Question: On December 31, 20X1, Roker, Inc., reported

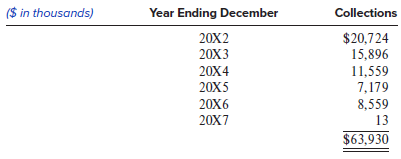

On December 31, 20X1, Roker, Inc., reported notes receivable of $63,930,000. This amount represents the present value of future cash flows (both principal and interest) discounted at a rate of 11.12% per annum. The schedule of collections of the receivables is provided next:

Assume that the interest due is paid along with the face value of the receivables at the end of each year.

Required:

Provide journal entries to record the interest received and the notes receivable collected in each year.

> Avenet Inc., a U.S. company, is a global provider of electronic parts, enterprise computing and storage products, and supply chain and logistics services for the electronic components industry. The company’s 2009 annual report contained the following not

> On January 1, 20X1, Mason Manufacturing borrows $500,000 and uses the money to purchasecorporate bonds for investment purposes. Interest rates were quite volatile that year and sowere the fair values of Mason’s bond investment (an asset

> On January 1, 20X1, Newell Manufacturing purchased a new drill press that had a cash purchase price of $6,340. Newell decided instead to pay on an installment basis. The installmentcontract calls for four annual payments of $2,000 each beginning in one y

> On January 1, 20X1, Fleetwood Inc. issued bonds with a face amount of $25 million and astated interest rate of 8%. The bonds mature in 10 years and pay interest semiannually on June 30 and December 31 of each year. The market rate of interest on January

> On July 1, 20X1, Heflin Corporation (a fictional company) issued $20 million of 12%, 20-yearbonds. Interest on the bonds is paid semiannually on December 31 and June 30 of each year,and the bonds were issued at a market interest rate of 8%. Required: 1.

> On January 1, 20X0, Korman, Inc., issued $1.0 billion of 3% zero coupon subordinated debentures, which were issued at a price of $553.68 per $1,000 principal amount at maturity. Thebonds were priced to yield 3% per annum, computed on an annual basis. The

> On January 1, 20X1, Chain Corporation issued $5 million of 7% coupon bonds at par. The bondsmature in 20 years and pay interest semiannually on June 30 and December 31 of each year. On December 31, 20Y1, the market interest rate for bonds of similar risk

> On January 1, 20X1, Nicks Corporation issued $250 million of floating-rate debt. The debtcarries a contractual interest rate of “LIBOR plus 5.5%,” which is reset annually on January 1of each year. The LIBOR rates on January 1, 20X1, 20X2, and 20X3, were

> On July 1, 20X1, McVay Corporation issued $15 million of 10-year bonds with an 8% statedinterest rate. The bonds pay interest semiannually on June 30 and December 31 of each year. The market rate of interest on July 1, 20X1, for bonds of this type was 10

> National Sweetener Company owns the patent to the artificial sweetener known as Supersweet. Assume that National Sweetener acquired the patent on January 1, 20X1, at a cost of $300 million;expected the patent to have an economic useful life of 12 years;

> Refer to the facts in Problem 11-8. Repeat requirements 2 through 5 using the cost model (asopposed to the revaluation model) under IFRS.

> In 20X0, the cereal division of Bloom Company (a fictional company) decided to test marketin 20X1 an organic corn-based cereal to be called Healthcrisp. The business plan calls for production to begin in late May 20X1, with retail store delivery starting

> Yachting in Paradise, Inc., was founded late in 20X0 by retired Admiral Andy Willits to provideexecutive retreats aboard a luxury yacht with ports of call scattered around the South Pacific. Yachting in Paradise is a U.S. firm and follows U.S. GAAP. On J

> Fly-by-Night is an international airline company. Its fleet includes Boeing 757s, 747s, and 737sand McDonnell Douglas MD-83s and MD-80s. Assume that Fly-by-Night made the followingexpenditures related to these aircraft in 20X1: a. New jet engines were in

> On April 23, 20X1, Starlight Department Stores, Inc., acquired a 75-acre tract of land by paying $25,000,000 in cash and by issuing a six-month note payable for $5,000,000 and 1,000,000shares of its common stock. On April 23, 20X1, Starlight’s common sto

> Crews Cable Company provides phone, internet, television, and security services to its customers. Crews offers a promotion where current customers can add phone and security services foran additional $60 per month if they sign a two-year contract. Custom

> Hopkins Co. often partners with other companies to deliver technology solutions to its clients. Because of these working relationships, Hopkins offers a sales incentive program to these companies for work that is brought to Hopkins. Hopkins agrees to pay

