Question: On October 14, 2005, eBay acquired Skype,

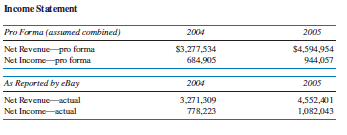

On October 14, 2005, eBay acquired Skype, paying $1.3 billion in cash plus $1.3 billion in stock. However, approximately 60% of the Skype shareholders opted for a lower cash amount and stock up front for the possibility of receiving a potential performance-based payment of up to another $1.3 billion in 2008 through 2009. In the following schedule, summary pro forma income statement data are prepared showing the performance of eBay as if the Skype acquisition were completed prior to the beginning of 2004. Summary data from the actual reported income statements for the two years are also presented in the following schedule.

Required:

1. Using these numbers, evaluate the wisdom of the acquisition of Skype by eBay. Discuss some of the reasons that ratio analyses alone may not tell the entire story.

2. Did the shareholders of Skype who opted for the lower cash amount and contingency payment make a wiser or poorer choice relative to the 40% who made the alternative choice? Why? What other factors might affect your answer?

Transcribed Image Text:

Income Statement Pro Forma (assumed combined) 2004 2005 Net Revenue pro forma Net Income pro forma $3,277,534 $4,594,954 684,905 944,057 As Reported by elBay 2004 2005 Net Revenue-actual 3,271,309 4,552,401 Net Income-actusal 778,223 1,082,043

> On January 1, 2011, Plank Company purchased 80% of the outstanding capital stock of Scoba Company for $53,000. At that time, Scoba’s stockholders’ equity consisted of capital stock, $55,000; other contributed capital,

> On January 26, 2010, the Emdeon acquired all of the voting interest of FutureVision Investment Group, L.L.C. and substantially all of the assets of two related companies, FVTech, Inc. and FVTech Arizona, Inc. (collectively, “FVTech&acir

> Consider the following footnote from a company’s 2012 10K concerning an acquisition occurring during February of 2011 (The Company’s year-end is January 31). The measurement period adjustment did not occur until Januar

> On November 19, 2009, eBay sold all the capital shares of Skype to Springboard Group. eBay received cash proceeds of approximately $1.9 billion, a subordinated note issued by a subsidiary of the Buyer in the principal amount of $125.0 million and an equi

> On October 14, 2005, eBay acquired all of the outstanding securities of Skype Technologies S.A. (“Skype”), for a total initial consideration of approximately $2.593 billion, plus potential performance- based payments of up to approximately $1.3 billion (

> When does the SEC staff believe that push down accounting should be applied?

> What is a reverse acquisition? How should the consideration transferred in a reverse acquisition be measured?

> FASB Statement No. 142 changed the guidance for goodwill and other intangibles. List all the topics in the Codification where this information can be found (i.e., ASC XXX). (Hint: There are two general topics.)

> What is the objective of the statement of cash flows?

> Management changed an accounting method. Several executives would have qualified for additional bonuses totaling $50,000 in the prior year under the new method. Can the firm restate the previous year’s income statement to include this expense?

> You are writing a research paper on the accounting for treasury stock. You wonder if it is possible to treat treasury stock as an asset. If not, you wonder if, over the history of GAAP, it has ever been acceptable for treasury stock to be classified as a

> On January 1, 2012, Perez Company purchased 90% of the capital stock of Sanchez Company for $85,000. Sanchez Company had capital stock of $70,000 and retained earnings of $12,000 at that time. On December 31, 2016, the trial balances of the two companies

> Can a firm choose a fair value option for reporting some of its investments on the balance sheet? If so, describe the conditions that must be met.

> Suppose that a company accounts for an investment using the equity method. Describe the appropriate accounting if the combined loss reported by the investee exceeds the investor’s balance in the investment account.

> Describe the equity method for accounting for investments. In order to qualify for the equity method, describe the conditions that must be met.

> A company changed its method of accounting for inventory and determined that it was impractical to determine the cumulative effect for all prior periods. The company decided to use the new method on a prospective basis. Is this acceptable under current G

> Is a correction of an error in the financial statements considered an accounting change?

