Question: On July 1, TruData Company issues 10,

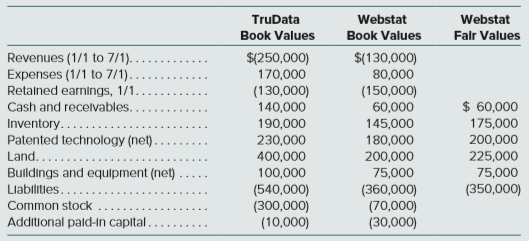

On July 1, TruData Company issues 10,000 shares of its common stock with a $5 par value and a $40 fair value in exchange for all of Webstat Company’s outstanding voting shares. Webstat’s precombination book and fair values are shown below along with book values for TruData’s accounts.

On its acquisition-date consolidated balance sheet, what amount should TruData report as common stock?

a. $70,000

b. $300,000

c. $350,000

d. $370,000

Transcribed Image Text:

TruData Webstat Webstat Book Values Book Values Falr Values Revenues (1/1 to 7/1). Expenses (1/1 to 7/1). Retalned earnings, 1/1. $(250,000) 170,000 $(130,000) 80,000 (130,000) 140,000 (150,000) 60,000 $ 60,000 175,000 Cash and recelvables. Inventory.... Patented technology (net). Land..... Bulldings and equlpment (net) 190,000 145,000 230,000 400,000 180,000 200,000 200,000 225,000 100,000 75,000 75,000 Llabilities..... (540,000) (300,000) (10,000) (360,000) (70,000) (30,000) (350,000) Common stock Additional pald-In capital.. ....

> A local partnership is liquidating and has only two assets (cash of $10,000 and land with a cost of $35,000). All partnership liabilities have been paid. All partners are personally insolvent. The partners have capital balances and share profits and loss

> Use the same information as in problem (5) except assume that the transfers were from Bottom Company to Top Company. What are the consolidated sales and cost of goods sold? a. $1,000,000 and $720,000 b. $1,000,000 and $755,000 c. $1,000,000 and $696,0

> Top Company holds 90 percent of Bottom Company’s common stock. In the current year, Top reports sales of $800,000 and cost of goods sold of $600,000. For this same period, Bottom has sales of $300,000 and cost of goods sold of $180,000. During the curren

> Parkette, Inc., acquired a 60 percent interest in Skybox Company several years ago. During 2017, Skybox sold inventory costing $160,000 to Parkette for $200,000. A total of 18 percent of this inventory was not sold to outsiders until 2018. During 2018, S

> What is the primary reason we defer financial statement recognition of gross profits on intra-entity sales for goods that remain within the consolidated entity at year-end? a. Revenues and COGS must be recognized for all intra-entity sales regardless of

> What is the purpose of a drawing account in a partnership’s financial records?

> If a partner is contributing attributes to a partnership such as an established clientele or a particular expertise, what two methods can be used to record the contribution? Describe each method.

> Describe the differences between a Subchapter S corporation and a Subchapter C corporation.

> When a partner sells an ownership interest in a partnership, what rights are conveyed to the new owner?

> By what methods can a new partner gain admittance into a partnership?

> What is a partnership dissolution? Does dissolution automatically necessitate the cessation of business and the liquidation of partnership assets?

> A partnership has the following account balances: Cash, $70,000; Other Assets, $540,000; Liabilities, $260,000; Nixon (50 percent of profits and losses), $170,000; Cleveland (30 percent), $110,000; Pierce (20 percent), $70,000. The company liquidates, an

> If no agreement exists in a partnership as to the allocation of income, what method is appropriate?

> What provisions in a partnership agreement can be used to establish an equitable allocation of income among all partners?

> At what point in the accounting process does the allocation of partnership income become significant?

> Clarke Company has a subsidiary operating in a foreign country. In relation to this subsidiary, what does the term functional currency mean? How is the functional currency determined?

> In translating the financial statements of a foreign subsidiary, why is the value assigned to retained earnings especially difficult to determine? How is this problem normally resolved?

> In what ways does IFRS differ from U.S. GAAP with respect to the translation of foreign currency financial statements?

> How does the timing of hedges of (a) foreign currency denominated assets and liabilities, (b) foreign currency firm commitments, and (c) forecasted foreign currency transactions differ?

