Question: Oneida Company’s operations began in August.

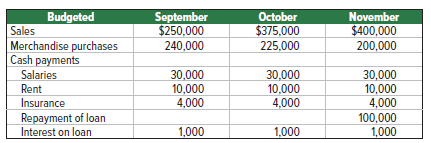

Oneida Company’s operations began in August. August sales were $215,000 and purchases were $125,000. The beginning cash balance for September is $5,000. Oneida’s owner approaches the bank for a $100,000 loan to be made on September 2 and repaid on November 30. The bank’s loan officer asks the owner to prepare monthly cash budgets. Its budgeted sales, merchandise purchases, and cash payments for other expenses for the next three months follow.

All sales are on credit where 70% of credit sales are collected in the month following the sale, and the remaining 30% collected in the second month following the sale. All merchandise is purchased on credit; 80% of the balance is paid in the month following a purchase, and the remaining 20% is paid in the second month.

Required

Prepare the following for the months of September, October, and November.

1. Schedule of cash receipts from sales.

2. Schedule of cash payments for direct materials.

3. Cash budget.

> Cheng Co. reports the following information. Determine its, (a) Time charge per hour of direct labor. (b) Materials markup percentage.

> Meng uses time and materials pricing. Its time charge per hour of direct labor is $55. Its materials markup is 30%. What price should Meng quote for a job that will take 80 direct labor hours and use $3,800 of direct materials?

> Raju is in a competitive product market. The expected selling price is $80 per unit, and Raju’s target profit is 20% of selling price. Using the target cost method, what is the highest Raju’s cost per unit can be?

> GoSnow sells snowboards. Each snowboard requires direct materials of $110, direct labor of $35, variable overhead of $45, and variable selling, general, and administrative costs of $10. The company has fixed overhead costs of $265,000 and fixed selling,

> José Ruiz starts a company that makes handcrafted birdhouses. Competitors sell a similar birdhouse for $245 each. José believes he can produce a birdhouse for a total cost of $200 per unit, and he plans a 25% markup on total cost. (a) Compute José’s plan

> Garcia Co. sells snowboards. Each snowboard requires direct materials of $100, direct labor of $30, variable overhead of $45, and variable selling, general, and administrative costs of $3. The company has fixed overhead costs of $635,000 and fixed sellin

> Rory Company has an old machine with a book value of $75,000 and a remaining five-year useful life. Rory is considering purchasing a new machine at a price of $90,000. Rory can sell its old machine now for $60,000. The old machine has variable manufactur

> A segment of a company reports the following loss for the year. All $140,000 of its variable costs are avoidable, and $75,000 of its fixed costs are avoidable. (a) Compute the income increase or decrease from eliminating this segment. (b) Should the segm

> A manufacturer is considering eliminating a segment because it shows the following $6,000 loss. All $20,000 of its variable costs are avoidable, and $36,000 of its fixed costs are avoidable. (a) Compute the income increase or decrease from eliminating th

> Use Apple’s financial statements in Appendix A to answer the following. 1. Using fiscal 2017 as the base year, compute trend percent’s for fiscal years 2017, 2018, and 2019 for total net sales, total cost of sales, operating income, other income (expense

> Surf Company can sell all of the two surfboard models it produces, but it has only 400 direct labor hours available. The Glide model requires 2 direct labor hours per unit. The Ultra model requires 4 direct labor hours per unit. Contribution margin per u

> Estela Company produces skateboards and scooters. Their per unit selling prices and variable costs follow. Skateboards require 2 machine hours per unit. Scooters require 3 machine hours per unit. For each product, compute (a) Contribution margin per unit

> Rosa Company produced 1,000 defective phones due to a production error. The phones had cost $60,000 to produce. A salvage company will buy the defective phones as scrap for $30,000. It would cost Rosa $80,000 to rework the phones. If the phones are rewor

> Garcia Company has 10,000 units of its product that were produced at a cost of $150,000. The units were damaged in a rainstorm. Garcia can sell the units as scrap for $20,000, or it can rework the units at a cost of $38,000 and then sell them for $50,000

