Question: On September 18, 2018, Gerald received land

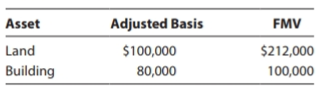

On September 18, 2018, Gerald received land and a building from Frank as a gift. Frank's adjusted basis and the fair market value at the date of the gift are as follows:

No gift tax was paid on the transfer.

a. Determine Gerald's adjusted basis for the land and building.

b. Assume instead that the fair market value of the land was $87,000 and that of the building was $65,000. Determine Gerald's adjusted basis for the land and building.

Transcribed Image Text:

Asset Adjusted Basis FMV Land $100,000 $212,000 Building 80,000 100,000

> A new client, John Dobson, recently formed John's Premium Steakhouse, Inc., to operate a new restaurant. The restaurant will be a first-time business venture for John, who recently retired after 30 years of military service. John transferred cash to the

> Compute the taxable incon1e for 2018 in each of the following independent situations: a. Drew and Meg, ages 40 and 41, respectively, are married and file a joint return. In addition to four dependent children, they have AG! of $125,000 and itemized deduc

> In 2018, Muhammad purchased a new computer for $16,000. The computer is used 100% for business. Muhammad did not make a § 179 election with respect to the computer. He does not claim any available additional first-year depreciation. If Muhammad uses the

> Wesley, who is single, listed his personal residence with a real estate agent on March 3, 2018, at a price of $390,000. He rejected several offers in the $350,000 range during the sumn1er. Finally, on August 16, 2018, he and the purchaser signed a contra

> Larry is the sole proprietor of a trampoline shop. During 2018, the following transactions occurred. • Unimproved land adjacent to the store was condemned by the city on Febnrary 1. The condemnation proceeds were $15,000. The land, acquired in 1986, had

> Alex, who is single, conducts an activity this year that is classified as a hobby. The activity produces the following revenues and expenses. Without regard to this activity, Alex's AGI is $42,000. Detern1ine the amount of gross income that Alex must r

> In 2018, Susan's sole proprietorship earns $300,000 of self-employment net income (after the deduction for one-half of self-employment tax). Calculate the maximum amount Susan can deduct for contributions to a defined contribution Keogh plan.

> Carri and Dane, ages 34 and 32, respectively, have been married for 11 years, and both are active participants in employer-qualified retirement plans. Their total AG! in 2018 is $192,000, and they earn salaries of $87,000 and $95,000, respectively. What

> Janet, age 29, is unmarried and is an active participant in a qualified retirement plan. Her modified AG! is $65,000 in 2018. a. Calculate the amount Janet can contribute to a traditional IRA and the amount she can deduct. b. Assume instead that Janet is

> Ashley (a single taxpayer) is the owner of ABC LLC. The LLC (a sole proprietor ship) reports QB! of $900,000 and is not a "specified services" business. ABC paid total W-2 wages of $300,000, and the total unadjusted basis of property held by ABC is $30,0

> Christine is a full-rime teacher of the fourth grade at Vireo Academy. During the current year, she spends $1,400 for classroom supplies. On the submission of adequate substantiation, Vireo reimburses her for $500 of these expenses-the maximum reimbursem

> Rick Beam has been an independent sales representative for various textile manufacturers for many years. His product5 consist of soft goods such as tablecloths, curtains, and drapes. Rick's customers are clothing store chains, department stores, and smal

> Caden and Lily are divorced on March 3. 2017. For financial reasons, however, Lily continues to live in Caden's apartment and receives her support from hin1. Caden does not claim Lily as a dependent on his 2017 Federal income tax return but does so on hi

> Belinda spent the last 60 days of 2018 in a nursing home. The cost of the services provided to her was $18,000 ($300 per day). Medicare paid $8,500 toward the cost of her stay. Belinda also received $5,500 of benefits under a long term care insurance pol

> On December 1, 2016, Lavender Manufacturing Company (a corporation) purchased another company's assets, including a patent. The patent was used in Lavender's manufacturing operations; $49,500 was allocated to the patent, and it was amortized at the rate

> Siena Industries (a sole proprietorship) sold three§ 1231 assets on October 10, 2018. Data on these property dispositions are as follows. a. Determine the an1ount and the character of the recognized gain or loss fron1 the disposition of eac

> Jinjie owns two parcels of land (§ 1231 assets). One parcel can be sold at a loss of $60,000, and the omer parcel can be sold at a gain of $70,000. Jinjie has no non recaptured § 1231 losses from prior years. The parcels could be sold at any time because