> What are the differences in accounting for a forward contract used as a cash flow hedge of (a) a foreign currency denominated asset or liability and (b) a forecasted foreign currency transaction?

> What are the differences in accounting for a forward contract used as a fair value hedge of (a) a foreign currency denominated asset or liability and (b) a foreign currency firm commitment?

> A parent acquires the outstanding bonds of a subsidiary company directly from an outside third party. For consolidation purposes, this transaction creates a gain of $45,000. Should this gain be allocated to the parent or the subsidiary? Why?

> A subsidiary sells land to the parent company at a significant gain. The parent holds the land for two years and then sells it to an outside party, also for a gain. How does the business combination account for these events?

> One company purchases the outstanding debt instruments of an affiliated company on the open market. This transaction creates a gain that is appropriately recognized in the consolidated financial statements of that year. Thereafter, a worksheet adjustment

> Washburn Company owns 75 percent of Metcalf Company’s outstanding common stock. During the current year, Metcalf issues additional shares to outside parties at a price more than its per share consolidated value. How does this transaction affect the busin

> If a seller makes an intra-entity sale of a depreciable asset at a price above book value, the seller’s beginning Retained Earnings is reduced when preparing each subsequent consolidation. Why does the amount of the adjustment change from year to year?

> Why does an intra-entity sale of a depreciable asset (such as equipment or a building) require subsequent adjustments to depreciation expense within the consolidation process?

> The partnership of Butler, Osman, and Ward was formed several years as a local tax preparation firm. Two partners have reached retirement age and the partners have decided to terminate operations and liquidate the business. Liquidation expenses of $34,00

> The partnership of Frick, Wilson, and Clarke has elected to cease all operations and liquidate its business property. A balance sheet drawn up at this time shows the following account balances: Part A Prepare a predistribution plan for this partnership

> Following is a series of independent cases. In each situation, indicate the cash distribution to be made to partners at the end of the liquidation process. Unless otherwise stated, assume that all solvent partners will reimburse the partnership for their

> On January 1, the partners of Van, Bakel, and Cox (who share profits and losses in the ratio of 5:3:2, respectively) decide to liquidate their partnership. The trial balance at this date follows: The partners plan a program of piecemeal conversion of th

> The partnership of Winn, Xie, Yang, and Zed has the following balance sheet Zed is personally insolvent, and one of his creditors is considering suing the partnership for the $10,000 that is currently owed. The creditor realizes that this litigation cou

> March, April, and May have been in partnership for a number of years. The partners allocate all profits and losses on a 2:3:1 basis, respectively. Recently, each partner has become personally insolvent and, thus, the partners have decided to liquidate th

> The consolidation process applicable when intra-entity land transfers have occurred differs somewhat from that used for intra-entity inventory sales. What differences should be noted?

> Intra-entity transfers between the component companies of a business combination are quite common. Why do these intra-entity transactions occur so frequently?

> On January 1, 2018, Fisher Corporation paid $2,290,000 for 35 percent of the outstanding voting stock of Steel, Inc., and appropriately applies the equity method for its investment. Any excess of cost over Steel’s book value was attributed to goodwill. D

> Use the same facts as in problem (22), but assume instead that Arturo pays cash of $4,200,000 to acquire Westmont. No stock is issued. Prepare Arturo’s journal entries to record its acquisition of Westmont. From problem 22: The followi

> Tiberend, Inc., sold $150,000 in inventory to Schilling Company during 2017 for $225,000. Schilling resold $105,000 of this merchandise in 2017 with the remainder to be disposed of during 2018. Assuming that Tiberend owns 25 percent of Schilling and appl

> How would the answer to problem (5) have been affected if the parent had applied the initial value method rather than the equity method? a. No effect: The method the parent uses is for internal reporting purposes only and has no impact on consolidated t

> When should a consolidated entity recognize a goodwill impairment loss? a. If both the fair value of a reporting unit and its associated implied goodwill fall below their respective carrying amounts. b. Whenever the entity’s fair value declines signifi

> On January 1, 2018, Jay Company acquired all the outstanding ownership shares of Zee Company. In assessing Zee’s acquisition-date fair values, Jay concluded that the carrying value of Zee’s long-term debt (8-year remaining life) was less than its fair v

