Question: Pension data for Sterling Properties include the

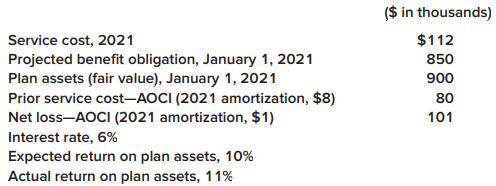

Pension data for Sterling Properties include the following:

Required:

Determine pension expense for 2021.

> SSG Cycles manufactures and distributes motorcycle parts and supplies. Employees are offered a variety of share-based compensation plans. Under its nonqualified stock option plan, SSG granted options to key officers on January 1, 2021. The options permit

> Walters Audio Visual Inc. offers an incentive stock option plan to its regional managers. On January 1, 2021, options were granted for 40 million $1 par common shares. The exercise price is the market price on the grant date—$8 per share. Options cannot

> Dowell Fishing Supply, Inc., sold $50,000 of Dowell Rods on December 15, 2021, to Bassadrome. Because of a shipping backlog, Dowell held the inventory in Dowell’s warehouse until January 12, 2022 (having assured Bassadrome that it would deliver sooner if

> On January 1, 2021, Adams-Meneke Corporation granted 25 million incentive stock options to division managers, each permitting holders to purchase one share of the company’s $1 par common shares within the next six years, but not before December 31, 2023

> Heidi Software Corporation provides a variety of share-based compensation plans to its employees. Under its executive stock option plan, the company granted options on January 1, 2021, that permit executives to acquire 4 million of the company’s $1 par c

> On January 1, 2021, David Mest Communications granted restricted stock units (RSUs) representing 30 million of its $1 par common shares to executives, subject to forfeiture if employment is terminated within three years. After the recipients of the RSUs

> Magnetic-Optical Corporation offers a variety of share-based compensation plans to employees. Under its restricted stock unit plan, the company on January 1, 2021, granted restricted stock units (RSUs) representing 4 million of its $1 par common shares t

> As part of its stock-based compensation package, on January 1, 2021, International Electronics granted restricted stock units (RSUs) representing 50 million $1 par common shares. At exercise, holders of the RSUs are entitled to receive cash or stock equa

> As part of its stock-based compensation package, International Electronics granted 24 million stock appreciation rights (SARs) to top officers on January 1, 2021. At exercise, holders of the SARs are entitled to receive cash or stock equal in value to th

> Facebook Inc. included the following disclosure note in an annual report: Share-Based Compensation (in part) Compensation expense related to these grants is based on the grant date fair value of the RSUs and is recognized on a straight-line basis over th

> As part of its stock-based compensation package, International Electronics (IE) granted 24 million stock appreciation rights (SARs) to top officers on January 1, 2021. At exercise, holders of the SARs are entitled to receive stock equal in value to the e

> Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Determine the specific seven-, eight-, or nine-digit Codification citation (XXX-XX-XX-X) for accounting for each of the following items: 1. Initial measurement of stock

> During 2021, its first year of operations, McCollum Tool Works entered into the following transactions relating to shareholders’ equity. The corporation was authorized to issue 100 million common shares, $1 par per share. Jan. 2 Issued 35 million common

> TopChop sells hairstyling franchises. TopChop receives $50,000 from a new franchisee for providing initial training, equipment, and furnishings that have a stand-alone selling price of $50,000. TopChop also receives $30,000 per year for use of the TopCho

> PHN Foods granted 18 million of its no-par common shares to executives, subject to forfeiture if employment is terminated within three years. The common shares have a market price of $5 per share on January 1, 2020, the grant date. Required: 1. What jour

> As part of its executive compensation plan, Vertovec Inc. granted 54,000 of its no-par common shares to executives, subject to forfeiture if employment is terminated within three years. Vertovec’s common shares have a market price of $5 per share on Janu

> Information from the financial statements of Ames Fabricators, Inc., included the following: Ames’s net income for the year ended December 31, 2021, is $500,000. The income tax rate is 25%. Ames paid dividends of $5 per share on its pre

> Stanley Department Stores reported net income of $720,000 for the year ended December 31, 2021. Additional Information: Common shares outstanding at Jan. 1, 2021 80,000 Incentive stock options (vested in 2020) outstanding throughout 2021 24,000 (Each opt