> Geraniun1, Inc., has the following net § 1231 results for each of the years shown. What is the nature of the net gain in 2017 and 2018? Таx Year Net 5 1231 Loss Net 5 1231 Gain 2013 $18,000 2014 33,000 2015 42,000 2016 $41,000 2017 30,00

> Joyce, a widow, lives in an apartment with her two minor children (ages 8 and 10), whom she supports. Joyce earns $33,000 during 2018. She uses the standard deduction. a. Calculate the an1ount, if any, of Joyce's earned income credit. b. During the year,

> Tom Howard and Frank Peters are good friends (and former college roommates). Each owns investment property in the other's hometown (Tom lives in Kalan1azoo, MI; Frank lives in Austin, TX). To make their lives easier, they decide to exchange the investmen

> Jenna, a longtin1e client of yours, is an architect and the president of the Communications local Rotary chapter. To keep up to date with the latest developments in her Digging Deeper profession, she attends continuing education seminars offered by the a

> Jim and Mary Jean are married and have two dependent children under the age of 13. Both parents are employed outside the home and, during 2018, earn salaries as follows: $16,000 (Jim) and $5,200 (Mary Jean). To care for their children while they work, th

> Your client, Jasper, is an employee of a defense contractor and was assigned to work on a military base in Australia. As a condition of his employment, he \Vas required to live in housing that was provided to military personnel. The housing provided was

> Paul and Karen Kent are married, and both are employed (Paul earns $44,000 and Karen earns $9,000 during 2018). Paul and Karen have two dependent children, both under the age of 13 (Samuel and Joy). So they can work outside the home, Paul and Karen pay $

> In Decen1ber of each year, Eleanor Young contributes 10%. of her gross income to the United Way (a 50% organization). Eleanor, who is in the 24% marginal tax bracket, is considering the following alternatives for satisfying the contribution. Eleanor ha

> The Wilmoths plan to purchase a house and would like to determine the after tax cost of financing its purchase. Given their projected taxable income, the Wilmoths are in the 24% Federal incon1e tax bracket and the Solo state income tax bracket (i.e., an

> Bob and Carol have been in and out of marital counseling for the past few years. Early in 2018, they decide to separate. However, because they are barely able to get by on their current incomes, they cannot afford separate housing or the legal costs of a

> Norma, who i5 single and uses the cash method of accounting, lives in a state that imposes an income tax. In April 2018, she files her state income tax return for 2017 and pays an additional $1,000 in state income taxes. During 2018, her withholdings for

> Emma Doyle is employed as a corporate attorney. For calendar year 2018, she had AG! of $100,000 and paid the following medical expenses: Bob and April would qualify as Emma's dependents, except that they file a joint return. Emma's medical insurance po

> Adrian was awarded an academic scholarship to State University for the 20182019 academic year. He received $6,500 in August and $7,200 in December 2018. Adrian had enough personal savings to pay all expenses as they came due. Adrian's expenditures for th

> In 2018, David is age 78, is a widower, and is a dependent of his son. How does this situation affect the following' a. David's own individual filing requirement. b. The standard deduction allowed to David. c. The availability of any additional standard

> Patrick and Eva are planning to divorce in 2018. Patrick has offered to pay Eva $12,000 each year until their 11-year-old daughter reaches age 21. Alternatively, Patrick will transfer to Eva common stock that he owns with a fair market value of $100,000.

> Compute the taxable income for 2018 for Aiden on the basis of the following information. Aiden is married but has not seen or heard from his wife since 2016. Salary Interest on bonds issued by the City of Boston $80,000 3,000 Interest on CD issued b

> One income exclusion that some states allow that the Federal government does not is for lottery winnings. Does your state have an exclusion for lottery winnings' If so, how does it work? Why do you think a state might allow winnings from its own state lo

> Con1pute the taxable income for 2018 for Emily on the basis of the following information. Her filing status is single. Salary Interest income from bonds issued by Xerox $85,000 1,100 Alimony payments received (divorce occurred in 2014) 6,000 Contrib

> Five years ago, Gerald invested $150,000 in a passive activity, his sole investment venture. On January 1, 2017, his amount at risk in the activity was $30,000. His shares of the income and losses were as follows: Gerald holds no suspended at-risk or p

> Harrier, who is single, is the owner of a sole proprietorship. Two years ago, Harriet developed a process for preserving doughnuL5 that gives the doughnut a much longer shelf life. The process is not patented or copyrighted, and only Harriet knows how it

> Bridgette is known as the "doll lady." She started collecting dolls as a child, always received one or more dolls as gifts on her birthday, never sold any dolls, and eventually owned 600 dolls. She is retiring and moving to a small apartment and has deci

> In 2018, Bertha Jarow had a $28,000 loss from the sale of a personal residence. She also purchased from an individual inventor for $7,000 (and resold in two montl1s for $18,000) a patent on a rubber bonding process. The patent had not yet been reduced to

> Terri, age 16, is a dependent of her parents in 2018. During the year, Terri earned $5,000 in interest income and $3,000 from part-time jobs. a. What is Terri's taxable income? b. What is Terri's net unearned income? c. What is Terri's tax liability'

> Paige, age 17, is a dependent of her parents in 2018. During 2018, Paige Digging Deeper earned $3,900 pet sitting and $4,100 in interest on a savings account. What are Paige's taxable income and tax liability for 2018?

