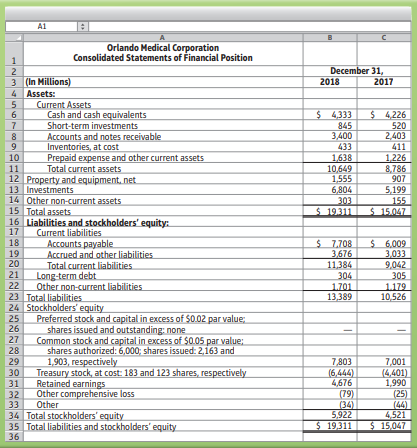

Question: Orlando Medical’s quick (acid-test) ratio

Orlando Medical’s quick (acid-test) ratio at year-end 2018 is closest to

a. 0.68.

b. $8,578 million.

c. 0.45.

d. 0.75.

> Suppose a Walmart store in Fillmore, Missouri, ended January 2018 with 900,000 units of merchandise that cost $5 each. Suppose the store then sold 50,000 units for $510,000 during February. Further, assume the store made two large purchases during Februa

> Jackson Petroleum, a giant oil company, holds reserves of oil and gas assets. At the end of 2018, assume the cost of Jackson’s oil reserves totaled $180 billion, representing 10 billion barrels of oil in the ground. 1. Which depreciation method is simila

> On January 1, 2017, Worldwide Manufacturing purchased a machine for $810,000 that it expected to have a useful life of four years. The company estimated that the residual value of the machine was $50,000. Worldwide Manufacturing used the machine for tw

> Fun Town Amusement Park paid $500,000 for a concession stand. Fun Town started out depreciating the building using the straight-line method over 25 years with a residual value of zero. After using the concession stand for four years, Fun Town determines

> Assume that on September 30, 2017, EuroAir, an international airline based in Germany, purchased a Jumbo aircraft at a cost of €45,000,000 (€ is the symbol for the euro). EuroAir expects the plane to remain useful for four years (4,000,000 miles) and to

> FlavorRite purchased a used van for use in its business on January 1, 2017. It paid $17,000 for the van. FlavorRite expects the van to have a useful life of four years, with an estimated residual value of $1,400. FlavorRite expects to drive the van 16,

> FlavorRite purchased a used van for use in its business on January 1, 2017. It paid $17,000 for the van. FlavorRite expects the van to have a useful life of four years, with an estimated residual value of $1,400. FlavorRite expects to drive the van 16,

> FlavorRite purchased a used van for use in its business on January 1, 2017. It paid $17,000 for the van. FlavorRite expects the van to have a useful life of four years, with an estimated residual value of $1,400. FlavorRite expects to drive the van 16,

> Examine the excerpt of a footnote from Albrecht Corporation’s September 30, 2018, annual report to follow. 1. What are Albrecht’s largest two categories of property and equipment as of September 30, 2018? Describe in

> Using the LIFO method, calculate the cost of ending inventory and cost of goods sold for Sandy Corporation.

> Using the FIFO method, calculate the cost of ending inventory and cost of goods sold for Sandy Corporation.

> Woody’s specializes in sound equipment. Company records indicate the following data for a line of speakers: Requirements: 1. Determine the amounts that Woody’s should report for cost of goods sold and ending inventory

> Using the average-cost method, calculate the cost of ending inventory and cost of goods sold for Sandy Corporation.

> This exercise should be used in conjunction with S6-4. Carson Print Supplies, Inc., is a corporation subject to a 25% income tax. Compute the company’s income tax expense under the average-cost, FIFO, and LIFO inventory costing methods.

> Carson Print Supplies, Inc., sells laser printers and supplies. Assume Carson started the year with 100 containers of ink (average cost of $8.90 each, FIFO cost of $9.00 each, LIFO cost of $7.80 each). During the year, the company purchased 800 container

> Beavercreek Company sold 14,000 jars of its organic honey in the most current year for $15 per jar. The company had paid $10.50 per jar of honey. (Assume that sales returns are nonexistent.) Calculate the following: 1. Sales revenue 2. Cost of goods so

> Beavercreek Company sold 14,000 jars of its organic honey in the most current year for $15 per jar. The company had paid $10.50 per jar of honey. (Assume that sales returns are nonexistent.) Calculate the following: 1. Sales revenue 2. Cost of goods so

> Here is the original schedule of cost of goods sold for Talladega Company for the years of 2016 through 2019: During the preparation of its 2019 financial statements, Talladega Company discovered that its 2017 ending inventory was understated by $400. M

> Warner Supply’s $3.5 million cost of inventory at the end of last year was understated by $1.9 million. 1. Was last year’s reported gross profit of $3.1 million overstated, understated, or correct? What was the correct amount of gross profit last year?

