Question: Refer to the information in PA12-2.

Refer to the information in PA12-2.

Required:

Prepare the cash flows from operating activities section of the statement of cash flows using the direct method.

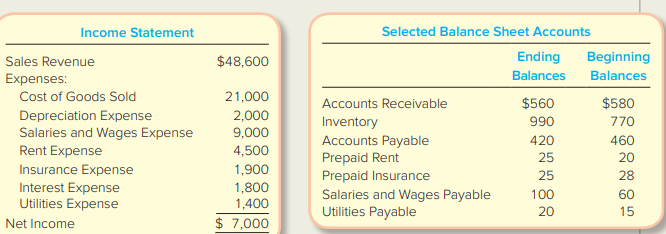

The income statement and selected balance sheet information for Direct Products Company for the year ended December 31 are presented below.

> Mondetta Clothing prepared its annual financial statements dated December 31. The company used the FIFO inventory costing method, but it failed to evaluate the net realizable value of its ending inventory. The preliminary income statement follows: Assum

> Refer to M10-18. Prepare CCC’s required journal entries on (a) January 1, 2018; (b) December 31, 2018; (c) December 31, 2019; (d) December 31, 2020; and (e) December 31, 2021. Data from M10-18: The following amortization schedule indi

> Mojo Industries tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period, as if it uses a periodic inventory system. Assume its accounting records provided the foll

> Sigfusson Supplies reported beginning inventory of 100 units, for a total cost of $2,000. The company had the following transactions during the month: Required: 1. Prepare the journal entries that would be recorded using a periodic inventory system. 2

> Emily’s Greenhouse Corporation is a local greenhouse organized 10 years ago as a corporation. The bookkeeper prepared the following statement at year-end (assume that all amounts are correct, but note the incorrect format): Required:

> Sky Communcations (SKY) usually sells a cell phone for $320 plus 12 months of cellular service for $480. SKY has a special, time-limited offer in which it gives the phone for free and sells the 12 months of cellular service for $420. Each phone costs SKY

> Larry’s Building Supplies (LBS) is a local hardware store. LBS uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $224,350). $500,000 b. Received

> Use the information in PB6-1 to complete the following requirements. Required: 1. For each of the events (a) through (c), indicate the amount and direction of the effect (+ for increase, − for decrease, and NE for no effect) on SSG i

> Define restricted cash and indicate how it should be reported on the balance sheet

> If you deposit $1,000 at the end of each period for 10 interest periods and you earn 8 percent interest, how much would you have at the end of period 10? Use a convenient format to display your computations and round to the nearest dollar.

> The transactions listed below are typical of those involving Southern Sporting Goods (SSG) and Sports R Us (SRU). SSG is a wholesale merchandiser and SRU is a retail merchandiser. Assume all sales of merchandise from SSG to SRU are made with terms n/30,

> Service World maintains a petty cash fund. The fund custodian encountered the following events. a. The fund was established when a check for $300 was cashed and deposited into a locked cash box. b. An employee submitted a receipt for a customer deliver

> The following amortization schedule indicates the interest and principal that Chip’s Cookie Corporation (CCC) must repay on an installment note established January 1, 2018. CCC has a December 31 year-end and makes the required annual pa

> The September bank statement and cash T-account for Terrick Company follow: There were no deposits in transit or outstanding checks at August 31. Required: 1. Identify and list the deposits in transit at the end of September. 2. Identify and list th

> The bookkeeper at Tony Company has asked you to prepare a bank reconciliation as of February 29. The February bank statement and the February T-account for cash showed the following (summarized): Tony Company’s bank reconciliation at t

> The following procedures are used by Complete Wholesale Incorporated. a. All sales are made on account, with each sale being indicated on a sequentially numbered sales invoice. b. Customer payments are received in the mail by the office receptionist, w

> Learn to Play, Inc., is a one-person company that provides private piano lessons. Its unadjusted trial balance at December 31, 2018, follows, along with information about selected accounts. Required: 1. Calculate the (preliminary) unadjusted net income

