Question: Presented here is selected information from the

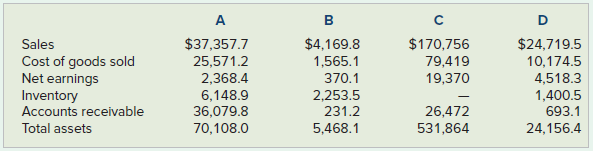

Presented here is selected information from the 2018 fiscal-year 10-K reports of four companies. The four companies, in alphabetical order, are:

AT&T, Inc., a company that provides communications and digital entertainment;

Deere & Company, a manufacturer of heavy machinery;

Starbucks, a company that sells coffee products; and

Tiffany & Company, a company that operates high-end jewelry and department stores.

The data for the companies, presented in the order of the amount of their sales in millions of dollars, are as follows.

Required

a. Divide the class into groups of four or five students per group and then organize the groups into four sections. Assign Task 1 to the first section of groups, Task 2 to the second section, Task 3 to the third section, and Task 4 to the fourth section.

Group Tasks

(1) Assume that you represent AT&T. Identify the set of financial data (Column A, B, C, or D) that relates to your company.

(2) Assume that you represent Deere. Identify the set of financial data (Column A, B, C, or D) that relates to your company.

(3) Assume that you represent Starbucks. Identify the set of financial data (Column A, B, C, or D) that relates to your company.

(4) Assume that you represent Tiffany. Identify the set of financial data (Column A, B, C, or D) that relates to your company.

Hint: In addition to the ratios presented in this chapter, you might also find it useful to compute a ratio from the first course of accounting, the gross margin percentage (Gross margin ÷ Sales).

b. Select a representative from each section. Have the representative explain the rationale for the group’s selection. The explanation should include a set of ratios that support the group’s conclusion.

> The Shirt Shop had the following transactions for T-shirts for Year 1, its first year of operations: During the year, The Shirt Shop sold 810 T-shirts for $20 each. Required a. Compute the amount of ending inventory The Shirt Shop would report on the bal

> The following information pertains to Mason Company for Year 2: Ending inventory consisted of 30 units. Mason sold 370 units at $90 each. All purchases and sales were made with cash. Operating expenses amounted to $4,100. Required a. Compute the gross ma

> For each of the following events, indicate whether the freight terms are FOB destination or FOB shipping point. a. Sold merchandise and the buyer paid the transportation costs. b. Purchased merchandise and the seller paid the transportation costs. c. Sol

> Powell Company began the Year 3 accounting period with $40,000 cash, $86,000 inventory, $60,000 common stock, and $66,000 retained earnings. During Year 3, Powell experienced the following events: 1. Sold merchandise costing $58,000 for $99,500 on accoun

> Obtain Target Corporation’s annual report for its 2018 fiscal year (year ended February 2, 2019) at http://investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. What was Target’s debt-to-assets ratio

> The following information was taken from the accounts of Green Market, a small grocery store, at December 31, Year 1. The accounts are listed in alphabetical order, and all have normal balances. Dollar amounts are given in thousands. Required First, prep

> The beginning account balances for Terry’s Auto Shop as of January 1, Year 2, follow: The following events affected the company during the Year 2 accounting period: 1. Purchased merchandise on account that cost $15,000. 2. The goods in

> Clark Bell started a personal financial planning business when he accepted $36,000 cash as advance payment for managing the financial assets of a large estate. Bell agreed to manage the estate for a one-year period beginning June 1, Year 1. Required a. S

> The following information was drawn from the Year 5 balance sheets of two companies: During Year 5, Butler’s net income was $25,200, while Lynch’s net income was $43,200. Required a. Compute the return-on-equity ratio

> On January 1, Year 2, LCJ Rental Cars purchased a car that is to be used to produce rental income. The car cost $35,000. It has an expected useful life of five years and a $5,000 salvage value. The car produced rental income of $9,000 per year throughout

