Question: Refer to the information in E5–7

Refer to the information in E5–7 regarding Mountain Dental.

Required:

1. Perform a least-squares regression using Mountain’s activity and cost information and state the linear cost equation (y = a + bx).

2. Explain what each component of the cost equation represents.

3. Do the regression results differ from those obtained using the high-low and scattergraph methods? If so, why?

Data from E5-7:

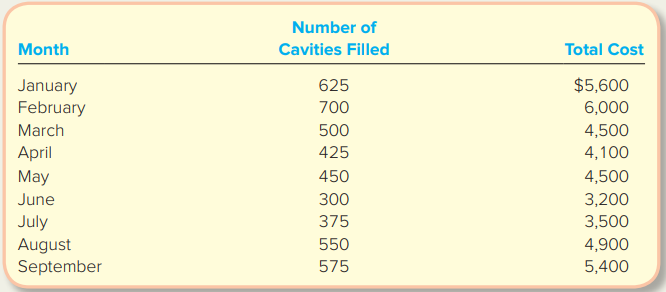

Mountain Dental Services is a specialized dental practice whose only service is filling cavities. Mountain has recorded the following for the past nine months:

> Manufacturing costs can be classified into three categories—direct materials, direct labor, and manufacturing overhead. Over the years, manufacturing companies have changed significantly with advances in technology and the automation of many manufacturin

> Refer to information in E8–5 for Shadee Corp. It expects the following unit sales for the third quarter: Sixty percent of Shadee’s sales are cash. Of the credit sales, 50 percent is collected in the month of the sale,

> Use the information and solutions from E8–5 through E8–9 for Shadee Corp. Required: Prepare Shadee’s budgeted income statement for the months of May and June. Data from E8-9: In addition to the information in E8–5 through E8–8 regarding Shadee Corp., th

> Samantha is the production manager for Wentworth Company. Each year, she is involved in the company’s budgeting process. Company President Leslie has asked Samantha to submit the facility’s budgeted production for the upcoming year. Leslie’s typical proc

> MSI’s educational products are currently sold without any supplemental materials. The company is considering the inclusion of instructional materials such as an overhead slide presentation, potential test questions, and classroom bullet

> MSI is considering eliminating a product from its ToddleTown Tours collection. This collection is aimed at children one to three years of age and includes “tours” of a hypothetical town. Two products, The Pet Store Par

> MSI is considering outsourcing the production of the handheld control module used with some of its products. The company has received a bid from Monte Legend Co. (MLC) to produce 10,000 units of the module per year for $16 each. The following information

> MSI has been approached by a fourth-grade teacher from Portland about the possibility of creating a specially designed game that would be customized for her classroom and environment. The teacher would like an educational game to correspond to her classr

> The following are a number of statements concerning relevant versus irrelevant costs and benefits. Complete each statement by providing the missing term or phrase. 1. _____ are costs that have already been incurred and are not relevant to future decisio

> Maria Turner has just graduated from college with a degree in accounting. She had planned to enroll immediately in the master’s program at her university but has been offered a lucrative job at a well-known company. The job is exactly w

> Assume you need to buy a new vehicle. The junker that you paid $5,000 for two years ago has a current value of $1,500. You have narrowed the choice down to a used 2008 Jeep Cherokee with a blue book value of $8,000 and a new Hyundai Elantra with a sticke

> For each of the following independent cases (A–E), compute the missing values in the table:

> Listed below are a number of statements concerning management’s decision-making process. Identify whether each statement is correct or incorrect. For all incorrect statements, indicate how to correct the statement. 1. The final step in management’s decis

> The following is a list of decisions and an associated cost or benefit that may or may not be relevant to the decision. For each situation, state whether the associated cost or benefit is relevant to the related decision. If a cost or benefit is irreleva

> Cordova’s marketing department has determined the following demand for its products: Required: Given the company’s limited resource and expected demand, compute how many units of each product Cordova should produce to

> Cordova manufactures three types of stained-glass window, cleverly named Products A, B, and C. Information about these products follows: Cordova currently is limited to 40,000 labor hours per month. Required: Assuming an infinite demand for each of Cordo

> Wholesome Dairy processes milk. The cost of the milk processing is $1,250,000. Wholesome is looking to increase its net income and is exploring the possibility of expanding its products to include cream and/or ice cream. It takes 1 gallon of milk to make

> Ironwood Company manufactures a variety of sunglasses. Production information for its most popular line, the Clear Vista (CV), follows: Suppose that Ironwood has been approached about producing a special order for 2,000 units of custom CV sunglasses for

> Anderson Publishing has two divisions: Book Publishing & Magazine Publishing. The Magazine division has been losing money for the last 5 years and Anderson is considering eliminating that division. Anderson’s information about the t

> Frannie Fans currently manufactures ceiling fans that include remotes to operate them. The current cost to manufacture 10,000 remotes is as follows: Frannie is approached by Lincoln Company which offers to make the remotes for $18 per unit. Required: 1.