> A company acquires a subsidiary and will prepare consolidated financial statements for external reporting purposes. For internal reporting purposes, the company has decided to apply the equity method. Why might the company have made this decision? a. It

> Kaplan Corporation acquired Star, Inc., on January 1, 2017, by issuing 13,000 shares of common stock with a $10 per share par value and a $23 market value. This transaction resulted in recognizing $62,000 of goodwill. Kaplan also agreed to compensate Sta

> On January 1, 2016, Phoenix Co. acquired 100 percent of the outstanding voting shares of Sedona Inc., for $600,000 cash. At January 1, 2016, Sedona’s net assets had a total carrying amount of $420,000. Equipment (eight-year remaining li

> On January 1, 2016, Phoenix Co. acquired 100 percent of the outstanding voting shares of Sedona Inc., for $600,000 cash. At January 1, 2016, Sedona’s net assets had a total carrying amount of $420,000. Equipment (eight-year remaining li

> The separate condensed balance sheets of Patrick Corporation and its wholly owned subsidiary, Sean Corporation, are as follows: Additional Information: ∙ On December 31, 2017, Patrick acquired 100 percent of Sean’s v

> The separate condensed balance sheets of Patrick Corporation and its wholly owned subsidiary, Sean Corporation, are as follows: Additional Information: ∙ On December 31, 2017, Patrick acquired 100 percent of Sean’s v

> On July 1, TruData Company issues 10,000 shares of its common stock with a $5 par value and a $40 fair value in exchange for all of Webstat Company’s outstanding voting shares. Webstat’s precombination book and fair va

> Catron Corporation is having liquidity problems, and as a result, it sells all of its outstanding stock to Lambert, Inc., for cash. Because of Catron’s problems, Lambert is able to acquire this stock at less than the fair value of the company’s net asset

> On July 1, TruData Company issues 10,000 shares of its common stock with a $5 par value and a $40 fair value in exchange for all of Webstat Company’s outstanding voting shares. Webstat’s precombination book and fair va

> On July 1, TruData Company issues 10,000 shares of its common stock with a $5 par value and a $40 fair value in exchange for all of Webstat Company’s outstanding voting shares. Webstat’s precombination book and fair va

> Prior to being united in a business combination, Atkins, Inc., and Waterson Corporation had the following stockholders’ equity figures: Atkins issues 51,000 new shares of its common stock valued at $3 per share for all of the outstandi

> On May 1, Donovan Company reported the following account balances: Current assets ................................. $ 90,000 Buildings & equipment (net) …....... 220,000 Total assets ...................................... $310,000 Liabilities.........

> On May 1, Donovan Company reported the following account balances: Current assets ................................. $ 90,000 Buildings & equipment (net) …....... 220,000 Total assets ...................................... $310,000 Liabilities.........

> On June 1, Cline Co. paid $800,000 cash for all of the issued and outstanding common stock of Renn Corp. The carrying amounts for Renn’s assets and liabilities on June 1 follow: Cash ........................................ $150,000 Accounts receivable..

> On January 1, 2016, Phoenix Co. acquired 100 percent of the outstanding voting shares of Sedona Inc., for $600,000 cash. At January 1, 2016, Sedona’s net assets had a total carrying amount of $420,000. Equipment (eight-year remaining li

> Dosmann, Inc., bought all outstanding shares of Lizzi Corporation on January 1, 2016, for $700,000 in cash. This portion of the consideration transferred results in a fair-value allocation of $35,000 to equipment and goodwill of $88,000. At the acquisiti

> If no legal, regulatory, contractual, competitive, economic, or other factors limit the life of an intangible asset, the asset’s assigned value is allocated to expense over which of the following? a. 20 years. b. 20 years with an annual impairment revi

> Duke Corporation owns a 70 percent equity interest in Salem Company, a subsidiary corporation. During the current year, a portion of this stock is sold to an outside party. Before recording this transaction, Duke adjusts the book value of its investment

> An acquired entity has a long-term operating lease for an office building used for central management. The terms of the lease are very favorable relative to current market rates. However, the lease prohibits subleasing or any other transfer of rights. In

> On January 1, Puckett Company paid $1.6 million for 50,000 shares of Harrison’s voting common stock, which represents a 40 percent investment. No allocation to goodwill or other specific account was made. Significant influence over Harrison is achieved b

