Question: On January 1, 2012, Seward Corporation issues $

On January 1, 2012, Seward Corporation issues $100,000 face value, 8% semiannual coupon bonds maturing three years from the date of issue. The coupons, dated for June 30 and December 31 of each year, each promise 4% of the face value, 8% total for a year. The firm issues the bonds to yield 10%, compounded semiannually.

a. Compute the initial issue proceeds of these bonds.

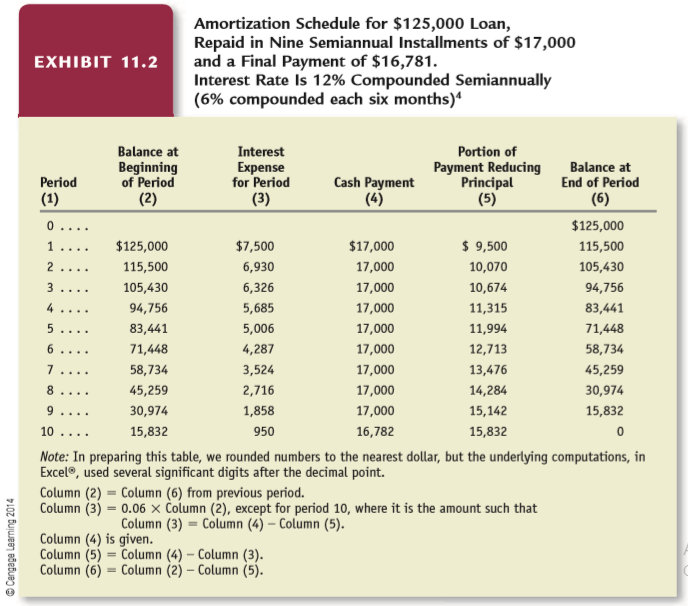

b. Construct an amortization schedule, similar to that in Exhibit 11.2, for this bond issue, assuming that Seward Company uses amortized cost measurement based on the historical market interest rate to account for the bonds.

c. Give the journal entries related to these bonds for 2012. Seward uses the calendar year as its reporting period.

d. On January 1, 2014, Seward Corporation reacquires $20,000 face value of these bonds for 102% of face value and retires them. Give the journal entry to record the retirement.

Exhibit 11.2:

Transcribed Image Text:

Amortization Schedule for $125,000 Loan, Repaid in Nine Semiannual Installments of $17,000 and a Final Payment of $16,781. Interest Rate Is 12% Compounded Semiannually (6% compounded each six months)* EXHIBIT 11.2 Balance at Interest Еxpense for Period (3) Portion of Period (1) Beginning of Period (2) Cash Payment (4) Payment Reducing Principal (5) Balance at End of Period (6) 0... $125,000 $125,000 $7,500 $17,000 $ 9,500 115,500 1. .... 2.... 115,500 6,930 17,000 10,070 105,430 105,430 6,326 17,000 10,674 94,756 94,756 5,685 17,000 11,315 83,441 4 .... 83,441 5,006 17,000 11,994 71,448 71,448 4,287 17,000 12,713 58,734 .... 7 58,734 3,524 17,000 13,476 45,259 .... 8. 45,259 2,716 17,000 14,284 30,974 .... 9.... 30,974 1,858 17,000 15,142 15,832 10 15,832 950 16,782 15,832 ... Note: In preparing this table, we rounded numbers to the nearest dollar, but the underlying computations, in Excel®, used several significant digits after the decimal point. Column (2) = Column (6) from previous period. Column (3) = 0.06 × Column (2), except for period 10, where it is the amount such that Column (3) = Column (4) – Column (5). Column (4) is given. Column (5) = Column (4) – Column (3). Column (6) = Column (2) – Column (5). © Cengage Learning 2014

> Bulls Eye Stores constructed new stores during the current year. The average balance in the Construction-in-Process account excluding the current year’s capitalized interest costs was $3,400,000. Bulls Eye Stores engaged in borrowing directly related to

> WollyMartin Limited, a large retailer, provided the following information from its accounting records for the year ended September 30, 2013: WollyMartin’s business is characterized by many retail customers—some of wh

