Question: Refer to Table 10–6. a. How

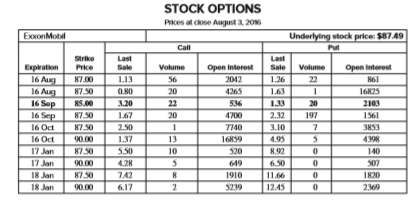

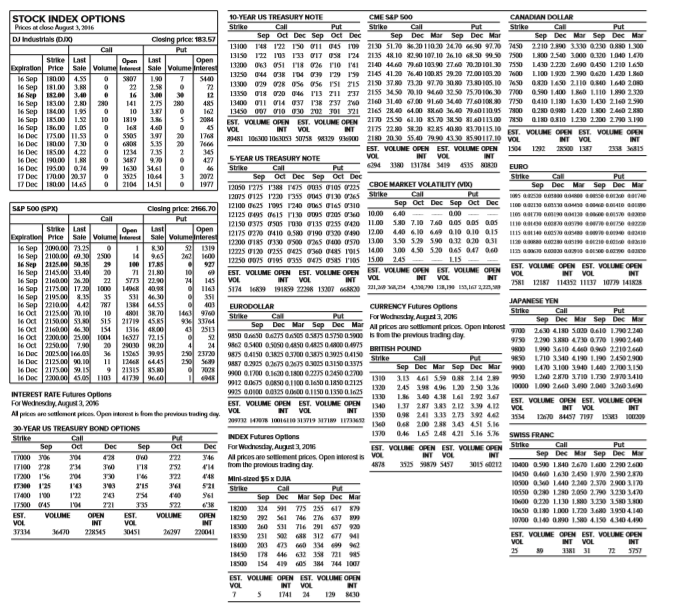

Refer to Table 10–6.

a. How many ExxonMobil October 2016 $90.00 put options were outstanding at the open of trading on August 3, 2016?

b. What was the closing price of a 10-year Treasury note December 13300 futures call option on August 3, 2016?

c. What was the closing and dollar price of a December 2160 call option on the S&P 500 Stock Index futures contract on August 3, 2016?

d. What was the open interest on September 2016 put options (with an exercise price of 185) on the DJ Industrial Average stock index on August 3, 2016?

Table 10–6:

Transcribed Image Text:

