Question: Pleni Company produces 18-ounce boxes of

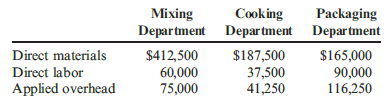

Pleni Company produces 18-ounce boxes of a wheat cereal in three departments: Mixing, Cooking, and Packaging. During August, Pleni produced 125,000 boxes with the following costs:

Required:

1. Calculate the costs transferred out of each department.

2. Prepare journal entries that reflect these cost transfers.

Transcribed Image Text:

Cooking Department Department Department Mixing Packaging $165,000 90,000 116,250 $412,500 $187,500 37,500 41,250 Direct materials Direct labor 60,000 Applied overhead 75,000

> The mixing department incurred $46,000 of manufacturing costs during the month of September. The department transferred out 2,300 units and had 500 units in EWIP, 40% complete. There was no BWIP. The cost of EWIP is a. $9,200. b. $10,000. c. $3,680. d.

> The mixing department incurred $46,000 of manufacturing costs during the month of September. The department transferred out 2,300 units and had 500 units in EWIP, 40% complete. There was no BWIP. The cost of goods transferred out is a. $42,320. b. $46,

> The mixing department incurred $46,000 of manufacturing costs during the month of September. The department transferred out 2,300 units and had 500 units in EWIP, 40% complete. There was no BWIP. The unit cost for the month of September is a. $20. b. $

> During the month of May, the grinding department produced and transferred out 2,300 units. EWIP had 500 units, 40% complete. There was no BWIP. The equivalent units of output for May are a. 2,000. b. 2,500. c. 2,300. d. 2,800. e. none of these.

> The costs transferred from a prior process to a subsequent process are a. treated as another type of materials cost for the receiving department. b. referred to as transferred-in costs (for the receiving department). c. referred to as the cost of goods

> Patrick Inc. makes industrial solvents. Budgeted direct labor hours for the first three months of the coming year are: January ……………………………………….. 13,140 February ……………………………………… 12,300 March ………………………………………….. 15,075 The variable overhead rate is $0.70

> To record the transfer of costs from a prior process to a subsequent process, the following entry would be made: a. debit Finished Goods and credit Work in Process. b. debit Work in Process (subsequent department) and credit Transferred-In Materials. c.

> Sequential processing is characterized by a. a pattern where partially completed units are worked on simultaneously. b. a pattern where partially completed units must pass through one process before they can be worked on in later processes. c. a pattern

> Transferred-in goods are treated by the receiving department as a. units started for the period. b. a material added at the beginning of the process. c. a category of materials separate from conversion costs. d. all of these. e. none of these.

> Job-order costing works well whenever a. homogeneous products pass through a series of processes and receive similar doses of conversion inputs and different doses of material inputs. b. homogeneous products pass through a series of processes and receiv

> With no uniform inputs, the cost of EWIP is calculated by a. adding the materials cost to the conversion cost. b. subtracting the cost of goods transferred out from the total cost of materials. c. multiplying the unit cost in each input category by the

> In a normal costing system, the cost of a job includes a. actual direct materials, actual direct labor, and estimated (applied) overhead. b. estimated direct materials, estimated direct labor, and estimated overhead. c. actual direct materials, actual d

> When materials are added either at the beginning or the end of the process, a unit cost should be calculated for the a. materials and conversion categories. b. materials category only. c. materials and labor categories. d. conversion category only. e. l

> For August, Lanny Company had 25,000 units in BWIP, 40% complete, with costs equal to $36,000. During August, the cost incurred was $450,000. Using the FIFO method, Lanny had 125,000 equivalent units for August. There were 100,000 units transferred out d

> Assume for August that Faust Manufacturing has manufacturing costs in BWIP equal to $80,000. During August, the cost incurred was $720,000. Using the FIFO method, Faust had 120,000 equivalent units for August. The cost per equivalent unit for August is

> During July, Faust Manufacturing started and completed 80,000 units. In BWIP, there were 25,000 units, 20% complete. In EWIP, there were 25,000 units, 80% complete. Using FIFO, the equivalent units are a. 80,000 units. b. 120,000 units. c. 65,000 units.