> Volcano Technology began the year with inventory of $275,000 and purchased $1,850,000 of goods during the year. Sales for the year are $2,600,000, and Volcano Technology’s gross profit percentage is 40% of sales. Compute Volcano Technology’s estimated co

> Fairbanks Company made sales of $24,600 million during 2018. Cost of goods sold for the year totaled $9,840 million. At the end of 2017, Fairbanks’ inventory stood at $1,000 million, and Fairbanks ended 2018 with inventory of $1,400 million. Compute Fair

> It is December 31, the end of the year, and the controller of Reed Corporation is applying the lowerof-cost-or-market (LCM) rule to inventories. Before any year-end adjustments, the company reports the following data: Reed determines that the net realiz

> Selma Company’s inventory records for the most recent year contain the following data:

> Jasmine Corporation purchased inventory costing $125,000 and sold 75% of the goods for $163,750. All purchases and sales were on account. Jasmine later collected 25% of the accounts receivable. Assume that sales returns are nonexistent. 1. Journalize th

> Using the data from E-S-15, make the adjusting entries that Glimmer Pools would need to make on December 31, 2018, related to the investment in AKL bonds. How would the bonds be reported on Glimmer Pools’ balance sheet as of December 31, 2018? What amoun

> Glimmer Pools purchased $50,000 of 7% AKL bonds on January 1, 2018, at a price of 104.2 when the market rate of interest was 6%. Glimmer intends to hold the bonds until their maturity date of January 1, 2023. The bonds pay interest semiannually on each J

> Using the data from E-S-12, make the adjusting entries that Brackett Insurance would need to make on December 31, 2018, related to the investment in AMS bonds. How would the bonds be reported on Brackett Insurance’s balance sheet as of December 31, 2018?

> Using the data from E-S-12, calculate the amount of discount amortization (using the straight-line amortization method) on July 1, 2018, and record the related journal entry. What is the total interest revenue for the first six months of 2018? (Hint: in

> Brackett Insurance purchased $60,000 of 10% AMS bonds on January 1, 2018, at a price of 85 when the market rate of interest was 12%. Brackett intends to hold the bonds until their maturity date of January 1, 2038. The bonds pay interest semiannually on e

> On January 1, 2018, Downtown Industries purchased $8,000 of 4% JMK bonds at a price of 100 (par). Downtown intends to hold the bonds until their maturity date of January 1, 2021. The bonds pay interest semiannually on each January 1 and July 1. Record th

> McGee Leasing leased a car to a customer. McGee will receive $300 a month, at the end of each month, for 36 months. Use the PV function in Excel® to calculate the answers to the following questions 1. What is the present value of the lease if the annual

> Use the data given in E-S-8. On January 1, 2019, Western Motors sold half of its investment in Yaza Motors. The sale price was $135 million. Calculate Western Motors’ gain or loss on the sale. Data from E-S-8: On January 1, 2018, Western Motors paid $4

> On January 1, 2018, Western Motors paid $450 million for a 40% investment in Yaza Motors. Yaza earned net income of $65 million and declared and paid cash dividends of $45 million during 2018. 1. What method should Western Motors use to account for the

> Use the data for Griffin Company in E6-16A to illustrate Griffin’s income tax advantage from using LIFO over FIFO. Sales revenue is $8,000, operating expenses are $2,000, and the income tax rate is 30%. How much in taxes would Griffin Company save by usi

> Use the data given in E-S-6. On May 21, 2019, Athens Company sold its investment in Technomite stock for $28 per share. 1. Journalize the sale. No explanation is required. 2. How does the gain or loss you recorded differ from the gain or loss recorded on

> For an investment to be classified as a current asset, a. the investment must be easily convertible to cash. b. the investor must intend to convert the investment to cash within one year or current operating cycle, whichever is longer, or use it to pay a

> Notes payable due in six months are reported as a. current liabilities on the balance sheet. b. current liabilities on the income statement. c. contra-assets on the income statement. d. long-term liabilities on the balance sheet.

