Question: Refer to Practice 9-8. Assume that

Refer to Practice 9-8. Assume that the company has no expenses except for cost of goods sold, the selling price per unit is $6 in each year, and that the income tax rate is 40%. Compute the total amount of income taxes owed for Year 1 through Year 4 assuming that

(1) The company uses LIFO inventory valuation and

(2) The company uses FIFO inventory valuation.

In Practice 9-8

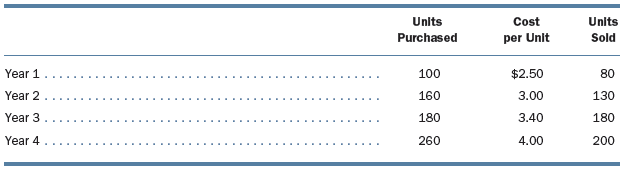

The company started business at the beginning of Year 1. Inventory purchases and sales during the first four years of the company’s business are as follows:

Transcribed Image Text:

Units Cost Units Purchased per Unit Sold Year 1 100 $2.50 80 Year 2 160 3.00 130 Year 3 180 3.40 180 Year 4 260 4.00 200

> Wright Manufacturing Co. acquired 20 similar machines at the beginning of 2008 for a total cost of $150,000. The machines have an average life of five years and no residual value. The group depreciation method is employed in writing off the cost of the m

> The FASB permits the use of an average market value of plan assets for some pension computations. In other cases, the fair market value at a specific measurement date must be used. Under what circumstances is the average market value permissible?

> What role does residual, or salvage, value play in the various methods of time-factor depreciation?

> Lyell Company started a newspaper delivery business on January 1, 2010. On that date, the company purchased a small pickup truck for $14,000. Lyell planned to depreciate the truck over three years and assumed an $800 residual value. During 2010 and 2011,

> A company buys a machine for $61,700 on January 1, 2010. The maintenance costs for the years 2010–2013 are as follows: 2010, $4,900; 2011, $4,700; 2012, $12,400 (includes $7,800 for cost of a new motor installed in December 2012); 2013, $4,800. Instruct

> On January 1, 2010, Ron Shelley purchased a new tractor to use on his farm. The tractor cost $100,000. Ron also had the dealer install a front-end loader on the tractor. The cost of the front-end loader was $7,000. The shipping charges were $600, and the

> A delivery truck was acquired by Navarro Inc. for $80,000 on January 1, 2013. The truck was estimated to have a 3-year life and a trade-in value at the end of that time of $20,000. The following depreciation methods are being considered: (a) Depreciation

> Olympus Equipment Company purchased a new piece of factory equipment on May 1, 2013, for $29,200. For income tax purposes, the equipment is classified as a 7-year asset. Because this is similar to the economic life expected for the asset, Olympus decides

> Rocky Point Foundry purchased factory equipment on March 15, 2012. The equipment will be depreciated for financial purposes over its estimated useful life, counting the year of acquisition as a half-year. The company accountant revealed the following inf

> Feng Company purchased a machine for $180,000 on September 1, 2013. It is estimated that the machine will have a 10-year life and a salvage value of $18,000. Its working hours and production in units are estimated at 36,000 and 750,000, respectively. It

> On January 2, 2013, Joshon Hardware Company traded with a dealer an old delivery truck for a newer model. Data relative to the old and new trucks follow: Old truck: Original cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

> Assume that Coaltown Corporation has a machine that cost $52,000, has a book value of $35,000, and has a fair value of $40,000. The machine is used in Coaltown’s manufacturing process. For each of the following situations, indicate the value at which the

> On April 1, 2013, Brandoni Company has a piece of machinery with a cost of $100,000 and accumulated depreciation of $75,000. On April 1, Brandoni decided to sell the machine within one year. As of April 1, 2013, the machine had an estimated selling price

> What distinguishes a troubled debt restructuring from other debt restructurings?

