Question: Presented below is information related to Rizzo

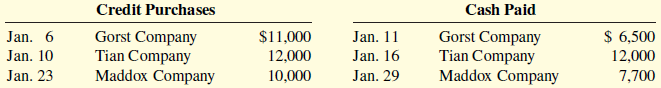

Presented below is information related to Rizzo Company for its first month of operations.

Determine the balances that appear in the accounts payable subsidiary ledger. What Accounts

Payable balance appears in the general ledger at the end of January?

Transcribed Image Text:

Credit Purchases Cash Paid Jan. 6 $ 6,500 Gorst Company Tian Company Maddox Company $11,000 12,000 Gorst Company Tian Company Maddox Company Jan. 11 Jan. 10 Jan. 16 12,000 Jan. 23 10,000 Jan. 29 7,700

> A new accountant at Wyne Inc. is trying to identify which of the amounts shown below should be reported as the current asset “Cash and cash equivalents” in the year-end balance sheet, as of April 30, 2020. 1. $60 of currency and coin in a locked box used

> Wynn Company has recorded the following items in its financial records. Cash in bank ………………...………………...$ 42,000 Cash in plant expansion fund ……………100,000 Cash on hand ………………...………………..12,000 Highly liquid investments ………………...34,000 Petty cash ………………...…

> The cash records of Dawes Company show the following four situations. For July: 1. The June 30 bank reconciliation indicated that deposits in transit total $920. During July, the general ledger account Cash shows deposits of $15,750, but the bank stateme

> The information below relates to the Cash account in the ledger of Minton Company. Balance September 1—$17,150; Cash deposited—$64,000. Balance September 30—$17,404; Checks written—$

> The following information pertains to Crane Video Company. 1. Cash balance per bank, July 31, $7,263. 2. July bank service charge not recorded by the depositor $28. 3. Cash balance per books, July 31, $7,284. 4. Deposits in transit, July 31, $1,300. 5. B

> On April 30, the bank reconciliation of Westbrook Company shows three outstanding checks: no. 254, $650; no. 255, $620; and no. 257, $410. The May bank statement and the May cash payments journal show the following. Instructions Using Step 2 in the rec

> Hasselback Company has the following selected transactions during March. Mar. 2 Purchased equipment costing $7,400 from Bole Company on account. 5 Received credit of $410 from Carwell Company for merchandise damaged in shipment to Hasselback. 7 Issued c

> Francisco Company uses the columnar cash journals illustrated in the textbook. In April, the following selected cash transactions occurred. 1. Made a refund to a customer as an allowance for damaged goods. 2. Received collection from customer within the

> R. Santiago Co. uses special journals and a general journal. The following transactions occurred during May 2020. May 1 R. Santiago invested $40,000 cash in the business. 2 Sold merchandise to Lawrie Co. for $6,300 cash. The cost of the merchandise sold

> Gomes Company uses special journals and a general journal. The following transactions occurred during September 2020. Sept. 2 Sold merchandise on account to H. Drew, invoice no. 101, $620, terms n/30. The cost of the merchandise sold was $420. 10 Purchas

> What is the major advantage and the major disadvantage of the specific identification method of inventory costing?

> Pennington Company has a balance in its Accounts Payable control account of $9,250 on January 1, 2020. The subsidiary ledger contains three accounts: Hale Company, balance $3,000; Janish Company, balance $1,875; and Valdez Company. During January, the fo

> Kieschnick Company has a balance in its Accounts Receivable control account of $10,000 on January 1, 2020. The subsidiary ledger contains three accounts: Bixler Company, balance $4,000; Cuddyer Company, balance $2,500; and Freeze Company. During January,

> Presented below is the subsidiary accounts receivable account of Jill Longley. Instructions Write a memo to Sara Fogelman, chief financial officer, that explains each transaction. Date Ref. Debit Credit Balance 2020 Sept. 2 S31 61,000 61,000 9 G4 1

> Selected account balances for Hulse Company at January 1, 2020, are presented below. Accounts Payable………………...$14,000 Accounts Receivable……………22,000 Cash………………...………………...17,000 Inventory………………...…………..13,500 Hulse’s sales journal for January shows a tot

> Tresh Products uses both special journals and a general journal as described in this chapter. Tresh also posts customers’ accounts in the accounts receivable subsidiary ledger. The postings for the most recent month are included in the

> Selected accounts from the ledgers of Youngblood Company at July 31 showed the following. Instructions From the data prepare: a. The single-column purchases journal for July. b. The general journal entries for July. GENERAL LEDGER Equipment No. 15

> The general ledger of Hensley Company contained the following Accounts Payable control account (in T-account form). Also shown is the related subsidiary ledger. Instructions a. Indicate the missing posting reference and amount in the control account, a

> The following are some typical transactions incurred by Ricketts Company. 1. Payment of creditors on account. 2. Return of merchandise sold for credit. 3. Collection on account from customers. 4. Sale of land for cash. 5. Sale of merchandise on account.

