Question: On January 1, 2014, Dunbar Corporation, an

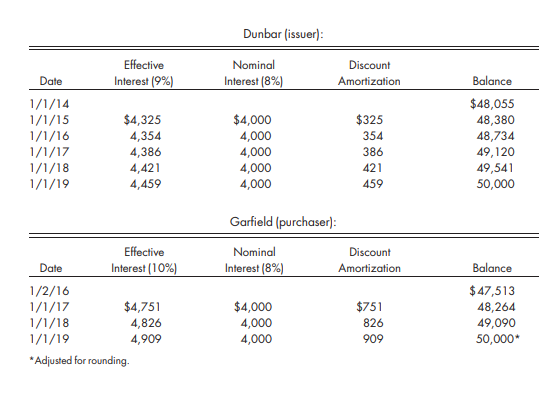

On January 1, 2014, Dunbar Corporation, an 85%-owned subsidiary of Garfield Industries, received $48,055 for $50,000 of 8%, 5-year bonds it issued when the market rate was 9%. When Garfield Industries purchased these bonds for $47,513 on January 2, 2016, the market rate was 10%. Given the following effective interest amortization schedules for both companies, calculate the gain or loss on retirement and the interest adjustments to the issuer’s income distribution schedules over the remaining term of the bonds.

Transcribed Image Text:

Dunbar (issuer): Effective Nominal Discount Date Interest (9%) Interest (8%) Amortization Balance $48,055 1/1/14 1/1/15 1/1/16 1/1/17 1/1/18 1/1/19 $4,325 4,354 4,386 4,421 4,459 $4,000 4,000 4,000 4,000 4,000 $325 48,380 48,734 49,120 49,541 50,000 354 386 421 459 Garfield (purchaser): Effective Nominal Discount Date Interest (10%) Interest (8%) Amortization Balance $ 47,513 1/2/16 1/1/17 1/1/18 1/1/19 $4,751 4,826 4,909 $4,000 4,000 4,000 $751 48,264 49,090 50,000* 826 909 *Adjusted for rounding.

> On January 1, 2015, Peanut Company acquired 80% of the common stock of Salt Company for $200,000. On this date, Salt had total owners’ equity of $200,000 (including retained earnings of $100,000). During 2015 and 2016, Peanut accounted

> Refer to the preceding information for Paulcraft’s acquisition of Switzer’s common stock. Assume that Paulcraft pays $400,000 for 80% of Switzer common stock. Paulcraft uses the cost method to account for its investmen

> Rainman Corporation is considering the acquisition of Largo Company through the acquisition of Largo’s common stock. Rainman Corporation will issue 20,000 shares of its $5 par common stock, with a fair value of $25 per share, in exchang

> Small Company acquired a controlling interest in Big Company. Private Company had the following balance sheet on the acquisition date: Big Company had the following book and fair values on the acquisition date: The shareholders of Small Company reque

> Green Company is considering acquiring theassets of Gold Corporation by assuming Gold’s liabilities and by making a cash payment. GoldCorporation has the following balance sheet on the date negotiations occur: Appraisals indicate that

> Grant Company purchased the net assets of Harding Company on January 1, 2015, and made the following entry to record the purchase: Current Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100,000

> The following nominal accounts apply to a primary beneficiary company and a VIE: The fair value of the VIE assets had a fair value $100,000 higher than book value on the date control was achieved. The asset adjusted had a 5 year life. The VIE agrees to

> On January 1, 2017, Lund Corporation purchases a 30% interest in Aluma-Boat Company for $200,000. At the time of the purchase, Aluma-Boat has total stockholders’ equity of $400,000. Any excess of cost over the equity purchased is attrib

> Hanson Corporation purchases a 10% interest in Novic Company on January 1, 2016, and an additional 15% interest on January 1, 2018. These investments cost Hanson Corporation $80,000 and $110,000, respectively. The following stockholders’

> Spancrete Corporation acquires a 30% interest in the outstanding stock of Werl Corporation on January 1, 2015. At that time, the following determination and distribution of excess schedule is prepared: During 2015, Spancrete purchases $200,000 of goods