> A company has already spent $5,000 to harvest tomatoes. The tomatoes can be sold as is for $90,000. Instead, the company could incur further processing costs of $48,000 and sell the resulting salsa for $126,000. (a) Prepare a sell as is or process furthe

> Holmes Company has already spent $50,000 to harvest peanuts. Those peanuts can be sold as is for $67,500. Alternatively, Holmes can process further into peanut butter at an additional cost of $312,500. If Holmes processes further, the peanut butter can b

> QualCo manufactures a single product in two departments: Cutting and Assembly. Information for the Cutting department for May follows. 1. Compute equivalent units of production for both direct materials and conversion. 2. Compute cost per equivalent unit

> Sierra Company manufactures soccer balls in two sequential processes: Cutting and Stitching. All direct materials enter production at the beginning of the cutting process. The following information is available regarding its May inventories. The followin

> Refer to the data in Problem 20-3A. Assume that Tamar uses the FIFO method of process costing. The units started and completed for May total 19,200. Required 1. Prepare the Forming department’s production cost report for May using FIFO. 2. Prepare the M

> Tamar Co. manufactures a single product in two departments: Forming and Assembly. Information for the Forming process for May follows. Required 1. Prepare the Forming department’s production cost report for May using the weighted avera

> Use Apple’s financial statements in Appendix A to answer the following. 1. Is Apple’s statement of cash flows prepared under the direct method or the indirect method? 2. For each fiscal year 2019, 2018, and 2017, identify the amount of cash provided by o

> Fast Co. produces its product through two processing departments: Cutting and Assembly. Information for the Cutting department follows. Required 1. Prepare the Cutting department’s production cost report for October using the weighted

> Victory Company uses weighted average process costing. The company has two production processes. Conversion cost is added evenly throughout each process. Direct materials are added at the beginning of the first process. Additional information for the fir

> Sadar Company is a store with two operating departments, Guitar and Piano. Information follows. The company reports the following indirect expenses for the year. Additional information about the two operating departments follows. Required 1. Allocate in

> Bonanza has two operating departments (Movies and Video Games) and one service department (Office). Its departmental income statements follow. Indirect expenses and service department expenses consist of rent, utilities, and office department expenses.

> Harmon’s has two operating departments, Clothing and Shoes. Indirect expenses for the period follow. The company occupies 4,000 square feet of a rented building. In prior periods, the company divided the $92,000 of indirect expenses by

> Britney Brown is the plant manager of GT Co.’s Chicago plant. The Refrigerator and Dishwasher operating departments manufacture products and have their own managers. The Office department, which Brown also manages, provides services equ

> California Orchards reports the following sales data for the year ended December 31. The company incurred the following joint costs for the year. Required 1. Use the value basis to allocate joint costs to the three grades of walnuts. 2. Compute gross pr

> Diaz Company is a retail store with two operating departments, Clothes and Shoes. Information follows. The company reports the following indirect expenses for the year. Additional information about the two departments follows. Required 1. Allocate indir

> Garcia Company has two operating departments (Phone and Earbuds) and one service department (Office). Its departmental income statements follow. Indirect expenses and service department expenses consist of rent, utilities, and office department expenses.

> National Retail has two departments, House wares and Sporting. Indirect expenses for the period follow. The company occupies 4,000 square feet of a rented building. In prior periods, the company divided the $80,000 of indirect expenses by 4,000 square fe

> Use Apple’s financial statements in Appendix A to answer the following. 1. Compute Apple’s return on total assets for the years ended September 28, 2019, and September 29, 2018. 2. Is the change in Apple’s return on total assets from part 1 favorable or

> Santana Rey’s two departments, Computer Consulting Services and Computer Workstation Furniture Manufacturing, have each been profitable for Business Solutions. Santana has heard of the cash conversion cycle and wants to use it as anothe

> Tampa Tomatoes reports the following sales data for the year ended December 31. The company incurred the following joint costs for the year. Required 1. Use the value basis to allocate joint costs to the three grades of tomatoes. 2. Compute gross profit

> Ana Perez is the plant manager of Travel Free’s Indiana plant. The Camper and Trailer operating departments manufacture products and have their own managers. The Office department, which Perez also manages, provides services equally to

> Business Solutions’s second-quarter 2022 fixed budget performance report for its computer furniture operations follows. The $156,000 budgeted expenses include $108,000 in variable expenses for desks and $18,000 in variable expenses for

> Refer to the information in Problem 23-1B. Toho Company reports actual amounts for the year below. Actual sales were 24,000 units. Required Prepare a flexible budget performance report for the year.

