Question: Provincial Imports Inc. has assembled past (2019)

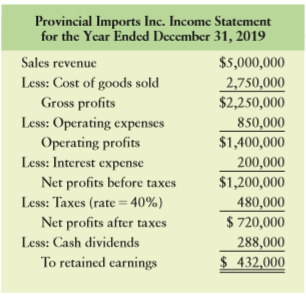

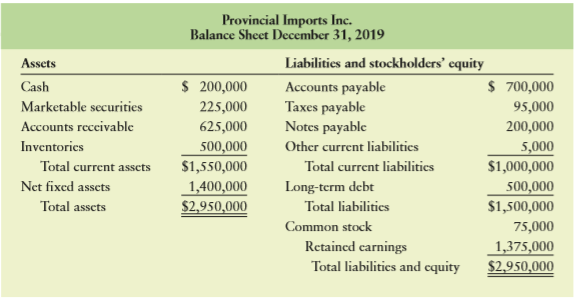

Provincial Imports Inc. has assembled past (2019) financial statements (income statement and balance sheet below) and financial projections for use in preparing financial plans for the coming year (2020).

Information related to financial projections for the year 2020 is as follows:

(1) Projected sales are $6,000,000.

(2) Cost of goods sold in 2019 includes $1,000,000 in fixed costs.

(3) Operating expense in 2019 includes $250,000 in fixed costs.

(4) Interest expense will remain unchanged.

(5) The firm will pay cash dividends amounting to 40% of net profits after taxes.

(6) Cash and inventories will double.

(7) Marketable securities, notes payable, long-term debt, and common stock will remain unchanged.

(8) Accounts receivable, accounts payable, and other current liabilities will change in direct response to the change in sales.

(9) A new computer system costing $356,000 will be purchased during the year. Total depreciation expense for the year will be $110,000.

(10) The tax rate will remain at 40%.

a. Prepare a pro forma income statement for the year ended December 31, 2020, using the fixed cost data given to improve the accuracy of the percent-of-sales method.

b. Prepare a pro forma balance sheet as of December 31, 2020, using the information given and the judgmental approach. Include a reconciliation of the retained earnings account.

c. Analyze these statements, and discuss the resulting external financing required.

Transcribed Image Text:

Provincial Imports Inc. Income Statement for the Year Ended December 31, 2019 Sales revenue Less: Cost of goods sold Gross profits Less: Operating expenses Operating profits Less: Interest expense $5,000,000 2,750,000 $2,250,000 850,000 $1,400,000 200,000 $1,200,000 480,000 $ 720,000 Net profits before taxes Less: Taxes (rate = 40%) Net profits after taxes Less: Cash dividends 288,000 $ 432,000 To retained earnings Provincial Imports Inc. Balance Sheet December 31, 2019 Liabilities and stockholders’ equity Assets $ 200,000 $ 700,000 95,000 Cash Accounts payable Taxes payable Notes payable Marketable securities 225,000 Accounts reccivable 625,000 200,000 Inventories 500,000 Other current liabilitics 5,000 $1,000,000 500,000 $1,500,000 Total current assets $1,550,000 Total current liabilities Net fixed assets Long-term debt 1,400,000 $2,950,000 Total assets Total liabilitics Common stock 75,000 Retained carnings Total liabilities and cquity 1,375,000 $2,950,000

> Everdeen Mining Inc. ended 2019 with a net profit before taxes of $436,000. The company is subject to a 40% tax rate and must pay $64,000 in preferred stock dividends before distributing any earnings on the 170,000 shares of common stock currently outsta

> Adam and Arin Adams have collected their personal income and expense information and have asked you to put together an income and expense statement for the year ended December 31, 2019. You have received the following information from the Adams family.