> Turf Company purchases a 30% interest in Minnie Company for $90,000 on January 1, 2015, when Minnie has the following stockholders’ equity: Common stock ($10 par). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $100,000 Paid-in capita

> Tucker Corporation purchases a 25% interest in Lincoln Company for $120,000 on January 1, 2017. The following determination and distribution of excess schedule is prepared: Lincoln Company earns income of $25,000 in 2017 and $30,000 in 2018. Lincoln Co

> On January 1, 2015, Peanut Company acquired 80% of the common stock of Salt Company for $200,000. On this date, Salt had total owners’ equity of $200,000 (including retained earnings of $100,000). During 2015 and 2016, Peanut appropriat

> The following diagram depicts the investment affiliations among Companies M, N, and O: The following facts apply to 2017 operations: All investments are made at a price equal to book value. 1. Prepare the simple equity method adjustments that wou

> On January 1, 2015, Bell Company acquires an 80% interest in Carter Company for $140,000. The purchase price results in a $30,000 (including NCI adjustment) increase in the patent which has a 10-year life. The investment is recorded under the simple equi

> Companies A, B, and C produce the following separate internally generated net incomes during 2015: Company A acquires an 80% interest in Company B on January 1, 2012, and Company B acquires a 60% interest in Company C on January 1, 2013. Each investm

> Baker Company acquires an 80% interest in the common stock of Cain Company for $440,000 on January 1, 2015. The price is equal to the book value of the interest acquired. Baker Company maintains its investment in Cain Company under the cost method. Able

> Lakecraft Company has the following balance sheet on December 31, 2015, when it is acquired for $950,000 in cash by Argo Corporation: All assets have fair values equal to their book values. The combination is structured as a tax free exchange. Lakecraf

> You have secured the following information for Companies A, B, and C concerning their internally generated net incomes (excluding subsidiary income) and dividends paid: 1. Assume Company A acquires an 80% interest in Company B on January 1, 2015, and

> The following comparative statements of stockholders’ equity are prepared for Nolan Corporation: Tarman Corporation acquires 60% of Nolan Corporation common stock for $12 per share on January 1, 2015, when the latter corporation is

> On January 1, 2015, Artic Company acquires an 80% interest in Calco Company for $400,000. On the acquisition date, Calco Company has the following stockholders’ equity: Common stock ($10 par). . . . . . . . . . . . . . . . . . $200,000 Paid-in capital

> Truck Company owns a 90% interest in Trailer Company on January 1, 2015, when Trail has the following stockholders’ equity: Common stock ($10 par). . . . . . . . . . . . . . . . . . . . . $100,000 Paid-in capital in excess of par . . . . . . . . . . .

> Myles Corporation and its subsidiary, Downer Corporation, have the following trial balances as of December 31, 2017: Myles Corporation acquires its 60% interest in Downer Corporation for $348,000 on January 1, 2015. At that time, Downerâ€&

> On January 1, 2015, 100% of the outstanding stock of Solo Company was purchased by Plato Corporation for $3,300,000. At that time, the book value of Solo’s net assets equaled $3,000,000. The excess was attributable to equipment with a 1

> On January 1, 2015, Talbot Company acquires 90% of the outstanding stock of Lego Company for $810,000. At the time of the acquisition, Lego Company has the following stockholders’ equity: Common stock ($10 par). . . . . . . . . . . . . . . . . $300,00

> On December 31, 2014, Zigler Corporation purchases an 80% interest in the common stock of Kim Company for $420,000. The stockholders’ equity of Kim Company on December 31, 2014, is as follows: 8% Cumulative preferred stock (2,000 shares, $100 par) . . .

> Brian Construction Company has the following stockholders’ equity on January 1, 2015, the date on which Roller Company purchases an 80% interest in the common stock for $720,000: 8% cumulative preferred stock (5,000 shares, $100 par) . . . . . . . . . .