> On December 31, 2013, Debenham Corporation sold an old machine for $15,000, having an original cost of $84,000 and a book value of $9,000. The terms of the sale were as follows: $3,000 down payment, $6,000 payable on December 31 of the next two years. Th

> Largest Company acquired Large Company on January 1. As part of the acquisition, $10,000 in goodwill was recognized; this goodwill was assigned to Largest’s Production reporting unit. During the year, the Production reporting unit repor

> An intangible asset cost $300,000 on January 1, 2013. On January 1, 2014, the asset was evaluated to determine whether it was impaired. As of January 1, 2014, the asset was expected to generate future cash flows of $25,000 per year (at the end of the yea

> The Rockington Co. applied for and received numerous patents at a total cost of $31,195 at the beginning of 2008. It is assumed the patents will have economic value for their remaining legal life of 16 years. At the beginning of 2010, the company paid $9

> Use the information given in Exercise 11-37 and assume that Della Bee Company is located in Hong Kong and uses International Financial Reporting Standards. Della Bee also has chosen to recognize increases in the value of long-term operating assets in acc

> Della Bee Company purchased a manufacturing plant building 10 years ago for $2,600,000. The building has been depreciated using the straight-line method with a 30-year useful life and 10% residual value. Della Bee’s manufacturing operations have experien

> Franklin Company purchased a machine on January 1, 2010, paying $150,000. The machine was estimated to have a useful life of eight years and an estimated salvage value of $30,000. In early 2012, the company elected to change its depreciation method from

> Finn Corporation purchased a machine on July 1, 2010, for $225,000. The machine was estimated to have a useful life of 12 years with an estimated salvage value of $15,000. During 2013, it became apparent that the machine would become uneconomical after D

> Goff Corporation purchased a machine on January 1, 2008, for $250,000. At the date of acquisition, the machine had an estimated useful life of 20 years with no salvage value. The machine is being depreciated on a straight-line basis. On January 1, 2013,

> On January 2, 2012, Adelaide Rose purchased land with valuable natural ore deposits for $13 million. The estimated residual value of the land was $4 million. At the time of purchase, a geological survey estimated 3 million tons of removable ore were unde

> How is the service cost portion of net periodic pension expense to be measured?

> On January 1, 2013, Major Company purchased a uranium mine for $800,000. On that date, Major estimated that the mine contained 1,000 tons of ore. At the end of the productive years of the mine, Major Company will be required to spend $4,200,000 to clean

> Jackson Manufacturing acquired a new milling machine on April 1, 2008. The machine has a special component that requires replacement before the end of the useful life. The asset was originally recorded in two accounts, one representing the main unit and

> Lundquist, Inc., uses the group depreciation method for its furniture account. The depreciation rate used for furniture is 21%. The balance in the furniture account on December 31, 2012, was $125,000, and the balance in Accumulated Depreciationâ

> The Anson Manufacturing Company reviewed its year-end inventory and found the following items. Indicate which items should be included in the inventory balance at December 31, 2013. Give your reasons for the treatment you suggest. (a) A packing case cont

> The management of Kauer Company has engaged you to assist in the preparation of year-end (December 31) financial statements. You are told that on November 30, the correct inventory level was 150,000 units. During the month of December, sales totaled 50,0

> Using the following data, compute the total cash expended for inventory in 2013. Accounts payable: January 1, 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 350,000 December

> The following inventory information is for Stevenson Company. Beginning inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 200 units @ $8 Purchases . . . . . . . . . . . . . . . . . . . . . .

> Jen and Barry’s Ice Milk Company used cash to purchase a new ice milk mixer on January 1, 2013. The new mixer is estimated to have a 20,000 - hour service life. Jen and Barry’s depreciates equipment on the service-hours method. The total price paid for t

> On November 6 of Year 1, the company purchased inventory (on account) from a supplier located in Indonesia. The purchase price is 100,000,000 Indonesian rupiah. On November 6, the exchange rate was 8,700 rupiah for 1 U.S. dollar. On December 31, the exch

> On November 17 of Year 1, the company entered into a commitment to purchase 250,000 ounces of gold on February 14 of Year 2 at a price of $1,110.20 per ounce. On December 31 of Year 1, the market price of gold is $1,075.10 per ounce. On February 14, the

> What is a joint venture, and how can a joint venture be a form of off-balance-sheet financing?

