Question: Refer to the financial statements of Target

Refer to the financial statements of Target Corporation in Appendix B at the end of this book. All dollar amounts are in millions.

1. Did the company accrue more or pay more for wages and benefits in the most recent fiscal year and by how much?

a. Target accrued more by $519.

b. Target accrued more by $1,677.

c. Target paid more by $1,158.

d. Target paid more by $1,716.

e. Cannot determine the effect or amount by the information provided.

2. Did the company receive more or accrue more for accounts and other receivables in the most recent fiscal year and by how much?

a. Target received more by $133.

b. Target accrued more by $259.

c. Target accrued more by $133.

d. Target received more by $259.

e. Cannot determine the effect or amount by the information provided.

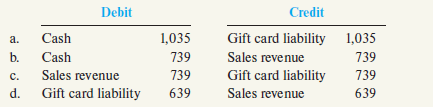

3. Of the $935 balance in gift card liability on February 1, 2020, what adjusting entry did Target make to recognize revenue during the most recent year for gift cards redeemed by customers?

4. What is(are) Target’s revenue recognition policy(ies) for merchandise sales?

a. Target records Target gift card sales upon redemption, which is typically within one year of issuance.

b. Target records almost all retail store revenues at the point of sale.

c. Target records digital sales upon delivery to the customer.

d. All of the above are revenue recognition policies for Target.

5. Which of the following is included in the closing entry for Target for the most recent year?

a. Debit to Cost of Sales, $66,177

b. Credit to Selling, General and Administrative expenses, $18,615

c. Debit to Accumulated Depreciation, $20,278

d. Credit to Sales Revenue, $92,400

e. Debit to Retained Earnings, $4,368

6. What is the total asset turnover ratio for the most recent fiscal year and what does this suggest about the company?

a. 1.99, suggesting that Target’s management generates $1.99 in operating revenues for every dollar of assets.

b. 0.51, suggesting that Target generates $0.51 for every dollar of sales revenue.

c. 0.09, suggesting that Target’s management is not effective at utilizing assets to generate earnings.

d. 2.47, suggesting that Target’s management is effective at balancing the ratio of current assets to total assets.

> At the beginning of 20X5, its first year of business, Marsalis Ltd. invested $64,000 in inventory and $300,000 in equipment. Total sales were $160,000. Of the initial inventory purchases, $25,000 remained in inventory at the end of the period. Marsalis d

> Indicate whether each statement is true or false: 1. The IASB has authority for setting Canadian accounting standards. 2. All Canadian corporations must comply with international accounting standards. 3. Most public Canadian corporations are listed on th

> On 3 January 20X5, London Company entered into a joint arrangement with two other investors to develop a gold mine called JDX Gold. Based on the contractual arrangement, London will have rights to the net assets and net income of JDX Gold. London has a 2

> On 3 January 20X4, Windsor Company purchased 30% of the shares of Brampton for $565,000 cash. Windsor will use the equity method. On this date, Brampton has $2,000,000 of assets, $1,600,000 of liabilities, and $400,000 of equity. Book values reflect fair

> In 20X1, FYY Ltd. purchased 500 shares of Humor Inc. for $6,000 plus $500 in commission. The shares had a fair value of $19,000 at the end of 20X1, $25,000 at the end of 20X2, and $40,000 at the end of 20X3. In 20X4, the shares were sold for $31,000 less

> On 30 June 20X2, King Ltd. purchased 10,000 shares of Prince Inc. for $12,000 plus $1,000 in commission. In 20X2, the company received $500 of dividends, and the shares had a fair value of $16,000 at the end of the year. In 20X3, there were no dividends

> On 1 July 20X2, King Ltd. purchased $500,000 bonds of Princess Inc. at par. The bonds pay 6% interest annually on June 30. The bonds mature on 30 June 20X9. King has a June 30 year-end. At 30 June 20X3, King assessed that the credit risk of the Princess

> On 1 January 20X2, Speedy Company purchased $3,000,000 of Wind Corp. 3% bonds, classified as an FVOCI-Bond investment for $2,737,438. The bonds pay semi-annual interest each 30 June and 31 December. The market interest rate was 5% on the date of purchase

> On 1 January 20X2, Lucky Company purchased $5,000,000 of Fire Corp. 3% bonds, classified as a FVTPL. The bonds pay semi-annual interest each 30 June and 31 December. The market interest rate was 4% on the date of purchase. The bonds mature on 30 December

> On 1 January 20X4, Queen Company purchased $5,000,000 of Sport Corp. 7% bonds, classified as an FVOCI-Bonds investment. The bonds pay semi-annual interest each 30 June and 31 December. The market interest rate was 5% on the date of purchase. The bonds ma

> IFRS or ASPE? - 20% investment in publicly traded company. Significant influence exists. - 25% investment in private company. Significant influence exists. - 70% investment in private company. Control exists. - 75% investment in publicly traded company.