> Kicks Shoe Store uses the retail inventory method for its two departments, Women’s Shoes and Men’s Shoes. The following information for each department is obtained. Instructions Compute the estimated cost of the endi

> The inventory of Hang Company was destroyed by fi re on March 1. From an examination of the accounting records, the following data for the first 2 months of the year are obtained: Sales Revenue $51,000, Sales Returns and Allowances $1,000, Purchases $31,

> Leah Clement believes that the allocation of cost of goods available for sale should be based on the actual physical flow of the goods. Explain to Leah why this may be both impractical and inappropriate.

> Shereen Company reported the following information for November and December 2020. Shereen’s ending inventory at December 31 was destroyed in a fire. Instructions a. Compute the gross profit rate for November. b. Using the gross prof

> Information about Elsa’s Boards is presented in E6.5. Additional data regarding Elsa’s sales of Xpert snowboards are provided below. Assume that Elsa’s uses a perpetual inventory system. Instruction

> Moath Company reports the following for the month of June. Instructions a. Calculate the cost of the ending inventory and the cost of goods sold for each cost fl ow assumption, using a perpetual inventory system. Assume a sale of 440 units occurred on

> Ehrhart Appliance uses a perpetual inventory system. For its flat-screen television sets, the January 1 inventory was 3 sets at $600 each. On January 10, Ehrhart purchased 6 units at $660 each. The company sold 2 units on January 8 and 5 units on January

> The cost of goods sold computations for Sooner Company and Later Company are shown below. Instructions a. Compute inventory turnover (round to two decimal places) and days in inventory (round to nearest day) for each company. b. Which company moves its

> This information is available for Abdullah’s Photo Corporation for 2018, 2019, and 2020. Instructions Calculate inventory turnover (round to two decimal places), days in inventory (round to one decimal place), and gross profit rate (f

> Charapata Company applied FIFO to its inventory and got the following results for its ending inventory. Cameras 100 units at a cost per unit of $65 Blu-ray players 150 units at a cost per unit of $75 iPods 125 units at a cost per unit of $80 The ne

> Freeze Frame Camera Shop uses the lower-of-cost-or-net realizable value basis for its inventory. The following data are available at December 31. Instructions Determine the amount of the ending inventory by applying the lower-of-cost-or-net realizable

> Smart Watch Company reported the following income statement data for a 2-year period. Smart uses a periodic inventory system. The inventories at January 1, 2019, and December 31, 2020, are correct. However, the ending inventory at December 31, 2019, wa

> Elliott’s Hardware reported cost of goods sold as follows. Elliott’s made two errors: (1) 2019 ending inventory was overstated $3,000, and (2) 2020 ending inventory was understated $5,000. Instructions Compute the c

> Texaco Oil Company issues its own credit cards. Assume that Texaco charges you $40 interest on an unpaid balance. Prepare the journal entry that Texaco makes to record this revenue.

> Inventory data for Moath Company are presented in E6.7. Instructions a. Compute the cost of the ending inventory and the cost of goods sold using the average-cost method. b. Will the results in (a) be higher or lower than the results under (1) FIFO and

> Shawn Company had 100 units in beginning inventory at a total cost of $10,000. The company purchased 200 units at a total cost of $26,000. At the end of the year, Shawn had 75 units in ending inventory. Instructions a. Compute the cost of the ending inv

> Moath Company reports the following for the month of June. Instructions a. Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO and (2) LIFO. b. Which costing method gives the higher ending inventory? Why? c. Which method

> Ballas Co. uses a periodic inventory system. Its records show the following for the month of May, in which 68 units were sold. Instructions Compute the ending inventory at May 31 and cost of goods sold using the FIFO and LIFO methods. Prove the amount

> The accounting records of Americo Electronics show the following data. Beginning inventory 3,000 units at $5 Purchases 8,000 units at $7 Sales 9,400 units at $10 Determine cost of goods sold during the period under a periodic inventory system us

> Gresa Company just took its physical inventory. The count of inventory items on hand at the company’s business locations resulted in a total inventory cost of $300,000. In reviewing the details of the count and related inventory transactions, you have di

> For 2020, Sale Company reported beginning total assets of $300,000 and ending total assets of $340,000. Its net income for this period was $50,000, and its net sales were $400,000. Compute the company’s asset turnover for 2020.