> Cemex S.A., a Mexican cement and construction firm, reported ending inventory, net for the year ended December 31 of $19,631 million (all amounts reported in millions of Mexican pesos). During the year, Cemex reported that application of the lower-of-cos

> Falcon Motor Company, a U.S. automotive manufacturer, reports that it uses the LIFO cost-flow assumption for inventory. For the year ended December 31, 2013, Falcon’s cost of goods sold was $142,587 million. It reported the following in

> Cat Incorporated manufactures machinery and engines for the construction, agriculture, and forestry industries. It follows U.S. GAAP and reports its results in millions of U.S. dollars ($). For the year ended December 31, 2013, it reported LIFO inventori

> Warren Company uses a FIFO cost-flow assumption and calculates Cost of Goods Sold as Beginning Inventory + Purchases – Ending Inventory. It uses a physical count of merchandise on hand to determine the balance in Ending Inventory. On December 30, 2012, W

> The following data relate to Crystal Chemical Corporation for the year ended December 31, 2013 (amounts in millions of euros): The company incurred manufacturing costs (direct material, direct labor, and manufacturing overhead) during the year totaling

> Arnold Company’s raw material purchases during January, its first month of operations, were as follows: The inventory on January 31 was 3,500 pounds. Compute the cost of the inventory on January 31 and the cost of raw materials issued

> GenDyn computes net income for 2012 of $1,500 and for 2013 of $1,800, its first two years of operations. Before issuing its financial statements for 2013, GenDyn discovers that an item requires an income-reducing adjustment of $400 after taxes. Indicate

> The following data relate to GenMet, a U.S. based consumer goods manufacturing firm, for the fiscal year ending October 31, 2013. Reported amounts are in millions of U.S. dollars ($). GenMet incurred manufacturing costs (direct material, direct labor,

> A customer shopping at Bed, Bath & Beyond, a home products retailer in the United States, made the following purchases: $100 for bath towels, $135 for an iron, $45 for an ironing board, and $250 for a gift certificate. Sales taxes on the purchase amounte

> An old agreement obliges the state to help a rural county maintain a bridge by paying $60,000 now and every two years thereafter forever. The state wants to discharge its obligation by paying a single sum to the county now for the payment due and all fut

> Consider the scholarship fund in the preceding question. Suppose that the first scholarship award occurs one year from now and the donor wants the scholarship to grow by 2% per year. How much should the donor deposit if the fund earns a. 6% per period? b

> To establish a fund that will provide a scholarship of $3,000 per year indefinitely, with the first award to occur now, how much must a donor deposit if the fund earns a. 6% per period? b. 8% per period?

> Mr. Grady agrees to lease a certain property for 10 years, at the following annual rental, payable in advance: Years 1 and 2—$1,000 per year Years 3 to 6—$2,000 per year Years 7 to 10—$2,500 per year What single immediate sum will pay all of these rent

> Compute the amount (future value) of an ordinary annuity (an annuity in arrears) of the following: a. 13 rental payments of $100 at 1% per period. b. 8 rental payments of $850 at 6% per period. c. 28 rental payments of $400 at 4% per period.

> Compute the present value of the following: a. $100 due in 30 years at 4% compounded annually. b. $250 due in 8 years at 8% compounded quarterly. c. $1,000 due in 2 years at 12% compounded monthly.

> Compute the future value of the following: a. $100 invested for 5 years at 4% compounded annually. b. $500 invested for 15 periods at 2% compounded once per period. c. $200 invested for 8 years at 3% compounded semiannually. d. $2,500 invested for 14 yea

> State the rate per period and the number of periods in the following: a. 12% per year, for 5 years, compounded annually. b. 12% per year, for 5 years, compounded semiannually. c. 12% per year, for 5 years, compounded quarterly. d. 12% per year, for 5 yea

> Assume no changes in physical quantities during the period. During a period of rising purchase prices, will a FIFO or a LIFO cost-flow assumption result in the higher ending inventory balance sheet carrying value? During a period of rising purchase price

> On October 1, 2013, Biddle Corporation purchases equipment from a supplier in France on account at a purchase price of €40,000 and denominates the transaction in euros. Biddle Corporation must pay the €40,000 on March 31

