Question: On March 31, 2018, the Herzog Company

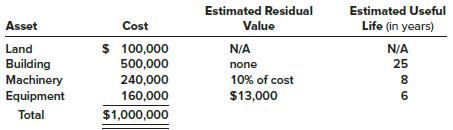

On March 31, 2018, the Herzog Company purchased a factory complete with machinery and equipment. The allocation of the total purchase price of $1,000,000 to the various types of assets along with estimated useful lives and residual values are as follows:

On June 29, 2019, machinery included in the March 31, 2018, purchase that cost $100,000 was sold for $80,000. Herzog uses the straight-line depreciation method for buildings and machinery and the sum-of-the-years’-digits method for equipment. Partial-year depreciation is calculated based on the number of months an asset is in service.

Required:

1. Compute depreciation expense on the building, machinery, and equipment for 2018.

2. Prepare the journal entries to record

(1) depreciation on the machinery sold on June 29, 2019, and

(2) The sale of machinery.

3. Compute depreciation expense on the building, remaining machinery, and equipment for 2019.

Transcribed Image Text:

Estimated Residual Estimated Useful Asset Cost Value Life (in years) $ 100,000 500,000 240,000 160,000 Land N/A N/A Building Machinery Equipment none 25 10% of cost $13,000 6 Total $1,000,000

> Kim Company bought 30% of the shares of Phelps, Inc., at the start of 2018. Kim paid $10 million for the shares. Thirty percent of the book value of Phelps’s net assets is $8 million, and the difference of $2 million is due to land that Phelps owns that

> Carnes Electronics sells consumer electronics that carry a 90-day manufacturer’s warranty. At the time of purchase, customers are offered the opportunity to also buy a two-year extended warranty for an additional charge. During the year, Carnes received

> The fair value of Wallis, Inc.’s depreciable assets exceeds their book value by $50 million. The assets have an average remaining useful life of 15 years and are being depreciated by the straight-line method. Park Industries buys 30% of Wallis’s common s

> Discuss the factors that influence the estimation of service life for a depreciable asset.

> Mercury Company has only one inventory pool. On December 31, 2018, Mercury adopted the dollar-value LIFO inventory method. The inventory on that date using the dollar-value LIFO method was $200,000. Inventory data are as follows: Required: Compute the

> The Bockner Company shipped merchandise to Laetner Corporation on December 28, 2018. Laetner received the shipment on January 3, 2019. December 31 is the fiscal year-end for both companies. The merchandise was shipped f.o.b. shipping point. Explain the d

> Tatum Company has four products in its inventory. Information about the December 31, 2018, inventory is as follows: The normal gross profit percentage is 25% of total cost. Required: 1. Determine the carrying value of inventory at December 31, 2018, a

> Turner Company owns 40% of the outstanding stock of ICA Company. During the current year, ICA paid a $5 million cash dividend on its common shares. What effect did this dividend have on Turner’s 2018 financial statements? Explain the reasoning for this e

> Turner Company owns 10% of the outstanding stock of ICA Company. During the current year, ICA paid a $5 million cash dividend on its common shares. What effect did this dividend have on Turner’s 2018 financial statements? Explain the reasoning for this e

> Adams Industries holds 40,000 shares of FedEx common stock, which is not a large enough ownership interest to allow Adams to exercise significant influence over FedEx. On December 31, 2018, and December 31, 2019, the market value of the stock is $95 and

> Assume the same facts as in BE 12–8, but that Fowler intends to hold the bonds until maturity. How much unrealized gain or loss would Fowler include in 2018 net income with respect to the bonds? In BE 12–8 Fowler Inc. purchased $75,000 of bonds on Janua

> At the beginning of 2016, the Healthy Life Food Company purchased equipment for $42 million to be used in the manufacture of a new line of gourmet frozen foods. The equipment was estimated to have a 10-year service life and no residual value. The straigh

> On July 15, 2018, the Nixon Car Company purchased 1,000 tires from the Harwell Company for $50 each. The terms of the sale were 2/10, n/30. Nixon uses a periodic inventory system and the gross method of accounting for purchase discounts. Required: 1. Pr