> Indicate whether each of the following statements is true or false: a. The unearned revenue account appears on the income statement. b. Supplies expense appears on the statement of cash flows. c. Prepaid rent appears on the balance sheet. d. The book val

> The following is a partial list of transactions Bok Company experienced during its Year 3 accounting period: 1. Paid cash to purchase supplies. 2. Paid cash to purchase insurance coverage for the coming year. 3. Collected cash for services to be performe

> Composite Fabricators, Inc. is a U.S.-based company that develops its financial statements under GAAP. The total amount of the company’s assets shown on its balance sheet for the current year was approximately $370 million. The president of Composite Fab

> Match the financial statements with the appropriate statement to describe them.

> Ortho Company experienced the following events during its first- and second-year operations: Year 1 Transactions: 1. Acquired $68,000 cash from the issue of common stock. 2. Borrowed $36,000 cash from the National Credit Union. 3. Earned $59,000 of cash

> The following data are based on information in the 2018 annual report of Cracker Barrel Old Country Store. As of August 3, 2018, Cracker Barrel operated 655 restaurants and gift shops in 45 states. Dollar amounts are in thousands. Required a. Calculate t

> As of January 1, Year 2, Room Designs Inc. had a balance of $9,900 in Cash, $3,500 in Common Stock, and $6,400 in Retained Earnings. These were the only accounts with balances on January 1, Year 2. During the Year 2 accounting period, the company had (1)

> Identify whether each of the following items would appear on the income statement (IS), statement of changes in stockholders’ equity (SE), balance sheet (BS), or statement of cash flows (CF). Some items may appear on more than one statement; if so, ident

> The following transactions pertain to the operations of Ewing Company for Year 2: 1. Acquired $30,000 cash from the issue of common stock. 2. Provided $65,000 of services on account. 3. Paid $22,000 cash on accounts payable. 4. Performed services for $8,

> During Year 6, Kincaid, Inc. earned $85,000 of cash revenue. The company incurs all operating expenses on account. The Year 6 beginning balance in Kincaid’s accounts payable account was $2,000, while the ending balance was $25,000. The company made cash

> Harbert, Inc. had a beginning balance of $12,000 in its Accounts Receivable account. The ending balance of Accounts Receivable was $10,500. During the period, Harbert collects $72,000 of its accounts receivable. Harbert incurred $63,000 of cash expenses

> Determine the missing amounts in each of the following four independent scenarios: a. X Co. had a $4,700 beginning balance in accounts payable on January 1, Year 8. During Year 8, the company incurred $67,600 of operating expenses on account and paid $68

> In Year 1, Lee Inc. billed its customers $62,000 for services performed. The company collected $51,000 of the amount billed. Lee incurred $39,000 of other operating expenses on account, and paid $31,000 of the accounts payable. It acquired $40,000 cash f

> Ollie Company experienced the following events during its first-year operations: 1. Acquired $72,000 cash from the issue of common stock. 2. Borrowed $26,000 from the First City Bank. 3. Earned $59,000 of cash revenue. 4. Incurred $43,000 of cash expense

> At the end of Year 1, Emma, Inc. had $600 of cash, $400 of liabilities, $200 of common stock, and zero in retained earnings. During Year 2, the company generated $560 of cash revenue and incurred $900 of cash expenses. Required Based on this information,

> Ollie Company experienced the following events during its first-year operations: 1. Acquired $72,000 cash from the issue of common stock. 2. Borrowed $26,000 from the First City Bank. 3. Earned $59,000 of cash revenue. 4. Incurred $43,000 of cash expense

> The following information is drawn from the accounting records of Kristy Company: Divide the class into groups of four or five students. Organize the groups into four sections. Assign each section of groups the following tasks: Required Group Tasks Sec

> Determine the missing amounts in each of the following four independent scenarios: a. X Co. had a $4,500 beginning balance in accounts receivable on January 1, Year 4. During Year 4, the company earned $69,400 of revenue on account and collected $68,200