> Napoli Manufacturing has old equipment that cost $52,000. The equipment has accumulated depreciation of $28,000. Napoli has decided to sell the equipment.

> Lofton Company purchased a delivery truck. The total cash payment was $27,900, including the following items. Negotiated purchase price ………………………………….. $24,000 Installation of special shelving ………………………………… 1,100 Painting and lettering ……………………………………………

> In 2020, Wainwright Company has net credit sales of $1,300,000 for the year. It had a beginning accounts receivable (net) balance of $101,000 and an ending accounts receivable (net) balance of $107,000. Compute Wainwright Company’s (a) accounts receivabl

> Topp Hat Shop received a shipment of hats for which it paid the wholesaler $2,970. The price of the hats was $3,000 but Topp was given a $30 cash discount and required to pay freight charges of $50. What amount will Topp record for inventory? Why?

> Gentry Wholesalers accepts from Benton Stores a $6,200, 4-month, 9% note dated May 31 in settlement of Benton’s overdue account. (a) What is the maturity date of the note? (b) What is the interest payable at the maturity date?

> Indicate whether each of the following statements is true or false. 1. A company has the following assets at the end of the year: cash on hand $40,000, cash refund due from customer $30,000, and checking account balance $22,000. Cash and cash equivalents

> Roger Richman owns Richman Blankets. He asks you to explain how he should treat the following reconciling items when reconciling the company’s bank account. 1. Outstanding checks. 2. A deposit in transit. 3. The bank charged to the company account a chec

> Identify which control activity is violated in each of the following situations, and explain how the situation creates an opportunity for fraud or inappropriate accounting practices. 1. Once a month, the sales department sends sales invoices to the accou

> Hinske Company had the following transactions during April. 1. Sold merchandise on account. 2. Purchased merchandise on account. 3. Collected cash from a sale to Renfro Company. 4. Recorded accrued interest on a note payable. 5. Paid $2,000 for supplies.

> Indicate whether the following statements are true or false. If false, indicate how to correct the statement. 1. A computerized accounting system must be customized to meet a company’s needs. 2. Companies with revenues of less than $5 million and up to 2

> Vanida Company understated its 2019 ending inventory by $27,000. Determine the impact this error has on ending inventory, cost of goods sold, and owner’s equity in 2019 and 2020.

> You and several classmates are studying for the next accounting exam. They ask you to answer the following questions: 1. If cash is borrowed on a $70,000, 9-month, 6% note on August 1, how much interest expense would be incurred by December 31? 2. The ca

> Medlen Company, has the following account balances at December 31, 2020. Notes payable ($60,000 due after 12/31/21) …………………………….. $100,000 Unearned service revenue ………………………………………………………….. 70,000 Other long-term debt ($90,000 due in 2021) …………………………….. 2

> Early in 2020, Yeng Company switched to a just-in-time inventory system. Its sales revenue, cost of goods sold, and inventory amounts for 2019 and 2020 are shown below. Determine the inventory turnover and days in inventory for 2019 and 2020. Discuss t

> In its first month of operations, Weatherall Company made three purchases of merchandise in the following sequence: (1) 300 units at $6, (2) 400 units at $7, and (3) 200 units at $8. Assuming there are 380 units on hand, compute the cost of the ending in

> Record the following transactions on the books of RAS Co. a. On July 1, RAS Co. sold merchandise on account to Waegelein Inc. for $17,200, terms 2/10, n/30. b. On July 8, Waegelein Inc. returned merchandise worth $3,800 to RAS Co. c. On July 11, Waegelei

> Peosta Company identifies the following items for possible inclusion in the taking of a physical inventory. Indicate whether each item should be included or excluded from the inventory taking. a. Goods shipped on consignment by Peosta to another company.

> In January, gross earnings in Lugo Company totaled $80,000. All earnings are subject to 7.65% FICA taxes, 5.4% state unemployment taxes, and 0.8% federal unemployment taxes. Prepare the entry to record January payroll tax expense.

> Data for Beth Corbin are presented in BE11.7. Prepare the journal entries to record (a) Beth’s pay for the period and (b) the payment of Beth’s wages. Use January 15 for the end of the pay period and the payment date.