> Oundjian Corporation recently sold inventory for $140,000. The goods had originally cost $94,000. Inflation during the period was 5%. The goods could be replaced from their long-time supplier for $115,000. For simplicity, assume that there are no other c

> IFRS or ASPE ? - Investment in 10-year bonds. Bonds were purchased when interest rates were high. Rates are expected to decline, and when this happens the bonds will be sold. - Investment in 10-year bonds with the intention to hold until maturity. Howeve

> On 1 July 20X2, a company bought an investment in IBM bonds at par for US$50,000 when the exchange rate was US$1 = Cdn$1.12. The investment is classified as FVTPL. The company paid cash on the acquisition date. At 31 December, the exchange rate was US$1

> On 1 January 20X2, Investor Company purchased $1,000,000 of Operating Corp. 5% bonds, classified as an AC investment. The bonds pay semi-annual interest each 30 June and 31 December. The market interest rate was 6% on the date of purchase. The bonds matu

> Montonne Corp. is a private company that complies with ASPE. Montonne has a piece of equipment that cost $254,000. Its useful life to the company is estimated to be 15 years, after which it is expected to have a net residual value of $125,000. The equipm

> Bovine Ltd. has the following assets in a CGU: The recoverable amount has been determined to be $1,500. The separate fair value less costs of disposal for land is $600; no other assets could be separately valued. Required: 1. Allocate the impairment loss

> Food Inc., a public company, has a machine that processes and packages tuna in oil. This machine cannot be used for any other purpose. The machine originally cost $100,000 and is being amortized on a straight-line basis over 20 years. The carrying amount

> Innovative Inc. has a piece of equipment with a carrying amount of $175,000. Technology has changed, indicating that the machine may be impaired. A new machine with updated technology could be purchased for $350,000. A used machine of similar vintage is

> Phillips Ltd. purchased a machine on 26 March 20X3 for $90,000 and began to use it immediately. The estimated useful life of the machine is 5 years, and it has an expected residual value of $10,000 at that time. Phillips uses straight-line depreciation.

> XYZ Inc. has a building it purchased for $400,000. It is estimated the building has a useful life of 25 years and zero residual value. The building has three major components. XYZ uses the straight-line method of depreciation. Required: 1. What is the am

> Vert Ltd. purchased a vehicle on 1 January 20X8 for $34,000 and began to use it immediately. The estimated physical life of the vehicle is 20 years, but the estimated useful life to Vert is 10 years. The vehicle has an estimated residual value of $8,000.

> In the blanks provided to the left below, enter the letters of the underlying assumption, measurement method, qualitative criteria, or constraint most closely associated with the statements. Some letters may be used more than once and some may not be use

> Indicate whether the use of IFRS or ASPE is either required or more likely for the following entities as preparers of financial statements:

> Bailey Delivery Company, Inc., was organized in 2021 in Wisconsin. The following transactions occurred during the year: a. Received cash from investors in exchange for 10,000 shares of stock (par value of $1.00 per share) with a market value of $4 per sh

> Higgins Company began operations last year. You are a member of the management team investigating expansion ideas that will require borrowing funds from banks. On January 1, the start of the current year, Higgins’ T-account balances wer

> Consolidated Edison, Inc. (Con Edison), is a public utility company operating primarily in New York whose annual revenues exceed $12 billion. It reported the following December 31 simplified balances in its statement of stockholders’ eq

> Gordon Company started operations on January 1 of the current year. It is now December 31, the end of the current annual accounting period. The part-time bookkeeper needs your help to analyze the following three transactions: a. During the year, the comp

> Preparing an Income Statement and Balance Sheet Analytics Corporation was organized on January 1, current year. At the end of the current year, the following financial data are available: Complete the following two statements:

> Emily Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 2: Required: Prepare a separate income statement through pr

> The Hershey Company is a global confectionery leader known for its branded portfolio of chocolate, sweets, mints, and other great-tasting snacks. The Company has more than 80 brands worldwide including such iconic brand names as Hershey’

> Griffin Service Company, Inc., was organized by Bennett Griffin and five other investors (that is, six in total). The following activities occurred during the year: a. Received $70,000 cash from the six investors; each investor was issued 8,400 shares of

> Campbell Soup Company is the world’s leading maker and marketer of soup and sells other well-known brands of food in 160 countries. Presented here are the items listed on a simplified version of its recent balance sheet (dollars in mill

