Question: Overtoom International Nederland BV manufactures

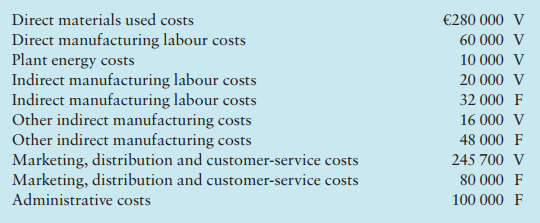

Overtoom International Nederland BV manufactures and sells metal shelving. It began operations on 1 January 2018. Costs incurred for 2018 (V stands for variable; F stands for fixed) are as follows:

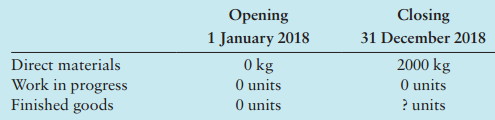

Variable manufacturing costs are variable with respect to units produced. Variable marketing, distribution, and customer-service costs are variable with respect to units sold. Stock data are as follows:

Production in 2018 was 100 000 units. Two kilograms of direct materials are used to make one unit of finished product. Revenues in 2018 were €873 600. The selling price per unit and the purchase price per kilogram of direct materials were stable throughout the year. The company’s ending stock of finished goods is carried at the average unit manufacturing costs for 2018. Finished goods stock, at 31 December 2018, was €41 940.

Required

1. Direct materials stock, total cost, 31 December 2018.

2. Finished goods stock, total units, 31 December 2018.

3. Selling price per unit 2018.

4. Operating profit 2018. Show your computations.

> Describe alternative ways to prorate end-of-period adjustments for under- or over allocated indirect costs.

> Give two reasons for under- or over allocation of indirect costs at the end of an accounting period.

> Describe the role of a manufacturing overhead allocation base in job costing.

> What are two major goals of a job-costing system?

> Compaq Computer incurs the following costs: a. Electricity costs for the plant assembling the Presario computer line of products. b. Transportation costs for shipping Presario software to a retail chain. c. Payment to David Kelley Designs for design of t

> Zimmermann GmbH is an international consulting firm. Its annual budget includes the following for each category of professional labor: Required 1. Calculate the budgeted direct-cost rate for professional labor (salary and fringe benefits) per hour for (

> A student association has hired a music group for a graduation party. The cost will be a fixed amount of €40 000. Required 1. Suppose 500 people attend the party. What will be the total cost of the music group? The unit cost per person? 2. Suppose 2000

> Olympiakos SA provides outsourcing services and advice to both government and corporate clients. For costing purposes, Olympiakos classifies its departments into two support departments The Administrative/Human Resource support percentages are based on h

> Meer has been offered a special-purpose metal-cutting machine for €110 000. The machine is expected to have a useful life of eight years with a terminal disposal value of €30 000. Savings in cash-operating costs are expected to be €25 000 per year. Howev

> Catherine MacDougall, a third-year undergraduate student at a university near Edinburgh, received an invitation to visit a prospective employer in Nice. A few days later, she received an invitation from a prospective employer in Copenhagen. She decided t

> Rolf, Ilse and Ulrich are members of the Frankfurt Fire Brigade. They share an apartment that has a lounge with the latest wide-screen TV. Ulrich owns the apartment, its furniture and the wide-screen TV. He can subscribe to a cable television company tha

> The Fredensborg power plant that services all manufacturing departments of Fabri-Danmark AS has a budget for the coming year. This budget has been expressed in the following terms on a monthly basis: The expected monthly costs for operating the departmen

> Brian McGarrigle went to Les Arcs for his annual winter vacation. Unfortunately, he suffered a broken ankle while skiing and had to spend two days at the Hôpital de Grasse. McGarrigle’s insurance company received a â

> Jyvaskyla Oyo is a retail chain of supermarkets. For many years, it has used gross margin (selling price minus cost of goods sold) to guide it in deciding on which products to emphasize or de-emphasize. And, for many years, it has not allocated any costs

> A computer-service centre of Madrid University serves two major users, the department of Engineering and the department of Humanities and Sciences (H&S). Required 1. When the computer equipment was initially installed, the procedure for cost allocation

> Koala Ltd has only two divisions: A and B. The following data apply to Division A. Required 1. Prepare a segment report for Division A that differentiates between the performance of the manager and the performance of the division. 2. Division Bâ&#