> Consider the following balance sheets and selected data from the income statement of Keith Corporation. a. Calculate the firm’s net operating profit after taxes (NOPAT) for the year ended December 31, 2019, using Equation 4.1. b. Ca

> McDougal Printing Inc. had sales totaling $40,000,000 in fiscal year 2019. Some ratios for the company are listed below. Use this information to determine the dollar values of various income statement and balance sheet accounts as requested. Calculate

> Financial information from fiscal year 2016 for two companies competing in the cosmetics industry—The Estée Lauder Companies and e.l.f. Beauty Inc.—appears in the table below. All dollar values are in tho

> You wish to calculate the risk level of your portfolio based on its beta. The five stocks in the portfolio with their respective weights and betas are shown in the accompanying table. Calculate the beta of your portfolio. Stock Portfolio weight Beta

> Pelican Paper Inc. and Timberland Forest Inc. are rivals in the manufacture of craft papers. Some financial statement values for each company follow. Use them in a ratio analysis that compares the firms’ financial leverage and profitabi

> On December 31, 2019, Cathy Chen, a self employed certified public accountant (CPA), completed her first full year in business. During the year, she charged her clients $360,000 for accounting services. She had two employees, a bookkeeper and a clerical

> Common-size statement analysis A common-size income statement for Creek Enterprises’ 2018 operations follows. Using the firm’s 2019 income statement presented in Problem 3–16, develop the

> Using Tables 3.1, 3.2, and 3.3, conduct a complete ratio analysis of the Bartlett Company for the years 2018 and 2019. You should assess the firm’s liquidity, activity, debt, and profitability ratios. Highlight any particularly positive

> The table below shows 2016 total revenues, cost of goods sold, earnings available for common stockholders, total assets, and stockholders’ equity for three companies competing in the bottled drinks market: The Coca-Cola Company, Pepsico

> Springfield Bank is evaluating Creek Enterprises, which has requested a $4,000,000 loan, to assess the firm’s financial leverage and financial risk. On the basis of the debt ratios for Creek, along with the industry average and Creek&ac

> The table below shows key financial data for three firms that compete in the consumer products market: Procter & Gamble, Colgate-Palmolive, and Clorox. All dollar values are in thousands. a. Calculate each of the following ratios for all three comp

> The table below shows that Blair Supply had an end-of-year accounts receivable balance of $300,000. The table also shows how much of the receivables balance originated in each of the previous 6 months. The company had annual sales of $2.4 million, and it

> Classify each of the following items as an inflow (I) or an outflow (O) of cash. Item Change ($) Item Change ($) Cash -300 Accounts receivable +1,700 Accounts payable Notes payable Long-term debt Inventory Fixed assets Net profits Depreciation Repur

> Three companies that compete in the footwear market are Foot Locker, Finish Line, and DSW. The table below shows inventory levels and cost of goods sold for each company for the 2016, 2015, and 2014 fiscal years. Calculate the inventory turnover ratio fo

> Your portfolio has three asset classes. U.S. government T-bills account for 45% of the portfolio, large-company stocks constitute another 40%, and small-company stocks make up the remaining 15%. If the expected returns are 2% for the T-bills, 10% for the

> Josh Smith has compiled some of his personal financial data to determine his liquidity position. The data are as follows. a. Calculate Josh’s liquidity ratio. b. Several of Josh’s friends have told him that they have

> Bauman Company’s total current assets, total current liabilities, and inventory for each of the past 4 years follow: a. Calculate the firm’s current and quick ratios for each year. Compare the resulting time series f

> Robert Arias recently inherited a stock portfolio from his uncle. Wishing to learn more about the companies in which he is now invested, Robert performs a ratio analysis on each one and decides to compare them to one another. Some of his ratios are liste

> Mark each of the accounts listed in the following table as follows: a. In column (1), indicate in which statement—income statement (IS) or balance sheet (BS)—the account belongs. b. In column (2), indicate whether the

> During the year just ended, Shering Distributors, Inc., had pretax earnings from operations of $490,000. In addition, during the year it received $20,000 in income from interest on bonds it held in Zig Manufacturing and received $20,000 in income from di

> Using the corporate tax rate schedule given in Table 1.2, perform the following: a. Find the marginal tax rate for the following levels of corporate earnings before taxes: $15,000; $60,000; $90,000; $200,000; $400,000; $1 million; and $20 million. b. Plo

> Using the corporate tax rate schedule given in Table 1.2, perform the following: a. Calculate the tax liability, after-tax earnings, and average tax rates for the following levels of corporate earnings before taxes: $10,000; $80,000; $300,000

> Tantor Supply, Inc., is a small corporation acting as the exclusive distributor of a major line of sporting goods. During 2017, the firm earned $92,500 before taxes. a. Calculate the firm’s tax liability using the corporate tax rate sch

> The Securities Exchange Act of 1934 limits, but does not prohibit, corporate insiders from trading in their own firm’s shares. What ethical issues might arise when a corporate insider wants to buy or sell shares in the firm where he or she works?