> On June 30, 20X1, Macrosoft Company acquired a 10-acre tract of land. On the tract was a warehouse that Macrosoft intended to use as a distribution center. At the time of purchase, theland had an assessed tax value of $6,300,000, and the building had an

> IceCap Hotels operates a series of northern European hotels and reports under IFRS. On June 30, 20X0, IceCap purchased a hotel for €2,100,000. IceCap reports hotel values on the balancesheet under Property, plant, and equipment. The esti

> White Ski Resorts operates a series of ski resorts in northern Europe and reports under IFRS. On June 30, 20X0, White purchased land for €3,000,000. White reports land values on thebalance sheet under Property, plant, and equipment. The

> 1. Contrast the economic sacrifice and expected benefit approaches to long-lived assetvaluation. 2. GAAP requires firms to use historical cost (in most cases) to report the value of long-livedassets. As a statement reader, do you think that firms should

> Prescott Co. management has committed to a plan to dispose of a group of assets associatedwith the manufacture of railroad cars. This group of assets qualifies as a component of anentity for financial reporting purposes. As of December 31, 20X1, manageme

> Refer to The Kroger Co. information in Case 15-3. Required: Explain how net benefit cost and OCI would change if The Kroger Co. were using IAS 19.

> Gardenia Co. and Lantana Co. both operate in the same industry. Gardenia began its operations in 20X1 with a $20 million initial investment in plant and equipment with an expectedlife of 10 years. Lantana’s net asset base is also $20 million, but its ass

> The 20X0 income statement and other information for Mallard Corporation, which is about to purchase a new machine at a cost of $500 and a new computer system at a cost of $300, follow. Additional Information: • The two new assets are ex

> Assume that Major Motors Corporation, a large automobile manufacturer, reported in a recentannual report to shareholders that its buildings had an original cost of $4,694,000,000. a. Major Motors uses the straight-line depreciation method to depreciate t

> Consider the following two scenarios: Scenario I: Over the 20X1–20X5 period, Micro Systems, Inc., spends $10 million a year todevelop patents on new computer hardware manufacturing technology. While some of itsprojects failed, the firm did develop severa

> To meet the increasing demand for its microprocessors, Intelligent Micro Devices began construction of a new manufacturing facility on January 1, 20X1. Construction costs were incurreduniformly throughout 20X1 and were recorded in the firm’s Construction

> On January 2, 20X0, Half, Inc., purchased a manufacturing machine for $864,000. The machinehas an eight-year estimated life and a $144,000 estimated salvage value. Half expects to manufacture 1,800,000 units over the machine’s life. During 20X1, Half man

> Parque Corporation (a fictional company) applied to Fairview Bank (another fictional company) early in 20X2 for a $400,000 five-year loan to finance plant modernization. The company proposes that the loan be unsecured and repaid from future operating cas

> During your audit of Patti Company’s ending inventory at December 31, 20X1, you find the following inventory accounting errors: a. Goods in Patti’s warehouse on consignment from Valley, Inc., were included in Patti’s ending inventory. b. On December 31,

> Packard, Inc., adopted the dollar-value LIFO inventory method on June 30, 20X1, the end of its fiscal year. Packard’s inventory records provide the following information: Required: Calculate the ending inventory for Packard, Inc., for

> Princess Retail Stores started doing business on January 1, 20X1. The following data reflect its inventory purchases and sales during the year: Required: 1. Compute gross margin and cost of ending inventory using the periodic FIFO cost flow assumption.

> The Kroger Co. operates numerous grocery store chains. Excerpts from Kroger’s Note 15 arepresented below. The 2017 amounts are for the fiscal year ended February 3, 2018. All amountsare in millions of U.S. dollars. At February 3, 2018,

> Diana Gomez Corporation, a manufacturer of cowboy boots, provided the following information from its accounting records for the year ended December 31, 20X1. Additional information is as follows: a. Work-in-process inventory costing $30,000 was sent to a

> Mastrolia Manufacturing produces pacifiers. The company uses absorption costing for external reporting, but management prefers variable costing for evaluating the profitability of each model. Bonuses, which make up a significant portion of each manager&a

> Bravo Wholesalers, Inc., began its business on January 1, 20X1. Information on its inventory purchases and sales during 20X1 follows: Assume a tax rate of 21%. Required: 1. Compute the cost of ending inventory and cost of goods sold under each of the fo