> Indicate the accounting equation effects (amount and direction) of each adjusting journal entry. Use + for increase, − for decrease, and NE for no effect. Provide an appropriate account name for any revenue and expense effects. Data f

> Cactus Company’s annual accounting year ends on June 30. Assume it is now June 30 and all of the entries except the following adjusting journal entries have been made: a. The company earned service revenue of $2,000 on a special job that was completed J

> Regis Corporation operates hair salons under various brand names including Supercuts, Mia & Maxx, and Style America. The following is a simplified list of accounts and amounts (in millions) reported in the company’s accounts for the

> The following items present a sample of business activities involving Dry Cleaner Corporation (DCC) for the year ended December 31. DCC provides cleaning services for individual customers and for employees of several large companies in the city. Dec 1

> Define cash and cash equivalents and indicate the types of items that should be reported as cash and cash equivalents.

> Jessica Pothier opened FunFlatables on June 1. The company rents out moon walks and inflatable slides for parties and corporate events. The company also has obtained the use of an abandoned ice rink located in a local shopping mall, where its rental prod

> On January 1, 2018, Buchheit Enterprises reported $95,000 in a liability called “Bonds Payable, Net.” This liability related to a $100,000 bond with a stated interest rate of 5 percent that was issued when the market interest rate was 6 percent. Assuming

> Robin Harrington established Time Definite Delivery on January 1. The following transactions occurred during the company’s most recent quarter. a. Issued common stock for $80,000. b. Provided delivery service to customers, receiving $16,000 in cash and

> Abercrombie & Fitch Co. (ANF) is a specialty retailer of casual apparel. The following is a series of accounts for ANF. The accounts are listed alphabetically and numbered for identification. Following the accounts is a series of transact

> Starbucks is a coffee company—a big coffee company. During a 10-year period, the number of Starbucks locations in China grew from 24 to over 1,000. The following is adapted from Starbucks’s annual report for the year e

> Bearings & Brakes Corporation (B&B) was incorporated as a private company. The company’s accounts included the following at June 30: During the month of July, the company had the following activities: a. Issued 6,000 shares of

> Swish Watch Corporation manufactures, sells, and services expensive watches. The company has been in business for three years. At the end of the previous year, the accounting records reported total assets of $2,255,000 and total liabilities of $1,780,000

> 1. Did Cheese Factory’s cash balance increase or decrease during the year ended August 31, 2018? Which financial statement shows the reasons for this change? 2. What would Cheese Factory’s 2018 net income have been ha

> Cheese Factory Incorporated reported the following information for the fiscal year ended August 31, 2018. Required: Prepare the four basic financial statements for the fiscal year ended August 31, 2018.

> 1. Is the company financed mainly by creditors or stockholders? Which financial statement provides the information to answer this question? 2. Was the company profitable? Which financial statement provides the information to answer this question? 3. By

> Moseby Corporation purchased equipment and in exchange signed a two-year promissory note. The note requires Moseby to make equal annual payments of $30,000 at the end of each of the next two years. Moseby has other promissory notes that charge interest

> What are the purposes of a bank reconciliation? What balances are reconciled?

> Clem Company issued $800,000, 10-year, 5 percent bonds on January 1, 2018. The bonds sold for $741,000. Interest is payable annually on December 31. Using effective-interest amortization, prepare journal entries to record (a) the bond issuance on January

> Given the following information, calculate cost of goods available for sale and ending inventory, then sales, cost of goods sold, and gross profit, under FIFO. Assume a periodic inventory system is used

> Peabody Corporation purchased equipment and in exchange signed a three-year promissory note. The note requires Peabody to make a single payment of $20,000 in three years. Peabody has other promissory notes that charge interest at the annual rate of 6 per

> PAC-1 Comparing Options Using Present Value Concepts After completing a long and successful career as senior partner at Pearson Hardman, you are preparing for retirement. After visiting the human resources office, you have found that you have several ret