> On January 1, 2021, Tru Fashions Corporation awarded restricted stock units (RSUs) representing 12 million of its $1 par common shares to key personnel, subject to forfeiture if employment is terminated within three years. After the recipients of the RSU

> On December 31, 2020, Berclair Inc. had 200 million shares of common stock and 3 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. On March 1, 2021, Berclair purchased 24 million shares of its common stock as treasur

> On December 31, 2020, Berclair Inc. had 200 million shares of common stock and 3 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. On March 1, 2021, Berclair purchased 24 million shares of its common stock as treasur

> On December 31, 2020, Berclair Inc. had 200 million shares of common stock and 3 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. On March 1, 2021, Berclair purchased 24 million shares of its common stock as treasur

> At December 31, 2020, Albrecht Corporation had outstanding 373,000 shares of common stock and 8,000 shares of 9.5%, $100 par value cumulative, nonconvertible preferred stock. On May 31, 2021, Albrecht sold for cash 12,000 shares of its common stock. No c

> At December 31, 2020, Albrecht Corporation had outstanding 373,000 shares of common stock and 8,000 shares of 9.5%, $100 par value cumulative, nonconvertible preferred stock. On May 31, 2021, Albrecht sold for cash 12,000 shares of its common stock. No c

> Assume the same facts as in BE 6–25. How much revenue will Saar recognize in 2021 under this arrangement if Saar reports under IFRS? Data from BE 6-25: Assume the same facts as in BE 6–24 except that the trade name “Saar Associates” is not well known in

> Hardaway Fixtures’ balance sheet at December 31, 2020, included the following: Shares issued and outstanding: Common stock, $1 par $800,000 Nonconvertible preferred stock, $50 par 20,000 On July 21, 2021, Hardaway issued a 25% stock dividend on its commo

> The Alford Group had 202,000 shares of common stock outstanding at January 1, 2021. The following activities affected common shares during the year. There are no potential common shares outstanding. 2021: Feb. 28 Purchased 6,000 shares of treasury stock.

> For the year ended December 31, 2021, Norstar Industries reported net income of $655,000. At January 1, 2021, the company had 900,000 common shares outstanding. The following changes in the number of shares occurred during 2021: Apr. 30 Sold 60,000 share

> Tesla Motors’s disclosure notes for the year ending December 31, 2017, included the following regarding its $0.001 par common stock: EMPLOYEE STOCK PURCHASE PLAN—Our employees are eligible to purchase our common stock through payroll deductions of up to

> Allied Paper Products, Inc., offers a restricted stock award plan to its vice presidents. On January 1, 2021, the company granted 16 million of its $1 par common shares, subject to forfeiture if employment is terminated within two years. The common share

> When companies offer new equity security issues, they publicize the offerings in the financial press and on Internet sites. Assume the following were among the equity offerings reported in December 2021: New Securities Issues Equity American Materials Tr

> Ozark Distributing Company is primarily engaged in the wholesale distribution of consumer products in the Ozark Mountain regions. The following disclosure note appeared in the company’s 2021 annual report: Note 5. Convertible Preferred Stock (in part): T

> On January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances: During January 2021, the following transactions occur: January 2: Issue an additional 2,000 shares of $1 par value common stock for $40,000. January 9: P

> Comparative balance sheets for Softech Canvas Goods for 2021 and 2020 are shown below. Softech pays no dividends and instead reinvests all earnings for future growth. Required: 1. Determine the return on shareholders’ equity for 2021. 2

> The balance sheet of Consolidated Paper, Inc., included the following shareholders’ equity accounts at December 31, 2020: During 2021, several events and transactions affected the retained earnings of Consolidated Paper. Required: 1. Pr

> Assume the same facts as in BE 6–24 except that the trade name “Saar Associates” is not well known in the marketplace and the owner provides no advertising or other benefits to a licensee of the Saar Associates trade name during the license period. How m

> Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Determine the specific eight-digit Codification citation (XXX-XX-XX-X) for accounting for each of the following items: 1. Requirements to disclose within the financial

> Douglas McDonald Company’s balance sheet included the following shareholders’ equity accounts at December 31, 2020: On March 16, 2021, a 4% common stock dividend was declared and distributed. The market value of the co

> The shareholders’ equity of Core Technologies Company on June 30, 2020, included the following: Common stock, $1 par; authorized, 8 million shares; issued and outstanding, 3 million shares $ 3,000,000 Paid-in capital—excess of par 12,000,000 Retained ear