> At the beginning of the year, Hallett Company estimated the following: Hallett uses departmental overhead rates. In the cutting department, overhead is applied on the basis of machine hours. In the sewing department, overhead is applied on the basis of

> For August, Kimbrell Manufacturing has costs in BWIP equal to $112,500. During August, the cost incurred was $450,000. Using the weighted average method, Kimbrell had 125,000 equivalent units for August. There were 100,000 units transferred out during th

> During June, Kimbrell Manufacturing completed and transferred out 100,000 units. In EWIP, there were 25,000 units, 80% complete. Using the weighted average method, the equivalent units are a. 100,000 units. b. 125,000 units. c. 105,000 units. d. 110,000

> During May, Kimbrell Manufacturing completed and transferred out 100,000 units. In EWIP, there were 25,000 units, 40% complete. Using the weighted average method, the equivalent units are a. 100,000 units. b. 125,000 units. c. 105,000 units. d. 110,000

> Process costing works well whenever a. heterogeneous products pass through a series of processes and receive different doses of materials, labor, and overhead. b. material cost is accumulated by process and conversion cost is accumulated by process. c.

> The method that assigns support department costs by giving full recognition to support department interactions is known as a. the sequential method. b. the proportional method. c. the reciprocal method. d. the direct method. e. None of these.

> The method that assigns support department costs by giving partial recognition to support department interactions is known as a. the sequential method. b. the proportional method. c. the reciprocal method. d. the direct method. e. None of these.

> The ending balance of which of the following accounts is calculated by summing the totals of the open (unfinished) job-order cost sheets? a. Raw Materials b. Overhead Control c. Work in Process d. Finished Goods e. Cost of Goods Sold

> The method that assigns support department costs only to producing departments in proportion to each department’s usage of the service is known as a. the sequential method. b. the proportional method. c. the reciprocal method. d. the direct method. e. N

> An example of a support department is a. data processing. b. personnel. c. a materials storeroom. d. payroll. e. All of these.

> An example of a producing department is a. a materials storeroom. b. the maintenance department. c. engineering design. d. assembly. e. All of these.

> Patrick Inc. makes industrial solvents sold in five-gallon drums. Planned production in units for the first three months of the coming year is: January ……………………………. 43,800 February …………………………… 41,000 March ………………………………. 50,250 Each drum requires 5.5 ga

> Those departments that provide essential services to producing departments are referred to as a. revenue generating departments. b. support departments. c. profit centers. d. production departments. e. None of these.

> Those departments responsible for creating products or services that are sold to customers are referred to as a. profit making departments. b. producing departments. c. cost centers. d. support departments. e. None of these.

> During June, Faust Manufacturing started and completed 80,000 units. In BWIP, there were 25,000 units, 80% complete. In EWIP, there were 25,000 units, 60% complete. Using FIFO, the equivalent units are a. 80,000 units. b. 95,000 units. c. 85,000 units.

> For September, Murphy Company has manufacturing costs in BWIP equal to $100,000. During September, the manufacturing costs incurred were $550,000. Using the weighted average method, Murphy had 100,000 equivalent units for September. The equivalent unit c

> The costs of a job are accounted for on the a. materials requisition sheet. b. time ticket. c. requisition for overhead application. d. sales invoice. e. job-order cost sheet.