> Euro-Medi Plc manufactures a wide range of medical instruments. Two testing instruments (101 and 201) are produced at its highly automated Limerick plant. Data for December 2018 are as follows: Manufacturing overhead is allocated to each instrument produ

> Germinal etAssociés provides tax advice to multinational firms. Germinal charges clients for (a) direct professional time (at an hourly rate) and (b) support services (at 30% of the direct professional costs billed). The three professionals

> Refer to the information in Exercise 4.17. Suppose Telemark-Kjemi determines standard costs of NKr 1050 per (equivalent) tone of transferred-in costs, NOK 390 per (equivalent) tone of direct materials and NOK 640 per (equivalent) tone of conversion costs

> Carmelo, SA, is planning to buy equipment costing €120 000 to improve its materials handling system. The equipment is expected to save €40 000 in cash-operating costs per year. Its estimated useful life is six years, and it will have zero terminal dispos

> Refer to the information in Exercise 4.17. Suppose that Telemark-Kjemi uses the FIFO method instead of the weighted-average method in all its departments. The only changes under the FIFO method are that the total transferred-in cost of opening work in pr

> Telemark-Kjemi AS manufactures an industrial solvent in two departments – mixing and cooking. This question focuses on the Cooking Department. During June 2018, 90 tones of solvent were completed and transferred out from the Cooking Dep

> Duddon Ltd makes a product that has to pass through two manufacturing processes, I and II. All the material is input at the start of process I. No losses occur in process I but there is a normal loss in process II equal to 7% of the input into that proce

> Consider the following data for the satellite Assembly Division of Aéro-France: Required 1. Calculate equivalent units of work done in the current period for direct materials and conversion costs. Show physical units in the first column. 2.

> 1. Using the FIFO process-costing method, do the requirements of Exercise 4.24. The transferred in costs from the Forming Department for the April opening work in progress are €17 520. During April, the costs transferred in are €103 566. All other data a

> Sligo Toys Ltd manufactures wooden toy figures at its Ballinode plant. It has two departments – the Forming Department and the Finishing Department. (Exercises 4.22 and 4.23 focused on the Forming Department.) Consider now the Finishing

> Do Exercise 4.22 (1) using FIFO and four decimal places for unit costs. Explain any difference between the cost of work completed and transferred out and cost of closing work in progress in the Forming Department under the weighted-average method and the

> Sligo Toys Ltd manufactures one type of wooden toy figure. It buys wood as its direct material for the Forming Department of its Ballinode plant. The toys are transferred to the Finishing Department, where they are hand-shaped and metal is added to them.

> Do Exercise 4.20 using the FIFO method of process costing. Explain any difference between the cost of work completed and transferred out and cost of closing work in progress in the Assembly Department under the weighted-average method and the FIFO method

> Euro-Défense is a manufacturer of military equipment. Its Tourcoing plant manufactures the Déca-Pite missile under contract to the French government and friendly countries. All Déca-Pites go through an identical man

> Euro-Jouets SNC sells neon-coated ‘Feu-Follet’ cars to several local toy stores. It has the capacity to make 250 000 of these units per year, but during the year ending 31 December 2018, it made and sold 130 000 cars t

> Europe Electronics SNC manufactures microchips in large quantities. Each microchip undergoes assembly and testing. The total assembly costs during January 2018 were: Required 1. Assume there was no opening stock on 1 January 2018. During January, 10 000

> For each journal entry in your answer to Exercise 3.18, (a) indicate the source document that would most probably authorize the entry and (b) give a description of the entry into the subsidiary ledgers, if any entry needs to be made there.

> The Editions Sorbonne is wholly owned by the university. It performs the bulk of its work for other university departments, which pay as though the Editions Sorbonne were an outside business enterprise. The Editions Sorbonne also publishes and maintains

> Eldorado SA is a management consulting firm. Its job-costing system has a single direct-cost category (consulting labor) and a single indirect-cost pool (consulting support). Consulting support is allocated to individual jobs using actual consulting labo

> Tricheur et Associés is a recently formed law partnership. Jean Racine, the managing partner of Tricheur et Associés, has just finished a tense telephone call with Blaise Rascal, president of Morges-Guyère, Sarl. Ras

> Ti-Enne Srl uses a normal costing system with a single manufacturing overhead cost pool and machine-hours as the allocation base. The following data are for 2019: Machine-hours data and the closing balances (before proration of under allocated or over al

> Consider the following selected cost data for Schwarz metal GmbH for 2019. Schwarz metal’s job-costing system has a single manufacturing overhead cost pool (allocated using a budgeted rate based on actual machine-hours). Any amount of u

> Budenmayer BV is a small machine shop that uses highly skilled labor and a job-costing system (using normal costing). The total debits and credits in certain accounts just before year-end are as follows: All materials purchased are for direct materials.