> On January 1, 2016, Boelter Company purchases 80% of the outstanding common stock of Mill Corporation for $280,000. On this date, Mill Corporation stockholders’ equity is as follows: 6% Preferred stock (1,000 shares, $100 par). . . . . . . . . . . . .

> Center, Inc., purchases 24,000 shares of Bruce Corporation, which equates to an 80% interest, on January 1, 2015. The following determination and distribution of excess schedule is prepared: Bruce Corporation reports net income of $35,000 for the six

> Your client, Lewison International, has informed you that it has reached an agreement with Herro Company to acquire all of Herro’s assets. Thistransaction will be accomplished through the issue of Lewison’s common stock. After your examination of the fin

> Carpenter Company has the following balance sheet on December 31, 2015: The investment in Hinckley Company account reflects the original cost of an 80% interest (40,000 shares) purchased on January 1, 2012. On the date of the purchase, Hinckley stock

> Rob Company purchases a 90% interest in Venus Company for $418,500 on January 1, 2017. Any excess of cost over book value is attributed to equipment, which is being depreciated over 20 years. Both companies end their reporting periods on December 31. Sin

> Baker Corporation purchases a 60% interest in Hardee Company on January 1, 2015, for $135,000. On that date, Hardee Company has the following stockholders’ equity: Common stock ($10 par). . . . . . . . . . . . . . . . $100,000 Retai

> Prior to January 2, 2018, Prestar and Saturn are separate corporations. Saturn Corporation is contemplating a major expansion and seeks to be purchased by a larger corporation with available cash. Prestar Corporation issues $1,350,000 of bonds and uses t

> Refer to the preceding information for Paulcraft’s acquisition of Switzer’s common stock. Assume that Paulcraft pays $420,000 for 100% of Switzer common stock. Paulcraft uses the simple equity method to account for its

> The separate income statements of Coors Company and its 60% owned subsidiary, Vespa Company, for the year ended December 31, 2017, are as follows: The following additional information is available: a. Coors Company acquires its interest in Vespa Co

> (This is the same as Exercise 5 but with separate taxation.) Dunker Company purchases an 80% interest in the common stock of Fennig Company for $850,000 on January 1, 2017. The fair value of the NCI is $212,500. At the time of the purchase, the total sto

> Deko Company purchases an 80% interest in the common stock of Farwell Company for $850,000 on January 1, 2017. At the time of the purchase, the total stockholders’ equity of Farwell is $968,750. The fair value of the NCI is $212,500. Th

> On May 1, 2016, Tole Company acquires a 80% interest in Marco Company for $400,000. The fair value of the NCI is $100,000. The following determination and distribution of excess schedule is prepared: Goodwill, applicable to the parentâ€

> Paridon Motors purchases an 80% interest in Snap Battery Company on January 1, 2012, for $700,000 cash. At that date, Snap Battery Company has the following stockholders’ equity: Common stock ($10 par). . . . . . . . . . . . . . . . . . . . . . $100,00

> Duckworth Corporation purchases an 80% interest in Panda Corporation on January 1, 2017, in exchange for 5,000 Duckworth shares (market value of $18) plus $155,000 cash. The fair value of the NCI is proportionate to the price paid by Duckworth for its in

> Avery Company acquires the net assets of Iowa Company on July 1, 2015. The net assets acquired include plant assets that are provision all estimated to have a fair value of $600,000 with a 10-year usable life and no salvage value. Depreciation is recorde

> Born Company acquires an 80% interest in Roland Company for $660,000 cash on January 1, 2017. The NCI has a fair value of $165,000. Any excess of cost over book value is attributed to goodwill. To help pay for the acquisition, Born Company issues 5,000 s

> The Auto Clinic is a wholly owned subsidiary of Fast-Check Equipment Company. Fast-Check Equipment sells and leases 4-wheel alignment machines. The usual selling price of each machine is $35,000; it has a cost to FastCheck Equipment of $25,000. On Januar

> On January 1, 2015, Traylor Company, an 80%-owned subsidiary of Parker Electronics, Inc., signed a 4-year direct financing lease with its parent for the rental of electronic equipment. The lease agreement requires a $12,000 payment on January 1 of each y