> A firm in the third year of depreciating its only asset, which originally cost $180,000 and has a 5-year MACRS recovery period, has gathered the following data relative to the current year’s operations. a. Use the relevant data to det

> The expected annual returns are 15% for investment 1 and 12% for investment 2. The standard deviation of the first investment’s return is 10%; the second investment’s return has a standard deviation of 5%. Which investment is less risky based solely on i

> Denim Industries can borrow its needed financing for expansion using one of two foreign lending facilities. It can borrow at a nominal annual interest rate of 8% in Mexican pesos, or it can borrow at 3% in Canadian dollars. If the peso is expected to dep

> A Brazilian company called Netshoes completed its IPO on April 12, 2017, and listed on the NYSE. Netshoes sold 8,250,000 shares of stock to primary market investors at an IPO offer price of $18, with an underwriting discount of 6.5%. Secondary market inv

> On April 13, 2017, Yext Inc. completed its IPO on the NYSE. Yext sold 10,500,000 shares of stock at an offer price of $11 with an underwriting discount of $0.77 per share. Yext’s closing stock price on the first day of trading on the secondary market was

> In late December you decide, for tax purposes, to sell a losing position that you hold in Twitter, which is listed on the NYSE, so that you can capture the loss and use it to offset some capital gains, thus reducing your taxes for the current year. Howev

> Explain why each of the following situations is an agency problem and what costs to the firm might result from it. Suggest how the problem might be handled short of firing the individual(s) involved. a. The front desk receptionist routinely takes an extr

> Ken Allen, capital budgeting analyst for Bally Gears, Inc., has been asked to evaluate a proposal. The manager of the automotive division believes that replacing the robotics used on the heavy truck gear line will produce total benefits of $560,000 (in t

> Â It is typical for Jane to plan, monitor, and assess her financial position using cash flows over a given period, typically a month. Jane has a savings account, and her bank loans money at 6% per year while it offers short-term investment rat

> Thomas Book Sales, Inc., supplies textbooks to college and university bookstores. The books are shipped with a proviso that they must be paid for within 30 days but can be returned for a full refund credit within 90 days. In 2018, Thomas shipped and bill

> Merideth Harper has invested $25,000 in Southwest Development Company. The firm has recently declared bankruptcy and has $60,000 in unpaid debts. Explain the nature of payments, if any, by Merideth in each of the following situations. a. Southwest Develo

> What does it mean to say that managers should maximize shareholder wealth “subject to ethical constraints”? What ethical considerations might enter into decisions that result in cash flow and stock price effects that are less than they might otherwise ha

> Hemingway Corporation is considering expanding its operations to boost its income, but before making a final decision, it has asked you to calculate the corporate tax consequences of such a decision. Currently, Hemingway generates before tax yearly incom

> Four analysts cover the stock of Fluorine Chemical. One forecasts a 5% return for the coming year. The second expects the return to be –5%. The third predicts a 10% return. The fourth expects a 3% return in the coming year. You are relatively confident t

> Pavlovich Instruments Inc., a maker of precision telescopes, expects to report pretax income of $430,000 this year. The company’s financial manager is considering the timing of a purchase of new computerized lens grinders. The grinders will have an insta

> Michaels Corporation expects earnings before interest and taxes to be $50,000 for the current period. Assuming a flat ordinary tax rate of 35%, compute the firm’s earnings after taxes and earnings available for common stockholders (earnings after taxes a

> You would like to purchase one Class A share of Berkshire Hathaway through your Scottrade brokerage account. Scottrade charges a $7 commission for online trades. You log into your account, check the real-time quotes for Berkshire Hathaway (you see a bid

> Home Health Inc. has come to Jane Ross for a yearly financial checkup. As a first step, Jane has prepared a complete set of ratios for fiscal years 2018 and 2019. She will use them to look for significant changes in the company’s situat

> Use the following 2016 financial information for ATT and Verizon to conduct a DuPont system of analysis for each company. a. Which company has the higher net profit margin? Higher asset turnover? b. Which company has the higher ROA? The higher ROE?