> When a job is completed, the total cost of the job is a. subtracted from the raw materials account. b. added to the work-in-process account. c. added to the finished goods account. d. added to the accounts payable account. e. subtracted from the cost of

> When materials are requisitioned for use in production in a job-order costing firm, the cost of materials is added to the a. raw materials account. b. work-in-process account. c. finished goods account. d. accounts payable account. e. cost of goods sold

> Which of the following statements is true? a. Job-order costing is used only in manufacturing firms. b. Process costing is used only for services. c. Job-order costing is simpler to use than process costing because the recordkeeping requirements are les

> The total variable overhead variance can be expressed as the sum of a. the under applied variable overhead and the spending variance. b. the efficiency variance and the over applied variable overhead. c. the spending, efficiency, and volume variances. d

> Because the calculation of both variances is based on direct labor hours, a favorable labor efficiency variance implies that a. the variable overhead efficiency variance will be favorable. b. the variable overhead efficiency variance will also be unfavo

> La Cucina Company sells kitchen supplies and housewares. Lava stone is used in production of molcajetes (mortars and pestles used in the making of guacamole) and is purchased from external suppliers. Each year, 8,000 pounds of lava stone is used; it is u

> A variable overhead spending variance can occur because a. prices for individual overhead items have increased. b. prices for individual overhead items have decreased. c. more of an individual overhead item was used than expected. d. less of an individu

> The total variable overhead variance is the difference between a. the budgeted variable overhead and the actual variable overhead. b. the actual variable overhead and the applied variable overhead. c. the budgeted variable overhead and the applied varia

> A firm comparing the actual variable costs of producing 10,000 units with the total variable costs of a static budget based on 9,000 units would probably see a. no variances. b. small favorable variances. c. large unfavorable variances. d. large favorab

> To help assess performance, managers should use a. a static budget. b. a master budget. c. a continuous budget. d. a before-the-fact flexible budget. e. none of these.

> To help deal with uncertainty, managers should use a. an after-the-fact flexible budget. b. a master budget. c. a static budget. d. a before-the-fact flexible budget. e. none of these.

> To create a meaningful performance report, actual costs and expected costs should be compared a. at the actual level of activity. b. weekly. c. at the budgeted level of activity. d. at the average level of activity. e. hourly.

> In activity-based budgeting, flexible budget formulas are created using a. only unit-level drivers. b. only nonunit-level drivers. c. both unit-level and nonunit-level drivers. d. only direct labor hours. e. all of these.

> Activity flexible budgeting makes it possible to a. predict what activity costs will be as activity output changes. b. improve traditional budgetary performance reporting. c. enhance the ability to manage activities. d. do all these. e. do only a and c.

> In activity-based budgeting, costs are classified as variable or fixed with respect to a. only the units budgeted. b. only the units produced. c. only the units sold. d. only the direct labor hours. e. none of these.

> Responsibility for the volume variance usually is assigned to a. the accounting department. b. the receiving department. c. the shipping department. d. the manufacturing department. e. none of these.

> An unfavorable volume variance can occur because a. too much finished goods inventory was held. b. the company overproduced. c. the actual output was less than expected or practical capacity. d. the actual output was greater than expected or practical c

> Because of the nature of fixed overhead items, the difference between the actual fixed overhead cost and the budgeted fixed overhead is a. likely to be small. b. likely to be large. c. usually a major concern. d. often attributable to labor inefficiency

> The total fixed overhead variance can be expressed as the sum of a. the spending and efficiency variances. b. the efficiency and volume variances. c. the spending and volume variances. d. the flexible budget and the volume variances. e. none of these.

> The total fixed overhead variance is a. the difference between actual and applied fixed overhead costs. b. the difference between budgeted and applied fixed overhead costs. c. the difference between budgeted fixed and variable overhead costs. d. the dif

> In a performance report that details the spending and efficiency variances, which of the following columns will be found? a. A cost formula for each item b. A budget for actual hours for each item c. A budget of standard hours for each item d. All of th

> For performance reporting, it is best to compare actual costs with budgeted costs using a. short-term budgets. b. static budgets. c. flexible budgets. d. master budgets. e. none of these.

> The standard quantity of materials allowed is computed as a. Unit Quantity Standard × Standard Output. b. Unit Quantity Standard × Normal Output. c. Unit Quantity Standard × Practical Output. d. Unit Quantity Standard × Actual Output. e. None of these.

> The underlying details for the standard cost per unit are provided in a. the standard work-in-process account. b. the standard production budget. c. the standard cost sheet. d. the balance sheet. e. none of these.