> Detner International purchases 80% of the outstanding stock of Hardy Company for $1,600,000 on January 1, 2015. At the purchase date, the inventory, equipment, and patents of Hardy Company have fair values of $10,000, $50,000, and $100,000, respectively,

> Grande Machinery Company purchased, for cash, a $60,000 custom machine on January 1, 2015. The machine has an estimated 5-year life and will be straight-line depreciated with no salvage value. The machine was then leased to Sunshine Engineering Company,

> Linco Industries is a 90%- owned subsidiary of Sharp Incorporated. On January 1, 2015, Linco issued $100,000 of 10- year, 6% bonds for $86,580, to yield 8% interest. Interest is paid annually on January 1. The effective interest method is used to amortiz

> Carlton Company is an 80%- owned subsidiary of Mirage Company. On January 1, 2015, Carlton sold $100,000 of 10-year, 7% bonds for $101,000. Interest is paid annually on January 1. The market rate for this type of bond was 9% on January 2, 2017, when Mira

> Cardinal Company is an 80%- owned subsidiary of Dove Corporation. Cardinal Company issued $100,000 of 8%, 10-year bonds for $96,000 on January 1, 2011. Annual interest is paid on January 1. Dove Corporation purchased the bonds on January 1, 2015, for $10

> Darcy Company is an 80%-owned subsidiary of Kraco Industries. Darcy Company issued 10-year, 8% bonds in the amount of $1,000,000 on January 1, 2015. The bonds were issued at face value, and interest is payable each January 1. On January, 1, 2017, Kraco I

> Model Engineering is a large corporation with the ability to obtain financing by selling its bonds at favorable rates. Currently, it pays 5% interest on its 10-year bond issues. In the past year, Model acquired an 80% interest in Mercer Industries. Merce

> Norton Corporation agrees to acquire the net assets of Payco Corporation. Just prior to the acquisition, Payco’s balance sheet is as follows: Fair values agree with book values except for the equipment, which has an estimated fair val

> Saratoga Company owns 80% of the outstanding common stock of Windsor Company. On May 1, 2017, Windsor Company arranges a 1-year, $50,000 loan from Saratoga Company. The loan agreement specifies that interest will accrue at the rate of 6% per annum and th

> Peninsula Company owns an 80% controlling interest in Sandbar Company. Sandbar regularly sells merchandise to Peninsula, which then sells to outside parties. The gross profit on all such sales is 40%. On January 1, 2015, Peninsula sells land and a buildi

> Jeter Corporation purchases 80% of the outstanding stock of Super Company for $275,000 on July 1, 2015. Super Company has the following stockholders’ equity on July 1, 2015: Common stock ($5 par). . . . . . . . . . . . . . . . . . . .

> The separate income statements of Danner Company and its 90%-owned subsidiary, Link Company, for the year ended December 31, 2016, are as follows: The following additional facts apply: a. On January 1, 2015, Link Company purchased a building, with a

> Hilton Corporation sold a press to its 80%-owned subsidiary, Agri Fab Inc., for $5,000 on January 1, 2016. The press originally was purchased by Hilton on January 1, 2015, for $20,000, and $6,000 of depreciation for 2015 had been recorded. The fair value

> Wavemasters Inc., owns an 80% interest in Sayner Development Company. In a prior period, Sayner Development purchased a parcel of land for $50,000. During 2015, it constructed a building on the land at a cost of $500,000. The land and building were sold

> On January 1, 2016, Jungle Company sold a machine to Safari Company for $30,000. The machine had an original cost of $24,000, and accumulated depreciation on the asset was $9,000 at the time of the sale. The machine has a 5-year remaining life and will b

> Norco Company is an 80%-owned subsidiary of Victory Corporation. The separate income statements of the two companies for 2016 are as follows: The following facts apply to 2016: a. Norco Company sold $90,000 of goods to Victory Corporation. The gross pr