> Beth Corbin’s regular hourly wage rate is $16, and she receives an hourly rate of $24 for work in excess of 40 hours. During a January pay period, Beth works 45 hours. Beth’s federal income tax withholding is $95, she has no voluntary deductions, and the

> On December 1, Bruney Company introduces a new product that includes a one-year warranty on parts. In December, 1,000 units are sold. Management believes that 5% of the units will be defective and that the average warranty costs will be $90 per unit. Pre

> Yahoo! Inc.’s recent financial statements contain the following selected data (in thousands). Compute (a) working capital and (b) current ratio. Current assets $ 4,594,772 Current liabilities $1,717,728 2,417,394 Total assets 14,9

> Derby University sells 4,000 season basketball tickets at $210 each for its 12 game home schedule. Give the entry to record (a) the sale of the season tickets and (b) the revenue recognized by playing the first home game.

> Coghlan Auto Supply does not segregate sales and sales taxes at the time of sale. The register total for March 16 is $16,380. All sales are subject to a 5% sales tax. Compute sales taxes payable, and make the entry to record sales taxes payable and sales

> Cody Company sells three different categories of tools (small, medium, and large). The cost and net realizable value of its inventory of tools are as follows. Determine the value of the company’s inventory under the lower-of-cost-or-n

> Peralta Company borrows $60,000 on July 1 from the bank by signing a $60,000, 10%, one-year note payable. a. Prepare the journal entry to record the proceeds of the note. b. Prepare the journal entry to record accrued interest at December 31, assuming ad

> At Ward Company, employees are entitled to one day’s vacation for each month worked. In January, 70 employees worked the full month. Record the vacation pay liability for January, assuming the average daily pay for each employee is $120.

> Swenson Company has the following payroll procedures. a. Supervisor approves overtime work. b. The human resources department prepares hiring authorization forms for new hires. c. A second payroll department employee verifies payroll calculations. d. The

> Jamison Company has the following obligations at December 31: (a) a note payable for $100,000 due in 2 years, (b) a 10-year mortgage payable of $300,000 payable in ten $30,000 annual payments, (c) interest payable of $15,000 on the mortgage, and (d) acco

> Prepare journal entries to record the following. a. Sound Tracker Company retires its delivery equipment, which cost $41,000. Accumulated depreciation is also $41,000 on this delivery equipment. No salvage value is received. b. Assume the same informat

> On January 1, 2020, the Morgantown Company ledger shows Equipment $32,000 and Accumulated Depreciation—Equipment $9,000. The depreciation resulted from using the straight-line method with a useful life of 10 years and salvage value of $2,000. On this dat

> Rosco Taxi Service uses the units-of-activity method in computing depreciation on its taxicabs. Each cab is expected to be driven 150,000 miles. Taxi no. 10 cost $39,500 and is expected to have a salvage value of $500. Taxi no. 10 is driven 30,000 miles

> Depreciation information for Corales Company is given in BE10.4. Assuming the declining-balance depreciation rate is double the straight-line rate, compute annual depreciation for the first and second years under the declining-balance method. Data From

> Chisenhall Company purchased land and a building on January 1, 2020. Management’s best estimate of the value of the land was $100,000 and of the building $200,000. However, management told the accounting department to record the land at $220,000 and the

> Corales Company acquires a delivery truck at a cost of $38,000. The truck is expected to have a salvage value of $6,000 at the end of its 4-year useful life. Compute annual depreciation expense for the first and second years using the straight-line metho

> a. Jovad Company ships merchandise to Martin Company on December 30. The merchandise reaches the buyer on January 6. Indicate the terms of sale that will result in the goods being included in (1) Jovad’s December 31 inventory, and (2) Martin’s December 3

> Flaherty Company had the following two transactions related to its delivery truck. 1. Paid $45 for an oil change. 2. Paid $400 to install special gear unit, which increases the operating efficiency of the truck. Prepare Flaherty’s journal entries to reco

> Rich Castillo Company incurs the following expenditures in purchasing a truck: cash price $30,000, accident insurance $2,000, sales taxes $2,100, motor vehicle license $100, and painting and lettering $400. What is the cost of the truck?

> Assume the same information as BE10.15, except that the fair value of the old delivery equipment is $33,000. Prepare the entry to record the exchange.

> Olathe Company exchanges old delivery equipment for new delivery equipment. The book value of the old delivery equipment is $31,000 (cost $61,000 less accumulated depreciation $30,000). Its fair value is $24,000, and cash of $5,000 is paid. Prepare the e

> In a recent annual report, Target reported beginning total assets of $44.1 billion, ending total assets of $44.5 billion, and net sales of $63.4 billion. Compute Target’s asset turnover.