> The company compiled the following information concerning inventory for the current year: Compute the inventory cost at year-end using the dollar-value LIFO retail method. Year-End Incremental Cost Percentage Price Index Incremental Inventory at Re

> The company exchanged an asset for a similar asset. The exchange was with another company in the same line of business. The old asset had a cost of $1,000 and accumulated depreciation of $850. The old asset had a market value of $400 on the date of the e

> On October 1, 2013, the company has a building with a cost of $375,000 and accumulated depreciation of $225,000. The company commits to a plan to sell the building by February 1, 2014. On October 1, 2013, the building has an estimated selling price of $1

> The company reported the following information relating to inventory for the month of April: Sales for the month totaled $80,000. Compute the estimated cost of inventory on hand at the end of the month using the average cost assumption. Cost Retall

> The company reported the following information for the month: Sales for the month totaled $94,000. Compute the estimated cost of inventory on hand at the end of the month using the average cost assumption. Cost Retail Inventory, January 1 $40,000 $

> The company reported the following information for the year: Beginning accounts receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $2,000 Sales . . . . . . . . . . . . . . . . . . . . . . . . .

> At the beginning of Year 1, the company’s inventory level was stated correctly. At the end of Year 1, inventory was overstated by $2,200. At the end of Year 2, inventory was understated by $450. At the end of Year 3, inventory was correctly stated. Repor

> On July 23, the company’s inventory was destroyed in a hurricane-related flood. For insurance purposes, the company must reliably estimate the amount of inventory on hand on July 23. The company uses a periodic inventory system. The following data have b

> The company sells large industrial equipment. A piece of equipment with an original cost of $250,000 and an original selling price of $390,000 was recently returned. It is expected that the equipment will be able to be resold for just $225,000. The compa

> The company started business at the beginning of Year 1. The company applies the lower-of-cost-or-market (LCM) rule to its inventory as a whole. Inventory cost and market values as of the end of Year 1 and Year 2 were as follows: The market value numbe

> Briefly describe the partial recognition approach to accounting for deferred income taxes.

> Refer to Practice 9-11. Apply lower-of-cost-or-market accounting to the inventory as a whole. What total amount should be reported as inventory in the balance sheet? In Practice 9-11 The following information pertains to the company’s

> The following information pertains to the company’s ending inventory: Apply lower-of-cost-or-market accounting to each inventory item individually. What total amount should be reported as inventory in the balance sheet? Selling Se

> Refer to Practice 9-8. Compute the following: In Practice 9-8 The company started business at the beginning of Year 1. Inventory purchases and sales during the first four years of the company’s business are as follows: 1. LIFO reserv

> The company started business at the beginning of Year 1. Inventory purchases and sales during the first four years of the company’s business are as follows: Compute the company’s ending inventory as of the end of Yea

> Refer to Practice 9-6. Assume that the sales occurred as follows: January 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100 July 15 . . . . . . . . . . . . . .

> The company acquired a machine on January 1 at an original cost of $70,000. The machine’s estimated residual value is $5,000, and its estimated lifetime output is 13,000 units. The actual output of the machine was as follows: Year 1, 3,000 units; Year 2,

> The company acquired a machine on January 1 at an original cost of $81,000. The machine’s estimated residual value is $15,000, and its estimated life is 20,000 service hours. The actual usage of the machine was as follows: Year 1, 9,000 hours; Year 2, 5,

> The company acquired a machine on January 1 at an original cost of $100,000. The machine’s estimated residual value is $10,000, and its estimated life is four years. The company uses double-declining-balance depreciation and switches to straight-line in

> The company acquired a machine on January 1 at an original cost of $115,000. The machine’s estimated residual value is $20,000, and its estimated life is five years. Assume that the company uses sum-of-the-years’-digits depreciation. Compute (1) Depreci

> What is meant by market rate of interest, stated or contract rate, and effective rate? Which of these rates changes during the lifetime of the bond issue?

> The company has 10,000 shares of 6%, $100 par preferred stock outstanding. In addition, the company has 100,000 shares of common stock outstanding. The company started business on January 1, 2012. Total cash dividends paid during 2012 and 2013 were $55,0

> Using the following information, compute (1) Working capital and (2) Current ratio. Deferred sales revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 900 Accounts payable . . . . .