> Giannacopoulos SA uses a job-costing system at its Korinthos plant. The plant has a Machining Department and an Assembly Department. Its job-costing system has two direct cost categories (direct materials and direct manufacturing labor) and two manufactu

> An auditor for the Inland Revenue is trying to reconstruct some partially destroyed records of two taxpayers. For each of the cases in the accompanying list, find the unknowns designated by letters A to D (figures are assumed to be in £000).

> ST operates in a highly competitive market and is considering introducing a new product to expand its current range. The new product will require the purchase of a specialized machine costing £825 000. The machine has a useful life of four y

> Pagnol-Carrelages SNC is a small distributor of marble tiles. Pagnol-Carrelages identifies its three major activities and cost pools as ordering, receiving and storage, and shipping, and reports the following details for 2018: Pagnol-Carrelages buys 250

> Required Prepare an income statement and a supporting schedule of cost of goods manufactured for the year ended 31 December 2018. (For additional questions regarding these facts, see the next problem.)

> Calculate cost of goods manufactured and cost of goods sold from the following account balances relating to 2018 (in € millions):

> A Toyota analyst is preparing a presentation on cost drivers. Unfortunately, both the list of its business function areas and the accompanying list of representative cost drivers are accidentally randomized. The two lists now on the computer screen are a

> Crescendo Srl operates a large store in Milan. The store has both a film (video/DVDs) section and a musical (compact discs and tapes) section. Crescendo reports revenues for the film section separately from the musical section. Required Classify each of

> Presta-Serviços SA is a marketing research firm that organises focus groups for consumer product companies. Each focus group has eight individuals who are paid €9000 per session to provide comments on new products. These foc

> Weltferien AG markets vacation packages to Tenerife from Dresden. The package includes a round-trip flight on Saxon-Air. Weltferien pays Saxon-Air €60 000 for each round-trip flight. The maximum load on a flight is 300 passengers. Required 1. What is th

> Aran Sweaters Ltd designs and markets wool jumpers to many retailers and distributors around Europe. Its corporate headquarters are situated in Dublin, Ireland. Manufacturing is done by a subcontractor (O’Neil’s Clothing Ltd) on Achill Island. The local

> A distraught employee, Guy Pirault-Manne, put a torch to a manufacturing plant on a blustery day, 26 February 2018. The resulting blaze completely destroyed the plant and its contents. Fortunately, certain accounting records were kept in another building

> Management accountants at WebNews.co.uk can play three key roles in each of the five decisions described in Exercise 1.23: problem solving, scorekeeping and attention directing. Required 1 Distinguish between the problem-solving, scorekeeping and attent

> Hraxin Co is appraising an investment project which has an expected life of four years and which will not be repeated. The initial investment, payable at the start of the first year of operation, is £5 million. Scrap value of £5

> WebNews.co.uk is an Internet company. It offers subscribers multiple online services ranging from an annotated TV guide to local-area information on restaurants and cinemas. It has two main revenue sources: The following decisions were made in the June t

> Kari-Anna Nedregotten is the new corporate controller of a multinational company that has just overhauled its organizational structure. The company is now decentralized. Each division is under an operating vice-president who, within wide limits, has resp

> In April 2018, Beranger Saunier, editor of The Sporting News (SN), decides to reduce the price per newspaper from €0.70 in April 2018 to €0.50 starting 1 May 2018. Actual paid circulation in April is 7.5 million (250 000 per day * 30 days). Saunier estim

> A survey on ways organizations are changing their management accounting systems reported the following: a. Company A now reports a value-chain income statement for each of the brands it sells. b. Company B now presents in a single report all costs relate

> For each of the following activities, identify the major function the accountant is performing – scorekeeping, attention directing or problem solving. a. Interpreting differences between actual results and budgeted amounts on a shipping manager’s perform

> For each of the following activities, identify the major function (scorekeeping, attention directing or problem solving) the accountant is performing. a. Preparing a monthly statement of Spanish sales for the BMW marketing vice-president. b. Interpreting

> Six uses of feedback are described in the chapter: a. Changing goals. b. Searching for alternative means of operating. c. Changing methods for making decisions. d. Making predictions. e. Changing the operating process. f. Changing the reward system. Req