> Given the following financial statements, historical ratios, and industry averages, calculate Sterling Company’s financial ratios for the most recent year. (Assume a 365-day year.) Analyze its overall financial situation from both a

> The financial statements of Zach Industries for the year ended December 31, 2019, follow. a. Use the preceding financial statements to complete the following table. Assume that the industry averages given in the table are applicable for both 2018 and

> Use the accompanying financial statements for Fox Manufacturing Company for the year ended December 31, 2019, along with the industry average ratios below, to do the following: a. Prepare and interpret a complete ratio analysis of the firmâ€&#

> The SEC is trying to get companies to notify the investment community more quickly when a “material change” will affect their forthcoming financial results. In what sense might a financial manager be seen as “more ethical” if he or she follows this direc

> An analyst predicted last year that the stock of Logistics Inc. would offer a total return of at least 10% in the coming year. At the beginning of the year, the firm had a total stock market capitalization of $10 million. At the end of the year, its mark

> Red Queen Restaurants wishes to prepare financial plans. Use the financial statements and the other information provided below to prepare the financial plans. The following financial data are also available: (1) The firm has estimated that its sales for

> In early 2019, Sosa Enterprises purchased a new machine for $10,000 to make cork stoppers for wine bottles. The machine has a 3-year recovery period and is expected to have a salvage value of $2,000. Develop a depreciation schedule for this asset using t

> Peabody & Peabody has 2019 sales of $10 million. It wishes to analyze expected performance and financing needs for 2021, which is 2 years ahead. Given the following information, respond to parts a and b. (1) The percent of sales for items that vary d

> Leonard Industries wishes to prepare a pro forma balance sheet for December 31, 2020. The firm expects 2020 sales to total $3,000,000. The following information has been gathered: (1) A minimum cash balance of $50,000 is desired. (2) Marketable securitie

> Allen Products Inc. wants to do a scenario analysis for the coming year. The pessimistic prediction for sales is $900,000; the most likely amount of sales is $1,125,000; and the optimistic prediction is $1,280,000. Allen’s income statem

> The marketing department of Metroline Manufacturing estimates that its sales in 2020 will be $1.5 million. Interest expense is expected to remain unchanged at $35,000, and the firm plans to pay $70,000 in cash dividends during 2020. Metroline Manufacturi

> Brownstein Inc. expects sales of $100,000 during each of the next 3 months. It will make monthly purchases of $60,000 during this time. Wages and salaries are $10,000 per month plus 5% of sales. Brownstein expects to make a tax payment of $20,000 in the

> Â Trotter Enterprises Inc. has gathered the following data to plan for its cash requirements and short-term investment opportunities for October, November, and December. All amounts are shown in thousands of dollars. a. Prepare a scenario an

> The following represent financial transactions that Johnsfield & Co. will be undertaking in the next planning period. For each transaction, check the statement or statements that will be affected immediately. Statement Pro forma balance sheet Pr

> The actual sales and purchases for Xenocore Inc. for September and October 2019, along with its forecast sales and purchases for the period November 2019 through April 2020, follow. The firm makes 20% of all sales for cash and collects on 40% of its sale

> Brash Corporation initiated a new corporate strategy that fixes its annual dividend at $2.25 per share forever. If the risk-free rate is 4.5% and the risk premium on Brash’s stock is 10.8%, what is the value of Brash’s stock?

