Question: Refer to Problem 5-15B and the

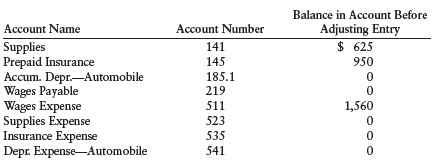

Refer to Problem 5-15B and the following additional information:

REQUIRED

1. Journalize the adjusting entries on page 3 of the general journal.

2. Post the adjusting entries to the general ledger. (If you are not using the working papers that accompany this text, enter the balances provided in this problem before posting the adjusting entries.)

Transcribed Image Text:

Balance in Account Before Adjusting Entry $ 625 Account Name Account Number 141 Supplies Prepaid Insurance Accum. Depr.-Automobile Wages Payable Wages Expense Supplies Expense Insurance Expense Depr. ExpenseAutomobile 145 950 185.1 219 511 1,560 523 535 541

> List the five steps taken in preparing a work sheet.

> The trial balance shows wages expense of $800. An additional $150 of wages was earned by the employees but has not yet been paid. Analyze the required adjustment using T accounts, and then formally enter this adjustment in the general journal.

> A six-month liability insurance policy was purchased for $750. Analyze the required adjustment as of July 31 using T accounts, and then formally enter this adjustment in the general journal.

> The trial balance indicates that the supplies account has a balance, prior to the adjusting entry, of $430. A physical count of the supplies inventory shows that $120 of supplies remain. Analyze the adjustment for supplies using T accounts, and then form

> Benito Mendez opened Mendez Appraisals. He rented office space and has a part-time secretary to answer the phone and make appraisal appointments. His chart of accounts is as follows: Mendez’s transactions for the first month of business

> Mary Smith purchased $350 worth of office equipment on account. The following entry was recorded on April 6. Find the error(s) and correct it (them) using the ruling method. On April 25, after the transactions had been posted, Smith discovered the follow

> From the following trial balance taken after one month of operation, prepare an income statement, a statement of owner’s equity, and a balance sheet. AT Speaker's Bureau Trial Balance March 31, 20 -- ACCOUNT NO. ACCDUNT E DEBIT BA

> From the information in Exercises 4-4B and 4-5B, Exercises 4-4B and 4-5B: Sengel Moon opened The Bike Doctor. Journalize the following transactions that occurred during the month of October of the current year. Use the following journal pages: October

> Set up general ledger accounts using the chart of accounts provided in Exercise 4-4B. Exercise 4-4B: Sengel Moon opened The Bike Doctor. Journalize the following transactions that occurred during the month of October of the current year. Use the follo

> Sengel Moon opened The Bike Doctor. Journalize the following transactions that occurred during the month of October of the current year. Use the following journal pages: October 1–12, page 1, and October 14–29, page 2.

> Set up T accounts for each of the general ledger accounts needed for Exercise 4-2B and post debits and credits to the accounts. Exercise 4-2B: For each of the following transactions, list the account to be debited and the account to be credited in the

> Name and describe six areas of specialization for a managerial accountant.

> For each of the following transactions, list the account to be debited and the account to be credited in the general journal. 1. Invested cash in the business, $1,000. 2. Performed services on account, $200. 3. Purchased office equipment on account, $500

> Prepare an income statement for David Segal for the month of October 20--.

> Label each of the following accounts as an asset (A), liability (L), or owner’s equity (OE) using the following format. Account Classification Cash Accounts Payable Supplics Bill Jones, Drawing Prepaid Insurance Accounts Receivable

> Refer to the trial balance in Problem 3-13B and to the analysis of the change in owner’s equity in Problem 3-14B. REQUIRED 1. Prepare an income statement for Jantz Plumbing Service for the month ended August 31, 20--. 2. Prepare a statement of owner’s e

> Refer to the trial balance of Jantz Plumbing Service in Problem 3-13B to determine the following information. Use the format provided below. 1. a. Total revenuc for the month b. Total expenscs for the month c. Net income for the month 2. a. Suc Jant

> Sue Jantz started a business in August 20-- called Jantz Plumbing Service. Jantz hired a part-time college student as an administrative assistant. Jantz has decided to use the following accounts: The following transactions occurred during August: (a) In

> From the information in the trial balance presented for Bill’s Delivery Service on page 80, prepare a balance sheet for Bill’s Delivery Service as of September 30, 20--.