> Refer to E7–6 through E7–9. Required: Identify at least three qualitative factors that MSI should consider when making each decision. Data from E7-6: MSI has been approached by a fourth-grade teacher from Portland abo

> Match each of the terms by inserting the appropriate definition letter in the space provided. Not all definitions will be used. A. Examination of alternatives focusing on costs that change between alternatives. B. A cost that has the potential to influen

> Suppose that your brother, Raymond, recently bought a new laptop computer for $800 to use in his land surveying business. After purchasing several add-on components for $400, he realized that they are not compatible with the laptop and, therefore, he c

> Joyce Murphy runs a courier service in downtown Seattle. She charges clients $0.50 per mile driven. Joyce has determined that if she drives 3,300 miles in a month, her total operating cost is $875. If she drives 4,400 miles in a month, her total operatin

> Match the definitions with the most appropriate term. Terms may be used once, more than once, or not at all. Description: 1. Buffer zone that identifies how much sales can drop before the business suffers a loss. 2. An investment in technology that incre

> Izzy Ice Cream has the following price and cost information: Required: 1. Determine Izzy’s break-even point in units and sales dollars. 2. Determine how many sundaes must be sold to generate a profit of $6,000. 3. Calculate Izzyâ&

> Refer to the information in E6–5 regarding Sandy Bank. Required: 1. Suppose that Sandy Bank raises its selling price to $675 per canoe. Calculate its new breakeven point in units and in sales dollars. 2. If Sandy Bank sells 650 canoes,

> Sandy Bank, Inc., makes one model of wooden canoe. Partial information for it follows: Required: 1. Complete the preceding table. 2. Suppose Sandy Bank sells its canoes for $550 each. Calculate the contribution margin per canoe and the contribution margi

> Refer to the information for Cove’s Cakes in E6–3. Required: 1. Calculate Cove’s new break-even point under each of the following independent scenarios: a. Sales price increases by $1.00 per cake. b.

> Cove’s Cakes is a local bakery. Price and cost information follows: Required: 1. Determine Cove’s break-even point in units and sales dollars. 2. Determine the bakery’s margin of safety if it currentl

> Erin Shelton, Inc., wants to earn a target profit of $800,000 this year. The company’s fixed costs are expected to be $1,000,000 and its variable costs are expected to be 60 percent of sales. Erin Shelton, Inc., earned $700,000 in profit last year. Requi

> Refer to the information in E6–22 for Juniper Corp. Suppose Juniper has improved its manufacturing process and expects total variable costs to decrease by 20 percent. The company expects sales revenue to remain stable at $400,000. Requi

> Juniper Corp. makes three models of insulated thermos. Juniper has $400,000 in total revenue and total variable costs of $240,000. Its sales mix is given below: Required: 1. Calculate the (overall) weighted-average contribution margin ratio. 2. Determine

> Noteworthy, Inc., produces and sells small electronic keyboards. Assume that you have the following information about Noteworthy’s costs for the most recent month. Required: Determine each of the following for Noteworthy: 1. Total produ

> Refer to the information in E6–20 for Tiago. Suppose the product mix has shifted to 40/30/30. Required: 1. Determine the new weighted-average contribution margin per unit. 2. Determine the number of units of each product that Tiago must

> Tiago makes three models of camera lens. Its product mix and contribution margin per unit follow: Required: 1. Determine the weighted-average contribution margin per unit. 2. Determine the number of units of each product that Tiago must sell to break eve

> On the graph presented, match each element to its appropriate description. Element: Point A Area G Area C Line H Line I Area B Area F Axis E Axis D Description: 1. Break-even point 2. Number of units of activity 3. Loss zone 4. Total cost 5. Total revenu

> Refer to the information presented in E6–18 for Biscayne’s Rent-A-Ride. Required: 1. Determine Biscayne’s new break-even point in each of the following independent scenarios: a. Product mix is 40/60.