> A lease involves payments of $10,000 per year for six years. The payments are made at the end of each year. The lease involves a bargain purchase option of $6,000 to be exercised at the end of the 6-year period. The total economic life of the leased asse

> Refer to Practice 15-6. Assume that the lease is to be accounted for as a capital lease. Also assume that the leased asset is to be amortized over the 12-year asset life rather than the 10-year lease term. Make the journal entries necessary on the books

> The company is a lessee and signed a 3-year operating lease that calls for a payment of $20,000 at the end of the first year and payments of $80,000 at the end of each year for the second and third years. Make the journal entries necessary to record the

> The lessor leased equipment to the lessee. The fair value of the equipment is $246,000. Lease payments are $35,000 per year, payable at the end of the year, for 10 years. The interest rate implicit in the lease is 9%. At the end of 10 years, the lessor w

> A lease involves payments of $16,000 per month for four years. The payments are made at the end of each month. The lease also involves a guaranteed residual value of $50,000 to be paid at the end of the 4-year period. Compute the present value of the min

> The lessor is computing the appropriate monthly lease payment. The fair value of the leased asset is $75,000. The guaranteed residual value at the end of the lease term is $12,000. The appropriate interest rate is 12% compounded monthly. The lease term i

> On January 1, the lessor company purchased a piece of equipment for $7,000 as inventory. The lessor company immediately leased the equipment under a sales-type lease agreement; the cash selling price of the equipment is $10,000. The lease calls for the l

> On January 1, the lessor company purchased a piece of equipment for $100,000. The equipment has an expected salvage value of $3,974; this amount is not guaranteed. The lessor company immediately leased the equipment under a direct financing lease agreeme

> Describe the major differences between the accounting for pensions and other postretirement benefits.

> Refer to Practice 15-12. Assume that the lease is accounted for as a direct financing lease instead of as an operating lease. The interest rate implicit in the lease is 9%. Make the journal entries necessary on the lessor’s books to record (1) The signi

> On January 1, the lessor company purchased a piece of equipment for $24,000. The equipment has an expected life of four years with zero salvage value. The lessor company immediately leased the equipment under an operating lease agreement. The lease calls

> Refer to Practice 15-6. Net income for the year was $10,000. Except for lease-related items, there were no changes in current operating assets or liabilities during the year, no purchases or sales of property, plant, or equipment, and no dividends paid,

> On January 1 of Year 1, Dridge Company purchased 2,500 shares of the 10,000 outstanding shares of Company C for a total of $100,000. At the time of the purchase, the book value of Company C’s equity was $300,000. Company C assets having

> On January 1 of Year 1, Stratton Company purchased 5,000 shares of the 15,000 outstanding shares of Company B for a total of $82,000. At the time of the purchase, the book value of Company B’s equity was $202,000. Any excess of investment purchase price

> On January 1 of Year 1, Burton Company purchased 2,000 shares of the 8,000 outstanding shares of Company A for a total of $54,000. The purchase price was equal to 25% of the book value of Company A’s equity. Company A’s net income in Year 1 was $40,000;

> Indicate how each of the following transactions or events would be reflected in a statement of cash flows prepared using the indirect method. Each transaction or event is independent of the others. For items (a) and (d), assume that the balance in the ma

> On January 1, the company purchased debt securities for cash of $25,518. The securities have a face value of $20,000, and they mature in 15 years. The securities have a stated interest rate of 10%, and interest is paid semiannually, on June 30 and Decemb

> During 2012, the first year of its operations, Profit Industries purchased the following securities: During 2013, Profit sold one-half of security A for $8,000 and one-half of security D for $15,000. Provide the journal entries required to do the follo

> Truss Builders Co. reported the following selected balances on its financial statements for each of the four years 2011–2014: Based on these balances, reconstruct the valuation entries that must have been made each year. 2011 2012

> Why is off-balance-sheet financing popular with many companies? What problems are associated with the use of this method of financing?