Stock Options Pices at cose August 3, 206 ExxonMobil Underlying stock price: $8749 Call Put Last Sale Last Sale Strike Open interest 2042 Expiration 16 Aug 16 Aug 16 Sep 16 Sep 16 Oct 16 Oct Price Volume Volume Open interest 87.00 L13 56 1.26 22 861 87.50 20 4265 1.63 16825 85.00 3.20 2103 22 20 536 1.33 20 87.50 167 2.50 4700 2.32 197 1561 87.50 TI40 3.10 3853 13 10 90.00 1.37 16859 4.95 4398 17 Jan 87.50 5.50 520 8.92 140 17 Jan 90.00 4.28 649 6.50 11.66 12.45 507 18 Jan 8750 7.42 1910 1820 18 Jan 90.00 6.17 5239 2369 10 YEAR US TREASURY NOTE CME SAP SOo CANADIAN DOLLAR STOCK INDEX OPTIONS Pices at close Augr 1, 2016 DJ Industrials (DD) Strike Call Put Sep oct Dec Sep Ooct Dec 13100 148 122 130 11 045 Call Strike Put Sep Dec Mar Sep Dec Mar 2130 51.70 20 11020 2470 6690 97.0 7450 2210 2.9O 3330 0230 0RO 1300 Call Put Strike Sep Dec Mar Sep Dec Mar Clesing price: 18357 109 Call Put 13150 122 103 133 O17 Os8 124 2135 4810 82.90 107.10 26.10 68.50 9950 7500 LA00 254) 3000 030 1040 LE0 Strike Last Open Last Open 13200 063 0SI F18 76 rio 141 2140 44.60 60 103.00 27.60 7020IOL30 7530 13250 044 38 I04 039 29 15 2145 41.20 76.40 100.K5 29.20 72.00 103.20 7600 13300 029 028 056 56 ISI 71S 2150 37.80 73.20 97.70 300 73D 10S.10 450 aaD 1AS0 2110 as0 164D 200 13350 O18 20 046 1'IS ZII 7I7 13400 011 14 037 1'38 77 2w0 2160 31.40 67.00 91.60 34.40 71.601ONL0 7I30 0410 1.180 1630 LA0 2.l60 2.90 13450 007 Vi0 030 2202 T01 321 2165 28.40 64.00 38.60 3640 7940I10.95 7O0 L430 220 260 GASO 1210 L6S0 Expiration Price Sale Volume Interest Sale Volume Interest 16 Sep 18000 16 Sep I81.0 3.8 16 Sep 16 Sep 183.00 16Sep 16Sup LIO 1.920 23300 GA20 LA0 L0 4.55 S07 22 1.90 2.58 3.0 S440 72 12 2155 3450 70.10 9400 3250 757010630 700 a.590 1400 180 L110 1990 230 18200 340 16 30 2.80 280 141 2.75 280 485 184.00 1.95 10 162 020 090 L420 100 2460 280 185.00 18600 EST. VOLUME OPEN EST. VOLUME OPEN 2170 25.30 6l.10 5.0 38.50 160113.00 70 VOL QID OSI0 12130 2200 2701190 2175 22 0 S20 8285 40.0 3.70115.10 EST. VOLUME OPEN EST. VOLUME OPEN 1.52 10 1819 204 4.60 45 6 Sup INT VOL NT 16 Dec 17500 1.53 18000 185.00 16 Dec 190.0 16 Dec 195.00 0.74 17 Dec 170.00 20.37 17 Dec 180.00 14.65 397 481 106300 10633 S758 I29 D 2I0 20.30 55.40 79.90 43.30 8590117.10 VOL NT VOL INT l6 Dec 7.30 535 EST. VOLUME OPEN EST. VOLUME OPEN 1504 122 IRSOD 1387 I6 Dec 122 1234 3487 1630 3525 715 345 427 Vol INT VOL 294 3380 131784 3419 INT 4535 0 9.30 SYEAR US TREASURY NOTE 99 34.61 46 Strke Call Put EURO Call 10.44 1451 Sep oct Dec Sep oct Dec 2072 Strike Sep Dec Mar Sep Dec Mr S a a ae se e are Put 2104 1977 12050 1275 I' r45 ouns g1os oas CHOE MARKET VOLATILITY (VDO 12075 0125 1220 355 o0MS 0130 0265 Shike Call Put Sep Oct Dec Sep Oct Dec 12100 0625 100s 1240 OKS Ol6s 0310 SAP 500 (SPX) Closing price: 2166.70 12125 0495 615 FI0 Ous 20s wO 1000 12150 0375 50s rO 135 255 40 1L00 12175 0270 0410 S0 190 0 0 12.00 12200 0185 (7330 0500 024S o0 0s0 13.00 12225 0120 0255 425 owo OS 1015 14.00 12250 0075 0195 0355 o47S OS I'IO5 15.00 - 000 530 7.10 7.60 a0s aas aas 6.40 s aIT mm a se e me Call Put Strike Last Open Last Sale