> On September 1, 2013, Turner Corporation places an order with a Japanese supplier for manufacturing equipment for delivery on June 30, 2014. The purchase is denominated in Japanese yen in the amount of ¥5,200,000. Turner Corporation purchases

> During 2013, Zeff Corporation sold marketable securities for $14,000 that had a carrying value of $13,000 at the time of sale. The financial statements of Zeff Corporation reveal the following information with respect to available-for-sale securities:

> Give the likely transaction or event that would result in making each of the independent journal entries that follow: а. Unrealized Loss on Available-for-Sale Securities . 4,000 Marketable Securities... 4,000 b. Cash 1,100 Realized Loss on Sale of A

> Events related to Simmons Corporation’s investments of temporarily excess cash appear below. The firm classifies these investments as available-for-sale securities and does not elect the fair value option. None of these three securiti

> Events related to Elston Corporation’s investments of temporarily excess cash appear below. The firm classifies these investments as available-for-sale securities and does not adopt the fair value option. Elston received no dividends

> Kelly Company acquired $500,000 face value of the outstanding bonds of Steedly Company on January 1, 2013. The bonds pay interest semiannually on June 30 and December 31 at an annual rate of 7% and mature on December 31, 2015. The bonds were priced on th

> Kelly Company acquired $500,000 face value of the outstanding bonds of Steedly Company on January 1, 2013. The bonds pay interest semiannually on June 30 and December 31 at an annual rate of 7% and mature on December 31, 2015. The bonds were priced on th

> Woodward Corporation purchases a new machine for $50,000 on January 1, 2013. The machine has a four-year estimated service life and an estimated salvage value of zero. After paying the cost of running and maintaining the machine, the firm enjoys a $25,00

> Lilly Company reports the following information about its financial statements and tax return for a year (amounts in euros): Depreciation Expense from Financial Statements …………………. €322,800 Financial Statement Pretax Book Income………………………………… 190,800 Inc

> Prepare journal entries to record each of the following items for Union Cable Company for 2012. Union Cable Company uses a calendar year reporting period. Ignore income tax effects. a. Discovers on January 15, 2012, that it neglected to amortize a patent

> Pownall Company reports the following information for a year: Book Income Before Income Taxes……………………………… $318,000 Income Tax Expense…………………………………………………….. 156,000 Income Taxes Payable for the Year …………………………………. 48,000 Income Tax Rate on Taxable Income

> Marytown Energy, an electric utility, reports the following information about its income taxes for three recent years (amounts in millions of U.S. dollars): a. Give the journal entries that Marytown Energy made to record income tax expense for 2011, 20

> Fleet Sneaks, an athletic shoe company, reports the following information about its income taxes for three recent years (amounts in millions of euros): a. Give the journal entries that Fleet Sneaks made to record income tax expense for 2011, 2012, and

> Reliance, an automobile manufacturer, reports the following information related to its health care plan for 2013 (amounts in millions of euros). Reliance applies U.S. GAAP. Health Care Plan Assets, Beginning of 2013………………….. € 6,497 Plus Actual Return o

> Tasty Dish Inc., a consumer foods company, reports the following information related to its only pension plan for 2013 (amounts in millions of U.S. dollars). Tasty Dish applies U.S. GAAP. Pension Plan Assets, Beginning of 2013…………………………..………$5,086 Plus

> Air Flight, an aerospace manufacturer, reports the following information related to its only pension plan for 2013 (amounts in millions of U.S. dollars). Air Flight applies U.S. GAAP. Pension Plan Assets, Beginning of 2013 ………………………..$43,484 Plus Actual

> Lorimar Company grows and ages tobacco. On January 2, 2013, the firm has aging tobacco in inventory with a cost of $200,000 and a current market value of $300,000. Lorimar wants to use this tobacco to obtain financing. The firm uses a December 31 year-en

> Cypres Appliance Store has $100,000 of accounts receivable on January 2, 2013. These receivables are due on December 31, 2013. The firm wants to use these accounts receivables to obtain financing. a. Prepare journal entries during 2013 for the transactio

> On January 1, 2013, Baldwin Products, as lessee, leases a machine used in its operations. The annual lease payment of $10,000 is due on December 31 of 2013, 2014, and 2015. The machine reverts to the lessor at the end of the three years. The lessor can e

> Sun Microsystems manufactures an engineering workstation for $7,200 and sells it for $12,000. Although the workstation has a physical life of approximately 10 years, rapid technological change limits its expected useful life to three years. Sun leases a

> Roth Company has prepared its financial statements for the year ended December 31, 2013, and for the three months ended March 31, 2014. You will prepare a statement of cash flows for the three months ended March 31, 2014. Exhibit 16.9 presents the compan

> Refer to the four scenarios in the preceding question. Describe the accounting for these leases under the new/current rules.

