Question: On January 22, 2021, Dobbins Supply, Inc.,

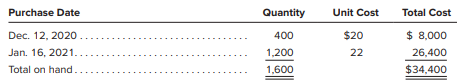

On January 22, 2021, Dobbins Supply, Inc., sold 700 toner cartridges to Foster Office Fitters. Immediately prior to this sale, Dobbins Supply’s perpetual inventory records for these units included the following cost layers.

Instructions:

Note: We present this problem in the normal sequence of the accounting cycle—that is, journal entries before ledger entries. However, you may find it helpful to work part b first.

a. Prepare a separate journal entry to record the cost of goods sold relating to the January 22 sale of 700 toner cartridges, assuming that Dobbins Supply uses the following.

1. Specific identification (300 of the units sold had been purchased on December 12, and the remaining 400 had been purchased on January 16).

2. Average cost.

3. FIFO.

4. LIFO.

b. Complete a subsidiary ledger record for the toner cartridges using each of the four inventory valuation methods listed. Your inventory records should show both purchases of this product, the sale on January 22, and the balance on hand at December 12, January 16, and January 22. Use the formats for inventory subsidiary records illustrated in Exhibits 8–3 through 8–5 of this chapter.

c. Refer to the cost of goods sold figures computed in part a. For financial reporting purposes, can Dobbins Supply, Inc., use the valuation method that resulted in the highest cost of goods sold if, for tax purposes, it used the method that resulted in the lowest cost of goods sold? Explain.

> Indicate whether each of the companies or individuals in the following independent cases would benefit more from a strong U.S. dollar (relatively low foreign exchange rates) or a weak U.S. dollar (relatively high foreign exchange rates). Provide a brief

> Monster Toys is considering a new toy monster called Garga. Annual sales of Garga are estimated at 100,000 units at a price of $8 per unit. Variable manufacturing costs are estimated at $3 per unit, incremental fixed manufacturing costs (excluding deprec

> Harvey Corporation produces several joint products from common materials and shared production processes. Why are costs incurred up to the split-off point not relevant in deciding which products Harvey sells at the split-off point and which products it p

> These selected statistics are from recent annual reports of two well-known retailers. a. Explain the significance of each of these three measures. b. Evaluate briefly the performance of each company on the basis of these three measures

> Identify the variances from standard cost that are generally computed for direct materials, direct labor, and manufacturing overhead.

> Heritage Furniture Co. uses a standard cost system. One of the company’s most popular products is an oak entertainment center that looks like an old icebox but houses a television, stereo, or other electronic components. The per-unit st

> Blind River, Inc., recently hired Neil Young as its bookkeeper. Mr. Young is somewhat inexperienced and has made numerous errors recording daily business transactions. Indicate the effects of the errors described as follows on each of the financial state

> Briefly state the purposes of a statement of cash flows.

> Sci-Fi Labs is a publicly owned company with several issues of capital stock outstanding. Over the past decade, the company has consistently earned modest profits and has increased its common stock dividend annually by 5 or 10 cents per share. Recently t

> Define the term free cash flow. Explain the significance of this measurement to (1) short-term creditors, (2) long-term editors, (3) stockholders, and (4) management.

> Tech Process, Inc., manufactures a variety of computer peripherals, such as tape drives and printers. Listed are five events that occurred during the current year.1. Declared a $1.00 per share cash dividend.2. Paid the cash dividend.3. Purchased 1,000 sh

> A recent annual report of Lowe’s indicates that property is capitalized at cost if it is expected to yield future benefits and has an original useful life that exceeds one year. Cost includes all applicable expenditures to deliver and install the propert

> Georgia Woods, Inc., manufactures furniture to customers’ specifications and uses job order cosign. A predetermined overhead rate is used in applying manufacturing overhead to individual jobs. In Department One, overhead is applied on t