Volumelnteres Open IIS aI S a ee e 4.40 6.10 6.e a10 a10 aIS 3.50 5.29 590 032 020 031 3.00 4.50 520 0AS 047 a0 2.45 Expiration Price Sale Volume ltret 16 Sep 2090.00 73.25 16 Sep 2100.00 2500 16 Sep 2125.00 .35 16 Sep 2145.00 140 Sep Sop 2175 I1 R aS ZIe e 52 1319 262 14 965 - LIS 29 100 17.85 927 EST. VOLUME OPEN EST. VOLUME OPEN 10 74 EST. VOLME OPEN EST. VOLUME OPEN EST. VOLUME OFEN EST. VOLUME OPEN 20 71 21.80 VOL INT VOL INT 22 STI3 22.90 145 VOL INT VOL INT VOL INT VOL NT 17.20 1000 35 148 40.9 S174 l9 191R9 2298 1307 i I IIra 38I 12187 11412 1I7 1079 1418 44.30 6455 3870 45 RS 351 403 1463 970 JAPANESE YEN Sep 2210 442 1384 EURODOLLAR CURRENCY Futures Options Call Sep Dec Mar Sep Dec Ma 70.10 10 Strike Put Stike For Wedsctay. Aget 3, 20NG Call Sep Dec Mar Sep Dec Mar Al prices are sotiument prices. Opon intrit 00 24D LID SO0 610 1790224 Put 16 Oct 2150.00 53.0 S15 21719 1316 16 Oct 16 Oct 16 Oct 46. N 154 48.00 QAsa OASO DAZ7S QASIS OSIS OS7S0 aS90m ktom the provious trading day Q 500 05e0 0.ARSO GARIS 0.0 04975BRITISH POUND 2200.00 25.00 1004 2250.00 7.90 16 Dac 2025.00 .0 16 Doc 2125.00 0.10 16 Dec 2175.00 9.15 16 Dec 2300.00 45.05 1103 72.15 4 290 2170 250 S 9790 2.290 3R80 4730 070 1990240 9800 1.990 3.610 40 00 2210260 9850 1.710 3340 4190 1.190 24502900 9900 20 29030 24 36 30.95 9875 04150 0385 0300 038IS 0.925 D4130 Call Sep Dec Mar Sep Dec Mar Strike Put 1248 213I5 S.0 41739 960 64.45 9A87 0.2915 03675 02675 0305 03150 03375 9900 0.100 0.16m 0.1800 0.275 02450 02700 L40 3.100 3940 1.440 27001190 1310 1.20 280 17IO 1.730 29703410 3.13 461 5.59 ON 214 2. 2.45 398 496 L20 250 3.26 130 0000 L000 240 30 2.00 1 0 INTEREST RATE Futures Options For Wechesdy. Agat 1, 20 Al picem are settlomert prices. Open interest om the previcn trading day. L6 140 438 Lal 292 367 EST. VOLUME OPEN EST. VOLUME OPEN EST. VOLUME OPEN EST. VOLUME OPEN 1340 1350 1.37 287 383 2.12 339 4.12 098 241 333 273 392 442 0.68 200 288 343 451 5.16 046 165 24S 421 S.16 5.36 SWISS FRANC NT VOL VOL 334 INT VOL NT VOL INT 30. YEAR US TREASURY BOND OPTIONS Cll 130 INDEX Futures Options For Wadnestay, Auget3, 205 Al prices aro sottioment prices. Open intorest is VOL from the provious trading day. Strike Sep Put EST. VOLUME OPEN EST. VOLLME OPENStrike INT VOL 3525 9879 5457 Put Sep Dec Mar Sep Dec M Call Oct Dec Sep Oct Dec 17000 306 304 428 222 346 INT 3015 612 10400 a990 L840 2670 LA00 2.290 2600 17100 228 234 4'14 J0M50 0A0 1630 2450 1.970 2.590 20 204 330 322 448 Mini-stzed $5 x DJIA OS00 ao L440 230 2.370 2900 310 10550 020 1280 2.050 2.790 3230 340 170 125 2'15 521 Strike Call Put 17400 100 122 254 Sep Dec Mar Sep Dec Mar 91 7I5 255 617 S9 S61 746 276 437 S3I 716 291 57 20 1000 020 1130 1.0 3230 1580 1800 1700 45 221 35 638 1800 324 1O50 Q10 L000 L720 360 190 4.10 EST. VOLUME OPEN EST. VOLUME OPEN 18290 292 00 a140 a0 1.S0 4.150 4340 4490 VOL INT 22RS45 VOL 30451 INT 220041 37114 3470 231 200 s00 8 312 n MI 473 446 632 358 721 5 EST. VOLUME OPEN EST. VOLUME OPEN VOL INT VOL INT 0 334 9 2 18400 1840 1800 25 31 72 14 419 as 34 744 10 EST. VOLUME OPEN EST. VOLUME OPEN INT VOL VOL NT 1741 24 129