> Biscayne’s Rent-A-Ride rents two models of automobiles: the standard and the deluxe. Information follows: Biscayne’s total fixed cost is $18,500 per month. Required: 1. Determine the contribution margin per rental day

> Tommy’s Tile Service is planning on purchasing new tile cleaning equipment that will improve their ability to remove tough stains from ceramic tiles. The company’s contribution margin is 30 percent and its current break-even point is $250,000 in sales re

> Refer to the information in E6–15 for Remo Company and Angelo Inc. Required: 1. Calculate each company’s degree of operating leverage. 2. Explain why companies with the same total sales and net operating income can hav

> Remo Company and Angelo Inc. are separate companies that operate in the same industry. Following are variable costing income statements for the two companies showing their different cost structures: Required: 1. Briefly describe the similarities and diff

> Lobster Trap Company is considering automating its manufacturing facility. Company information before and after the proposed automation follows: Required: 1. Calculate Lobster Trap’s break-even sales dollars before and after automation.

> Dublin Company and Gary Corp. have degrees of operating leverage of 4.5 and 2.7, respectively. Both companies have net income of $80,000. Required: 1. Without performing any calculations, discuss what the degrees of operating leverage tell us about the t

> Blockett Company makes automobile sunshades and incurs the costs listed in the table below. Required: Use an X to categorize each of the following costs. You may have more than one X for each item.

> Refer to the information regarding Dana’s Ribbon World in E6–11. Required: 1. Suppose Dana’s would like to generate a profit of $800. Determine how many rosettes it must sell to achieve this target pr

> Dana’s Ribbon World makes award rosettes. Following is information about the company: Required: 1. Determine how many rosettes Dana’s must sell to break even. 2. Calculate the break-even point in sales dollars. 3. Prep

> Last month, Laredo Company sold 450 units for $25 each. During the month, fixed costs were $2,520 and variable costs were $9 per unit. Required: 1. Determine the unit contribution margin and contribution margin ratio. 2. Calculate the break-even point in

> Suppose your sister works for a small real estate office as a receptionist. Her employer might be forced to lay off several employees. The employer explained that the company was not “breaking even” and that layoffs would start next month unless things c

> Refer to the information in E5–7 regarding Mountain Dental. Required: 1. Create a scattergraph using Mountain’s activity and cost information and draw a line on the graph that you believe has the best fit. 2. Using thi

> Mountain Dental Services is a specialized dental practice whose only service is filling cavities. Mountain has recorded the following for the past nine months: Required: 1. Use the high-low method to estimate total fixed cost and variable cost per cavity

> Morning Dove Company’s owner, Sylvester, believes that he can sell 2,000 birdbaths during the month of April and has predicted a net operating income of $6,820 as shown in the following contribution margin statement: Required: Explain t

> Refer to the information for Morning Dove Company in E5–4. Suppose it sells each birdbath for $25. Required: 1. Calculate the unit contribution margin and contribution margin ratio for each birdbath sold. 2. Prepare a contribution margi

> Morning Dove Company manufactures one model of birdbath, which is very popular. Morning Dove sells all units it produces each month. The relevant range is 0 to 1,500 units, and monthly production costs for the production of 500 units follow. Morning Dove

> The following information is available for Wonderway, Inc., for 2018: Required: Calculate each of the following costs for Wonderway: 1. Direct labor. 2. Manufacturing overhead. 3. Prime cost. 4. Conversion cost. 5. Total manufacturing cost. 6. Period exp

> Match each of the following graphs to the correct cost behavior. Cost Behavior 1. Variable cost per unit. 2. Total variable cost. 3. Fixed cost per unit. 4. Total fixed cost. 5. Total mixed cost.

> Tempe Office Services and Supplies (TOSS) provides various products and services in the Tempe Research Park, home to numerous high-tech and bio-tech companies. Making color copies is one of its most popular and profitable services. The controller perform

> The following information pertains to the first year of operation for Crystal Cold Coolers Inc.: Required: Prepare Crystal Cold’s full absorption costing income statement and variable costing income statement for the year.

