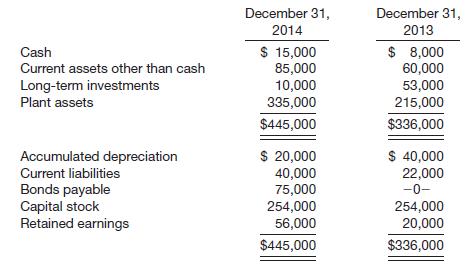

Question: Presented below are data taken from the

Presented below are data taken from the records of Alee Company.

Additional information:

1. Held-to-maturity securities carried at a cost of $43,000 on December 31, 2013, were sold in 2014 for $34,000. The loss (not extraordinary) was incorrectly charged directly to Retained Earnings.

2. Plant assets that cost $50,000 and were 80% depreciated were sold during 2014 for $8,000. The loss (not extraordinary) was incorrectly charged directly to Retained Earnings.

3. Net income as reported on the income statement for the year was $57,000.

4. Dividends paid amounted to $10,000.

5. Depreciation charged for the year was $20,000.

Instructions

Prepare a statement of cash flows for the year 2014 using the indirect method.

Transcribed Image Text:

December 31, December 31, 2014 2013 $ 15,000 85,000 10,000 335,000 $ 8,000 60,000 53,000 215,000 Cash Current assets other than cash Long-term investments Plant assets $445,000 $336,000 Accumulated depreciation Current liabilities Bonds payable Capital stock Retained earnings $ 20,000 40,000 75,000 254,000 56,000 $ 40,000 22,000 -0- 254,000 20,000 $445,000 $336,000

> The accounts below appear in the ledger of Anita Baker Company. Instructions From the postings in the accounts above, indicate how the information is reported on a statement of cash flows by preparing a partial statement of cash flows using the indirect

> A partial trial balance of Julie Hartsack Corporation is as follows on December 31, 2015. Additional adjusting data: 1. A physical count of supplies on hand on December 31, 2015, totaled $1,100. 2. Through oversight, the Salaries and Wages Payable accoun

> The following facts pertain to a noncancelable lease agreement between Alschuler Leasing Company and McKee Electronics, a lessee, for a computer system. The collectibility of the lease payments is reasonably predictable, and there are no important uncert

> Henning Company sponsors a defined benefit pension plan for its employees. The following data relate to the operation of the plan for the year 2014 in which no benefits were paid. 1. The actuarial present value of future benefits earned by employees for

> During 2014, Kate Holmes Co.’s first year of operations, the company reports pretax financial income at $250,000. Holmes’s enacted tax rate is 45% for 2014 and 40% for all later years. Holmes expects to have taxable in

> Jupiter Company sells goods on January 1 that have a cost of $500,000 to Danone Inc. for $700,000, with payment due in 1 year. The cash price for these goods is $610,000, with payment due in 30 days. If Danone paid immediately upon delivery, it would rec

> On January 1, 2013, Phantom Company acquires $200,000 of Spiderman Products, Inc., 9% bonds at a price of $185,589. The interest is payable each December 31, and the bonds mature December 31, 2015. The investment will provide Phantom Company a 12% yield.

> On May 1, 2014, Friendly Company issued 2,000 $1,000 bonds at 102. Each bond was issued with one detachable stock warrant. Shortly after issuance, the bonds were selling at 98, but the fair value of the warrants cannot be determined. Instructions (a) Pre

> Outline the accounting procedures involved in applying the operating method by a lessee.

> State how each of the following items is reflected in the financial statements. (a) Change from FIFO to LIFO method for inventory valuation purposes. (b) Charge for failure to record depreciation in a previous period. (c) Litigation won in current year,

> Presented below are three independent situations. Situation 1: A company offers a one-year warranty for the product that it manufactures. A history of warranty claims has been compiled, and the probable amounts of claims related to sales for a given peri

> Jobim Inc. had the following condensed balance sheet at the end of operations for 2013. During 2014, the following occurred. 1. A tract of land was purchased for $9,000. 2. Bonds payable in the amount of $15,000 were redeemed at par. 3. An additional $10

> Peter Henning Tool Company’s December 31 year-end financial statements contained the following errors. An insurance premium of $66,000 was prepaid in 2014 covering the years 2014, 2015, and 2016. The entire amount was charged to expense

> Winston Industries and Ewing Inc. enter into an agreement that requires Ewing Inc. to build three diesel-electric engines to Winston’s specifications. Upon completion of the engines, Winston has agreed to lease them for a period of 10 years and to assume