> Fowler Inc. purchased $75,000 of bonds on January 1, 2018. The bonds pay interest semiannually and mature in 20 years, at which time the $75,000 principal will be paid. The bonds do not pay any amounts other than interest and principal. Fowler’s intentio

> For several years Fister Links Products has held Microsoft bonds, considered by the company to be securities available-for-sale. The bonds were acquired at a cost of $500,000. At the end of 2018, their fair value was $610,000 and their amortized cost was

> Western Die-Casting Company holds an investment in unsecured bonds of LGB Heating Equipment, Inc. When the investment was acquired, management’s intention was to hold the bonds for resale. Now management has the positive intent and ability to hold the bo

> Identify and define the three characteristics of an asset that must be established to determine periodic depreciation, depletion, or amortization.

> Why are holding gains and losses treated differently for trading securities and securities available-for-sale?

> What is “comprehensive income”? Its composition varies from company to company but may include which items related to available-for-sale investments that are not included in net income?

> Reporting an investment at its fair value means adjusting its carrying amount for changes in fair value after its acquisition (or since the last reporting date if it was held at that time). Such changes are called unrealized holding gains and losses beca

> The inventory of Royal Decking consisted of five products. Information about the December 31, 2018, inventory is as follows: Selling costs consist of a sales commission equal to 10% of selling price and shipping costs equal to 5% of cost. The normal gr

> On January 1, 2018, the Haskins Company adopted the dollar-value LIFO method for its one inventory pool. The pool’s value on this date was $660,000. The 2018 and 2019 ending inventory valued at year-end costs were $690,000 and $760,000, respectively. The

> When a debt investment is acquired to be held for an unspecified period of time as opposed to being held to maturity, it is reported at the fair value of the investment securities on the reporting date. Why?

> Cupola Awning Corporation introduced a new line of commercial awnings in 2018 that carry a two-year warranty against manufacturer’s defects. Based on their experience with previous product introductions, warranty costs are expected to approximate 3% of s

> Branch Corporation issued $12 million of commercial paper on March 1 on a nine-month note. Interest was discounted at issuance at a 9% discount rate. Prepare the journal entry for the issuance of the commercial paper and its repayment at maturity.

> The company controller, Barry Melrose, has asked for your help in interpreting the authoritative accounting literature that addresses the recognition and measurement of impairment losses for property, plant, and equipment and intangible assets. “We have

> Does GAAP distinguish between fair values that are readily determinable from current market prices versus those needing to be calculated based on the company’s own assumptions? Explain how a user will know about the reliability of the inputs used to dete

> When market rates of interest rise after a fixed-rate security is purchased, the value of the now-below-market, fixed-interest payments declines, so the market value of the investment falls. On the other hand, if market rates of interest fall after a fix

> How does IFRS differ from current U.S. GAAP in accounting for other-than-temporary impairments?

> Explain how the CECL model (introduced in ASU No. 2016-13 and required in 2020) differs from current GAAP in its calculation of impairment losses.

> Redline Publishers, Inc. produces various manuals ranging from computer software instructional booklets to manuals explaining the installation and use of large pieces of industrial equipment. At the end of 2018, the company’s balance sheet reported total

> On April 1, 2016, the KB Toy Company purchased equipment to be used in its manufacturing process. The equipment cost $48,000, has an eight-year useful life, and has no residual value. The company uses the straight-line depreciation method for all manufac

> [This problem is a continuation of Problem 10–3 in Chapter 10 focusing on depreciation.] Problem 10–3 The plant asset and accumulated depreciation accounts of Pell Corporation had the following balances at December 31

> The Reuschel Company began 2018 with inventory of 10,000 units at a cost of $7 per unit. During 2018, 50,000 units were purchased for $8.50 each. Sales for the year totaled 54,000 units leaving 6,000 units on hand at the end of 2018. Reuschel uses a peri

> Depreciation is a process of cost allocation, not valuation. Explain this statement.

> Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Required: 1. Obtain the relevant authoritative literature on recognition of contingent losses. What is the specific citation that describes the guidelines for determin

> At December 31, 2017, Cord Company’s plant asset and accumulated depreciation and amortization accounts had balances as follows: Depreciation methods and useful lives: Buildings—150% declining balance; 25 years. Mach

> The fact that generally accepted accounting principles allow companies flexibility in choosing between certain allocation methods can make it difficult for a financial analyst to compare periodic performance from firm to firm. Suppose you were a financia

> On May 1, 2018, Hecala Mining entered into an agreement with the state of New Mexico to obtain the rights to operate a mineral mine in New Mexico for $10 million. Additional costs and purchases included the following: Development costs in preparing the m

> At the beginning of 2016, Metatec Inc. acquired Ellison Technology Corporation for $600 million. In addition to cash, receivables, and inventory, the following assets and their fair values were also acquired: Plant and equipment (depreciable assets) …………

> Collins Corporation purchased office equipment at the beginning of 2016 and capitalized a cost of $2,000,000. This cost figure included the following expenditures: Purchase price ………………………………………. $1,850,000 Freight charges ……………………………………………. 30,000 Insta

> Herman Company has three products in its ending inventory. Specific per unit data at the end of the year for each of the products are as follows: Required: What unit values should Herman use for each of its products when applying the lower of cost or n

> Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Determine the specific citation for each of the following items: 1. Define the meaning of cost as it applies to the initial measurement of inventory. 2. Indicate the ci

> Described below are three independent and unrelated situations involving accounting changes. Each change occurs during 2018 before any adjusting entries or closing entries are prepared. a. On December 30, 2014, Rival Industries acquired its office buildi

> The property, plant, and equipment section of the Jasper Company’s December 31, 2017, balance sheet contained the following: The land and building were purchased at the beginning of 2013. Straight-line depreciation is used and a resid

> The following information concerns the intangible assets of Epstein Corporation: a. On June 30, 2018, Epstein completed the acquisition of the Johnstone Corporation for $2,000,000 in cash. The fair value of the net identifiable assets of Johnstone was $1

> At December 31, 2018, Newman Engineering’s liabilities include the following: 1. $10 million of 9% bonds were issued for $10 million on May 31, 1999. The bonds mature on May 31, 2029, but bondholders have the option of calling (demanding payment on) the

> The market value of Helig Forestry and Mining Corporation bonds dropped 6 1 ⁄ 8 points when the federal government passed new legislation banning one of the company’s primary techniques for extracting ore. Harris Corporation owns Helig bonds and classifi

> In 2018, the Marion Company purchased land containing a mineral mine for $1,600,000. Additional costs of $600,000 were incurred to develop the mine. Geologists estimated that 400,000 tons of ore would be extracted. After the ore is removed, the land will

> AEP Industries Inc. is a leading manufacturer of plastic packing films. The company uses the LIFO inventory method for external reporting but maintains its internal records using FIFO. The following disclosure note was included in a recent quarterly repo

> The Thompson Corporation, a manufacturer of steel products, began operations on October 1, 2016. The accounting department of Thompson has started the fixed-asset and depreciation schedule presented below. You have been asked to assist in completing this

> On January 2, 2018, the Jackson Company purchased equipment to be used in its manufacturing process. The equipment has an estimated life of eight years and an estimated residual value of $30,625. The expenditures made to acquire the asset were as follows

> Highsmith Rental Company purchased an apartment building early in 2018. There are 20 apartments in the building and each is furnished with major kitchen appliances. The company has decided to use the group depreciation method for the appliances. The foll

> Howarth Manufacturing Company purchased a lathe on June 30, 2014, at a cost of $80,000. The residual value of the lathe was estimated to be $5,000 at the end of a five-year life. The lathe was sold on March 31, 2018, for $17,000. Howarth uses the straigh

> Briefly explain the difference between U.S. GAAP and IFRS in the measurement of an impairment loss for property, plant, and equipment and finite-life intangible assets.