> Boots, which operates a chain of pharmacies in the UK, incurs the following costs: a. Cost of redesigning blister packs to make drug containers more tamperproof. b. Cost of videos sent to doctors to promote sales of a new drug. c. Cost of website’s ‘freq

> Matching terms with definitions: Terms a. Split-off point b. Joint cost c. Separable cost d. By-product e. Joint product f. Product Definitions 1. Product with low sales value compared with the sales value of the main or joint product(s). 2. Any output t

> Nor-Pharma AS manufactures three joint products from a joint process: Altox, Lorex and Hycol. Data regarding these products for the fiscal year ended 31 May 2018 are as follows: The joint production cost up to the split-off point where Altox, Lorex and H

> Dinamica Lda is planning to replace one of its production lines, which has a remaining useful life of 10 years, book value of €9 million, a current disposal value of €5 million, and a neglegible terminal disposal value 10 years from now. The average inve

> Protomastoras SA produces three products: Alpha, Beta and Gamma. Alpha and Gamma are joint products and Beta is a by-product of Alpha. No joint costs are to be allocated to the by product. The production processes for a given year are as follows: a. In D

> Schmidsendl GmbH buys crude vegetable oil. Refining this oil results in four products at the split-off point: A, B, C and D. Product C is fully processed at the split-off point. Products A, Band D can be individually further refined into Super A, Super B

> Jerónimos Ltda produces two products, turpentine and methanol (wood alcohol), by a joint process. Joint costs amount to €120 000 per batch of output. Each batch totals 40 000 litres: 25% methanol and 75% turpentine. Both products are processed further wi

> A company simultaneously produces three products (X, Y and Z) from a single process. X and Y are processed further before they can be sold; Z is a by-product that is sold immediately for $6 per unit without incurring any further costs. The sales prices o

> Joint product/by-product distinctions, ethics (continuation of Exercise 6.16) (20–30 minutes) Flori-Dante classifies animal feed as a by-product. The by-product is inventoried at its selling price when produced; the net realizable value of the product is

> Flori-Dante Srl grows, processes, packages and sells three joint apple products: (a) sliced apples that are used in frozen pies, (b) apple sauce, and (c) apple juice. The apple peel, processed as animal feed, is treated as a by-product. Flori-Dante uses

> Pohjanmaan Oy processes an ore in Department 1, out of which come three products, L, W and X. Product L is processed further through Department 2. Product W is sold without further processing. Product X is considered a by-product and is processed further

> Miljø-Såpe AS produces two joint products, cooking oil and soap oil, from a single vegetable oil refining process. In July 2018, the joint costs of this process were NOK 24 000000. Separable processing costs beyond the split-off point were cooking oil, N

> Archibald Ltd manufactures and sells one product. Its budgeted profit statement for the first month of trading is as follows: The budget was prepared using absorption costing principles. If budgeted production in the first month had been 2000 units then

> Pinafore Ltd manufactures and sells a single product. The budgeted profit statement for this month, which has been prepared using marginal costing principles, is as follows: The normal monthly level of production is 25 000 units and stocks are valued at

> Bayern-Bauwerk is thinking of buying, at a cost of €220 000, some new packaging equipment that is expected to save €50 000 in cash-operating costs per year. Its estimated useful life is 10 years, and it will have zero terminal disposal value. The requir

> Soleil Voyages SA is a travel agency specializing in flights between Paris and London. It books passengers on Air Chanson. Air Chanson charges passengers €1000 per round-trip ticket. Soleil Voyages receives a commission of 8% of the ticket price paid by

> Haselbach GmbH sells its razors at €3 per unit. The company uses a first-in, first-out actual costing system. A new fixed manufacturing overhead allocation rate is calculated each year by dividing the actual fixed manufacturing overhead

> Ennerdale Ltd has been asked to quote a price for a one-off contract. The company’s management accountant has asked for your advice on the relevant costs for the contract. The following information is available: Materials The contract r

> Vier-und-Zwanzig GmbH operates a chain of food stores open 24 hours a day. Each store has a standard 4000 square meter of floor space available for merchandise. Merchandise is grouped in two categories: grocery products and dairy products. Vier-und-Zwanz

> Fiordi-Ligi Srl assembles and sells two products: printers and desktop computers. Customers can purchase either (a) a computer, or (b) a computer plus a printer. The printers are not sold without the computer. The result is that the quantity of printers