> Selected items from successive annual reports of Middlebrook, Inc., appear as follows. Dividends of $16,000 were declared and paid in year 2. Compute the following: a. Current ratio for year 2 and year 1. b. Debt ratio for year 2 and year 1. c. Earnings

> Alexander, Inc., declared and distributed a 10 percent stock dividend on its 700,000 shares of outstanding $5 par value common stock when the stock was selling for $12 per share. The outstanding shares had originally been sold at $8 per share. The balanc

> Timberlake Corporation is a publicly owned company. The following information is taken from a recent balance sheet. Dollar amounts (except for per-share amounts) are stated in thousands Instructions: From this information, compute answers to the follow

> Dyelot Industries manufactures dyes and uses cost standards. The dye is produced in 1,000 pound batches; the normal level of production is 500 batches of dye per month. The standard costs per batch are as follows. Instructions: You have been engaged to

> Anton Company manufactures wooden magazine stands. An accountant for Anton just completed the variance report for the current month. After printing the report, his computer’s hard drive crashed, effectively destroying most of the actual

> Briefly distinguish between management and financial accounting information in terms of (a) the intended users of the information, and (b) the purpose of the information.

> In the Home Depot 2018 annual report, the following statement is included in explaining the primary risks facing the company. (This statement is an excerpt from a section of the annual report that is not included in Appendix A at the end of this textbook

> The following income statement was prepared by a new and inexperienced employee in theaccounting department of Dexter, Inc., a business organized as a corporation Instructions:a. Prepare a corrected income statement for the year ended December 31, 2021,

> On August 1, year 1, Hampton Construction received a 4.5 percent, 6-month note receivable from Dusty Roads, one of Hampton Construction’s problem credit customers. Roads had owed $43,200 on an outstanding account receivable. The note re

> A recent balance sheet of Sweet as Sugar included the following items, among others. (Dollar amounts are stated in thousands.) The company also reported total assets of $600,000, total liabilities of $90,000, and a return on total assets of 20 percent.

> Many companies have established business codes of conduct outlining procedures that enable employees, suppliers, customers, and members of the Board of Directors to report illegal and or unethical circumstances. Coca-Cola Company provides a Code of Busin

> Explain the meaning of an impairment of an asset. Provide several examples. What accounting event should occur when an asset has become substantially impaired?

> You’ve just read in The Wall Street Journal that the U.S. dollar has strengthened relative to the euro. All else equal, what would you expect to happen to the quantity of Italian leather jackets sold in the United States? Why?

> The following journal entry summarizes for the current year the income tax expense of Sophie’s Software Warehouse. a. Briefly explain the term deferred income tax. b. What is the amount of income tax that the company has paid or expec

> Starting with the most general and moving to the more specific, what are the three primary objectives of financial reporting?

> At the beginning of the year, Gannon, Inc., had 100,000 shares of common stock outstanding. During the current year, the company distributed a 10 percent stock dividend and subsequently paid a $0.50 per share cash dividend. Calculate the number of shares

> The following information has been excerpted from the statement of stockholders’ equity includedin a recent annual report of Thompson Supply Company. (Dollar figures are in millions.) Instructions:Use the information about Thompson Sup

> Arietta Inc. produces a popular brand of air conditioner that is backed by a five-year warranty. In year 1, Arietta began implementing a total quality management program that has resulted in significant changes in its cost of quality. Listed as follows i

> The following is a series of related transactions between Isogon Shoes, a shoe wholesaler, and Sole Mates, a chain of retail shoe stores. Instructions: a. Record this series of transactions in the general journal of Isogon Shoes. (The company records s

> What factors should be considered in drawing up an agreement as to the way in which income shall be shared by two or more partners

> Distinguish between trend percentages and component percentages. Which would be better suited for analyzing the change in sales over several years?

> The following are responsibility income statements for Sotheby, Inc., for the month of June. Instructions: a. The company plans to initiate an advertising campaign for one of the two products in Division 1. The campaign would cost $8,000 per month and i

> What factors should be considered when comparing the net income figure of a partnership to that of a corporation of similar size?