> Hide Corporation is a wholly owned subsidiary of Seek Company. During 2015, Hide sold all of its production to Seek Company for $400,000, a price that includes a 25% gross profit. 2015 was the first year that such intercompany sales were made. By year-en

> Assume the same facts as in Exercise 11, but in addition, assume that Saratoga is itself in need of cash. It discounts the note received from Windsor at First Bank on July 1, 2017, at a discount rate of 8% per annum. 1. Prepare the entries that both comp

> Sorel is an 80%-owned subsidiary of Pattern Company. The two affiliates had the following separate income statements for 2015 and 2016. Sorel sells at the same gross profit percentage to all customers. During 2015, Sorel sold goods to Pattern for the

> Pederson Company acquires the net assets of Shelby Company by issuing 100,000 of its $1 par value shares of common stock. The shares have a fair value of $20 each. Just prior to the acquisition, Shelby’s balance sheet is as follows: F

> Whitney Company acquires an 80% interest in Masters Company common stock on January 1, 2015. Appraisals of Masters’ assets and liabilities are performed, and Whitney ends up paying an amount that is greater than the fair value of Master

> Sandin Company prepares the following balance sheet on January 1, 2015: On this date, Prescott Company purchases 8,000 shares of Sandin Company’s outstanding stock for a total price of $270,000. Also on this date, the buildings are u

> The trial balances of Parker and Sargent companies of Exercise 7 for December 31, 2016, are presented as follows: Parker Company continues to use the cost method. 1. Prepare all the eliminations and adjustments that would be made on the 2016 consolidat

> Parker Company acquires an 80% interest in Sargent Company for $300,000 in cash on January 1, 2015, when Sargent Company has the following balance sheet: The excess of the price paid over book value is attributable to the fixed assets, which have a fai

> Baker Enterprises purchases an 80% interest in Kohlenberg International for $850,000 on January 1, 2015. The estimated fair value of the NCI is $190,000. On the purchase date, Kohlenberg International has the following stockholders’ equ

> On January 1, 2015, Paro Company purchases 80% of the common stock of Solar Company for $320,000. On this date, Solar has common stock, other paid-in capital in excess of par, and retained earnings of $50,000, $100,000, and $150,000, respectively. Net in

> You are working on a consolidated trial balance of a parent and an 80% owned subsidiary. What components will enter into the total noncontrolling interest, and how will it be displayed in the consolidated balance sheet?

> Since a primary beneficiary’s share of VIE income is not based on common stock ownership, how might it be calculated?

> The trial balances of Parker and Sargent companies of Exercise 5 for December 31, 2016, are presented as follows: Parker Company continues to use the sophisticated equity method. 1. Prepare all the eliminations and adjustments that would be made on the

> A parent company may want to shift profits to the controlling interest and may use intercompany capital leases to accomplish that end. Is there an opportunity to do that with both direct financing and sales-type leases? What are the differences between t

> What does the elimination process accomplish?

> Panther Company is about to acquire a 100% interest in Snake Company. Snake has identifiable net assets with book and fair values of $300,000 and $500,000, respectively. As payment, Panther will issue common stock with a fair value of $750,000. How would

> Bell Corporation purchases all of the outstanding stock of Stockdon Corporation for $220,000 in cash on January 1, 2017. On the purchase date, Stockdon Corporation has the following condensed balance sheet: Any excess of book value over cost is attribu

> Major Corporation is acquiring Abrams Company by issuing its common stock in a nontaxable exchange. Major is issuing common stock with a fair value of $850,000for net identifiable assets with book and fair values of $400,000 and $600,000, respectively. W

> During 2015, Company P sold $50,000 of goods to subsidiary Company S at a profit of $12,000. One-fourth of the goods remain unsold at year-end. What specific adjustments are needed on the consolidated worksheet to deal with these issues?