> Assuming that all entries have been posted, prepare correcting entries for each of the following errors. 1. The following entry was made to record the purchase of $400 in equipment on account: Supplies 142 400 Cash 101 400 2. The following entry was

> Ann Taylor owns a suit tailoring shop. She opened business in September. She rented a small work space and has an assistant to receive job orders and process claim tickets. Her trial balance shows her account balances for the first two months of business

> what type of information is found on each of the following source documents? 1. Cash register tape 2. Sales ticket (issued to customer) 3. Purchase invoice (received from supplier or vendor) 4. Check stub

> List the 10 steps in the accounting cycle.

> The following accounts have normal balances. Prepare a trial balance for Betty’s Cleaning Service as of September 30, 20--. $14,000 8,000 1,200 1,800 18,000 6,000 Cash Betty Par, Capital Betty Par, Drawing Delivery Fees Wages Expens

> Based on the transactions recorded in Exercise 3-7B, prepare a trial balance for Nickie’s Neat Ideas as of January 31, 20--.

> Nicole Lawrence opened a business called Nickie’s Neat Ideas in January 20--. Set up T accounts for the following accounts: Cash; Accounts Receivable; Office Supplies; Computer Equipment; Office Furniture; Accounts Payable; Nicole Lawrence, Capital; Nico

> Foot and balance the T accounts prepared in Exercise 3-5B if necessary. Exercise 3-5B: George Atlas started a business on June 1, 20--. Analyze the following transactions for the first month of business using T accounts. Label each T account with the t

> George Atlas started a business on June 1, 20--. Analyze the following transactions for the first month of business using T accounts. Label each T account with the title of the account affected and then place the transaction letter and the dollar amount

> Indicate the normal balance (debit or credit) for each of the following accounts: 1. Cash 2. Rent Expense 3. Notes Payable 4. Owner’s drawing 5. Accounts Receivable 6. Owner’s Capital 7. Tools

> Roberto Alvarez began a business called Roberto’s Fix-It Shop. 1. Create T accounts for Cash; Supplies; Roberto Alvarez, Capital; and Utilities Expense. Identify the following transactions by letter and place them on the proper side of the T accounts: (a

> Complete the following statements using either “debit” or “credit”: (a) The asset account Prepaid Insurance is increased with a _________. (b) The owner’s drawing account is increased with a _________. (c) The asset account Accounts Receivable is decreas

> From the information in the trial balance presented above, prepare a statement of owner’s equity for Bill’s Delivery Service for the month ended September 30, 20--.

> From the information in the trial balance presented above, prepare an income statement for Bill’s Delivery Service for the month ended September 30, 20--.

> What is the purpose of the post-closing trial balance?

> Foot and balance the accounts payable T account shown below. Accounts Payable 300 450 250 350 150

> David Segal started a business. During the first month (October 20--), the following transactions occurred. (a) Invested cash in the business, $15,000. (b) Bought office supplies for $3,800: $1,800 in cash and $2,000 on account. (c) Paid one-year insuran

> Dr. Patricia Parsons is a dentist. As of January 31, Parsons owned the following property that related to her professional practice: Cash ……………â

> Prepare a statement of owner’s equity assuming Lopez had a net loss of $2,000.

> Efran Lopez started a financial consulting service on June 1, 20--, by investing $15,000. His net income for the month was $6,000, and he withdrew $7,000 for personal use. Prepare a statement of owner’s equity for the month of June.