> Your friend, Manuel Rodriguez, has been working as a staff accountant for Williams Company, a small local manufacturing company. His job responsibilities to date have entailed several aspects of financial accounting: preparing monthly financial statement

> Bethany Link delivers parts for several local auto parts stores. She charges clients $0.75 per mile driven. She has determined that if she drives 2,100 miles in a month, her average operating cost is $0.55 per mile. If Bethany drives 4,200 miles in a mon

> Joyce Murphy runs a courier service in downtown Seattle. She charges clients $0.50 per mile driven. Joyce has determined that if she drives 3,300 miles in a month, her total operating cost is $875. If she drives 4,400 miles in a month, her total operatin

> Steve Silversmith produces unique and exclusive sterling silver rings, pendants, buckles, and chains. Steve pays one supervisor to oversee the work performed by several part-time silversmiths. He pays each silversmith to work 20 hours per week or 40 hou

> Refer to the information presented in E5–17 for Riverside. Each of the following scenarios is a variation of Riverside’s original data. Required: Prepare Riverside’s contribution margin income stateme

> Starcups Coffee Company is launching a new sustainability initiative that would reward customers for purchasing a reusable cup. During the cup promotion, customers would pay an extra $1.00 for the reusable cup and would receive a 25 percent discount each

> Riverside Inc. makes one model of wooden canoe. Partial information for it follows: Required: 1. Complete the preceding table. 2. Identify three costs that would be classified as fixed costs and three that would be classified as variable costs for Rivers

> For each of the following independent cases (A through E), compute the missing values in the table:

> Suppose you are a sales manager for Books on Wheels, Inc., which makes rolling book carts often used by libraries. The company is considering adding a new product aimed at university students. The new product will be a small, collapsible, wheeled tote

> Weir Company (a fictional company) uses straight-line depreciation for its property, plant, andequipment, which, stated at cost, consisted of the following: Weir’s depreciation expenses for 20X1 and 20X0 were $55,000 and $50,000, respec

> Kobe Company began constructing a building for its own use in February 20X1. During 20X1, Kobe incurred interest of $70,000 on specific construction debt and $15,000 on other borrowings. Interest computed on the weighted-average amount of accumulated exp

> Clay Company started construction on a new office building on January 1, 20X1, and it movedinto the finished building on July 1, 20X2. Of the building’s $2,500,000 total cost, $2,000,000was incurred in 20X1 evenly throughout the year. Clay’s incremental

> The income statement and statement of cash flows for ABC Equipment Company for 20X1 areprovided below. Supplemental Information: Other current liabilities represent obligations for general and administrative expenses. Required: Derive a direct method p

> Rosario Company’s International Division reported the following results: The constant currency growth rate for 20X2 represents what the year-over-year sales growth versus 20X1 would have been if exchange rates had not changed from 20X1

> Lindy, a calendar-year U.S. corporation, bought inventory items from a supplier in Germany on November 5, 20X1, for 100,000 euros, when the spot exchange rate was $1.40 per euro. At Lindy’s December 31, 20X1, year-end, the spot exchange rate was $1.38. O

> A wholly owned subsidiary of Ward Inc. has certain expense accounts for the year ended December 31, 20X3, stated in local currency units (LCUs) as follows: The exchange rates at various dates are as follows: Assume that the LCU is the subsidiaryâ&#

> On September 1, 20X1, Cano & Company, a U.S. corporation, sold merchandise to a foreign firm for 250,000 euros. Terms of the sale require payment in euros on February 1, 20X2. On September 1, 20X1, the spot exchange rate was $1.30 per euro. At Cano’s yea

> The CEO of Crawford, Inc., evaluates financial statement information for four distinct operating segments: Television stations, Television entertainment production, Movie entertainment production, and Merchandise sales. The Television stations segment ea

> The CEO of Mannix, Inc., evaluates financial statement information for five distinct operating segments: Appliances, Heathcare, Transportation, Financial services, and Other stuff. Operating profit for each segment follows: Required: Explain which of Ma

> Refer to the information about Clear One Communications in Case C2-2 from Chapter 2. Required: Obtain the Form 10-K Clear One filed with the SEC on August 18, 2005. (Go to www.sec.gov and select “Filings” and then “Search for Company Filings.” Search fo

> The CEO of Lannister, Inc., evaluates financial statement information for five distinct operating segments: Hardware sales, Consulting, Hardware servicing, Financing, and Rising technology. Revenue and assets for the segments expressed as percentages of

> United Company has two foreign subsidiaries, Cancorp and Britcorp. Cancorp operates in Canada and Britcorp operates in the United Kingdom. Both companies are 100% owned by United Company and their financial statements are translated into U.S. dollars usi

> Wick Corporation has a Mexican subsidiary that had the following balance sheet at December 31, 20X1 (stated in millions of pesos): At December 31, 20X1, it took 19.66 pesos to buy one U.S. dollar. At December 31, 20X2, it took only 19.50 pesos to buy one