> Paar Corporation bought 100 percent of Kimmel, Inc., on January 1, 2015. On that date, Paar’s equipment (10-year remaining life) has a book value of $420,000 but a fair value of $520,000. Kimmel has equipment (10-year remaining life) with a book value of

> Under fair-value accounting for an equity investment, which of the following affects the income the investor recognizes from its ownership of the investee? a. The investee’s reported income adjusted for excess cost over book value amortizations. b. Cha

> Hawkins Company has owned 10 percent of Larker, Inc., for the past several years. This ownership did not allow Hawkins to have significant influence over Larker. Recently, Hawkins acquired an additional 30 percent of Larker and now will use the equity me

> Which of the following does not indicate an investor company’s ability to significantly influence an investee? a. Material intra-entity transactions. b. The investor owns 30 percent of the investee but another owner holds the remaining 70 percent. c.

> A company acquires a subsidiary and will prepare consolidated financial statements for external reporting purposes. For internal reporting purposes, the company has decided to apply the initial value method. Why might the company have made this decision?

> In question (8), how would the parent record the sales transaction?

> CCES Corporation acquires a controlling interest in Schmaling, Inc. CCES may utilize any one of three methods to internally account for this investment. Describe each of these methods, and indicate their advantages and disadvantages.

> On January 1, 2017, Allan Company bought a 15 percent interest in Sysinger Company. The acquisition price of $184,500 reflected an assessment that all of Sysinger’s accounts were fairly valued within the company’s acco

> Benns adopts the equity method for its 100 percent investment in Waters. At the end of six years, Benns reports an investment in Waters of $920,000. What figures constitute this balance?

> On July 1, 2018, Truman Company acquired a 70 percent interest in Atlanta Company in exchange for consideration of $720,000 in cash and equity securities. The remaining 30 percent of Atlanta’s shares traded closely near an average price that totaled $290

> Following are the individual financial statements for Gibson and Davis for the year ending December 31, 2018: Gibson acquired 60 percent of Davis on April 1, 2018, for $528,000. On that date, equipment owned by Davis (with a five-year remaining life) wa

> The Holtz Corporation acquired 80 percent of the 100,000 outstanding voting shares of Devine, Inc., for $7.20 per share on January 1, 2017. The remaining 20 percent of Devine’s shares also traded actively at $7.20 per share before and a

> Nascent, Inc., acquires 60 percent of Sea-Breeze Corporation for $414,000 cash on January 1, 2015. The remaining 40 percent of the Sea-Breeze shares traded near a total value of $276,000 both before and after the acquisition date. On January 1, 2015, Sea

> Following are several account balances taken from the records of Karson and Reilly as of December 31, 2018. A few asset accounts have been omitted here. All revenues, expenses, and dividend declarations occurred evenly throughout the year. An

> Miller Company acquired an 80 percent interest in Taylor Company on January 1, 2016. Miller paid $664,000 in cash to the owners of Taylor to acquire these shares. In addition, the remaining 20 percent of Taylor shares continued to trade at a total value

> On January 1, 2016, Telconnect acquires 70 percent of Bandmor for $490,000 cash. The remaining 30 percent of Bandmor’s shares continued to trade at a total value of $210,000. The new subsidiary reported common stock of $300,000 on that

> Posada Company acquired 7,000 of the 10,000 outstanding shares of Sabathia Company on January 1, 2016, for $840,000. The subsidiary’s total fair value was assessed at $1,200,000 although its book value on that date was $1,130,000. The $70,000 fair value

> On January 1, 2018, Morey, Inc., exchanged $178,000 for 25 percent of Amsterdam Corporation. Morey appropriately applied the equity method to this investment. At January 1, the book values of Amsterdam’s assets and liabilities approximated their fair val

> On January 1, 2017, Holland Corporation paid $8 per share to a group of Zeeland Corporation shareholders to acquire 60,000 shares of Zeeland’s outstanding voting stock, representing a 60 percent ownership interest. The remaining 40,000

> Several years ago, Jenkins Company acquired a controlling interest in Lambert Company. Lambert recently borrowed $100,000 from Jenkins. In consolidating the financial records of these two companies, how will this debt be handled?

