Question: Refer to Table 25.2 in the

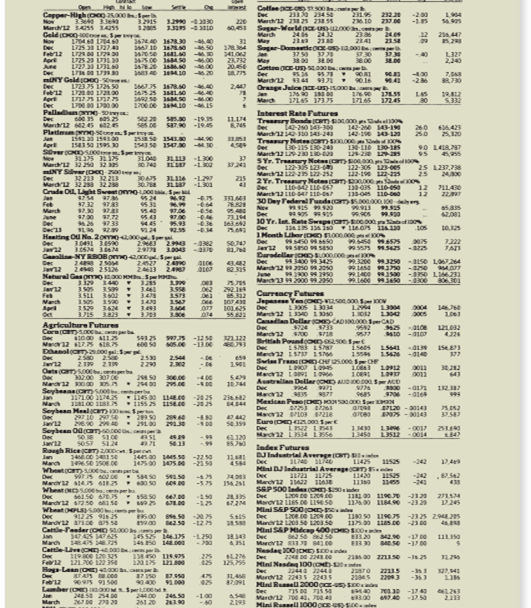

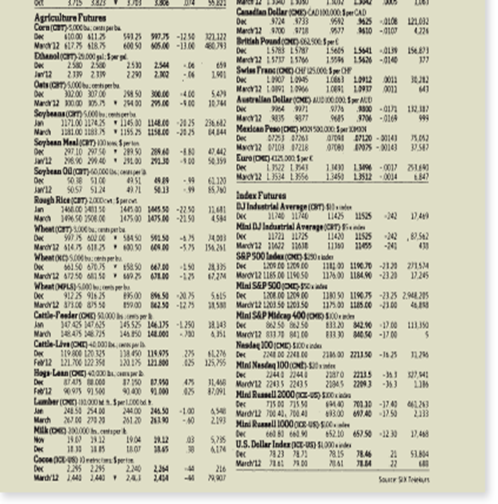

Refer to Table 25.2 in the text to answer this question. Suppose you purchase a March 2012 cocoa futures contract on November 22, 2011, at the last price of the day. What will your profit or loss be if cocoa prices turn out to be $2,431 per metric ton at expiration?

Table 25.2

Transcribed Image Text:

