Question: On January 1, Jarel acquired 80 percent

On January 1, Jarel acquired 80 percent of the outstanding voting stock of Suarez for $260,000 cash consideration. The remaining 20 percent of Suarez had an acquisition-date fair value of $65,000. On January 1, Suarez possessed equipment (five-year remaining life) that was undervalued on its books by $25,000. Suarez also had developed several secret formulas that Jarel assessed at $50,000. These formulas, although not recorded on Suarez’s financial records, were estimated to have a 20-year future life.

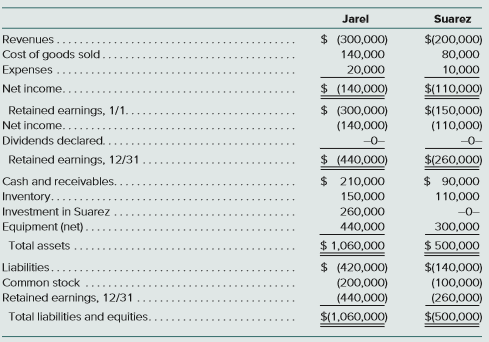

As of December 31, the financial statements appeared as follows:

Included in the above statements, Jarel sold inventory costing $80,000 to Suarez for $100,000. Of these goods, Suarez still owns 60 percent on December 31.

What is the total of consolidated expenses?

a. $30,000

b. $36,000

c. $37,500

d. $39,000

Transcribed Image Text:

Jarel Suarez Revenues $ (300,000) $(200,000) Cost of goods sold 140,000 80,000 Expenses . 20,000 10,000 Net income. $ (140,000) $(110,000) $ (300,000) (140,000) Retained earnings, 1/1.. $(150,000) Net income.... (110,000) Dividends declared. Retained earnings, 12/31 $ (440,000) $(260,000) Cash and receivables.. $ 210,000 $ 90,000 Inventory..... 150,000 110,000 Investment in Suarez 260,000 440,000 -0- Equipment (net). 300,000 Total assets $ 1,060,000 $ 500,000 $ (420,000) (200,000) (440,000) Liabilities... $(140,000) Common stock (100,000) (260,000) Retained earnings, 12/31 Total liabilities and equities. $(1,060,000) $(500,000)

> Placid Lake Corporation acquired 80 percent of the outstanding voting stock of Scenic, Inc., on January 1, 2017, when Scenic had a net book value of $400,000. Any excess fair value was assigned to intangible assets and amortized at a rate of $5,000 per y

> McCarthy, Inc.’s Brazilian subsidiary borrowed 100,000 euros on January 1, 2017. Exchange rates between the Brazilian real (BRL) and euro (€) and between the U.S. dollar ($) and BRL are as follows: What amo

> McCarthy, Inc.’s Brazilian subsidiary borrowed 100,000 euros on January 1, 2017. Exchange rates between the Brazilian real (BRL) and euro (€) and between the U.S. dollar ($) and BRL are as follows: At what

> The functional currency of Bertrand, Inc.’s Irish subsidiary is the euro. Bertrand borrowed euros as a partial hedge of its investment in the subsidiary. Since then, the euro has decreased in value. Bertrand’s negative translation adjustment on its inves

> A Clarke Corporation subsidiary buys marketable equity securities and inventory on April 1, 2017, for 100,000 won each. It pays for both items on June 1, 2017, and they are still on hand at year-end. Inventory is carried at cost under the lower-of-cost-o

> A Clarke Corporation subsidiary buys marketable equity securities and inventory on April 1, 2017, for 100,000 won each. It pays for both items on June 1, 2017, and they are still on hand at year-end. Inventory is carried at cost under the lower-of-cost-o

> St. Philip Company ordered parts costing €100,000 from a foreign supplier on January 15 when the spot rate was $0.20 per €. A one-month forward contract was signed on that date to purchase €100,000 at a forward rate of $0.23. The forward contract is prop

> On July 1, 2017, Mifflin Company borrowed 200,000 euros from a foreign lender evidenced by an interest-bearing note due on July 1, 2018. The note is denominated in euros. The U.S. dollar equivalent of the note principal is as follows: In its 2018 income

> On October 1, 2017, Tile Co., a U.S. company, purchased products from Azulejo, a Portuguese company, with payment due on December 1, 2017. If Tile’s 2017 operating income included no foreign exchange gain or loss, the transaction could have a. Been deno

> On December 15, 2017, Lisbeth Inc. (a U.S. company) purchases merchandise inventory from a foreign supplier for 50,000 schillings. Lisbeth agrees to pay in 45 days after it sells the merchandise. Lisbeth makes sales rather quickly and pays the entire obl

> Peerless Corporation (a U.S. company) made a sale to a foreign customer on September 15, for 100,000 crowns. It received payment on October 15. The following exchange rates for 1 crown apply: September 15………..$0.60 September 30………….0.66 October 15……………….