> Both balance sheets shown in the following table were dated as of December 31, Year 3. Required a. Based only on the information shown in the balance sheets, can Allen Co. pay a $2,000 cash dividend? b. Based only on the information shown in the balance

> Jones Enterprises was started on January 1, Year 1, when it acquired $6,000 cash from creditors and $10,000 from owners. The company immediately purchased land that cost $12,000. The land purchase was the only transaction occurring during Year 1. Require

> This exercise continues the scenario described in Exercise 1-11A shown earlier. Specifically, the Better Corp. Year 1 ending balances become the Year 2 beginning balances. These balances are shown in the following accounting equation. Better Corp. comple

> Better Corp. (BC) began operations on January 1, Year 1. During Year 1, BC experienced the following accounting events: 1. Acquired $7,000 cash from the issue of common stock. 2. Borrowed $12,000 cash from the State Bank. 3. Collected $47,000 cash as a r

> Cordell Inc. experienced the following events in Year 1, its first year of operation: 1. Received $40,000 cash from the issue of common stock. 2. Performed services on account for $82,000. 3. Paid a $6,000 cash dividend to the stockholders. 4. Collected

> Riley Company paid $60,000 cash to purchase land from Clay Company. Clay originally paid $60,000 for the land. Required a. Did this event cause the balance in Riley’s cash account to increase, decrease, or remain unchanged? b. Did this event cause the ba

> Milea Inc. experienced the following events in Year 1, its first year of operations: 1. Received $20,000 cash from the issue of common stock. 2. Performed services on account for $56,000. 3. Paid the utility expense of $2,500. 4. Collected $48,000 of the

> On June 1, Year 1, Hamlin, Inc. paid $12,000 for 12 months rent on its warehouse in Huntsville, Alabama. In addition, on October 1, Year 1, Hamlin paid $3,000 for a one-year insurance policy on the warehouse. Hamlin’s reporting period ends on December 31

> Troy Company earned $15,000 of cash revenue. Troy incurred $12,000 of utility expense on account during Year 1. The company made cash payments of $8,000 to reduce its accounts payable during Year 1. Required Based on this information alone, determine the

> Obtain Target Corporation’s annual report for its 2018 fiscal year (year ended February 2, 2019) at http://investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. Which accounts on Target’s balance shee

> The Containers Inc. experienced the following events during its first year of operations, Year 1: 1. Acquired $42,000 cash by issuing common stock. 2. Earned $25,000 revenue on account. 3. Paid $18,000 cash for operating expenses. 4. Borrowed $10,000 cas

> Selected data from Emporia Company follow: Required Compute the following and round computations to two decimal points: a. The accounts receivable turnover for Year 3. b. The inventory turnover for Year 3. c. The net margin for Year 2.

> The following balances were drawn from the accounts of Carter Company. The accounts and balances shown here are presented in random order: Equipment–$14,000; Cash–$25,000; Depreciation Expense–$7,000; Notes Payable–$22,000; Common Stock–$41,000; Accumula

> The following information was drawn from the accounting records of Chapin Company. 1. On January 1, Year 1, Chapin paid $56,000 cash to purchase a truck. The truck had a five-year useful life and a $6,000 salvage value. 2. As of December 31, Year 1, Chap

> Explain how each of the following posting errors affects a trial balance. State whether the trial balance will be out of balance because of the posting error, and indicate which side of the trial balance will have a higher amount after each independent e

> In July 2015, H. J. Heinz Company and Kraft Foods Group completed their merger. The new company, named The Kraft Heinz Company (KHC), became the fifth largest food and beverage company in the world. Prior to the merger, Kraft had been much larger than He

> J. Talbot is the accounting manager for Kolla Waste Disposal Corporation. Kolla is having its worst financial year since its inception. The company is expected to report a net loss. In the midst of such bad news, Ms. Talbot surprised the company presiden