> Label each of the following accounts as an asset (A), liability (L), owner’s equity (OE), revenue (R), or expense (E). Indicate the financial statement on which the account belongs—income statement (IS), statement of o

> Assume Jon Wallace completed the following additional transactions during March. Show the effect of each transaction on the basic elements of the expanded accounting equation: Assets = Liabilities + Owner’s Equity (Capital – Drawing + Revenues – Expenses

> Jon Wallace started a business. During the first month (March 20--), the following transactions occurred. Show the effect of each transaction on the accounting equation: Assets = Liabilities + Owner’s Equity. After each transaction, show the new account

> Using the accounting equation, compute the missing elements. Owner's Equity $ 5,000 Assets Liabilities $20,000 $15,000 $30,000 $20,000 $10,000 + I || || I

> Match the following steps of the accounting process with their definitions. Analyzing Recording Classifying Summarizing Reporting Interpreting a. Telling the results b. Looking at events that have taken place and thinking about how they affect the bu

> Identify the sales documents commonly used in retail and wholesale businesses.

> Describe the kind of information needed by the users listed. Owners (present and future) Managers Creditors (present and future) Government agencies

> Prepare a balance sheet for David Segal as of October 31, 20--.

> Prepare a statement of owner’s equity for David Segal for the month of October 20--.

> A beginning accounting student tried to complete a work sheet for Dick Ady’s Bookkeeping Service. The following adjusting entries were to have been analyzed and entered in the work sheet: (a) Ending inventory of supplies on July 31, $130. (b) Unexpired i

> Val Nolan started a business called Nolan’s Home Appraisals. The trial balance as of October 31, after the first month of operations, is as follows: REQUIRED 1. Analyze the following adjustments and enter them on the work sheet. (a) Sup

> The following is a list of outstanding notes payable as of December 31, 20--: REQUIRED 1. Compute the accrued interest at the end of the year. 2. Prepare the adjusting entry in the general journal. Date of Note No. of Days Payee X. Rayal G. Richards

> Creswell Entertainment issued the following bonds: Date of issue and sale: ………………………………………………… April 1, 20-1 Principal amount: …………………………………………………………... $600,000 Sale price of bonds: ………………………………………………………………. 100 Denomination of bonds: ……………………………………………

> Financial statements for McGinnis Company as well as additional information relevant to cash flows during the period are given below and on the next page. Additional information: 1. Office equipment was sold in 20-2 for $35,000. Additional information o

> Powell Company’s condensed income statement for the year ended December 31, 20-2, was as follows: Net sales………………&a

> If the total of the schedule of accounts receivable does not agree with the Accounts Receivable balance, what procedures should be used to search for the error?

> Mueller and Kenington Company is trying to decide whether to discontinue department A. Operating results for the year just ended for each of the company’s three departments and for the entire operation are as follows: REQUIRED 1. Prepa

> Tom Peterson owns the business Peterson’s Furniture and Appliances. The following information is provided for the year ended December 31, 20--: REQUIRED 1. Prepare an income statement showing departmental direct operating margin and tot

> Sonya McDowell owns a business called The Knitting Chamber. She has divided her business into two departments: domestic yarn and international yarn. The following information is provided for the fiscal year ended June 30, 20--: REQUIRED 1. Prepare an inc

> Bacon and Hand Distributors has divided its business into two departments: retail sales and wholesale sales. The following information is provided for the year ended December 31, 20--: Net sales, retail sales department ……………………………………………….. $570,000 Net

> The sales, gross profit, and condensed direct and indirect operating expenses of departments A and B of Robin Sun Enterprises are as follows: Compute the departmental direct operating margin and direct operating margin percentage for each department.