> On January 1, 2017, Corgan Company acquired 80 percent of the outstanding voting stock of Smashing, Inc., for a total of $980,000 in cash and other consideration. At the acquisition date, Smashing had common stock of $700,000, retained earnings of $250,0

> On November 1, 2017, Dos Santos Company forecasts the purchase of raw materials from a Brazilian supplier on February 1, 2018, at a price of 200,000 Brazilian reals. On November 1, 2017, Dos Santos pays $1,500 for a three-month call option on 200,000 rea

> On November 1, 2017, Dos Santos Company forecasts the purchase of raw materials from a Brazilian supplier on February 1, 2018, at a price of 200,000 Brazilian reals. On November 1, 2017, Dos Santos pays $1,500 for a three-month call option on 200,000 rea

> On June 1, 2017, Micro Corp. received an order for parts from a Mexican customer at a price of 1,000,000 Mexican pesos with a delivery date of July 31, 2017. On June 1, when the U.S. dollar–Mexican peso spot rate is $0.115, Micro Corp. entered into a two

> On June 1, 2017, Micro Corp. received an order for parts from a Mexican customer at a price of 1,000,000 Mexican pesos with a delivery date of July 31, 2017. On June 1, when the U.S. dollar–Mexican peso spot rate is $0.115, Micro Corp. entered into a two

> On June 1, 2017, Micro Corp. received an order for parts from a Mexican customer at a price of 1,000,000 Mexican pesos with a delivery date of July 31, 2017. On June 1, when the U.S. dollar–Mexican peso spot rate is $0.115, Micro Corp. entered into a two

> On September 1, 2017, Jensen Company received an order to sell a machine to a customer in Canada at a price of 100,000 Canadian dollars. Jensen shipped the machine and received payment on March 1, 2018. On September 1, 2017, Jensen purchased a put option

> On September 1, 2017, Jensen Company received an order to sell a machine to a customer in Canada at a price of 100,000 Canadian dollars. Jensen shipped the machine and received payment on March 1, 2018. On September 1, 2017, Jensen purchased a put option

> On September 1, 2017, Jensen Company received an order to sell a machine to a customer in Canada at a price of 100,000 Canadian dollars. Jensen shipped the machine and received payment on March 1, 2018. On September 1, 2017, Jensen purchased a put option

> Torres Corporation (a U.S.-based company) expects to order goods from a foreign supplier at a price of 100,000 pounds, with delivery and payment to be made on September 20. On July 20, Torres purchased a two-month call option on 100,000 pounds and design

> On March 1, Pimlico Corporation (a U.S.-based company) expects to order merchandise from a supplier in Sweden in three months. On March 1, when the spot rate is $0.10 per Swedish krona, Pimlico enters into a forward contract to purchase 500,000 Swedish k

> Following are several figures reported for Allister and Barone as of December 31, 2018: Allister acquired 90 percent of Barone in January 2017. In allocating the newly acquired subsidiary’s fair value at the acquisition date, Allister

> MNC Corp. (a U.S.-based company) sold parts to a South Korean customer on December 1, 2017, with payment of 10 million South Korean won to be received on March 31, 2018. The following exchange rates apply: MNC’s incremental borrowing r

> MNC Corp. (a U.S.-based company) sold parts to a South Korean customer on December 1, 2017, with payment of 10 million South Korean won to be received on March 31, 2018. The following exchange rates apply: MNC’s incremental borrowing r

> On December 1, 2017, Ringling Company (a U.S.-based company) entered into a three-month forward contract to purchase 1,000,000 pesos on March 1, 2018. The following U.S. dollar per peso exchange rates apply: Ringling’s incremental borr

> Bensman Corporation is computing EPS. One of its subsidiaries has stock warrants outstanding. How do these convertible items affect Bensman’s EPS computation? a. No effect is created because the stock warrants were for the subsidiary company’s shares.