> On December 31, 20X1, the Stockholders’ Equity section of Mercedes Corporation was as follows: On March 1, 20X2, the board of directors declared a 10% stock dividend and accordingly issued 900 additional shares. The stockâ€&#

> Newton Corporation was organized on January 1, 20X1. On that date, it issued 200,000 shares of its $10 par value common stock at $15 per share (400,000 shares were authorized). During the period from January 1, 20X1, through December 31, 20X3, Newton rep

> Warren Corporation was organized on January 1, 20X1, with an authorization of 500,000 shares of common stock ($5 par value per share). During 20X1, the company had the following capital transactions: Required: What should be the balance in the Additional

> Forever Yours, Inc., a manufacturer of wedding rings, issued two financial instruments at the beginning of 20X1: a $10 million, 40-year bond that pays interest at the rate of 11% annually and 10,000 shares of $100 preferred stock that pays a dividend of

> The stockholders’ equity section of Peter Corporation’s balance sheet at December 31, 20X1, follows: On January 2, 20X2, Peter purchased and retired 100,000 shares of its stock for $1,800,000. Required: What is the ba

> On July 1, 20X1, Amos Corporation granted nontransferable, nonqualified stock options to certain key employees as additional compensation. The options permit the purchase of 20,000 shares of Amos’s $1 par common stock at a price of $32 per share. On the

> Information concerning the capital structure of the Petrock Corporation is as follows: During 20X1, Petrock paid dividends of $1 per share on its common stock and $2.40 per share on its preferred stock. The preferred stock is convertible into 20,000 shar

> Refer to the salesforce.com financial statement excerpts given below to answer the questions. On January 31, 2019, the price of salesforce.com stock was $151.97, and there were 770 million shares of common stock outstanding. The price of its stock on Jan

> Fountain Inc. has 5,000,000 shares of common stock outstanding on January 1, 20X1. It issued an additional 1,000,000 shares of common stock on April 1, 20X1, and 500,000 more on July 1, 20X1. On October 1, 20X1, Fountain issued 10,000 convertible bonds;

> Tam Company’s net income for the year ending December 31, 20X1, was $10,000. During the year, Tam declared and paid $1,000 cash dividends on preferred stock and $1,750 cash dividends on common stock. At December 31, 20X1, the company had 12,000 shares of

> Effective April 27, 20X1, Dorr Corporation’s shareholders approved a two-for-one split of the company’s common stock and an increase in authorized common shares from 100,000 shares (par value of $20 per share) to 200,0

> The Retained earnings account for Nathan Corporation had a credit balance of $800,000 at the end of 20X0. Selected transactions during 20X1 follow: a. Net income was $130,000. b. Cash dividends declared were $60,000. c. Repurchased 100 shares of Nathan C

> Mason Manufacturing had 600,000 shares of common stock outstanding and 150,000 shares of $100 par value preferred stock outstanding January 1, 20X1. An additional 120,000 shares of common stock were issued on August 1 and 24,000 common shares were repurc

> On April 30, 20X1, Pound Corp. acquired for cash all 200,000 shares of the outstanding common stock of Shake Corp. for $20 per share. At April 30, 20X1, Shake’s balance sheet showed net assets with a $3,000,000 book value. On that date, the fair value o

> Sage Inc. bought 40% of Adams Corporation’s outstanding common stock on January 2, 20X1, for $400,000. The carrying amount of Adams’s net assets at the purchase date totaled $900,000. Fair values and carrying amounts were the same for all items except fo

> In January 20X1, Harold Corporation acquired 20% of Otis Company’s outstanding common stock for $400,000. This investment gave Harold the ability to exercise significant influence over Otis. The book value of Otis’s net assets was $1,500,000. The excess

> Information related to Jones Company’s portfolio of trading securities at December 31, 20X1, follows: Amortized cost of securities……………………………..$340,000 Gross unrealized gains (cumulative)………………… 8,000 Gross unrealized losses (cumulative)………………... 52,000

> The following data pertain to Tyne Company’s investments in marketable equity securities. (Assume that all securities were held throughout 20X0 and 20X1.) Required: 1. What amount should Tyne report as unrealized holding gain (loss) in

> Cephalon Inc. issued $750 million of zero-coupon convertible notes. Because the notes were issued at par, meaning that Cephalon received $750 million cash for the notes, they have a zero yield-to-maturity. Settlement in cash upon conversion is not permit