Question: On July 1, 2012, Torvill Construction Company

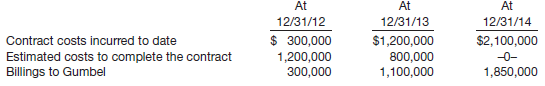

On July 1, 2012, Torvill Construction Company Inc. contracted to build an office building for Gumbel Corp. for a total contract price of $1,900,000. On July 1, Torvill estimated that it would take between 2 and 3 years to complete the building. On December 31, 2014, the building was deemed substantially completed. Following are accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Gumbel for 2012, 2013, and 2014.

Instructions

(a) Using the percentage-of-completion method, prepare schedules to compute the profit or loss to be recognized as a result of this contract for the years ended December 31, 2012, 2013, and 2014. (Ignore income taxes.)

(b) Using the completed-contract method, prepare schedules to compute the profit or loss to be recognized as a result of this contract for the years ended December 31, 2012, 2013, and 2014. (Ignore income taxes.)

Transcribed Image Text:

At At At 12/31/12 12/31/13 12/31/14 $ 300,000 $2,100,000 $1,200,000 800,000 1,100,000 Contract costs incurred to date Estimated costs to complete the contract Billings to Gumbel 1,200,000 300,000 -0- 1,850,000

> Buhl Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2012, the following balances relate to this plan. Plan assets …………………………………………………….. $480,000 Defined benefit obligation ……………………………….... 625,000 Pension asset/liability

> Brecker Company leases an automobile with a fair value of $10,906 from Emporia Motors, Inc., on the following terms: 1. Non-cancelable term of 50 months. 2. Rental of $250 per month (at end of each month). (The present value at 1% per month is $9,800.) 3

> Hobbs Co. has the following defined benefit pension plan balances on January 1, 2012. Projected benefit obligation ………………â€

> Dingel Corporation has contracted with you to prepare a statement of cash flows. The controller has provided the following information. Additional data related to 2012 are as follows. 1. Equipment that had cost $11,000 and was 30% depreciated at time o

> The following statement was prepared by Maloney Corporation’s accountant. MALONEY CORPORATION STATEMENT OF SOURCES AND APPLICATION OF CASH FOR THE YEAR ENDED SEPTEMBER 30, 2012 Sources of cash Net income ………………………………………………………………………………………………………. $111,000

> Lowell Corporation has used the accrual basis of accounting for several years. A review of the records, however, indicates that some expenses and revenues have been handled on a cash basis because of errors made by an inexperienced bookkeeper. Income sta

> Shapiro Inc. was incorporated in 2011 to operate as a computer software service firm with an accounting fiscal year ending August 31. Shapiro’s primary product is a sophisticated online inventory-control system; its customers pay a fixed fee plus a usage

> Wise Company began operations at the beginning of 2013. The following information pertains to this company. 1. Pretax financial income for 2013 is $100,000. 2. The tax rate enacted for 2013 and future years is 40%. 3. Differences between the 2013 income

> On May 3, 2012, Eisler Company consigned 80 freezers, costing $500 each, to Remmers Company. The cost of shipping the freezers amounted to $840 and was paid by Eisler Company. On December 30, 2012, a report was received from the consignee, indicating tha

> Tarkington Co. purchased a machine on January 1, 2009, for $440,000. At that time it was estimated that the machine would have a 10-year life and no salvage value. On December 31, 2012, the firm’s accountant found that the entry for depreciation expense

> A lease agreement between Lennox Leasing Company and Gill Company is described in E21-8. In E21-8 The following facts pertain to a noncancelable lease agreement between Lennox Leasing Company and Gill Company, a lessee. Inception date: ……………………………………………

> The pretax financial income (or loss) figures for Synergetics Company are as follows. 2008 …………………….. $160,000 2009 ………………………. 250,000 2010 ………………………… 90,000 2011 ……………………… (160,000) 2012 ……………………. (350,000) 2013 ………………………. 120,000 2014 ………………………. 100,00

> Waubansee Corp. uses the direct method to prepare its statement of cash flows. Relevant balances for Waubansee at December 31, 2012 and 2011, are as follows. Additional information: 1. Waubansee purchased $5,000 in equipment during 2012. 2. Waubansee a

> Use the information from BE18-7, but assume Turner uses the completed-contract method. Prepare the company’s 2012 journal entries. In BE18-7 Turner, Inc. began work on a $7,000,000 contract in 2012 to construct an office building. During 2012, Turner, I