> Comparative consolidated balance sheet data for Iverson, Inc., and its 80 percent–owned subsidiary Oakley Co. follow: Additional Information for Fiscal Year 2018 ∙ Iverson and Oakley’s consolidated

> Comparative consolidated balance sheet data for Iverson, Inc., and its 80 percent–owned subsidiary Oakley Co. follow: Additional Information for Fiscal Year 2018 ∙ Iverson and Oakley’s consolidated

> Aceton Corporation owns 80 percent of the outstanding stock of Voctax, Inc. During the current year, Voctax made $140,000 in sales to Aceton. How does this transfer affect the consolidated statement of cash flows? a. The transaction should be included i

> The parent company acquires all of a subsidiary’s common stock but only 70 percent of its preferred shares. This preferred stock pays a 7 percent annual cumulative dividend. No dividends are in arrears at the current time. How is the noncontrolling inter

> Pesto Company possesses 80 percent of Salerno Company’s outstanding voting stock. Pesto uses the initial value method to account for this investment. On January 1, 2014, Pesto sold 9 percent bonds payable with a $10 million face value (maturing in 20 yea

> Redfield Company reports current earnings of $420,000 while declaring $52,000 in cash dividends. Snedeker Company earns $147,000 in net income and declares $13,000 in dividends. Redfield has held a 70 percent interest in Snedeker for several years, an in

> Several years ago, Bennett, Inc., bought a portion of the outstanding bonds of Smith Corporation, a subsidiary organization. The acquisition was made from an outside party. In the current year, how should these intra-entity bonds be accounted for within

> Aaron Company’s books show current earnings of $430,000 and $46,000 in cash dividends. Zeese Company earns $164,000 in net income and declares $11,500 in dividends. Aaron has held a 70 percent interest in Zeese for several years, an investment with an ac

> Mattoon, Inc., owns 80 percent of Effingham Company. For the current year, this combined entity reported consolidated net income of $500,000. Of this amount $465,000 was attributable to Mattoon’s controlling interest while the remaining $35,000 was attri

> Dane, Inc., owns Carlton Corporation. For the current year, Dane reports net income (without consideration of its investment in Carlton) of $185,000 and the subsidiary reports $105,000. The parent had a bond payable outstanding on January 1, with a carry

> Arcola, Inc., acquires all 40,000 shares of Tuscola Company for $725,000. A year later, when Arcola’s equity adjusted balance in its investment in Tuscola equals $800,000, Tuscola issues an additional 10,000 shares to outside investors for $25 per share

> Neill Company purchases 80 percent of the common stock of Stamford Company on January 1, 2017, when Stamford has the following stockholders’ equity accounts: Common stock—40,000 shares outstanding .......... $100,000 Additional paid-in capital...........

> Neill Company purchases 80 percent of the common stock of Stamford Company on January 1, 2017, when Stamford has the following stockholders’ equity accounts: Common stock—40,000 shares outstanding .......... $100,000 Additional paid-in capital...........

> Neill Company purchases 80 percent of the common stock of Stamford Company on January 1, 2017, when Stamford has the following stockholders’ equity accounts: Common stock—40,000 shares outstanding .......... $100,000 Additional paid-in capital...........

> Aaron owns 100 percent of the 12,000 shares of Veritable, Inc. The Investment in Veritable account has a balance of $588,000, corresponding to the subsidiary’s unamortized acquisition-date fair value of $49 per share. Veritable issues 3,000 new shares to

> Premier Company owns 90 percent of the voting shares of Stanton, Inc. Premier reports sales of $480,000 during the current year and Stanton reports $264,000. Stanton sold inventory costing $28,800 to Premier (upstream) during the year for $57,600. Of thi

> On January 1, Coldwater Company has a net book value of $2,174,000 as follows 2,000 shares of preferred stock; par value $100 per share; cumulative, nonparticipating, nonvoting; call value $108 per share ..................................................

> A subsidiary has (1) a convertible preferred stock and (2) a convertible bond. How are these items factored into the computation of earnings per share for the parent company?

> On January 1, Tesco Company spent a total of $4,384,000 to acquire control over Blondel Company. This price was based on paying $424,000 for 20 percent of Blondel’s preferred stock and $3,960,000 for 90 percent of its outstanding common stock. At the acq

> On January 1, Jarel acquired 80 percent of the outstanding voting stock of Suarez for $260,000 cash consideration. The remaining 20 percent of Suarez had an acquisition-date fair value of $65,000. On January 1, Suarez possessed equipment (five-year remai

> On January 1, Jarel acquired 80 percent of the outstanding voting stock of Suarez for $260,000 cash consideration. The remaining 20 percent of Suarez had an acquisition-date fair value of $65,000. On January 1, Suarez possessed equipment (five-year remai

> On January 1, Jarel acquired 80 percent of the outstanding voting stock of Suarez for $260,000 cash consideration. The remaining 20 percent of Suarez had an acquisition-date fair value of $65,000. On January 1, Suarez possessed equipment (five-year remai

> On January 1, Jarel acquired 80 percent of the outstanding voting stock of Suarez for $260,000 cash consideration. The remaining 20 percent of Suarez had an acquisition-date fair value of $65,000. On January 1, Suarez possessed equipment (five-year remai

> On January 1, Jarel acquired 80 percent of the outstanding voting stock of Suarez for $260,000 cash consideration. The remaining 20 percent of Suarez had an acquisition-date fair value of $65,000. On January 1, Suarez possessed equipment (five-year remai

> Thomson Corporation owns 70 percent of the outstanding stock of Stayer, Incorporated. On January 1, 2016, Thomson acquired a building with a 10-year life for $460,000. Thomson depreciated the building on the straight-line basis assuming no salvage value.