> The shareholders’ equity of ILP Industries includes the items shown below. The board of directors of ILP declared cash dividends of $8 million, $20 million, and $150 million in its first three years of operation—2021,

> Shown below in T-account format are the changes affecting the retained earnings of Brenner-Jude Corporation during 2021. At January 1, 2021, the corporation had outstanding 105 million common shares, $1 par per share. Required: 1. From the information pr

> In keeping with a modernization of corporate statutes in its home state, UMC Corporation decided in 2021 to discontinue accounting for reacquired shares as treasury stock. Instead, shares repurchased will be viewed as having been retired, reassuming the

> At December 31, 2020, the balance sheet of Meca International included the following shareholders’ equity accounts: Required: Assuming that Meca International views its share buybacks as treasury stock, record the appropriate journal en

> In 2021, Western Transport Company entered into the treasury stock transactions described below. In 2019, Western Transport had issued 140 million shares of its $1 par common stock at $17 per share. Required: Prepare the appropriate journal entry for eac

> In 2021, Borland Semiconductors entered into the transactions described below. In 2018, Borland had issued 170 million shares of its $1 par common stock at $34 per share. Required: Assuming that Borland retires shares it reacquires, record the appropriat

> Borner Communications’ articles of incorporation authorized the issuance of 130 million common shares. The transactions described below effected changes in Borner’s outstanding shares. Prior to the transactions, Borner

> Saar Associates sells two licenses to Kim & Company on September 1, 2021. First, in exchange for $100,000, Saar provides Kim with a copy of its proprietary investment management software, which Saar does not anticipate updating and which Kim can use perm

> The following is from the 2021 annual report of Kaufman Chemicals, Inc.: Kaufman reports accumulated other comprehensive income in its balance sheet as a component of shareholders’ equity as follows: Required: 1. What is comprehensive i

> How might your answer differ if we assume Sterling Properties prepares its financial statements according to International Financial Reporting Standards (IFRS)? The interest rate on high-grade corporate bonds is 6%. Data from E 17-8: Pension data for St

> Frazier Refrigeration amended its defined benefit pension plan on December 31, 2021, to increase retirement benefits earned with each service year. The consulting actuary estimated the prior service cost incurred by making the amendment retroactive to pr

> Southeast Technology provides postretirement health care benefits to employees. On January 1, 2021, the following plan-related data were available: On January 1, 2021, Southeast amends the plan in response to spiraling health care costs. The amendment es

> Gorky-Park Corporation provides postretirement health care benefits to employees who provide at least 12 years of service and reach age 62 while in service. On January 1, 2021, the following plan related data were available: On January 1, 2021, Gorky-Par

> Cahal-Michael Company has a postretirement health care benefit plan. On January 1, 2021, the following plan-related data were available: ($ in thousands) Net loss—AOCI $ 336 Accumulated postretirement benefit obligation 2,800 Fair value of plan asset

> Data pertaining to the postretirement health care benefit plan of Sterling Properties include the following for 2021: ($ in thousands) Service cost $124 Accumulated postretirement benefit obligation, January 1 700 Plan assets (fair value), Ja

> Lorin Management Services has an unfunded postretirement benefit plan. On December 31, 2021, the following data were available concerning changes in the plan’s accumulated postretirement benefit obligation with respect to one of Lorin&a

> The following data are available pertaining to Household Appliance Company’s retiree health care plan for 2021: Required: 1. What is the accumulated postretirement benefit obligation at the beginning of 2021? 2. What is interest cost to

> On January 1, 2021, Hodge Beanery received $8,000 from the Kennedy Company in exchange for a coffee roaster that it will deliver to Kennedy on December 31, 2021. Assuming that Hodge views the time value of money to be a significant component of this tran

> Refer to the situation described in BE 5–2. Assume that the trip will cost $26,600. What interest rate, compounded annually, must Bill earn to accumulate enough to pay for the trip? Data from BE 5-2: Bill O’Brien would like to take his wife, Mary, on a

> The purpose of this case is to introduce you to the information available on the website of the Financial Accounting Standards Board (FASB). Required: Access the FASB home page on the Internet. The web address is www.fasb.org. Answer the following questi