> In March 2018, the Phillips Tool Company signed two purchase commitments. The first commitment requires Phillips to purchase inventory for $100,000 by June 15, 2018. The second commitment requires the company to purchase inventory for $150,000 by August

> Smith-Kline Company maintains inventory records at selling prices as well as at cost. For 2018, the records indicate the following data: Required: Assuming the price level increased from 1.00 at January 1 to 1.10 at December 31, 2018, use the dollar-va

> On July 1, 2013, Farm Fresh Industries purchased a specialized delivery truck for $126,000. At the time, Farm Fresh estimated the truck to have a useful life of eight years and a residual value of $30,000. On March 1, 2018, the truck was sold for $58,000

> Reporting an investment at its fair value requires adjusting its carrying amount for changes in fair value after its acquisition (or since the last reporting date if it was held at that time). Such changes are called unrealized holding gains and losses b

> Mercury Inc. purchased equipment in 2016 at a cost of $400,000. The equipment was expected to produce 700,000 units over the next five years and have a residual value of $50,000. The equipment was sold for $210,000 part way through 2018. Actual productio

> Dower Corporation prepares its financial statements according to IFRS. On March 31, 2018, the company purchased equipment for $240,000. The equipment is expected to have a six-year useful life with no residual value. Dower uses the straight-line deprecia

> On June 30, 2018, Rosetta Granite purchased a machine for $120,000. The estimated useful life of the machine is eight years and no residual value is anticipated. An important component of the machine is a specialized high-speed drill that will need to be

> On March 31, 2018, Susquehanna Insurance purchased an office building for $12,000,000. Based on their relative fair values, one-third of the purchase price was allocated to the land and two-thirds to the building. Furniture and fixtures were purchased se

> On April 30, 2018, Quality Appliances purchased equipment for $260,000. The estimated service life of the equipment is six years and the estimated residual value is $20,000. Quality’s fiscal year ends on December 31. Required: Calculate depreciation for

> Causwell Company began 2018 with 10,000 units of inventory on hand. The cost of each unit was $5.00. During 2018 an additional 30,000 units were purchased at a single unit cost, and 20,000 units remained on hand at the end of 2018 (20,000 units therefore

> For each of the following depreciable assets, determine the missing amount (?). Abbreviations for depreciation methods are SL for straight line, SYD for sum-of-the-years’-digits, and DDB for double-declining balance. Residual Value

> Tristen Company purchased a five-story office building on January 1, 2016, at a cost of $5,000,000. The building has a residual value of $200,000 and a 30-year life. The straight-line depreciation method is used. On June 30, 2018, construction of a sixth

> Demmert Manufacturing incurred the following expenditures during the current fiscal year: annual maintenance on its machinery, $5,400; remodeling of offices, $22,000; rearrangement of the shipping and receiving area resulting in an increase in productivi

> Identify any differences between U.S. GAAP and International Financial Reporting Standards in the subsequent valuation of property, plant, and equipment and intangible assets.

> On October 1, 2018, the Allegheny Corporation purchased machinery for $115,000. The estimated service life of the machinery is 10 years and the estimated residual value is $5,000. The machine is expected to produce 220,000 units during its life. Require

> When market rates of interest rise after a fixed-rate security is purchased, the value of the now-below-market, fixed-interest payments declines, so the market value of the investment falls. If that drop in fair value is viewed as giving rise to an other

> On October 6, 2018, the Elgin Corporation signed a purchase commitment to purchase inventory for $60,000 on or before March 31, 2019. The company’s fiscal year-end is December 31. The contract was exercised on March 21, 2019, and the inventory was purcha

> On January 1, 2018, the Allegheny Corporation purchased machinery for $115,000. The estimated service life of the machinery is 10 years and the estimated residual value is $5,000. The machine is expected to produce 220,000 units during its life. Require

> On January 1, 2018, the Excel Delivery Company purchased a delivery van for $33,000. At the end of its five-year service life, it is estimated that the van will be worth $3,000. During the five-year period, the company expects to drive the van 100,000 mi

> Cadillac Construction Company uses the retirement method to determine depreciation on its small tools. During 2016, the first year of the company’s operations, tools were purchased at a cost of $8,000. In 2018, tools originally costing $2,000 were sold f

> Listed below are several items and phrases associated with depreciation, depletion, and amortization. Pair each item from List A with the item from List B (by letter) that is most appropriately associated with it. List A List B 1. Depreciation 2. Se

> On September 30, 2016, Leeds LTD. acquired a patent in conjunction with the purchase of another company. The patent, valued at $6 million, was estimated to have a 10-year life and no residual value. Leeds uses the straightline method of amortization for

> Belltone Company made the following expenditures related to its 10-year-old manufacturing facility: 1. The heating system was replaced at a cost of $250,000. The cost of the old system was not known. The company accounts for improvements as reductions of