> Webb Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2014, the following balances relate to this plan. As a result of the operation of the plan during 2014, the following additional data are provided by the actuary. Instruc

> Taxable income and pretax financial income would be identical for Huber Co. except for its treatments of gross profit on installment sales and estimated costs of warranties. The income computations shown on page 1164 have been prepared. The tax rates in

> Frozen Delight, Inc. charges an initial franchise fee of $75,000 for the right to operate as a franchisee of Frozen Delight. Of this amount, $25,000 is collected immediately. The remainder is collected in 4 equal annual installments of $12,500 each. Thes

> Assume the same information as in E17-3 except that the securities are classified as available-for-sale. The fair value of the bonds at December 31 of each year-end is as follows. Instructions (a) Prepare the journal entry at the date of the bond purchas

> On September 1, 2014, Sands Company sold at 104 (plus accrued interest) 4,000 of its 9%, 10-year, $1,000 face value, nonconvertible bonds with detachable stock warrants. Each bond carried two detachable warrants. Each warrant was for one share of common

> Ace Inc. produces electronic components for sale to manufacturers of radios, television sets, and digital sound systems. In connection with her examination of Ace’s financial statements for the year ended December 31, 2015, Gloria Rodd, CPA, completed fi

> Name three approaches to measuring benefit obligations from a pension plan and explain how they differ.

> The balance sheet data of Brown Company at the end of 2014 and 2013 follow. Land was acquired for $30,000 in exchange for common stock, par $30,000, during the year; all equipment purchased was for cash. Equipment costing $10,000 was sold for $3,000; boo

> The reported net incomes for the first 2 years of Sandra Gustafson Products, Inc., were as follows: 2014, $147,000; 2015, $185,000. Early in 2016, the following errors were discovered. 1. Depreciation of equipment for 2014 was overstated $17,000. 2. Depr

> Cleveland Inc. leased a new crane to Abriendo Construction under a 5-year noncancelable contract starting January 1, 2014. Terms of the lease require payments of $33,000 each January 1, starting January 1, 2014. Cleveland will pay insurance, taxes, and m

> Taveras Enterprises provides the following information relative to its defined benefit pension plan. Instructions (a) Prepare the note disclosing the components of pension expense for the year 2014. (b) Determine the amounts of other comprehensive income

> Novotna Inc.’s only temporary difference at the beginning and end of 2013 is caused by a $3 million deferred gain for tax purposes for an installment sale of a plant asset, and the related receivable (only one-half of which is classified as a current ass

> Schuss Corporation sold equipment to Potsdam Company for $20,000. The equipment is on Schuss’s books at a net amount of $13,000. Schuss collected $10,000 in 2014, $5,000 in 2015, and $5,000 in 2016. If Schuss uses the cost-recovery method, what amount of

> On January 1, 2013, Hi and Lois Company purchased 12% bonds having a maturity value of $300,000 for $322,744.44. The bonds provide the bondholders with a 10% yield. They are dated January 1, 2013, and mature January 1, 2018, with interest receivable Dece

> Illiad Inc. has decided to raise additional capital by issuing $170,000 face value of bonds with a coupon rate of 10%. In discussions with investment bankers, it was determined that to help the sale of the bonds, detachable stock warrants should be issue

> Koch Corporation is in the process of preparing its annual financial statements for the fiscal year ended April 30, 2015. Because all of Koch’s shares are traded intrastate, the company does not have to file any reports with the Securit

> Presented below are data taken from the records of Alee Company. Additional information: 1. Held-to-maturity securities carried at a cost of $43,000 on December 31, 2013, were sold in 2014 for $34,000. The loss (not extraordinary) was incorrectly charged

> Roth Inc. has a deferred tax liability of $68,000 at the beginning of 2015. At the end of 2015, it reports accounts receivable on the books at $90,000 and the tax basis at zero (its only temporary difference). If the enacted tax rate is 34% for all perio

> You have been engaged to review the financial statements of Gottschalk Corporation. In the course of your examination, you conclude that the bookkeeper hired during the current year is not doing a good job. You notice a number of irregularities as follow

> Glaus Leasing Company agrees to lease machinery to Jensen Corporation on January 1, 2014. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic li

> Assume the same information as E19-14, except that at the end of 2013, Jennifer Capriati Corp. had a valuation account related to its deferred tax asset of $45,000. In E19-14 Jennifer Capriati Corp. has a deferred tax asset account with a balance of $150

> At December 31, 2014, Grinkov Corporation had the following account balances. Most of Grinkov’s sales are made on a 2-year installment basis. Indicate how these accounts would be reported in Grinkov’s December 31, 201