> List some of the major differences in accounting between IFRS and U.S. GAAP.

> How does the FASB view its role in the development of an international accounting system? Currently, two members of the IASB were previously affiliated with the FASB. Comment on what effect this might have on the likelihood that the U.S. standard-setters

> For each of the items listed below, determine how the amount would be classified in Fund Balance (either nonspendable, restricted, committed, assigned, or unassigned fund balance). 1. Inventory costing $17,000 was purchased to be used for highway repair

> Describe the attitude of the FASB toward the IASB (International Accounting Standards Board).

> Discuss the types of ADRs that non-U.S. companies might use to access the U.S. markets.

> The following footnote was disclosed at the beginning of 2016 (January 1, 2016). The capital lease began on January 1, 2015 when the fair value of the capital lease was $21,776 (with a six-year life). The operating lease began on January 1, 2016 when t

> On December 1, 2014, King Company exported equipment that had cost $210,000 to a Brazilian company for 1,000,000 real. The account is to be settled on January 31, 2015. King Company is a calendar-year company and uses a perpetual inventory system. Direct

> The first two lines of Unilever Group’s 2013 consolidated income statement (using IFRS) report the following amounts (in millions of euros): Required: A. On the income statement, the first two lines in Unilever’s inc

> Is a debt restructuring always classified as a troubled debt restructuring if the entity is experiencing some financial difficulties? Explain.

> British Petroleum’s income statement was prepared using IFRS is presented below (in $ millions). ExxonMobil Corporation’s income statement prepared using U.S. GAAP is presented below (in $ millions). Required: A.

> Three funds of the Leukemia Foundation, a nonprofit welfare organization, began an investment pool on January 1, 2016. The costs and fair market values on this date were as follows: During 2016 the investment pool reinvested $20,000 in realized gains a

> The December 31, 2015, statement of financial position for the Blood Donors of America Foundation is presented below. Statement of Financial Position December 31, 2015 Assets Cash ………â

> Preston Library, a nonprofit organization, presented the following statement of financial position and statement of activities for its fiscal year ended February 28, 2014. The following transactions occurred during the fiscal year ended February 28,

> Several independent financial activities of a governmental unit are given below. 1. Revenue from the sale of licenses and permits for the first two months totaled $15,000. 2. Land that had been donated previously was sold for $100,000. 3. An order was pl

> The following transactions of Beltville College transpired during 2015. The funds necessary are the Endowment Fund, the Annuity Fund, the Plant Fund—Unexpended, the Plant Fund Investment in Plant, the Loan Fund, the Unrestricted Current

> A partial statement of financial position of Century University is shown below. Century University Partial Statement of Financial Position June 30, 2014 Assets Current Funds Unrestricted Cash ……â€&brvba

> On January 1, 2015, a new Board of Directors was elected for Bradley Hospital. The new board switched to a different accountant. After reviewing the hospital’s books, the accountant decided that the accounts should be adjusted. Effectiv

> The following events were recorded on the books of Mercy Hospital for the year ended December 31, 2015. 1. Revenue from patient services totaled $16,000,000. The allowance for uncollectibles was established at $3,400,000. Of the $16,000,000 revenue, $6,0

> The Village of Oakridge, which was incorporated recently, began financial operations on July 1, 2015, the beginning of its fiscal year. The following transactions occurred during this first fiscal year, July 1, 2015, to June 30, 2016. 1. The Village Coun

> You have been engaged to examine the financial statements of the Town of Bridgeport for the year ended June 30, 2015. Your examination disclosed that, because of the inexperience of the town’s bookkeeper, all transactions were recorded

> Where in the Codification are the conditions listed that allow an entity that sells a product to recognize revenue on an accrual basis?

> The following transactions take place. 1. Bond proceeds of $1,000,000 were received to be used in constructing a firehouse. An equal amount is contributed from general revenues. 2. $800,000 of serial bonds matured. Interest of $120,000 was paid on these

> The following activities and transactions are typical of those that may affect the various funds used by a typical municipal government. Required: Prepare journal entries to record each transaction and identify the fund in which each entry is recorded.