> Standard costs are developed for a. direct materials. b. direct labor. c. variable overhead. d. fixed overhead. e. all of these.

> Reasons for adopting a standard costing system include a. to encourage purchasing managers to purchase cheap materials. b. to imitate most other firms. c. to enhance operational control. d. that the weighted average method can be used for process manufa

> Bowling Company provided the following information for last year. Master Budget Actual Data Budgeted production 4,000 ………………………… 3,800 units Direct materials: 3 pounds @ $0.60 per pound ………………………. $6,800 Direct labor: 0.5 hr. @ $16.00 per hour ……………

> An ideal standard is one that a. uses only historical experience. b. relies on maximum efficiency. c. can be achieved under efficient operating conditions. d. makes allowances for normal breakdowns, interruptions, less than perfect skill, and so on. e.

> A currently attainable standard is one that a. relies on maximum efficiency. b. uses only historical experience. c. is based on ideal operating conditions. d. can be easily achieved. e. is none of these.

> The standard cost per unit of output for a particular input is calculated as a. Actual Input Price per Unit × Actual Input Used per Unit. b. Standard Input Price × Inputs Allowed for the Actual Output. c. Standard Input Price × Standard Input Allowed pe

> Standards set by engineering studies a. can determine the most efficient way of operating. b. can provide rigorous guidelines. c. may not be achievable by operating personnel. d. often do not allow operating personnel to have much input. e. do all of th

> Which of the following is true concerning labor variances that are not material in amount? a. They are closed to Cost of Goods Sold. b. They are prorated among Work in Process, Finished Goods, and Cost of Goods Sold. c. They are prorated among Materials

> Which of the following items describes practices surrounding the recording of variances? a. All inventories are typically carried at standard. b. Unfavorable variances appear as debits. c. Favorable variances appear as credits. d. Immaterial variances a

> Responsibility for the labor efficiency variance typically is assigned to a. labor unions. b. personnel. c. engineering. d. production. e. outside trainers.

> Responsibility for the labor rate variance typically is assigned to a. production. b. labor markets. c. personnel. d. labor unions. e. engineering.

> Responsibility for the materials usage variance is usually assigned to a. the chief executive officer (CEO). b. marketing. c. purchasing. d. personnel. e. production.

> The materials price variance is usually computed a. when goods are finished. b. when materials are issued to production. c. when materials are purchased. d. after suppliers are paid. e. as none of these.

> La Cucina Company sells kitchen supplies and housewares. Lava stone is used in production of molcajetes (mortars and pestles used in the making of guacamole) and is purchased from external suppliers. Each year, 8,000 pounds of lava stone is used; it is c

> Responsibility for the materials price variance typically belongs to a. production. b. purchasing. c. marketing. d. personnel. e. the chief executive officer (CEO).

> Investigating variances from standard is a. always done. b. done if the variance is inside an acceptable range. c. not done if the variance is expected to recur. d. done if the variance is outside the control limits. e. none of these.

> The materials usage variance is computed as a. (SP × AQ) - (AP × SQ). b. (AP × AQ) - (SP × SQ). c. (SP × AQ) - (SP × SQ). d. (AP × SP) - (AQ × SQ). e. None of these.

> The standard direct labor hours allowed is computed as a. Unit Labor Standard × Actual Output. b. Unit Labor Standard × Practical Output. c. Unit Labor Standard × Standard Output. d. Unit Labor Standard × Normal Output. e. Unit Labor Standard × Theoreti

> Historical experience should be used with caution in setting standards because a. they may perpetuate operating inefficiencies. b. ideal standards are always better than historical standards. c. they may not be achievable by operating personnel. d. most

> Which of the following is needed to prepare the production budget? a. Direct materials needed for production b. Direct labor needed for production c. Expected unit sales d. Units of materials in ending inventory e. None of these.