> Boeing manufactures a jet aircraft at a cost of $50 million. The usual selling price for this aircraft is $60 million, and its typical useful life is 25 years. United Airlines desires to lease this aircraft from Boeing. The parties contemplate the follow

> Restin Corporation issues $20,000,000 face value, 10 year, 8% semiannual coupon bonds on January 1, 2014. The bonds promise coupon payments on June 30 and December 31 of each year. The market initially priced the bonds to yield 7% compounded semiannually

> Corporation issues $10,000,000 face value, 10-year, 6% semiannual coupon bonds on January 1, 2013. The bonds require coupon payments on June 30 and December 31 of each year. The market initially priced the bonds to yield 6% compounded semiannually. The c

> Several years ago, Huergo Dooley Corporation (HDC) issued $2,000,000 face value, 8% semiannual coupon bonds on the market initially priced to yield 10% compounded semiannually. The bonds require HDC to make semiannual payments of 4% of face value on June

> Robinson Company issues $5,000,000 face value, 8% semiannual coupon bonds maturing in 10 years. The market initially prices these bonds to yield 10% compounded semiannually. Robinson Company accounts for these bonds using amortized cost measurement based

> O’Brien Corporation issues $8,000,000 face value, 8% semiannual coupon bonds maturing in 20 years. The market initially prices these bonds to yield 6% compounded semiannually. O’Brien Corporation accounts for these bonds using amortized cost measurement

> On January 1 of the current year, Womack Company issues 10% semiannual coupon bonds maturing five years from the date of issue. The firm issues the bonds to yield 8% compounded semiannually. The bonds have a face value of $100,000. a. Compute the initial

> Compute the issue price of each of the following bonds. a. $1,000,000 face value, zero coupon bonds due in 20 years, priced on the market to yield 10% compounded semiannually. b. $1,000,000 face value, serial bonds repayable in equal semiannual installme

> Company A and Company B both start 2012 with $1 million of shareholders’ equity and 100,000 shares of common stock outstanding. During 2012, both companies earn net income of $100,000, a return of 10% on common shareholders’ equity at the beginning of 20

> Hager Company acquires a computer from Volusia Computer Company. The cash price (fair value) of the computer is $37,938. Hager Company gives a three-year, interest-bearing note with a maturity value of $40,000. The note requires annual payments of 6% of

> Give correcting entries for the following situations. In each case, the firm uses the straight-line method of depreciation and closes its books annually on December 31. a. A firm purchased a computer for $3,000 on January 1, 2011. It depreciated the comp

> The balance sheets of Wilcox Corporation at the beginning and end of the year contained the following data: During the year, Wilcox Corporation sold machinery and equipment at a gain of $4,000. It purchased new machinery and equipment at a cost of $230

> Fedup Express acquired a delivery truck on January 1, 2009, for $48,000. It estimated that the truck would have a six-year useful life and $6,000 salvage value. Fedup Express uses the straight-line depreciation method. On July 1, 2013, Fedup Express sell

> Tillis Corporation acquired the assets of Kieran Corporation (Kieran) on January 1, 2011, for $2,400,000. On this date the fair values of the assets of Kieran were as follows: land, $400,000; building, $600,000; equipment, $900,000. On June 15, 2013, a c

> Wildwood Properties owns an apartment building that has a carrying value of $15,000,000 on January 1, 2013. The highway department has decided to construct a new highway near the building, which substantially decreases its attractiveness to tenants. Wild

> Give the journal entries for the following selected transactions of Florida Manufacturing Corporation. The company uses the straight-line method of calculating depreciation and reports on a December 31 year-end. a. The firm purchases a cutting machine on