> Norton Co. had the following amounts related to its pension plan in 2012. Actuarial liability loss for 2012 ………………………………………………………………….. $28,000 Unexpected asset gain for 2012 ……………………………………………………………….…. 18,000 Accumulated other comprehensive income (G/L)

> Joblonsky Inc. has recently hired a new independent auditor, Karen Ogleby, who says she wants “to get everything straightened out.” Consequently, she has proposed the accounting changes shown below and on the next page in connection with Joblonsky Inc.’s

> Loveless Corporation had the following 2012 income statement. Revenues ….………… $100,000 Expenses ……â€&br

> Roundtree Manufacturing Co. is preparing its year-end financial statements and is considering the accounting for the following items. 1. The vice president of sales had indicated that one product line has lost its customer appeal and will be phased out o

> Shetland Inc. had pretax financial income of $154,000 in 2012. Included in the computation of that amount is insurance expense of $4,000 which is not deductible for tax purposes. In addition, depreciation for tax purposes exceeds accounting depreciation

> Mitchell Corporation had income before income taxes of $195,000 in 2012. Mitchell’s current income tax expense is $48,000, and deferred income tax expense is $30,000. Prepare Mitchell’s 2012 income statement, beginning with Income before income taxes.

> Use the information for Rode Inc. given in IFRS19-7. Assume that it is probable that the entire net operating loss carryforward will not be realized in future years. Prepare the journal entry(ies) necessary at the end of 2012. In IFRS19-7 Rode Inc. incu

> The following defined pension data of Doreen Corp. apply to the year 2012. Defined benefit obligation, 1/1/12 (before amendment) ……………………………… $560,000 Plan assets, 1/1/12 ……………………………………………………………………………..………. 546,200 Pension asset/liability…………………………………………

> Bill Novak is working on an audit of an IFRS client. In his review of the client’s interim reports, he notes that the reports are prepared on a discrete basis. That is, each interim report is viewed as a distinct period. Is this acceptable under IFRS? If

> Use the information for Rick Kleckner Corporation from IFRS21-7. Assume that at December 31, 2012, Kleckner made an adjusting entry to accrue interest expense of $29,530 on the lease. Prepare Kleckner’s January 1, 2013, journal entry to record the second

> The financial statements of Marks and Spencer plc (M&S) are available at the book’s companion website or can be accessed at http://corporate.marksandspencer.com/documents/publications/2010/Annual_Report_2010. Instructions Refer to M&S’s financial statem

> Nimble Health and Racquet Club (NHRC), which operates eight clubs in the Chicago metropolitan area, offers one-year memberships. The members may use any of the eight facilities but must reserve racquetball court time and pay a separate fee before using t

> On December 31, 2012, Shellhammer Co. sold 6-month-old equipment at fair value and leased it back. There was a loss on the sale. Shellhammer pays all insurance, maintenance, and taxes on the equipment. The lease provides for eight equal annual payments,

> Lemke Company sponsors a defined benefit pension plan for its employees. The following data relate to the operation of the plan for the years 2012 and 2013. Instructions (a) Prepare a pension worksheet presenting both years 2012 and 2013 and accompanyi

> Comparative balance sheet accounts of Sharpe Company are presented below. Additional data: 1. Equipment that cost $10,000 and was 60% depreciated was sold in 2012. 2. Cash dividends were declared and paid during the year. 3. Common stock was issued in

> On March 5, 2013, you were hired by Hemingway Inc., a closely held company, as a staff member of its newly created internal auditing department. While reviewing the company’s records for 2011 and 2012, you discover that no adjustments h

> On January 1, 2012, Cage Company contracts to lease equipment for 5 years, agreeing to make a payment of $137,899 (including the executory costs of $6,000) at the beginning of each year, starting January 1, 2012. The taxes, the insurance, and the mainten

> The information below was disclosed during the audit of Elbert Inc. 1. Year _____Amount Due per Tax Return 2012 ……………………………………….……… $130,000 2013 …………………………………………………. 104,000 2. On January 1, 2012, equipment costing $600,000 is purchased. For financial

> Gordon Company has two temporary differences between its pretax financial income and taxable income. The information is shown below. The income tax rate for all years is 40%. Instructions (a) Prepare the journal entry to record income tax expense, def

> Listed below are various types of accounting changes and errors. ______ 1. Change from FIFO to average cost inventory method. ______ 2. Change due to overstatement of inventory. ______ 3. Change from sum-of-the-years’-digits to straight-line method of de