> On January 1, 2013, Dagwood Company purchased at par 12% bonds having a maturity value of $300,000. They are dated January 1, 2013, and mature January 1, 2018, with interest receivable December 31 of each year. The bonds are classified in the held-to-mat

> On January 1, 2014, Gottlieb Corporation issued $4,000,000 of 10-year, 8% convertible debentures at 102. Interest is to be paid semiannually on June 30 and December 31. Each $1,000 debenture can be converted into eight shares of Gottlieb Corporation $100

> Matheny Inc. went public 3 years ago. The board of directors will be meeting shortly after the end of the year to decide on a dividend policy. In the past, growth has been financed primarily through the retention of earnings. A stock or a cash dividend h

> You have been engaged to review the financial statements of Gottschalk Corporation. In the course of your examination, you conclude that the bookkeeper hired during the current year is not doing a good job. You notice a number of irregularities as follow

> Presented below are four independent situations. (a) On December 31, 2014, Zarle Inc. sold computer equipment to Daniell Co. and immediately leased it back for 10 years. The sales price of the equipment was $520,000, its carrying amount is $400,000, and

> Under what conditions may a seller who is exposed to continued risks of a high rate of return of the product sold recognize sales transactions as current revenue?

> The following defined pension data of Rydell Corp. apply to the year 2014. Instructions For 2014, prepare a pension worksheet for Rydell Corp. that shows the journal entry for pension expense and the year-end balances in the related pension accounts.

> Jennifer Capriati Corp. has a deferred tax asset account with a balance of $150,000 at the end of 2013 due to a single cumulative temporary difference of $375,000. At the end of 2014, this same temporary difference has increased to a cumulative amount of

> Lazaro Inc. sells goods on the installment basis and uses the installment-sales method. Due to a customer default, Lazaro repossessed merchandise that was originally sold for $800, resulting in a gross profit rate of 40%. At the time of repossession, the

> For the following investments identify whether they are: 1. Trading Securities 2. Available-for-Sale Securities 3. Held-to-Maturity Securities Each case is independent of the other. (a) A bond that will mature in 4 years was bought 1 month ago when the p

> The December 31, 2014, balance sheet of Kepler Corp. is as follows. On March 5, 2015, Kepler Corp. called all of the bonds as of April 30 for the principal plus interest through April 30. By April 30, all bondholders had exercised their conversion to com

> Presented below is the comparative balance sheet for Gilmour Company. Instructions (a) Prepare a comparative balance sheet of Gilmour Company showing the percent each item is of the total assets or total liabilities and stockholders’ eq

> The first audit of the books of Bruce Gingrich Company was made for the year ended December 31, 2015. In examining the books, the auditor found that certain items had been overlooked or incorrectly handled in the last 3 years. These items are: 1. At the

> Assume that on January 1, 2014, Elmer’s Restaurants sells a computer system to Liquidity Finance Co. for $680,000 and immediately leases the computer system back. The relevant information is as follows. 1. The computer was carried on Elmer’s books at a v

> Gingrich Importers provides the following pension plan information. Instructions From the data above, compute the actual return on the plan assets for 2014. Fair value of pension plan assets, January 1, 2014 Fair value of pension plan assets, Decembe

> What are the arguments for giving separate accounting recognition to the conversion feature of debentures?

> At the end of 2013, Lucretia McEvil Company has $180,000 of cumulative temporary differences that will result in reporting future taxable amounts as shown on the next page. Tax rates enacted as of the beginning of 2012 are: McEvil’s tax

> Gordeeva Corporation began selling goods on the installment basis on January 1, 2014. During 2014, Gordeeva had installment sales of $150,000; cash collections of $54,000; cost of installment sales of $102,000. Prepare the company’s entries to record ins

> Hillsborough Co. has an available-for-sale investment in the bonds of Schuyler Corp. with a carrying (and fair) value of $70,000. Hillsborough determined that due to poor economic prospects for Schuyler, the bonds have decreased in value to $60,000. It i

> On January 1, 2013, when its $30 par value common stock was selling for $80 per share, Plato Corp. issued $10,000,000 of 8% convertible debentures due in 20 years. The conversion option allowed the holder of each $1,000 bond to convert the bond into five

> Bradburn Corporation was formed 5 years ago through a public subscription of common stock. Daniel Brown, who owns 15% of the common stock, was one of the organizers of Bradburn and is its current president. The company has been successful, but it current

> Condensed financial data of Pat Metheny Company for 2014 and 2013 are presented below. Additional information: During the year, $70 of common stock was issued in exchange for plant assets. No plant assets were sold in 2014. Instructions Prepare a stateme