> A company reported net income of $15,000, including an extraordinary loss of $3,000. Another company owns 40% of this company and uses the equity method to account for the investment. On the investee company’s books, does the investee report the net inco

> Variable interest entities (VIEs) are discussed in FASB Interpretation No. 46R. List all the topics in the Codification where this information can be found (i.e., ASC XXX). (Hint: There are three main topics.)

> Suppose a firm purchases treasury stock but pays an amount significantly larger than the market value of the stock. Describe the appropriate accounting for the treasury stock.

> Can treasury stock be listed as an asset on the balance sheet?

> There are two specific operating cash payments that are required to be disclosed as supplemental information to the statement of cash flows (if not presented as line items under the direct method). What are they and where is this located in the Codificat

> Place Company purchased 92% of the common stock of Shaw, Inc. on January 1, 2012, for $400,000. Trial balances at the end of 2012 for the companies were: Inventory balances on December 31, 2012, were $25,000 for Place and $15,000 for Shaw, Inc. Shaw&ac

> Accounting for contingencies was originally addressed in SFAS No. 5. Where is this information included in the Codification? Is all the guidance listed within one topic?

> A company considered displaying negative amounts using red print in a manner that clearly distinguishes the negative attribute. When determining methods of display, does the company need to give consideration to the limitations of reproduction and microf

> The rules providing accounting guidance on subsequent events were originally listed in FASB Statement No. 165. Where is this information located in the Codification? List all the topics and subtopics in the Codification where this information can be foun

> List all the topics found under General Topic 200—Presentation (Hint: There are 15 topics).

> What instruments qualify as cash equivalents?

> In the 1990s, the pooling of interest method was a preferred method of accounting for consolidations by many managers because of the creation of instant earnings if the acquisition occurred late in the year. Can the firms that used pooling of interest in

> Does current GAAP require that the information on the income statement be reported in chronological order with the most recent year listed first, or is the reverse order acceptable as well?

> GAAP requires that firms test for goodwill impairment on an annual basis. One reporting unit performs the impairment test during January while a second reporting unit performs the impairment test during July. If the firm reports annual results on a calen

> Distinguish between an asset acquisition and the acquisition of a business.

> Can the provisions of the Codification be ignored if the item is immaterial?

> Passion Company is trying to decide whether or not to acquire Desiree Inc. The following balance sheet for Desiree Inc. provides information about book values. Estimated market values are also listed, based upon Passion Company’s appraisals.

> How many years of comparative financial statements are required under current GAAP?

> If guidance for a transaction is not specifically addressed in the Codification, what is the appropriate procedure to follow in identifying the proper accounting?

> Suppose a firm entered into a capital lease, debiting an asset account and crediting a lease liability account for $150,000. Does this transaction need to be disclosed as part of the statement of cash flows? If so, where?

> The rules defining the conditions to classify an item as extraordinary on the income statement were originally listed in APB Opinion No 30, paragraph 20. Where is this information located in the Codification?

> The conditions determining whether a lease is classified as an operating lease or a capital lease were prescribed in SFAS No. 13, paragraph 7. Where is this located in this Codification?

> Perkins Company acquired 100% of Schultz Company on January 1, 2012, for $161,500. On December 31, 2012, the companies prepared the following trial balances: Required: A. What method is being used by Perkins to account for its investment in Schultz Com

> Parry Corporation acquired a 100% interest in Sent Company on January 1, 2011, paying $140,000. Financial statement data for the two companies for the year ended December 31, 2011 follow: Required: A. What method is being used by Parry to account for i

> From 1999 to 2001, Tyco’s revenue grew approximately 24% and it acquired over 700 companies. It was widely rumored that Tyco executives aggressively managed the performance of the companies that they acquired by suggesting that before the acquisition, th

> On January 1, 2011, Perelli Company purchased 90,000 of the 100,000 outstanding shares of common stock of Singer Company as a long-term investment. The purchase price of $4,972,000 was paid in cash. At the purchase date, the balance sheet of Singer Compa

> The following information from the financial statements of Kraft Foods and Cadbury PLC is available for the three years prior to their merger. Evaluate the performance of each company leading up to the year of the acquisition (2010). Note that Cadbury&ac

> On February, 2, 2010, Cadbury’s Board of Directors recommended that Cadbury’s shareholders accept the terms of Kraft’s final offer to acquire Cadbury. This ended one of the larger hostile takeovers that combined one company (Kraft) that reported using U.

