Question: Rachel Sells is unable to reconcile the

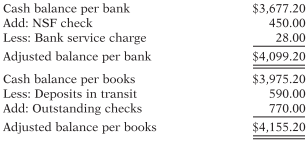

Rachel Sells is unable to reconcile the bank balance at January 31. Rachel’s reconciliation is shown here.

Instructions

(a) What is the proper adjusted cash balance per bank?

(b) What is the proper adjusted cash balance per books?

(c) Prepare the adjusting journal entries necessary to determine the adjusted cash balance per books.

Transcribed Image Text:

Cash balance per bank Add: NSF check Less: Bank service charge $3,677.20 450.00 28.00 Adjusted balance per bank $4,099.20 Cash balance per books Less: Deposits in transit Add: Outstanding checks $3,975.20 590.00 770.00 Adjusted balance per books $4,155.20

> In their annual reports to stockholders, companies must report or disclose information about all liabilities, including potential liabilities related to environmental clean-up. There are many situations in which you will be asked to provide personal fina

> Partial adjusted trial balance data for Levin Corporation are presented in BE4-10. The balance in Retained Earnings is the balance as of January 1. Prepare a retained earnings statement for the year assuming net income is $10,400.

> Selected transactions for Montes Company are presented below in journal form (without explanations). Post the transactions to T-accounts. Date Account Title Debit Credit May Accounts Receivable 3,800 Service Revenue 3,800 12 Cash 1,600 Accounts Recei

> Lance Morrow cannot understand why the cash realizable value does not decrease when an uncollectible account is written off under the allowance method. Clarify this point for Lance.

> What is the normal balance for each of these accounts? (a) Accounts Receivable. (b) Cash. (c) Dividends. (d) Accounts Payable. (e) Service Revenue. (f) Salaries and Wages Expense. (g) Common Stock.

> On January 1, 2017, Harvee Company had Accounts Receivable of $54,200 and Allowance for Doubtful Accounts of $3,700. Harvee Company prepares fi nancial statements annually. During the year, the following selected transactions occurred. Jan. 5 Sold $4,000

> Explain the differences between depreciation expense and accumulated depreciation.

> The May transactions of Chulak Corporation were as follows. May 4 Paid $700 due for supplies previously purchased on account. 7 Performed advisory services on account for $6,800. 8 Purchased supplies for $850 on account. 9 Purchased equipment for $1,000

> Al Medina, D.D.S., opened an incorporated dental practice on January 1, 2017. During the first month of operations, the following transactions occurred. 1. Performed services for patients who had dental plan insurance. At January 31, $760 of such service

> The July 28, 2007, issue of the Wall Street Journal includes an article by Kathryn Kranhold entitled “GE’s Accounting Draws Fresh Focus on News of Improper Sales Bookings.” Instructions Read the article and answer the following questions. (a) What improp

> The adjusted trial balance of Levin Corporation at December 31, 2017, includes the following accounts: Retained Earnings $17,200, Dividends $6,000, Service Revenue $32,000, Salaries and Wages Expense $14,000, Insurance Expense $1,800, Rent Expense $3,900

> Use the data in BE3-8 and journalize the transactions. (You may omit explanations.) Data from BE3-8: Aug. 1 Issues shares of common stock to investors in exchange for $10,000. 4 Pays insurance in advance for 3 months, $1,500. 16 Receives $900 from client

> State the rules of debit and credit as applied to (a) asset accounts, (b) liability accounts, and (c) the Common Stock account.

> “Depreciation is a process of valuation that results in the reporting of the fair value of the asset.” Do you agree? Explain.

> Transaction data for McCall Real Estate Agency are presented in E3-8.(given below) Oct. 1 Stockholders invest $30,000 in exchange for common stock of the corporation. 2 Hires an administrative assistant at an annual salary of $36,000. 3 Buys office furni

> Internal control is concerned only with enhancing the accuracy of the accounting records.” Do you agree? Explain.