> You have the opportunity to invest $10,000 in one of two companies from a single industry. The only information you have is shown here. The word high refers to the top third of the industry; average is the middle third; low is the bottom third. Required

> The financial statements for Royale and Cavalier companies are summarized here: These two companies are in the same business and state but different cities. Each company has been in operation for about 10 years. Both companies received an unqualified au

> Coke and Pepsi are well-known international brands. Coca-Cola Co. sells more than $42 billion each year while annual sales of PepsiCo products exceed $62 billion. Compare the two companies as a potential investment based on the following ratiosÂ&nb

> A condensed income statement for Simulates Corporation and a partially completed vertical analysis are presented below Required: 1. Complete the vertical analysis by computing each line item (a)–(f) as a percentage of sales revenues.

> A condensed balance sheet for Simultech Corporation and a partially completed vertical analysis are presented below. Required: 1. Complete the vertical analysis by computing each line item (a)–(d) as a percentage of total assets. Roun

> Use the data given in PA13-1 for Pinnacle Plus. Required: 1. Compute the gross profit percentage in the current and previous years. Round the percentages to one decimal place. Are the current year results better, or worse, than those for the previous

> Pinnacle Plus declared and paid a cash dividend of $6,600 in the current year. Its comparative financial statements, prepared at December 31, reported the following summarized information: Required: 1. Complete the two final columns shown beside each i

> Assume the same facts as PA12-4, except for the income statement and additional data item (a). The new income statement is shown below. Instead of item (a) from PA12-4, assume that the company bought new equipment for $1,800 cash and sold existing equipm

> Sim ko Company issued $600,000, 10-year, 5 percent bonds on January 1, 2018. The bonds were issued for $580,000. Interest is payable annually on December 31. Using straight-line amortization, prepare journal entries to record (a) the bond issuance on Jan

> What is the primary internal control goal for cash payments?

> Refer to PA12-4. Required: Complete requirements 1 and 2 using the direct method Heads Up Company was started several years ago by two hockey instructors. The company’s comparative balance sheets and income statement follow, along

> Heads Up Company was started several years ago by two hockey instructors. The company’s comparative balance sheets and income statement follow, along with additional information. Additional Data: a. Bought new hockey equipment for cas

> XS Supply Company is developing its annual financial statements at December 31. The statements are complete except for the statement of cash flows. The completed comparative balance sheets and income statement are summarized: Additional Data: a. Bought

> The income statement and selected balance sheet information for Direct Products Company for the year ended December 31 are presented below. Required: Prepare the cash flows from operating activities section of the statement of cash flows using the indi

> Motif Furniture is an Austin-based furniture company. For each of the following first-quarter transactions, indicate whether operating (O), investing (I), or financing activities (F) are affected and whether the effect is a cash inflow (+) or outflow (&a

> Two online magazine companies reported the following in their financial statements: Required: 1. Compute the 2018 ROE for each company (express ROE as a percentage rounded to one decimal place). Which company appears to generate greater returns on stoc

> Ritz Company had the following stock outstanding and Retained Earnings at December 31, 2018: On December 31, 2018, the board of directors is considering the distribution of a cash dividend to the common and preferred stockholders. No dividends were decl

> At December 31, the records of Kozmetsky Corporation provided the following selected and incomplete data: Required: 1. Complete the following: Shares issued . Shares outstanding . 2. The balance in Additional Paid-In Capital would be $ . 3. Earnings

> BSO, Inc., has assets of $600,000 and liabilities of $450,000, resulting in a debt-to-assets ratio of 0.75. For each of the following transactions, determine whether the debt-to-assets ratio will increase, decrease, or remain the same. Each item is indep

> National Chocolate Corp. produces chocolate bars and snacks under the brand names Blast and Soothe. A press release contained the following information: Required: 1. Prepare any journal entries that National Chocolate Corp. should make on the four date

> What are the three points of the fraud triangle? Is fraud more or less likely to occur if one of these elements is missing?

