Question: QP Corp. sold 4,000 units of

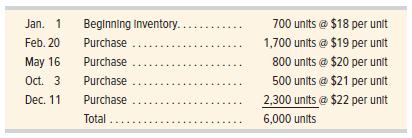

QP Corp. sold 4,000 units of its product at $50 per unit during the year and incurred operating expenses of $5 per unit in selling the units. It began the year with 700 units in inventory and made successive purchases of its product as follows.

Required

1. Prepare comparative year-end income statements for the three inventory costing methods of FIFO, LIFO, and weighted average. (Round all amounts to cents.) Include a detailed cost of goods sold section as part of each statement. The company uses a periodic inventory system.

2. How would the financial results from using the three alternative inventory costing methods change if the company had been experiencing declining costs in its purchases of inventory?

3. What advantages and disadvantages are offered by using (a) LIFO and (b) FIFO? Assume the continuing trend of increasing costs.

> On July 23 of the current year, Dakota Mining Co. pays $4,715,000 for land estimated to contain 5,125,000 tons of recoverable ore. It installs and pays for machinery costing $410,000 on July 25. The company removes and sells 480,000 tons of ore during it

> Analyze each of the following transactions by showing the effects on the accounting equation— specifically, identify the accounts and amounts (including + or −) for each transaction. a. The company provides $20,000 of services on credit. b. The company e

> Access the July 28, 2016, 10-K filing (for year-end June 30, 2016) of Microsoft (ticker: MSFT) at SEC.gov. Review its note 4, “Investments.” Required 1. How does the “cost-basis” total amount for its investments as of June 30, 2016, compare to the prior

> On January 1, Manning Co. purchases and installs a new machine costing $324,000 with a five-year life and an estimated $30,000 salvage value. Management estimates the machine will produce 1,470,000 units of product during its life. Actual production of u

> On December 1, Daw Co. accepts a $10,000, 45-day, 6% note from a customer. (1) Prepare the year-end adjusting entry to record accrued interest revenue on December 31. (2) Prepare the entry required on the note’s maturity date assuming it is honored.

> Samsung’s statement of cash flows in Appendix A reports the change in cash and equivalents for the year ended December 31, 2018. Identify the cash generated (or used) by operating activities, by investing activities, and by financing activities.

> Determine the maturity date and compute interest for each note.

> Many commercials include comments similar to the following: “We accept VISA” or “We do not accept American Express.” Conduct your own research by contacting at least five companies via interviews, phone calls, or the Internet to determine the reason(s) c

> Nichole Mustard and Credit Karma are introduced in the chapter’s opening feature. Assume that they are considering two options. Plan A. The company would begin selling access to a premium version of its website. The new online customers would use their

> In addition, its unadjusted trial balance includes the following items. At December 31, Hawke Company reports the following results for its calendar year. Required 1. Prepare the adjusting entry to record bad debts under each separate assumption. a. Bad

> Onslow Co. purchased a used machine for $178,000 cash on January 2. On January 3, Onslow paid $2,840 to wire electricity to the machine. Onslow paid an additional $1,160 on January 4 to secure the machine for operation. The machine will be used for six y

> Each member of a team is to participate in estimating uncollectibles using the aging schedule and percents shown in Problem 7-3A. The division of labor is up to the team. Your goal is to accurately complete this task as soon as possible. After estimating

> On January 1, ProTech Co. pays a lump-sum amount of $1,550,000 for land, Building A, Building B, and Land Improvements B. Building A has no value and will be demolished. Building B will be an office and is appraised at $482,800, with a useful life of 15

> At December 31, Ingleton Company reports the following results for the year. In addition, its unadjusted trial balance includes the following items. Required 1. Prepare the adjusting entry to record bad debts under each separate assumption. a. Bad debts

> Use Apple’s financial statements in Appendix A to answer the following. 1. What is the amount of Apple’s accounts receivable as of September 29, 2018? 2. Compute Apple’s accounts receivable turnover as of September 29, 2018. 3. Apple’s most liquid assets

> Access eBay’s January 30, 2019, filing of its 10-K report for the year ended December 31, 2018, at SEC.gov. Required 1. What is the amount of eBay’s net accounts receivable at December 31, 2018, and at December 31, 2017? 2. “Financial Statement Schedule