> The following facts pertain to a noncancelable lease agreement between Lennox Leasing Company and Gill Company, a lessee. Inception date: ………………………………………………………………………………. May 1, 2012 Annual lease payment due at the beginning of each year, beginning with M

> Kenseth Corp. has the following beginning-of-the-year present values for its projected benefit obligation and market-related values for its pension plan assets. The average remaining service life per employee in 2011 and 2012 is 10 years and in 2013 an

> Many business organizations have been concerned with providing for the retirement of employees since the late 1800s. During recent decades, a marked increase in this concern has resulted in the establishment of private pension plans in most large compani

> Messner Co. reported $145,000 of net income for 2012. The accountant, in preparing the statement of cash flows, noted several items occurring during 2012 that might affect cash flows from operating activities. These items are listed below and on page 148

> O’Neil, Inc. began work on a $7,000,000 contract in 2012 to construct an office building. O’Neil uses the percentage-of-completion method. At December 31, 2012, the balances in certain accounts were Construction in Process $2,450,000; Accounts Receivable

> Indicate the effect—Understate, Overstate, No Effect—that each of the following errors has on 2012 net income and 2013 net income. 2012 2013 (a) Equipment purchased in 2010 was expensed. (b) Wages payable were not

> Roth Inc. has a deferred tax liability of $68,000 at the beginning of 2013. At the end of 2013, it reports accounts receivable on the books at $90,000 and the tax basis at zero (its only temporary difference). If the enacted tax rate is34% for all period

> Dingel Corporation has contracted with you to prepare a statement of cash flows. The controller has provided the following information. Additional data related to 2012 are as follows. 1. Equipment that had cost $11,000 and was 40% depreciated at time o

> Use the information from IFRS18-6, but assume Turner uses the cost-recovery method. Prepare the company’s 2012 journal entries. In IFRS18-6 Turner, Inc. began work on a $7,000,000 contract in 2012 to construct an office building. During 2012, Turner, In

> Rick Kleckner Corporation recorded a finance lease at $300,000 on January 1, 2012. The interest rate is 12%. Kleckner Corporation made the first lease payment of $53,920 on January 1, 2012. The lease requires eight annual payments. The equipment has a us

> Tevez Company experienced an actuarial loss of $750 in its defined benefit plan in 2012. Tevez has elected to recognize these losses immediately. For 2012, Tevez’s revenues are $125,000, and expenses (excluding pension expense of $14,000, which does not

> Rode Inc. incurred a net operating loss of $500,000 in 2012. Combined income for 2010 and 2011 was $350,000. The tax rate for all years is 40%. Rode elects the carryback option. Prepare the journal entries to record the benefits of the loss carryback and

> Lillehammer Lakes is a new recreational real estate development which consists of 500 lake-front and lake-view lots. As a special incentive to the first 100 buyers of lake-view lots, the developer is offering 3 years of free financing on 10-year, 12% not

> The amount of income taxes due to the government for a period of time is rarely the amount reported on the income statement for that period as income tax expense. Instructions (a) Explain the objectives of accounting for income taxes in general-purpose

> On January 1, 2012, Perriman Company sold equipment for cash and leased it back. As seller-lessee, Perriman retained the right to substantially all of the remaining use of the equipment. The term of the lease is 8 years. There is a gain on the sale porti

> Hanson Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2012, the following balances related to this plan. Plan assets (market-related value) ……………………………… $520,000 Projected benefit obligation ……………………………………..….. 700,000 Pen

> Chapman Company, a major retailer of bicycles and accessories, operates several stores and is a publicly traded company. The comparative balance sheet and income statement for Chapman as of May 31, 2012, are shown on the next page. The company is prepari

> You have been assigned to examine the financial statements of Zarle Company for the year ended December 31, 2012. You discover the following situations. 1. Depreciation of $3,200 for 2012 on delivery vehicles was not recorded. 2. The physical inventory c

> Ludwick Steel Company as lessee signed a lease agreement for equipment for 5 years, beginning December 31, 2012. Annual rental payments of $40,000 are to be made at the beginning of each lease year (December 31). The taxes, insurance, and the maintenance

> Crosley Corp. sold an investment on an installment basis. The total gain of $60,000 was reported for financial reporting purposes in the period of sale. The company qualifies to use the installment-sales method for tax purposes. The installment period is

> The following defined pension data of Rydell Corp. apply to the year 2012. Projected benefit obligation, 1/1/12 (before amendment) ……………………… $560,000 Plan assets, 1/1/12 …………………………………………………………………………………. 546,200 Pension liability ………………………………………………………………