> On January 1, 2013, Luck Delivery Company acquired a new truck for $30,000. It estimated the truck to have a useful life of five years and no salvage value. The company closes its books annually on December 31. Indicate the amount of the depreciation cha

> Duck Vehicle Manufacturing Company incurs various costs in developing a new, amphibious vehicle for use in providing tours on land and water. Indicate the accounting treatment for each of the following expenditures. Duck Vehicle applies U.S. GAAP. (

> Bolton Company purchased a plot of land for $90,000 as a factory site. A small office building sits on the plot, conservatively appraised at $20,000. The company plans to use the office building after making some modifications and renovations (item (4) b

> Boslan Group reported having 89.1 million shares outstanding at the end of its most recent fiscal year, ended December 31, 2012. On March 1, 2013, Boslan issued 25.1 million shares of common stock, at a price of $32 per share. On August 1, 2013, Boslan r

> For each of the following expenditures or acquisitions, indicate the type of account debited. Classify the account as (1) asset other than product cost, (2) product cost (Work-in-Process Inventory), or (3) expense. If the account debited is an asset acco

> Outback Steakhouse opened a new restaurant on the site of an existing building. It paid the owner $260,000 for the land and building, of which it attributes $52,000 to the land and $208,000 to the building. Outback incurred legal costs of $12,600 to cond

> On December 31, 2012, Delchamps Group reported a balance in Restructuring Provisions of €50.9 million, of which €12.5 million was expected to be paid in 2013, with the remainder to be settled during 2014–2015. The balance in this account at the start of

> For the fiscal year ended September 30, Sappi Paper Limited, a South African paper company, reported an ending balance in its Restructuring Provision, the balance sheet account, of ZAR16 million (ZAR denotes the South Africa Rand currency). The beginning

> Kingspeed Bikes offers three-year warranties against defects on the sales of its high-end racing bikes. The firm estimates that the total cost of warranty claims over the three-year warranty period on bikes sold will equal 6% of sales revenue. Kingspeed

> Miele Company is a German family-owned appliance business. Assume that Miele provides a two-year warranty on its products and that Miele estimates current year warranty costs to be 4% of sales revenues. At the beginning of last year, Mieleâ€&#

> Hurley Corporation sells household appliances (for example, refrigerators, dishwashers) to customers on account. The firm also provides warranty services on products sold. Hurley estimates that 2% of sales will ultimately become uncollectible and that wa

> During the year ended June 30, McGee Associates’ office employees earned wages of $700,000. McGee withheld 30% of this amount for payments for various income and payroll taxes. In addition, McGee must pay 10% of gross wages for the employer’s share of va

> EKG Company, a manufacturer of medical supplies, began the year with 10,000 units of product that cost $8 each. During the year, it produced another 60,000 units at a cost of $15 each. Sales for the year were expected to total 70,000 units. During Novemb

> Harmon Corporation commenced operations on January 1, 2011. It uses a LIFO cost-flow assumption. Its purchases and sales for the first three years of operations appear next: a. Compute the amount of ending inventory for each of the three years. b. Comp

> Kennett Corporation reported having 214.6 million shares outstanding at the end of its most recent fiscal year, ended December 31, 2012. On April 1, 2013, Kennett issued 36.2 million shares of common stock, at a price of $18 per share. On September 1, 20

> Sun Health Food’s purchases of vitamins during its first year of operations were as follows: The inventory on December 31 was 420 units. Compute the cost of the inventory on December 31 and the cost of goods sold for the year under ea

> Ericsson, a Swedish networks and communications firm, reported a gross value of inventory of SEK25,227 on December 31. It also reported an ending balance in the allowance for impairments of SEK2,752 million. During the year, Ericsson recognized a write-d

> Fun-in-the-Sun Tanning Lotion Company manufactures suntan lotion made from organic materials. During its first year of operations, it purchased raw materials costing $78,200, of which it used $56,300 in manufacturing suntan lotions. It incurred manufactu

> Tesco Plc. is the U.K.’s largest grocery store chain. It applies IFRS and reports its results in millions of pounds sterling (£). For a recent year, Tesco reported at year-end and at the beginning of the year, as follows:

> Target Corporation, a U.S.-based retailer, follows U.S. GAAP and reports its results in millions of U.S. dollars ($). Its balance sheet for the End of Year and Beginning of Year contains the following information: Target’s income stat