> An administrative section of the County Assessor’s Office of Mecklenburg County serves as the billing and collection agency for all property taxes assessed in Mecklenburg County. A charge of 1% of taxes and penalties collected is apport

> Q, R, S, and T are partners, sharing profits and losses 40%:20%:20%:20%, respectively. After sale of firm assets and payment of the available cash to the partnership creditors, a partnership trial balance and the personal status of each partner are as fo

> Beth, Steph, and Linda have been operating a small gift shop for several years. After an extensive review of their past operating performance, the partners concluded that the business needed to expand in order to provide an adequate return to the partner

> Bill and Jane share profits and losses in a 70:30 ratio. Mike is to be admitted into a partnership upon the investment of $14,000 for a one-third capital interest. Account balances for Bill and Jane on June 30, 2014 just before the admission of Mike are

> Phil Phoenix and Tim Tucson are partners in an electrical repair business. Their respective capital balances are $90,000 and $50,000, and they share profits and losses equally. Because the partners are confronted with personal financial problems, they de

> Hill, Jones, and Vose have been partners throughout 2014. Their average balances for the year and their balances at the end of the year before closing the nominal accounts are as follows: The income for 2014 is $108,000 before charging partnersâ&

> On January 1, 2014, Tony and Jon formed T&J Personal Financial Planning with capital investments of $480,000 and $340,000, respectively. The partners wanted to draft a profit and loss agreement that would reward each individual for the resources invested

> Mary and Nancy invested $80,000 each to form a partnership. Mary has been authorized a salary of $20,000, while Nancy’s salary is $25,000. Each partner is to receive 10% on the original capital investment. The profit and loss agreement stipulates that an

> Jones, Silva, and Thompson form a partnership and agree to allocate income equally after recognition of 10% interest on beginning capital balances and monthly salary allowances of $2,000 to Jones and $1,500 to Thompson. Capital balances on January 1 were

> Tom and Julie formed a management consulting partnership on January 1, 2014. The fair value of the net assets invested by each partner follows: During the year, Tom withdrew $15,000 and Julie withdrew $12,000 in anticipation of operating profits. Net p

> Kazma, Folkert, and Tucker are partners with capital account balances of $30,000, $75,000, and $45,000, respectively. Income and losses are divided in a 4:4:2 ratio. When Tucker decided to withdraw, the partnership revalued its assets from $225,000 to $2

> In the appendix to this chapter, the balance sheet for the General Fund for the City of Atlanta is reported. 1. How is the format used on the balance sheet for the general fund different from the format used by for-profit organizations? Which categories

> The partnership agreement of ABC Associates provides that income should be allocated in the following manner: 1. Each partner receives interest of 20% of beginning capital. 2. Sue receives a salary of $25,000 and Josh receives a salary of $21,000. 3. Jos

> Select the best answer for each of the following. 1. Which of the following is not a characteristic of a partnership? (a) Limited life. (b) Mutual agency. (c) Limited liability. (d) Right to dispose of partnership interest. 2. The articles of partnership

> Select the best answer for each of the following. 1. Jon and Joe formed a partnership on July 1, 2014, and invested the following assets: The realty was subject to a mortgage of $25,000, which was assumed by the partnership. The partnership agreement p

> John, Jeff, and Jane decided to engage in a real estate venture as a partnership. John invested $100,000 cash and Jeff provided office equipment that is carried on his books at $82,000. The partners agree that the equipment has a fair value of $110,000.

> Select the best answer for each of the following. 1. Which of the following is not a consideration in segment reporting for diversified companies? (a) Consolidation policy. (b) Defining the segments. (c) Transfer pricing. (d) Allocation of joint costs. 2

> Spur Company’s actual earnings for the first two quarters of 2014 and its estimate during each quarter of its annual earnings are: Actual first-quarter earnings ………………………………………………….. $ 400,000 Actual second-quarter earnings …………………………………………………. 510,000

> Day Company, which uses the FIFO inventory method, had 254,000 units in inventory at the beginning of the year at a FIFO cost per unit of $30. No purchases were made during the year. Quarterly sales information and two sets of end-of-quarter replacement

> The following information concerns the operations of Blane Company for the year ended December 31, 2014. Required: Determine the operating profit (loss) for each of Blane’s two segments for 2014. (In Thousands of Dollars) General

> Twodor Company is involved in four separate industries. Selected financial information concerning Twodor’s involvement in each of the four industries is presented below: Required: Using all tests, determine which of the industry segme

> Pong Industries’ operations involve four operating segments, A, B, C, and D. During the past year, the operating profit (loss) of each segment was Segment Operating Profit (Loss) A ……………………………………………………………………………… $(600) B ………………………………………………………………………