Open Sere Cotfee po R 233a 234 50 Capper-Higho s00 2319 Z10 Dec 232 -2.00 32915 329043010 220 Merch12 2 25 2 March12 SASS 1455 Geld (C cco Now Dec Feb12 Agr Sugar-WorldpU 00.c 24 2432 21 Sogar-DometieO 2.000 37 50 37 Merch Mey 23 2341 20.447 24. .12 3674.40 147.30 10 1S0 50 -6.00 31 17834 341.0 Z3.72 2045 09 L725 3 2740 37.30 8.00 -40 1725 21 17L L327 2,240 5.00 1se 00 D782 1. 0 00 20 38.00 Cottee -U 0 L DO 17 Dec mINY Gald OO- Dec Der 430 -26 Merd12 344 9n 016 Orange Julcp-u o 176 0 17145 17375 1723 75 1725 S0 244 Jan 17245 LAS 30 Apr Dec Palladan me-sy: Dec March12 425 625 Platimum Os eya March 5332 Interest Rate Futures Treaury Bonda C .00 Del Dec March12 1to 143-24 Treaury Note m 0 0 Dec March12 L2-230 LD- SYr. Treamury Nete(T)s0n Dec March12 L22-2is 122-252 2Yr. Treaury Notes m 00e Dec March12110-47 ID- 30 Dey Tederl Fundscom.000 00 es Nee Der 10 Yr. let. Rate Swepe(cm-o0.000 Dec 1Month Libor CHD FO0.000 00 Dec Ja2 DaradellarOD0000e Dec March12 5o 200 June Marc3 9200 99 2050 sea 20 ss0 ses De -19.5 -19.45 S87.90 142-20 13-1 260 250 64423 25120 142-190 143-120 25 se 154L 0 1543 5 154 0 Jan Apr Sver O 00 New March12 225a 12 5 INY Sver (C-0 Dec Mard2 322 228 Crade OL, Lght Sweet omo 130-LIO 130-S 90 1418787 95 31375 31S 3L3 -L300 32 122-35 123- 25 127.78 25 240 122-305 123-0es 122-19 12-225 30A75 30.7 L87 L30 32 213 32 213 3L116 -1297 215 12 12 71L430 22 13-os 110-000 Jan Fet 531 -4 97.32 9783 .30 170 7.72 .26 March June Dec De13 Heating O Na. 2omo000 Sp Dec Ja12 73.14 99.90s 99.0 42.001 445 36 92.55 4 97.33 124 99.5450 575 7222 JATI 3.0491 390 seso saso Caasline NY RBOB omoo S AR 2 5O 99300 3425 993200 32se -aIsO LO67264 Der Ja2 24 e 25126 Natural Gasomo MM Sp Dec Ja12 Feb 240 43.2 82 315 2413 1400 s0 -0 LIM231 99160 9350 -300 806.301 3.5 3.44 3.511 3 A 3.55 062 292 Currency Putures Jepanee Yen(O so.000 SoON Dec March12 10 130 Canadlan Dellar CADI0.000 SerCAD Dec Marc12 00 Brttah Pound co soeSpet Dec March 1529 3424 - 13 3.715 130S L3034 1304 0004 14 Apr Oct 3.823 379 014 Agriculture Futures Corn Cs.0 c 3724 3733 Dec Mard12 75 sI Danalc .00l Sa S125 600 s0 05.00 -13.00 S975 -1250 121122 i sees 1.5 2580 25 De 2530 2299 2544 Dec Marc12 LO891 109 Australlan Dellar OME AUD D L.907 L0945 0011 0011 Oats 00 ceb De Mard12 0.00 05. 1.0 30200 30700 2 50 • 24 00 30.00 5.4 Dec 9971 132. Seybeans msc0cprb Jan Narh Mac2 3835 3706 -0164 999 1171.00 114.2 l1e5 0 L14E.0 181.00 1185 1155 25 LiSE.c0 -20 5 -2025 2362 444 Mexican Pese(CHE) NSac.co0 S ON Dec aros PL20 - 30141 Seybean MealcT 297 10 2 e 26.90 294e Mac2 1OB 7218 De 2 4442 EureDa00n Ser Dec 2100 2130 -100 -0017 0014 Soybean Odamso.cocc ea De Jan12 Raugh Rice gc) z Spec Marc12 L3534 L55 13459 13512 s0 $10e sOS S124 61120 Index Futures DJIndustrial Averge ( e Dec Mini DJIndutrial AverageC) d Dec 14.co sese 1650 2506.0e Jan March Wheat cT)00.cperbe Dec 147500 1S e -2150 111 454 11525 242 172a L2s 11430 S450 s.50 050 D0 -242 -24 -5.75 154.21 Wheat O .co cpr Dec SSPS00 ledeOM de 1IL 00 119 -21 11600 1184.90 -23 29 150 S a 50 -150 -125 Dec Maro12 LIES De LI S0 Mini SEP S0 Dec Marc2 L205e 12050 Mini SAP Mdcag 00OD0 Dec 17245 Wheat PLs e Dec Mard2 arsDe as se 912 25 916 25 95.00 50205 900 e2sa -12 75 110 50 L1975 -23 25 2.94.20s Cattle-Feeder OHD S00 347425 147625 14S 4s 145 S 14175 14550 14.es Jan -1.290 17 00 Bese -100 Marh Cattle LveOHE) De De Fe12 Nasdag 200HED Snd 138 0 L14.975 120175 1800 275 425 Dec 224 De 224 De 2as00 221use 121200 122 35t 125,755 Mini Nesdag 100CON te Hags Lean (CHE) .o De 244 2244 Dec Mard12 22435 22435 Mini Reeu 2000g-us) S Dec Mard2 e 4, 04 Mini Ruasell 1000 ocE-U5)5.00lee 2aro TAS .cee 1750 a 9000 .000 47% 2045 22093 -353 Far2 425 87091 Lamber (C noMSpro Ja 7030 -1743 7.40 -1750 1.23 2113 24400 24.50 -1.00 -40 454 3.00 March 2J DO 27 20 261 20 2193 3.50 Agriculture Futures Corn(m parba Canadlan Dellar ADIO00 SCAD De Mard12 00 78 125 95 -1250 121122 600 50 5.00 -130 Britiah Pund(00 et De Med2 157 1S 1. 154 -01e 250 2500 219 219 Oats o ne 0200 307 06 Nard2 0 A 40 2.e -400 Seybean(m el De 2530 2290 244 Swl TrancONDOH US.000 O De 101 LO LOS Ma2 1O 10 1.00 10 0011 41 5.49 Australlan Dellar OME) AUDO D0 NCD De Jan 11100 11S 6 0 110 -2025 22 Mal2M5 77 A Mexdcan PnoDE ON S SpN De aro A0 - 3014 A Seybean MealCT) f 207 10 27 54 230 2 IN 140 LM 0017 B 13450 L3512 0014 De Seybean Odama000 De Ma2 LI534 LI56 5057 S124 471 ladex Futures Rough Rice (cT) 2Don Spron Narch 150 500.00 Whet(om , t De 144 00 1MS -220 145 00 1475.0 -2150 111 JIndustrial Average (m a 45 Dec Miai DJ Indurtrial AveregeCT)i 121 I125 -24 Wheat NOSO h SEP 500 laden O de 2M Maror2 LIES 00 LIM 50 Mini SAP S00O a Sais Dec S Mardv2 L200 50 120050 Mini SAP Midcap 400 SC0n 1100 L18490 -2320 D245 Wheat 0 0 Dec Mard2 10e BS 50 Cattle-leeler (CHE) 000 912 25 916 25 500 8.50 075 19900 259 -1275 11NI 90 LI5 -235 294.25 11500 L185.00 2300 4 145 525 1415 -250 14 50 14.000 0 R143 De Marh RAS S Catle Live (O) 4 D0 De Fe2 121.0 12 35 Hags Lann (O) 400 D B 30 M0 -17 00 Neslag 100CME) SDende L2 De 425 125% Mini Nasdag 100O te De LA Merdv12 22435 22435 091 Mini Ruasell 2000 p) S n Der 45 Vard2 40, 700 40 219 Mini Runel 1000 oU) Sle 13A 0 114975 275 47% 21045 2209) 6) F12 975 91500 Lamber (OoDM.Sp M 4450 254.00 20 00 2 20 90400 V1000 425 24400 244 0 -100 20120 210 1300 70 -17 50 March Der 52 10 457 50 12 0 Now De U.S. Dellar Inden C-S) SO AIN Der 30 7823 747 21 S14 22 Cace Dr p Dec Mard2 14 1440 24 244 2 2295 Merc2 1 A D0 240 216 Saur n