> The following information pertains to Yuji Corporation: Required: Sales revenue during 20X1 was $300,000. The income tax rate is 21%. Compute the following: 1. Cost of raw materials used. 2. Cost of goods manufactured/completed. 3. Cost of goods sold. 4

> 1. Refer to the facts in Problem 10-16. Repeat the requirements assuming that Jake uses the FIFO cost flow assumption. 2. Explain how the financial statements are affected when a company decides that NRV should be used for the inventory value. 3. Repeat

> Ramps by Jake, Inc., manufactures skateboard ramps. The company uses independent sales representatives to market its products and pays a commission of 8% on each sale. Data regarding the five styles of ramps in the company’s inventory a

> Caldwell Corporation (a fictional company) operates an ice cream processing plant and uses the FIFO inventory cost flow assumption. A partial income statement for the year ended December 31, 20X2, follows: Caldwell’s physical inventory

> Sirotka Retail Company began doing business in 20X1. The following information pertains to its first three years of operation: Assume the following: • The income tax rate is 21%. • Purchase and sale prices change only

> Bourne Company (a fictional company) has the following inventory note in its 20X3 annual report. LIFO revaluations decreased $140 million in 20X3, compared with decreases of $169 million in 20X2 and $82 million in 20X1. Included in these changes were dec

> JKW Corporation (a fictional company) has been selling plumbing supplies since 1981. In 2003, the company adopted the LIFO method of valuing its inventory. The company has grown steadily over the years and a layer has been added to its LIFO inventory in

> AT&T reported pre-tax income of $24,873 million, $15,139 million, and $12,976 millionfor the years ended December 31, 2018, 2017, and 2016, respectively. At December 31, 2018, it had 7,281.6 million common shares outstanding and a common share price

> The following is an excerpt from the financial statements of Talbot Industries (a fictional company): During 20X2, Chaney Technologies (a fictional company) changed its inventory cost flow assumption from LIFO to the average cost method. The following is

> Keefer, Inc., began business on January 1, 20X1. Information on its inventory purchases and sales during 20X1 and 20X2 follow: Required: 1. Calculate ending inventory, cost of goods sold, and gross margin for 20X1 and 20X2 under the periodic FIFO invent

> On January 1, 20X1, Hillock Brewing Company sold 50,000 bottles of beer to various customers for $45,000 using credit terms of 3/10, n/30. These credit terms mean that customers receive a cash discount of 3% of invoice price for payments made within 10 d

> On January 2, 20X1, Criswell Acres purchased from Mifflinburg Farm Supply a new tractor that had a cash selling price of $109,837. As payment, Criswell gave Mifflinburg Farm Supply $25,000 in cash and a $100,000, five-year note that provided for annual i

> The following information pertains to the financial statements of Buffalo Supply Company, a provider of plumbing fixtures to contractors in central Pennsylvania. Required: Reconstruct all journal entries pertaining to Gross accounts receivable and Allow

> On December 1, 20X1, Eva Corporation, a mortgage bank, has the following amounts on its balance sheet (in millions): Also on December 1, 20X1, Eva transfers mortgage receivables with a book value of $20,000,000 to a securitization entity (SE). The averag

> At December 31, 20X0, Oettinger Corporation, a premium kitchen cabinetmaker for the home remodeling industry, reported the following accounts receivable information on its year-end balance sheet: During 20X1, the company had credit sales of $8,200,000, o

> Avillion Corporation had a $45,000 debit balance in Accounts receivable and a $3,500 credit balance in Allowance for credit losses on December 31, 20X1. The company prepared the following aging schedule to record the adjusting entry for bad debts on Dece

> Baer Enterprises’s balance sheet at October 31, 20X1 (fiscal year-end), includes the following: Transactions for fiscal year 20X2 include the following: a. Due to a product defect, previously sold merchandise totaling $10,500 was return

> Refer to the 2017 General Electric Retiree Health and Life Benefits disclosure appearing in Exhibit 15.9. Required: 1. Reconstruct the journal entries that GE would have made in 2017 to record the effects ofits retiree health and life benefits plans. Th

> The following notes for three fictional companies represent what analysts may see in practice. Required: How do the three companies record the transfer of their receivables—that is, as a sale or borrowing? Is their accounting treatment

> Mikeska Companies purchased equipment for $108,000 from Power-line Manufacturing on January 1, 20X0. Mikeska paid $18,000 in cash and signed a five-year, 5% installment note for the remaining $90,000 of the purchase price. The note calls for annual payme

> Fish Spotters, Inc., purchased a single-engine aircraft from National Aviation on January 1, 20X0. Fish Spotters paid $55,000 cash and signed a three-year, 8% note for the remaining $45,000. Terms of the note require Fish Spotters to pay accrued interest

