manufacturing company that makes model trains to sell to toy stores. It has a small service department that repairs customers’ trains for a fee. The company has been in business for five years. At th

> Repeat M10-9 assuming the bonds are issued at 102 Data from M10-9: E-Tech Initiatives Limited plans to issue $500,000, 10-year, 4 percent bonds. Interest is payable annually on December 31. All of the bonds will be issued on January 1, 2019. Show how t

> 1. Did Nice Bite rely more on creditors or stockholders for its financing at December 31, 2016? What is your information source? 2. Did the retained earnings at December 31, 2016, arise primarily from current year earnings or earnings retained from prio

> The following information for the year ended December 31, 2016, was reported by Nice Bite, Inc. Required: Prepare the four basic financial statements for 2016.

> 1. Is the company financed mainly by creditors or stockholders? Which financial statement provides the information to answer this question? 2. By how much did cash increase (decrease)? Which financial statement would report the business activities respo

> Assume you are the president of High Power Corporation. At the end of the first year of operations (December 31), the following financial data for the company are available: Required: Prepare an income statement for the year ended December 31. 2 . Prep

> Lisa Company had outstanding 100,000 shares of common stock. On January 10, 2018, Marg Company purchased a block of these shares in the open market at $20 per share, with the intent of holding the shares for a long time. At the end of 2018, Lisa reported

> On July 12, 2018, Rossow Corporation purchased 1,000 shares of Reimer Company for $30,000. The following information applies to the fair value of Reimer Company: Reimer Company declares and pays cash dividends of $2 per share on May 1 of each year. Re

> In what way does a mandatory vacation policy act as a control?

> The following table shows three cases, each with one missing element. Required: Use the bond calculator at www.fncalculator.com to determine the missing element for each case. Assume simple annual compounding and round to the nearest dollar or whole pe

> The following table shows three cases, each with one missing element. Required: Use the bond calculator at www.fncalculator.com to determine the missing element for each case. Assume simple annual compounding and round amounts to the nearest dollar or

> A local theater company sells 1,500 season ticket packages at a price of $250 per package. The first show in the 10-show season starts this week. Show the accounting equation effects and prepare the journal entries related to (a) the sale of the season t

> Legendary Corporation purchased equipment and in exchange signed a three-year promissory note. The note requires Legendary to make equal annual payments of $10,000 at the end of each of the next three years. Legendary has other promissory notes that char

> Stellar Corporation purchased equipment and in exchange signed a two-year promissory note. The note requires Stellar to make a single payment of $100,000 in two years. Stellar has other promissory notes that charge interest at the annual rate of 5 percen

> Assume you won the big prize of “$20 million” on a game show. This prize will be paid out in one of three ways: (1) you can receive $1 million per year for the next 20 years, (2) you can have $8 million today, or (3) you can have $2 million today and rec

> You have the opportunity to invest $10,000 in one of two companies from a single industry. The only information you have follows. The word high refers to the top third of the industry; average is the middle third; low is the bottom third. Required: Whi

> The financial statements for Armstrong and Blair companies are summarized here: The companies are in the same line of business and are direct competitors in a large metropolitan area. Both have been in business approximately 10 years and each has had st

> Kohl’s Corporation is a national retail department store. The company’s total revenues for the twelve months ended October 31, 2016, were $19 billion. Macy’s is a larger department store company with

> A condensed income statement for Electronic Arts and a partially completed vertical analysis follow. Required: 1. Complete the vertical analysis by computing each line item (a)–(d) as a percentage of net revenues. Round to

> In what ways can independent verification occur?

> Use Tables C.1 to C.4 to complete the following schedule:

> Electronic Arts is a video game company that competes with Activision Blizzard. A condensed balance sheet for Electronic Arts and a partially completed vertical analysis are presented below Required: 1. Complete the vertical analysis by computing each

> Prepare journal entries to record these transactions: (a) Morrell Corporation disposed of two computers at the end of their useful lives. The computers had cost $4,800 and their Accumulated Depreciation was $4,800. No residual value was received. (b) Ass

> Use the data given in CP13-1 for Golden Corporation. Required: 1. Compute the gross profit percentage for the current and previous years. Round the percentages to one decimal place. Are the current year results better, or worse, than those for the pre

> Golden Corporation declared and paid $3,000 of cash dividends during the current year ended December 31. Its financial statements also reported the following summarized data: Required: 1. Complete the two final columns shown beside each item in Golden

> Assume the same facts as CP12-4, except for additional data item (a) and the income statement. Instead of item (a) from CP12-4, assume that the company bought new golf clubs for $3,000 cash and sold existing clubs for $1,000 cash. The clubs that were sol

> Refer to CP12-4. Required: Complete requirements 1 and 2 using the direct method. TIP: Remember to exclude depreciation expense when converting to the cash basis. Data from CP12-4: Soft Touch Company was started several years ago by two golf instruct

> Refer to the information in CP12-2. Required: Prepare the cash flows from operating activities section of the statement of cash flows using the direct method. TIP: Convert the cost of goods sold to cash paid to suppliers by adding the increase in inve

> Soft Touch Company was started several years ago by two golf instructors. The company’s comparative balance sheets and income statement are presented below, along with additional information. Additional Data: a. Bought new golf clubs

> Hunter Company is developing its annual financial statements at December 31. The statements are complete except for the statement of cash flows. The completed comparative balance sheets and income statement are summarized: Additional Data: a. Bought eq

> Hamburger Heaven’s income statement for the current year and selected balance sheet data for the current and prior years ended December 31 are presented below. Required: Prepare the cash flows from operating activities section of the

> For each of the following transactions, indicate whether operating (O), investing (I), or financing activities (F) are affected and whether the effect is a cash inflow (+) or outflow (−). Use (NE) if the transaction has no effect on cas

> In what ways does documentation act as a control?