> Presented below are the comparative income statements for Pannebecker Inc. for the years 2011 and 2012. The following additional information is provided. 1. In 2012, Pannebecker Inc. decided to switch its depreciation method from sum-of-the-yearsâ

> On January 1, 2012, Palmer Company leased equipment to Woods Corporation. The following information pertains to this lease. 1. The term of the noncancelable lease is 6 years, with no renewal option. The equipment reverts to the lessor at the termination

> On January 1, 2012, Harrington Company has the following defined benefit pension plan balances. Projected benefit obligation ………………&ac

> Turner, Inc. began work on a $7,000,000 contract in 2012 to construct an office building. During 2012, Turner, Inc. incurred costs of $1,700,000, billed its customers for $1,200,000, and collected $960,000. At December 31, 2012, the estimated future cost

> At January 1, 2012, Beidler Company reported retained earnings of $2,000,000. In 2012, Beidler discovered that 2011 depreciation expense was understated by $400,000. In 2012, net income was $900,000 and dividends declared were $250,000. The tax rate is 4

> At December 31, 2012, Hillyard Corporation has a deferred tax asset of $200,000. After a careful review of all available evidence, it is determined that it is more likely than not that $60,000 of this deferred tax asset will not be realized. Prepare the

> At December 31, 2012, Hillyard Corporation has a deferred tax asset of $200,000. After a careful review of all available evidence, it is determined that it is probable that $60,000 of this deferred tax asset will not be realized. Prepare the necessary jo

> Villa Company has experienced tough competition, leading it to seek concessions from its employees in the company’s pension plan. In exchange for promises to avoid layoffs and wage cuts, the employees agreed to receive lower pension benefits in the futur

> Turner, Inc. began work on a $7,000,000 contract in 2012 to construct an office building. During 2012, Turner, Inc. incurred costs of $1,700,000, billed its customers for $1,200,000, and collected $960,000. At December 31, 2012, the estimated future cost

> Joblonsky Inc. has recently hired a new independent auditor, Karen Ogleby, who says she wants “to get everything straightened out.” Consequently, she has proposed the following accounting changes in connection with Joblonsky Inc.’s 2012 financial stateme

> Your firm has been engaged to examine the financial statements of AlmadenCorporation for the year 2012. The bookkeeper who maintains the financial records has prepared all the unaudited financial statements for the corporation since its organization on J

> Maria Rodriquez and Lynette Kingston are discussing accounting for income taxes. They are currently studying a schedule of taxable and deductible amounts that will arise in the future as a result of existing temporary differences. The schedule is as foll

> Brockman Guitar Company is in the business of manufacturing top-quality, steel-string folk guitars. In recent years, the company has experienced working capital problems resulting from the procurement of factory equipment, the unanticipated buildup of re

> Vickie Plato, accounting clerk in the personnel office of Streisand Corp., has begun to compute pension expense for 2014 but is not sure whether or not she should include the amortization of unrecognized gains/losses. She is currently working with the fo

> On March 1, 2012, Pechstein Construction Company contracted to construct a factory building for Fabrik Manufacturing Inc. for a total contract price of $8,400,000. The building was completed by October 31, 2014. The annual contract costs incurred, estima

> Aykroyd Inc. has sponsored a noncontributory, defined benefit pension plan for its employees since 1989. Prior to 2012, cumulative net pension expense recognized equaled cumulative contributions to the plan. Other relevant information about the pension p

> Comparative balance sheet accounts of Marcus Inc. are presented below. Additional data (ignoring taxes): 1. Net income for the year was $42,500. 2. Cash dividends declared and paid during the year were $21,125. 3. A 20% stock dividend was declared dur

> On December 31, 2012, before the books were closed, the management and accountants of Madrasa Inc. made the following determinations about three depreciable assets. 1. Depreciable asset A was purchased January 2, 2009. It originally cost $540,000 and, fo

> Presented below are two independent situations related to future taxable and deductible amounts resulting from temporary differences existing at December 31, 2012. 1. Mooney Co. has developed the following schedule of future taxable and deductible amount

> Listed below are items that are commonly accounted for differently for financial reporting purposes than they are for tax purposes. Instructions For each item below, indicate whether it involves: (1) A temporary difference that will result in future ded

> The following are Sullivan Corp.’s comparative balance sheet accounts at December 31, 2012 and 2011, with a column showing the increase (decrease) from 2011 to 2012. Additional information: 1. On December 31, 2011, Sullivan acquired 2

> Access the glossary (“Master Glossary”) to answer the following. (a) What is an accumulated benefit obligation? (b) What is a defined benefit postretirement plan? (c) What is the definition of “actuarial present value”? (d) What is a prior service cost?