> Macy’s, Inc., operates the two best-known high-end department store chains in North America: Macy’s and Bloomingdale’s. The following simplified data (in millions) were taken from its recent annual re

> Target Corporation, is a general merchandise retailer that sells products through its stores and digital channels. The company offers everyday essentials and merchandise at discounted prices. The items reported on its income statement for an earlier year

> A + T Williamson Company is making adjusting entries for the year ended December 31 of the current year. In developing information for the adjusting entries, the accountant learned the following: a. A two-year insurance premium of $4,800 was paid on Octo

> Completing a Balance Sheet and Inferring Net Income Bennett Griffin and Chula Garza organized Cole Valley Book Store as a corporation; each contributed $80,000 cash to start the business and received 4,000 shares of common stock. The store completed its

> Pool Corporation, Inc., is the world’s largest wholesale distributor of swimming pool supplies and equipment. It is a publicly traded corporation that trades on the NASDAQ exchange under the symbol POOL. It sells these products to swimm

> Pool Corporation, Inc., reported in its recent annual report that “In 2010, our industry experienced some price deflation. . . . In 2011, our industry experienced more normalized price inflation of approximately 2 percent overall despit

> Pool Corporation, Inc., sells swimming pool supplies and equipment. It is a publicly traded corporation that trades on the NASDAQ exchange. The majority of Pool’s customers are small, family-owned businesses. Assume that Pool issued bonds with a face val

> Pool Corporation, Inc., is the world’s largest wholesale distributor of swimming pool supplies and equipment. Assume Pool Corporation purchased for cash new loading equipment for the warehouse on January 1 of Year 1, at an invoice price of $72,000. It al

> Keurig Dr Pepper, is a leading worldwide integrated brand owner, bottler, and distributor of non-alcoholic beverages. Key brands include Dr Pepper, Snapple, 7-UP, Mott’s juices, A&W root beer, Canada Dry ginger ale, Bai antioxidant

> Brothers Herm and Steve Hargenrater began operations of their tool and die shop (H & H Tool) on January 1, 1987, in Meadville, PA. The annual reporting period ends December 31. Assume that the trial balance on January 1, 2023, was as follows: Transac

> Aubrae and Tylor Williamson began operations of their furniture repair shop (Furniture Refinishers, Inc.) on January 1, 2019. The annual reporting period ends December 31. The trial balance on January 1, 2024, was as follows: Transactions during 2024 fol

> Using Financial Reports: Identifying and Correcting Deficiencies in an Income Statement and Balance Sheet Precision Corporation was organized on January 1, 2021. At the end of 2021, the company had not yet employed an accountant; however, an employee who

> Refer to the information regarding Bill’s Catering Company in AP4-3. Required: 1. Indicate whether each transaction relates to a deferred revenue, deferred expense, accrued revenue, or accrued expense. 2. Using the following headings, i

> Broadening Financial Research Skills: Locating Financial Information on the SEC’s Database The Securities and Exchange Commission (SEC) regulates companies that issue stock on the stock market. It receives financial reports from public companies electron

> Comparing Companies within an Industry Refer to the following: • Target Corporation in Appendix B, • Walmart Inc. in Appendix C, and the • Industry Ratio Report in Appendix D at the end of this book.

> Refer to the financial statements of Walmart given in Appendix C at the end of this book. At the bottom of each statement, the company warns readers that “The accompanying notes are an integral part of these financial statements.” The following questions

> Refer to the financial statements and footnotes of Walmart given in Appendix C at the end of this book. All dollar amounts are in millions. Round your answers to two decimal places. For calculations that require net income, use the “Consolidated net inco

> Refer to the financial statements and footnotes of Target given in Appendix B at the end of this book. All dollar amounts are in millions. Round your answers to two decimal places. Required: 1. For the most recent fiscal year, compute the return on equit

> Refer to the financial statements of Target (Appendix B) and Walmart (Appendix C), and the Industry Ratio Report (Appendix D) at the end of this book. Required: 1. Compute the quality of income ratio for both companies for the most recent reporting year.

