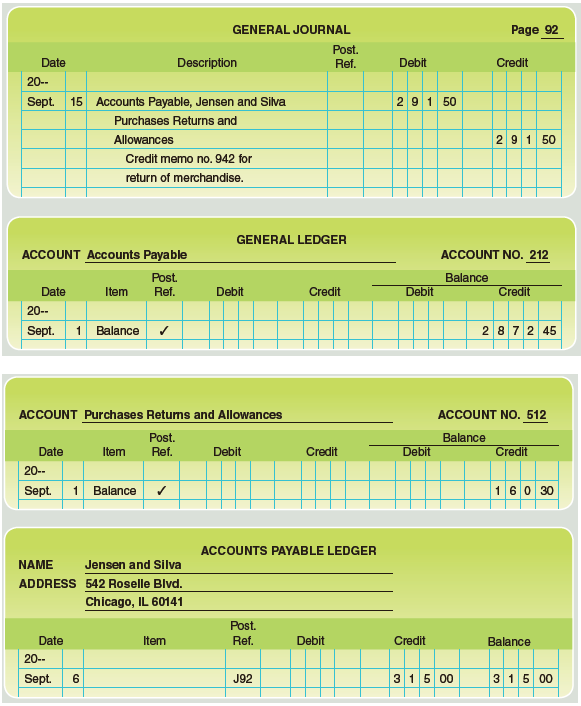

Question: Post the following entry to the general

Post the following entry to the general ledger and the subsidiary ledger.

Transcribed Image Text:

GENERAL JOURNAL Page 92 Post. Date Description Ref. Debit Credit 20-- Sept. 15 Accounts Payable, Jensen and Silva 291 50 Purchases Returns and Allowances 2 9 1 50 Credit memo no. 942 for return of merchandise. GENERAL LEDGER ACCOUNT Accounts Payable ACCOUNT NO. 212 Post. Balance Date Item Ref. Debit Credit Debit Credit 20-- Sept. 1 Balance / 2 872 45 ACCOUNT Purchases Returns and Allowances ACCOUNT NO. 512 Post. Balance Date Item Ref. Debit Credit Debit Credit 20-- Sept. 1 Balance 160 30 ACCOUNTS PAYABLE LEDGER NAME Jensen and Silva ADDRESS 542 Roselle Blvd. Chicago, IL 60141 Post. Date Item Ref. Debit Credit Balance 20-- Sept. 6 J92 3 15 00 3 15 00

> Following is a trial balance prepared just before you were hired. Two accounts are missing, and the amount for Sales is off. Here are a few facts to consider. Our business is in a state that collects sales tax. I ran some totals, and we collected $1,800

> You are the bookkeeper at a small merchandising firm. You are comparing the income statements from the last three years. You notice that the Purchases Returns and Allowances account (as a percentage of net sales) has been increasing at an alarming rate.

> Jax Mercantile Co. has been northern Colorado’s premier outdoor gear source for over 50 years. Jax sells men’s, women’s, and children’s clothing for any outdoor activity. Customers can also find camping and fishing gear, mountaineering tools, and hunting

> You work for Gregory Plumbing Supply. You are responsible for training a new accounting clerk. She has the following questions for you to answer about this invoice. 1. Who is the buyer? 2. Who is paying the freight? 3. What is the customerâ€

> You are the manager of the Accounts Receivable Department for a merchandising business. Your billing clerk sent a bill for $2 to a customer who had charged $100 in goods (including sales tax) with terms 2/10, n/30. The customer called and indicated his d

> With regard to goods sold and purchased, explain how sales returns and allowances and purchases returns and allowances are different from each other.

> If you’re ever in Santa Cruz, California, take some time to visit Bookshop Santa Cruz. You’ll find books “that entertain, help solve problems, or occasionally, change a life.” Since opening in 1966, Bookshop Santa Cruz has been a vital part of the Bay Ar

> The following transactions were completed by Nelson’s Hardware, a retailer, during September. Terms on sales on account are 1/10, n/30, FOB shipping point. Sept. 4 Received cash from M. Alex in payment of August 25 invoice of $275, less cash discount. 7

> Hardy’s Landscape Service’s total revenue on account for 2018 amounted to $273,205. The company, which uses the allowance method, estimates bad debts at ½ percent of total revenue on account. Required Journalize the following selected entries: 2012 Dec.