> On December 31, 2016, when its Allowance for Doubtful Accounts had a debit balance of $1,400, Dallas Co. estimates that 9% of its accounts receivable balance of $90,000 will become uncollectible and records the necessary adjustment to Allowance for Doubt

> The ledger of Howard Rental Agency on March 31 of the current year includes the selected accounts below before adjusting entries have been prepared. An analysis of the accounts shows the following. 1. The equipment depreciates $280 per month. 2. Half of

> Vanessa Jones is the assistant chief accountant at IBT Company, a manufacturer of computer chips and cellular phones. The company presently has total sales of $20 million. It is the end of the first quarter and Vanessa is hurriedly trying to prepare a tr

> The trial balance of Woods Company includes the following balance sheet accounts. Identify the accounts that might require adjustment. For each account that requires adjustment, indicate (1) the type of adjusting entry (prepaid expense, unearned revenue,

> Tilton Corporation has the following transactions during August of the current year. Indicate (a) the basic analysis and (b) the debit–credit analysis illustrated on pages 111–116. Aug. 1 Issues shares of common stock to investors in exchange for $10,000

> Misty Reno, a beginning accounting student, believes debit balances are favorable and credit balances are unfavorable. Is Misty correct? Discuss.

> What types of accounts does a company debit and credit in a prepaid expense adjusting entry?

> This information relates to McCall Real Estate Agency. Oct. 1 Stockholders invest $30,000 in exchange for common stock of the corporation. 2 Hires an administrative assistant at an annual salary of $36,000. 3 Buys office furniture for $3,800, on account.

> Wang Company accumulates the following adjustment data at December 31. (a) Services performed but unbilled total $600. (b) Store supplies of $160 are on hand. The supplies account shows a $1,900 balance. (c) Utility expenses of $275 are unpaid. (d) Servi

> Klean Sweep Company offers home cleaning service. Two recurring transactions for the company are billing customers for services performed and paying employee salaries. For example, on March 15 bills totaling $6,000 were sent to customers, and $2,000 was

> The bookkeeper for Tran Company asks you to prepare the following accrual adjusting entries at December 31. Use these account titles: Service Revenue, Accounts Receivable, Interest Expense, Interest Payable, Salaries and Wages Expense, and Salaries and W

> The August 31, 2009, issue of the Wall Street Journal includes an article by Serena Ng and Cari Tuna entitled “Big Firms Are Quick to Collect, Slow to Pay.” Instructions Read the article and answer the following questions. (a) How many days did InBev tel

> Laser Recording Systems, founded in 1981, produces disks for use in the home market. The following is an excerpt from Laser Recording Systems’ financial statements (all dollars in thousands). LASER RECORDING SYSTEMS Management Discussion Accrued liabilit

> Rae Mohlee, a fellow student, is unclear about the basic steps in the recording process. Identify and briefly explain the steps in the order in which they occur.

> Distinguish between the two categories of adjusting entries, and identify the types of adjustments applicable to each category.

> Barry Barack, a fellow student, contends that the double-entry system means each transaction must be recorded twice. Is Barry correct? Explain.

> Selected transactions for Front Room, an interior decorator corporation, in its first month of business, are as follows. 1. Issued stock to investors for $15,000 in cash. 2. Purchased used car for $10,000 cash for use in business. 3. Purchased supplies o

> BizCon, a consulting firm, has just completed its first year of operations. The company’s sales growth was explosive. To encourage clients to hire its services, BizCon offered 180-day financing—meaning its largest customers do not pay for nearly 6 months

> Saira Morrow operates Dressage Riding Academy, Inc. The academy’s primary sources of revenue are riding fees and lesson fees, which are provided on a cash basis. Saira also boards horses for owners, who are billed monthly for boarding f

> Using the data in BE4-6, journalize and post the entry on July 1 and the adjusting entry on December 31 for Marsh Insurance Co. Marsh uses the accounts Unearned Service Revenue and Service Revenue.

> Use the data in BE3-5 and journalize the transactions. (You may omit explanations.) Data from BE3-5: June 1 Issues common stock to investors in exchange for $5,000 cash. 2 Buys equipment on account for $1,100. 3 Pays $740 to landlord for June rent. 12 Se

> The terms debit and credit mean “increase” and “decrease,” respectively. Do you agree? Explain.