> A company with high earnings quality is more likely to experience than a company with low earnings quality. a. low revenue levels in the future b. increasing operating expenses, compared to sales, in the future c. high earnings in the future d. low earn

> The quality of earnings concept indicates that a. stockholders want the corporation to earn enough income to be able to pay its debts. b. net income is the best measure of the results of operations. c. continuing operations and one-time transactions are

> Book value per share1 of Orlando Medical’s common stock outstanding at December 31, 2018, was a. 137.9. b. $35,147. c. $2.99. d. 20.1

> How many shares of common stock did Orlando Medical have outstanding, on average, during 2018? (Hint: Calculate earnings per share.) a. 137.9 million b. 1,880 million c. 20.1 million d. 35,147 million

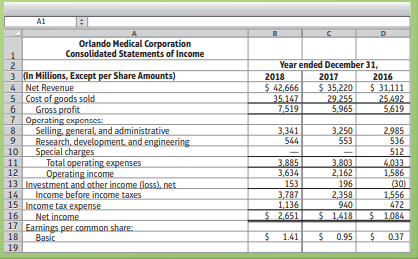

> Orlando Medical’s trend of return on sales is a. improving. b. declining. c. stuck at 22.1%. d. worrisome.

> Orlando Medical’s long-term debt carries an annual interest rate of 11%. During the year ended December 31, 2018, Orlando’s times-interest-earned ratio was a. 137.9 times. b. $35,147. c. 20.1 times. d. 108.7 times.

> Orlando Medical’s inventory turnover during fiscal year 2018 was a. $35,147. b. very slow. c. 83 times. d. 137.9 times

> Use the data for Griffin Company in E6-16A to answer the following. Requirements: 1. Compute cost of goods sold and ending inventory, using each of the following methods: a. Specific identification, with seven $165 units and four $175 units still on h

> Orlando Medical’s days’ sales in receivables during 2018 was (assuming all revenue is on credit) a. 137.9 days. b. 25 days. c. 35 days. d. 20.1 days.

> Orlando Medical’s common-size income statement for 2018 would report cost of goods sold as a. 82.4%. b. $35,147 million. c. up by 20.1%. d. 137.9%.

> Using the earliest year available as the base year, the trend percentage for Orlando Medical’s net revenue during 2018 was a. 121%. b. up by 21.1%. c. up by $11,555 million. d. 137%.

> What is the largest single item included in Orlando Medical’s debt ratio at December 31, 2018? a. Accounts payable b. Cash and cash equivalents c. Common stock d. Investments

> Orlando Medical’s current ratio at year-end 2018 is closest to a. $735. b. $8,578. c. 0.94. d. 1.2

> During 2018, Orlando Medical’s total assets a. increased by $1,863 million. b. increased by 28.3%. c. Both a and b. d. increased by 22.1%.

> Movens Company gathered the following data (in millions) for the past two years: In a vertical analysis of 2019, the gross profit percentage would be closest to a. 18%. b. 46%. c. 100%. d. 325%

> Bond Company reported the following inventory data: Use 2016 as the base year. The trend percentage in 2019 is closest to a. 83%. b. 87%. c. 92%. d. 115%

> If you want an indication of the direction a business is taking, you would use a. benchmarking. b. trend percentages. c. industry analysis. d. vertical analysis.

> Simon Granite & Stone Corporation reported the following comparative income statements for the years ended September 30, 2018, and 2017: Simon’s president and shareholders are thrilled by the company’s boost in

> public company’s annual report filed with the SEC includes a. a description of the business. b. financial statements. c. management’s explanations for trends in sales. d. All of the above are included in an annual report.