> Toho Company reports the following fixed budget. It is based on an expected production and sales volume of 20,000 units. Required 1. Classify all items listed in the fixed budget as variable or fixed. For variable costs, determine their amounts per unit

> Amada Company’s standard cost system reports this information from its December operations. Required 1. Prepare December 31 journal entries to record the company’s costs and variances for the month for (a) direct mate

> Refer to the information in Problem 23-4A. Required Compute these variances: (a) variable overhead spending and efficiency, (b) fixed overhead spending and volume, and (c) overhead controllable.

> Trini Company set the following standard costs per unit for its single product. Overhead is applied using direct labor hours. The standard overhead rate is based on a predicted activity level of 80% of the company’s capacity of 60,000 u

> Refer to the information in Problem 23-1A. Phoenix Company reports the following actual results. Actual sales were 18,000 units. Required Prepare a flexible budget performance report for the year.

> Use Apple’s financial statements in Appendix A to answer the following. Note: Apple’s long term debt is called “Term debt” under non-current liabilities. 1. Identify Apple’s long-term debt as reported on its balance sheet at (a) September 28, 2019, and (

> Isle Corp., a merchandising company, reports the following balance sheet at December 31. To prepare a master budget for January, February, and March, use the following information. a. The company’s single product is purchased for $30 pe

> Connick Company sells its product for $22 per unit. Its actual and budgeted sales follow. All sales are on credit where 40% is collected in the month of the sale, and the remaining 60% is collected in the month following the sale. Merchandise purchases c

> Sony Stereo began operations in March. March sales were $180,000 and purchases were $100,000. The beginning cash balance for April is $3,000. Sony’s owner approaches the bank for an $80,000 loan to be made on April 2 and repaid on June

> HOG Company makes its product for $60 per unit and sells it for $130 per unit. The sales staff receives a commission of 10% of sales. Its June income statement follows. Management expects June’s results to be repeated in July, August, a

> Dimsdale Sports, a merchandising company, reports the following balance sheet at December 31. To prepare a master budget for January, February, and March, use the following information. a. The company’s single product is purchased for $

> Aztec Company sells its product for $180 per unit. Its actual and budgeted sales follow. All sales are on credit. Collections are as follows: 30% is collected in the month of the sale, and the remaining 70% is collected in the month following the sale. M

> The management of Zigby Manufacturing prepared the following balance sheet for March 31. To prepare a master budget for April, May, and June, management gathers the following information. a. Sales for March total 20,500 units. Budgeted sales in units fol

> Santana Rey expects second quarter 2022 net income of Business Solutions’s line of computer furniture to be the same as the first quarter’s net income (reported below) without any changes in strategy. Sales were 120 de

> Merline Manufacturing makes its product for $75 per unit and sells it for $150 per unit. The sales staff receives a commission of 10% of sales. Its December income statement follows. Management expects December’s results to be repeated

> Use Apple’s financial statements in Appendix A to answer the following. 1. How many shares of Apple common stock are issued and outstanding at (a) September 28, 2019, and (b) September 29, 2018? 2. What is the total amount of cash dividends paid to commo

> Rivera Co. sold 20,000 units of its only product and reported income of $20,000 for the current year. During a planning session for next year’s activities, the production manager notes that variable costs can be reduced 25% by installin

> The following costs result from the production and sale of 12,000 LEGO sets manufactured by LEGO Company for the year ended December 31. The LEGO sets sell for $20 each. Required 1. Prepare a contribution margin income statement for the year. 2. Compute

> Sun Co.’s monthly data for the past year follow. Management wants to use these data to predict future variable and fixed costs. Required 1. Estimate both the variable costs per unit and the total monthly fixed costs using the high-low

> Patriot Co. manufactures flags in two sizes, small and large. The company has total fixed costs of $240,000 per year. Additional data follow. The company is considering buying new equipment that would increase total fixed costs by $48,000 per year and re

