Question: One Trick Pony (OTP) incorporated and began

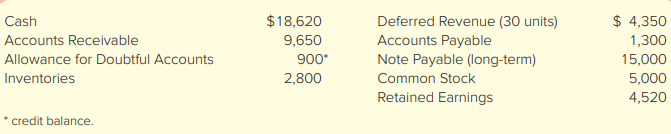

One Trick Pony (OTP) incorporated and began operations near the end of the year, resulting in the following post-closing balances at December 31:

The following information is relevant to the first month of operations in the following year:

• OTP will sell inventory at $145 per unit. OTP’s January 1 inventory balance consists of 35 units at a total cost of $2,800. OTP’s policy is to use the FIFO method, recorded using a perpetual inventory system.

• In December, OTP received a $4,350 payment for 30 units OTP is to deliver in January; this obligation was recorded in Deferred Revenue. Rent of $1,300 was unpaid and recorded in Accounts Payable at December 31.

• OTP’s note payable matures in three years, and accrues interest at a 10% annual rate. January Transactions

a. Included in OTP’s January 1 Accounts Receivable balance is a $1,500 balance due from Jeff Letrotski. Jeff is having cash flow problems and cannot pay the $1,500 balance at this time. On 01/01, OTP arranges with Jeff to convert the $1,500 balance to a six-month note, at 12% annual interest. Jeff signs the promissory note, which indicates the principal and all interest will be due and payable to OTP on July 1 of this year.

b. OTP paid a $500 insurance premium on 01/02, covering the month of January; the payment is recorded directly as an expense.

c. OTP purchased an additional 150 units of inventory from a supplier on account on 01/05 at a total cost of $9,000, with terms n/30.

d. OTP paid a courier $300 cash on 01/05 for same-day delivery of the 150 units of inventory.

e. The 30 units that OTP’s customer paid for in advance in December are delivered to the customer on 01/06. f. On 01/07, OTP received a purchase allowance of $1,350 on account, and then paid the amount necessary to settle the balance owed to the supplier for the 1/05 purchase of inventory (in c).

g. Sales of 40 units of inventory occurring during the period of 01/07–01/10 are recorded on 01/10. The sales terms are n/30.

h. Collected payments on 01/14 from sales to customers recorded on 01/10.Â

i. OTP paid the first 2 weeks’ wages to the employees on 01/16. The total paid is $2,200.

j. Wrote off a $1,000 customer’s account balance on 01/18. OTP uses the allowance method, not the direct write-off method.

k. Paid $2,600 on 01/19 for December and January rent. See the earlier bullets regarding the December portion. The January portion will expire soon, so it is charged directly to expense.

l. OTP recovered $400 cash on 01/26 from the customer whose account had previously been written off on 01/18.

m. An unrecorded $400 utility bill for January arrived on 01/27. It is due on 02/15 and will be paid then.

n. Sales of 65 units of inventory during the period of 01/10–01/28, with terms n/30, are recorded on 01/28.

o. Of the sales recorded on 01/28, 15 units are returned to OTP on 01/30. The inventory is not damaged and can be resold. OTP charges sales returns directly against Sales Revenue.

p. On 01/31, OTP records the $2,200 employee salary that is owed but will be paid February 1.

q. OTP uses the aging method to estimate and adjust for uncollectible accounts on 01/31. All of OTP’s accounts receivable fall into a single aging category, for which 8% is estimated to be uncollectible. (Update the balances of both relevant accounts prior to determining the appropriate adjustment, and round your calculation to the nearest dollar.)

r. Accrue interest for January on the note payable on 01/31.

s. Accrue interest for January on Jeff Letrotski’s note on 01/31 (see a).

Required:

1. Prepare all January journal entries and adjusting entries for items (a)–(s).

2. If you are completing this problem manually, set up T-accounts using the December 31 balances as the beginning balances, post the journal entries from requirement 1, and prepare an adjusted trial balance at January 31. If you are completing this problem in Connect using the general ledger tool, this requirement will be completed automatically using your previous answers.

3. Prepare an income statement, statement of retained earnings, and classified balance sheet at the end of January.

4. For the month ended January 31, indicate the (i) gross profit percentage (rounded to one decimal place), (ii) number of units in ending inventory, and (iii) cost per unit of ending inventory (include dollars and cents).