> Refer to the financial statements of Walmart given in Appendix C at the end of this book. Required: 1. On the statement of cash flows, what was the largest item (in absolute value) listed under “Adjustments to reconcile consolidated net income to net cas

> Refer to the financial statements of Target given in Appendix B at the end of this book. Required: 1. Does Target, use the direct or indirect method to report cash flows from operating activities? How did you know? a. Direct because it lists the individu

> A recent annual report for Apple Inc. contained the following information (dollars in millions): In 2020, Apple declared dividends equal to $0.795 per share. Assume all of the dividends were paid with cash by year end. Approximately how much cash in tota

> South Bend Repair Service Co. keeps its records without the help of an accountant. After much effort, an outside accountant prepared the following unadjusted trial balance as of the end of the annual accounting period on December 31: Data not yet recorde

> Refer to the financial statements of Target (Appendix B) and Walmart (Appendix C) and the Industry Ratio Report (Appendix D) at the end of this book. Required: 1. Compare basic earnings per share for Target and Walmart. 2. How would repurchasing treasury

> Refer to the financial statements of Target (Appendix B) and Walmart (Appendix C) and the Industry Ratio Report (Appendix D) at the end of this book. Required: 1. Compute the debt-to-equity ratio for both companies for the most recent fiscal year. (Round

> Refer to the financial statements and footnotes of Walmart given in Appendix C at the end of this book. All dollar amounts are in millions. Required: 1. What is the amount of cash Walmart paid for interest during the most recent fiscal year?____________

> Refer to the financial statements and footnotes of Target given in Appendix B at the end of this book. All dollar amounts are in millions. Required: 1. Where does Target report the amount of cash paid for interest during the most recent fiscal year? a. S

> Refer to the financial statements of Target (Appendix B) and Walmart (Appendix C) and the Industry Ratio Report (Appendix D) at the end of this book. Required: 1. Compute the accounts payable turnover ratio for both companies for the most recent fiscal y

> Refer to the financial statements and footnotes of Walmart given in Appendix C at the end of this book. All dollar amounts are in millions. 1. What is the amount of accrued wages and benefits at the end of the most recent fiscal year?_________________ 2.

> You are a financial analyst charged with evaluating the asset efficiency of companies in the hotel industry. Recent financial statements for Marriott International include the following note: Required: 1. Assume that Marriott followed this policy for a m

> As stated in its recent annual report, “Sysco Corporation . . . is the largest global distributor of food and related products primarily to the foodservice or food-away-from-home industry. We provide products and related services to ove

> Refer to the following: • Target Corporation in Appendix B, • Walmart Inc. in Appendix C, and the • Industry Ratio Report in Appendix D at the end of this book. All dollar amounts are in millions of d

> An annual report for International Paper Company included the following note: The last-in, first-out inventory method is used to value most of International Paper’s U.S. inventories . . . If the first-in, first-out method had been used, it would have inc

> Taos Company is completing the information processing cycle at the end of its fiscal year on December 31. Following are the correct balances at December 31 of the current year for the accounts both before and after the adjusting entries for the current y

> Refer to the financial statements of Target (Appendix B) and Walmart (Appendix C) and the Industry Ratio Report (Appendix D) at the end of this book. Required: 1. Compute the inventory turnover ratio for both companies for the current year. 2. What do yo

> Refer to the financial statements of Walmart, given in Appendix C at the end of this book. Required: 1. The company uses LIFO to account for its “Walmart U.S. inventory” and FIFO to account for its “Walmart International inventory.” Is there anything spe

> Refer to the financial statements of Target given in Appendix B at the end of this book. All dollar amounts in the statements and answers are in millions. Required: 1. How much inventory does the company hold at the end of the most recent year? a. $44,94

> Cripple Creek Company has one trusted employee who, as the owner said, “handles all of the bookkeeping and paperwork for the company.” This employee is responsible for counting, verifying, and recording cash receipts and payments; making the weekly bank

> Symbol Technologies, Inc., was a fast-growing maker of bar-code scanners. According to the federal charges, Tomo Razmilovic, the CEO at Symbol, was obsessed with meeting the stock market’s expectation for continued growth. His executive team responded by

> Refer to the financial statements of Walmart given in Appendix C at the end of this book. All dollar amounts in the statements are in millions. Required: 1. (a) How much cash and cash equivalents does the company report at the end of the current year? (E

> Refer to the financial statements of Target given in Appendix B at the end of this book. Required: 1. What does the company include in its category of cash and cash equivalents? How close do you think the disclosed amount is to actual fair market value?