> On April 19, 2011, IBM announced first-quarter 2011 earnings of $2.31 per share (compared to earnings of $1.97 per share in the first quarter of 2010), an increase of 17%. First-quarter net income was $2.9 billion, compared to $2.6 billion in the first q

> In its 10-K amended filing on April 30, 2010, Bronco Drilling reported the financial statements of Challenger Limited (an unconsolidated subsidiary) for its year ending December 31, 2009. The balance sheet and the income statement are reported as follows

> You have purchased a put option on Kimberly Clark common stock. The option has an exercise price of $95.00 and Kimberly Clark’s stock currently trades at $96.18. The option premium is $1.25 per contract. a. Calculate your net profit on the option if Kimb

> You have purchased a call option contract on Johnson & Johnson common stock. The option has an exercise price of $89.00 and J & J’s stock currently trades at $90.43. The option premium is quoted at $2.17 per contract. a. Calculate your net profit on the

> You have written a put option on Diebold Inc. common stock. The option has an exercise price of $28 and Diebold’s stock currently trades at $30.50. The option premium is $0.75 per contract. a. What is your net profit if Diebold’s stock price increases to

> Refer to Table 10–4. a. What was the settlement price on the December 2017 Eurodollar futures contract on August 3, 2016? b. How many five-year Treasury note futures contracts traded on August 2, 2016? c. What is the face value on a Swi

> Jones Bank has been borrowing in the U.S. markets and lending abroad, thereby incurring foreign exchange risk. In a recent transaction, it issued a one-year $5 million CD at 4 percent and is planning to fund a loan in yen at 6 percent for a 2 percent exp

> North Bank has been borrowing in the U.S. markets and lending abroad, thereby incurring foreign exchange risk. In a recent transaction, it issued a one-year $2 million CD at 6 percent and is planning to fund a loan in British pounds at 8 percent for a 2

> East Bank has purchased a 5 million one-year Swiss franc (Sf) loan that pays 6 percent interest annually. The spot rate of U.S. dollars for Swiss francs (CHF/USD) is 1.0175. It has funded this loan by accepting a Canadian dollar (C$)– denominated deposit

> Sun Bank USA has purchased a 16 million one-year Australian dollar loan that pays 12 percent interest annually. The spot rate of U.S. dollars for Australian dollars (AUD/USD) is $0.757/ A$1. It has funded this loan by accepting a British pound (BP)– deno

> Bankone issued $200 million worth of one-year CD liabilities in Brazilian reals at a rate of 6.50 percent. The exchange rate of U.S. dollars for Brazilian reals at the time of the transaction was $0.305/Br 1. a. Is Bankone exposed to an appreciation or d

> A bond you are evaluating has a 10 percent coupon rate (compounded semiannually), a $1,000 face value, and is 10 years from maturity. a. If the required rate of return on the bond is 6 percent, what is its fair present value? b. If the required rate of r

> Bank USA recently purchased $10 million worth of euro denominated one-year CDs that pay 10 percent interest annually. The current spot rate of U.S. dollars for euros is $1.104/€1. (LG 9-5) a. Is Bank USA exposed to an appreciation or depreciation of the

> On July 15, 2016, you convert 500,000 U.S. dollars to Japanese yen in the spot foreign exchange market and purchase a six-month forward contract to convert yen into dollars. How much will you receive in U.S. dollars at the end of six months? Use the data

> The following table lists balance of payment current accounts for Country A. a. What is Country A’s total current accounts? b. What is Country A’s balance on goods? c. What is Country A’s balance on

> Assume that annual interest rates are 5 percent in the United States and 4 percent in Turkey. An FI can borrow (by issuing CDs) or lend (by purchasing CDs) at these rates. The spot rate is $0.3310/Turkish lira (TL). a. If the forward rate is $0.3420/TL,

> Assume that annual interest rates are 8 percent in the United States and 4 percent in Switzerland. An FI can borrow (by issuing CDs) or lend (by purchasing CDs) at these rates. The spot rate is $1.02/Sf. a. If the forward rate is $1.08/Sf, how could the

> If a bundle of goods in Japan costs ¥4,000,000 while the same goods and services cost $40,000 in the United States, what is the current exchange rate of U.S. dollars for yen? If, over the next year, inflation is 6 percent in Japan and 10 percent in the U