> Under what circumstances might a company have a high p/e ratio even when investors are not optimistic about the company’s future prospects?

> Meager Mining, Inc., has just discovered two new mining sites for iron ore. Geologists and engineers have come up with the estimates on the following page regarding costs and ore yields if the mines are opened. Meier’s owners currently

> Stevens Manufacturing Company obtained authorization to issue 10-year bonds with a face value of $5 million. The bonds are dated June 1, 2021, and have a contract rate of interest of 6 percent. They pay interest on December 1 and June 1. The bonds are is

> In financial statement analysis, what information is produced by computing a ratio that is not available in a simple observation of the underlying data?

> Kolhapur Company manufactures two products: KAP1, which sells for $120; and QUIN, which sells for $220. Estimated cost and production data for the current year are as follows. In addition, fixed manufacturing overhead is estimated to be $2,000,000 and va

> An investor states, “I bought this stock for $50 several years ago and it now sells for $100. It paid $5 per share in dividends last year so I’m earning 10 percent on my investment.” Evaluate this statement.

> The following information is taken from the current year financial statements of Espier Corporation. (Dollar figures and shares of stock are in thousands.) The first three items are net of applicable income tax. The loss from continuing operations does n

> James Lighting manufactures switches that it uses in several of its products. Management is considering whether to continue manufacturing the switches or to buy them from an outside source. The following information is available. 1. The company needs 100

> Why are unfavorable variances recorded by using debit entries and favorable variances recorded by using credit entries?

> Assume that you are preparing a seminar on cost-volume-profit analysis for no accountants. Several potential attendees have approached you and have asked why they should be interested in learning about your topic. The individuals include the following. 1

> Refer to the adjusted trial balance of Wilderness Guide Services, Inc., illustrated in Exercise 5.3 to respond to the following items. a. Prepare all necessary closing entries at December 31, current year. b. Prepare an after-closing trial balance date

> Pfizer, Inc., develops and manufactures various pharmaceutical products. Visit its home page at the following address: www.pfizer.com From the home page, access the company’s most recent financial report by clicking on the Investors tab. Instructions: a

> Potter Corporation mass-produces pencils through several processing departments 10 hours per day, 300 days per year. The company currently uses a process costing system and traces manufacturing costs from one process department to the next. The company p

> Explain the significance of par value. Does par value indicate the reasonable market price for a share of stock? Explain

> The following information relates to the manufacturing operations of Morrhead Manufacturing during the month of July. The company uses job order costing. a. Purchases of direct materials during the month amount to $80,000. (All purchases were made on ac

> The following information relates to the manufacturing operations of Trevino Golf Company during the month of March. The company uses job order costing. a. Purchases of direct materials during the month amount to $83,580. (All purchases were made on acc

> The following are responsibility income statements for Butterfield, Inc., for the month of March. Instructions: a. The company plans to initiate an advertising campaign for one of the two products in Division 1. The campaign would cost $10,000 per month

> Home Team Corporation recently hired Steve Willits as its bookkeeper. Mr. Willits is somewhat inexperienced and has made numerous errors recording daily business transactions. Indicate the effects of the errors described as follows on each of the financi

> Schmaltz Industries organized in January and recorded the following transactions during its first month of operations a. Prepare journal entries for each of these transactions. b. Compute the balance of the Cost of Goods Sold account at January 31. c. D

> The Kroger Company is one of the world’s largest supermarket chains. These selected items were adapted from Kroger’s balance sheet as of February 3, 2018. (Dollar amounts are in millions.) Instructions: a. Using this

> Corner Suites began making high-quality office furniture in January. The company’s executive desks are produced in two departments: Cutting and Finishing. Component kits are produced in the Cutting Department and then transferred to the Finishing Departm