> Information related to plant assets, natural resources, and intangibles at the end of 2020 for Dent Company is as follows: buildings $1,100,000, accumulated depreciation—buildings $600,000, goodwill $410,000, coal mine $500,000, and accumulated depletion

> Campanez Company purchases a patent for $140,000 on January 2, 2020. Its estimated useful life is 10 years. a. Prepare the journal entry to record amortization expense for the first year. b. Show how this patent is reported on the balance sheet at the en

> Franceour Mining Co. purchased for $7 million a mine that is estimated to have 35 million tons of ore and no salvage value. In the first year, 5 million tons of ore are extracted. a. Prepare the journal entry to record depletion for the first year. b. Sh

> Gunkelson Company sells equipment on September 30, 2020, for $18,000 cash. The equipment originally cost $72,000 and as of January 1, 2020, had accumulated depreciation of $42,000. Depreciation for the first 9 months of 2020 is $5,250. Prepare the journa

> The following expenditures were incurred by McCoy Company in purchasing land: cash price $50,000, accrued taxes $3,000, attorneys’ fees $2,500, real estate broker’s commission $2,000, and clearing and grading $3,500. What is the cost of the land?

> In January, the payroll supervisor determines that gross earnings for Carlyle Company are $120,000. All earnings are subject to 7.65% FICA taxes, 5.4% state unemployment taxes, and 0.8% federal unemployment taxes. Record the employer’s payroll taxes.

> Compute interest and find the maturity date for the following notes. Date of Note Principal Interest Rate (%) Terms 6% 60 days 90 days 75 days a. June 10 $80,000 July 14 April 27 7% 8% b. $64,000 с. $12,000

> Presented below are two independent transactions. a. Tony’s Restaurant accepted a Visa card in payment of a $175 lunch bill. The bank charges a 4% fee. What entry should Tony’s make? b. Larkin Company sold its accounts receivable of $60,000. What entry s

> Kingston Co. uses the percentage-of-receivables basis to record bad debt expense. It estimates that 1% of accounts receivable will become uncollectible. Accounts receivable are $420,000 at the end of the year, and the allowance for doubtful accounts has

> Assume the same information as BE9.4. On March 4, 2021, Carpenter Co. receives payment of $6,200 in full from Megan Gray. Prepare the journal entries to record this transaction. Information from BE 9.4: At the end of 2020, Carpenter Co. has accounts rec

> At the end of 2020, Carpenter Co. has accounts receivable of $700,000 and an allowance for doubtful accounts of $54,000. On January 24, 2021, the company learns that its receivable from Megan Gray is not collectible, and management authorizes a write-off

> Financial Statement During its fi rst year of operations, Gavin Company had credit sales of $3,000,000; $600,000 remained uncollected at year-end. The credit manager estimates that $31,000 of these receivables will become uncollectible. a. Prepare the jo

> The financial statements of Minnesota Mining and Manufacturing Company (3M) report net sales of $20.0 billion. Accounts receivable (net) are $2.7 billion at the beginning of the year and $2.8 billion at the end of the year. Compute 3M’s accounts receivab

> On January 10, 2020, Perez Co. sold merchandise on account to Robertsen Co. for $15,600, n/30. On February 9, Robertsen Co. gave Perez Co. a 10% promissory note in settlement of this account. Prepare the journal entry to record the sale and the settlemen

> Presented below are three receivables transactions. Indicate whether these receivables are reported as accounts receivable, notes receivable, or other receivables on a balance sheet. a. Sold merchandise on account for $64,000 to a customer. b. Received a

> Identify the special journal(s) in which the following column headings appear. a. Sales Discounts Dr. d. Sales Revenue Cr. b. Accounts Receivable Cr. e. Inventory Dr. c. Cash Dr.

> In January, gross earnings in Burrell Company were $80,000. All earnings are subject to 7.65% FICA taxes. Federal income tax withheld was $14,000, and state income tax withheld was $1,600. (a) Calculate net pay for January, and (b) record the payroll.

> The key to successful business operations is effective inventory management.” Do you agree? Explain.

> The comparative balance sheets of Sally Fagan Design Studio, Inc., at June 30, 2016, and 2015, and transaction data for fiscal 2016, are as follows: Transaction data for the year ended June 30, 2016, follows: a. Net income, $70,600 b.