> Sam and Suzy Size man need to prepare a cash budget for the last quarter of 2020 to make sure they can cover their expenditures during the period. Sam and Suzy have been preparing budgets for the past several years and have been able to identify the perc

> Basic Grenoble Enterprises had sales of $50,000 in March and $60,000 in April. Forecast sales for May, June, and July are $70,000, $80,000, and $100,000, respectively. The firm has a cash balance of $5,000 on May 1 and wishes to maintain a minimum cash b

> On March 20, 2019, Norton Systems acquired two new assets. Asset A was research equipment costing $17,000 and having a 3-year recovery period. Asset B was duplicating equipment with an installed cost of $45,000 and a 5-year recovery period. Using the MAC

>  Listed are the equity sections of balance sheets for years 2018 and 2019 as reported by Mountain Air Ski Resorts Inc. The overall value of stockholders’ equity has risen from $2,000,000 to $7,500,000. Use the statements to

> Hayes Enterprises began 2019 with a retained earnings balance of $928,000. During 2019, the firm earned $377,000 after taxes. From this amount, preferred stockholders were paid $47,000 in dividends. At year-end 2019, the firm’s retained earnings totaled

> Hudson-Perry Recordings Inc. has one issue of preferred stock and one issue of common stock outstanding. Given their stockholders’ equity account that follows, determine the original price per share at which the firm sold its single iss

> Conrad Air Inc. reported net income of $1,365,000 for the year ended December 31, 2020. Show how Conrad’s balance sheet would change from 2019 to 2020 depending on how Conrad “spent” those earnings as

> Samantha Fong sold her home in San Francisco in 2017 for $1.5 million, which was the median home price for that city. Samantha had lived in that house for 17 years, having purchased it from Michael Shoven in 2000 for $545,000. What average annual rate of

> Mia Salto wishes to determine how long it will take to repay a $14,000 loan given that the lender requires her to make annual end-of year installment payments of $2,450. a. If the interest rate on the loan is 12%, how long will it take her to repay the l

> In each of the following cases, determine the number of years that the given ordinary annuity cash flows must continue to provide the desired rate of return given the cost of the annuity. Case Cost of annuity Annuity payment Desired rate of return $

> Stacker Weight Loss currently pays an annual year-end dividend of $1.20 per share. It plans to increase this dividend by 5% next year and maintain it at the new level for the foreseeable future. If the required return on this firm’s stock is 8%, what is

> Manuel Rios wishes to determine how long it will take an initial deposit of $10,000 to double. a. If Manuel earns 10% annual interest on the deposit, how long will it take for him to double his money? b. How long will it take if he earns only 7% annual

> For each of the following cases, determine the number of years it will take for the initial deposit to grow to equal the future amount at the given interest rate. Case Initial deposit Future amount Interest rate $ 300 $ 1,000 A 7% В 12,000 15,000 5

> John Flemming has been shopping for a loan to finance the purchase of a used car. He has found three possibilities that seem attractive and wishes to select the one with the lowest interest rate. The information available with respect to each of the thre

> Anna Waldheim was seriously injured in an industrial accident. She sued the responsible parties and was awarded a judgment of $2,000,000. Today, she and her attorney are attending a settlement conference with the defendants. The defendants have made an i

> Raina Herzig wishes to choose the best of four annuities available to her. In each case, in exchange for paying a lump sum today, she will receive equal, end-of-year cash payments for a specified number of years. She considers the annuities equally risky

> What is the rate of return on an investment of $10,606 if the investor will receive $2,000 each year for the next 10 years?

> Clare Jaccard has $5,000 to invest. Because she is only 25 years old, she is not concerned about the length of the investment’s life. What she is sensitive to is the rate of return she will earn on the investment. With the h

> Rishi Singh has $1,500 to invest. His investment counselor suggests that Rishi should buy an investment that pays no interest but will be worth $2,000 after 3 years. a. What average annual rate of return will Rishi earn with this investment? b. Rishi is

> Jamie El-Erian is a savvy investor. On January 1, 2010, she bought shares of stock in Amazon, Chipotle Mexican Grill, and Netflix. The table below shows the price she paid for each stock, the price she received when she eventually sold her sh

> Monthly loan payments Tim Smith is shopping for a used luxury car. He has found one priced at $30,000. The dealer has told Tim that if he can come up with a down payment of $5,000, the dealer will finance the balance of the price at a 6% annual rate ove

> Today the common stock of Gresham Technology closed at $24.60 per share, down $0.35 from yesterday. If the company has 4.6 million shares outstanding and annual earnings of $11.2 million, what is its P/E ratio today? What was its P/E ratio yesterday?