> Discuss the IRS criteria for determining whether a lease is tax deductible. In each case give a rationale for the criterion.

> What are the two types of risk that are measured by a levered beta?

> The Litzenberger Company has projected the following quarterly sales amounts for the coming year: a. Accounts receivable at the beginning of the year are $310. Litzenberger has a 45-day collection period. Calculate cash collections in each of the four q

> Is it possible for a firm’s cash cycle to be longer than its operating cycle? Explain why or why not.

> You are short 25 gasoline futures contracts, established at an initial settle price of $2.46 per gallon, where each contract represents 42,000 gallons. Over the subsequent four trading days, gasoline settles at $2.42, $2.47, $2.50, and $2.56, respectivel

> A company produces an energy-intensive product and uses natural gas as the energy source. The competition primarily uses oil. Explain why this company is exposed to fluctuations in both oil and natural gas prices.

> A warrant gives its owner the right to purchase three shares of common stock at an exercise price of $53 per share. The current market price of the stock is $58. What is the minimum value of the warrant?

> What is dilution, and why does it occur when warrants are exercised?

> Jet Black is an international conglomerate with a petroleum division and is currently competing in an auction to win the right to drill for crude oil on a large piece of land in one year. The current market price of crude oil is $93 per barrel, and the l

> Explain why a swap is effectively a series of forward contracts. Suppose a firm enters a swap agreement with a swap dealer. Describe the nature of the default risk faced by both parties.