> The following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Workin

> R. J. Hinton Company sells electrical supplies on a wholesale basis. The balances of the accounts as of April 1 have been recorded in the general ledger in your Working Papers and CengageNow. The following transactions took place during April of this yea

> Refer to the information for Problem 10-1B on. In Problem 10-1B The following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of

> May’s Beauty Store records sales and purchase transactions in the general journal. In addition to a general ledger, May’s Beauty Store also uses an accounts receivable ledger and an accounts payable ledger. Transactions for January related to the sales a

> Lowery’s Pet Depot records purchase transactions in the general journal. The company is located in Cleveland, Ohio. In addition to a general ledger, Lowery’s Pet Depot also uses an accounts payable ledger. Transactions for October related to the purchase

> Abbott Florists sells flowers on a retail basis. Most of the sales are for cash; however, a few steady customers have credit accounts. Abbott’s sales staff fills out a sales slip for each sale. There is a state retail tax of 5 percent, which is collected

> Prepare entries in general journal form to record the following: Aug. 6 Woodard Company failed to pay its 30-day, 10 percent note for $600, dated July 9. The note is thus dishonored at maturity.

> The following T accounts show a series of four transactions concerning a sale of merchandise on account and subsequent payment of the amount owed. Describe what happened in each transaction. Accounts Cash Receivable Sales + (а) 1,500 | (b) 130 (c) 2

> Explain the following credit terms: (a) n/30; (b) 2/10, n/60; (c) 1/15, EOM, n/30.

> Prepare entries in general journal form to record the following: June 12 Sold merchandise on account to K. Perrot; terms n/30; $1,740. July 12 Received $740 in cash from K. Perrot and a 60-day, 7 percent note for $1,000, dated July 12. Aug. 17 Discounted

> Rogan Company’s total sales on account for the year amounted to $327,000. The company, which uses the allowance method, estimated bad debts at 1 percent of its credit sales. Required Journalize the following selected entries: 2017 Dec. 31 Record the adj

> On March 11, Rainz Company received a 90-day, 6 percent note for $1,500, dated March 11, from J. Rose, a charge customer, to satisfy his open account receivable. a. What is the due date of the note? b. How much interest is due at maturity? Given the prec

> On August 5, M. Valenty borrowed $8,500 from Costner State Bank for 45 days, with a discount rate of 7 percent. Accordingly, M. Valenty signed a note for $8,500, dated August 5. Write entries in general journal form to record the following transactions:

> As a result of a loan from Plateau State Bank, Trent Company signed a 90-day note, dated March 12, for $12,700 that the bank discounted at 7 percent. Journalize the entries for the maker in general journal form to record the following, assuming that the

> Andy Cooke gave a 60-day, 5.5 percent note, dated February 14, to Key Company, a creditor, in the amount of $10,500. a. What is the due date of the note? b. How much interest is to be paid on the note at maturity? c. Write the entries in general journal

> Part A: Calculate the interest on the following notes: Part B: Determine the maturity dates on the following notes: Date of Issue ___________Life of Note 1. January 18 …………

> The following transactions were completed by Nelson’s Boutique, a retailer, during July. Terms of sales on account are 2/10, n/30, FOB shipping point. July 3 Received cash from J. Smith in payment of June 29 invoice of $350, less cash discount. 6 Issued

> The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Wor

> Gomez Company sells electrical supplies on a wholesale basis. The balances of the accounts as of April 1 have been recorded in the general ledger in your Working Papers and CengageNow. The following transactions took place during April of this year: Apr.

> Refer to the information for Problem 10-1A. In Problem 10-1A The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of

> Use the information in Problem A-1 to solve this problem. Assume that the van is five-year property for tax purposes. In Problem A-1 A delivery van was bought for $18,000. The estimated life of the van is four years. The trade-in value at the end of fou

> Why is an accounts receivable ledger or an accounts payable ledger necessary for a business with large numbers of credit customers or large numbers of vendors/suppliers?

> Shirley’s Beauty Store records sales and purchase transactions in the general journal. In addition to a general ledger, Shirley’s Beauty Store also uses an accounts receivable ledger and an accounts payable ledger. Transactions for January related to the

> Berry’s Pet Store records purchase transactions in the general journal. The company is located in Boston, Massachusetts. In addition to a general ledger, Berry’s Pet Store also uses an accounts payable ledger. Transactions for April related to the purcha

> Abbott Florists sells flowers on a retail basis. Most of the sales are for cash; however, a few steady customers have credit accounts. Abbott’s sales staff fills out a sales slip for each sale. There is a state retail tax of 5 percent, which is collected