> What is insider trading anyway? Consider the following: Many years ago, a student in a consolidated financial statements class came to me and said that Grand Central (a multi-store grocery and variety chain in Salt Lake City and surrounding towns and c

> On April 5, 2006, the New York State Attorney sued a New York online advertising firm for surreptitiously installing spyware advertising programs on consumers’ computers. The Attorney General claimed that consumers believed they were downloading free gam

> Part I. You are working on the valuation of accounts receivable, and bad debt reserves for the current year’s annual report. The CFO stops by and asks you to reduce the reserve by enough to increase the current year’s EPS by 2 cents a share

> There have been several recent cases of a CEO or CFO resigning or being ousted for misrepresenting academic credentials. For instance, during February 2006, the CEO of RadioShack resigned by “mutual agreement” for inflating his educational background. Du

> During 2005, eBay acquired four different companies. In the schedule below, the acquired companies are listed with the aggregate purchase price and with the estimated acquisition-related costs (dollars in thousands). Required: 1. What are acquisition-r

> If a parent company elects to use the partial equity method rather than the cost method to record its investments in subsidiaries, what effect will this choice have on the consolidated financial statements? If the parent company elects the complete equit

> When stock is exchanged for stock in a business combination, how is the stock exchange ratio generally expressed?

> Pequity Company purchased 85% of the common stock of Sequity Company on April 1, Year 1. The fair value of the consideration transferred consisted of a cash payment of $545,000 and contingent consideration as described in the earnout agreement below. Und

> Is the recognition of a deferred tax asset or deferred tax liability when allocating the difference between book value and the value implied by the purchase price affected by whether or not the affiliates file a consolidated income tax return? (See onlin

> Business combinations may be classified into three types based upon the relationships among the combining entities (e.g., combinations with suppliers, customers, competitors, etc.). Identify and define these types.

> Meredith Company and Kyle Company were combined in a purchase transaction. Meredith was able to acquire Kyle at a bargain price. The sum of the market or appraised values of identifiable assets acquired less the fair value of liabilities assumed exceeded

> Corporation A purchased the net assets of Corporation B for $80,000. On the date of A’s purchase, Corporation B had no long-term investments in marketable securities and $10,000 (book and fair value) of liabilities. The fair values of Corporation B’s ass

> On a consolidated workpaper for a parent and its partially owned subsidiary, the noncontrolling interest column accumulates the noncontrolling interests’ share of several account balances. What are these accounts?

> Peep Inc. acquired 100% of the outstanding common stock of Shy Inc. for $2,500,000 cash and 15,000 shares of its common stock ($2 par value). The stock’s market value was $40 on the acquisition date. Required: Prepare the journal entry to record the acq

> Polychromasia, Inc. had a number of receivables from subsidiaries at the balance sheet date, as well as several payables to subsidiaries. Of its five subsidiaries, four are consolidated in the financial statements (Green Company, Black Inc., White & Sons

> Define a tender offer and describe its use.

> Why are consolidated workpapers used in preparing consolidated financial statements?

> Accounting textbooks under the former GAAP hierarchy were considered level 4 authoritative. Where do accounting textbooks stand in the Codification?

> Pcost Company purchased 85% of the common stock of Scost Company on April 1, Year 1. The fair value of the consideration transferred consisted of a cash payment of $545,000 and contingent consideration as described in the earnout agreement below. Under t

> Alpha Company is considering the purchase of Beta Company. Alpha has collected the following data about Beta: Cumulative total net cash earnings for the past five years of $850,000 includes extraordinary cash gains of $67,000 and nonrecurring cash loss

> What is the primary legal constraint on business combinations? Why does such a constraint exist?

> What are pro forma financial statements? What is their purpose?

> How should nonconsolidated subsidiaries be reported in consolidated financial statements?

> What is the effect on the noncontrolling share of consolidated income that results from the recording in the consolidated statements workpaper of differences between book value and the value implied by the purchase price (and their allocation to deprecia

> P Company acquired a 100% interest in S Company. On the date of acquisition, the fair value of the assets and liabilities of S Company was equal to their book value except for land that had a fair value of $1,500,000 and a book value of $300,000. At what

> What are the arguments for and against the alternatives for the handling of bargain acquisitions? Why are such acquisitions unlikely to occur with great frequency?