> In the previous question, over what range of lease payments will the lease be profitable for both parties? Required information You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a common practice wi

> What are the prices of a call option and a put option with the following characteristics? Stock price = $57 Exercise price = $60 Risk-free rate = 6% per year, compounded continuously Maturity = 3 months Standard devi ation = 54% per year

> Discuss the accounting criteria for determining whether a lease must be reported on the balance sheet. In each case give a rationale for the criterion.

> North Pole Fishing Equipment Corporation and South Pole Fishing Equipment Corporation would have identical equity betas of 1.10 if both were all equity financed. The market value information for each company is shown here: The expected return on the ma

> If Wild Widgets, Inc., were an all-equity company, it would have a beta of .85. The company has a target debt–equity ratio of .40. The expected return on the market portfolio is 11 percent, and Treasury bills currently yield 4 percent. The company has on

> Indicate the impact of the following on the cash and operating cycles, respectively. Use the letter I to indicate an increase, the letter D for a decrease, and the letter N for no change. a. The terms of cash discounts offered to customers are made less

> You are long 10 gold futures contracts, established at an initial settle price of $1,580 per ounce, where each contract represents 100 ounces. Over the subsequent four trading days, gold settles at $1,587, $1,582, $1,573, and $1,584, respectively. Comput

> Bubbling Crude Corporation, a large Texas oil producer, would like to hedge against adverse movements in the price of oil because this is the firm’s primary source of revenue. What should the firm do? Provide at least two reasons why it probably will not

> Hannon Home Products, Inc., recently issued $2 million worth of 8 percent convertible debentures. Each convertible bond has a face value of $1,000. Each convertible bond can be converted into 21.50 shares of common stock any time before maturity. The sto

> What happens to the price of a convertible bond if interest rates increase?

> General Modems has five-year warrants that currently trade in the open market. Each warrant gives its owner the right to purchase one share of common stock for an exercise price of $55. a. Suppose the stock is currently trading for $51 per share. What is

> The Webber Company is an international conglomerate with a real estate division that owns the right to erect an office building on a parcel of land in downtown Sacramento over the next year. This building would cost $25 million to construct. Due to low d

> Utility companies often face a decision to build new plants that burn coal, oil, or both. If the prices of both coal and gas are highly volatile, how valuable is the decision to build a plant that can burn either coal or oil? What happens to the value of

> The price of Tara, Inc., stock will be either $50 or $70 at the end of the year. Call options are available with one year to expiration. T-bills currently yield 5 percent. a. Suppose the current price of Tara stock is $62. What is the value of the call o

> Assume that your company does not contemplate paying taxes for the next several years. What are the cash flows from leasing in this case? You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a common p

> Comment on the following remarks: a. Leasing reduces risk and can reduce a firm’s cost of capital. b. Leasing provides 100 percent financing. c. If the tax advantages of leasing were eliminated, leasing would disappear.

> Milano Pizza Club owns three identical restaurants popular for their specialty pizzas. Each restaurant has a debt–equity ratio of 40 percent and makes interest payments of $41,000 at the end of each year. The cost of the firm’s levered equity is 19 perce

> Indicate the effect that the following will have on the operating cycle. Use the letter I to indicate an increase, the letter D for a decrease, and the letter N for no change. a. Receivables average goes up. b. Credit repayment times for customers are in

> For the year just ended, you have gathered the following information about the Holly Corporation: a. A $200 dividend was paid. b. Accounts payable increased by $500. c. Fixed asset purchases were $900. d. Inventories increased by $625. e. Long-term debt

> Suppose a financial manager buys call options on 50,000 barrels of oil with an exercise price of $95 per barrel. She simultaneously sells a put option on 50,000 barrels of oil with the same exercise price of $95 per barrel. Consider her gains and losses

> What is the difference between a forward contract and a futures contract? Why do you think that futures contracts are much more common? Are there any circumstances under which you might prefer to use forwards instead of futures? Explain.

> When should a firm force conversion of convertibles? Why?

> Eckely, Inc., recently issued bonds with a conversion ratio of 17.5. If the stock price at the time of the bond issue was $48.53, what was the conversion premium?

> Gasworks, Inc., has been approached to sell up to 5 million gallons of gasoline in three months at a price of $3.65 per gallon. Gasoline is currently selling on the wholesale market at $3.30 per gallon and has a standard deviation of 58 percent. If the r

> What is the difference between an American option and a European option?