> The sales, cost of goods sold, and total operating expenses of departments A and B of Barker Company are as follows: Compute the departmental operating income for each department. Dept. A $180,000 138,000 27,000 Dept. B $152,000 118,000 16,000 Sales

> Herbert Quiong owns a furniture store that offers free delivery of merchandise delivered within the local area. Mileage records for the three sales departments are as follows: Department 1: ……………………………. 4,000 miles Department 2: ……………………………. 13,000 mile

> Amelia Diaz owns a sporting goods store. She has divided her store into three departments. Net sales for the month of July are as follows: Football: ………………………. $10,000 Basketball: ………………………. 6,000 Baseball: …………………………. 9,000 Advertising expense for Jul

> Johnson Company rents 5,000 square feet of store space for $40,000 per year. The amount of square footage by department is as follows: Department A: ………………………………………………... 1,200 sq. ft. Department B: ………………………………………………… 1,400 sq. ft. Department C: ………………

> Nicole Lawrence and Josh Doyle are partners in a business that sells cheerleading uniforms. They have organized the business, called L and D Uniforms, on a departmental basis as follows: letters, sweaters, and skirts. At the end of the first year of oper

> What steps are followed in posting cash receipts from the general ournal to the general ledger?

> Name the types of cash flows associated with financing activities.

> Based on the information provided in Problem 10-11A, Problem 10-11A: Sourk Distributors is a retail business. The following sales, returns, and cash receipts occurred during March 20--. There is an 8% sales tax. Beginning general ledger account balanc

> Sourk Distributors is a retail business. The following sales, returns, and cash receipts occurred during March 20--. There is an 8% sales tax. Beginning general ledger account balances were Cash, $9,586; and Accounts Receivable, $1,016. Beginning custome

> Zebra Imaginarium, a retail business, had the following cash receipts during December 20--. The sales tax is 6%. Dec. 1 received payment on account from Michael Anderson, $1,360. 2 Received payment on account from Ansel Manufacturing, $382. 7 Cash sales

> For each document or procedure listed below, indicate whether it would be used for a retail business or a wholesale business, as described in the chapter.

> Willamette Manufacturing estimated that its total payroll for the coming year would be $650,000. The workers’ compensation insurance premium rate is 0.3%. REQUIRED 1. Calculate the estimated workers’ compensation insurance premium and prepare the journa

> Cascade Company has four employees. All are paid on a monthly basis. The fiscal year of the business is June 1 to May 31. The accounts kept by Cascade include the following: REQUIRED 1. Journalize the preceding transactions using a general journal. 2. Op

> Selected information from the payroll register of Ebeling’s Dairy for the week ended July 7, 20--, is shown below. The SUTA tax rate is 5.4%, and the FUTA tax rate is 0.6%, both on the first $7,000 of earnings. Social Security tax on th

> Specialty Manufacturing estimated that its total payroll for the coming year would be $450,000. The workers’ compensation insurance premium rate is 0.2%. REQUIRED 1. Calculate the estimated workers’ compensation insurance premium and prepare the journal

> Angel Ruiz owns a business called Ruiz Construction Co. He does his banking at Citizens National Bank in Portland, Oregon. The amounts in his general ledger for payroll taxes and the employees’ withholding of Social Security, Medicare, and federal income

> Mandy Feng employs Jay Johnson at a salary of $35,000 a year. Feng is subject to employer Social Security taxes at a rate of 6.2% and Medicare taxes at a rate of 1.45% on Johnson’s salary. In addition, Feng must pay SUTA tax at a rate of 5.4% and FUTA ta

> What steps are followed in posting sales returns and allowances from the general journal to the general ledger and accounts receivable ledger?

> Selected information from the payroll register of Joanie’s Boutique for the week ended September 14, 20--, is as follows. Social Security tax is 6.2% on the first $118,500 of earnings for each employee. Medicare tax is 1.45% of gross ea

> Earnings for several employees for the week ended March 12, 20--, are as follows: Calculate the employer’s payroll taxes expense and prepare the journal entry as of March 12, 20--, assuming that FUTA tax is 0.6%, SUTA tax is 5.4%, Socia

> Indicate with an “X” in which columns, Income Statement Debit or Credit or Balance Sheet Debit or Credit, a net income or a net loss would appear on a work sheet. Income Statement Balance Sheet Debit Credit Debit