> The parent company’s share of the fair value of the net assets of a subsidiary may exceed acquisition cost. How must this excess be treated in the preparation of consolidated financial statements?

> How do you determine the amount of “the difference between book value and the value implied by the purchase price” to be allocated to a specific asset of a less than wholly owned subsidiary?

> In what account is the difference between book value and the value implied by the purchase price recorded on the books of the investor? In what account is the “excess of implied over fair value” recorded?

> Distinguish among the following concepts: (a) Difference between book value and the value implied by the purchase price. (b) Excess of implied value over fair value. (c) Excess of fair value over implied value. (d) Excess of book value over fair value.

> On April 1, Year 1, Company P purchased 85% of S Company for total consideration of $357,000, which included $30,000 of contingent consideration as measured according to GAAP at fair value. Each company has a December 31 year-end. The complete equity met

> Describe two methods for treating the preacquisition revenue and expense items of a subsidiary purchased during a fiscal period.

> At the date of an 80% acquisition, a subsidiary had common stock of $100,000 and retained earnings of $16,250. Seven years later, at December 31, 2015, the subsidiary’s retained earnings had increased to $461,430. What adjustment will be made on the cons

> Define: Consolidated net income; consolidated retained earnings.

> How is the income reported by the subsidiary reflected on the books of the investor under each of the methods of accounting for investments?

> How are dividends declared and paid by a subsidiary during the year eliminated in the consolidated workpapers under each method of accounting for investments?

> How are liquidating dividends treated on the books of an investor, assuming the investor uses the cost method? Assuming the investor uses the equity method?

> Identify two types of temporary differences that may arise in the consolidated financial statements when the affiliates file separate income tax returns. (See online appendix 4B available at www.wiley.com/college/jeter)

> The FASB elected to require that deferred tax effects relating to unrealized intercompany profits be calculated based on the income tax paid by the selling affiliate rather than on the future tax benefit to the purchasing affiliate. Describe circumstance

> What assumptions must be made about the realization of undistributed subsidiary income when the affiliates file separate income tax returns? Why? (See online appendix 4B available at www.wiley.com/college/jeter)

> What do potential voting rights refer to, and how do they affect the application of the equity method for investments under IFRS? Under U.S. GAAP? What is the term generally used for equity method investments under IFRS?

> On April 1, Year 1, Company P purchased 85% of S Company for total consideration of $357,000, which included $30,000 of contingent consideration as measured according to GAAP at fair value. Each company has a December 31 year-end. The cost method is used

> In the preparation of a consolidated statement of cash flows, what adjustments are necessary because of the existence of a noncontrolling interest? (AICPA adapted)

> A principal limitation of consolidated financial statements is their lack of separate financial information about the assets, liabilities, revenues, and expenses of the individual companies included in the consolidation. Identify some problems that the r

> What effect does a noncontrolling interest have on the amount of intercompany receivables and payables eliminated on a consolidated balance sheet?

> What effect do subsidiary treasury stock holdings have at the time the subsidiary is acquired? How should the treasury stock be treated on consolidated work papers?

> Define noncontrolling (minority) interest. List three methods that might be used for reporting the noncontrolling interest in a consolidated balance sheet, and state which is preferred under current GAAP.

> What aspects of control must exist before a subsidiary is consolidated?

> Why is it often necessary to prepare separate financial statements for each legal entity in a consolidated group even though consolidated statements provide a better economic picture of the combined activities?

> What is the justification for preparing consolidated financial statements when, in fact, it is apparent that the consolidated group is not a legal entity?

> Current rules require that a deferred tax asset or liability be recognized for likely differences between the reported values and tax bases of assets and liabilities recognized in business combinations (for example, in exchanges that are nontaxable to

> What are the advantages of acquiring the majority of the voting stock of another company rather than acquiring all its voting stock?

> The consolidated income statement for the year December 31, 2014, and comparative balance sheets for 2013 and 2014 for Parks Company and its 90% owned subsidiary SCR, Inc. are as follows: SCR, Inc. declared and paid an $8,000 dividend during 2014. Requ

> What is the difference between net income, or earnings, and comprehensive income?

> How does the FASB’s conceptual framework influence the development of new standards?