> A conceptual question in accounting for derivatives is this: Should gains and losses on a hedge instrument be recorded as they occur, or should they be recorded to coincide (match) with income effects of the item being hedged? ABI Wholesalers plans to is

> The following is an excerpt from a disclosure note of Johnson & Johnson: 6. Fair Value Measurements (in part) As of December 31, 2017, the balance of deferred net gains on derivatives included in accumulated other comprehensive income was $70 million aft

> “This one’s got me stumped,” you say to no one in particular. “First day on the job; I’d better get it right.” It’s the classification of notes payable in the statement of cash flows that has you in doubt. Having received an “A” in Intermediate Accountin

> Refer to the financial statements and related disclosure notes of The Kroger Company for the fiscal year ending January 30, 2018. You can locate the report online from “investor relations” at www.kroger.com. Notice that Kroger’s net income has declined o

> After graduating near the top of his class, Ben Naegle was hired by the local office of a Big 4 CPA firm in his hometown. Two years later, impressed with his technical skills and experience, Park Electronics, a large regional consumer electronics chain,

> Locate the financial statements and related disclosure notes of FedEx Corporation for the fiscal year ended May 31, 2017. You can locate the report online at www.fedex.com. Use the information provided in the statement of cash flows to respond to the que

> You are a loan officer for First Benevolent Bank. You have an uneasy feeling as you examine a loan application from Daring Corporation. The application included the following financial statements. It is not Daring’s profitability that w

> “Why can’t we pay our shareholders a dividend?” shouted your new boss. “This income statement you prepared for me says we earned $5 million in our first half-year!”

> Ray Solutions decided to make the following changes in its accounting policies on January 1, 2021: a. Changed from the cash to the accrual basis of accounting for recognizing revenue on its service contracts. b. Adopted straight-line depreciation for all

> On January 1, 2021, Wooten Technology Associates sold computer equipment to the Denison Company. Delivery was made on January 1, 2021, but payment for the equipment of $10,000 is not due until December 31, 2021. Assuming that Wooten views the time value

> DRS Corporation changed the way it depreciates its computers from the sum-of-the-year’s-digits method to the straight-line method beginning January 1, 2021. DRS also changed its estimated residual value used in computing depreciation for its office build

> It’s financial statements preparation time at Center Industries, where you have been assistant controller for two months. Ben Huddler, the controller, seems to be pleasant but unpredictable. Today, although your schedule is filled with meetings with inte

> Early one Wednesday afternoon, Ken and Larry studied in the dormitory room they shared at Fogelman College. Ken, an accounting major, was advising Larry, a management major, regarding a project for Larry’s Business Policy class. One asp

> Late in 2021, you and two other officers of Curbo Fabrications Corporation just returned from a meeting with officials of the City of Jackson. The meeting was unexpectedly favorable even though it culminated in a settlement with city authorities that you

> Late one Thursday afternoon, Joy Martin, a veteran audit manager with a regional CPA firm, was reviewing documents for a long-time client of the firm, AMT Transport. The year-end audit was scheduled to begin Monday. For three months, the economy had been

> Mayfair Department Stores operates over 30 retail stores in the Pacific Northwest. Prior to 2021, the company used the FIFO method to value its inventory. In 2021, Mayfair decided to switch to the dollar-value LIFO retail inventory method. One of your re

> Danville Bottlers is a wholesale beverage company. Danville uses the FIFO inventory method to determine the cost of its ending inventory. Ending inventory quantities are determined by a physical count. For the fiscal year-end June 30, 2021, ending invent

> Some inventory errors are said to be “self-correcting,” in that the error has the opposite financial statement effect in the period following the error, thereby “correcting,” the original account balance errors. Required: Despite this self-correcting fea

> Sometimes a business entity will change its method of accounting for certain items. The change may be classified as a change in accounting principle, a change in accounting estimate, or a change in reporting entity. Listed below are three independent, un

> Webster Products, Inc., adopted the dollar-value LIFO method of determining inventory costs for financial and income tax reporting on January 1, 2021. Webster continues to use the FIFO method for internal decision-making purposes. Webster’s FIFO inventor

> In January 2021, Continental Fund Services, Inc., enters into a one-year contract with a client to provide investment advisory services. The company will receive a management fee, prepaid at the beginning of the contract, that is calculated as 1% of the