5. If OTP had used the percentage of sales method (using 2% of Net Sales) rather than the aging method, what amounts would OTC’s January financial statements have reported for (i) Bad Debt Expense and (ii) Accounts Receivable, net?

6. If OTP had used LIFO rather than FIFO, what amount would OTC have reported for Cost of Goods Sold on 01/10?

> Define long-lived assets. What are the two common categories of long-lived assets? Describe each.

> What are the three components of the interest formula? Explain how this formula adjusts for interest periods that are less than a full year.

> What is the primary difference between accounts receivable and notes receivable

> Describe the equation that provides the structure for the income statement. Explain the three major items reported on the income statement.

> A local phone company had a customer who rang up $300 in charges during September 2018 but did not pay. Despite reminding the customer of this balance, the company was unable to collect in October, November, or December. In March 2019, the company finall

> How does the use of calculated estimates differ between the aging of accounts receivable method and the percentage of credit sales method?

> What is the effect of the write-off of uncollectible accounts (using the allowance method) on (a) net income and (b) net accounts receivable?

> Using the allowance method, is Bad Debt Expense recognized in the period in which (a) sales related to the uncollectible account were made or (b) the seller learns that the customer is unable to pay?

> Which basic accounting principles does the allowance method of accounting for bad debts satisfy?

> In March 2015, Target Corporation decided to discontinue its Target credit card operations. What factors would this company have considered prior to making this decision?

> Refer to question 7. What amounts would be reported if the direct write-off method were used? Which method (allowance or direct write-off) more accurately reports the financial results?

> Describe how (and when) the direct write-off method accounts for uncollectible accounts. What are the disadvantages of this method?

> When customers experience economic difficulties, companies consider extending longer credit periods. What are the possible consequences of longer credit periods on Sales, Accounts Receivable, Allowance for Doubtful Accounts, Net Income, and the receivabl

> What two approaches discussed in this chapter can managers take to speed up sluggish collections of receivables? List one advantage and disadvantage for each approach.

> Describe the basic accounting equation that provides the structure for the balance sheet. Define the three major components reported on the balance sheet

> Does an increase in the receivables turnover ratio generally indicate faster or slower collection of receivables? Explain.

> As of May 1, 2016, Krispy Kreme Doughnuts had $1,170,000 of Notes Receivable due within one year, $29,039,000 of Accounts Receivable, and $346,000 in its Allowance for Doubtful Accounts (assume all related to accounts receivable). How should these accoun

> What are the advantages and disadvantages of extending credit to customers?

> Explain briefly the application of the LCM/NRV rule to ending inventory. Describe its effect on the balance sheet and income statement when inventory value is lower than cost.

> Several managers in your company are experiencing personal financial problems and have asked that your company switch from LIFO to FIFO so that they can receive bigger bonuses, which are tied to the company’s net income. How would you respond to this req

> Contrast the income statement effect of LIFO versus FIFO (on Cost of Goods Sold and Gross Profit) when (a) costs are rising and (b) costs are falling.

> Contrast the effects of LIFO versus FIFO on ending inventory when (a) costs are rising and (b) costs are falliv

> Where possible, the inventory costing method should mimic actual product flows.” Do you agree? Explain.

> Which inventory cost flow method is most similar to the flow of products involving (a) a gumball machine, (b) bricks off a stack, and (c) gasoline out of a tank?v

> The chapter discussed four inventory costing methods. List the four methods and briefly explain each.

> Briefly explain the difference between net income and net loss.

> Describe the specific types of inventory reported by merchandisers and manufacturers.

> Explain why an error in ending inventory in one period affects the following period

> Distinguish perpetual inventory systems from periodic inventory systems by describing when and how cost of goods sold is calculated when using LIFO.

> You work for a made-to-order clothing company, whose reputation is based on its fast turnaround from order to delivery. The owner of your company is considering outsourcing much of the clothing production because she thinks this will improve inventory tu

> As a sales representative for a publicly traded pharmaceutical company, you become aware of new evidence that one of your company’s main drugs has significant life-threatening side effects that were not previously reported. Your company has a significant

> What are three goals of inventory management?