> The following information is taken from the financial statements of Ramsay Health Care Inc.: Required: 1. Reconstruct all journal entries relating to Gross accounts receivable and Allowance for credit losses for the year ended December 31, 20X3. You may

> Aardvark, Inc., began 20X1 with the following receivables-related account balances: Accounts receivable…………………………………………….$575,000 Allowance for credit losses…………………………………..43,250 Aardvark’s transactions during 20X1 include the following: a. On April 1, 2

> Big Energy Corporation received regulatory approval for its 20X1 electricity rate. The company has been authorized to charge customers $0.10 per kilowatt-hour (kwh), a rate lower than other utilities in the state charge. Details of the rate calculation f

> Duke Energy Corporation’s 2018 annual report to shareholders contains the following note disclosure (edited for brevity): Regulated Operations Substantially all of Duke Energy’s regulated operations meet the criteria for application of regulatory account

> Food Galore operates a chain of retail supermarkets. The supermarket business is highly competitive, and it is characterized by low profit margins. Food Galore recently entered into a credit agreement with a group of banks. Excerpts from the loan agreeme

> Following your retirement as senior vice president of finance for a large company, you joined the board of Cayman Grand Cruises, Inc. You serve on the compensation committee and help set the bonuses paid to the company’s top five execut

> On March 14, 2019, Core Molding Technologies, Inc. filed a Form 8-K disclosing an amendment to one of its borrowing agreements as follows: Required: 1. What is a minimum fixed charge coverage ratio, and what purpose does it serve in a companyâ

> Following are the consolidated statement of operations, balance sheet, and portions of theincome tax note from Acme United Corporation’s December 31, 2011, Form 10-K. (For thesake of brevity, the statements have been condensed in ways t

> Explain the potential conflict of interest that arises when doctors own the hospitals in which they work.

> Exhibit 7.5 describes the key financial ratios Standard & Poor’s analysts use to assess credit risk and assign credit ratings to industrial companies. Those same financial ratios for a single company over time follow. The company wa

> As discussed in the chapter, abnormal earnings (AE) are Required: 1. Calculate each firm’s AEt each year from 20X1 to 20X5. 2. Which firm was better managed over the 20X1–20X 5 periods? Why? 3. Which firm is likely to

> As shown in equation (7.10), the price equation for a firm with positive growth opportunities is Required: 1. Why does eBay have a higher cost of equity capital (re) than Walmart? 2. Compute NPVGO for each company. 3. Compute NPVGO as a percent of stock

> Randall Manufacturing has requested a $2 million, four-year term loan from Farmers State Bank. It will use the money to expand its warehouse and to upgrade its assembly line. Randall supplied the following cash flow forecasts as part of the loan applicat

> Margaret O’Flaherty, a portfolio manager for MCF Investments, is considering investing in Alpine Chemical 7% bonds, which mature in 10 years. She asks you to analyze the company to determine the riskiness of the bonds. Required: 1. Usi

> Griffin and Lasky, Inc. (G&L), supplies industrial automation equipment and machine tools to the automotive industry. G&L recognizes revenue on its long-term contracts over time. Customer orders have long lead times because they involve multiyear

> Tiffany & Company is a luxury jeweler and specialty retailer that sells timepieces, sterling silverware, china, crystal, fragrances, and accessories through its retail stores worldwide. Signet Jewelers Ltd. operates a number of well-known retail stor

> Nucor Corporation produces steel and steel products at its eight mills and is a major recycler of scrap metal. The following data relate to Nucor for four years. In 2017, Nucor’s net income was higher by $175.2 million because of a one-

> Danaher Corporation manufactures a variety of products, including electronic measurement instruments and network communications products, water quality measurement systems, and medical and dental instruments. Selected financial statement data and related

> ABC Inc. is in the business of airframe maintenance, modification and retrofit services, avionics and aircraft interior installations, the overhaul and repair of aircraft engines, and otherrelated services.The following are excerpted from its income stat

> Packaging Corporation of America produces containerboard and white papers. WestRock Co. manufactures paper products and corrugated products. Financial statement data for these two companies follow: Required: 1. Determine the receivables turnover ratios

> The following table provides ROA and ROCE for Best Buy, a retailer of consumer electronics. The adjusted February 3, 2018, amounts exclude the one-time income statement effect of the Tax Cuts and Jobs Act. Required: 1. In analyzing Best Buy, is it most