> Robillard Inc. acquired the following assets in January of 2009. Equipment, estimated service life, 5 years; salvage value, $15,000 …………… $465,000 Building, estimated service life, 30 years; no salvage value ………………………. $780,000 The equipment has been de

> Wadkins Company, a machinery dealer, leased a machine to Romero Corporation on January 1, 2012. The lease is for an 8-year period and requires equal annual payments of $38,514 at the beginning of each year. The first payment is received on January 1, 201

> Gingrich Importers provides the following pension plan information. Fair value of pension plan assets, January 1, 2012 …………..…….. $2,400,000 Fair value of pension plan assets, December 31, 2012 ……….………. 2,725,000 Contributions to the plan in 2012 …………………

> Howser Inc. is a manufacturer of electronic components and accessories with total assets of $20,000,000. Selected financial ratios for Howser and the industry averages for firms of similar size are presented below. Howser is being reviewed by several e

> Data for Norman Company are presented in E23-5. In E23-5 Norman Company’s income statement for the year ended December 31, 2012, contained the following condensed information. Norman’s balance sheet contained the fo

> At December 31, 2012, Percheron Inc. had a deferred tax asset of $30,000. At December 31, 2013, the deferred tax asset is $59,000. The corporation’s 2013 current tax expense is $61,000. What amount should Percheron report as total 2013 income tax expense

> What factors must be considered by the actuary in measuring the amount of pension benefits under a defined benefit plan?

> Differentiate between an originating temporary difference and a reversing difference.

> When is revenue recognized under the cost-recovery method?

> Describe the procedure(s) involved in classifying deferred tax amounts on the statement of financial position under IFRS.

> Holtzman Company is in the process of preparing its financial statements for 2012. Assume that no entries for depreciation have been recorded in 2012. The following information related to depreciation of fixed assets is provided to you. 1. Holtzman purch

> Discuss how a change in accounting policy is handled when it is impracticable to determine previous amounts.

> At December 31, 2012, Higley Corporation has one temporary difference which will reverse and cause taxable amounts in 2013. In 2012, a new tax act set taxes equal to 45% for 2012, 40% for 2013, and 34% for 2014 and years thereafter. Instructions Explain

> You are compiling the consolidated financial statements for Winsor Corporation International. The corporation’s accountant, Anthony Reese, has provided you with the segment information shown below. Instructions Determine which of the

> Albertsen Corporation is a diversified company with nationwide interests in commercial real estate developments, banking, copper mining, and metal fabrication. The company has offices and operating locations in major cities throughout the United States.

> Hiatt Toothpaste Company initiates a defined benefit pension plan for its 50 employees on January 1, 2012. The insurance company which administers the pension plan provided the following selected information for the years 2012, 2013, and 2014. There we

> Matheny Inc. went public 3 years ago. The board of directors will be meeting shortly after the end of the year to decide on a dividend policy. In the past, growth has been financed primarily through the retention of earnings. A stock or a cash dividend h

> You have completed the field work in connection with your audit of Alexander Corporation for the year ended December 31, 2012. The balance sheet accounts at the beginning and end of the year are shown below. Your working papers from the audit contain t

> The management of Utrillo Instrument Company had concluded, with the concurrence of its independent auditors, that results of operations would be more fairly presented if Utrillo changed its method of pricing inventory from last-in, first-out (LIFO) to a

> Assume the same information as in P21-4. In P21-4 The following facts pertain to a noncancelable lease agreement between Alschuler Leasing Company and McKee Electronics, a lessee, for a computer system. Inception date …â€&

> Jennings Inc. reported the following pretax income (loss) and related tax rates during the years 2008–2014. Pretax financial income (loss) and taxable income (loss) were the same for all years since Jennings began business. The tax ra

> Glaus Leasing Company agrees to lease machinery to Jensen Corporation on January 1, 2012. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic li

> The following facts relate to Alschuler Corporation. 1. Deferred tax liability, January 1, 2012, $40,000. 2. Deferred tax asset, January 1, 2012, $0. 3. Taxable income for 2012, $115,000. 4. Pretax financial income for 2012, $200,000. 5. Cumulative tempo