> Daisey Company is a very profitable small business. It has not, however, given much consideration to internal control. For example, in an attempt to keep clerical and office expenses to a minimum, the company has combined the jobs of cashier and book- ke

> Why may the financial information in an unadjusted trial balance not be up-to-date and complete?

> The financial statements of Louis Vuitton are presented in Appendix F. Instructions for accessing and using the company’s complete annual report, including the notes to its financial statements, are also provided in Appendix F. Instructions Use Louis Vui

> The following accounts, in alphabetical order, were selected from recent financial statements of Krispy Kreme Doughnuts, Inc. Accounts Payable Interest Income Accounts Receivable Inventories Common Stock Prepaid Expenses Depreciation Expense Property and

> Franken Company, a ski tuning and repair shop, opened on November 1, 2016. The company carefully kept track of all its cash receipts and cash payments. The following information is available at the end of the ski season, April 30, 2017. The repair shop

> The January 27, 2011, edition of the New York Times contains an article by Richard Sandomir entitled “N.F.L. Finances, as Seen Through Packers’ Records.” The article discusses the fact that the Green Bay Packers are the only NFL team that publicly publis

> On July 1, 2017, Ling Co. pays $12,400 to Marsh Insurance Co. for a 2-year insurance contract. Both companies have fiscal years ending December 31. For Ling Co., journalize and post the entry on July 1 and the annual adjusting entry on December 31.

> Transactions for Jayne Company for the month of June are presented below. Identify the accounts to be debited and credited for each transaction. June 1 Issues common stock to investors in exchange for $5,000 cash. 2 Buys equipment on account for $1,100.

> Why is an account referred to as a T-account?

> “The historical cost principle of accounting requires adjusting entries.” Do you agree? Explain.

> Ayala Architects incorporated as licensed architects on April 1, 2017. During the first month of the operation of the business, these events and transactions occurred: Apr 1 Stockholders invested $18,000 cash in exchange for common stock of the corporati

> The tabular analysis of transactions for Wolfe Company is presented in E3-4(Given below). Instructions Prepare an income statement and a retained earnings statement for August and a classified balance sheet at August 31, 2017. Assets = Liabilities +

> In its first year of operations, Gomes Company recognized $28,000 in service revenue, $6,000 of which was on account and still outstanding at year-end. The remaining $22,000 was received in cash from customers. The company incurred operating expenses of

> The following information is available for Berlin Corp. for the year ended December 31, 2017: Prepare a multiple-step income statement for Berlin Corp. and comprehensive income statement. The company has a tax rate of 30%. This rate also applies to the

> The following accounts are taken from the ledger of Chillin’ Company at December 31, 2017. Notes Payable….………………….……..$20,000 Cash………………………………..…………..$6,000 Common Stock…………………..…………25,000 Supplies………………………………………….5,000 Equipment………………………..………….76,000 Re

> Purpose: This activity provides information about career opportunities for CPAs. Address: www.startheregoplaces.com/why-accounting,orgo to www.wiley.com/college/kimmel Instructions Go the address shown above and then answer the following questions. (a)

> At the end of its first year, the trial balance of Rayburn Company shows Equipment $22,000 and zero balances in Accumulated Depreciation—Equipment and Depreciation Expense. Depreciation for the year is estimated to be $2,750. Prepare the annual adjusting

> For each of the following accounts, indicate the effect of a debit or a credit on the account and the normal balance. (a) Accounts Payable (b) Advertising Expense. (c) Service Revenue. (d) Accounts Receivable. (e) Retained Earnings (f) Dividends.

> Indicate how each business transaction affects the basic accounting equation. (a) Paid cash for janitorial services. (b) Purchased equipment for cash. (c) Issued common stock to investors in exchange for cash. (d) Paid an account payable in full.

> In completing the engagement in Question 3, Wilson pays no costs in March, $2,500 in April, and $2,200 in May (incurred in April). How much expense should the firm deduct from revenues in the month when it recognizes the revenue? Why?