> Bean Nursery sells bark to its customers at retail. Bean buys bark from a plywood mill in bulk and transports the bark in its own trucks. Information relating to the beginning inventory and purchases of bark is as follows: Beginning inventory ………………. 1,

> Record general journal entries to correct the errors described below. Assume that the incorrect entries were posted in the same period in which the errors occurred and were recorded using the periodic inventory system. a. A freight cost of $85 incurred o

> Record the following transactions in general journal form on the books of the seller (Fuentes Company) and then on the books of the buyer (Lowe Company) using the periodic inventory system. Fuentes Company a. Sold merchandise on account to Lowe Company,

> Record the following transactions in general journal form using the periodic inventory system: June 5 Sold merchandise on account to Wilson, Inc., $520; terms 1/10, n/30. 12 Bought merchandise on account from Mastercraft Company, $425; terms 2/10, n/45;

> Describe the transactions recorded in the following T accounts: Cash Accounts Payable Purchases (c) 1,176 (b) 150 | (a) 1,350 (a) 1,350 (c) 1,200 Purchases Returns and Allowances Purchases Discounts (b) 150 (c) 24

> Describe the transactions recorded in the following T accounts: Cash Accounts Receivable Sales (c) 5,042.10 (a) 5,320 (b) 175 (a) 5,320 (c) 5,145 Sales Returns and Allowances Sales Discounts (b) 175 (c) 102.90

> Indicate the journal in which each of the following transactions should be recorded. Assume a three-column purchases journal. Journal Transaction P CR | CP J a. Paid a creditor on account. b. Bought merchandise on account. c. Sold merchandise for ca

> What is the purpose of each of the following? a. Schedule of accounts receivable b. Schedule of accounts payable

> Use the information in Problem A-1 to solve this problem. In Problem A-1 A delivery van was bought for $18,000. The estimated life of the van is four years. The trade-in value at the end of four years is estimated to be $2,000. Required Prepare a sched

> For the following purchases of merchandise, determine the amount of cash to be paid: Total Credit Amount of Рurchase Freight Charges Invoice Invoice Returns and Date Purchase Date Terms FOB Amount Allowances Pald June 1 2/10, n/30 Destination $550 $

> Kelley Company has completed the following October sales and purchases journals: a. Total and post the journals to T accounts for the general ledger and the accounts receivable and accounts payable ledgers. b. Complete a schedule of accounts receivable f

> Williams Corporation had the following purchases for May: May 3 Bought ten lawn rakes from Owens Company, invoice no. J34Y9, $250.25; terms net 15 days; dated May 1; FOB shipping point, freight prepaid and added to the invoice, $15 (total $265.25). 11 Bo

> Toby Company had the following sales transactions for March: Mar. 6 Sold merchandise on account to Osbourne, Inc., invoice no. 1128, $563.17. 14 Sold merchandise on account to Ortiz Company, invoice no. 1129, $823.50. 20 Sold merchandise on account to Ba

> Record the following transactions for a perpetual inventory system in general journal form. a. Sold merchandise on account to Southridge Manufacturing, Inc., invoice no. 6910, $1,815.24. The cost of merchandise was $1,320. b. Issued credit memorandum no.

> Record the following transactions in general journal form for Ford Education Outfitters and Romero Textbooks, Inc. a. Ford Educational Outfitters bought merchandise on account from Romero Textbooks, Inc., invoice no. 10594, $1,875.34; terms net 30 days;

> Journalize the following transactions in general journal form. a. Bought merchandise on account from Brewer, Inc., invoice no. B2997, $914; terms net 30 days; FOB destination. b. Received credit memo no. 96 from Brewer, Inc., for merchandise returned, $2

> Record the following transactions in general journal form. a. Sold merchandise on account to A. Bauer, $680 plus $54.40 sales tax (invoice no. D446). b. Bauer returned $105.50 of the merchandise. Issued credit memo no. 114 for $113.94 ($105.50 for the am

> What is the difference between a cash discount and a trade discount?

> What is the difference between a periodic inventory system and a perpetual inventory system?

> Describe the posting procedure for a cash payments journal with an Other Accounts Debit column and several special columns, including an Accounts Payable Debit column.

> Describe the procedure for posting each of the following: a. From the sales journal to the accounts receivable ledger b. From the purchases journal to the accounts payable ledger

> Dawson Co. produces wine. The company expects to produce 2,535,000 two-liter bottles of Chablis in 2018. Dawson purchases empty glass bottles from an outside vendor. Its target ending inventory of such bottles is 77,000; its beginning inventory is 54,000

> The Coby Company expects sales in 2018 of 201,000 units of serving trays. Coby’s beginning inventory for 2018 is 13,000 trays, and its target ending inventory is 29,000 trays. Compute the number of trays budgeted for production in 2018.