> Dunn Corporation owns 100 percent of Grey Corporation’s common stock. On January 2, 2017, Dunn sold to Grey $40,000 of machinery with a carrying amount of $30,000. Grey is depreciating the acquired machinery over a five-year remaining l

> Angela, Inc., holds a 90 percent interest in Corby Company. During 2017, Corby sold inventory costing $77,000 to Angela for $110,000. Of this inventory, $40,000 worth was not sold to outsiders until 2018. During 2018, Corby sold inventory costing $72,000

> A local partnership is liquidating and has only two assets (cash of $10,000 and land with a cost of $35,000). All partnership liabilities have been paid. All partners are personally insolvent. The partners have capital balances and share profits and loss

> Use the same information as in problem (5) except assume that the transfers were from Bottom Company to Top Company. What are the consolidated sales and cost of goods sold? a. $1,000,000 and $720,000 b. $1,000,000 and $755,000 c. $1,000,000 and $696,0

> Top Company holds 90 percent of Bottom Company’s common stock. In the current year, Top reports sales of $800,000 and cost of goods sold of $600,000. For this same period, Bottom has sales of $300,000 and cost of goods sold of $180,000. During the curren

> Parkette, Inc., acquired a 60 percent interest in Skybox Company several years ago. During 2017, Skybox sold inventory costing $160,000 to Parkette for $200,000. A total of 18 percent of this inventory was not sold to outsiders until 2018. During 2018, S

> What is the primary reason we defer financial statement recognition of gross profits on intra-entity sales for goods that remain within the consolidated entity at year-end? a. Revenues and COGS must be recognized for all intra-entity sales regardless of

> What is the purpose of a drawing account in a partnership’s financial records?

> If a partner is contributing attributes to a partnership such as an established clientele or a particular expertise, what two methods can be used to record the contribution? Describe each method.

> Describe the differences between a Subchapter S corporation and a Subchapter C corporation.

> When a partner sells an ownership interest in a partnership, what rights are conveyed to the new owner?

> By what methods can a new partner gain admittance into a partnership?

> What is a partnership dissolution? Does dissolution automatically necessitate the cessation of business and the liquidation of partnership assets?

> A partnership has the following account balances: Cash, $70,000; Other Assets, $540,000; Liabilities, $260,000; Nixon (50 percent of profits and losses), $170,000; Cleveland (30 percent), $110,000; Pierce (20 percent), $70,000. The company liquidates, an

> If no agreement exists in a partnership as to the allocation of income, what method is appropriate?

> What provisions in a partnership agreement can be used to establish an equitable allocation of income among all partners?

> At what point in the accounting process does the allocation of partnership income become significant?

> Clarke Company has a subsidiary operating in a foreign country. In relation to this subsidiary, what does the term functional currency mean? How is the functional currency determined?

> In translating the financial statements of a foreign subsidiary, why is the value assigned to retained earnings especially difficult to determine? How is this problem normally resolved?

> In what ways does IFRS differ from U.S. GAAP with respect to the translation of foreign currency financial statements?

> How does the timing of hedges of (a) foreign currency denominated assets and liabilities, (b) foreign currency firm commitments, and (c) forecasted foreign currency transactions differ?

> What are the differences in accounting for a forward contract used as a cash flow hedge of (a) a foreign currency denominated asset or liability and (b) a forecasted foreign currency transaction?

> What are the differences in accounting for a forward contract used as a fair value hedge of (a) a foreign currency denominated asset or liability and (b) a foreign currency firm commitment?

> A parent acquires the outstanding bonds of a subsidiary company directly from an outside third party. For consolidation purposes, this transaction creates a gain of $45,000. Should this gain be allocated to the parent or the subsidiary? Why?

> A subsidiary sells land to the parent company at a significant gain. The parent holds the land for two years and then sells it to an outside party, also for a gain. How does the business combination account for these events?