> Burchard Company sold 40,000 units of its only product for $25 per unit this year. Manufacturing and selling the product required $525,000 of fixed costs. Its per unit variable costs follow. For the next year, management will use a new material, which wi

> Henna Co. produces and sells two products, Carvings and Mementos. It manufactures these products in separate factories and markets them through different channels. They have no shared costs. This year, the company sold 50,000 units of each product. Incom

> Astro Co. sold 20,000 units of its only product and reported income of $25,000 for the current year. During a planning session for next year’s activities, the production manager notes that variable costs can be reduced 40% by installing

> The following costs result from the production and sale of 1,000 drum sets manufactured by Tight Drums Company for the year ended December 31. The drum sets sell for $500 each. Required 1. Prepare a contribution margin income statement for the year. 2.

> Milano Co. manufactures backpacks in two sizes, small and large. The company has total fixed costs of $520,000 per year. Additional data follow. The company is considering buying new equipment that would increase total fixed costs by $50,000 per year and

> Hip-Hop Co. manufactures and markets several products. Management is considering the future of one product, electronic keyboards, that has not been as profitable as planned. Because this product is manufactured and marketed independently of the other pro

> Take a step back in time and imagine Apple in its infancy as a company. The year is 1976, and Steve Wozniak, Steve Jobs, and Ron Wayne are the organizing partners. Required 1. Read the history of Apple from 1976 to 1980 at en.wikipedia.org/wiki/Apple I

> Connor Company sold 30,000 units of its only product for $28 per unit this year. Manufacturing and selling the product required $225,000 of fixed costs. Its per unit variable costs follow. For the next year, management will use a new material, which will

> Stam Co. produces and sells two products, BB and TT. It manufactures these products in separate factories and markets them through different channels. They have no shared costs. This year, the company sold 50,000 units of each product. Income statements

> Alden Co.’s monthly data for the past year follow. Management wants to use these data to predict future variable and fixed costs. Required 1. Estimate both the variable costs per unit and the total monthly fixed costs using the high-lo

> Manufactures baseball bats. In addition to its work in process inventories, the company maintains inventories of raw materials and finished goods. It uses raw materials as direct materials in production and as indirect materials. Its factory payroll cost

> Based on customer interest in February, Santana expands her computer workstation furniture business to include mass production of standardized desks and chairs. She uses the weighted average method of process costing for these products. Desks are made in

> Belda Co. makes organic juice in two departments: Cutting and Blending. Direct materials are added at the beginning of each process, and conversion costs are added evenly throughout each process. The company uses the FIFO method of process costing. Data

> Harson Co. manufactures a single product in two departments: Forming and Assembly. Information for the Forming department for May follows. 1. Compute equivalent units of production for both direct materials and conversion. 2. Compute cost per equivalent

> Ho Chee makes ice cream in two sequential processes: Mixing and Blending. Direct materials enter production at the beginning of each process. The following information is available regarding its March inventories. The following additional information des

> Refer to the information in Problem 20-3B. Assume that Switch uses the FIFO method of process costing. The units started and completed for January total 210,000. Required 1. Prepare the Cutting department’s production cost report for January using FIFO

> Switch Co. manufactures a single product in two departments: Cutting and Assembly. Information for the Cutting process for January follows. Required 1. Prepare the Cutting department’s production cost report for January using the weigh

> Use the table below and Apple’s financial statements in Appendix A to answer the following. 1. Compute times interest earned for each of the three years shown. 2. Is Apple in a good or bad position to pay interest obligations? Assume an

> Assumed data for Samsung and Apple follow. Required 1. Compute the degree of operating leverage for each company. 2. Based on the degree of operating leverage, which company’s income will increase more from an increase in unit sales?