> Describe in words the journal entries that are made in a perpetual inventory system when inventory is sold on credit.

> What is the difference between FOB shipping point and FOB destination? How do these terms relate to the revenue principle?

> Why is a physical count of inventory necessary in a periodic inventory system? Why is it still necessary in a perpetual inventory system?

> What is the main distinction between perpetual and periodic inventory systems? Which type of system provides better internal control over inventory? Explain why

> Explain why the income statement, statement of retained earnings, and statement of cash flows would be dated “For the Year Ended December 31, 2018,” whereas the balance sheet would be dated “At December 31, 2018.”

> Describe how transportation costs to obtain inventory (freight-in) are accounted for by a merchandising company using a perpetual inventory system. Explain the reasoning behind this accounting treatment.

> How do the accounting methods used for investments involving a significant influence and investments involving control differ?

> How do the accounting methods used for passive investments and investments involving a significant influence differ?

> When is it appropriate to use acquisition/consolidation, equity, or fair value methods for an investment in another corporation?

> What are the two sources of return for passive investments?

> Under the equity method, dividends received from the affiliated company are not recorded as revenue. Recording these dividends as revenue would involve double-counting. Explain.

> Define beginning inventory and ending inventory.

> What are consolidated financial statements and what do they attempt to accomplish?

> Use the information in C6-1 to complete the following requirements. Required: 1. Prepare journal entries for the transactions described in events (a) through (j), using the date of each transaction as its reference. Assume BSS uses perpetual inventory

> Run Heavy Corporation (RHC) is a corporation that manages a local band. RHC was formed with an investment of $10,000 cash, paid in by the leader of the band on January 3 in exchange for common stock. On January 4, RHC purchased music equipment by paying

> One Product Corp. (OPC) incorporated at the beginning of last year. The balances on its postclosing trial balance prepared on December 31, at the end of its first year of operations, wer The following information is relevant to the first month of operat

> American Laser, Inc., reported the following account balances on January 1. The company entered into the following transactions during the year. Required: 1. Analyze the effects of each transaction on total assets, liabilities, and stockholdersâ

> WorldBiz operates divisions around the world. Its European division—EuroBiz (EB)—has recently reported the following information to you at WorldBiz’s head office. You are trying to decide whether to d

> Okay Optical, Inc. (OOI), began operations in January, selling inexpensive sunglasses to large retailers like Walgreens and other smaller stores. Assume the following transactions occurred during its first six months of operations Required: 1. Complete

> Tracer Advance Corporation (TAC) sells a tracking implant that veterinarians surgically insert into pets. TAC began January with an inventory of 400 tags purchased from its supplier in November last year at a cost of $24 per tag, plus 200 tags purchased

> College Coasters is a San Diego–based merchandiser specializing in logo-adorned drink coasters. The company reported the following balances in its unadjusted trial balance at December 1. The company buys coasters from one supplier. All

> Define goods available for sale. How does it differ from cost of goods sold?

> You have been given responsibility for overseeing a bank’s small business loans division. The bank has included loan covenants requiring a minimum current ratio of 1.80 in all small business loans. When you ask which inventory costing m

> Complete C7-9 but assume Stolte Trimble Corporation (STC) uses LIFO in its perpetual inventory system. Data from C7-9: Stolte Trimble Corporation (STC) uses a perpetual inventory system. At the beginning of May, STC had 30 units of inventory, of which

> Complete C7-9 but assume Stolte Trimble Corporation (STC) uses weighted average cost in its perpetual inventory system. Data from C7-9: Stolte Trimble Corporation (STC) uses a perpetual inventory system. At the beginning of May, STC had 30 units of inv

> Stolte Trimble Corporation (STC) uses a perpetual inventory system. At the beginning of May, STC had 30 units of inventory, of which 10 units were purchased in March for $60 per unit and 20 units were purchased in April for $66 per unit. STC uses its per

> Complete C7-6Â but assume Chipolo uses LIFO in its perpetual inventory system. Data from C7-6: Chipolo sells a coin-sized tracking tag that attaches to keys, wallets, and other personal items. Chipolo began January with an inventory of 200 t