> Cucina Corp. signed a new installment note on January 1, 2018, and deposited the proceeds of $50,000 in its bank account. The note has a three-year term, compounds 5 percent interest annually, and requires an annual installment payment on December 31. Cu

> Assume the same facts as PA10-7, except that Surreal uses the simplified effective-interest bond amortization method, as shown in Chapter Supplement 10C. Required: 1. Prepare a bond amortization schedule. 2. Give the journal entry to record the bond

> On January 1, 2018, Surreal Manufacturing issued 600 bonds, each with a face value of $1,000, a stated interest rate of 3 percent paid annually on December 31, and a maturity date of December 31, 2020. On the issue date, the market interest rate was 4 pe

> On January 1, 2018, Loop Raceway issued 600 bonds, each with a face value of $1,000, a stated interest rate of 5 percent paid annually on December 31, and a maturity date of December 31, 2020. On the issue date, the market interest rate was 6 percent, so

> Macromedia, Inc., is the original maker of shockwave and flash technologies. One of its annual reports indicated a lawsuit had been filed against the company and five of its former officers for securities fraud in connection with allegedly making false o

> Net Work Corporation, whose annual accounting period ends on December 31, issued the following bonds: Required: For each of the three independent cases that follow, provide the amounts to be reported on the January 1, 2018, financial statements immedia

> Lakeview Company completed the following two transactions. The annual accounting period ends December 31. a. On December 31, calculated the payroll, which indicates gross earnings for wages ($80,000), payroll deductions for income tax ($8,000), payroll

> Using data from PA10-1, complete the following requirements. Required: 1. Prepare journal entries for each of the transactions through August 31. 2. Prepare all adjusting entries required on December 31. 3. Show how all of the liabilities arising fr

> The balance sheet for Shaver Corporation reported the following: cash, $5,000; short-term investments, $10,000; net accounts receivable, $35,000; inventory, $40,000; prepaids, $10,000; equipment, $100,000; current liabilities, $40,000; notes payable (lon

> Jack Hammer Company completed the following transactions. The annual accounting period ends December 31. Required: 1. For each listed transaction and related adjusting entry, indicate the accounts, amounts, and effects (+ for increase, âˆ

> The following transactions and adjusting entries were completed by a paper-packaging company called Gravure Graphics International during 2018 and 2019. The company uses straight-line depreciation for trucks and other vehicles, double-declining-balance d

> How is cash received in person independently verified?

> Precision Construction entered into the following transactions during a recent year Required: 1. Analyze the accounting equation effects and record journal entries for each of the transactions. 2. For the tangible and intangible assets acquired in the

> Ly Company disposed of two different assets. On January 1, prior to their disposal, the accounts reflected the following: The machines were disposed of in the following ways: a. Machine A: Sold on January 1 for $9,000 cash. b. Machine B: On January 1,

> At the beginning of the year, Grillo Industries bought three used machines from Freeman Incorporated. The machines immediately were overhauled, were installed, and started operating. Because the machines were different, each was recorded separately in th

> Coca-Cola and PepsiCo are two of the largest and most successful beverage companies in the world in terms of the products that they sell and their receivables management practices. To evaluate their ability to collect on credit sales, consider the follow

> Web Wizard, Inc., has provided information technology services for several years. For the first two months of the current year, the company has used the percentage of credit sales method to estimate bad debts. At the end of the first quarter, the company

> C&S Marketing (CSM) recently hired a new marketing director, Jeff Otos, for its downtown Minneapolis office. As part of the arrangement, CSM agreed on February 28, 2018, to advance Jeff $50,000 on a one-year, 8 percent note, with interest to be paid at m

> Expedia, Inc., disclosed the following rounded amounts (in thousands) concerning the Allowance for Doubtful Accounts on its Form 10-K annual report. Required: 1. Create a T-account for the Allowance for Doubtful Accounts and enter into it the 2014 amou