> Consider the information presented in E 13–11. In E 13–11 An annual report of Sprint Corporation contained a rather lengthy narrative entitled “Review of Segmental Results of Operation.” The narrative noted that short-term notes payable and commercial p

> Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Determine the specific citation for each of the following items: 1. Depreciation involves a systematic and rational allocation of cost rather than a process of valuatio

> The following information is taken from the inventory records of the CNB Company for the month of September: Beginning inventory, 9/1/2018 ……………………… 5,000 units @ $10.00 Purchases: 9/7 ……………………………………………………………… 3,000 units @ $10.40 9/25 ………………………………………………

> Explain the differences in the accounting treatment of repairs and maintenance, additions, improvements, and rearrangements.

> Whole-life insurance policies typically can be surrendered while the insured is still alive in exchange for a determinable amount of money called the cash surrender value. When a company buys a life insurance policy on the life of a key officer to protec

> The FASB Accounting Standards Codification represents the single source of authoritative U.S. generally accepted accounting principles. Required: 1. Obtain the relevant authoritative literature on the impairment or disposal of long-lived assets using th

> On May 28, 2018, Pesky Corporation acquired all of the outstanding common stock of Harman, Inc. for $420 million. The fair value of Harman’s identifiable tangible and intangible assets totaled $512 million, and the fair value of liabilities assumed by Pe

> Listed below are several terms and phrases associated with inventory measurement. Pair each item from List A with the item from List B (by letter) that is most appropriately associated with it. List A List B 1. Gross profit ratio 2. Cost-to-retail p

> Refer to the situation described in E 11–30, requirement 1. Alliant prepares its financial statements according to IFRS, and Centerpoint is considered a cash-generating unit. Assume that Centerpoint’s fair value of $220 million approximates fair value le

> In 2016, Alliant Corporation acquired Centerpoint, Inc. for $300 million, of which $50 million was allocated to goodwill. At the end of 2018, management has provided the following information for a required goodwill impairment test: Fair value of Centerp

> General Optic Corporation operates a manufacturing plant in Arizona. Due to a significant decline in demand for the product manufactured at the Arizona site, an impairment test is deemed appropriate. Management has acquired the following information for

> Is it necessary for an investor to report individual amounts for the three categories of investments—held-to-maturity, available-for-sale, or trading—in the financial statements? What information should be disclosed about these investments?

> Collinsworth LTD., a U.K. company, prepares its financial statements according to International Financial Reporting Standards. Late in its 2018 fiscal year, a significant adverse change in business climate indicated to management that the assets of its a

> Refer to the situation described in Exercise 11–26. In Exercise 11–26 Chadwick Enterprises, Inc. operates several restaurants throughout the Midwest. Three of its restaurants located in the center of a large urban area have experienced declining profits

> Chadwick Enterprises, Inc. operates several restaurants throughout the Midwest. Three of its restaurants located in the center of a large urban area have experienced declining profits due to declining population. The company’s management has decided to t

> In 2018, internal auditors discovered that PKE Displays, Inc. had debited an expense account for the $350,000 cost of equipment purchased on January 1, 2015. The equipment’s life was expected to be five years with no residual value. Straight-line depreci

> What is a LIFO inventory pool? How the cost of ending inventory is determined when pools are used?

> There are various types of accounting changes, each of which is required to be reported differently. Required: 1. What type of accounting change is a change from the sum-of-the-years’-digits method of depreciation to the straight-line method for previou

> Explain what is meant by the impairment of the value of property, plant, and equipment and intangible assets. How should these impairments be accounted for?

> For financial reporting, Clinton Poultry Farms has used the declining-balance method of depreciation for conveyor equipment acquired at the beginning of 2015 for $2,560,000. Its useful life was estimated to be six years, with a $160,000 residual value. A

> Alta Ski Company’s inventory records contained the following information regarding its latest ski model. The company uses a periodic inventory system. Beginning inventory, January 1, 2018 ……………… 600 units @ $80 each Purchases: January 15 …………………………………………

> Alteran Corporation purchased office equipment for $1.5 million in 2015. The equipment is being depreciated over a 10-year life using the sum-of-the-years’-digits method. The residual value is expected to be $300,000. At the beginning of 2018, Alteran de