> Brun Company produces its product through two processing departments: Mixing and Baking. Information for the Mixing department follows. Required 1. Prepare the Mixing department’s production cost report for November using the weighted

> Abraham Company uses weighted average process costing to account for its production costs. The company has two production processes. Conversion is added evenly throughout each process. Direct materials are added at the beginning of the first process. Add

> Dengo Co. makes a trail mix in two departments: Roasting and Blending. Direct materials are added at the beginning of each process, and conversion costs are added evenly throughout each process. The company uses the FIFO method of process costing. Octobe

> ComPro is designing a new smart phone. Each unit of this new phone will require $285 of direct materials; $10 of direct labor; $30 of variable overhead; $5 of variable selling, general, and administrative costs; $14 of fixed overhead costs; and $16 of fi

> Sung Company produces two models of its product with the same machine. The machine has a capacity of 200 hours per month. The following information is available.

> Micron Manufacturing produces telescopes. This month it produced 50 telescopes at a cost of $9,000. These telescopes were damaged in storage. Management has identified three alternatives for these telescopes. 1. They can be sold as scrap to a wholesaler

> MAX produces and sells power adapters. Its contribution margin income statement follows. A potential customer offers to buy 10,000 units for $5.80 each. These sales would not affect the company’s sales through its normal channels. Detai

> Ace produces and sells energy drinks. Its contribution margin income statement follows. A potential customer offers to buy 50,000 units for $3.00 each. These sales would not affect the company’s sales through its normal channels. Detail

> Matsu Company’s annual accounting period ends on October 31. The following information concerns the adjusting entries that need to be recorded as of that date. Entries can draw from the following partial chart of accounts: Cash; Accounts Receivable; Offi

> The accounting records of Tama Co. show the following assets and liabilities as of December 31 for Year 1 and for Year 2. Required 1. Prepare balance sheets for the business as of December 31 for Year 1 and Year 2. Hint: Report only total equity on the

> Refer to Apple’s financial statements in Appendix A to answer the following. 1. What percent of the original cost of Apple’s Property, Plant and Equipment account remains to be depreciated as of (a) September 28, 2019, and (b) September 29, 2018? Assume

> Use the information in Problem 1-3B to prepare the current year-end balance sheet for Audi Company.

> Use the information in Problem 1-3B to prepare the statement of owner’s equity for Audi Company for the current year ended December 31. Hint: The owner invested $100 cash during the year.

> As of December 31 of the current year, Audi Company’s records show the following. Required Prepare the income statement for Audi Company for the current year ended December 31.

> Archer Foods is considering whether to overhaul an old freezer or replace it with a new freezer. Information about the two alternatives follows. Management requires a 10% rate of return on its investments. Alternative 1: Keep the old freezer and have it

> Aster Company is considering an investment in technology to improve its operations. The investment costs $800,000 and yields the following net cash flows. Management requires a 10% return on its investments. Required 1. Determine the payback period for t

> Milan Co. is considering two alternative investment projects. Each requires a $300,000 initial investment. Project A is expected to generate net cash flows of $90,000 per year over the next five years. Project B is expected to generate net cash flows of

> Lopez Co. can invest in one of two alternative projects. Project Y requires a $240,000 initial investment for new machinery with a four-year life and no salvage value. Project Z requires a $240,000 initial investment for new machinery with a three-year l

> Project A requires a $240,000 investment for new machinery with a four-year life and no salvage value. The project yields the following annual results. Cash flows occur evenly within each year. Required 1. Compute Project A’s annual net

> Cortino Company is planning to add a new product to its line. To manufacture this product, the company needs to buy a new machine at a $300,000 cost with an expected four-year life and a $20,000 salvage value. Additional annual information for this new p

> King Company builds custom order fulfillment centers for large e-commerce companies. On June 1, the company had no inventories of work in process or finished goods but held the following raw materials. On June 3, the company began work on Job 450 for Enc

> Use Apple’s financial statements in Appendix A to answer the following. 1. What is the amount of Apple’s accounts receivable as of September 28, 2019? 2. Compute Apple’s accounts receivable turnover as of September 28, 2019. 3. Apple’s most liquid assets

> At the beginning of the year, Paella Company’s manager estimated total direct labor cost to be $1,500,000. The manager also estimated the following overhead costs for the year. For the year, the company incurred $725,000 of actual over

> Perez Company shows the following costs for three jobs worked on in September. Additional Information a. Raw Materials Inventory has an August 31 balance of $150,000. b. Raw materials purchases in September are $400,000, and total factory payroll cost i