> One company purchases the outstanding debt instruments of an affiliated company on the open market. This transaction creates a gain that is appropriately recognized in the consolidated financial statements of that year. Thereafter, a worksheet adjustment

> Washburn Company owns 75 percent of Metcalf Company’s outstanding common stock. During the current year, Metcalf issues additional shares to outside parties at a price more than its per share consolidated value. How does this transaction affect the busin

> If a seller makes an intra-entity sale of a depreciable asset at a price above book value, the seller’s beginning Retained Earnings is reduced when preparing each subsequent consolidation. Why does the amount of the adjustment change from year to year?

> Why does an intra-entity sale of a depreciable asset (such as equipment or a building) require subsequent adjustments to depreciation expense within the consolidation process?

> The partnership of Butler, Osman, and Ward was formed several years as a local tax preparation firm. Two partners have reached retirement age and the partners have decided to terminate operations and liquidate the business. Liquidation expenses of $34,00

> The partnership of Frick, Wilson, and Clarke has elected to cease all operations and liquidate its business property. A balance sheet drawn up at this time shows the following account balances: Part A Prepare a predistribution plan for this partnership

> Following is a series of independent cases. In each situation, indicate the cash distribution to be made to partners at the end of the liquidation process. Unless otherwise stated, assume that all solvent partners will reimburse the partnership for their

> On January 1, the partners of Van, Bakel, and Cox (who share profits and losses in the ratio of 5:3:2, respectively) decide to liquidate their partnership. The trial balance at this date follows: The partners plan a program of piecemeal conversion of th

> The partnership of Winn, Xie, Yang, and Zed has the following balance sheet Zed is personally insolvent, and one of his creditors is considering suing the partnership for the $10,000 that is currently owed. The creditor realizes that this litigation cou

> March, April, and May have been in partnership for a number of years. The partners allocate all profits and losses on a 2:3:1 basis, respectively. Recently, each partner has become personally insolvent and, thus, the partners have decided to liquidate th

> The consolidation process applicable when intra-entity land transfers have occurred differs somewhat from that used for intra-entity inventory sales. What differences should be noted?

> Intra-entity transfers between the component companies of a business combination are quite common. Why do these intra-entity transactions occur so frequently?

> On January 1, 2018, Fisher Corporation paid $2,290,000 for 35 percent of the outstanding voting stock of Steel, Inc., and appropriately applies the equity method for its investment. Any excess of cost over Steel’s book value was attributed to goodwill. D

> Use the same facts as in problem (22), but assume instead that Arturo pays cash of $4,200,000 to acquire Westmont. No stock is issued. Prepare Arturo’s journal entries to record its acquisition of Westmont. From problem 22: The followi

> Tiberend, Inc., sold $150,000 in inventory to Schilling Company during 2017 for $225,000. Schilling resold $105,000 of this merchandise in 2017 with the remainder to be disposed of during 2018. Assuming that Tiberend owns 25 percent of Schilling and appl

> How would the answer to problem (5) have been affected if the parent had applied the initial value method rather than the equity method? a. No effect: The method the parent uses is for internal reporting purposes only and has no impact on consolidated t

> When should a consolidated entity recognize a goodwill impairment loss? a. If both the fair value of a reporting unit and its associated implied goodwill fall below their respective carrying amounts. b. Whenever the entity’s fair value declines signifi

> On January 1, 2018, Jay Company acquired all the outstanding ownership shares of Zee Company. In assessing Zee’s acquisition-date fair values, Jay concluded that the carrying value of Zee’s long-term debt (8-year remaining life) was less than its fair v

> A company acquires a subsidiary and will prepare consolidated financial statements for external reporting purposes. For internal reporting purposes, the company has decided to apply the equity method. Why might the company have made this decision? a. It

> Kaplan Corporation acquired Star, Inc., on January 1, 2017, by issuing 13,000 shares of common stock with a $10 per share par value and a $23 market value. This transaction resulted in recognizing $62,000 of goodwill. Kaplan also agreed to compensate Sta

> On January 1, 2016, Phoenix Co. acquired 100 percent of the outstanding voting shares of Sedona Inc., for $600,000 cash. At January 1, 2016, Sedona’s net assets had a total carrying amount of $420,000. Equipment (eight-year remaining li

> On January 1, 2016, Phoenix Co. acquired 100 percent of the outstanding voting shares of Sedona Inc., for $600,000 cash. At January 1, 2016, Sedona’s net assets had a total carrying amount of $420,000. Equipment (eight-year remaining li

> The separate condensed balance sheets of Patrick Corporation and its wholly owned subsidiary, Sean Corporation, are as follows: Additional Information: ∙ On December 31, 2017, Patrick acquired 100 percent of Sean’s v