> Complete C7-6Â but assume Chipolo uses weighted average cost in its perpetual inventory system Data from C7-6: Chipolo sells a coin-sized tracking tag that attaches to keys, wallets, and other personal items. Chipolo began January with an in

> Chipolo sells a coin-sized tracking tag that attaches to keys, wallets, and other personal items. Chipolo began January with an inventory of 200 tags purchased from its supplier in November last year at a cost of $12 per tag, plus 100 tags purchased in D

> Complete C7-3Â but assume Tracer Advance Corporation (TAC) uses LIFO in its perpetual inventory system. Data from C7-3: Tracer Advance Corporation (TAC) sells a tracking implant that veterinarians surgically insert into pets. TAC began Janua

> Complete C7-3Â but assume Tracer Advance Corporation (TAC) uses weighted average cost in its perpetual inventory system. Data from C7-3: Tracer Advance Corporation (TAC) sells a tracking implant that veterinarians surgically insert into pets

> (a) On October 1, the Business Students’ Society (BSS) placed an order for 100 golf shirts at a unit cost of $20, under terms 2/10, n/30. (b) The order was received on October 10, but some golf shirts differed from what had been ordered. Uncertain whethe

> If a Chicago-based company ships goods on September 30 to a customer in Hawaii with sales terms FOB destination, does the Chicago-based company include the inventory or the sale in its September financial statements?

> Vanishing Games Corporation (VGC) operates a massively multiplayer online game, charging players a monthly subscription of $15. At the start of January 2018, VGC’s income statement accounts had zero balances and its balance sheet accoun

> Fit for Life (FFL) operates a fitness center and snack lounge. The following is a partial list of FFL transactions during its year ended December 31. FFL adjusts its records only at year-end. Required: 1. Calculate the cost of goods sold on January 8,

> Grid Iron Prep Inc. (GIPI) is a service business incorporated in January of the current year to provide personal training for athletes aspiring to play college football. The following transactions occurred during the month ended January 31. a. GIPI issue

> On January 1, Pulse Recording Studio (PRS) had the following account balances. The following transactions occurred during January. a. Received $2,500 cash on 1/1 from customers on account for recording services completed in December. b. Wrote checks o

> Nicole’s Getaway Spa (NGS) continues to grow and develop. Nicole is now evaluating a computerized accounting system and needs your help in understanding how source documents inform accounting processes. She also needs some help reconcil

> Assume it is now December 31, 2018, and Nicole has just completed her first year of operations at Nicole’s Getaway Spa. After looking through her trial balance, she noticed that there are some items that have either not been recorded or are no longer up-

> Starting in May, Nicole has decided that she has everything she needs to open her doors to customers. To keep up with competition, Nicole has added gift certificates and has started to advertise her company more to keep her business going in the long ter

> CC2-1 Accounting for the Establishment of a Business Nicole has decided that she is going to start her business, Nicole’s Getaway Spa (NGS). A lot has to be done when starting a new business. Here are some transactions that have occurred prior to April 3

> Nicole Mackisey is thinking of forming her own spa business, Nicole’s Getaway Spa (NGS). Nicole expects that she and two family members will each contribute $10,000 to the business and receive 1,000 shares each. Nicole forecasts the following amounts for

> Looking back over the last few years, it is clear that Nicole Mackisey has accomplished a lot running her business, Nicole’s Getaway Spa (NGS). Nicole is curious about her company’s performance as she compares its fina

> What is gross profit? How is the gross profit percentage computed? Illustrate its calculation and interpretation assuming Net Sales is $100,000 and Cost of Goods Sold is $60,000.

> During a recent year, Nicole’s Getaway Spa (NGS) reported net income of $2,300. The company reported the following activities: a. Increase in inventory of $400. b. Depreciation of $3,000. c. Increase of $2,170 in prepaid expenses. d. Payments of $4,600 o

> CC11-1 Accounting for Equity Financing Nicole has been financing Nicole’s Getaway Spa (NGS) using equity financing. Currently NGS has authorized 100,000 no-par preferred shares and 200,000 $2 par common shares. Outstanding shares include 50,000 preferred

> Nicole thinks that her business, Nicole’s Getaway Spa (NGS), is doing really well and she is planning a large expansion. With such a large expansion, Nicole will need to finance some of it using debt. She signed a one-year note payable with the bank for