> At year-end December 31, Chan Company estimates its bad debts as 1% of its annual credit sales of $487,500. Chan records its bad debts expense for that estimate. On the following February 1, Chan decides that the $580 account of P. Park is uncollectible

> As the accountant for Pure-Air Distributing, you attend a sales managers’ meeting devoted to a discussion of credit policies. At the meeting, you report that bad debts expense is estimated to be $59,000 and accounts receivable at year-end amount to $1,75

> Anton Blair is the manager of a medium-size company. A few years ago, Blair persuaded the owner to base a part of his compensation on the net income the company earns each year. Each December he estimates year-end financial figures in anticipation of the

> Refer to Samsung’s December 31, 2018, Samsung report its accounts receivable, titled as “Trade receivables,” as a current or noncurrent asset?

> Refer to Samsung’s financial statements in Appendix A. What is the amount of Samsung’s accounts receivable, titled as “Trade receivables,” on its December 31, 2018, balance sheet?

> Refer to Samsung’s balance sheet in Appendix A. How does its cash (titled “Cash and cash equivalents”) compare with its other current assets (in both amount and percent) as of December 31, 2018? Compare and assess its cash at December 31, 2018, with its

> The following data are for Rocky Company. (a) Compute Rocky’s accounts receivable turnover. (b) If its competitor, Dixon, has an accounts receivable turnover of 7.5, which company appears to be doing a better job of managing its recei

> Assume that you are Jolee Company’s accountant. Company owner Mary Jolee has reviewed the 2020 financial statements you prepared and questions the $6,000 loss reported on the sale of its investment in Kemper Co. common stock. Jolee acquired 50,000 shares

> Complete the following table by filling in missing amounts.

> Santana Rey, owner of Business Solutions, realizes that she needs to begin accounting for bad debts expense. Assume that Business Solutions has total revenues of $44,000 during the first three months of 2021 and that the Accounts Receivable balance on Ma

> The following transactions are from Springer Company. Year 1 Nov. 1 Accepted a $4,800, 90-day, 8% note in granting Steve Julian a time extension on his past-due account receivable. Dec. 31 Made an adjusting entry to record the accrued interest on the Jul

> Archer Co. completed the following transactions and uses a perpetual inventory system. Aug. 4 Sold $3,700 of merchandise on credit (that had cost $2,000) to McKenzie Carpenter, terms n∕10. 10 Sold $5,200 of merchandise (that had cost $2,800) to customers

> Robotix Co. purchases a patent for $20,000 on January 1. The patent is good for 18 years, after which anyone can use the patent technology. However, Robotix plans to sell products using that patent technology for only 5 years. Prepare the intangible asse

> Mayfair Co. completed the following transactions and uses a perpetual inventory system. June 4 sold $650 of merchandise on credit (that had cost $400) to Natara Morris, terms n∕15. 5 Sold $6,900 of merchandise (that had cost $4,200) to customers who used

> The following information is from the annual financial statements of Raheem Company. (1) Compute its accounts receivable turnover for Year 2 and Year 3. (2) Assuming its competitor has a turnover of 11, is Raheem performing better or worse at collecting

> On November 30, Petrov Co. has $128,700 of accounts receivable and uses the perpetual inventory sys- tem. (1) Prepare journal entries to record the following transactions. (2) Which transaction would most likely require a note to the financial statements

> Prepare journal entries to record the following transactions of Ridge Company. Mar. 21 Accepted a $9,500, 180-day, 8% note from Tamara Jackson in granting a time extension on her past-due account receivable. Sep. 17 Jackson dishonored her note. Dec. 31 A

> Following are selected data from Samsung, Apple, and Google. Required 1. Compute Samsung’s return on total assets for the two most recent years. 2. For the current year, is Samsung’s return on total assets better or wo

> Prepare journal entries to record transactions for Vitalo Company. Nov. 1 Accepted a $6,000, 180-day, 8% note from Kelly White in granting a time extension on her past-due account receivable. Dec. 31 Adjusted the year-end accounts for the accrued interes

> Refer to the information in Exercise 7-17 and prepare the journal entries for the following year for Danica Company. Jan. 27 Received Lee’s payment for principal and interest on the note dated December 13. Mar. 3 Accepted a $5,000, 10%, 90-day note in

> Use the information in Problem 1-3B to prepare the statement of retained earnings for Audi Company for the current year ended December 31.