> The following ratios are for four companies in different industries. Some of these ratios have been discussed in the textbook and others have not, but their names explain how the ratio was computed. The four sets of ratios, presented randomly, are as fol

> Presented as follows are 12 financial ratios for two companies in separate industries. Ford Motor Company manufactures automobiles and sells them to retail dealers. AutoZone, Inc. sells automobile parts and car-care products directly to consumers. Requir

> Presented as follows are 12 financial ratios for two companies in the sane industry. Colgate-Palmolive Co. (Colgate) and Procter & Gamble Co. (P&G). Both of these companies sell health, beauty, and other household consumer goods. Required a. Dete

> Corola Corporation reported $34,000 of net income and $25,000 of net cash flow from operating activities. All revenue is earned on account. Required Write a brief memo that explains how earning revenue on account could have caused the difference between

> The following information relates to Home Depot, Inc., and Lowe’s Companies, Inc. for their 2017 and 2016 fiscal years. Required a. Compute the following ratios for the companies’ 2017 fiscal years (years ending in Jan

> In 2017 and 2016, Sears Holding Corporation reported net losses and negative cash flows from operating activities. Using the company’s Form 10-K for the fiscal year ended February 3, 2018 (2017), complete the requirements shown as follows. The Form 10-K

> The following information was taken from the annual reports of Pfizer, Inc. and Ford Motor Company. These data are for 2018, and all amounts are in millions. Required a. Calculate the amount of inventory that Pfizer purchased during 2018. b. Calculate ho

> The following financial statements and information are available for Blythe Industries Inc.: Additional Information 1. Sold land that cost $40,000 for $44,000. 2. Sold equipment that cost $30,000 and had accumulated depreciation of $20,000 for $18,000. 3

> Tesla, Inc. began operations in 2003 but did not begin selling its stock to the public until June 28, 2010. It has lost money every year it has been in existence, and by December 31, 2016, it had total lifetime losses of approximately $5 billion. In addi

> Obtain Target Corporation’s annual report for its 2018 fiscal year (year ended February 2, 2019) at http://investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. For the year ended February 2, 2019 (20

> Using either Bed Bath & Beyond, Inc.’s most current Form 10-K or the company’s annual report, answer the following questions. To obtain the Form 10-K, use either the EDGAR system, following the instructions in Appendix A, or the company’s website. The co

> There were 37,855 McDonald’s Company restaurants in over 100 countries as of December 31, 2018. Chipotle Mexican Grill, Inc., a much newer fast-food restaurant company, began operations with one restaurant in 1993. At one time, McDonald

> Listed here are data for five companies. These data are for the companies’ 2017 fiscal years. The market price per share is the closing price of the companies’ stock as of February 28, 2018, two months after the end of

> The following data are based on information in the 2017 annual report of YUM! Brands, Inc. YUM! Brands is the parent company of KFC, Pizza Hut, and Taco Bell. As of December 31, 2017, the parent company owned or franchised over 45,000 restaurants in 135

> Listed here are the stockholders’ equity sections of three public companies for fiscal years ending in 2017 and 2016. Note that for General Mills these data are for the fiscal years ended on May 27, 2018 (2017) and May 28, 2017 (2016).

> Obtain Target Corporation’s annual report for its 2018 fiscal year (year ended February 2, 2019) at http:// investors.target.com using the instructions in Appendix B, and use it to answer the following questions: Required a. What is the par value per sha

> Interest rates in the United States were at historic lows for much of the period from 2013 through 2019. The economy was slowly recovering from the recession of 2008 and 2009, and the Federal Reserve kept interest rates low to encourage this recovery. Be

> Mack Company plans to invest $50,000 in land that will produce annual rent revenue equal to 15 percent of the investment, starting on January 1, Year 1. The revenue will be collected in cash at the end of each year, starting December 31, Year 1. Mack can