> Bradley’s Miniature Golf and Driving Range Inc. was opened on March 1 by Bob Dean. These selected events and transactions occurred during March. Mar 1 Stockholders invested $50,000 cash in the business in exchange for common stock of the corporation. 3 P

> The Financial Accounting Standards Board (FASB) is a private organization established to improve accounting standards and financial reporting. The FASB conducts extensive research before issuing a “Statement of Financial Accounting Standards,” which repr

> A tabular analysis of the transactions made during August 2017 by Wolfe Company during its first month of operations is shown below. Each increase and decrease in stock-holders’ equity is explained. Instructions (a) Describe each trans

> Your examination of the records of a company that follows the cash basis of accounting tells you that the company’s reported cash-basis earnings in 2017 are $33,640. If this firm had followed accrual-basis accounting practices, it would

> Boyd Docker recorded the following transactions during the month of April. Post these entries to the Cash account of the general ledger to determine the ending balance in cash. The beginning balance in cash on April 1 was $1,900. Аprг. 3 Cash Servi

> Recently, it was announced that two giant French retailers, Carrefour SA and Promodes SA, would merge. A headline in the Wall Street Journal blared, “French Retailers Create New WalMart Rival.” While Wal-Martâ

> a. Indicate in which financial statement each of the following adjusted trial balance accounts would be presented. Service Revenue Accounts Receivable Notes Payable Accumulated Depreciation Common Stock Utilities Expense b. Paloma Company shows the follo

> Chieftain International, Inc., is an oil and natural gas exploration and production company. A recent balance sheet reported $208 million in assets with only $4.6 million in liabilities, all of which were short-term accounts payable. During the year, Chi

> Lahey Advertising Company’s trial balance at December 31 shows Supplies $8,800 and Supplies Expense $0. On December 31, there are $1,100 of supplies on hand. Prepare the adjusting entry at December 31 and, using T-accounts, enter the balances in the acco

> During 2017, Rostock Company entered into the following transactions. 1. Purchased equipment for $286,176 cash. 2. Issued common stock to investors for $137,590 cash. 3. Purchased inventory of $68,480 on account. Using the following tabular analysis, sho

> Here are some accounting reporting situations. (a) East Lake Company recognizes revenue at the end of the production cycle but before sale. The price of the product, as well as the amount that can be sold, is not certain. (b) Hilo Company is in its fifth

> Max Wilson, a lawyer, accepts a legal engagement in March, performs the work in April, and is paid in May. If Wilson’s law firm prepares monthly financial statements, when should it recognize revenue from this engagement? Why?

> Ivy Company purchased land and a building on January 1, 2017. Management’s best estimate of the value of the land was $100,000 and of the building $250,000. However, management told the accounting department to record the land at $230,000 and the buildin

> During 2017, its first year of operations as a delivery service, Persimmon Corp. entered into the following transactions. 1. Issued shares of common stock to investors in exchange for $100,000 in cash. 2. Borrowed $45,000 by issuing bonds. 3. Purchased d

> Are the following events recorded in the accounting records? Explain your answer in each case. (a) A major stockholder of the company dies. (b) Supplies are purchased on account. (c) An employee is fired. (d) The company pays a cash dividend to its stock

> Bindy Crawford created a corporation providing legal services, Bindy Crawford Inc., on July 1, 2017. On July 31 the balance sheet showed Cash $4,000, Accounts Receivable $2,500, Supplies $500, Equipment $5,000, Accounts Payable $4,200, Common Stock $6,20

> Boyd Docker engaged in the following activities in establishing his photography studio, SnapShot!: 1. Opened a bank account in the name of SnapShot! and deposited $8,000 of his own money into this account in exchange for common stock. 2. Purchased photog

> Salt Creek Golf Inc. was organized on July 1, 2017. Quarterly financial statements are prepared. The trial balance and adjusted trial balance on September 30 are shown below. Instructions (a) Journalize the adjusting entries that were made. (b) Prepare

> Briefly describe some of the similarities and differences between GAAP and IFRS with respect to the accounting for inventories.