> The first step in preparing the sales budget is to a. prepare a sales forecast. b. review the production budget carefully. c. assess the desired ending inventory of finished goods. d. talk with past customers. e. increase sales beyond the forecast level

> Before a direct materials purchases budget can be prepared, you should first a. prepare a sales budget. b. prepare a production budget. c. decide on the desired ending inventory of materials. d. obtain the expected price of each type of material. e. do

> Which of the following is not part of the operating budget? a. The direct labor budget b. The cost of goods sold budget c. The production budget d. The capital budget e. The selling and administrative expenses budget

> A moving, 12-month budget that is updated monthly is a. not used by manufacturing firms. b. waste of time and effort. c. a master budget. d. a continuous budget. e. always used by firms that prepare a master budget.

> La Cucina Company sells kitchen supplies and housewares. Lava stone is used in production of molcajetes (mortars and pestles used in the making of guacamole) and is purchased from external suppliers. Each year, 8,000 pounds of lava stone is used; it is c

> The budget committee a. reviews the budget. b. resolves differences that arise as the budget is prepared. c. approves the final budget. d. is directed (typically) by the controller. e. does all of these.

> Which of the following is not an advantage of budgeting? a. It forces managers to plan. b. It provides information for decision making. c. It guarantees an improvement in organizational efficiency. d. It provides a standard for performance evaluation. e

> Which of the following items is a possible example of myopic behavior? a. Failure to promote deserving employees b. Reducing expenditures on preventive maintenance c. Cutting back on new product development d. Buying cheaper, lower-quality materials so

> Which of the following is part of the control process? a. Monitoring of actual activity b. Comparison of actual with planned activity c. Investigating d. Taking corrective action e. All of these.

> Which of the following is not an advantage of participative budgeting? a. It encourages budgetary slack. b. It tends to lead to a higher level of performance. c. It fosters a sense of responsibility. d. It encourages greater goal congruence. e. It foste

> Some key budgetary features that tend to promote positive managerial behavior are a. frequent feedback on performance. b. participative budgeting. c. realistic standards. d. well-designed monetary and nonmonetary incentives. e. all of these.

> An ideal budgetary system is one that a. encourages dysfunctional behavior. b. encourages goal-congruent behavior. c. encourages myopic behavior. d. encourages subversion of an organization’s goals. e. does none of these.

> The percentage of accounts receivable that are uncollectible can be ignored for cash budgeting because a. no cash is received from an account that defaults. b. it is included in cash sales. c. it appears on the budgeted income statement. d. for most com

> Assume that a company has the following accounts receivable collection pattern: Month of sale ………………………………. 40% Month following sale ……………………. 60% All sales are on credit. If credit sales for January and February are $100,000 and $200,000, respectively

> The following six situations at Diviney Manufacturing Inc. are independent. a. A manual insertion process takes 30 minutes and 8 pounds of material to produce a product. Automating the insertion process requires 15 minutes of machine time and 7.5 pounds

> Gorman Nurseries Inc. grows poinsettias and fruit trees in a greenhouse/nursery operation. The following information was provided for the coming year. A sales commission of 4% of sales is paid for each of the two product lines. Direct fixed selling and

> The following six situations at Diviney Manufacturing Inc. are independent. a. A manual insertion process takes 30 minutes and 8 pounds of material to produce a product. Automating the insertion process requires 15 minutes of machine time and 7.5 pounds

> For each of the following independent situations, give the source document that would be referred to for the necessary information. Required: 1. Direct materials costing $460 are requisitioned for use on a job. 2. Greiner’s Garage uses a job-order costi

> At the beginning of the year, Debion Company estimated the following: Overhead ……………………………………… $522,900 Direct labor hours …………………………….. 83,000 Debion uses normal costing and applies overhead on the basis of direct labor hours. For the month of March,

> Describe the difference between the variable overhead efficiency variance and the labor efficiency variance.

> The variable overhead efficiency variance has nothing to do with efficient use of variable overhead. Do you agree or disagree? Why?

> Explain why the variable overhead spending variance is not a pure price variance.

> What is the purpose of an after-the-fact flexible budget?