> Apple, Inc. manufactures and markets mobile phones, personal computers, and related software. The following data were taken from the company’s 2018 and 2015 annual reports. All dollar amounts are in millions. Required a. Calculate the E

> The following three companies issued the following bonds: 1. Carr, Inc. issued $100,000 of 8 percent, five-year bonds at 102¼ on January 1, Year 1. Interest is payable annually on December 31. 2. Kim, Inc. issued $100,000 of 8 percent, five-year bonds at

> Obtain Target Corporation’s annual report for its 2018 fiscal year (year ended February 2, 2019) at http:// investors.target.com using the instructions in Appendix B, and use it to answer the following questions: Required a. What was the average interest

> Advanced Micro Devices, Inc. (AMD) is “a global semiconductor company with facilities around the world.” AMD began operations in 1969. Texas Instruments, Inc. is the company that invented the integrated circuit over 45

> In the liabilities section of its 2017 balance sheet, Bank of America reported “Deposits in U.S. offices: Noninterest-bearing” in U.S. offices of over $430 billion. Bank of America is a very large banking company. In the liabilities section of its 2017 b

> Obtain Target Corporation’s annual report for its 2018 fiscal year (year ended February 2, 2019) at http:// investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. What was Target’s current ratio for it

> The following cash transactions occurred in six real-world companies: 1. In January, 2018 Ford Motor Company announced that it was acquiring Autonomic and TransLoc to enhance its development of driverless automobiles. No price was given. Assume this was

> Electronic Arts, Inc. (commonly know as EA Sports) develops, markets, and publishes electronic games. Union Pacific Corporation is one of the largest railway networks in the nation, with 32,122 miles of railroads. The following data were taken from one o

> The following ratios are for four companies in different industries. Some of these ratios have been dis- cussed in the textbook, others have not, but their names explain how the ratio was computed. These data are for the companies’ 2017

> Obtain Target Corporation’s annual report for its 2018 fiscal year (year ended February 2, 2019) at http:// investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. What method of depreciation does Targe

> AutoZone, Inc. claims to be the nation’s leading auto parts retailer. It sells replacement auto parts directly to the consumer. BorgWarner, Inc. has over 30,000 employees and produces automobile parts, such as transmissions and cooling

> Presented here are the average days to collect accounts receivable for four companies in different industries. The data are for 2017. Required Write a brief memorandum that provides possible answers to each of the following questions: a. Why would a comp

> Obtain Target Corporation’s annual report for its 2018 fiscal year (year ended February 2, 2019) at http://investors.target.com using the instruction in Appendix B. Anyone who has shopped at Target knows that many of its customers use a credit card to pa

> The following transactions apply to Barclay Co. for Year 1, its first year of operations: 1. Received $50,000 cash from the issue of a short-term note with a 5 percent interest rate and a one-year maturity. The note was made on April 1, Year 1. 2. Receiv

> The accounting records of Octavia’s Flower Shop reflected the following balances as of January 1, Year 3: The following five transactions occurred in Year 3: 1. First purchase (cash): 130 units @ $140 2. Second purchase (cash): 180 unit

> Use the financial statements for Bluffton Company from Problem 14-17B to perform a vertical analysis (based on total assets, total equities, and sales) of both the balance sheets and income statements for Year 4 and Year 3. Round computations to one deci

> Required For each of the following fraudulent acts, describe one or more internal control procedures that could have prevented (or helped prevent) the problems. a. Linda Hinson, the administrative assistant in charge of payroll, created a fictitious empl

> Use the financial statements for Bluffton Company from Problem 14-17B to compute the following for Year 4. Round percentages to two decimal points. a. Current ratio. b. Quick (acid-test) ratio. c. Average days to collect accounts receivable, assuming all

> The December 31, Year 2, balance sheet for Mason Dixon Corp. (MDC) showed Cash of $80,000, Common Stock of $30,000, and Retained Earnings of $50,000. During Year 3, MDC experienced the following accounting events: 1. MDC purchased merchandise inventory f