> ResellFast purchases residential and commercial real estate for resale. ResellFast has a December 31 year-end and prepares financial statements quarterly. On February 5, 2012, ResellFast acquired an openair mall in Miami, Florida, with space for 15 retai

> Trembly Department Store commenced operations on January 1, 2012. It engaged in the following transactions during January. Identify the amount that the firm should include in the valuation of merchandise inventory. a. Purchases of merchandise on account

> Ringgold Winery is a large U.S.-based winery. In 2012 Ringgold spent $2.2 million to acquire grapes (including transportation costs of $200,000). Ringgold incurred processing costs of $50,000 in materials (such as barrels, bottles, and corks), $145,000 i

> Liquid Crystal Display Corporation (LCD), a Korean multinational firm, reported an ending balance for Prepayments of KRW345,609 million for the year ending December 31, 2012. For the year ended December 31, 2011, the ending balance in this account was KR

> A Belgian food distributor reported ending balances in Prepayments of €30.7 million, €25.8 million, and €42.1 million for the years ended December 31, 2012, 2011, and 2010, respectively. Assume that Prepayments pertain to insurance premiums on warehouses

> Calculating earnings per share. The following information pertains to Hatchet Limited for the years ended December 31, 2012 and 2013: Calculate the missing amounts in the above table: a. Net income, 2012. b. Weighted average number of shares outstandin

> Give the likely transaction or event that would result in making each of the independent journal entries that follow. Bad Debt Expense .... 2,300 а. Allowance for Uncollectible Accounts 2,300 b. Allowance for Uncollectible Accounts 450 Accounts Rece

> The balance sheets of Milton Corporation on December 31, 2013 and 2014, showed gross accounts receivable of $15,200,000 and $17,600,000, respectively. The balances in the Allowance for Uncollectible Accounts account at the beginning and end of 2014 were

> During the year ended December 31, 2012, an aircraft manufacturer sold a jet for $72 million; assume that the cost to produce the jet was $57 million. The customer agreed to pay the manufacturer $24 million per year, for three years, with the first payme

> During the year ended December 31, 2013, Cunningham Realty Partners sold a tract of land costing $80,000 for $120,000. The customer agreed to pay the purchase price in four equal annual installments, with the first payment made on December 31, 2013. Comp

> Raytheon has agreed to construct missile detection system for $900 million. Expected and actual costs to construct the system were as follows: 2011, $200 million; 2012, $200 million; and 2013, $300 million. Raytheon completed the system in 2013. Compute

> The Shannon Construction Company agreed to build a warehouse for $6,000,000. Expected and actual costs to construct the warehouse were as follows: 2012, $1,200,000; 2013, $3,000,000; and 2014, $600,000. The firm completed the warehouse in 2014. Compute r

> Hamilia S.A.’s financial records show the following balances in its accounts receivable: Age of Accounts………………………………………………………..Balance Receivable 0–30 Days……………………………………………………………………………..€980,000 31–60 Days ……………………………………………………………………………….130,000 91–150 D

> Suggest reasons why the total assets and total liabilities of a defined benefit pension plan do not appear, but their net amount does appear, on the employer’s balance sheet.

> U.S. GAAP and IFRS require firms to amortize the fair value of stock options as an expense over the periods the firm expects to receive employee services as a result of granting the options. What is the theoretical rationale for this amortization?

> Common shareholders have voting rights, but preferred shareholders have higher seniority. What does the difference in seniority mean?

> Describe the rationale for why an investor using the equity method must recognize its share of Other Comprehensive Income of the investee.

> Describe the rationale for why an investor using the equity method must amortize any excess purchase price attributable to assets with a definite service life.

> Assume the following data from the accounts of Fujitsu Limited for the years ended March 31, 2012, and March 31, 2011. Fujitsu reports its results in millions of yen (Â¥). For purposes of this problem, assume that Fujitsu applies U.S. GAAP or I

> Dividends received or receivable from another company are revenue in calculating net income, a return of investment, or eliminated, depending on the method of accounting the investor uses.” Explain.

> Why must we eliminate intercompany transactions when preparing consolidated financial statements?