> The 2020 annual report of Software City, Inc., included the following comparative summary of earnings per share over the last three years. In 2021, Software City, Inc., declared and distributed a 2-for-1 stock split. Following this distribution of stock

> Freeze, Inc., sells air conditioners. The company has two sales territories, Northern and Southern. Two products are sold in each territory: Economy and Efficiency. During January, the following data are reported for the Northern territory Common fixed

> Frank’s Fun Company owns 30 pizza parlors and a minor league baseball team. During the current year, the company sold three of its pizza parlors and closed another when the lease on the building expired. Should any of these events be classified as discon

> The following are data regarding last year’s production of Dicer Ricer, one of the major products of Kitchen Gadget Company. During the year, 61,000 units of this product were manufactured and 62,100 units were sold. Selected informati

> Refer to the adjusted trial balance of Green Lawns, Inc., illustrated in Exercise 5.2 to respond to the following items. a. Prepare all necessary closing entries at December 31, current year. b. Prepare an after-closing trial balance dated December 31,

> On July 1, Pine Region Dairy leased equipment from Farm America for a period of three years. The lease calls for monthly payments of $2,500 payable in advance on the first day of each month, beginning July 1. Prepare the journal entry needed to record th

> The following information is taken from the current year financial statements of Cardinal Manufacturing Corporation. (Dollar figures and shares of stock are in thousands.) The first three itemsare net of applicable income tax. The loss from continuing op

> Identify three factors that may cause net income to differ from net cash flows from operating activities.

> On October 1, 2021, Jenco signed a four-year, $100,000 note payable to Vicksburg State Bank in conjunction with the purchase of equipment. The note calls for interest at an annual rate of 12Â percent (1 percent per month). The note is fully am

> Easy Writer manufactures an erasable ballpoint pen, which sells for $1.75 per unit. Management recently finished analyzing the results of the company’s operations for the current month. At a break-even point of 40,000 units, the company’s total variable

> Floyd Christianson is the chief executive officer of Morongo Pharmaceuticals. The company has been struggling in recent years to break even and its stock price has been on the decline. The company’s Jacksonville plant manufactures a prescription drug tha

> You can find a large amount of information on the Internet to evaluate the performance of companies. Many firms provide links to this information on their home pages. Access the home page of The Gap, Inc., at www.gapinc.com. Instructions: a. What link

> Explain the accounting principle of revenue recognition.

> Over what period of time the cost of various types of intangible assets should be amortized by regular charges against revenue? (Your answer should be in the form of a principle or guideline rather than a specific number of years.) What method of amortiz

> A large art gallery has in inventory more than 100 paintings. No two are alike. The least expensive is priced at more than $1,000 and the higher-priced items carry prices of $100,000 and more. Which of the four methods of inventory valuation discussed in

> Explain the immediate effects, if any, of each of the following transactions on a company’s earnings per a. Split the common stock 3-for-1. b. Realized a gain from the sale of a discontinued operation. c. Declared and paid a cash dividend on common stock

> During July, jobs no. 103 and 104 were completed, and jobs no. 101, 102, and 104 were delivered to customers. Jobs no. 105 and 106 are still in process at July 31. From this information, compute the following. a. The work in process inventory at June 30

> Wolfe Computer is a U.S. company that manufactures portable personal computers. Many of the components for the computer are purchased abroad, and the finished product is sold in foreign countries as well as in the United States. Among the recent transact

> Refer to Problem 4.4A in the previous chapter. Prepare a 10-column worksheet for Campus Theater dated August 31, current year. At the bottom of your worksheet, prepare a brief explanation keyed to each adjusting entry.

> The balances in the perpetual inventory accounts of Valleyview Manufacturing Corporation at the beginning and end of the current year are as follows. Total dollar amounts debited and credited during the year to the accounts used in recording manufacturi

> Give two examples of unusual and/or infrequent items. How are these items presented in an income statement?