> BioWare’s year-end unadjusted trial balance shows accounts receivable of $17,000 and sales of $150,000. Uncollectibles are estimated to be 2% of sales. Prepare the December 31 year-end adjusting entry for uncollectibles using the percent of sales method.

> The records of Alaska Company provide the following information for the year ended December 31. Required 1. Use the retail inventory method to estimate the company’s year-end inventory at cost. 2. A year-end physical inventory at retail

> Selected accounts from Bennett Co.’s adjusted trial balance for the year ended December 31 follow. Prepare a classified balance sheet. Note: Allowance for doubtful accounts is subtracted from accounts receivable on the companyâ

> Prepare journal entries for the following transactions of Danica Company. Dec. 13 Accepted a $9,500, 45-day, 8% note in granting Miranda Lee a time extension on her past-due account receivable. 31 Prepared an adjusting entry to record the accrued intere

> Prepare Garzon Company’s journal entries to record the following transactions for the current year. Jan.1 Purchases 6% bonds (as a held-to-maturity investment) issued by PBS at a cost of $40,000, which is the par value. July.1 Receives first semiannual p

> At December 31, Folgeys Coffee Company reports the following results for its calendar year. Its year-end unadjusted trial balance includes the following items. 1. Prepare the adjusting entry to record bad debts expense assuming uncollectibles are estimat

> Following is a list of credit customers along with their amounts owed and the days past due at December 31. Following that list are five classifications of accounts receivable and estimated bad debts percent for each class. 1. Create an aging of accounts

> Refer to the information in Exercise 7-13 to complete the following requirements. a. Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 4.5% of total accounts receivable to estimate uncollectibles, instead of the aging

> Daley Company prepared the following aging of receivables analysis at December 31. a. Estimate the balance of the Allowance for Doubtful Accounts using aging of accounts receivable. b. Prepare the adjusting entry to record bad debts expense using the est

> Mazie Supply Co. uses the percent of accounts receivable method. On December 31, it has outstanding accounts receivable of $55,000, and it estimates that 2% will be uncollectible. Prepare the year-end adjusting entry to record bad debts expense under the

> Warner Company’s year-end unadjusted trial balance shows accounts receivable of $99,000, allowance for doubtful accounts of $600 (credit), and sales of $140,000. Uncollectibles are estimated to be 1% of sales. Prepare the December 31 year-end adjusting e

> Use Apple’s financial statements in Appendix A to answer the following. 1. Compute Apple’s return on total assets for the years ended September 29, 2018, and September 30, 2017. 2. Is the change in Appleâ€&#

> Refer to Google’s recent balance sheet in Appendix A. What is the book value of its total net property and equipment assets at December 31, 2018?

> On December 31 of Swift Co.’s first year, $50,000 of accounts receivable was not yet collected. Swift estimated that $2,000 of its accounts receivable was uncollectible and recorded the year-end adjusting entry. 1. Compute the realizable value of account

> Identify the following as intangible assets, natural resources, or some other asset. a. Oil well b. Trademark c. Leasehold d. Gold mine e. Building f. Copyright g. Franchise h. Coal mine i. Salt mine

> Navajo Company’s year-end financial statements show the following. The company recently discovered that in making physical counts of inventory, it had made the following errors: Year 1 ending inventory is understated by $56,000 and Year

> A physical inventory of Liverpool Company taken at December 31 reveals the following. Required 1. Compute the lower of cost or market for the inventory applied separately to each item. 2. If the market amount is less than the recorded cost of the invento

> Refer to the information in Problem 5-3A and assume the perpetual inventory system is used. Required 1. Compute cost of goods available for sale and the number of units available for sale. 2. Compute the number of units in ending inventory. 3. Compute th

> Montoure Company uses a periodic inventory system. It entered into the following calendar-year purchases and sales transactions. (For specific identification, units sold consist of 600 units from beginning inventory, 300 from the February 10 purchase, 20

> Use the following information to prepare a statement of cash flows for Studio One for the month ended December 31. The cash balance at the start of December 1 was $1,000.