> Buzz Coffee Shops is famous for its large servings of hot coffee. After a famous case involving McDonald’s, the lawyer for Buzz warned management (during 2014) that it could be sued if someone were to spill hot coffee and be burned. “With the temperature

> The Kraft Heinz Company was formed in 2015 with the merger of Kraft Foods and H. J. Heinz Corporation. The company reported the following rounded amounts for the year ended January 3, 2016 (all amounts in millions): Required: 1. Assume Kraft Heinz uses

> Partial income statements for Sherwood Company summarized for a four-year period show the following: An audit revealed that in determining these amounts, the ending inventory for 2016 was overstated by $20,000. The inventory balance on December 31, 2017

> Using the information in PA7-1, calculate the cost of goods sold and ending inventory for Gladstone Company assuming it applies the LIFO cost method perpetually at the time of each sale. Compare these amounts to the periodic LIFO calculations in requirem

> What internal control functions are performed by a cash register and point-of-sale system? How are these functions performed when cash is received by mail?

> Harman International Industries is a world-leading producer of loudspeakers and other electronics products, which are sold under brand names like JBL, Infinity, and Harman/Kardon. The company reported the following amounts in its financial statements (in

> Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company reported its inventory using the LIFO inventory costing method but did not compare the cost of its ending inventory to its market value (replacement cost

> Gladstone Company tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period, as if it uses a periodic inventory system. Assume its accounting records provided the fo

> Home Hardware reported beginning inventory of 20 shovels, for a total cost of $100. The company had the following transactions during the month: Required: 1. Prepare the journal entries that would be recorded using a periodic inventory system. 2. Prep

> Big Tommy Corporation is a local grocery store organized seven years ago as a corporation. The bookkeeper prepared the following statement at year-end (assume that all amounts are correct, but note the incorrect format): Required: 1. Prepare a properly

> Hospital Equipment Company (HEC) acquired several fMRI machines for its inventory at a cost of $2,300 per machine. HEC usually sells these machines to hospitals at a price of $5,800. HEC also separately sells 12 months of training and repair services for

> What is the difference between Accounts Payable for advertising and Advertising Expense?

> Hair World Inc. is a wholesaler of hair supplies. Hair World uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $28,797). $51,200 b. Received mer

> Use the information in PA6-1 to complete the following requirements. Required: 1. For each of the events (a) through (c), indicate the amount and direction of the effect (+ for increase, − for decrease, and NE for no effect) on New B

> The transactions listed below are typical of those involving New Books Inc. and Readers’ Corner. New Books is a wholesale merchandiser and Readers’ Corner is a retail merchandiser. Assume all sales of merchandise from New Books to Readers’ Corner are mad

> Harristown Hockey Club (HHC) maintains a petty cash fund for minor club expenditures. The petty cash custodian, Wayne Crosby, describes the events that occurred during the last two months: a. I established the fund by cashing a check from HHC for $250 m

> What is the primary internal control goal for cash receipts?

> The December bank statement and cash T-account for Stewart Company follow: There were no deposits in transit or outstanding checks at November 30. Required: 1. Identify and list the deposits in transit at the end of December. 2. Identify and list t

> The bookkeeper at Martin Company has asked you to prepare a bank reconciliation as of May 31. The May 31 bank statement and the May T-account for cash (summarized) are below. Martin Company’s bank reconciliation at the end of April show

> The following procedures are used by The Taco Shop. a. Customers pay cash for all food orders. Cash is placed in a cash register and a receipt is issued upon request by the customer. b. At the end of each day, the cashier counts the cash, prepares a ca

> Val’s Hair Emporium operates a hair salon. Its unadjusted trial balance as of December 31, 2018, follows, along with information about selected accounts. Required: 1. Calculate the (preliminary) unadjusted net income for the year ende

> Indicate the accounting equation effects (amount and direction) of each adjusting journal entry. Use + for increase, − for decrease, and NE for no effect. Provide an appropriate account name for any revenue and expense effects. Data fr