> Below is the net income of Anita Ferreri Instrument Co., a private corporation, computed under the three inventory methods using a periodic system. Instructions (Ignore tax considerations.) (a) Assume that in 2015 Ferreri decided to change from the FIFO

> On February 20, 2014, Barbara Brent Inc., purchased a machine for $1,500,000 for the purpose of leasing it. The machine is expected to have a 10-year life, no residual value, and will be depreciated on the straight-line basis. The machine was leased to R

> Andrews Company has five employees participating in its defined benefit pension plan. Expected years of future service for these employees at the beginning of 2014 are as follows. On January 1, 2014, the company amended its pension plan, increasing its p

> The following facts relate to Duncan Corporation. 1. Deferred tax liability, January 1, 2014, $60,000. 2. Deferred tax asset, January 1, 2014, $20,000. 3. Taxable income for 2014, $105,000. 4. Cumulative temporary difference at December 31, 2014, giving

> What are the major types of subsequent events? Indicate how each of the following “subsequent events” would be reported. (a) Collection of a note written off in a prior period. (b) Issuance of a large preferred stock offering. (c) Acquisition of a compan

> Archer Construction Company began work on a $420,000 construction contract in 2014. During 2014, Archer incurred costs of $278,000, billed its customer for $215,000, and collected $175,000. At December 31, 2014, the estimated future costs to complete the

> The following information relates to Starbucks for the year ended October 2, 2011: net income 1,245.7 million; unrealized holding loss of $10.9 million related to available-for-sale securities during the year; accumulated other comprehensive income of $5

> Vargo Company has bonds payable outstanding in the amount of $500,000, and the Premium on Bonds Payable account has a balance of $7,500. Each $1,000 bond is convertible into 20 shares of preferred stock of par value of $50 per share. All bonds are conver

> Cineplex Corporation is a diversified company that operates in five different industries: A, B, C, D, and E. The following information relating to each segment is available for 2015. Sales of segments B and C included intersegment sales of $20,000 and $1

> Data for Brecker Inc. are presented in E23-13. In E23-13 Instructions Prepare a statement of cash flows using the indirect method. BRECKER INC. COMPARATIVE BALANCE SHEET As OF DECEMBER 31, 2014 AND 2013 12/31/14 12/31/13 Cash $ 6,000 $ 7,000 62,000

> Cullen Construction Company, which began operations in 2014, changed from the completed-contract to the percentage-of-completion method of accounting for long-term construction contracts during 2015. For tax purposes, the company employs the completed co

> On January 1, 2014, a machine was purchased for $900,000 by Young Co. The machine is expected to have an 8-year life with no salvage value. It is to be depreciated on a straight-line basis. The machine was leased to St. Leger Inc. on January 1, 2014, at

> The following facts apply to the pension plan of Boudreau Inc. for the year 2014. Instructions Using the preceding data, compute pension expense for the year 2014. As part of your solution, prepare a pension worksheet that shows the journal entry for pen

> At December 31, 2013, Belmont Company had a net deferred tax liability of $375,000. An explanation of the items that compose this balance is as follows. In analyzing the temporary differences, you find that $30,000 of the depreciation temporary differenc

> Guillen, Inc. began work on a $7,000,000 contract in 2014 to construct an office building. Guillen uses the completed-contract method. At December 31, 2014, the balances in certain accounts were Construction in Process $1,715,000; Accounts Receivable $24

> Identify the following items as (1) operating, (2) investing, or (3) financing activities: purchase of land, payment of dividends, cash sales, and purchase of treasury stock.

> Cleveland Company has a stock portfolio valued at $4,000 (available-for-sale). Its cost was $3,300. If the Fair Value Adjustment account has a debit balance of $200, prepare the journal entry at year-end.

> Aubrey Inc. issued $4,000,000 of 10%, 10-year convertible bonds on June 1, 2014, at 98 plus accrued interest. The bonds were dated April 1, 2014, with interest payable April 1 and October 1. Bond discount is amortized semiannually on a straight-line basi

> Peter M. Dell Co. purchased equipment for $510,000 which was estimated to have a useful life of 10 years with a salvage value of $10,000 at the end of that time. Depreciation has been entered for 7 years on a straight-line basis. In 2015, it is determine

> On January 1, 2014, Doug Nelson Co. leased a building to Patrick Wise Inc. The relevant information related to the lease is as follows. 1. The lease arrangement is for 10 years. 2. The leased building cost $4,500,000 and was purchased for cash on January

> Using the information in E20-2, In E20-2 Prepare a pension worksheet inserting January 1, 2014, balances, showing December 31, 2014, balances, and the journal entry recording pension expense. $ 90,000 105,000 10,000 64,000 40,000 640,000 700,000 150

> Felicia Rashad Corporation has pretax financial income (or loss) equal to taxable income (or loss) from 2006 through 2014 as follows. Pretax financial income (loss) and taxable income (loss) were the same for all years since Rashad has been in business.