> Cramer Corporation formats operating cash flows using the indirect method in questions 46–54. Cramer uses the direct method in question Assume Cramer uses the direct method to prepare the statement of cash flows. Income tax payable wa

> Cramer Corporation formats operating cash flows using the indirect method in questions 46–54. Cramer uses the direct method in question Assume Cramer uses the direct method to prepare the statement of cash flows. Credit sales totaled

> Cramer Corporation formats operating cash flows using the indirect method in questions 46–54. Cramer uses the direct method in question Cramer’s net cash flow from financing activities for 2018 was (assume no stock di

> Cramer Corporation formats operating cash flows using the indirect method in questions 46–54. Cramer uses the direct method in question Cramer’s largest financing cash flow for 2018 resulted from (assume no stock divi

> Cramer Corporation formats operating cash flows using the indirect method in questions 46–54. Cramer uses the direct method in question How many items enter the computation of Cramer’s net cash flow from financing ac

> Cramer Corporation formats operating cash flows using the indirect method in questions 46–54. Cramer uses the direct method in question The book value of equipment sold during 2018 was $22,000. Cramer’s net cash flow

> Cramer Corporation formats operating cash flows using the indirect method in questions 46–54. Cramer uses the direct method in question How many items enter the computation of Cramer’s net cash flow from investing ac

> Cramer Corporation formats operating cash flows using the indirect method in questions 46–54. Cramer uses the direct method in question Cramer’s net cash provided by operating activities during 2018 was a. $32,000. b.

> Cramer Corporation formats operating cash flows using the indirect method in questions 46–54. Cramer uses the direct method in question How do accounts receivable affect Cramer’s cash flows from operating activities f

> Sokol Antiques, Inc., began June with inventory of $48,400. The business made net purchases of $51,300 and had net sales of $104,000 before a fire destroyed the company’s inventory. For the past several years, Sokol’s gross profit percentage has been 3

> Cramer Corporation formats operating cash flows using the indirect method in questions 46–54. Cramer uses the direct method in question How do Cramer’s accrued liabilities affect the company’s statem

> Cramer Corporation formats operating cash flows using the indirect method in questions 46–54. Cramer uses the direct method in question How many items enter the computation of Cramer’s net cash provided by operating a

> PhotoEase Camera Co. sold equipment with a cost of $19,000 and accumulated depreciation of $7,000 for an amount that resulted in a gain of $1,000. What amount should PhotoEase report on the statement of cash flows as “proceeds from sale of plant assets”?

> If the indirect method is used, which of the following items appears on a statement of cash flows? a. Collections from customers b. Payments to suppliers c. Cash receipt of interest revenue d. Depreciation expense

> The issuance of stock for cash is reported on the statement of cash flows under a. financing activities. b. operating activities. c. noncash investing and financing activities. d. investing activities.

> The issuance of common stock in exchange for cash is reported in: a. the operating activities section of the statement of cash flows. b. the investing activities section of the statement of cash flows. c. the financing activities section of the statement

> In a DuPont analysis, what are the components of return on assets? a. Net Profit Margin Ratio and Debt Ratio b. Net Profit Margin Ratio and Leverage Ratio c. Net Profit Margin Ratio and Asset Turnover Ratio d. Asset Turnover Ratio and Leverage Ratio

> Amir Company’s net income and net sales are $18,000 and $1,100,000, respectively, and average total assets are $100,000. What is Amir’s return on assets? a. 20.0% b. 18.0% c. 3.7% d. 7.0%

> A corporation has 100,000 shares of 4% preferred stock outstanding. Also, there are 100,000 shares of common stock outstanding. Par value for each is $100. If a $825,000 dividend is paid, how much goes to the preferred stockholders? a. None b. $400,000 c

> A corporation has 100,000 shares of 4% preferred stock outstanding. Also, there are 100,000 shares of common stock outstanding. Par value for each is $100. If a $825,000 dividend is paid, how much goes to the preferred stockholders? a. None b. $400,000 c

> Spicer Industries prepares budgets to help manage the company. Spicer is budgeting for the fiscal year ended January 31, 2018. During the preceding year ended January 31, 2017, sales totaled $9,700 million and cost of goods sold was $6,400 million. At

> Hodson Corp. purchased ten $1,000 8% bonds of Eagle Corporation when the market rate of interest was 6%. Interest is paid semiannually, and the bonds will mature in four years. Using the PV function in Excel®, compute the price Hodson paid (the present v

> Marvin’s Foods has outstanding 400 shares of 2% preferred stock, $100 par value; and 1,500 shares of common stock, $15 par value. Marvin’s declares dividends of $13,800. Which of the following is the correct entry?