> Refer to Table 9–1. a. On June 15, 2016, you purchased a British pound– denominated CD by converting $1 million to pounds at a rate of 0.7605 pound for U.S. dollars. It is now July 15, 2016. Has the U.S. dollar appreci

> Suppose all of the conditions in Problem 18 hold except that the forward rate of exchange is also $1.35/£1. How could an investor take advantage of this situation? Data from Problem 18: If the interest rate in the United Kingdom is 8 percent, the inter

> If the interest rate in the United Kingdom is 8 percent, the interest rate in the United States is 10 percent, the spot exchange rate is $1.35/£1, and interest rate parity holds, what must be the one-year forward exchange rate?

> Suppose that the current spot exchange rate of U.S. dollars for Australian dollars, SUS$/A$, is 0.757 (i.e., $0.757 can be received for 1 Australian dollar). The price of Australian- produced goods increases by 5 percent (i.e., inflation in Australia, IP

> Suppose that the current one-year rate (one-year spot rate) and expected one-year T-bill rates over the following three years (i.e., years 2, 3, and 4, respectively) are as follows: 1 R 1 = 6%, E( 2 r 1 ) = 7%, E( 3 r 1 ) = 7.5%, E( 4 r 1 ) = 7.85%

> The following are the foreign currency positions of an FI, expressed in the foreign currency: The exchange rate of dollars for Sf is 1.02, of dollars for British pound is 1.31, and of dollars for yen is 0.00953.The following are the foreign currency po

> P.J. Chase Stanley Bank holds $75 million in foreign exchange assets and $68 million in foreign exchange liabilities. P.J. Chase Stanley also conducted foreign currency trading activity in which it bought $165 million in foreign exchange contracts and so

> Citibank holds $23 million in foreign exchange assets and $18 million in foreign exchange liabilities. Citibank also conducted foreign currency trading activity in which it bought $5 million in foreign exchange contracts and sold $12 million in foreign e

> Suppose that, instead of funding the $200 million investment in 10 percent German loans with U.S. CDs, the FI manager in Problem 10 funds the German loans with $200 million equivalent one-year euro CDs at a rate of 7 percent. Now the balance sheet of the

> Suppose that a U.S. FI has the following assets and liabilities: The promised one-year U.S. CD rate is 4 percent, to be paid in dollars at the end of the year; one-year, default risk–free loans in the United States are yielding 6 per

> Refer to Table 9–1. a. What was the spot exchange rate of Canadian dollars for U.S. dollars (USD/CAD) on July 15, 2016? b. What was the six-month forward exchange rate of Canadian dollars for U.S. dollars (USD/CAD) on July 1

> Use the information in the following stock quote to calculate McKesson’s earnings per share over the last year. (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11) (12) (13) (14) (15) Net 52 Week 52 Week YTD Name Symbol Open High Low Clo

> Refer to the stock market quote in Table 8–1. a. What was the closing stock price for Abercrombie & Fitch on July 6, 2016? b. What was the dividend yield on El Paso Electric stock as of July 7, 2016. c. What were the earnings per s

> Suppose you own 100,000 shares of common stock in a firm with 12.5 million total shares outstanding. The firm announces a plan to sell an additional 2.5 million shares through a rights offering. The market value of the stock is $22.50 before the rights o

> Suppose you own 50,000 shares of common stock in a firm with 2.5 million total shares outstanding. The firm announces a plan to sell an additional 1 million shares through a rights offering. The market value of the stock is $35 before the rights offering

> Suppose the Federal Reserve instructs the Trading Desk to purchase $1 billion of securities. Show the result of this transaction on the balance sheets of the Federal Reserve System and commercial banks.