> Jääskinen Oy has just today paid for and installed a special machine for polishing cars at one of its several outlets. It is the first day of the company’s fiscal year. The machine cost €20 000. Its annual operating costs total €15 000, exclusive of depr

> Jours-Daim SA operates a printing press with a monthly capacity of 2000 machine-hours. Jours-Daim has two main customers, Harpes-Ã Gonds, SNC and Fourbe-Riz SA. Data on each customer for January follow: Each of the following requirements ref

> Monteagudo-Playa SA is a take-away food store at a popular beach resort. Consuelo Herreros, owner of Monteagudo-Playa, is deciding how much refrigerator space to devote to four different drinks. Pertinent data on these four drinks are as follows: Consuel

> Pauline Raphaël, executive assistant to the principal of Ecole Supérieure des Mines de St Etienne,is concerned about the overhead costs at her university. Cost pressures are severe, so controlling and reducing overheads is very

> Assume the same information for Genève Défense Systèmes as in Exercise 9.17 except that Genève Défense Systèmes uses a 90% incremental unit-time learning curve as a basis for forecasting direct manufacturing labour-hours. (A 90% learning curve implies q

> Les Saturniens SA makes digital watches. Les Saturniens is preparing a product life-cycle budget for a new watch, MX3. Development on the new watch with features such as a calculator and a daily diary is to start shortly. Les Saturniens expects the watch

> Genève Défense Systèmes manufactures radar systems. It has just completed the manufacture of its first newly designed system, RS-32. It took 3000 direct manufacturing labor-hours (DMLH) to produce this one unit. Genève Défense Systèmes believes that a 90

> Hans Mehrlich owns a catering company that prepares banquets and parties for both individual and business functions throughout the year. Mehrlich’s business is seasonal, with a heavy schedule during the summer months and the year-end ho

> Pierre Corneille, managing director of Marre-Quise Consultants SA, is examining how overhead costs behave with variations in monthly professional labour-hours billed to clients. Assume the following historical data: Required 1. Calculate the linear cost

> Lorenzo-Netto, Srl, operates a brushless car wash. Incoming cars are put on an automatic, continuously moving conveyor belt. Cars are washed as the conveyor belt carries the car from the start station to the finish station. After the car moves off the co

> Given below are a number of charts, each indicating some relationship between cost and a cost driver. No attempt has been made to draw these charts to any particular scale; the absolute numbers on each axis may be closely or widely spaced. Required Indi

> Bellingwolde BV operates car rental agencies at over 20 airports. Customers can choose from one of three contracts for car rentals of one day or less: Contract 1: €50 for the day. Contract 2: €30 for the day plus €0.20 per km travelled. Contract 3:

> SVC is a car manufacturer. SVC is planning the development of a prototype hydrogen-powered car, the Model Q. The prototype Model Q car will have a limited production run of 250 cars. Toensure that the Model Q is ready by SVC’s stated de

> Espasso SA has just finished production of Tornado, the latest action film directed by Domingos Vieira and starring Arnaldo Moura and Victoria Rebello. The total production cost to Espasso was €5 million. All the production personnel and actors on Tornad

> Koninklijke BolsWessanen NV has fixed costs of €300 000 and a variable-cost percentage of 80%. The company earns net profit of €84 000 in 2018. The income tax rate is 40%. Required Calculate: (1) operating profit (2) contribution margin (3) total revenu

> Knitwear Ltd is considering three countries for the sole manufacturing site of its new sweater: Cyprus, Turkey and Ireland. All sweaters are to be sold to retail outlets in Ireland at €32 per unit. These retail outlets add their own mark

> Ella Ltd recently started to manufacture and sell product DG. The variable cost of product DG is £4 per unit and the total weekly fixed costs are £18 000. The company has set the initial selling price of product DG by adding a

> Maria Kabaliki is planning to sell a vegetable slicer-dicer for €15 per unit at a country fair. She purchases units from a local distributor for €6 each. She can return any unsold units for a full refund. Fixed costs for booth rental, set-up and cleaning

> Grünberg Lehrmittelverlag GmbH manufactures and sells pens. Present sales output is 5 million annually at a selling price of €0.50 per unit. Fixed costs are €900 000 per year. Variable costs are €0.30 per unit. Required (Consider each case separately.)

> Air Chanson changes its commission structure to travel agents. Up to a ticket price of €600, the 8% commission applies. For tickets costing €600 or more, there is a fixed commission of €48. Assume Soleil Voyages has fixed costs of €22 000 per month and v