> The accounting firm of Brooke & Doggett, CPAs, recently completed the audits of three separate companies. During these audits, the following events were discovered, and Brooke & Doggett is trying to decide if each event is material. If an item is materia

> As of January 1, Year 5, the accounting records for High Tech Supply (HTS) showed Cash of $180,000, Common Stock of $120,000, and Retained Earnings of $60,000. During Year 5, HTS experienced the following accounting events: 1. HTS purchased merchandise i

> Indicate whether each of the following accounts normally has a debit or credit balance: a. Retained Earnings b. Prepaid Insurance c. Insurance Expense d. Accounts Receivable e. Salaries Payable f. Cash g. Common Stock h. Rent Expense i. Salaries Expense

> On January 1, Year 1, Lakeview Company is started when it issues 100 shares of $20 par value stock for a cash price of $25 per share. Also, on January 1 Year 1, Lakeview borrows $45,000 cash by issuing a note payable to the Metropolitan Bank. Lakeview im

> The Corners Corporation experienced three events that affected its financial statements, as shown in the following table. Assume that the original issue (Event 1) was for 400,000 shares, and the treasury stock was acquired for $4 per share (Event 2). Req

> Show the effect of each of the following independent accounting events on the financial statements using a horizontal statements model like the following one. Use + for increase, − for decrease, and NA for not affected. The first event

> Whitten Company was started when it issued bonds with $300,000 face value on January 1, Year 1. The bonds were issued for cash at 103. Whitten uses the straight-line method of amortization. They had a 15-year term to maturity and a 6 percent annual inter

> Dame Co. issued $250,000 of 10-year, 6 percent, callable bonds on January 1, Year 1, with interest payable annually on December 31. The bonds were issued at their face amount. The bonds are callable at 101½. The fiscal year of the corporati

> Mott Company has a line of credit with Bay Bank. Mott can borrow up to $400,000 at any time over the course of the Year 1 calendar year. The following table shows the prime rate expressed as an annual percentage, along with the amounts borrowed and repai

> The following transactions apply to Ritter Co. for Year 1: 1. Received $40,000 cash from the issue of common stock. 2. Purchased inventory on account for $128,000. 3. Sold inventory for $200,000 cash that had cost $110,000. Sales tax was collected at the

> Maddox Co. pays salaries monthly on the last day of the month. The following information is available from Maddox Co. for the month ended December 31, Year 1. Assume the Social Security tax rate is 6 percent on the first $130,000 of salaries, while the M

> Required Obtain Target Corporation’s annual report for its 2018 fiscal year (year ended February 2, 2019) at http://investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. Who are the independent audito

> Metals Exploration Corporation engages in the exploration and development of many types of natural resources. In the last two years, the company has engaged in the following activities: Jan. 1, Year 1 Purchased a coal mine estimated to contain 300,000

> The following transactions pertain to Accounting Solutions Inc. Assume the transactions for the purchase of the computer and any capital improvements occur on January 1 each year. Year 1 1. Acquired $80,000 cash from the issue of common stock. 2. Purchas

> Fill in the blanks (indicated by the alphabetic letters in parentheses) in the following financial statements. Assume the company started operations January 1, Year 1, and all transactions involve cash.

> The following information was drawn from the Year 5 balance sheets of two companies: During Year 5, Steelman’s net income was $45,800, while Bingum’s net income was $22,300. Required a. Compute the debt-to-assets ratio

> After reconciling its bank account, Addy Equipment Company made the following adjustments to its cash account: Required Identify the event depicted in each adjustment as asset source (AS), asset use (AU), asset exchange (AE), or claims exchange (CE). Als

> On January 1, Year 4, Franklin Company paid $200,000 cash to purchase a new theme ride. The ride has a $5,000 salvage value and a six-year useful life. Assume that Franklin earns $70,000 of cash revenue per year for Year 4 through Year 10 of the asset’s