> Mei Co. has a current ratio of 3 to 1. Ono Corp. has a current ratio of 2 to 1. Does this mean that Mei’s operating cycle is longer than Ono’s? Why?

> Ye Lode Bump & Grind, Inc., is an automobile body and fender repair shop. Repair work is done by hand and with the use of small tools. Customers are billed based on time (direct labor hours) and materials used in each repair job. The shopâ€

> The following is a note accompanying a recent financial statement of International Paper Company. Plants, Properties, and Equipment Plants, properties, and equipment are stated at cost, less accumulated depreciation. Expenditures for betterments are capi

> List and briefly explain the two budget philosophies described in the chapter.

> Shown as follows are the amounts from the stockholders’ equity section of the balance sheets of Wasson Corporation for the years ended December 31, 2020 and 2021. a. Calculate the amount of additional investment that the stockholders m

> Some of the accounts appearing in the year-end financial statements of Glaven, Inc., are as follows. This list includes all of the company’s current assets and current liabilities. Instructions: a. Prepare a schedule of the company&aci

> Who might a plant accountant consult with when establishing direct labor quantity or rate standards?

> E-Z Manufacturing Company is a partnership among Yolanda Gonzales, Willie Todd, and Linda Walker. The partnership contract states that partnership profits will be split equally among the three partners. During the current year Gonzales withdrew $25,000,

> Snack Happy makes chocolate brownies. The brownies pass through three production processes: mixing the batter, baking, and packaging. The company uses process costing. The following are data concerning the costs incurred in each process during August, al

> The following information was developed from the financial statements of Donelson, Inc. At the beginning of 2021, the company’s former supplier went bankrupt, and the company began buying merchandise from another supplier. Instructions

> Juan Ramirez and Jimmy Smith are considering forming a partnership to engage in the business of aerial photography. Ramirez is a licensed pilot, is currently earning $48,000 a year, and has $50,000 to invest in the partnership. Smith is a professional ph

> Briefly explain the operation of process costing, including the manner in which the unit costs of finished goods are determined.

> The Sebeka Company reports the following information pertaining to the month of January. During January, the company purchased $60,000 of direct materials and incurred $80,000 of direct labor costs. Total manufacturing overhead costs for the month amoun

> William Nelson, the chief accountant of West Texas Guitar Company, was injured in an automobile accident shortly before the end of the company’s first year of operations. At year-end, a clerk with a very limited understanding of account

> The credit manager of Montour Fuel has gathered the following information about the company’s accounts receivable and credit losses during the current year: Prepare one journal entry summarizing the recognition of uncollectible account

> This exercise stresses the relationships between the information recorded in a periodic inventory system and the basic elements of an income statement. Each of the five lines represents a separate set of information. You are to fill in the missing amount

> The following information was taken from the accounting records of Light Tool Corporation. Overhead assigned to production was $500,000. Compute the amount of the work in process inventory on hand at year-end.

> Doctors Mowtain, Lawrence, and Curley are radiologists living in Yukville, Maine. They realize that many of the state’s small rural hospitals cannot afford to purchase their own magnetic resonance imaging devices (MRIs). The doctors are

> A schedule of the cost of finished goods manufactured is a helpful tool in determining the per-unit cost of manufactured products. Explain several ways in which information about per-unit manufacturing costs is used by (a) management accountants and (b)

> At the end of the year, when closing the books, what is the treatment for immaterial standard variance account balances? What is the treatment for standard variance account balances that are material in amount?

> Canfield Appliance Company is planning to introduce a coffee grinder to its line of small home appliances. Annual sales of the grinder are estimated at 15,000 units at a price of $40 per unit. Variable manufacturing costs are estimated at $18 per unit, i

> I.C. Cream is considering two possible expansion plans. Proposal A involves opening eight stores in northern Alaska at a total cost of $4,000,000. Under another strategy, Proposal B, I.C. Cream would focus on southern Alaska and open five stores for a to