> After recording depreciation for the current year, Media Mania Incorporated decided to discontinue using its printing equipment. The equipment had cost $750,000, accumulated depreciation was $550,000, and its fair value (based on estimated future cash fl

> Indicate whether a company interested in minimizing its income taxes should choose the FIFO or LIFO inventory costing method under each of the following circumstances. _____ a. Declining costs _____ b. Rising costs

> Tower Corp. had the following stock outstanding and Retained Earnings at December 31, 2018: On December 31, 2018, the board of directors is considering the distribution of a cash dividend to the common and preferred stockholders. No dividends were decla

> At December 31, the records of Nortech Corporation provided the following selected and incomplete data:

> Activision Blizzard, Inc., reported the following in the notes to its financial statements. Required: 1. Describe the effects that this transaction would have had on the company’s financial statements. Assume that 600 million shares w

> Worldwide Company obtained a charter from the state in January that authorized 200,000 shares of common stock, $10 par value. During the first year, the company earned $38,200, declared no dividends, and the following selected transactions occurred in th

> The Peg Corporation (TPC) issued bonds and received cash in full for the issue price. The bonds were dated and issued on January 1, 2018. The stated interest rate was payable at the end of each year. The bonds mature at the end of four years. The followi

> Complete the requirements of CP10-6, assuming Southwest Corporation uses simplified effectiveinterest amortization shown in Chapter Supplement 10C. Data from CP10-6: Southwest Corporation issued bonds with the following details: The annual accounting

> Complete the requirements of CP10-6, assuming Southwest Corporation uses effective-interest amortization. Data from CP10-6: Southwest Corporation issued bonds with the following details: The annual accounting period ends December 31. The bonds were is

> Southwest Corporation issued bonds with the following details: The annual accounting period ends December 31. The bonds were issued at 104 on January 1, 2018, when the market interest rate was 8 percent. Assume the company uses straight-line amortizatio

> Brunswick Corporation is a multinational company that manufactures and sells marine and recreational products. A prior annual report contained the following information: Required: If Brunswick recorded a liability for $133.2 million (3 × $

> Sikes Corporation, whose annual accounting period ends on December 31, issued the following bonds: Required: 1. For each of the three independent cases that follow, provide the amounts to be reported on the January 1, 2018, financial statements immedia

> Calculate the amount of depreciation to report during the year ended December 31 for equipment that was purchased at a cost of $43,000 on October 1. The equipment has an estimated residual value of $3,000 and an estimated useful life of five years or 20,

> What are some of the methods for restricting access?

> Riverside Company completed the following two transactions. The annual accounting period ends December 31. a. On December 31, calculated the payroll, which indicates gross earnings for wages ($130,000), payroll deductions for income tax ($13,000), payro

> Using data from CP10-1, complete the following requirements. Required: 1. Prepare journal entries for each of the transactions through December 20. 2. Prepare any adjusting entries required on December 31. 3. Show how all of the liabilities arising

> Hondor Corporation issued bonds and received cash in full for the issue price. The bonds were dated and issued on January 1, 2018. The stated interest rate was payable at the end of each year. The bonds mature at the end of four years. The following sch

> EZ Curb Company completed the following transactions. The annual accounting period ends December 31. Required: 1. For each listed transaction and related adjusting entry, indicate the accounts, amounts, and effects (+ for increase, −

> Palmer Cook Music Productions manages and operates two bands. The company entered into the following transactions during a recent year. Required: 1. Analyze the accounting equation effects and record journal entries for each of the transactions. TIP: G

> During the current year, Martinez Company disposed of two different assets. On January 1, prior to their disposal, the accounts reflected the following: The machines were disposed of in the following ways: a. Machine A: Sold on January 2 for $20,000 ca

> At the beginning of the year, Young Company bought three used machines from Vince, Inc. The machines immediately were overhauled, were installed, and started operating. Because the machines were different, each was recorded separately in the accounts. B

> Mattel, Inc., and Hasbro are two of the largest and most successful toymakers in the world, in terms of the products they sell and their receivables management practices. To evaluate their ability to collect on credit sales, consider the following inform

> Execusmart Consultants has provided business consulting services for several years. The company has been using the percentage of credit sales method to estimate bad debts but switched at the end of the first quarter this year to the aging of accounts rec

> A machine that cost $400,000 has an estimated residual value of $40,000 and an estimated useful life of four years. The company uses double-declining-balance depreciation. Calculate its book value at the end of year 3. Round to the nearest dollar.

> Jung & Newbicalm Advertising (JNA) recently hired a new creative director, Howard Rachell, for its Madison Avenue office in New York. To persuade Howard to move from San Francisco, JNA agreed to advance him $100,000 on April 30, 2018, on a one-year, 10 p

> Why should responsibilities for certain duties, like cash handling and cash recording, be separated? What types of responsibilities should be separated?

> Callaway Golf Company sells on account to golf pro shops and general sporting goods retailers. In its financial statements for the year ended December 31, 2015, Callaway reported the following balances and changes in the Allowance for Doubtful Accounts (

> Red Hat, Inc., is a software development company that recently reported the following amounts (in thousands) in its unadjusted trial balance as of February 29, 2016. Required: 1. Assume Red Hat uses ¼ of 1 percent of revenue to estimate i