> The price of Ervin Corp. stock will be either $74 or $96 at the end of the year. Call options are available with one year to expiration. T-bills currently yield 5 percent. a. Suppose the current price of Ervin stock is $80. What is the value of the call

> What would the lease payment have to be for both the lessor and the lessee to be indifferent about the lease? You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a common practice with expensive, high

> What are some of the potential problems with looking at IRRs when evaluating a leasing decision?

> Gemini, Inc., an all-equity firm, is considering a $1.7 million investment that will be depreciated according to the straight-line method over its four-year life. The project is expected to generate earnings before taxes and depreciation of $595,000 per

> McConnell Corp. has a book value of equity of $13,205. Long-term debt is $8,200. Net working capital, other than cash, is $2,205. Fixed assets are $18,380. How much cash does the company have? If current liabilities are $1,630, what are current assets?

> Refer to Table 25.2 in the text to answer this question. Suppose you sell five March 2012 silver futures contracts on November 22, 2011, at the last price of the day. What will your profit or loss be if silver prices turn out to be $31.39 per ounce at ex

> If a firm is buying call options on pork belly futures as a hedging strategy, what must be true about the firm’s exposure to pork belly prices?

> In the previous problem, suppose you wanted the option to sell the land to the buyer in one year. Assuming all the facts are the same, describe the transaction that would occur today. What is the price of the transaction today? Data from previous problem

> Explain the following limits on the prices of warrants: a. If the stock price is below the exercise price of the warrant, the lower bound on the price of a warrant is zero. b. If the stock price is above the exercise price of the warrant, the lower bound

> Jared Lazarus has just been named the new chief executive officer of BluBell Fitness Centers, Inc. In addition to an annual salary of $410,000, his three-year contract states that his compensation will include 15,000 at-the-money European call options on

> Complete the following sentence for each of these investors: a. A buyer of call options. b. A buyer of put options. c. A seller (writer) of call options. d. A seller (writer) of put options. “The (buyer/seller) of a (put/call) option (pays/receives) mone

> Zoso is a rental car company that is trying to determine whether to add 25 cars to its fleet. The company fully depreciates all its rental cars over five years using the straight-line method. The new cars are expected to generate $175,000 per year in ear

> Use the option quote information shown here to answer the questions that follow. The stock is currently selling for $114. a. Suppose you buy 10 contracts of the February 110 call option. How much will you pay, ignoring commissions? b. In part (a), supp

> Indicate the impact of the following corporate actions on cash, using the letter I for an increase, D for a decrease, or N when no change occurs. a. A dividend is paid with funds received from a sale of debt. b. Real estate is purchased and paid for with

> If a firm is selling futures contracts on lumber as a hedging strategy, what must be true about the firm’s exposure to lumber prices?

> Gary Levin is the chief executive officer of Mountainbrook Trading Company. The board of directors has just granted Mr. Levin 30,000 at-the-money European call options on the company’s stock, which is currently trading at $50 per share. The stock pays no

> What is a call option? A put option? Under what circumstances might you want to buy each? Which one has greater potential profit? Why?

> In the previous problem, assume that the exercise style on the option is American rather than European. What is the price of the option now? Previous problem The stock price is $73, and the standard deviation of the stock returns is 70 percent. The optio

> Why might a firm choose to engage in a sale and leaseback transaction? Give two reasons.

> Suppose a three-factor model is appropriate to describe the returns of a stock. Information about those three factors is presented in the following chart: a. What is the systematic risk of the stock return? b. Suppose unexpected bad news about the firm

> A stock has had returns of 27 percent, 12 percent, 32 percent, 212 percent, 19 percent, and 231 percent over the last six years. What are the arithmetic and geometric returns for the stock?

> In contrast to the CAPM, the APT does not indicate which factors are expected to determine the risk premium of an asset. How can we determine which factors should be included? For example, one risk factor suggested is the company size. Why might this be

> The Durkin Investing Agency has been the best stock picker in the country for the past two years. Before this rise to fame occurred, the Durkin newsletter had 200 subscribers. Those subscribers beat the market consistently, earning substantially higher r

> Schultz Industries is considering the purchase of Arras Manufacturing. Arras is currently a supplier for Schultz, and the acquisition would allow Schultz to better control its material supply. The current cash flow from assets for Arras is $7.5 million.