> Jayden calculates his 2018 income tax by using both the Tax Tables and the Tax Rate Schedules. Because the Tax Rate Schedules yield a slightly lower tax liability, he plans to pay this amount. a. Why is there a difference? b. Is Jayden's approach permiss

> Roy and Brandi are engaged and plan to get married. During 2018, Roy is a full-time student and earns $9,000 from a part-time job. With this income, student loans, savings, and nontaxable scholarships, he is self-supporting. For the year, Brandi is emplo

> Which of the following individuals are required to file a tax return for 2018' Should any of these individuals file a return even if filing is not required' Why or why not? a. Patricia, age 19, is a self-employed single individual with gross income of $5

> A nonresident alien earns money in the United States that is subject to Federal income tax. What guidance does the IRS provide about what tax form needs to be used and when it should be filed? In terms of the proper filing date, does it matter whether th

> Morgan (age 45) is single and provides more than 500/o of the support of Rosalyn (a family friend), Flo (a niece, age 18), and Jerold (a nephew, age 18). Both Rosalyn and Flo live with Morgan, but Jerold (a French citizen) lives in Canada. Morgan earns a

> Charlotte (age 40) is a surviving spouse and provides all of the support of her four minor children who live with her. She also maintains the household in which her parents live and furnished 6001o of their support. Besides interest on City of Miami bond

> Taylor, age 18, is a dependent of her parents. For 2018, she has the follow income: $4,000 of wages from a summer job, $1,800 of interest from a money market account, and $2,000 of interest from City of Boston bonds. a. What is Taylor's taxable income fo

> For tax year 2018, determine who is considered a dependent of another taxpayer in each of the following independent situations: a. Leo and Amanda (ages 48 and 46, respectively) are husband and wife and furnish more than 500%. of the support of their cwo

> Determine the amount of the standard deduction allowed for 2018 in the following independent situations. In each case, assume that the taxpayer is the dependent of another taxpayer. a. Curtis, age 18, has income as follows: $700 interest from a certifica

> During the year, Eugene had the four property transactions summarized below. Eugene is a collector of antique glassware and occasionally sells a piece to get funds to buy another. What are the amount and nature of the gain or loss from each of these tran

> Blue Corporation, a manufacturing company, decided to develop a new line of merchandise. The project began in 2018. Blue had the following expenses in connection with the project: The new product will be introduced for sale beginning in July 2020. Dete

> Maple Company owns land (adjusted basis of $90,000; fair market value of S 125,000) that it uses in its business. Maple exchanges it for another parcel of land (worth $100,000) and stock (worth $25,000). Determine Maple's: a. Realized and recognized gain

> Sarah exchanges a building and land (used in its business) for Tyler's land and building and some equipment (used in its business). The assets have the following characteristics: a. What are Sarah's recognized gain or loss and basis for the land and bu

> Ashby and Curtis are married and have a 2-year-old son, Jason. Curtis works full-tin1e as an electrical engineer, but Ashby has not worked outside the home since Jason was born. As Jason is getting older, Ashby thinks that Jason would benefit from attend

> Your client, New Shoes Ltd., is a retailer that often issues store gift (debit) cards to customers in lieu of a cash refund. You recall that the IRS issued a revenue procedure that provided d1at the prepaid income n1les in Revenue Procedure 2004-34 could

> Elaine Case (single with no dependents) has the following transactions in 2018: What is Elaine's net capital gain or loss' Draft a letter to Elaine describing how the net capital gain or loss will be treated on her tax return. Assume that Elaine's inco

> Dennis sells short 100 shares of ARC stock at $20 per share on January 15, Digging Deeper 2018. He buys 200 shares of ARC stock on April 1, 2018, at $25 per share. On May 2, 2018, Dennis closes the short sale by delivering 100 of the shares purchased on

> Maria held vacant land that qualified as an investment asset. She purchased the vacant land on April 10, 2014. She exchanged the vacant land for a rental house in a qualifying like-kind exchange on January 22, 2018. Maria was going to hold the house for