> On January 1, 2016, Parflex Corporation exchanged $344,000 cash for 90 percent of Eagle Corporation’s outstanding voting stock. Eagle’s acquisition date balance sheet follows: On January 1, 2016, Parflex prepared the

> Plaza, Inc., acquires 80 percent of the outstanding common stock of Stanford Corporation on January 1, 2018, in exchange for $900,000 cash. At the acquisition date, Stanford’s total fair value, including the noncontrolling interest, was

> On January 1, Beckman, Inc., acquires 60 percent of the outstanding stock of Calvin for $36,000. Calvin Co. has one recorded asset, a specialized production machine with a book value of $10,000 and no liabilities. The fair value of the machine is $50,000

> Parker, Inc., acquires 70 percent of Sawyer Company for $420,000. The remaining 30 percent of Sawyer’s outstanding shares continue to trade at a collective value of $174,000. On the acquisition date, Sawyer has the following accounts:

> On January 1, 2017, Palka, Inc., acquired 70 percent of the outstanding shares of Sellinger Company for $1,141,000 in cash. The price paid was proportionate to Sellinger’s total fair value, although at the acquisition date, Sellinger ha

> On January 1, Patterson Corporation acquired 80 percent of the 100,000 outstanding voting shares of Soriano, Inc., in exchange for $31.25 per share cash. The remaining 20 percent of Soriano’s shares continued to trade for $30 both befor

> On January 1, 2018, Johnsonville Enterprises, Inc., acquired 80 percent of Stayer Company’s outstanding common shares in exchange for $3,000,000 cash. The price paid for the 80 percent ownership interest was proportionately representative of the fair val

> On January 1, 2017, Harrison, Inc., acquired 90 percent of Starr Company in exchange for $1,125,000 fair-value consideration. The total fair value of Starr Company was assessed at $1,200,000. Harrison computed annual excess fair-value amortization of $8,

> Allen Company acquired 100 percent of Bradford Company’s voting stock on January 1, 2014, by issuing 10,000 shares of its $10 par value common stock (having a fair value of $14 per share). As of that date, Bradford had stockholders&acir

> On January 1, 2017, Pinnacle Corporation exchanged $3,200,000 cash for 100 percent of the outstanding voting stock of Strata Corporation. On the acquisition date, Strata had the following balance sheet: Pinnacle prepared the following fair-value allocat

> When a parent company applies the initial value method or the partial equity method to an investment, a worksheet adjustment must be made to the parent’s beginning Retained Earnings account (Entry *C) in every period after the year of acquisition. What i

> On January 1, 2017, Prestige Corporation acquired 100 percent of the voting stock of Stylene Corporation in exchange for $2,030,000 in cash and securities. On the acquisition date, Stylene had the following balance sheet: At the acquisition date, the bo

> On January 3, 2016, Persoff Corporation acquired all of the outstanding voting stock of Sea Cliff, Inc., in exchange for $6,000,000 in cash. Persoff elected to exercise control over Sea Cliff as a wholly owned subsidiary with an independent accounting sy

> Allison Corporation acquired all of the outstanding voting stock of Mathias, Inc., on January 1, 2017, in exchange for $5,875,000 in cash. Allison intends to maintain Mathias as a wholly owned subsidiary. Both companies have December 31 fiscal year-ends.

> Foxx Corporation acquired all of Greenburg Company’s outstanding stock on January 1, 2016, for $600,000 cash. Greenburg’s accounting records showed net assets on that date of $470,000, although equipment with a 10-year

> Adams, Inc., acquires Clay Corporation on January 1, 2017, in exchange for $510,000 cash. Immediately after the acquisition, the two companies have the following account balances. Clay’s equipment (with a five-year remaining life) is ac

> Chapman Company obtains 100 percent of Abernethy Company’s stock on January 1, 2017. As of that date, Abernethy has the following trial balance: During 2017, Abernethy reported net income of $80,000 while declaring and paying dividends

> Chapman Company obtains 100 percent of Abernethy Company’s stock on January 1, 2017. As of that date, Abernethy has the following trial balance: During 2017, Abernethy reported net income of $80,000 while declaring and paying dividends

> Destin Company recently acquired several businesses and recognized goodwill in each acquisition. Destin has allocated the resulting goodwill to its three reporting units: Sand Dollar, Salty Dog, and Baytowne. Destin opts to skip the qualitative assessmen