> Suppose a stock had an initial price of $75 per share, paid a dividend of $1.20 per share during the year, and had an ending share price of $86. What was the dividend yield? The capital gains yield?

> Suppose a stock had an initial price of $75 per share, paid a dividend of $1.20 per share during the year, and had an ending share price of $86. Compute the percentage total return.

> The following diagram shows the cumulative abnormal returns (CAR) for 386 oil exploration companies announcing oil discoveries between 1950 and 1980. Month 0 in the diagram is the announcement month. Assume that no other information is received and the s

> Based on the following information, calculate the expected return and standard deviation for each of the following stocks. What are the covariance and correlation between the returns of the two stocks? Probability of State of Economy State of Return

> Is the following statement true or false? A risky security cannot have an expected return that is less than the risk-free rate because no risk-averse investor would be willing to hold this asset in equilibrium. Explain.

> Assuming that the returns from holding small company stocks are normally distributed, what is the approximate probability that your money will double in value in a single year? Triple in value?

> Based on the following information, calculate the expected return and standard deviation of each of the following stocks. Assume each state of the economy is equally likely to happen. What are the covariance and correlation between the returns of the two

> Suppose the returns on long-term government bonds are normally distributed. Based on the historical record, what is the approximate probability that your return on these bonds will be less than 23.7 percent in a given year? What range of returns would yo

> Imagine that a particular macroeconomic variable that influences your firm’s net earnings is positively serially correlated. Assume market efficiency. Would you expect price changes in your stock to be serially correlated? Why or why not?

> Suppose you have been hired as a financial consultant to Defense Electronics, Inc. (DEI), a large, publicly traded firm that is the market share leader in radar detection systems (RDSs). The company is looking at setting up a manufacturing plant overseas

> You have $100,000 to invest in a portfolio containing Stock X, Stock Y, and a risk-free asset. You must invest all of your money. Your goal is to create a portfolio that has an expected return of 11.22 percent and that has only 96 percent of the risk of

> You bought one of Bergen Manufacturing Co.’s 7 percent coupon bonds one year ago for $1,080.50. These bonds make annual payments and mature six years from now. Suppose you decide to sell your bonds today when the required return on the bonds is 5.5 perce

> Suppose the market is semistrong form efficient. Can you expect to earn excess returns if you make trades based on: a. Your broker’s information about record earnings for a stock? b. Rumors about a merger of a firm? c. Yesterday’s announcement of a succe

> Define the three forms of market efficiency.

> The following three stocks are available in the market: Assume the market model is valid. a. Write the market model equation for each stock. b. What is the return on a portfolio with weights of 30 percent Stock A, 45 percent Stock B, and 25 percent Sto

> Trower Corp. has a debt–equity ratio of .85. The company is considering a new plant that will cost $145 million to build. When the company issues new equity, it incurs a flotation cost of 8 percent. The flotation cost on new debt is 3.5 percent. What is

> You want to create a portfolio equally as risky as the market, and you have $1,000,000 to invest. Given this information, fill in the rest of the following table: Asset Investment Beta Stock A $180,000 85 Stock B $290,000 1.40 Stock C 1.45 Risk-free

> You’ve observed the following returns on Mary Ann Data Corporation’s stock over the past five years: 27 percent, 13 percent, 18 percent, 214 percent, and 9 percent. Suppose the average inflation rate over this period was 4.2 percent, and the average T-bi

> Refer to T able 10.1 in the text and look at the period from 1973 through 1980. a. Calculate the average return for Treasury bills and the average annual inflation rate (consumer price index) for this period. b. Calculate the standard deviation of Treasu

> Photochronograph Corporation (PC) manufactures time series photographic equipment. It is currently at its target debt–equity ratio of .55. It’s considering building a new $50 million manufacturing facility. This new plant is expected to generate aftertax

> Consider the following information about three stocks: a. If your portfolio is invested 40 percent each in A and B and 20 percent in C, what is the portfolio expected return? The variance? The standard deviation? b. If the expected T-bill rate is 3.80