> Suppose a firm has 50 million shares of common stock outstanding and eight candidates are up for election to six seats on the board of directors. a. If the firm uses cumulative voting to elect its board, what is the minimum number of votes needed to ensu

> Use the information in the following stock quote to calculate Abercrombie & Fitch’s earnings per share over the last year. (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11) (12) (13) (14) (15) Net 52 Week 52 Week YTD Symbol Open Hi

> Suppose a firm has 15 million shares of common stock outstanding and six candidates are up for election to five seats on the board of directors a. If the firm uses cumulative voting to elect its board, what is the minimum number of votes needed to ensure

> You plan to purchase a $240,000 house using either a 30-year mortgage obtained from your local bank with a rate of 5.75 percent, or a 15-year mortgage with a rate of 5.00 percent. You will make a down payment of 20 percent of the purchase price. a. Calcu

> You plan to purchase a $200,000 house using either a 30-year mortgage obtained from your local savings bank with a rate of 7.25 percent, or a 15-year mortgage with a rate of 6.50 percent. You will make a down payment of 20 percent of the purchase price.

> You plan to purchase a $200,000 house using a 30-year mortgage obtained from your local credit union. The mortgage rate offered to you is 6.50 percent. You will make a down payment of 20 percent of the purchase price a. Calculate your monthly payments on

> You plan to purchase a $150,000 house using a 15-year mortgage obtained from your local credit union. The mortgage rate offered to you is 5.25 percent. You will make a down payment of 20 percent of the purchase price. a. Calculate your monthly payments o

> You plan to purchase an $80,000 house using a 15-year mortgage obtained from your local bank. The mortgage rate offered to you is 8.00 percent. You will make a down payment of 20 percent of the purchase price. a. Calculate your monthly payments on this m

> You plan to purchase a $175,000 house using a 15-year mortgage obtained from your local bank. The mortgage rate offered to you is 7.75 percent. You will make a down payment of 20 percent of the purchase price. a. Calculate your monthly payments on this m

> You plan to purchase a $300,000 house using a 15-year mortgage obtained from your bank. The mortgage rate offered to you is 4.50 percent. You will make a down payment of 20 percent of the purchase price. a. Calculate your monthly payments on this mortgag

> MHM Bank currently has $250 million in transaction deposits on its balance sheet. The current reserve requirement is 10 percent, but the Federal Reserve is increasing this requirement to 12 percent. a. Show the balance sheet of the Federal Reserve and MH

> You plan to purchase a $220,000 house using a 15-year mortgage obtained from your bank. The mortgage rate offered to you is 4.75 percent. You will make a down payment of 20 percent of the purchase price. a. Calculate your monthly payments on this mortgag

> You plan to purchase a house for $175,000 using a 15-year mortgage obtained from your local bank. You will make a down payment of 25 percent of the purchase price. You will not pay off the mortgage early. a. Your bank offers you the following two options

> You plan to purchase a house for $195,000 using a 30-year mortgage obtained from your local bank. You will make a down payment of 20 percent of the purchase price. You will not pay off the mortgage early. a. Your bank offers you the following two options

> You plan to purchase a house for $115,000 using a 30-year mortgage obtained from your local bank. You will make a down payment of 20 percent of the purchase price. You will not pay off the mortgage early. a. Your bank offers you the following two options

> You plan to purchase a $100,000 house using a 30-year mortgage obtained from your local credit union. The mortgage rate offered to you is 8.25 percent. You will make a down payment of 20 percent of the purchase price. a. Calculate your monthly payments

> A municipal bond you are considering as an investment currently pays a yield of 6.75 percent. a. Calculate the tax equivalent yield if your marginal tax rate is 28 percent. b. Calculate the tax equivalent yield if your marginal tax rate is 21 percent.

> Consider an investor who, on January 1, 2020, purchases a TIPS bond with an original principal of $100,000, a 4.50 percent annual (or 2.25 percent semiannual) coupon rate, and 5 years to maturity. (LG 6-2) a. If the semiannual inflation rate during the

> Consider an investor who, on January 1, 2019, purchases a TIPS bond with an original principal of $100,000, an 8 percent annual (or 4 percent semiannual) coupon rate, and 10 years to maturity. a. If the semiannual inflation rate during the first six mont

> On July 10, 2019, you purchase a $10,000 T-note that matures on December 31, 2028 (settlement occurs one day after purchase, so you receive actual ownership of the bond on July 11, 2019). The coupon rate on the T-note is 2.125 percent and the current pri

> On October 5, 2019, you purchase a $10,000 T-note that matures on August 15, 2031 (settlement occurs one day after purchase, so you receive actual ownership of the bond on October 6, 2019). The coupon rate on the T-note is 4.375 percent and the current p