> Bicknel Technologies Inc. purchased the following securities during 2012: At the beginning of 2012, Bicknel Technologies had a zero balance in each of its market adjustment accounts. During 2013, after the 2012 financial statements had been issued, Bic

> Kyoto Inc. had the following portfolio of securities at the end of its first year of operations: 1. Provide the entry necessary to adjust the portfolio of securities to its fair value. 2. In the following year, Kyoto elects to reclassify security B as

> The securities portfolio for Malibu Industries contained the following trading securities: 1. Assuming that all changes in fair value are considered temporary, what is the effect of the changes in value on the 2012 and 2013 financial statements? Give t

> American Steel Corp. acquired the following securities in 2013: At the beginning of 2013, American Steel had a zero balance in each of its market adjustment accounts. 1. What entry or entries would be made at the end of 2013, assuming the preceding fai

> During 2012, Spelling Inc. purchased the following trading securities: At the beginning of 2012, Spelling had a zero balance in Market Adjustment—Trading Securities. 1. What entry would be made at year-end, assuming the preceding valu

> During 2013, Litten Company purchased trading securities as a short-term investment. The costs of the securities and their fair values on December 31, 2013, follow: At the beginning of 2013, Litten had a zero balance in the market adjustmentâ

> Using the information from Exercise 14-30, provide the journal entry that would be necessary to properly value the debt security if, on December 31, 2013, the bond’s fair value was $96,500. Assume the security was initially classified as follows: 1. A tr

> On January 1, 2013, Cougar Creations Inc. purchased $100,000 of 5-year, 8% bonds when the effective rate of interest was 10%, paying $92,277. Interest is to be paid on July 1 and December 31. 1. Prepare an interest amortization schedule for the bonds. 2.

> On January 1, the company purchased debt securities with a face value of $100,000. The securities mature in seven years. The securities have a stated interest rate of 8%, and interest is paid semiannually. The prevailing market interest rate on these deb

> On January 1, 2013, Randy Incorporated purchased $600,000 of 20-year, 10% bonds when the market rate of interest was 8%. Interest is to be paid on June 30 and December 31 of each year. 1. Prepare the journal entry to record the purchase of the debt secur

> In the past, why was accounting for income taxes not as significant an issue in some foreign countries as it is in the United States?

> On January 3, 2013, McDonald Inc. purchased 40% of the outstanding common stock of Old Farms Co., paying $128,000 when the book value of the net assets of Old Farms equaled $250,000. The difference was attributed to equipment, which had a book value of $

> Alpha Co. acquired 20,000 shares of Beta Co. on January 1, 2012, at $12 per share. Beta Co. had 80,000 shares outstanding with a book value of $800,000. The difference between the book value and fair value of Beta Co. on January 1, 2012, is attributable

> On January 10, 2013, Delta Corporation acquired 12,000 shares of the outstanding common stock of Kennedy Company for $600,000. At the time of purchase, Kennedy Company had outstanding 48,000 shares with a book value of $2.4 million. On December 31, 2013,

> For each of the following independent situations, determine the appropriate accounting method to be used: cost or equity. For cost method situations, determine whether the security should be classified as trading or available for sale. For equity method

> During January 2013, Aragorn Inc. purchased the following securities: During 2013, Aragorn received interest from Mirkwood and the U.S. Treasury totaling $3,630. Dividends received on the stock held amounted to $1,760. During November 2013, Aragorn sol

> The following transactions of Kelsey, Inc., occurred within the same accounting period: (a) Purchased $55,000 U.S. Treasury 6% bonds, paying 102 plus accrued interest of $1,400. Kelsey uses the revenue approach to record accrued interest on purchased bo

> Refer to Practice 14-21. Make all journal entries necessary on the lending company’s books in connection with the loan during Year 2, Year 3, Year 4, and Year 5. Assume that all cash payments are received according to the renegotiated schedule. In Pract

> On January 1 of Year 1, the lending company made a $10,000, 8% loan. The $800 interest is receivable at the end of each year, with the principal amount to be received at the end of five years. As of the end of Year 1, the first year’s interest of $800 ha

> During Year 1, Walters Company purchased 6,000 shares of Company A common stock for $25 per share and 10,000 shares of Company B common stock for $32 per share. These investments are classified as available-for-sale securities. At December 31, Year 1, Wa

> Refer to Practice 14-18. Assume that the securities are classified as trading and that they were purchased for operating purposes. Compute (1) Cash flow from operating activities and (2) Cash flow from investing activities. In Practice 14-18 The compa