> Quill Corporation paid $28 per share to purchase 900 shares of its common stock as treasury stock. The stock was originally issued at $12 per share. Which of the following would be the journal entry that Quill would make to record the purchase of the tre

> Sportplace’s net income for the period is $119,600 and its average common stockholders’ equity is $699,415. Sportplace’s return on common stockholders’ equity is closest to a. 17.1%. b. 17.2%. c. 18.4%. d. 17.3%.

> What is total paid-in capital for Sportplace? (Assume that treasury stock does not reduce total paid-in capital.) a. $632,300 b. $709,900 c. $643,700 d. $638,000 e. None of the above

> What is total paid-in capital for Sportplace? (Assume that treasury stock does not reduce total paid-in capital.) a. $632,300 b. $709,900 c. $643,700 d. $638,000 e. None of the above

> Spirit World, Inc., issued 250,000 shares of no-par common stock for $5 per share. The journal entry to record the issuance would be:

> The basic form of capital stock is a. par value stock. b. the corporate charter. c. a share of preferred stock. d. a share of common stock.

> Apollo Corporation issued $300,000, five-year bonds at 98 on January 1, 2016. On December 31, 2020, the bonds matured. The payment of the bonds at maturity would be reported on the statement of cash flows as a cash outflow of a. $294,000 in the financing

> The leverage ratio is equal to average total divided by average. a. long-term debt; common stockholders’ equity b. assets; common stockholders’ equity c. debt; total assets d. debt; common stockholders’ equity

> Cases Unlimited reported operating income of $780,000, interest expense of $120,000, and net income of $575,000. The weighted-average number of shares of common stock outstanding during the year was 100,000 shares. What is the times-interest-earned ratio

> The Red Wagon Shop had the following inventory data: Company managers need to know the company’s gross profit percentage and rate of inventory turnover for 2018 under 1. FIFO. 2. LIFO. Which method produces a higher gross profit perce

> Which of the following items is most likely a short-term liability? a. Deferred income taxes b. Finance lease covering 30-year term c. Bonds payable d. Accounts payable

> Corporate bonds that can be exchanged for shares of the corporation’s common stock if certain conditions are met are called a. callable bonds. b. equity bonds. c. convertible bonds. d. exchangeable bonds

> Josselle Corporation retires its bonds at 106 on January 1, after the payment of interest. The face value of the bonds is $750,000. The carrying value of the bonds at retirement is $775,600. The entry to record the retirement will include a a. debit of $

> On January 1, 2020, Fergus Corporation issued $800,000, 10%, 5-year bonds. The bond interest is payable on January 1 and July 1. The bonds sold for $864,887. The market rate of interest when the bonds were issued was 8%. Under the effective-interest meth

> Maridell’s Fashions has a debt that has been properly reported as a long-term liability up to the present year (2018). Some of this debt comes due in 2018. If Maridell’s Fashions continues to report the current position as a long-term liability, the effe

> Using the facts in the preceding question, Mcdonaugh’s entry to record the interest expense on July 1, 2019, will include a a. debit to Premium on Bonds Payable. b. credit to Discount on Bonds Payable. c. debit to Bonds Payable. d. credit to Interest Exp

> Mcdonaugh Corporation issued $250,000 of 5%, 10-year bonds payable on January 1, 2019. The market interest rate when the bonds were issued was 8%. Interest is paid semiannually on January 1 and July 1. The first interest payment is July 1, 2019. Using th

> Cheyenne Company sells $400,000 of 14%, 10-year bonds for 92.613 on April 1, 2018. The market rate of interest on that day is 15.5%. Interest is paid each year on April 1.Cheyenne Company uses the straight-line amortization method. The amount of interest

> Cheyenne Company sells $400,000 of 14%, 10-year bonds for 92.613 on April 1, 2018. The market rate of interest on that day is 15.5%. Interest is paid each year on April 1. The entry to record the sale of the bonds on April 1 would be as follows:

> The carrying value on bonds equals Bonds Payable a. minus Premium on Bonds Payable. b. plus Discount on Bonds Payable. c. plus Premium on Bonds Payable. d. minus Discount on Bonds Payable. e. both a and b f. both c and d

> Refer to the data in E6-37B. Compute all ratio values to answer the following questions: ■ Which company has the highest and which company has the lowest gross profit percentage? ■ Which company has the highest and which has the lowest rate of inventory