> AK Steel Holding Corporation is a fully integrated producer of steel. It produces cold-rolled and hot-rolled steel products as well as specialty stainless and electrical steels that are sold to the domestic automotive, appliance, industrial machinery and

> The following table reports the operating cycle, cash conversion cycle, and current ratio for three apparel retailers all having year-ends at February 3, 2018. American Eagle Outfitters is a multi brand specialty retailer of casual apparel and accessorie

> In 20X2, the new CEO of Watsontown Electric Supply became concerned about the company’s apparently deteriorating financial position. Wishing to make certain that the grim monthly reports he was receiving from the companyâ€

> KEW Enterprises began operations in January 20X1 to manufacture a hand sanitizer that promised to be more effective and gentler on the skin than existing products. Family members, one of whom was delegated to be the office manager and bookkeeper, staffed

> In 20X2, ABBA Fabrics, Inc., elected to change its method of valuing inventory to the weighted average cost (“WAC”) method, whereas in all prior years inventory was valued using the last-in, first out (LIFO) method. Th

> Barden, Inc., operates a retail chain that specializes in baby clothes and accessories that are made to its specifications by a number of overseas manufacturers. Barden began operations 20 years ago and has always employed the FIFO method to value its in

> The statement of cash flows for the year ended December 31, 20X1, and other data for Bradley Corporation are shown below: Cash flows from operating activities: Cash collections from customers………

> The following is the operating section of the statement of cash flows (direct method) of Battery Builders, Inc.: Collections from customers………………………………………………………………….$ 28,000 Payments to suppliers for inventory purchases………………………………………(13,000) Payments fo

> Delta Air Lines adopted the provisions of ASC Topic 842 using the optional alternative ­transitionmethod in which a company makes a cumulative adjustment to the opening balance of retained earnings in the period of adoption instead of to the f

> The following cash flow information pertains to the 20X1 operations of Fish master, Inc., a maker of fishing equipment. Cash collections from customers……………………………………………….$ 79,533 Cash payments to suppliers of inventory……………………………………64,097 Cash payments f

> The following cash flow information pertains to the 20X1 operations of Matterhorn, Inc., a maker of ski equipment: Cash collections from customers……………………………………………….$ 16,670 Cash payments to suppliers of inventory……………………………………19,428 Cash payments for va

> A December 31, 20X1, post closing trial balance for Short Erin Company follows. Additional information about Short Erin’s account balances: 1. Cash includes $12,000 in U.S. treasury bills purchased on December 21, 20X1, that mature in J

> Kay Wing, Inc., prepared the following balance sheet at December 31, 20X0. The following occurred during 20X1. 1. A $35,000 note payable was issued. 2. Land was purchased for $50,000. 3. Bonds payable (maturing in 20X5) in the amount of $30,000 were reti

> Ricky Corporation had the following alphabetical account balance listing at December 31, 20X1 (in thousands of dollars). Required: Prepare a balance sheet for Ricky Corporation at December 31, 20X1.

> Berger Company had sales in 20X1 of $200,000. The goods sold cost Berger $125,000. The goods were sold with the right of return. By the end of 20X1, goods having a total selling price of $10,000 had been returned. As of December 31, 20X1, Berger expected

> Online Auction Company (OAC) provides a platform for its users to buy and sell goods. Sellers post goods for sale and other users bid on them. The high bidder wins the auction and purchases the goods. After each auction, the seller pays OAC a 10% fee and

> Zahava Corporation sells equipment to Ari Company for $700,000. Ari does not need the equipment until December 31, 20X3, but agrees to pay $600,000 immediately on December 31, 20X1, in order to assist Zahava with its finances. The remaining $100,000 is d

> Zahava Corporation sells equipment to Ari Company for $700,000 on December 31, 20X1. The two companies agree that Ari will pay $100,000 upon delivery (December 31, 20X1), with the remaining $600,000 due on December 31, 20X3. Zahava is confident that Ari

> Ladd Corporation sells construction equipment to a customer for $200,000 on January 1, 20X1. The equipment comes with a standard 10-year warranty covering all maintenance and repairs during that time. Initially, Ladd estimates that it will incur $10,000

> Refer to the Target Corporation financial statement information contained in C13-1. Required: Explain how the financial statements and disclosures would change if Target were using IFRS 16. Be as specific as possible.

> On January 1, 20X1, Quenneville Corporation sold equipment to Wirtz, Inc., for $500,000. The equipment had cost $300,000 to manufacture. The contract with Wirtz requires Quenneville to provide complete maintenance and repair services on the equipment for