> Nicole’s Getaway Spa (NGS) purchased a hydrotherapy tub system to add to the wellness programs at NGS. The machine was purchased at the beginning of the year at a cost of $7,000. The estimated useful life was five years and the residual value was $500. A

> The following transactions occurred over the months of September to December at Nicole’s Getaway Spa (NGS). Required: 1. Prepare journal entries for each of the transactions. Assume a perpetual inventory system. 2. Estimate the Allow

> In October, Nicole eliminated all existing inventory of cosmetic items. The trouble of ordering and tracking each product line had exceeded the profits earned. In December, a supplier asked her to sell a prepackaged spa kit. Feeling she could manage a si

> Nicole’s Getaway Spa (NGS) has been so successful that Nicole has decided to expand her spa by selling merchandise. She sells things such as nail polish, at-home spa kits, cosmetics, and aromatherapy items. Nicole uses a perpetual inven

> You are one of three stockholders who own and operate Mary’s Maid Service. The company has been operating for seven years. One of the other stockholders has prepared the company’s annual financial statements. Recently, you proposed the financial statemen

> Complete this case involving Adelphia Communications, which your instructor may access from and make available to you in the Connect eBook. By completing the requirements of this case, which ask you to explain how accounting concepts apply to Adelphia’s

> As a team, select an industry to analyze. Reuters provides lists of industries in the online stock screener at stockscreener.us.reuters.com/Stock/US. Another source is csimarket.com. Each group member should access the annual report (or Form 10-K filed w

> Why is revenue from selling a product/service bundle allocated between the product and service

> Refer to the financial statements of The Home Depot in Appendix A and Lowe’s in Appendix B at the end of this book. (Note: Fiscal 2106 for The Home Depot runs from February 1, 2016, to January 29, 2017. Fiscal 2016 for Lowe’s runs from January 30, 2016,

> Answer the following questions by referring to the financial statements of The Home Depot in Appendix A at the end of this book. (Note: Fiscal 2016 for The Home Depot runs from February 1, 2016, to January 29, 2017. As with many retail companies, The Hom

> Enter the account names and dollar amounts from the comparative balance sheets in Exhibit 13.1 into a worksheet in a spreadsheet file. Create a second copy of the worksheet in the same spreadsheet file. Required: 1. To the right of the comparative num

> Speedy Company uses the double-declining-balance method to depreciate its property, plant, and equipment and Turtle Company uses the straight-line method. The two companies are exactly alike except for the difference in depreciation methods. Required:

> Capital Investments Corporation (CIC) requested a sizable loan from First Federal Bank to acquire a large piece of land for future expansion. CIC reported current assets of $1,900,000 (including $430,000 in cash) and current liabilities of $1,075,000. Fi

> This case is available online in the Connect eBook. To complete this case, you will consider the negative effects of auditors (a) failing to identify going-concern problems that exist and (b) reporting going-concern problems that do not exist.

> As a team, select an industry to analyze. Using your web browser, each team member should access the annual report or 10-K for one publicly traded company in the industry, with each member selecting a different company. (See S1-3 in Chapter 1 for a descr

> Lumber Liquidators, Inc., competes with Lowe’s in product lines such as hardwood flooring, moldings, and noise-reducing underlay. The two companies reported the following financial results in fiscal 2016: Required: 1. Calculate the di

> Compute the following three ratios for The Home Depot’s year ended January 29, 2017: (i) fixed asset turnover, (ii) days to sell, and (iii) debt-to-assets. To calculate the ratios, use the Fiscal 2016 financial statements of The Home Depot in Appendix A

> Change the amounts for selected balance sheet accounts in the spreadsheets created for either S12-7 or S12-8 to calculate the net cash flows from operating activities if, just before the current year-end, the company’s management took the actions listed

> Explain the difference between Sales Revenue (gross) and Net Sales.

> Refer to the information presented in S12-7. Required: Complete the same requirements, except use the direct method only. You’ve recently been hired by B2B Consultants to provide financial advisory services to small business manager

> You’ve recently been hired by B2B Consultants to provide financial advisory services to small business managers. B2B’s clients often need advice on how to improve their operating cash flows and, given your accounting b