> Raynham’s Radiology Center (RRC) performs X-rays, ultrasounds, computer tomography (CT) scans, and magnetic resonance imaging (MRI). RRC has developed a reputation as a top radiology center in the state. RRC has achieved this status bec

> Market Pulse performs market research for consumer product companies across the country. The company conducts telephone surveys and gathers consumers together in focus groups to review foods, cleaning products, and toiletries. Market Pulse uses a normal-

> Joseph Underwood joined Anderson Enterprises as controller in October 2016. Anderson Enterprises manufactures and installs home greenhouses. The company uses a normal-costing system with two direct-cost pools, direct materials and direct manufacturing la

> Resource Room prints custom training material for corporations. The business was started January 1, 2017. The company uses a normal-costing system. It has two direct-cost pools, materials and labor, and one indirect-cost pool, overhead. Overhead is charg

> Estevez Company uses normal costing in its job-costing system. The company produces kitchen cabinets. The beginning balances (December 1) and ending balances (as of December 30) in their inventory accounts are as follows: Additional information follows:

> Keezel Company uses normal costing in its job-costing system. Partially completed T-accounts and additional information for Keezel for 2017 are as follows: Additional information follows: a. Direct manufacturing labor wage rate was $15 per hour. b. Ma

> Adventure Designs makes custom backyard play structures that it sells to dealers across the Midwest. The play structures are produced in two departments, fabrication (a mostly automated department) and custom finishing (a mostly manual department). The c

> Gardi Manufacturing uses normal costing for its job-costing system, which has two direct-cost categories (direct materials and direct manufacturing labor) and one indirect-cost category (manufacturing overhead). The following information is obtained for

> The Zaf Radiator Company uses a normal-costing system with a single manufacturing overhead cost pool and machine-hours as the cost-allocation base. The following data are for 2017: Budgeted manufacturing overhead costs…â€&b

> Kidman has just completed a review of its job-costing system. This review included a detailed analysis of how past jobs used the firm’s resources and interviews with personnel about what factors drive the level of indirect costs. Manage

> “Managers should always buy inventory in quantities that result in the lowest purchase cost per unit.” Do you agree? Why?

> Kidman & Associates is a law firm specializing in labor relations and employee-related work. It employs 30 professionals (5 partners and 25 associates) who work directly with its clients. The average budgeted total compensation per professional for 2017

> The Solomon Company uses a job-costing system at its Dover, Delaware, plant. The plant has a machining department and a finishing department. Solomon uses normal costing with two direct-cost categories (direct materials and direct manufacturing labor) an

> LawnCare USA provides lawn care and landscaping services to commercial clients. LawnCare USA uses activity-based costing to bid on jobs and to evaluate their profitability. LawnCare USA reports the following budgeted annual costs: Wages and salaries&acir

> Marshall Devices manufactures metal products and uses activity-based costing to allocate overhead costs to customer orders for pricing purposes. Many customer orders are won through competitive bidding based on costs. Direct material and direct manufactu

> Wharton has two classifications of professional staff: partners and associates. Peyton asks his assistant to examine the relative use of partners and associates on the recent Steger Enterprises and Bluestone Inc. jobs. The Steger Enterprises job used 1,0

> Peyton asks her assistant to collect details on those costs included in the $500,000 indirect-cost pool that can be traced to each individual job. After analysis, Wharton is able to reclassify $300,000 of the $500,000 as direct costs: Peyton decides to

> Wharton Associates is a recently formed law partnership. Denise Peyton, the managing partner of Wharton Associates, has just finished a tense phone call with Gus Steger, president of Steger Enterprises. Gus strongly complained about the price Wharton cha

> Sunto Scientific manufactures GPS devices for a chain of retail stores. Its most popular model, the Magellan XS, is assembled in a dedicated facility in Savannah, Georgia. Sunto is keenly aware of the competitive threat from smartphones that use Google M

> Derek Wilson operates Clean Ride Enterprises, an auto detailing company with 20 employees. Jamal Jackson has recently been hired by Wilson as a controller. Clean Ride’s previous accountant had done very little in the area of variance analysis, but Jackso

> MicroDisk is the market leader in the Secure Digital (SD) card industry and sells memory cards for use in portable devices such as mobile phones, tablets, and digital cameras. Its most popular card is the Mini SD, which it sells through outlets such as T

> Describe three features of a good balanced scorecard.