> Kiona Co. set up a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in May (the last month of the company’s fiscal year). May 1 prepared a company check for $300 to establish the petty cash

> Refer to the information in Problem 5-1A and assume the perpetual inventory system is used. Required 1. Compute cost of goods available for sale and the number of units available for sale. 2. Compute the number of units in ending inventory. 3. Compute th

> Warnerwoods Company uses a periodic inventory system. It entered into the following purchases and sales transactions for March. (For specific identification, the March 9 sale consisted of 80 units from beginning inventory and 340 units from the March 5 p

> On January 1, JKR Shop had $225,000 of beginning inventory at cost. In the first quarter of the year, it purchased $795,000 of merchandise, returned $11,550, and paid freight charges of $18,800 on purchased merchandise, terms FOB shipping point. The comp

> Helix reported the following information in its financial statements. Write-offs of accounts receivable were $200 in the current year. Helix did not recover any write-offs. Determine bad debts expense for the current year.

> Refer to the information in QS 5-5 and assume the periodic inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the weighted average method. (Round per unit costs and inventory amounts to cents.)

> Dakota Company had net sales (at retail) of $260,000. The following additional information is available from its records. Use the retail inventory method to estimate Dakota’s year-end inventory at cost.

> Comparative figures for Samsung, Apple, and Google follow. Required 1. Compute total asset turnover for the most recent two years for Samsung using the data shown. 2. Is the change in Samsung’s asset turnover favorable or unfavorable? 3

> Use the following information for Palmer Co. to compute inventory turnover for Year 3 and Year 2, and its days’ sales in inventory at December 31, Year 3 and Year 2. From Year 2 to Year 3, did Palmer improve its (a) inventory turnover a

> Cruz Company uses LIFO for inventory costing and reports the following financial data. It also recomputed inventory and cost of goods sold using FIFO for comparison purposes. 1. Compute its current ratio, inventory turnover, and days’ s

> Vibrant Company had $850,000 of sales in each of Year 1, Year 2, and Year 3, and it purchased merchandise costing $500,000 in each of those years. It also maintained a $250,000 physical inventory from the beginning to the end of that three-year period. I

> Martinez Company’s ending inventory includes the following items. Compute the lower of cost or market for ending inventory applied separately to each product.

> Following are five separate cases involving internal control issues. a. Chi Han receives all incoming customer cash receipts for her employer and posts the customer payments to their respective accounts. b. At Tico Company, Julia and Trevor alternate lun

> Flora’s Gifts reported the following current-month data for its only product. The company uses a periodic inventory system, and its ending inventory consists of 60 units—50 units from the January 6 purchase and 10 unit

> Use the information in QS 1-15 to prepare a December 31 balance sheet for Hawkin. Hint: Retained Earnings, December 31, equals $8,800.

> In its first year of operations, Cloudbox has credit sales of $200,000. Its year-end balance in Accounts Receivable is $10,000, and the company estimates that $1,500 of its accounts receivable is uncollectible. a. Prepare the year-end adjusting entry to

> Lopez Company reported the following current-year data for its only product. The company uses a periodic inventory system, and its ending inventory consists of 150 units—50 from each of the last three purchases. Determine the cost assig

> Refer to sales and purchases data from Exercise 5-11 and record journal entries for Tree Seedlings’s sales and purchases transactions. Assume for this assignment that the company uses a perpetual inventory system and LIFO. All sales and purchases are mad

> Refer to the information in Exercise 5-11 and assume the perpetual inventory system is used. Determine the costs assigned to ending inventory and to cost of goods sold using (a) FIFO and (b) LIFO. (c) Compute the gross profit for each method.

> Tree Seedlings has the following current-year purchases and sales for its only product. Required The company uses a periodic inventory system. Determine the costs assigned to ending inventory and to cost of goods sold using (a) FIFO and (b) LIFO. (c) Com

> Comparative figures for Apple and Google follow. Required 1. Compute total asset turnover for the most recent two years for Apple and Google using the data shown. 2. In the current year, which company is more efficient in generating net sales given total

> Refer to the information in QS 5-5 and assume the periodic inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on LIFO. (Round per unit costs and inventory amounts to cents.)

> Refer to the information in Exercise 5-8 and assume the perpetual inventory system is used. Determine the costs assigned to ending inventory and to cost of goods sold using (a) FIFO and (b) LIFO. (c) Compute the gross profit for each method.