> The Vary Company has total assets with a book value of $3,000,000 and a fair value of $4,000,000. A potential primary beneficiary company has guaranteed the debt of the Vary Company and will receive a share of income of the Vary Company based on contract

> Company R owns a 30% interest in Company E, which it acquires at book value. Company E reports net income of $50,000 for 2015 (ignore taxes). There is an intercompany sale of equipment at a gain of $20,000 on January 1, 2015. The equipment has a 5-year l

> Company R pays $170,000 for a 30% interest in Company E on January 1, 2015. Company E’s total stockholders’ equity on that date is $500,000. The excess price is attributed to equipment with a 5-year life. During 2015, Company E reports net income of $35,

> A parent company acquired an 80% interest in a subsidiary on January 1, 2015, at a price high enough to result in goodwill. Included in the assets of the subsidiary are inventory with a book value of $50,000 and a fair value of $55,000 and equipment with

> A parent company acquired an 80% interest in a subsidiary on July 1, 2015. The subsidiary closed its books on that date. The subsidiary reported net income of $60,000 for 2015, earned evenly during the year. The parent’s net income, exclusive of any inco

> Parker Company acquires an 80% interest in Sargent Company for $300,000 on January 1, 2015, when Sargent Company has the following balance sheet: The excess of the price paid over book value is attributable to the fixed assets, which have a fair value

> What is the noncontrolling share of consolidated net income? Does it reflect adjustments based on fair values at the purchase date? How has it been displayed in income statements in the past, and how should it be displayed?

> A parent company paid $500,000 for a 100% interest in a subsidiary. At the end of the first year, the subsidiary reported net income of $40,000 and paid $5,000 in dividends. The price paid reflected understated equipment of $70,000, which will be amortiz

> The trial balances of Charles Company and its subsidiary, Lehto, Inc., are as follows on December 31, 2017: On January 1, 2015, Charles Company exchanges 20,000 shares of its common stock, with a fair value of $20 per share, for all the outstanding sto

> It seems as if consolidated net income is always less than the sum of the parent’s and subsidiary’s separately calculated net incomes. Is it possible that the consolidated net income of the two affiliated companies could actually exceed the sum of their

> Pillow Company is purchasing an 80% interest in the common stock of Sleep Company for $800,000. Sleep’s balance sheet amounts at book and fair value are as follows: Use a valuation analysis schedule to determine what will be the amoun

> Pillow Company is purchasing an 80% interest in the common stock of Sleep Company. Sleep’s balance sheet amounts at book and fair values are as follows: Use valuation analysis schedules to determine what adjustments to recorded values

> Pillow Company is purchasing a 100% interest in the common stock of Sleep Company. Sleep’s balance sheet amounts at book and fair values are as follows: Use valuation analysis schedules to determine what adjustments to recorded values

> Paulos Company purchases a controlling interest in Sanjoy Company. Sanjoy had identifiable net assets with a book value of $500,000 and a fair value of $800,000. It was agreed that the total fair value of Sanjoy’s common stock was $1,200,000. Use value a

> What is meant by date alignment? Does it exist on the consolidated worksheet under the following methods, and if not, how is it created prior to elimination of the investment account under each of these methods? a. The simple equity method b. The sophist

> Jacobson Company is considering an investment in the common stock of Biltrite Company. What are the accounting issues surrounding the recording of income in future periods if Jacobson purchases: a. 15% of Biltrite’s outstanding shares. b. 40% of Biltrite

> Company P owns 90% of Company S’s shares. Assume Company S then purchases 2% of Company P’s outstanding shares of common stock. When consolidating, what happens to the 2% holding in the consolidated financial statements?

> The trial balances of Parker and Sargent companies of Exercise 3 for December 31, 2016, are presented as follows: Parker Company continues to use the simple equity method. 1. Prepare all the eliminations and adjustments that would be made on the 2016

> Company A owns 80% of Company B. Company B owns 60% of Company C. From a consolidated viewpoint, does A control C? How will $10,000 of Company C income flow to the members of the consolidated firms when it is distributed at year-end?

> Quail Company purchases 80% of the common stock of Commo Company for $800,000. At the time of the purchase, Commo has the following balance sheet: The fair values of assets are as follows: Cash equivalents . . . . . . . . . . . . . . . . . $120,000 In