> Elena Martinez employs two workers in her wedding cake bakery. The first worker, Gabrielle, has been making wedding cakes for 20 years and is paid $25 per hour. The second worker, Joseph, is less experienced and is paid $15 per hour. One wedding cake req

> You are a new junior accountant at In Focus Corporation, maker of lenses for eyeglasses. Your company sells generic-quality lenses for a moderate price. Your boss, the controller, has given you the latest month’s report for the lens tra

> Collegiate Corn Hole is a small business that Zach Morris developed while in college. He began building wooden corn hole game sets for friends, hand painted with college colors and logos. As demand grew, he hired some workers and began to manage the oper

> On May 1, 2017, Bovar Company began the manufacture of a new paging machine known as Dandy. The company installed a standard costing system to account for manufacturing costs. The standard costs for a unit of Dandy follow: Direct materials (3 lb. at $4 p

> Sandy’s Snacks produces snack mixes for the gourmet and natural foods market. Its most popular product is Tempting Trail Mix, a mixture of peanuts, dried cranberries, and chocolate pieces. For each batch, the budgeted quantities and bud

> Oyster Bay Surfboards manufactures fiberglass surfboards. The standard cost of direct materials and direct manufacturing labor is $248 per board. This includes 35 pounds of direct materials, at the budgeted price of $3 per pound, and 11 hours of direct m

> Katharine Johnson is the owner of Best Bikes, a company that produces high-quality cross-country bicycles. Best Bikes participates in a supply chain that consists of suppliers, manufacturers, distributors, and elite bicycle shops. For several years Best

> You have been invited to interview for an internship with an international food manufacturing company. When you arrive for the interview, you are given the following information related to a fictitious Belgian chocolatier for the month of June. The choco

> Ellis Animal Health, Inc., produces a generic medication used to treat cats with feline diabetes. The liquid medication is sold in 100 ml vials. Ellis employs a team of sales representatives who are paid varying amounts of commission. Given the narrow ma

> Student Finance (StuFi) is a start-up that aims to use the power of social communities to transform the student loan market. It connects participants through a dedicated lending pool, enabling current students to borrow from a school’s

> “A component part should be purchased whenever the purchase price is less than its total manufacturing cost per unit.” Do you agree? Why?

> Nantucket Enterprises manufactures insulated cold beverage cups printed with college and corporate logos, which it distributes nationally in lots of 12 dozen cups. In June 2017, Nantucket produced 5,000 lots of its most popular line of cups, the 24-ounce

> Prepare journal entries and post them to T-accounts for all transactions in Exercise 7-30, including requirement 2. Summarize how these journal entries differ from the normal-costing entries described in Chapter 4, pages 120–123. From exercise 30: Daws

> Dawson, Inc., is a privately held furniture manufacturer. For August 2017, Dawson had the following standards for one of its products, a wicker chair: Standards per Chair Direct materials………………………….3 square yards of input at $5.50 per squar

> The Schuyler Corporation manufactures lamps. It has set up the following standards per finished unit for direct materials and direct manufacturing labor: Direct materials: 10 lb. at $4.50 per lb…………………………………..$45.00 Direct manufacturing labor: 0.5 hour

> Rugged Life, Inc., designs and manufactures fleece quarter-zip jackets. It sells its jackets to brand-name outdoor outfitters in lots of one dozen. Rugged Life’s May 2017 static budget and actual results for direct inputs are as follows

> Consider the following data collected for Great Homes, Inc.: Required: Compute the price, efficiency, and flexible-budget variances for direct materials and direct manufacturing labor. Direct Cost incurred: Actual inputs × actual prices Actual input

> Sunshine Foods manufactures pumpkin scones. For January 2017, it budgeted to purchase and use 14,750 pounds of pumpkin at $0.92 a pound. Actual purchases and usage for January 2017 were 16,000 pounds at $0.85 a pound. Sunshine budgeted for 59,000 pumpkin

> Cascade, Inc., produces the basic fillings used in many popular frozen desserts and treats—vanilla and chocolate ice creams, puddings, meringues, and fudge. Cascade uses standard costing and carries over no inventory from one month to t

> The Clarkson Company produces engine parts for car manufacturers. A new accountant intern at Clarkson has accidentally deleted the company’s variance analysis calculations for the year ended December 31, 2017. The following table is wha

> Bank Management Printers, Inc., produces luxury checkbooks with three checks and stubs perpage. Each checkbook is designed for an individual customer and is ordered through the customer’s bank. The company’s operating budget for September 2017 included t