> Freys, Inc., sells a 12-year franchise to Reynaldo. The franchise contains many restrictions on how Reynaldo may operate its store. For instance, Reynaldo cannot use less than Grade 10 Idaho potatoes; must fry the potatoes at a constant 410 degrees; must

> Abby's home had a basis of $360,000 ($160,000 attributable to l11e land) and a fair market value of $340,000 ($155,000 attributable to the land) when she converted 70% of it to business use by opening a bed-and-breakfast. Four years after the conversion,

> Sam owns 1,500 shares of Eagle, Inc., stock that he purchased over 10 years ago for $80,000. Although the stock has a current market value of $52,000, Sam still views the stock as a solid long-term investment. He has sold other stock during the year with

> Carla was the owner of vacant land that she was holding for investment. She paid $2 million for the land in 2016. Raymond was an investor in vacant land. He thought Carla's land might be the site of an exit ramp from a new freeway. Raymond gave Carla $83

> Benny purchased $400,000 of Peach Corporation face value bonds for $320,000 on November 13, 2017. The bonds had been issued with $80,000 of original issue discount because Peach was in financial difficulty in 2017. On December 3, 2018, Benny sold the bon

> Eagle Partners meets all of the requirements of§ 1237 (subdivided realty). In 2018, Eagle Partners begins selling lots and sells four separate lots to four different purchasers. Eagle Partners also sells two contiguous lots to another purchaser. The sale

> George is the owner of numerous classic automobiles. His intention is to hold the automobiles until they increase in value and then sell them. He rents the automobiles for use in various events (e.g., antique automobile shows) while he is holding them. I

> Locate IRS Form 2120 (at ,vww.irs.gov), and answer the following questions. a. Who must sign the form? b. Who must file the form? c. Can it be used for someone who is not related to the taxpayer? Explain.

> Al is a physician who conducts his practice as a sole proprietor. During 2018, he received cash of $280,000 for medical services. Of the amount collected, $40,000 was for services provided in 2017. At the end of 2018, Al held accounts receivable of $60,0

> Rod Clooney purchases Agnes Mitchell's sole proprietorship for $990,000 on August 15, 2018. The assets of the business are as follows: a. Calculate Agnes's realized and recognized gain. b. Determine Rod's basis for each of the assets. c. Write a letter

> Kevin purchases 1,000 shares of Bluebird Corporation stock on October 3, 2018, for $300,000. On December 12, 2018, Kevin purchases an additional 750 shares of Bluebird stock for $210,000. According to n1arket quotations, Bluebird stock is selling for $28

> Yancy's personal residence is condemned as part of an urban renewal project. His adjusted basis for the residence is $480,000. He receives conden1nation proceeds of $460,000 and invests the proceeds in stocks and bonds. a. Calculate Yancy's realized and

> Prance, in Problem 3, reports $600,000 of pretax book net income in 2019. Prance's book depreciation exceeds tax depreciation that year by $20,000. Prance reports no other temporary or permanent book-tax differences. Assuming that the pertinent U.S. tax

> Edith's warehouse (adjusted basis of $450,000) is destroyed by a hurricane in October 2018. Edith, a calendar year taxpayer, receives insurance proceeds of $525,000 in January 2019. Calculate Edith's realized gain or loss, recognized gain or Joss, and ba

> Mitchell, a calendar year taxpayer, is the sole proprietor of a fast-food restaurant. His adjusted basis for the building and the related land is $450,000. On March 12, 2018, state authorities notify Mitchell chat his property is going to be condemned so

> For each of the following involuntary conversions, indicate whether the property acquired qualifies as replacement property, the recognized gain, and the basis for the property acquired. a. Frank owns a warehouse that is destroyed by a tornado. The space

> Howard's roadside vegetable stand (adjusted basis of $275,000) is destroyed by a tractor-trailer accident. He receives insurance proceeds of $240,000 ($300,000 fair market value - $60,000 coinsurance). Howard immediately uses the proceeds plus additional

> Randall owns an office building (adjusted basis of $250,000) that he has been Critical Thinking renting to a group of physicians. During negotiations over a new seven-year Ethics and Equity lease, the physicians offer to purchase the building for $900,00

> Kathy and Bren Ouray married in 2000. They began to experience marital difficulties in 2014 and, in the current year, although they are not legally separated, consider themselves completely estranged. They have contemplated getting a divorce. However, be

> On November 4, 2016, Blue Company acquired an asset (27.5-year residential real property) for $200,000 for use in its business. In 2016 and 2017, respectively, Blue rook $642 and $5,128 of cost recovery. These amounts were incorrect; Blue applied the wro

> Cardinal Properties, Inc., exchanges real estate used in its business along with stock for real estate to be held for investn1ent. The stock transferred has an adjusted basis of $45,000 and a fair market value of $50,000. The real estate transferred has

> Steve owns real estate (adjusted basis of $12,000 and fair market value of $15,000), which he uses in his business. Steve sells the real estate for $15,000 to Aubry (a dealer) and then purchases a new parcel of land for $15,000 from Joan (also a dealer).