> Use the information from BE18-7, but assume Turner uses the completed-contract method. In BE18-7 O’Neil, Inc. began work on a $7,000,000 contract in 2014 to construct an office building. O’Neil uses the percentage-of-completion method. At December 31, 2

> Zoop Corporation purchased for $300,000 a 30% interest in Murphy, Inc. This investment enables Zoop to exert significant influence over Murphy. During the year, Murphy earned net income of $180,000 and paid dividends of $60,000. Prepare Zoop’s journal en

> For each of the unrelated transactions described below, present the entry(ies) required to record each transaction. 1. Grand Corp. issued $20,000,000 par value 10% convertible bonds at 99. If the bonds had not been convertible, the company’s investment b

> Edna Millay Inc. is a manufacturer of electronic components and accessories with total assets of $20,000,000. Selected financial ratios for Millay and the industry averages for firms of similar size are presented below. Millay is being reviewed by severa

> Define a change in estimate and provide an illustration. When is a change in accounting estimate effected by a change in accounting principle?

> On January 1, 2011, Jackson Company purchased a building and equipment that have the following useful lives, salvage values, and costs. Building, 40-year estimated useful life, $50,000 salvage value, $800,000 cost Equipment, 12-year estimated useful life

> Laura Leasing Company signs an agreement on January 1, 2014, to lease equipment to Plote Company. The following information relates to this agreement. 1. The term of the noncancelable lease is 5 years with no renewal option. The equipment has an estimate

> The following information is available for the pension plan of Radcliffe Company for the year 2014. Instructions (a) Compute pension expense for the year 2014. (b) Prepare the journal entry to record pension expense and the employer’s c

> The pretax financial income (or loss) figures for Jenny Spangler Company are as follows. Pretax financial income (or loss) and taxable income (loss) were the same for all years involved. Assume a 45% tax rate for 2009 and 2010 and a 40% tax rate for the

> O’Neil, Inc. began work on a $7,000,000 contract in 2014 to construct an office building. O’Neil uses the percentage-of-completion method. At December 31, 2014, the balances in certain accounts were Construction in Process $2,450,000; Accounts Receivable

> Fairbanks Corporation purchased 400 shares of Sherman Inc. common stock as an available for-sale investment for $13,200. During the year, Sherman paid a cash dividend of $3.25 per share. At yearend, Sherman stock was selling for $34.50 per share. Prepare

> Ferraro, Inc. established a stock-appreciation rights (SAR) program on January 1, 2014, which entitles executives to receive cash at the date of exercise for the difference between the market price of the stock and the pre-established price of $20 on 5,0

> Picasso Company is a wholesale distributor of professional equipment and supplies. The company’s sales have averaged about $900,000 annually for the 3-year period 2012–2014. The firm’s total assets at

> Joy Cunningham Co. purchased a machine on January 1, 2012, for $550,000. At that time, it was estimated that the machine would have a 10-year life and no salvage value. On December 31, 2015, the firm’s accountant found that the entry for depreciation exp

> Morgan Leasing Company signs an agreement on January 1, 2014, to lease equipment to Cole Company. The following information relates to this agreement. 1. The term of the noncancelable lease is 6 years with no renewal option. The equipment has an estimate

> Explain the distinction between a direct-financing lease and a sales-type lease for a lessor.

> Veldre Company provides the following information about its defined benefit pension plan for the year 2014. Instructions Compute the pension expense for the year 2014. $ 90,000 105,000 10,000 64,000 40,000 640,000 700,000 150,000 Service cost Contrib

> Button Company has the following two temporary differences between its income tax expense and income taxes payable. The income tax rate for all years is 40%. Instructions (a) Assuming there were no temporary differences prior to 2014, prepare the journal

> Turner, Inc. began work on a $7,000,000 contract in 2014 to construct an office building. During 2014, Turner, Inc. incurred costs of $1,700,000, billed its customers for $1,200,000, and collected $960,000. At December 31, 2014, the estimated future cost

> Fairbanks Corporation purchased 400 shares of Sherman Inc. common stock as an available for-sale investment for $13,200. During the year, Sherman paid a cash dividend of $3.25 per share. At yearend, Sherman stock was selling for $34.50 per share. Prepare