> “I thought I understood earnings per share,” lamented Brad Dawson, “but you’re telling me we need to pretend our convertible bonds have been converted! Or maybe not?” Dawson, your boss, is the new manager of the Fabricating division of BVT Corporation. H

> Del Conte Construction Company has experienced generally steady growth since its inception in 1973. Management is proud of its record of having maintained or increased its earnings per share in each year of its existence. The economic downturn has led to

> “I guess I’ll win that bet!” you announced to no one in particular. “What bet?” Renee asked. Renee Patey was close enough to overhear you. “When I bought my REC stock last year Randy insisted it was a mistake, that they were going to collapse. I bet him

> The shareholders’ equity of Proactive Solutions, Inc., included the following at December 31, 2021: Common stock, $1 par Paid-in capital—excess of par on common stock 7% cumulative convertible preferred stock, $100 par value Paid-in capital—excess of par

> The 2018 annual report of Best Buy Co., Inc., reported profitable operations for the most recent six years. However, the company suffered a net loss in 2012. Best Buy reported the following for the twelve months ended March 3, 2012: Note: The calculation

> International Network Solutions provides products and services related to remote access networking. The company has grown rapidly during its first 10 years of operations. As its segment of the industry has begun to mature, though, the fast growth of prev

> You are in your second year as an auditor with Dantly and Regis, a regional CPA firm. One of the firm’s longtime clients is Mayberry-Cleaver Industries, a national company involved in the manufacturing, marketing, and sales of hydraulic devices used in s

> You are assistant controller of Stamos & Company, a medium-size manufacturer of machine parts. On October 22, 2020, the board of directors approved a stock option plan for key executives. On January 1, 2021, a specific number of stock options were grante

> “Now what do I do?” moaned your colleague Matt. “This is a first for me,” he confided. You and Matt are recent hires in the Accounting Division of National Paper. A top executive in the company has been given share-based incentive instruments that permit

> While eating his Kellogg’s Frosted Flakes one January morning, Tony noticed the following article in his local paper: Kellogg Company Reports Fourth-Quarter 2017 Results and Provides Guidance For 2018 (in part) BATTLE CREEK, Mich., Feb. 8, 2018 /PRNewswi

> Aria Perfume, Inc., sold 3,210 boxes of white musk soap during January of 2021 at the price of $90 per box. The company offers a full refund to unsatisfied customers for any product returned within 30 days from the date of purchase. Based on historical e

> IGF Foods Company is a large, primarily domestic, consumer foods company involved in the manufacture, distribution, and sale of a variety of food products. Industry averages are derived from Troy’s The Almanac of Business and Industrial

> Microsoft provides compensation to executives in the form of a variety of incentive compensation plans, including restricted stock award grants. The following is an excerpt from a disclosure note from Microsoft’s 2017 annual report: Not

> AGF Foods Company is a large, primarily domestic, consumer foods company involved in the manufacture, distribution, and sale of a variety of food products. Industry averages are derived from Troy’s The Almanac of Business and Industrial

> Nike is the world’s leading designer, marketer, and distributor of authentic athletic footwear, apparel, equipment, and accessories. The following is a press release from the company: NIKE, INC. ANNOUNCES 11 PERCENT INCREASE IN QUARTERLY DIVIDEND BEAVERT

> Titan Networking became a public company through an IPO (initial public offering) two weeks ago. You are looking forward to the challenges of being assistant controller for a publicly owned corporation. One such challenge came in the form of a memo in th

> The shareholders’ equity portion of the balance sheet of Sessel’s Department Stores, Inc., a large regional specialty retailer. Disclosures elsewhere in Sessel’s annual report revealed the following changes in shareholders’ equity accounts for 2022, 2021

> Refer to the 2017 financial statements and related disclosure notes of FedEx Corporation. The financial statements can be found at the company’s website (www.fedex.com). Required: 1. Does FedEx sponsor defined benefit pension plans for its employees? Def

> You are in your third year as internal auditor with VXI International, manufacturer of parts and supplies for jet aircraft. VXI began a defined contribution pension plan three years ago. The plan is a so-called 401(k) plan (named after the Tax Code secti

> Refer to the financial statements and related disclosure notes of Microsoft Corporation (www.microsoft.com). Required: 1. What type of pension plan does Microsoft sponsor for its employees? Explain. 2. Who bears the “risk” of factors that might reduce re