> A stock has had the following year-end prices and dividends: What are the arithmetic and geometric returns for the stock? Year Price Dividend $61.18 2 64.83 $.72 3 72.18 .78 4 63.12 .86 69.27 .95 76.93 1.08 56

> Happy Times, Inc., wants to expand its party stores into the Southeast. In order to establish an immediate presence in the area, the company is considering the purchase of the privately held Joe’s Party Supply. Happy Times currently has debt outstanding

> Using the CAPM, show that the ratio of the risk premiums on two assets is equal to the ratio of their betas.

> Advance, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 17 years to maturity that is quoted at 95 percent of face value. The issue makes semiannual payments and has a coupon rate of 8 percent annually. What is A

> You own a portfolio that has $2,100 invested in Stock A and $3,200 invested in Stock B. If the expected returns on these stocks are 11 percent and 14 percent, respectively, what is the expected return on the portfolio?

> You find a certain stock that had returns of 12 percent, 221 percent, 9 percent, and 32 percent for four of the last five years. If the average return of the stock over this period was 11 percent, what was the stock’s return for the missing year? What is

> Based on the following information, calculate the expected return and standard deviation: State of Probability of State of Economy Rate of Return Economy if State Occurs Depression 10 -.105 Recession 25 .059 Normal 45 130 Вoom .20 211

> TransTrust Corp. has changed how it accounts for inventory. Taxes are unaffected, although the resulting earnings report released this quarter is 20 percent higher than what it would have been under the old accounting system. There is no other surprise i

> Floyd Industries stock has a beta of 1.3. The company just paid a dividend of $.95, and the dividends are expected to grow at 4.5 percent per year. The expected return on the market is 11 percent, and Treasury bills are yielding 4.3 percent. The most rec

> In the previous problem, what would the risk-free rate have to be for the two stocks to be correctly priced?

> Refer back to Table 10.2. What range of returns would you expect to see 68 percent of the time for large-company stocks? What about 95Â percent of the time? Table 10.2 Arithmetic Standard Mean Deviation Series (%) (K) Distribution (%) Smal

> Delta, United, and American Airlines announced purchases of planes on July 18 (7/18), February 12 (2/12), and October 7 (10/7), respectively. Given the following information, calculate the cumulative abnormal return (CAR) for these stocks as a group. Gra

> Newtech Corp. is going to adopt a new chip-testing device that can greatly improve its production efficiency. Do you think the lead engineer can profit from purchasing the firm’s stock before the news release on the device? After reading the announcement

> Goodbye, Inc., recently issued new securities to finance a new TV show. The project cost $19 million, and the company paid $1,150,000 in flotation costs. In addition, the equity issued had a flotation cost of 7 percent of the amount raised, whereas the d

> Stock Y has a beta of 1.35 and an expected return of 14 percent. Stock Z has a beta of .80 and an expected return of 11.5 percent. If the risk-free rate is 4.5 percent and the market risk premium is 7.3 percent, are these stocks correctly priced?

> Refer back to Table 10.2. What range of returns would you expect to see 68 percent of the time for long-term corporate bonds? What about 95Â percent of the time? Table 10.2 Arithmetic Standard Deviation Mean Series (*) (*) Distribution (%)

> Today, the following announcement was made: “Early today the Justice Department reached a decision in the Universal Product Care (UPC) case. UPC has been found guilty of discriminatory practices in hiring. For the next five years, UPC must pay $2 million

> Is it possible that a risky asset could have a beta of zero? Explain. Based on the CAPM, what is the expected return on such an asset? Is it possible that a risky asset could have a negative beta? What does the CAPM predict about the expected return on s

> The Saunders Investment Bank has the following financing outstanding. What is the WACC for the company? Debt: 60,000 bonds with a coupon rate of 6 percent and a current price quote of 109.5; the bonds have 20 years to maturity. 230,000 zero coupon bon

> Asset W has an expected return of 12.3 percent and a beta of 1.3. If the risk-free rate is 4 percent, complete the following table for portfolios of Asset W and a risk-free asset. Illustrate the relationship between portfolio expected return and portfoli