> Megan Company (not a corporation) was careless about its financial records during its first year of operations, the current year. It is December 31 of the current year the end of the annual accounting period. An outside CPA has examined the records and d

> Zoltar Moving Co. has been in operation for over 30 years providing moving services for local households and businesses. It is now December 31, 2024, the end of the annual accounting period. Assume that the company has not done well financially during th

> Carey Land Company, a closely held corporation, invests in commercial rental properties. Carey’s annual accounting period ends on December 31. At the end of each year, numerous adjusting entries must be made because many transactions completed during cur

> Kiwi, Inc., headquartered in Boston, Massachusetts, designs, manufactures, and markets headphones and other audio components. The following is Kiwi’s (simplified) balance sheet from a recent fiscal year ending on June 30. Assume that th

> You are the regional sales manager for Jackie Branco News Company. Jackie is making adjusting entries for the year ended March 31, 2024. On September 1, 2023, customers in your region paid $36,000 cash for three-year magazine subscriptions beginning on t

> Evaluating an Ethical Dilemma: Analyzing Management Incentives On December 5, 2019, the Securities and Exchange Commission (SEC) charged two top executives of Celadon Group, Inc., an Indiana-based trucking company, for their participation in an accountin

> Lisa Knight owns and operates Lisa’s Day Spa and Salon, Inc. She has decided to sell the business and retire, and is in discussions with Helen Bailey, the owner of a regional chain of day spas. The discussions are at the complex stage o

> Using Financial Reports: Analyzing the Balance Sheet Recent balance sheets are provided for Twitter, Inc., a global platform for real-time public self-expression and conversation. Show your answers in thousands of dollars. Required: 1. Is Twitter a corpo

> Using Financial Reports: Evaluating the Reliability of a Balance Sheet Frances Sabatier asked a local bank for a $50,000 loan to expand her small company. The bank asked Frances to submit a financial statement of the business to supplement the loan appli

> The financial statements for Lainey’s Famous Pizza are below. Lainey’s operates more than 250 locations in 30 states and 11 countries. Required 1. Compute the following ratios for Year 3 using information from the comp

> Wolf Company uses the LIFO method to account for inventory and Tiger Company uses the FIFO method. The two companies are exactly alike except for the difference in inventory cost flow assumptions. Costs of inventory items for both companies have been ris

> Tabor Company has just prepared the following comparative annual financial statements for the current year: Required: 1. Using average balances for balance sheet accounts and year-end balances for all income statement accounts, compute the following rati

> Coca-Cola and PepsiCo are well-known international beverage and snack companies. Compare the two companies as a potential investment based on the following ratios:

> Murray Company is developing its annual financial statements at December 31, current year. The statements are complete except for the statement of cash flows. The completed comparative balance sheets and income statement are summarized as follows: Additi

> Refer to the information regarding Hannah Company in AP4-2. Required: 1. Indicate whether each transaction relates to a deferred revenue, deferred expense, accrued revenue, or accrued expense. 2. Using the following headings, indicate the effect of each

> Golden Deer Company is developing its annual financial statements at December 31, current year. The statements are complete except for the statement of cash flows. The completed comparative balance sheets and income statement are summarized below: Additi

> Athena Company’s accountants have just completed the income statement and balance sheet for the year and have provided the following information (dollars in thousands): The company issued $50,000, 9 percent bonds payable at par during t

> Alonzo and Mika, two students in a financial statement analysis class, were reviewing financial statements for Facebook, one of the world’s largest social-media companies. Alonzo noted that the company did not report any dividends in the financing activi

> Kainen Company reported the following information at the end of the year: The board of directors is considering the distribution of a cash dividend to the two groups of stockholders. No dividends were declared during the previous two years. Assume the th

> The following was in the financial press pertaining to Zoom Video Communications: Zoom’s (ZM) stock was sold for $65 per share during its opening day of trading. Zoom sold 21 million shares at its IPO. Required: 1. Record the issuance of stock, assuming

> Salish Corporation received its charter during January of this year. The charter authorized the following stock: Preferred stock: 10 percent, $10 par value, 31,000 shares authorized Common stock: $8 par value, 60,000 shares authorized During the year, th

> Assume for each of the following independent cases that the annual accounting period ends on December 31. Revenues for the year were $288,000. Expenses for the year were $328,000. Case A: Assume that Weather Company is a sole proprietorship owned by Mrs.

> Chukanut Company completed the following transactions during Year 1. Chukanut’s fiscal year ends on December 31. Jan. 20 Paid cash for office supplies (held as office supplies inventory). The invoice amount was $17,900. Apr. 1 Borrowed $458,000 from Roya

> Sabre Company has just completed a physical inventory count at year-end, December 31 of the current year. Only the items on the shelves, in storage, and in the receiving area were counted and costed on a FIFO basis. The inventory amounted to $96,000. Dur

> Required: Using the events (a) through (h) in AP2-3, indicate whether each transaction is an investing (I) or financing (F) activity for the quarter and the direction and amount of the effect on cash flows (+ for increase and − for decrease). If there is

> Assume that Witz and Steenhoven, Inc. uses the aging approach to estimate bad debt expense at the end of each accounting year. Credit sales occur frequently on terms n/45. The balance of each account receivable is aged on the basis of four time periods a