> Jean Karns is the new owner of Jean’s Computer Services. At the end of July 2017, her first month of ownership, Jean is trying to prepare monthly financial statements. She has the following information for the month. 1. At July 31, Jean owed employees $1

> Amazon.com, Inc.’s financial statements are presented in Appendix D. Financial statements of Wal-Mart Stores, Inc. are presented in Appendix E. Instructions (a) Based on the information contained in the financial statements, determine t

> Cortina Company accumulates the following adjustment data at December 31. Indicate (1) the type of adjustment (prepaid expense, accrued revenue, and so on) and (2) the status of the accounts before adjustment (for example, “assets understated and revenu

> During 2017, Manion Corp. entered into the following transactions. 1. Borrowed $60,000 by issuing bonds. 2. Paid $9,000 cash dividend to stockholders. 3. Received $13,000 cash from a previously billed customer for services performed. 4. Purchased supplie

> At December 31, 2017, the trial balance of Malone Company contained the following amounts before adjustment. Instructions (a) Prepare the adjusting entry at December 31, 2017, to record bad debt expense, assuming that the aging schedule indicates that $1

> The financial statements of Apple Inc. are presented in Appendix A at the end of this textbook. Instructions Answer the following questions using the financial statements and the notes to the financial statements. (a) What were Apple’s total current asse

> Boyd Docker has just rented space in a strip mall. In this space, he will open a photography studio, to be called SnapShot! A friend has advised Boyd to set up a double-entry set of accounting records in which to record all of his business transactions.

> These accounting concepts were discussed in this and previous chapters. 1. Economic entity assumption. 2. Expense recognition principle. 3. Monetary unit assumption. 4. Periodicity assumption. 5. Historical cost principle. 6. Materiality. 7. Full disclos

> Brady Company entered into these transactions during May 2017, its first month of operations. 1. Stockholders invested $40,000 in the business in exchange for common stock of the company. 2. Purchased computers for office use for $30,000 from Ladd on acc

> Can a business enter into a transaction that affects only the left side of the basic accounting equation? If so, give an example.

> Identify and state two generally accepted accounting principles that relate to adjusting the accounts.

> Nona Curry started her own consulting firm, Curry Consulting Inc., on May 1, 2017. The following transactions occurred during the month of May. May 1 Stockholders invested $15,000 cash in the business in exchange for common stock. 2 Paid $600 for office

> Your friend Will Juritz has been hired to help take the physical inventory in Byrd’s Hardware Store. Explain to Will what this job will entail.

> The ledger of Umatilla, Inc. on March 31, 2017, includes the following selected accounts before adjusting entries. An analysis of the accounts shows the following. 1. Insurance expires at the rate of $300 per month. 2. Supplies on hand total $900. 3. Th

> The financial statements of Columbia Sportswear Company are presented in Appendix B. Financial statements of VF Corporation are presented in Appendix C. Instructions (a) Based on the information contained in these financial statements, determine the norm

> The ledger of Melmann Company includes the following accounts. Explain why each account may require adjustment. (a) Prepaid Insurance. (b) Depreciation Expense. (c) Unearned Service Revenue (d) Interest Payable.

> The accounting records of Ohm Electronics show the following data. Beginning inventory……………………………….3,000 units at $5 Purchases………………………………………………8,000 units at $7 Sales………………………………………..…………...9,400 units at $10 Determine cost of goods sold during the per

> Presented below are three economic events. On a sheet of paper, list the letters (a), (b), and (c) with columns for assets, liabilities, and stockholders’ equity. In each column, indicate whether the event increased (+), decreased (−), or had no effect (

> A list of concepts is provided below in the left column, with descriptions of the concepts in the right column. There are more descriptions provided than concepts. Match the description to the concept. 1. ______ Cash-basis accounting. 2. ______ Fiscal ye

> Describe the accounting information system.

> (a) How does the periodicity assumption affect an accountant’s analysis of accounting transactions? (b) Explain the term fiscal year.

> On April 1, Wonder Travel Agency Inc. was established. These transactions were completed during the month. 1. Stockholders invested $30,000 cash in the company in exchange for common stock. 2. Paid $900 cash for April office rent. 3. Purchased office equ

> The financial statements of Louis Vuitton are presented in Appendix F. Instructions for accessing and using the company’s complete annual report, including the notes to its financial statements, are also provided in Appendix F. Instructions Describe in w