> Refer to the information in Exercise 5-8. Ending inventory consists of 45 units from the March 14 purchase, 75 units from the July 30 purchase, and all 100 units from the October 26 purchase. Using the specific identification method, compute (a) the cost

> On January 1, Walker purchased a used machine for $150,000. On January 4, Walker paid $3,510 to wire electricity to the machine. Walker paid an additional $4,600 on January 5 to secure the machine for operation. The machine will be used for seven years a

> Hemming Co. reported the following current-year purchases and sales for its only product. Required Hemming uses a periodic inventory system. Determine the costs assigned to ending inventory and to cost of goods sold using (a) FIFO and (b) LIFO. (c) Comp

> On January 1, Wei Company begins the accounting period with a $30,000 credit balance in Allowance for Doubtful Accounts. a. On February 1, the company determined that $6,800 in customer accounts was uncollectible; specifically, $900 for Oakley Co. and $5

> Use the data and results from Exercise 5-5 to compute gross profit for the month of January for the company similar to that in Exhibit 5.8 for the four inventory methods. Required 1. Which method yields the highest gross profit? 2. Does gross profit usin

> Refer to sales and purchases data from Exercise 5-3 and record journal entries for Laker Company’s sales and purchases transactions. Assume for this assignment that the company uses a perpetual inventory system and FIFO. All sales and purchases are made

> Use the information in QS 1-15 to prepare a statement of retained earnings for Hawkin for the month ended December 31. Hint: Net income is $5,800.

> Refer to the information in Exercise 5-3 and assume the perpetual inventory system is used. Determine the costs assigned to ending inventory and to cost of goods sold using (a) specific identification, (b) weighted average, (c) FIFO, and (d) LIFO. (Round

> Use the data in Exercise 5-3 to compute gross profit for the month of January for Laker Company similar to that in Exhibit 5.8 for the four inventory methods. 1. Which method yields the highest gross profit? 2. Does gross profit using weighted average fa

> Laker Company reported the following January purchases and sales data for its only product. Required The company uses a periodic inventory system. Determine the cost assigned to ending inventory and to cost of goods sold using (a) specific identification

> Brinkley Company, which began operations in Year 1, had the following transactions and events in its long-term investments. Year 1 Jan. 5 Brinkley purchased 20,000 shares (25% of total) of Bloch’s common stock for $200,500. Aug.1 Bloch declared and paid

> Walberg Associates, antique dealers, purchased goods for $75,000. Terms of the purchase were FOB ship- ping point, and the cost of transporting the goods to Walberg Associates’ warehouse was $2,400. Walberg Associates insured the shipment at a cost of $3

> 1. At year-end, Barr Co. had shipped $12,500 of merchandise FOB destination to Lee Co. Which company should include the $12,500 of merchandise in transit as part of its year-end inventory? 2. Parris Company has shipped $20,000 of goods to Harlow Co., and

> Match each document in a voucher system with its description. Document 1. Purchase requisition 2. Purchase order 3. Invoice 4. Receiving report 5. Invoice approval 6. Voucher Description A. An itemized statement of goods prepared by the vendor listing th

> Dexter Company uses the direct write-off method. Prepare journal entries to record the following transactions. Mar. 11 Dexter determines that it cannot collect $45,000 of its accounts receivable from Leer Co. 29 Leer Co. unexpectedly pays its account in

> A solar panel dealer acquires a used panel for $9,000, with terms FOB shipping point. Compute total inventory costs assigned to the used panel if additional costs include $1,500 for sales staff salaries. $135 for shipping insurance. $280 for transportat

> In taking a physical inventory at the end of Year 1, Grant Company forgot to count certain units and understated ending inventory by $10,000. Determine how this error affects each of the following. a. Year 1 cost of goods sold c. Year 2 cost of goods sol

> Spade Co. is considering either FIFO or LIFO. Determine which method results in the lowest income tax expense in the current year when (a) inventory costs are rising and (b) inventory costs are falling. The income tax rate is 20% and is calculated as a p

> Complete the following table by indicating whether FIFO or LIFO results in the lower reported amount for each of the three accounting measures.

> Compute the missing amounts in the separate income statements A, B, and C.