> Liz Rogers just closed a $10,000 business loan that she must repay in three equal, end-of-year payments. The interest rate on the loan is 13%. As part of her firm’s detailed financial planning, Liz wishes to determine the annual interest deduction attrib

> Joan Messineo borrowed $45,000 at a 4% annual rate of interest that she must repay over 3 years. The loan is amortized into three equal, end-of-year payments. a. Calculate the end-of-year loan payment. b. Prepare a loan amortization schedule showing the

> Â Determine the equal, end-of-year payment required each year over the life of the loans shown in the following table to repay them fully during the stated term of the loan. Loan Principal Interest rate Term of loan (ycars) A $12,000 8% 3

> While vacationing in Florida, John Kelley saw the vacation home of his dreams. It was listed with a sale price of $200,000. The only catch is that John is 40 years old and plans to continue working until he is 65. John believes that prices generally incr

> A retirement home at Deer Trail Estates now costs $185,000. Inflation is expected to increase this price by 6% per year over the 20 years before C. L. Donovan retires. If Donovan earns 10% on his investments, how large must an equal, end-of-year deposit

> To supplement your retirement, you estimate that you need to accumulate $220,000 exactly 42 years from today. You plan to make equal, end-of-year deposits into an account paying 8% annual interest. a. How large must the annual deposits be to create the $

> For each case shown in the following table, determine the amount of the equal, end-of-year deposits necessary to accumulate the given sum at the end of the specified period, assuming the stated annual interest rate. Sum to be Accumulation Interest C

> Janet Boyle intends to deposit $300 per year in a credit union for the next 10 years, and the credit union pays an annual interest rate of 8%. a. Determine the future value that Janet will have in 10 years, given that end-of period deposits are made and

> You plan to invest $2,000 in an individual retirement account (IRA) today at a nominal annual rate of 8%, which is expected to apply to all future years. a. How much will you have in the account after 10 years if interest is compounded (1) annually, (2)

> For each of the cases in the following table, find the future value at the end of the deposit period, assuming that interest is compounded continuously at the given nominal annual rate. Nominal annual rate, r Deposit period (ycars), n Amount of Case

> Figurate Industries has 750,000 shares of cumulative preferred stock outstanding. It has passed the last three quarterly dividends of $2.50 per share and now (at the end of the current quarter) wishes to distribute a total of $12 million to its sharehold

> For each of the cases in the table below: a. Calculate the future value at the end of the specified deposit period. b. Determine the effective annual rate, EAR. c. Compare the nominal annual rate, r, to the effective annual rate, EAR. What relationship e

> Using annual, semiannual, and quarterly compounding periods for each of the following, (1) calculate the future value if $5,000 is deposited initially, and (2) determine the effective annual rate (EAR). a. At 12% annual interest for 5 years. b. At 16% an

> The table below shows a mixed cash flow stream starting in 1 year, except that the cash flow for year 3 is missing. Suppose you somehow know that the present value of the entire stream is $32,911.03 and that the discount rate is 4%. What is the amount

> Using the information in the accompanying table, answer the questions that follow. a. Determine the present value of the mixed stream of cash flows, using a 5% discount rate. b. Suppose you had a lump sum equal to your answer in part a on hand today. I

> Herr Mining Company plans to open a new coal mine. Developing the mine will cost $10 million right away, but cash flows of $4 million will arrive starting in 1 year and then continuing for the next 4 years (i.e., years 2 through 5). After that, no coal w

> Harte Systems Inc., a maker of electronic surveillance equipment, is considering selling the rights to market its home security system to a well-known hardware chain. The proposed deal calls for the hardware chain to pay Harte $30,000 and $25,000 at the