> In 2018, Gray Corporation, a calendar year C corporation, holds a $75,000 charitable contribution carryover from a gift made in 2012. Gray is contemplating a gift of land to a qualified charity in either 2018 or 2019. Gray purchased the land as an invest

> Tanya Fletcher owns undeveloped land (adjusted basis of $80,000 and fair Decision Making market value of $92,000) on the East Coast. On January 4, 2018, she exchanges Communications it with Lisa Martin (an unrelated party) for undeveloped land on the Wes

> Egret Corporation, a calendar year C corporation, was formed on March 6, 2018, and opened for business on July 1, 2018. After its formation but prior to opening for business, Egret incurred the following expenditures: What is the maximum amount of thes

> In 2018, Sue exchanges a sport-utility vehicle (adjusted basis of $16,000; fair market value of $19,500) for cash of $2,000 and a pickup tn1ck (fair market value of $17,500). Both vehicles are for business use. Sue believes that her basis for the truck i

> Surendra's personal residence originally cost $340,000 (ignore land). After living in the house for five years, he converts it to rental property. Al the date of conversion, the fair market value of the house is $320,000. As to the rental property, calcu

> Tyneka inherited 1,000 shares of Aqua, Inc. stock from Joe. Joe's basis was $35,000, and the fair market value on July 1, 2018 (the date of death), was $45,000. The shares were distributed to Tyneka on July 15, 2018. Tyneka sold the stock on July 30, 201

> J\1ario, a single taxpayer with two dependent children, has the following items of income and expense during 2018: a. Determine Mario's taxable income for 2018. b. Determine Mario's NOL for 2018. Gross receipts from business $144,000 Business expe

> Locate the following Code citations, and list the subchapter, part, and subpart in which it is located. Then give a brief topical description of each. a. § 708(a). b. § 137l(a). c. § 2503(a)

> Dan bought a hotel for $2,600,000 in January 2014. In May 2018, he died and left the hotel to Ed. While Dan owned the hotel, he deducted $289,000 of cost recovery. The fair market value in May 2018 was $2,800,000. The fair market value six months later w

> Simon owns stock that has declined in value since acquired. He has decided either to give the stock to his nephew, Fred, or to sell it and give Fred the proceeds. If Fred receives the stock, he will sell it to obtain the proceeds. Simon is in the 12% tax

> Roberto has received various gift5 over the years. He has decided to dispose of several of these assets. What is the recognized gain or loss from each of the following transactions, assuming that no gift tax was paid when the gifts were made? a. In 1981

> Thomas believes that he has an NOL for the current year and plans to carry it Critical Thinking forward, offsetting it against future incon1e. In determining his NOL, Thomas offset his business income by alin1ony payn1ents he made to his ex-spouse and co

> Lori, who is single, purchased 5-year class property for $200,000 and 7-year Decision Making class property for $420,000 on May 20, 2018. Lori expects the taxable income derived from her business (without regard to the amount expensed under§ 179) to be a

> Jiu has $105,000 of losses from a real estate rental activity in which she actively participates. She has other rent income of $25,000 and other passive activity income of $32,000. Her AG! before considering these items of income and loss is $95,000. How

> On May 5, 2018, Christy purchased and placed in service a hotel. The hotel cost $10.8 million. Calculate Christy's cost recovery deductions for 2018 and for 2028.

> Debra acquired the following new asset5 during 2018: Determine Debra's cost recovery deductions for the current year. Debra does nor elect immediate expensing under § 179. She does not claim any available additional first-year depreciation.

> Bonnie and Jake (ages 35 and 36, respectively) are married with no dependents and live in Montana (not a community property state). Because Jake has large medical expenses, they seek your advice about filing separately to save taxes. Their income and exp

> Aquamarine Corporation, a calendar year C corporation, makes the following donations to qualified charitable organizations during the current year: Adjusted Basis Fair Market Value Painting held four years as an investment, to a church, which sold i

> Locate the following Tax Court case: Thomas J Green, Jr., 59 T.C. 456 (1972). Briefly describe the issue in the case, and explain what the Tax Court said about using IRS publications to support a research conclusion.