> Listed below are the weekly cash register tape amounts for service fees and the related cash counts during the month of July. A change fund of $100 is maintained. REQUIRED 1. Prepare the journal entries to record the cash service fees and cash short and

> Mary’s Luxury Travel in Problem 8-9A keeps employee earnings records. Problem 8-9A: Mary Losch operates a travel agency called Mary’s Luxury Travel. She has five employees, all of whom are paid on a weekly basis. The

> Portions of the payroll register for Barney’s Bagels for the week ended July 15 are shown below. The SUTA tax rate is 5.4%, and the FUTA tax rate is 0.6%, both of which are levied on the first $7,000 of earnings. The Social Security tax

> Mary Losch operates a travel agency called Mary’s Luxury Travel. She has five employees, all of whom are paid on a weekly basis. The travel agency uses a payroll register, individual employee earnings records, and a general journal. Mar

> Donald Chin works for Northwest Supplies. His rate of pay is $8.50 per hour, and he is paid 1½ times the regular rate for all hours worked in excess of 40 per week. During the last week of January of the current year, he worked 48 hours. Chin is married

> Journalize the following data taken from the payroll register of Copy Masters as of April 15, 20: Regular earnings ………………………………………. $5,715.00 Overtime earnings ………………………………………... 790.00 Deductions: Federal income tax ………………………………………. 625.00 Social Sec

> On December 31, the payroll register of Hamstreet Associates indicated the following information: Determine the amount of Social Security and Medicare taxes to be withheld and record the journal entry for the payroll, crediting Cash for the net pay.

> What steps are followed in posting sales from the general journal to the accounts receivable ledger?

> Mary Sue Guild works for a company that pays its employees 1½ times the regular rate for all hours worked in excess of 40 per week. Guild’s pay rate is $10 per hour. Her wages are subject to deductions for federal income t

> Assume a Social Security tax rate of 6.2% is applied to maximum earnings of $118,500 and a Medicare tax rate of 1.45% is applied to all earnings. Calculate the Social Security and Medicare taxes for the following situations: Cumul. Pay Before Curren

> Using the table in Figure 8-4 on pages 288 and 289, Figure 8-4: Determine the amount of federal income tax an employer should withhold weekly for employees with the following marital status, earnings, and withholding allowances: SINGLE Persons-W

> Rebecca Huang receives a regular salary of $2,600 a month and is paid 1½ times the regular hourly rate for hours worked in excess of 40 per week. (a) Calculate Huang’s overtime rate of pay. (b) Calculate Huang’s total gross weekly pay if she works 45 hou

> Ryan Lawrence’s regular hourly rate is $15. He receives 1½ times the regular rate for any hours worked over 40 a week and double the rate for work on Sunday. During the past week, Lawrence worked 8 hours each day Monday through Thursday, 10 hours on Frid

> The book balance in the checking account of Lyle’s Salon as of November 30 is $3,282.95. The bank statement shows an ending balance of $2,127. By examining last month’s bank reconciliation, comparing the deposits and checks written per books and per bank

> The book balance in the checking account of Johnson Enterprises as of October 31 is $5,718. The bank statement shows an ending balance of $5,217. The following information is discovered by (1) comparing last month’s deposits in transit

> Based on the following information, prepare the weekly entries for cash receipts from service fees and cash short and over. A change fund of $100 is maintained. Cash Register Receipt Amount $268.50 237.75 Actual Cash Change Fund $100 Date Counted Apr

> Based on the following petty cash information, prepare (a) the journal entry to establish a petty cash fund, and (b) the journal entry to replenish the petty cash fund. On January 1, 20--, a check was written in the amount of $300 to establish a petty

> Based on the following bank reconciliation, prepare the journal entries: Carmen Lui Associates Bank Reconciliation July 31, 20-- Bank statement balance, luly 31 Add deposits in transit $3 3 16 80 $300 00 118 00 4 18 00 $3 73 4 80 Deduct outstanding

> What steps are followed in posting sales from the general journal to the general ledger?